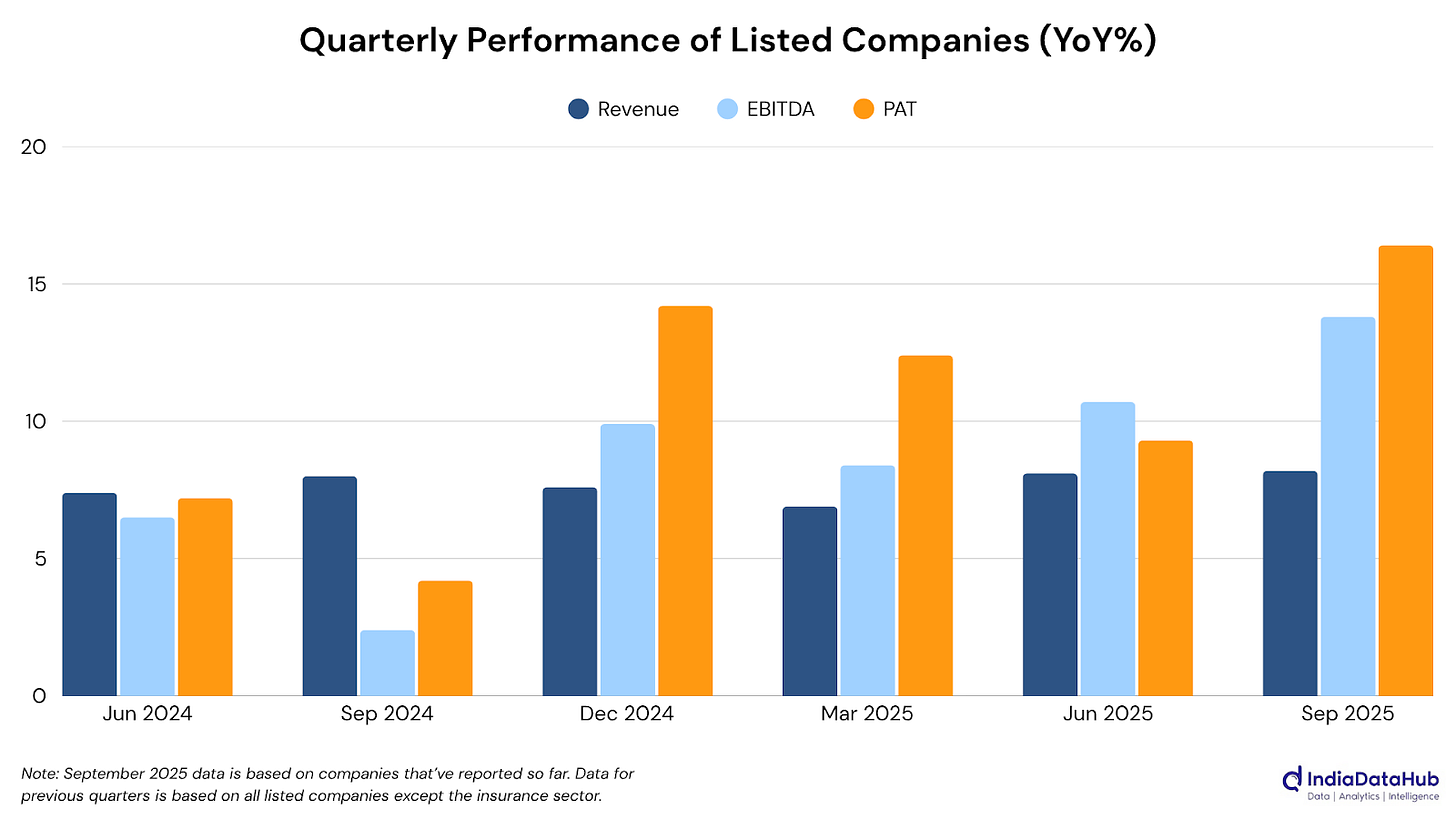

Welcome back to This Week in Earnings. The Q2 FY26 season is now in its second half and in aggregate the trend is encouraging. While aggregate revenues are up 8% year-on-year as of Friday, EBITDA and PAT have seen an impressive growth of 14% and 16% respectively. Excluding Financial Services, profits have seen an impressive growth of 24% YoY, reflecting solid margin recovery. That said the recovery is uneven across the different sectors.

This newsletter is structured into two sections. The first section looks at the week’s aggregate trends and sectoral highlights. The second dives into the key results during the week. More details (and lots of charts) can be accessed from a detailed PDF here:

The big picture summary is that the overall earnings recovery is broadening, with margins again doing much of the heavy lifting. Input cost moderation and operational efficiency—especially in autos, energy, and building materials—are cushioning patchy rural and service-sector demand. Even as consumption pockets remain mixed, the tone of this season suggests that corporate India has settled into a more stable, margin-driven growth cycle rather than one purely dependent on top-line expansion.

Key Sectoral Trends

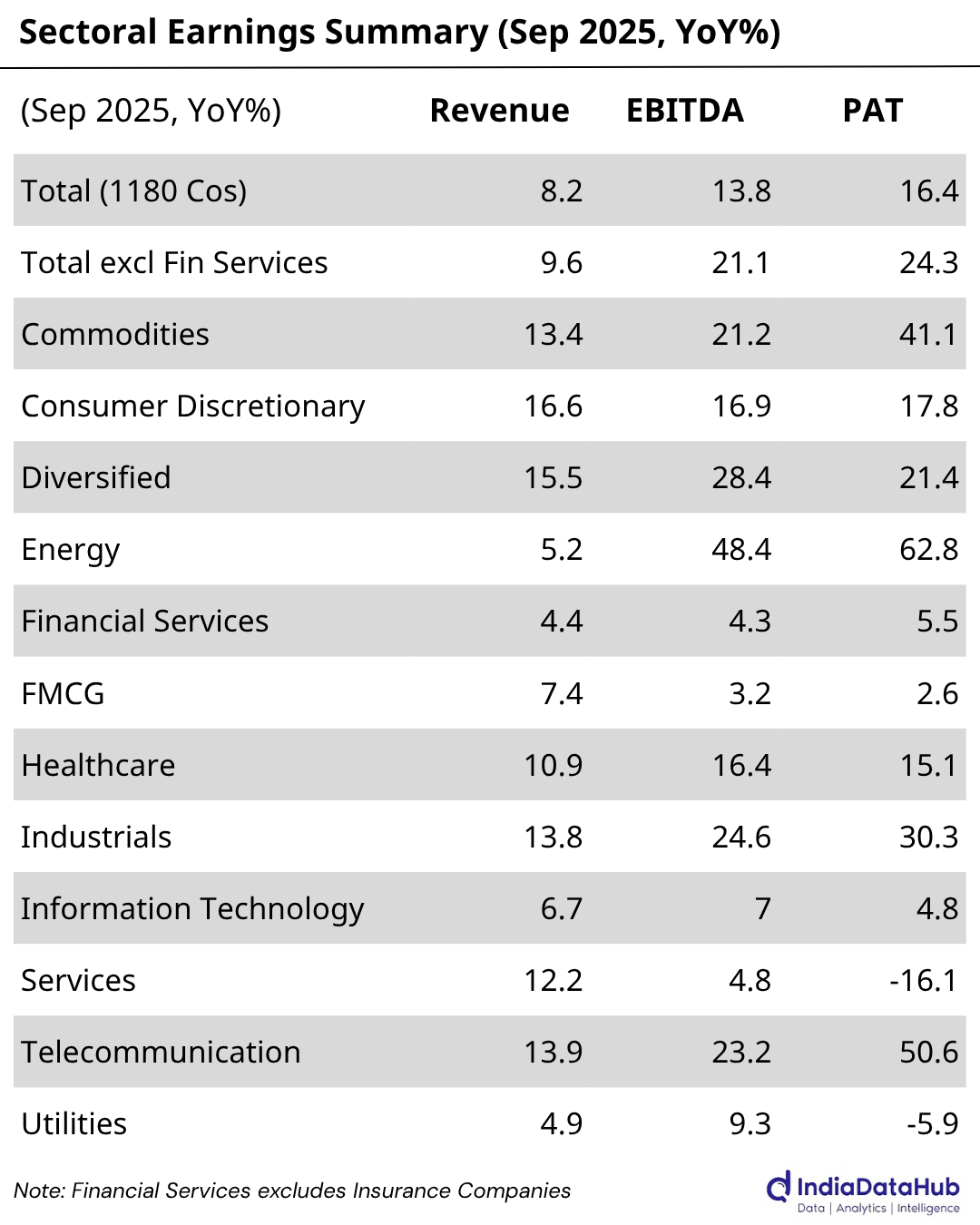

Energy, Commodities and Industrials continue to be the key sectors with especially strong margin performance driving profit growth.

Energy remained the top performer, with profits surging nearly 63% on the back of strong refining spreads and operational efficiency. Companies like Aegis Logistics delivered record volumes and multi-year highs in margins, while even softer performers such as Petronet LNG maintained stability through disciplined cost control.

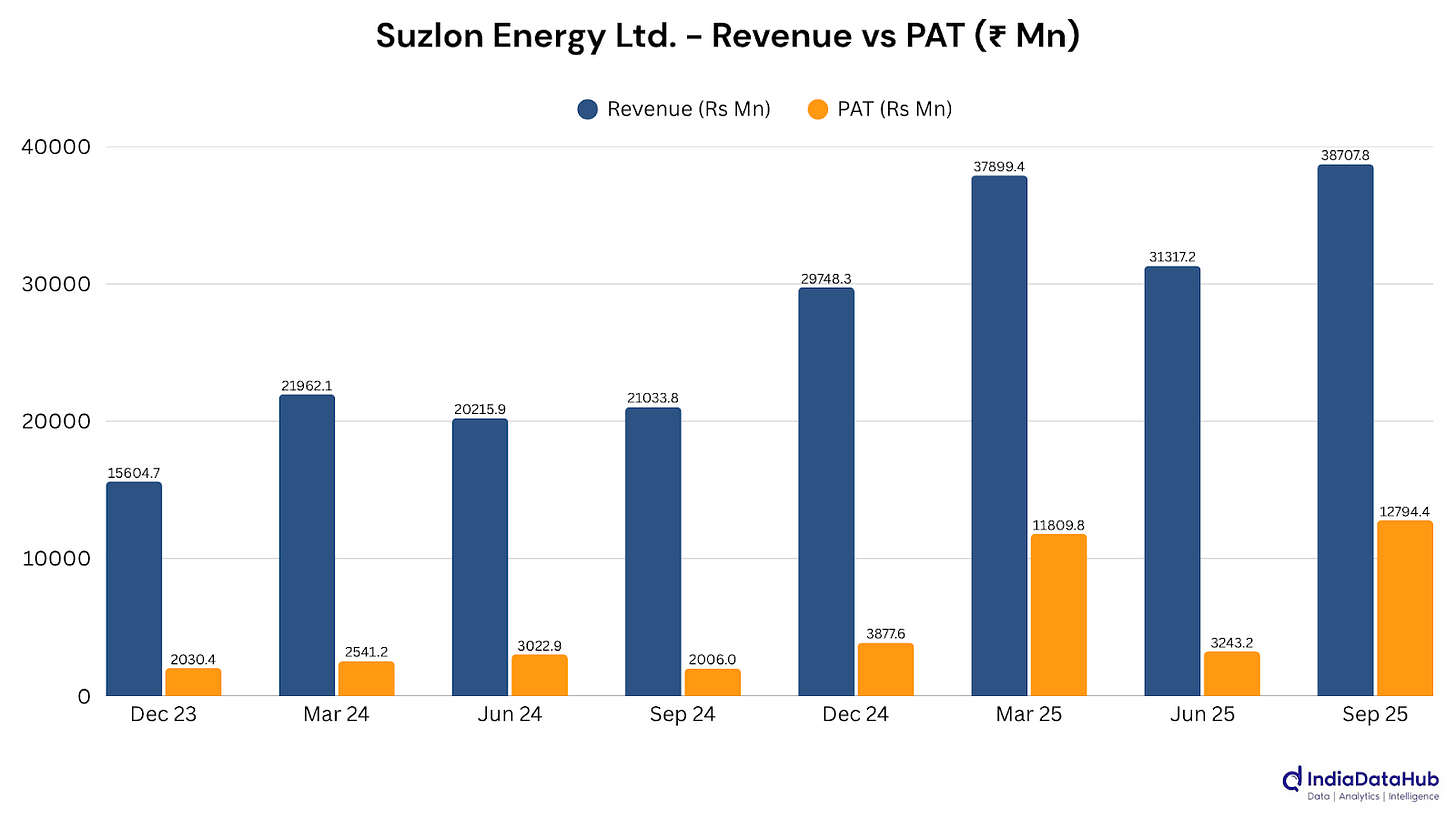

Industrials continued their broad-based uptrend, with profits rising over 30% and revenue up nearly 14%. The recovery remains rooted in execution strength and capex momentum. Suzlon Energy’s fivefold profit surge and Grasim Industries’ 76% jump underline how scale, diversification, and leverage on utilization are driving outperformance.

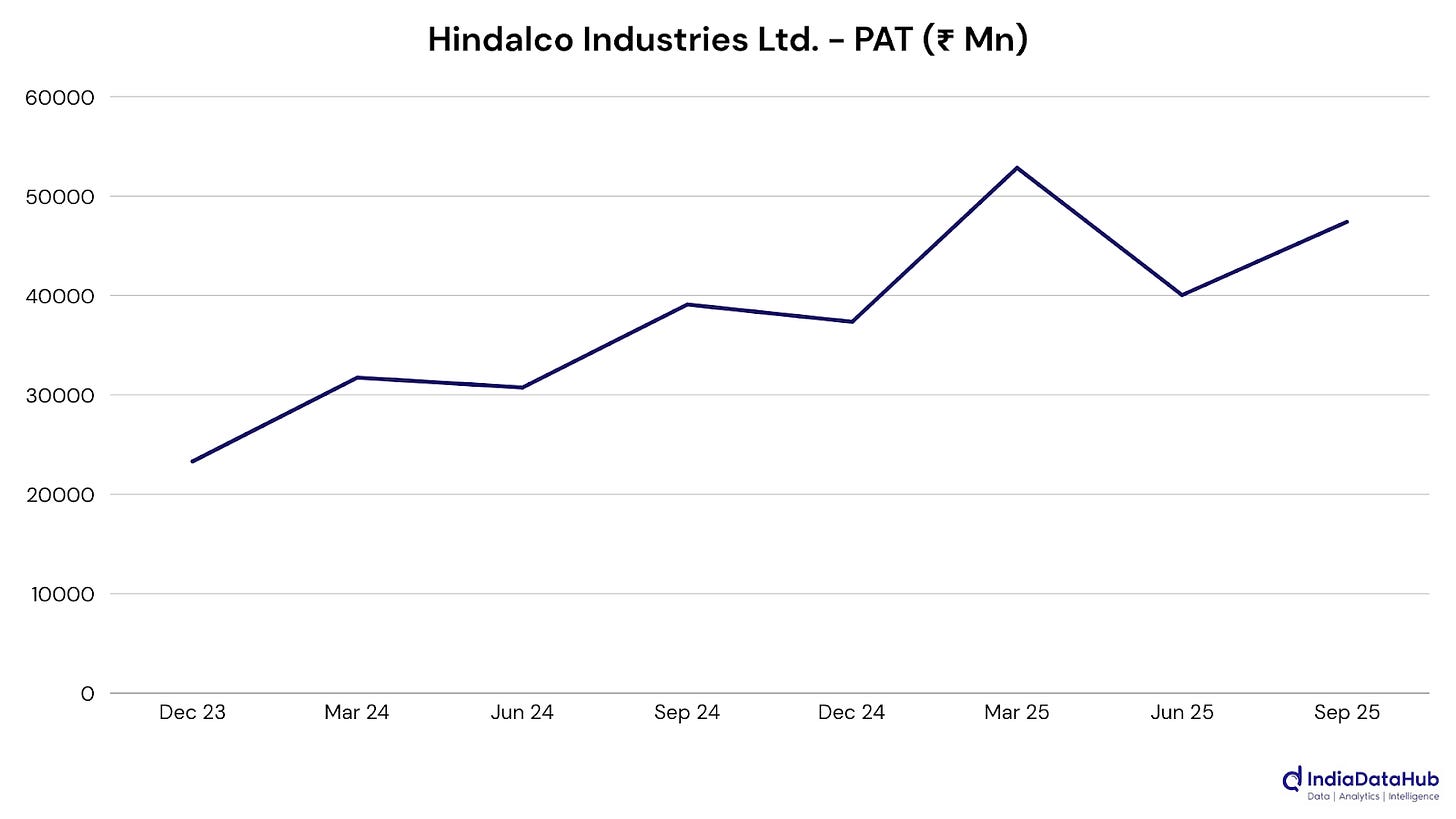

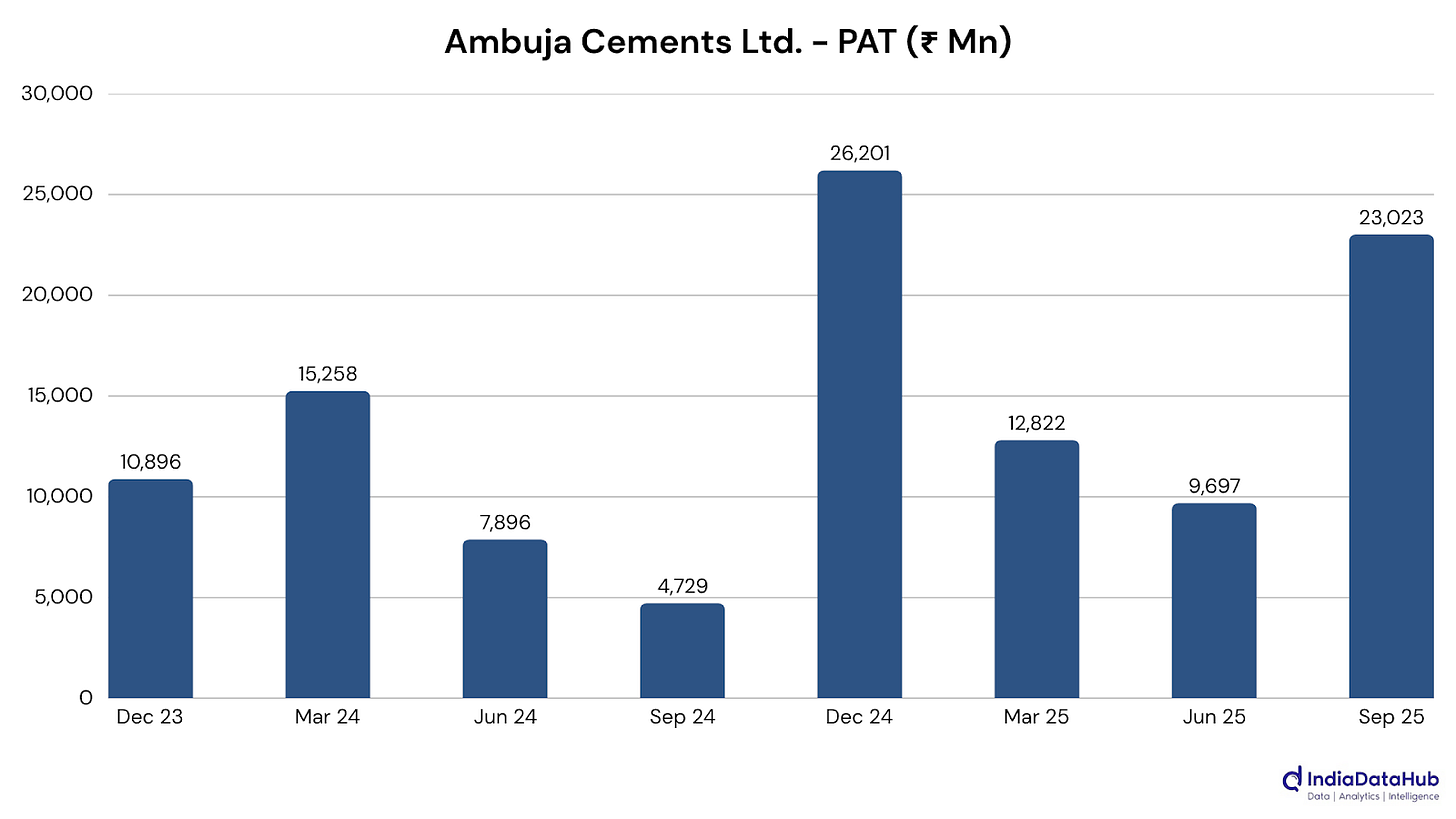

Commodities sustained their rebound, with profits up 41% and margin expansion evident across metals, cement, and fertilisers. Hindalco and NALCO benefited from firm non-ferrous prices and cost tailwinds, while Ambuja Cements and JK Cement reflected how pricing discipline and tax reversals helped cement players deliver standout quarters. Fertiliser majors like Paradeep Phosphates and Chambal Fertilisers rode strong volume momentum despite rising input costs.

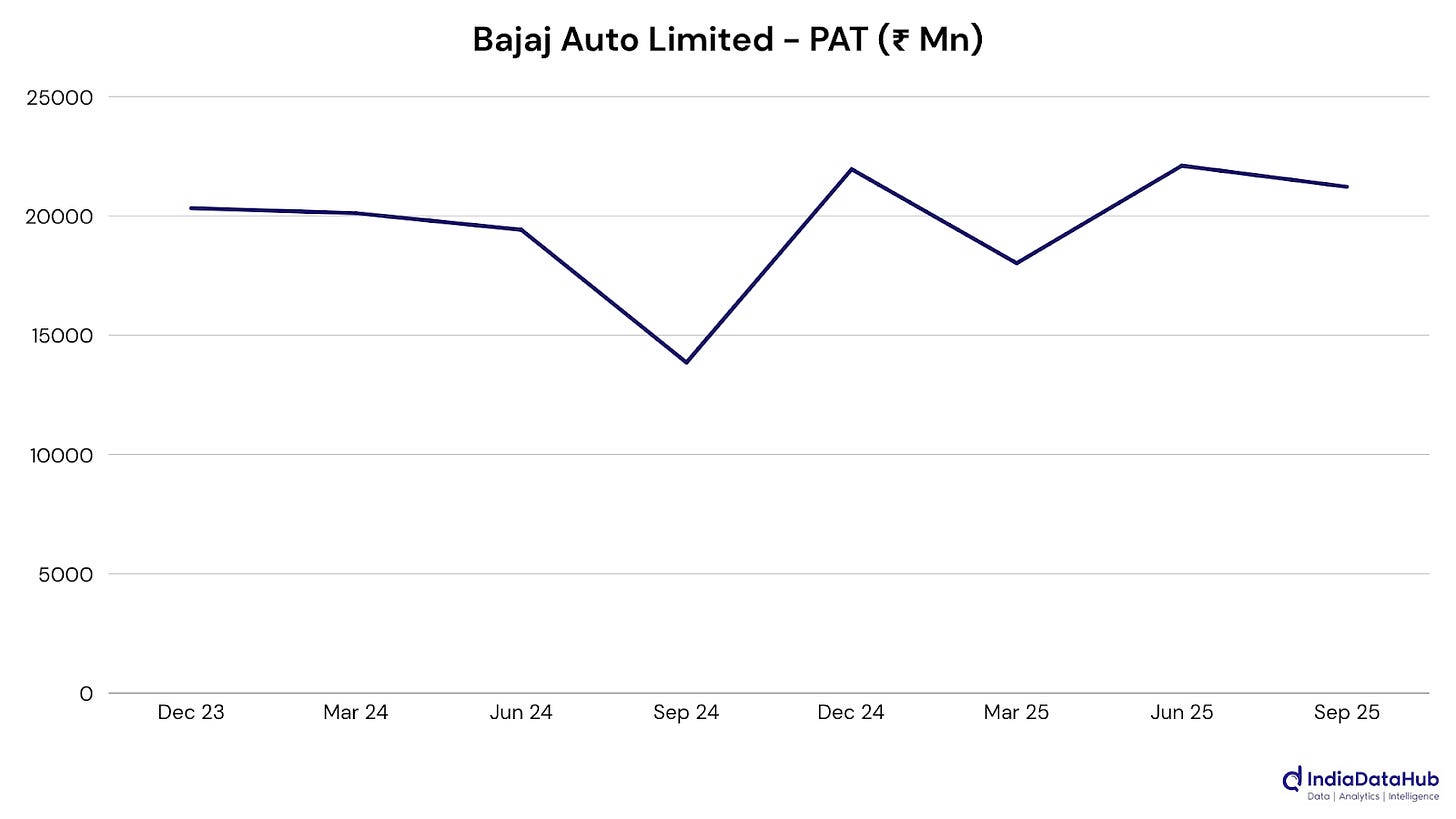

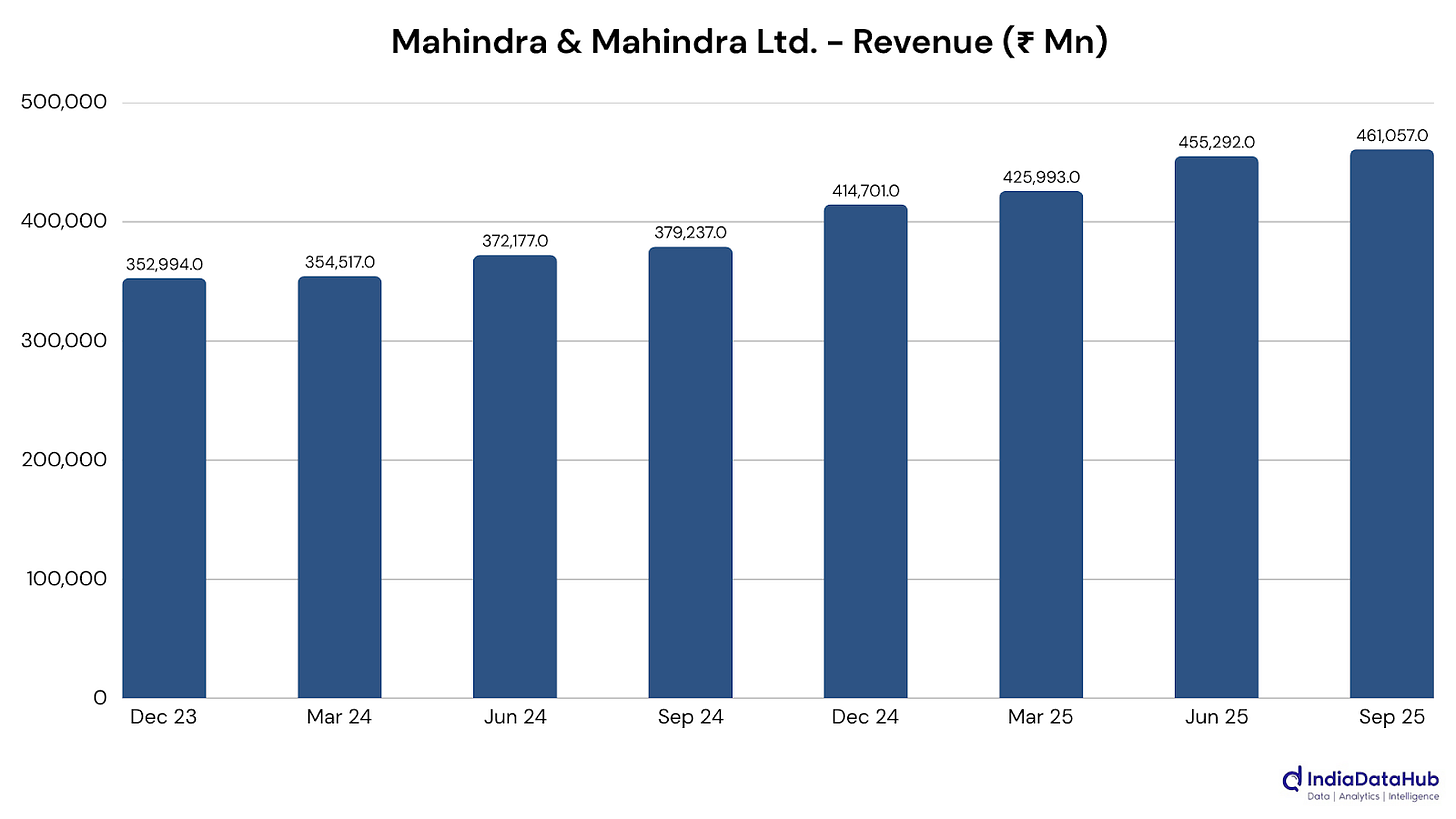

Consumer Discretionary remained upbeat, posting a 17.8% profit rise as festive and wedding-season demand lifted sales across autos, retail, and jewellery. Bajaj Auto and Kalyan Jewellers set new benchmarks, while Nykaa and Titan signalled sustained momentum in premium consumption. Trent and M&M continued to extend their structural gains through volume growth and margin resilience.

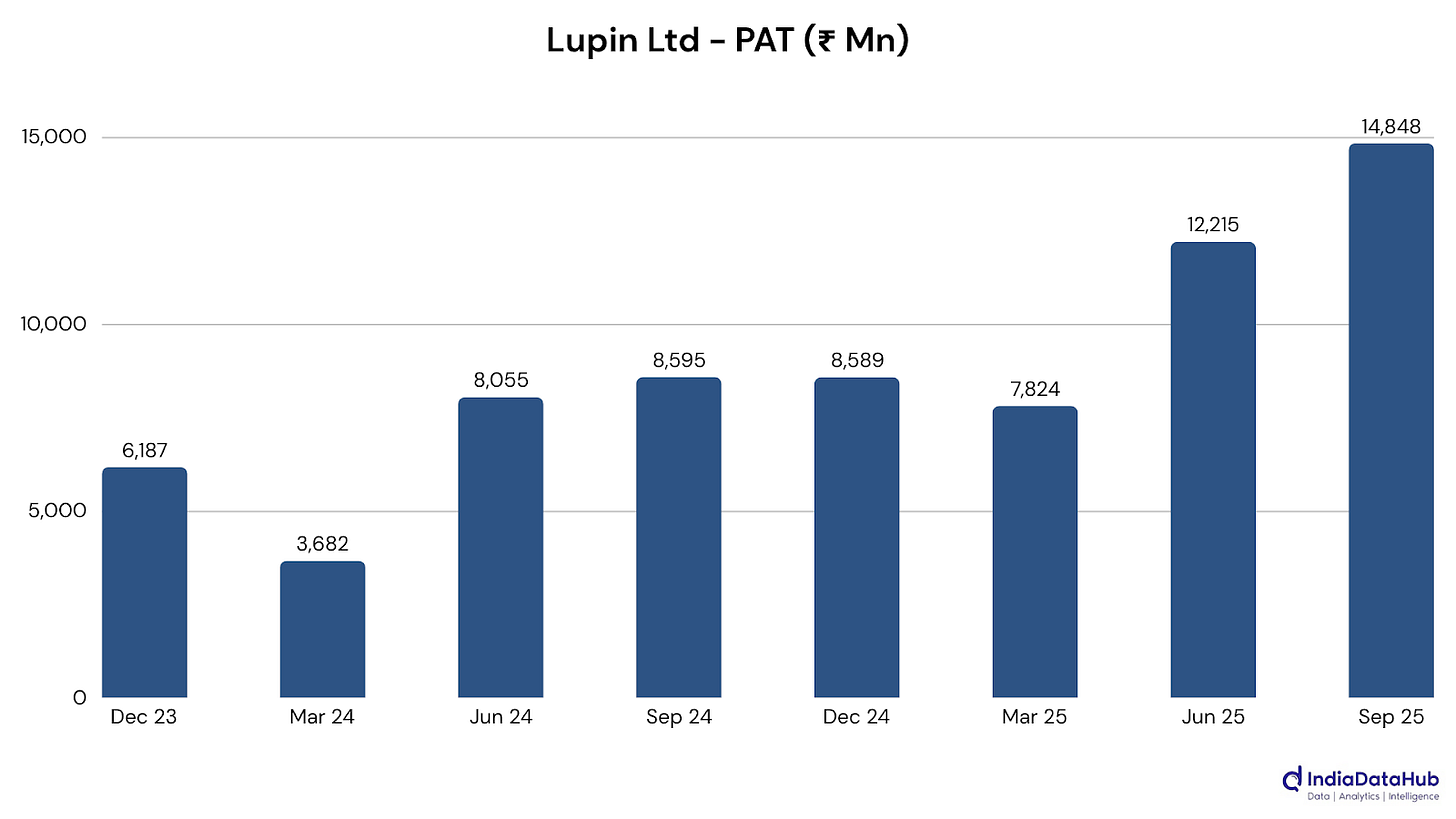

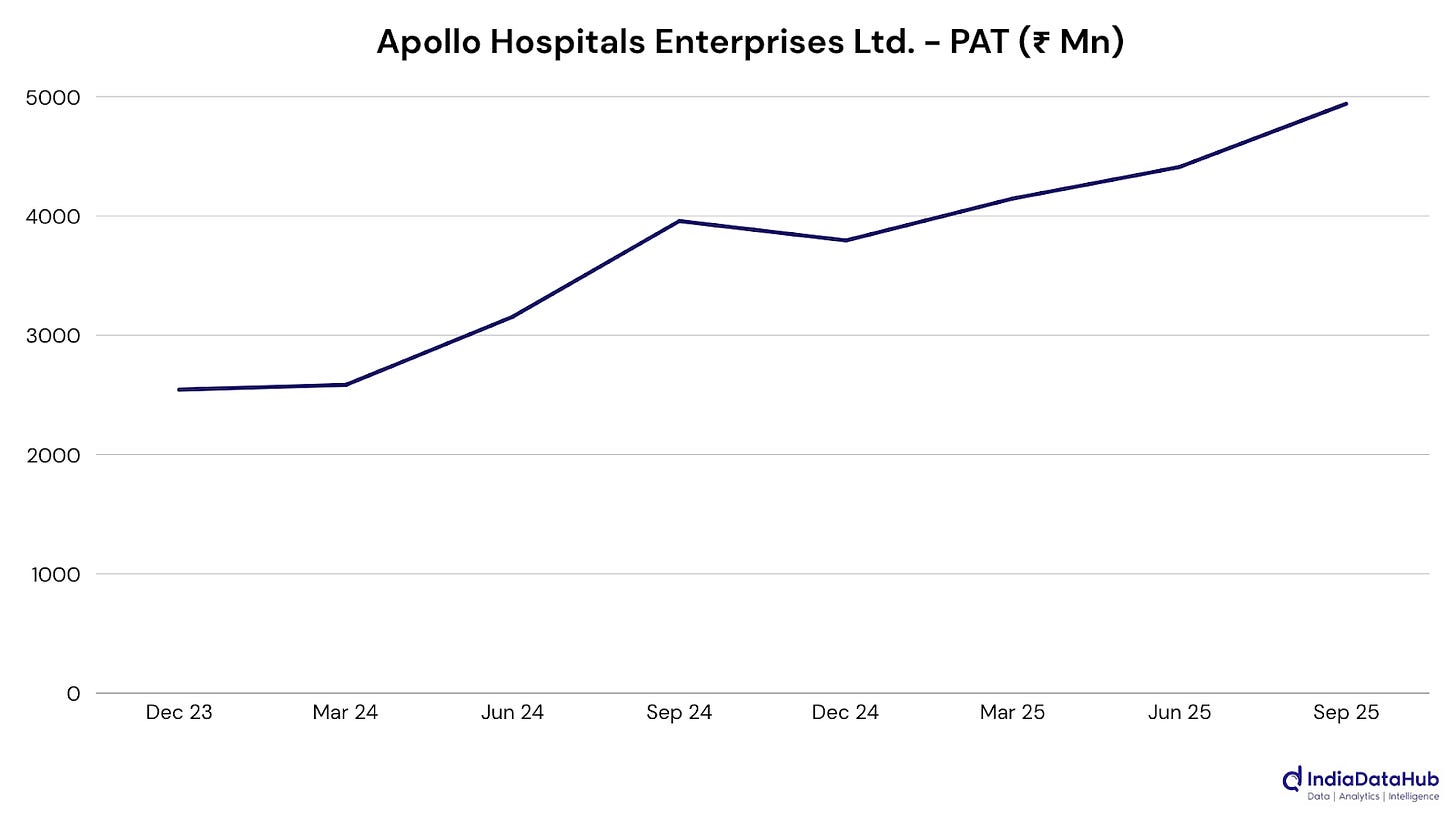

Healthcare and Information Technology both showed steady mid-teens growth in profits, with healthcare once again outperforming on stronger exports and branded formulations. Lupin, Zydus, and Torrent Pharma led the charge, while Apollo Hospitals and Divi’s Labs added scale through a mix of digital and global operations.

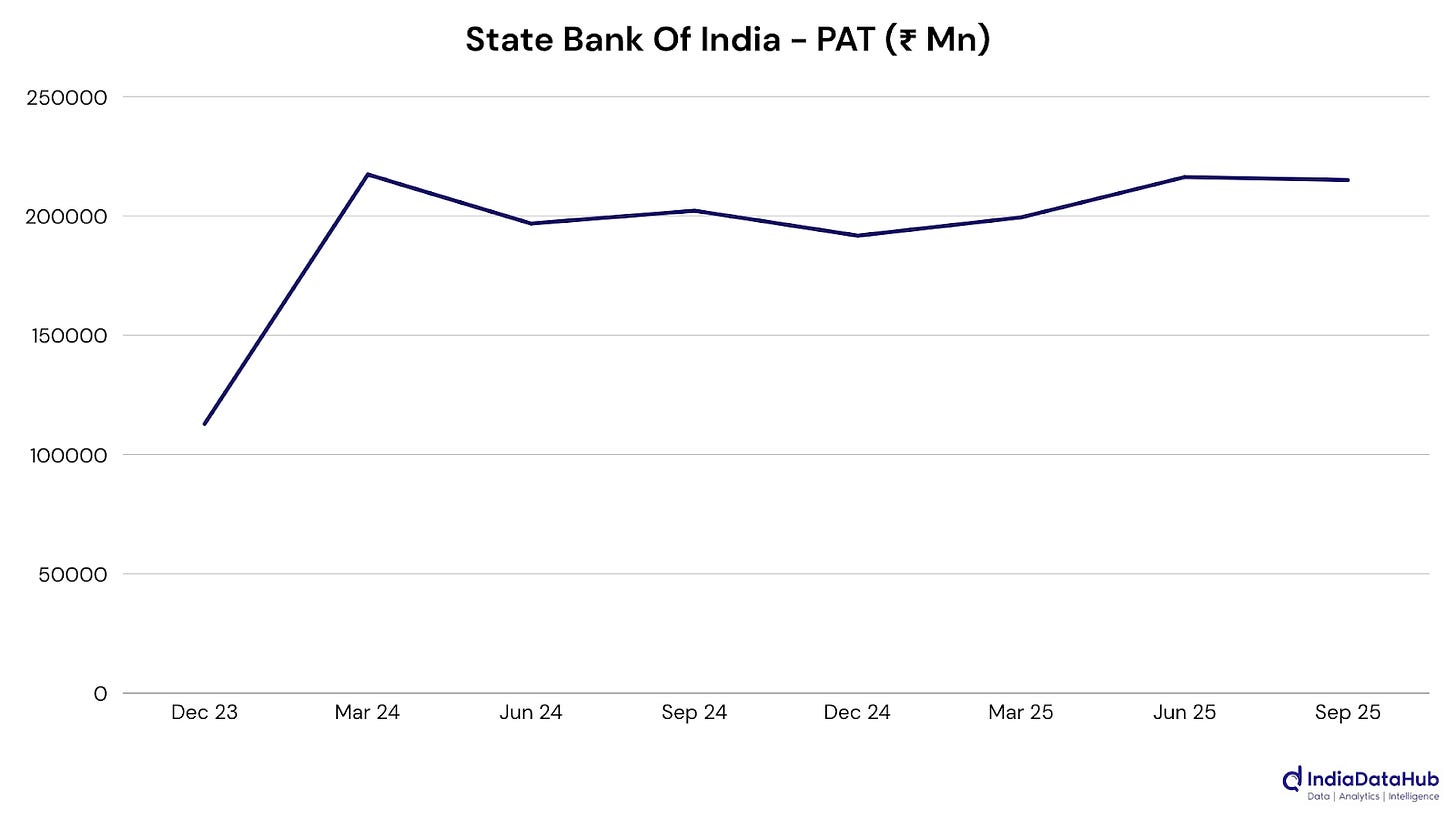

Among the more moderate performers, Financial Services remained stable, up 5.5%, led by SBI, Cholamandalam, and PFC, where loan growth and asset quality held firm even amid narrower NIMs. FMCG saw muted gains at 2.6%, though players like Britannia and Tata Consumer managed solid margin expansion despite uneven rural demand.

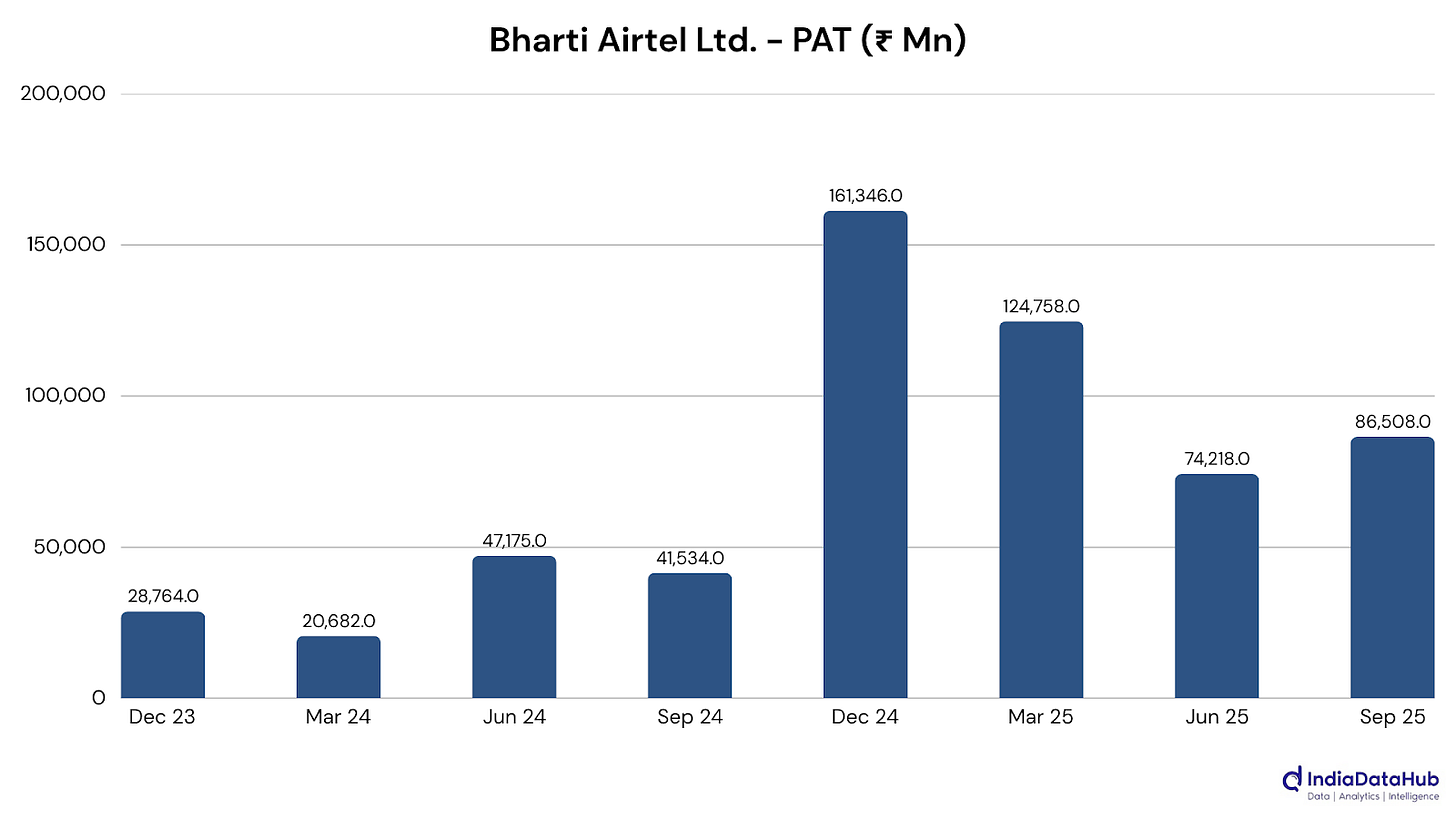

Telecom is having another strong quarter, with sector profits up 51% on the back of rising ARPU and data monetization, exemplified by Bharti Airtel’s doubling of profit. In contrast, Utilities and Services lagged, the former weighed down by higher costs at Power Grid, the latter by softer freight rates and integration costs that hit Delhivery and Shipping Corporation of India.

Key Results During The Week

Hindalco Industries Ltd. (Commodities): Revenue and profit rose sharply on stronger aluminium and copper demand, with downstream gains and Novelis’ steady performance adding lift. Cost discipline and expansion plans likely kept Hindalco’s growth momentum well-anchored despite higher debt.

Ambuja Cements Ltd. (Commodities): Revenue grew sharply by 22% and profit jumped nearly fourfold, driven by strong cement volumes and better operating performance, but amplified by a large income tax provision reversal. With record Q2 volumes and an ongoing efficiency- and expansion-led strategy, Ambuja is well-positioned to ride emerging sector tailwinds.

Bajaj Auto Ltd. (Consumer Discretionary): Record revenue and a more than 50% jump in profit marked this quarter, helped by a tilt towards premium bikes, strong exports, and healthier margins, while early EV efforts and cost discipline likely added support.

Mahindra & Mahindra Ltd. (Consumer Discretionary): Revenue jumped over 20% and profit grew strongly, underpinned by higher SUV and tractor volumes, healthier margins in auto and farm, and solid contributions from finance and tech arms that likely soften cyclicality.

State Bank of India (Financial Services): Revenue grew nearly 6% and profit rose a little over 6%, helped by steady retail and SME loan growth and improving asset quality. A one-time Yes Bank stake sale boosted results, but even without it, SBI’s broad-based credit growth and low NPAs underscore its strong fundamentals.

Lupin Ltd. (Healthcare): A standout print as revenue climbed 24%, but the main story was profit, which jumped nearly 73% as EBITDA margins pushed into the mid-30s. Much of the uplift seems to be coming from a stronger US franchise, where high-value launches and new ANDA approvals are adding heft, alongside faster-growing emerging markets. With R&D spending still healthy and a visible pipeline in specialty generics and possibly biosimilars, Lupin looks to be shifting from a basic volume game toward a more disciplined, margin-rich growth phase rather than just riding a one-off quarter.

Apollo Hospitals Enterprises Ltd. (Healthcare): Revenue rose nearly 13%, and profit jumped 25% as both hospital operations and digital health platforms grew strongly. Pharmacy and diagnostics drove much of the momentum, while Apollo HealthCo’s fourfold profit surge stood out as a highlight. Even with occupancy easing slightly, margins held firm and expansion plans gathered pace, with thousands of new beds and wider tech integration set to power Apollo’s next growth chapter.

Suzlon Energy Ltd. (Industrials): This was an outsized quarter: revenue surged 84% and profit leapt over fivefold, powered by record turbine deliveries and fat operating leverage as execution scaled up. On top of that, a large tax write-back gave the bottom line an extra one-off boost, making the headline numbers look even more dramatic. With a hefty multi-GW order book, net cash on the balance sheet, and policy tailwinds for wind and hybrid projects, this looks more like an inflection phase than just a lucky quarter.

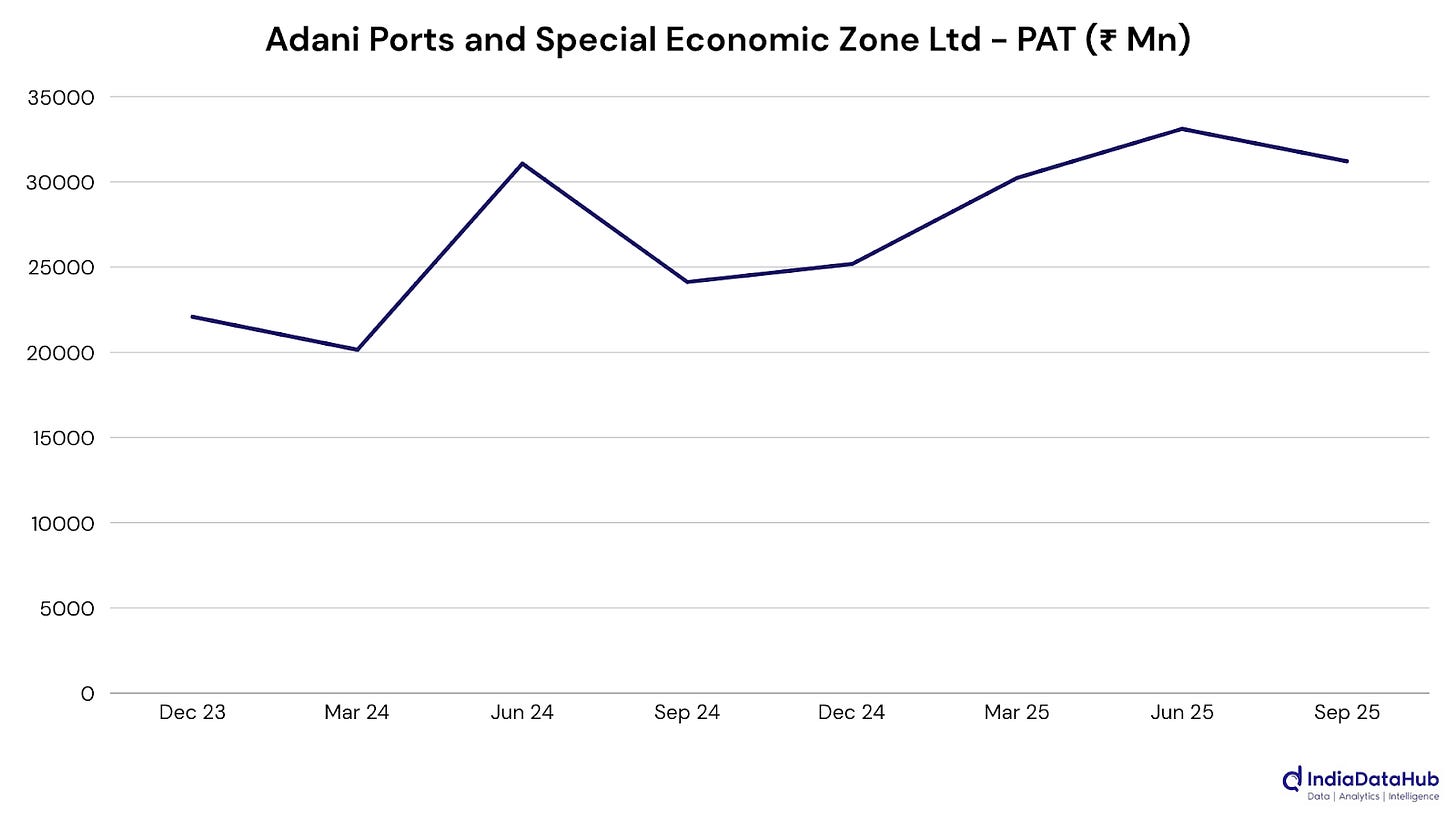

Adani Ports and Special Economic Zone Ltd. (Services): This was a big step-up quarter: revenue and profit both rose about 30%, with higher cargo volumes at domestic ports, a surging logistics arm, and a turbocharged marine business (helped by new vessels) all pulling in the same direction. Even with a slight margin squeeze, EBITDA climbed strongly and returns on capital improved, suggesting the integrated “port-to-hinterland” model is starting to pay off in a more durable, compounding way rather than just riding a trade uptick.

Bharti Airtel Ltd. (Telecommunication): Logged a standout quarter with revenue up 26% and profit more than doubling, helped by higher ARPU, more premium/postpaid users, and solid India–Africa growth, as 5G rollout and digital services deepen its grip on high-value customers.

That’s it for this edition. There will be a lot more to analyse and unpack in the coming weeks; we’ll be back next week!