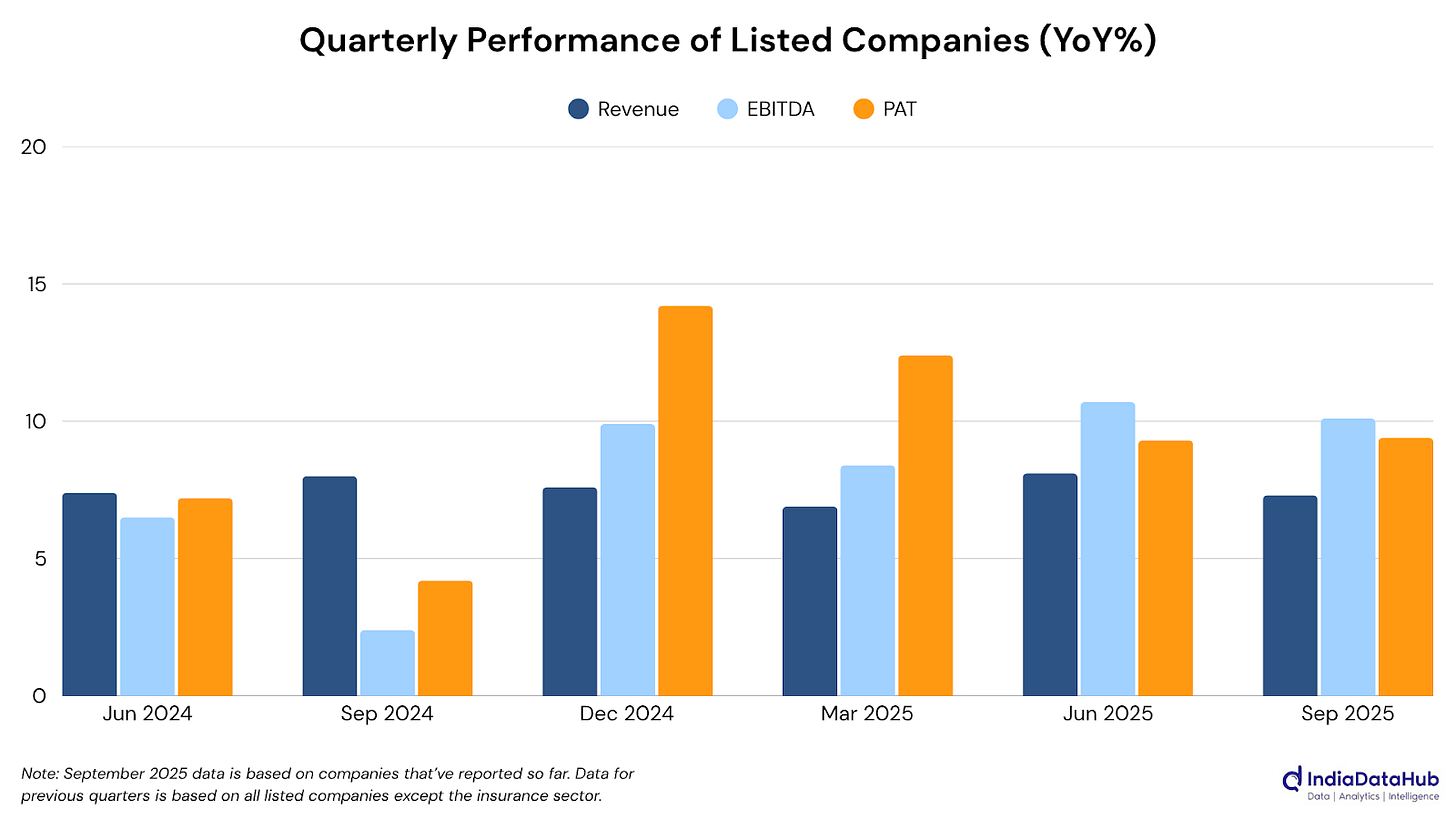

Welcome back to This Week in Earnings. The Q2 FY26 results season was slow last week, with the festivals underway, and only 57 new companies have reported this week, bringing the total tally to 274. Aggregate revenues are up 7.3% year-on-year, EBITDA by 10.1%, and PAT by 9.4%. Excluding financial services, profit growth strengthens to 14.1%.

Key Sectoral Trends

The strongest results this week came from Healthcare, Consumer Discretionary, and Commodities sectors, each building on momentum seen earlier in the season. Healthcare profits surged by 78%, led by normalization in pharma margins and a pickup in diagnostics volumes. Consumer Discretionary, meanwhile, remains buoyant with 44% profit growth, supported by a stable urban demand and a continued revival in premium housing and leisure spending.

The Commodities sector continues to stand out with a 73% profit surge, highlighting its cost discipline and its leverage to domestic demand. UltraTech Cement and Bhageria Industries exemplified this strength, both benefiting from lower input costs and efficient operations.

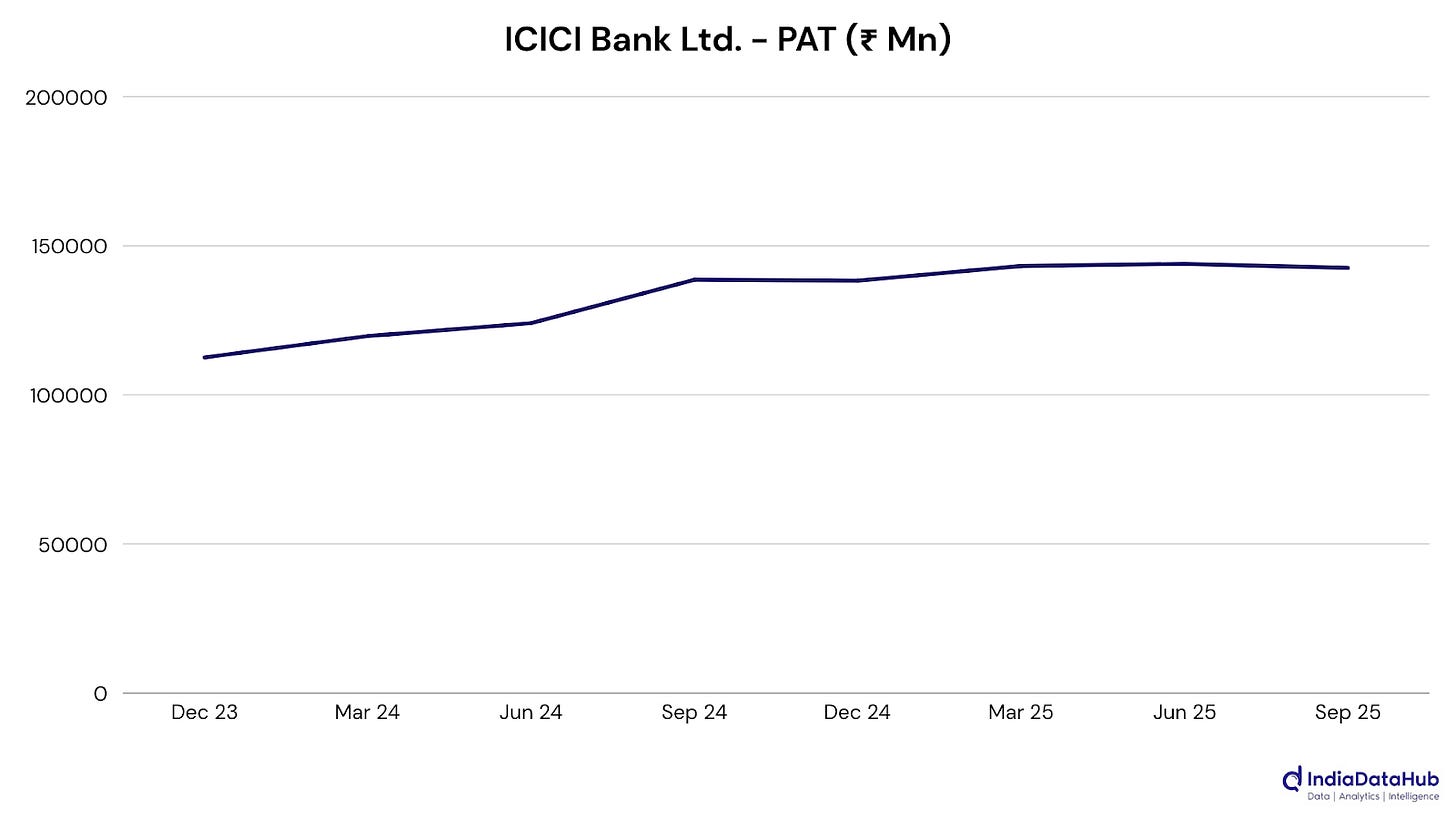

Financial Services continues to expand steadily, with 5% profit growth driven by strong loan growth and improvements in asset quality. HDFC Bank, ICICI Bank, and IDFC First Bank all turned in healthy quarters despite tighter margins. Industrials posted a solid 14% profit increase, benefiting from sustained capital spending and order execution, though rising costs continue to trim margins. Energy stayed firm, up 22%, with integrated players maintaining steady earnings despite volatile input prices.

Information Technology grew modestly (3.8% PAT rise), yet selective players such as Cigniti Technologies outperformed, with 56% profit growth highlighting margin gains in digital assurance and successful integration efforts. FMCG, on the other hand, remained subdued as Hindustan Unilever’s 3.8% profit growth came largely from a tax gain, with rural demand still sluggish and cost pressures high.

At the weaker end, Telecom continued to drag the aggregate down with another deep loss, while Services and Utilities posted healthy revenue growth but limited profit traction.

Overall, the last week suggests a familiar theme: earnings strength is broad though uneven. Margin management remains the key differentiator, with commodity producers, healthcare firms, and consumer-facing companies setting the tone for now. As more results flow in, the test will be whether these gains translate into a sustained, broad-based profit recovery across sectors.

Key Results During The Week

Bhageria Industries Ltd.: Margins expanded sharply this quarter, with profit up 80% and revenue up 58%, helped by operational efficiencies and a sharper product mix. A broader recovery in textile demand and shifts in global sourcing are likely to have reinforced this strong showing.

Jammu & Kashmir Bank Ltd.: Revenue more than doubled and profit rose 77%, supported by steady loan and deposit growth. Improved asset quality and a high CASA base kept profitability strong, though regional concentration may continue to shape future performance.

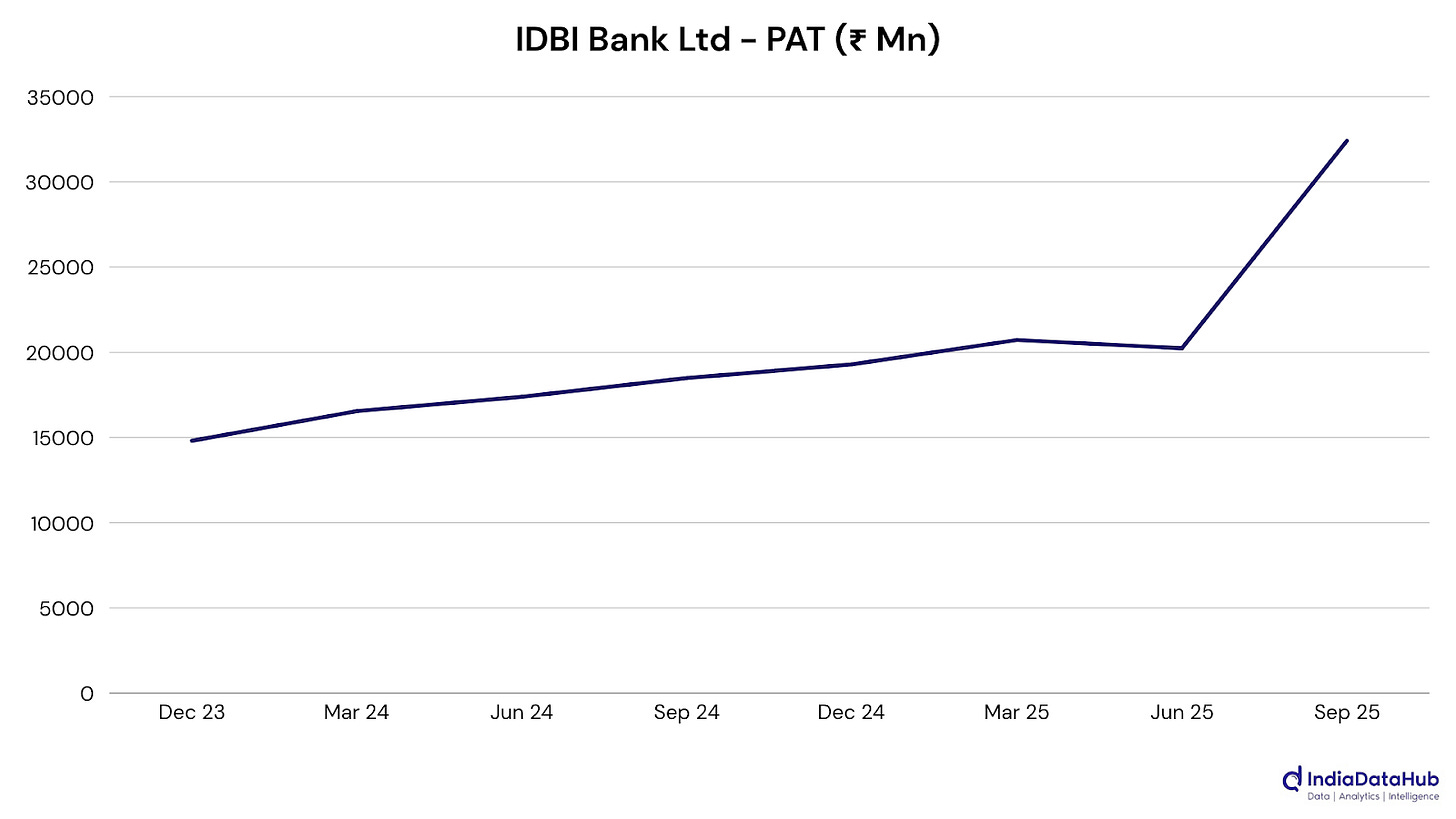

IDBI Bank Ltd.: Profit surged over 75%, mainly from a one-time stake sale in NSDL that lifted overall earnings. Despite softer interest income, strong capital buffers and improving asset quality kept the bank’s financial position steady.

IDFC First Bank Ltd.: Net profit rose 64% as loan and deposit growth stayed strong and asset quality improved. Lower provisions and steady retail expansion lifted margins, marking another solid quarter in the bank’s ongoing retail-focused transformation.

Cigniti Technologies Ltd.: Revenue grew 13.6% and profit jumped 56%, helped by stronger execution and margin gains in digital assurance services. Expanding client relationships and efficiency improvements kept momentum steady as integration with Coforge continued to unfold.

UltraTech Cement Ltd.: Profit rose 50% on 25% revenue growth, supported by higher realizations and lower energy costs. Strong demand from housing and infrastructure, along with ongoing capacity expansion, kept UltraTech well ahead of broader industry trends.

Hindustan Unilever Ltd.: Profit grew 3.8% on modest 2% revenue growth, supported by a one-time tax gain. Flat volumes and higher costs weighed on margins, with rural softness and GST-related shifts keeping recovery gradual for now.

HDFC Bank Ltd.: Profit rose 10% on steady loan growth and firm asset quality, even as funding costs went up. Expanding retail and SME lending kept momentum intact, though post-merger integration and margin pressure will remain key watchpoints.

ICICI Bank Ltd.: Revenue rose 4% and profit 2.9%, supported by steady loan and fee income growth alongside improved asset quality. While funding costs may stay high, ICICI’s strong capital base and balanced portfolio kept performance steady.

UTI Asset Management Co. Ltd.: Revenue fell 22% and profit halved, mainly due to last year’s high base and one-off costs. Core income and AUM growth remained steady, suggesting underlying operations are holding firm despite industry-wide margin pressure.

That’s it for this edition. There’s much to analyse and unpack in the coming weeks; we’ll be back next week!