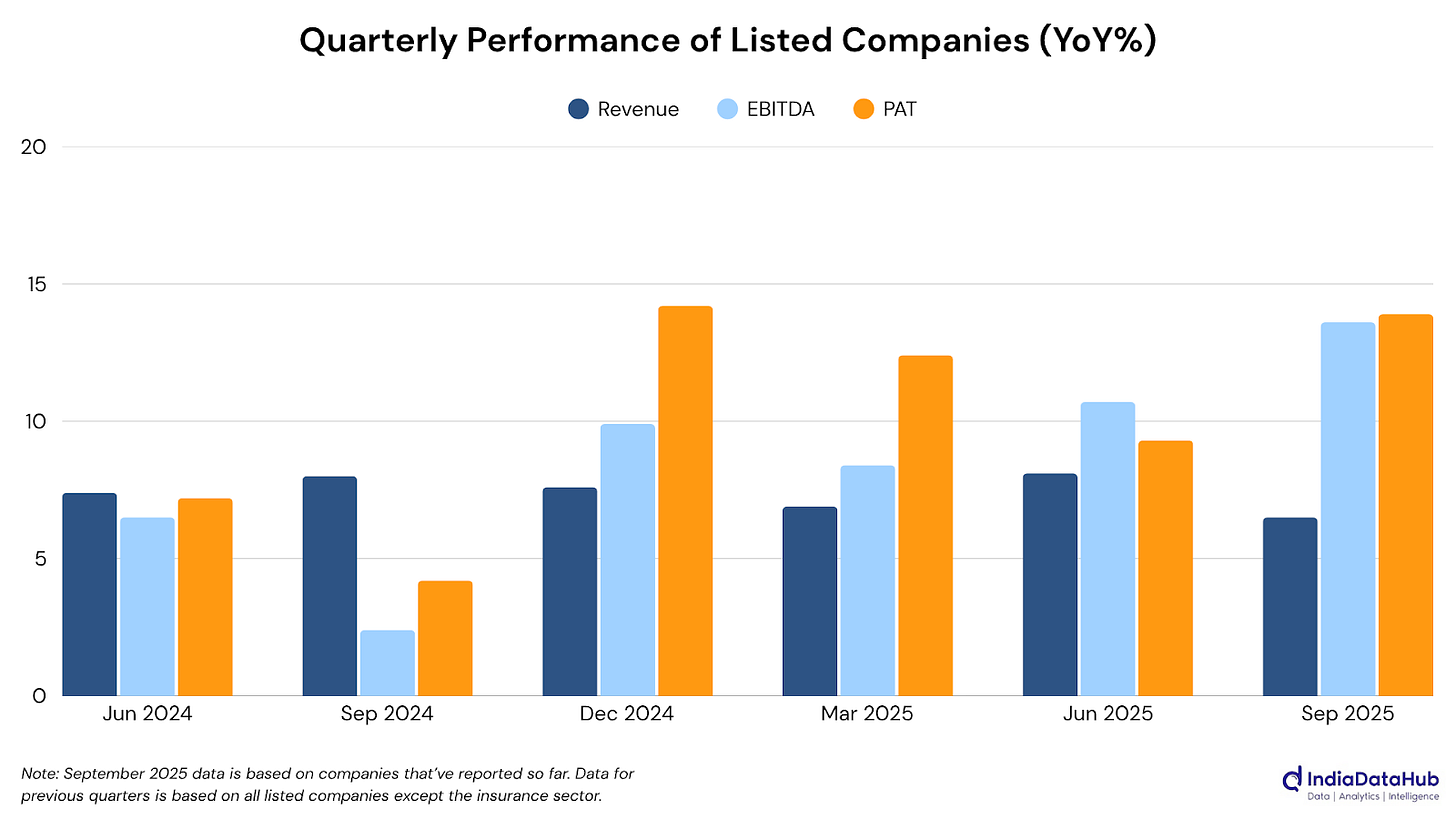

Welcome back to This Week in Earnings. The Q2 FY26 results season has picked up further pace, with a sharper rebound across most sectors. As of Friday a total of 569 companies have reported results. Aggregate revenues have grown rose 6.5% year-on-year, while EBITDA and PAT have seen a 13.6% and 13.9% growth respectively. Excluding Financial Services, profit growth has seen an even stronger growth of 20%, highlighting the broad-based momentum despite a cautious consumption backdrop.

This newsletter is structured into two sections. The first section looks at the week’s aggregate trends and sectoral highlights. The second dives into the key results during the week. More details can be accessed from a detailed PDF at the end of this newsletter.

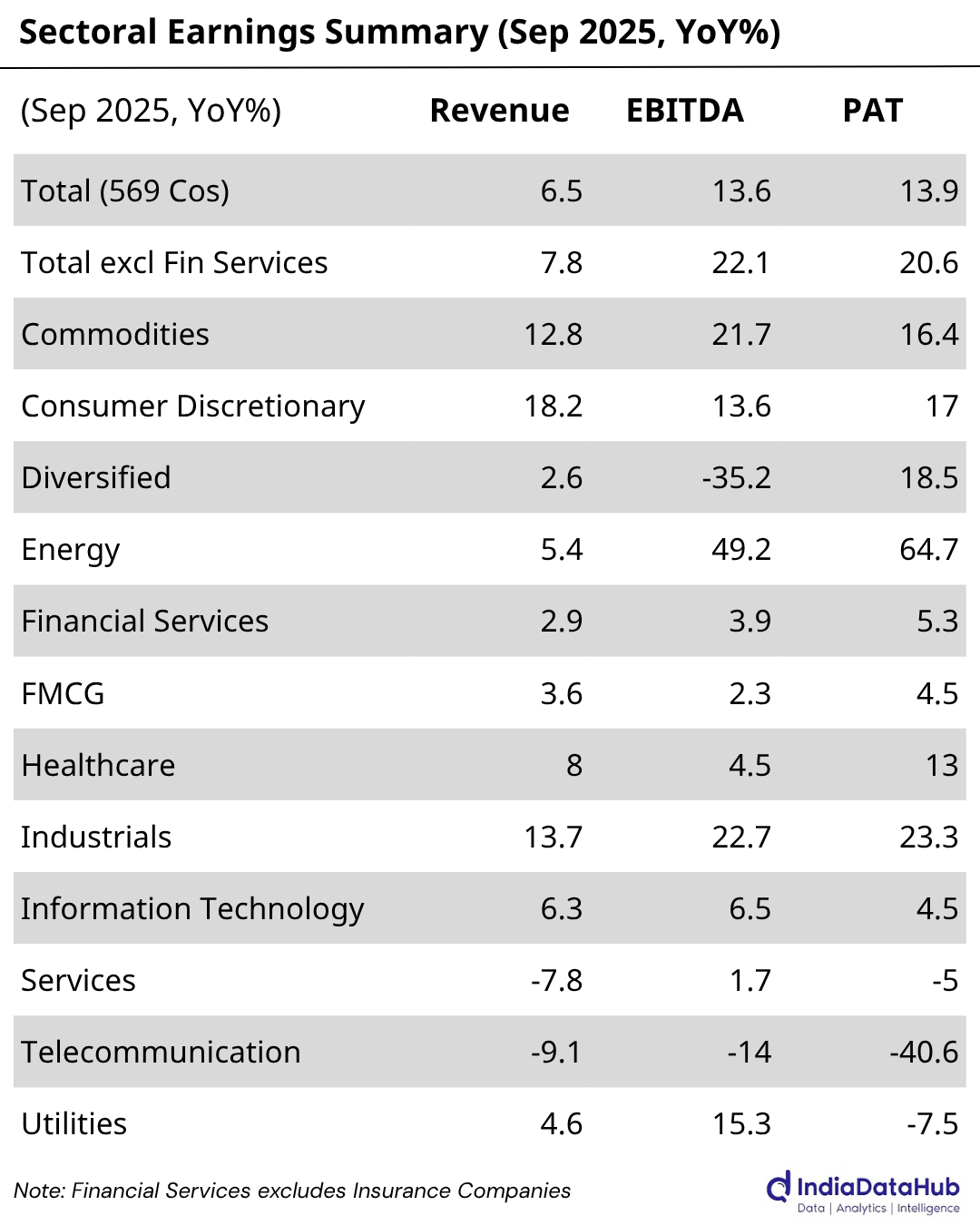

Key Sectoral Trends

The week’s highlights came from Energy, Industrials, and Commodities, each showing notable margin expansion and earnings growth.

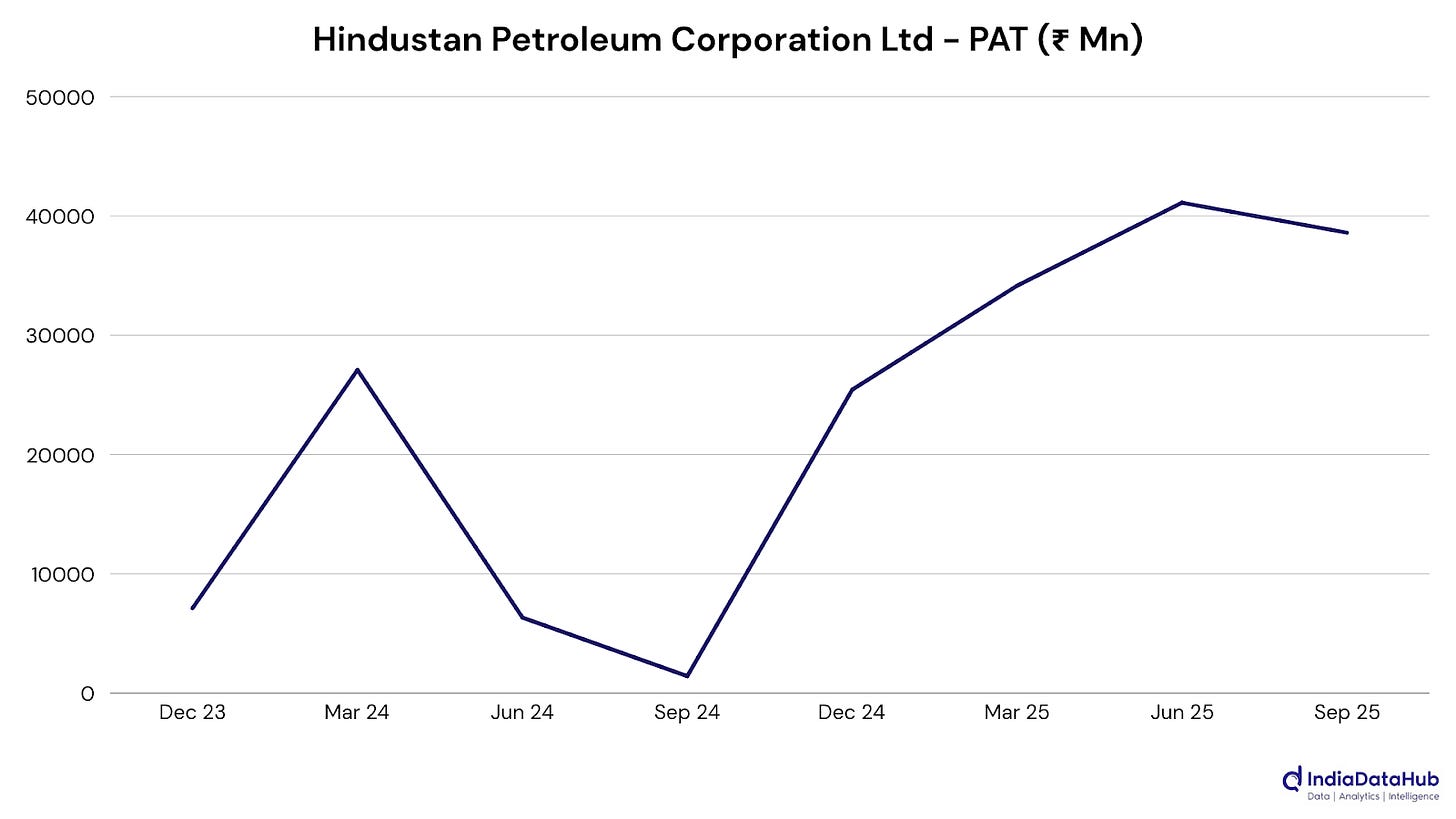

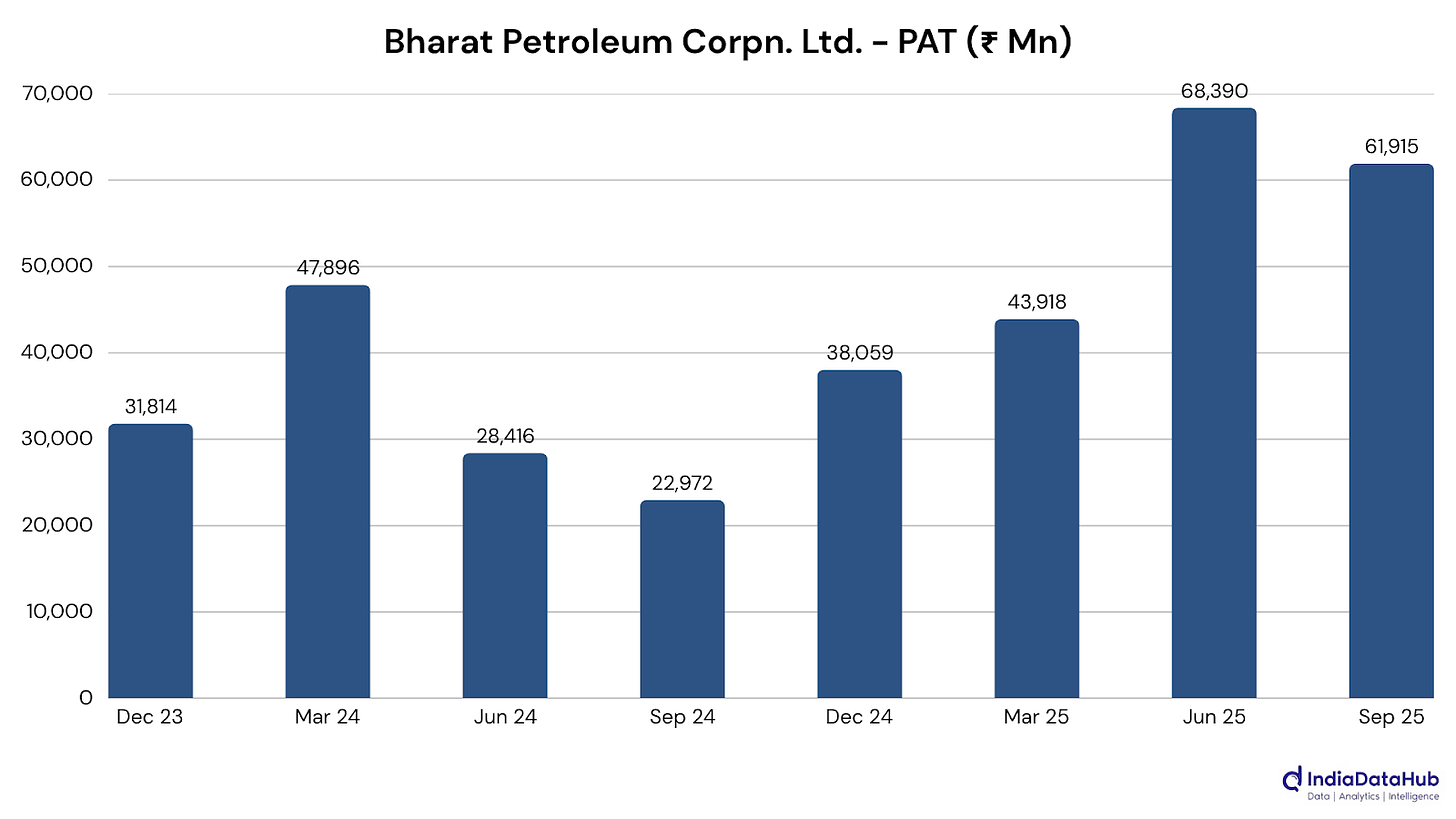

Energy sector’s profits surged 65%, supported by favorable refining margins and disciplined cost control. This uptrend was evident in refiners like HPCL and BPCL.

Industrials continued to build momentum, with profits up 23%, ensuring sustained capital expenditure and operational efficiency. The ongoing infrastructure push and order execution strength were evident across capital goods and manufacturing firms, with several companies reporting margin gains from improved utilization and tighter costs.

Commodities maintained their strong trajectory, with profits rising 16%, aided by lower input prices and improving realizations. The positive earnings trend was reflected across both cement and specialty chemical makers, highlighting persisting strength in industrial consumption and cost rationalization.

Consumer Discretionary remained upbeat, with profits growing 17%, underpinned by robust urban demand and healthy pre-sales in housing and apparel segments. Financial Services delivered steady 5% growth, supported by stable loan books, improving asset quality, and expanding digital channels.

FMCG saw modest profit growth of 4.5%, as consumer spending stayed uneven. Select players saw margin recovery in niche categories, even as broader volume growth remained tepid.

Among lagging sectors, Telecom continued to post losses, held back by high operating costs and muted revenue growth, while Utilities and Services saw softer profits despite moderate topline growth.

The earnings recovery seems to be firming up, though still marked by contrasts. Margin gains are emerging as the common thread, whether through softer commodity input costs or execution efficiency in industrials. Demand, while steady in urban consumption and housing, remains patchy across staples and services. The contours of this broad but uneven recovery will become clearer with time.

Key Results During The Week

Hindustan Petroleum Corporation Ltd: Profits skyrocketed this quarter as stronger refining margins and higher crude throughput lifted earnings. Improved retail performance and refinery upgrades helped HPCL post one of its sharpest rebounds, even with modest topline growth.

Bharat Petroleum Corpn. Ltd. (BPCL): Profits nearly tripled, powered by stronger refining margins and tight expense control. Softer crude prices and steady product spreads kept conditions favorable for refiners, helping BPCL sustain high profitability despite a modest topline growth.

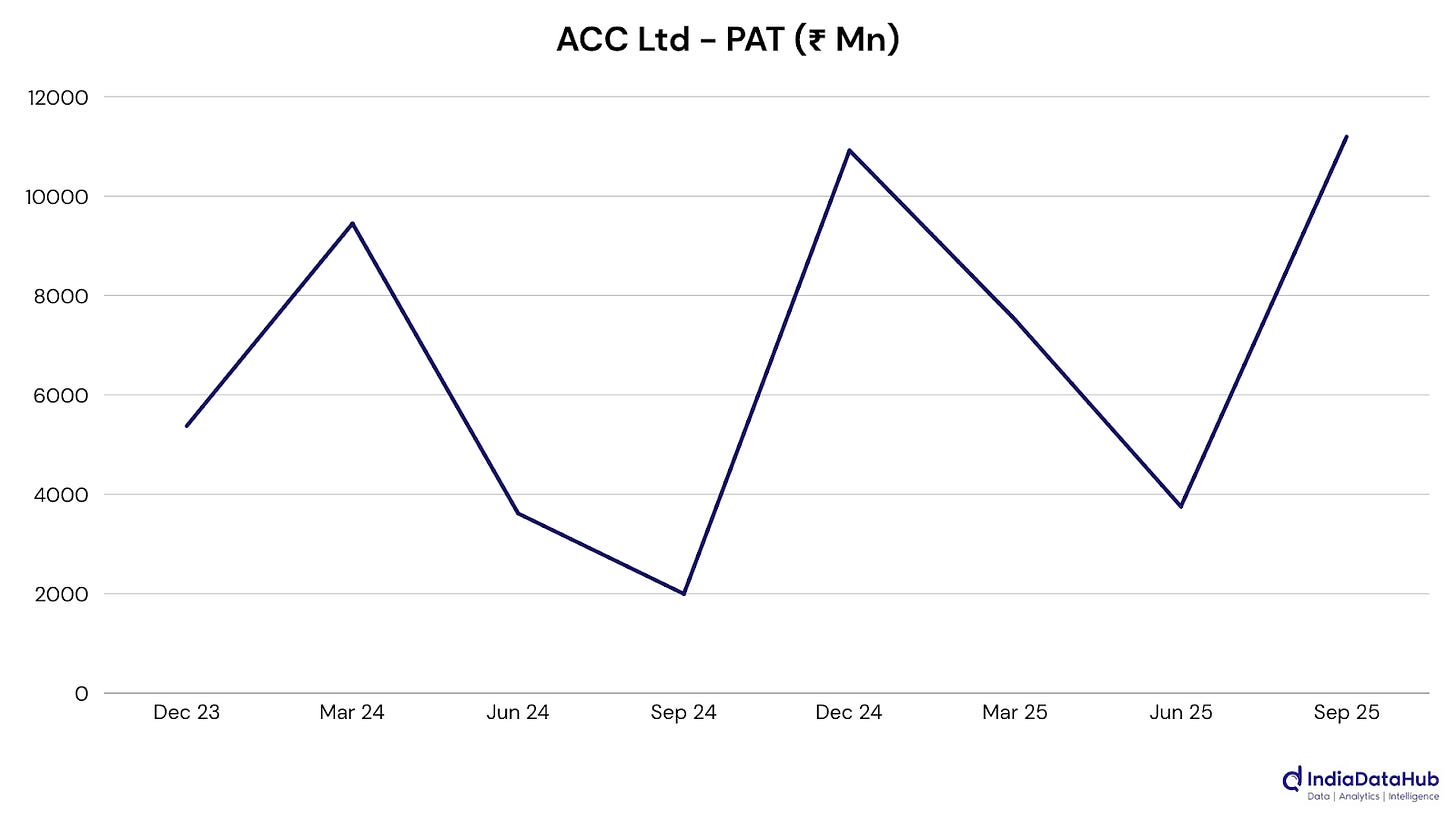

ACC Ltd: The profits surge was helped by a one-off tax credit and robust cement demand. Higher volumes, improved realizations, and lower energy costs pushed margins to new highs, marking one of ACC’s strongest quarters in recent years.

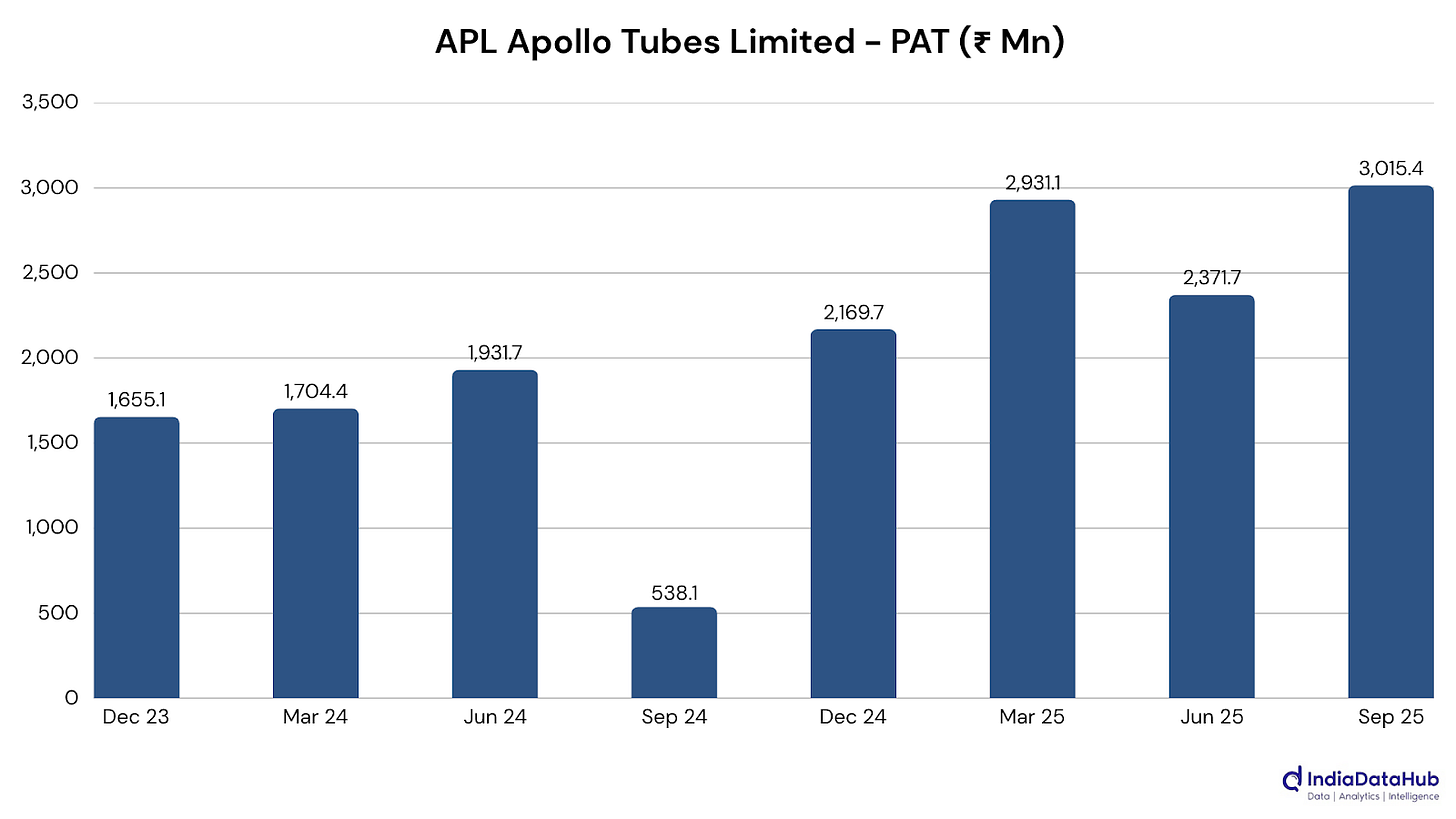

APL Apollo Tubes Limited: Profits shot up, thanks to higher sales volumes and value-added products, which boosted margins. Efficiency gains and tight cost control helped offset weak seasonal demand, keeping APL Apollo firmly ahead in the steel tubes space.

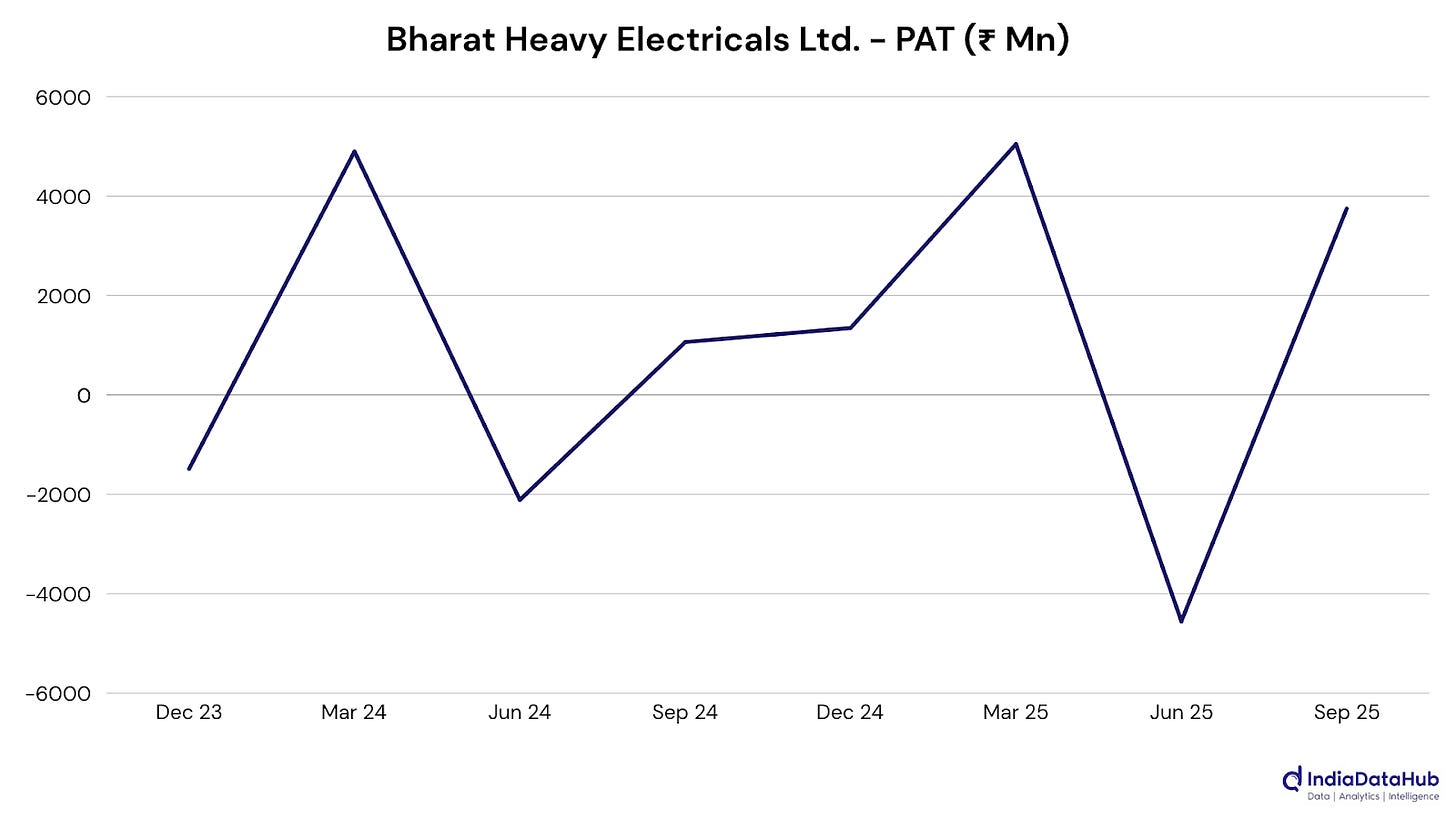

Bharat Heavy Electricals Ltd.: Profits more than tripled this quarter as stronger project execution and leaner costs boosted margins. Rising orders in power and industrial segments maintained the high momentum, reflecting BHEL’s sharper efficiency and tailwinds from India’s infrastructure push.

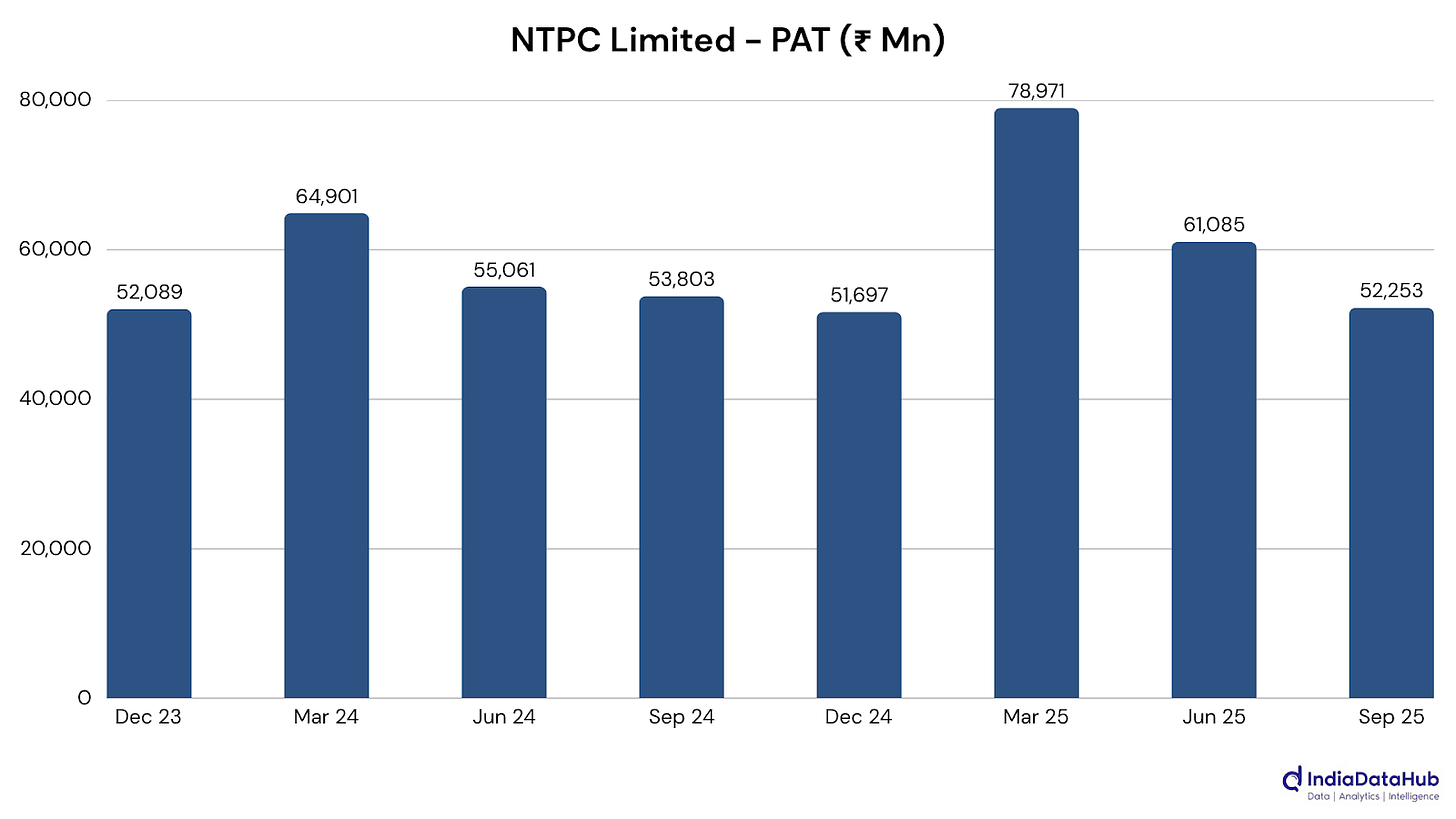

NTPC Limited: Profits eased slightly as higher taxes and interest costs offset efficiency gains. Seasonal demand softness kept revenue flat, though NTPC’s steady margins highlight continued operational discipline amid shifting power demand.

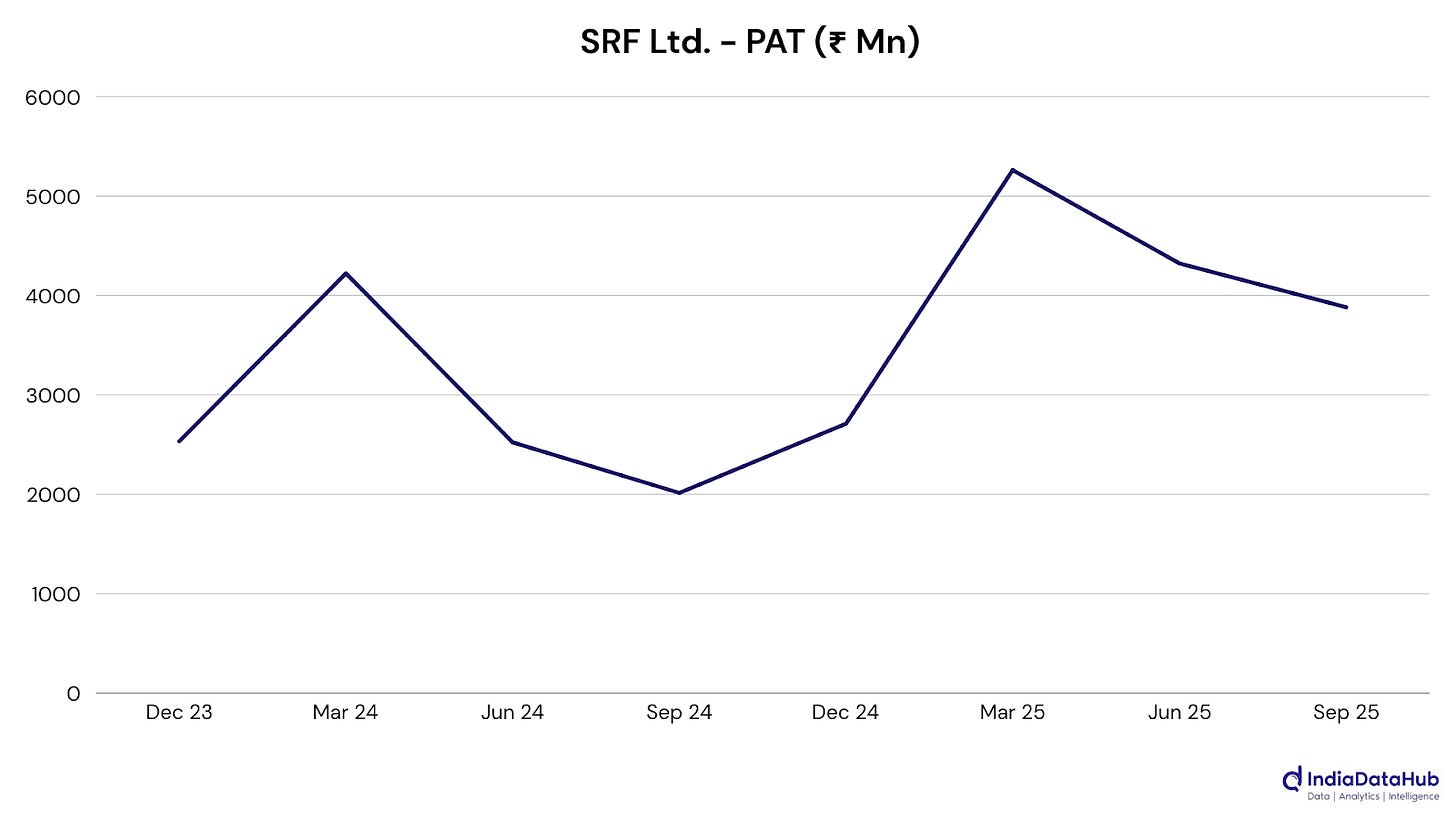

SRF Ltd.: Profits almost doubled as strong chemical sales and tighter cost control lifted margins. Gains in specialty chemicals and polymers offset softness in technical textiles, keeping SRF’s overall performance well-balanced.

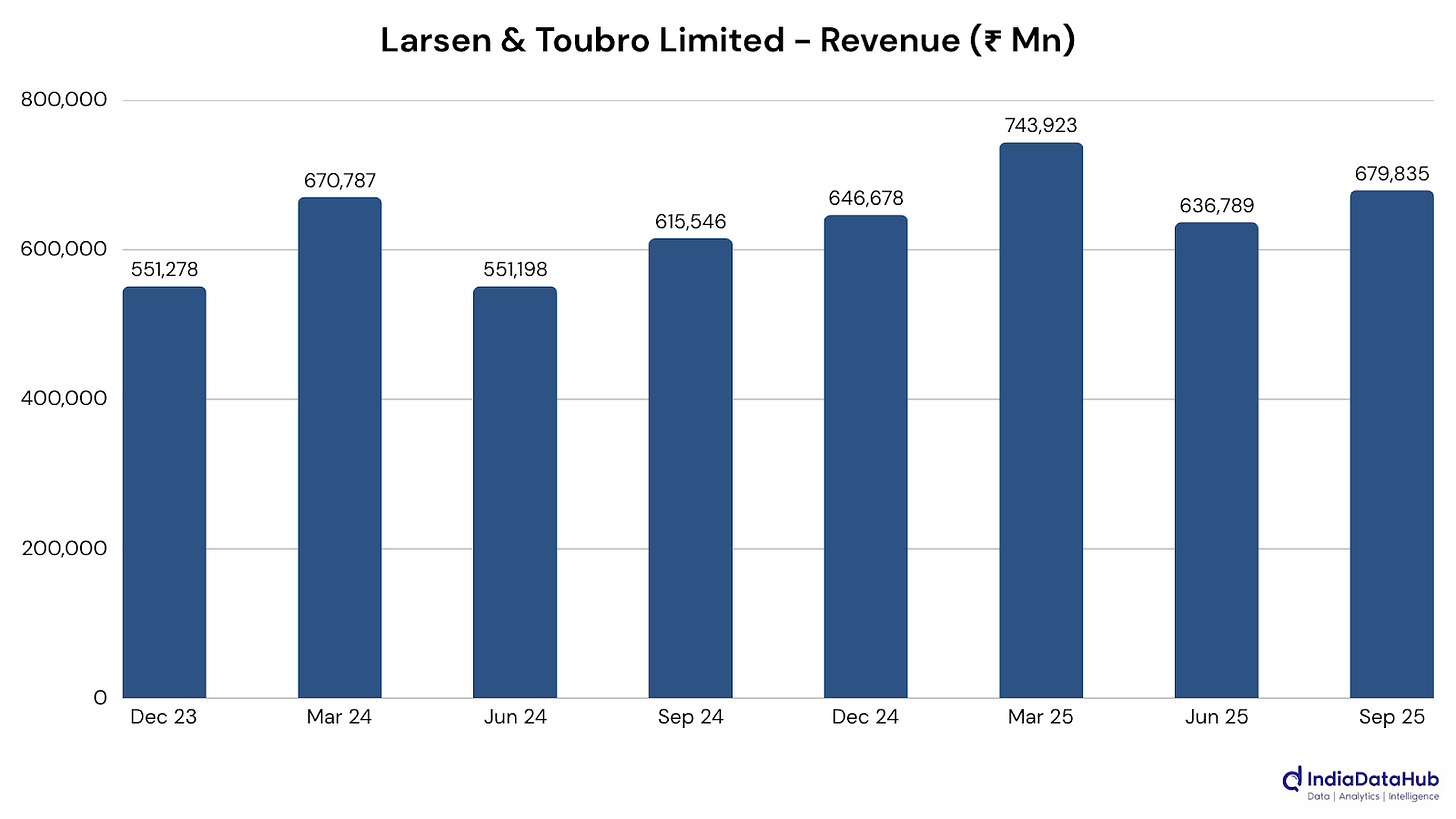

Larsen & Toubro Limited: Profits rose steadily, thanks to record order inflows and broad-based project wins. While margins softened slightly, L&T’s expanding global order book and infrastructure push kept growth momentum firm across core and emerging sectors.

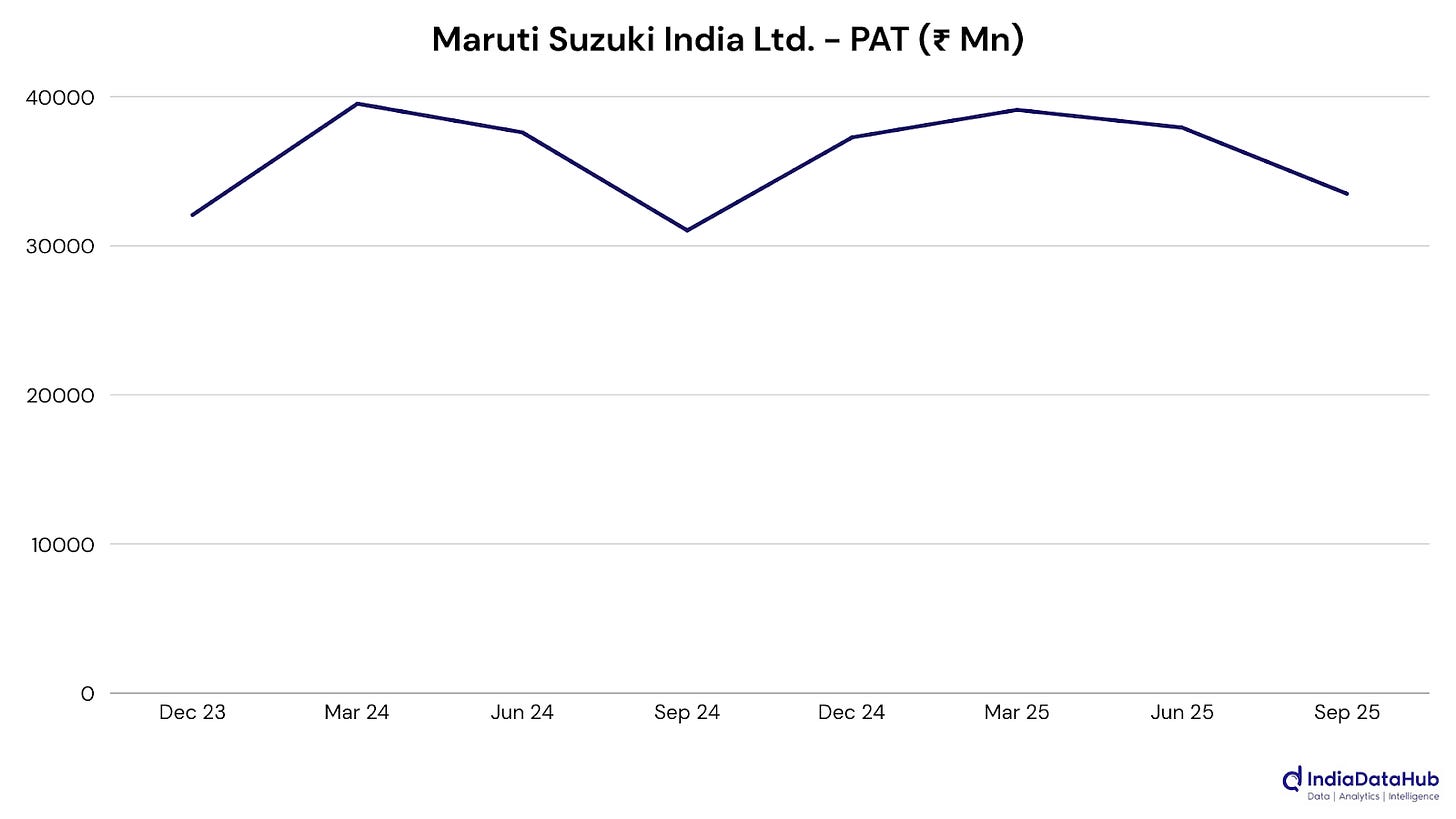

Maruti Suzuki India Ltd.: Revenue hit a record, lifted by booming exports even as domestic sales softened. Margins came under pressure from higher input costs and promotions, but Maruti’s global momentum kept overall growth steady.

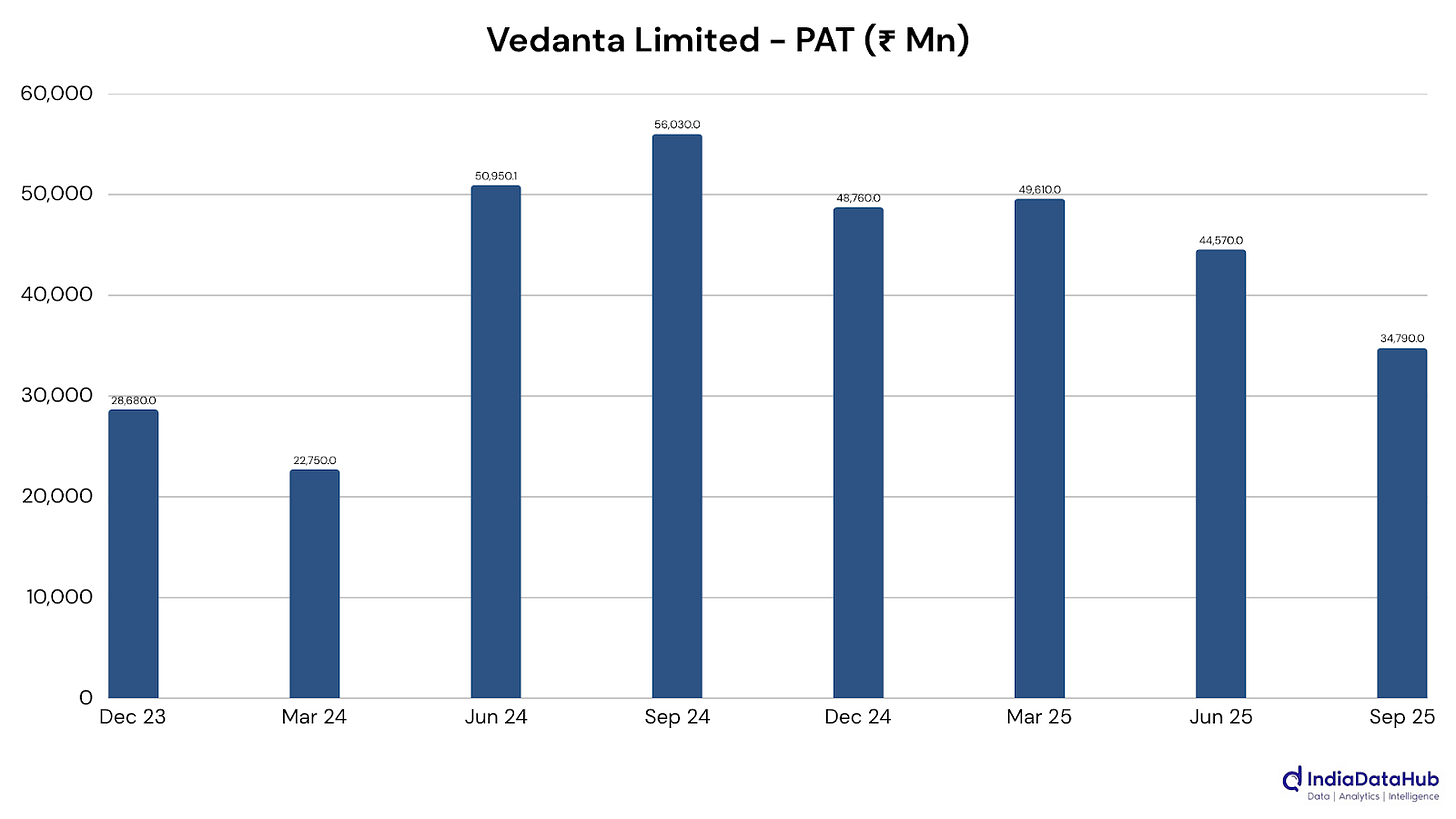

Vedanta Limited: Revenue rose modestly, but profits fell sharply due to one-time asset write-offs and settlements. Strong aluminium and power sales kept core operations steady, with disciplined cost control helping cushion Vedanta’s bottom line.

For a more detailed analysis where we analyse key company results sector-wise, download this PDF.

That’s it for this edition. There’s much to analyse and unpack in the coming weeks; we’ll be back next week!

Thank you team!