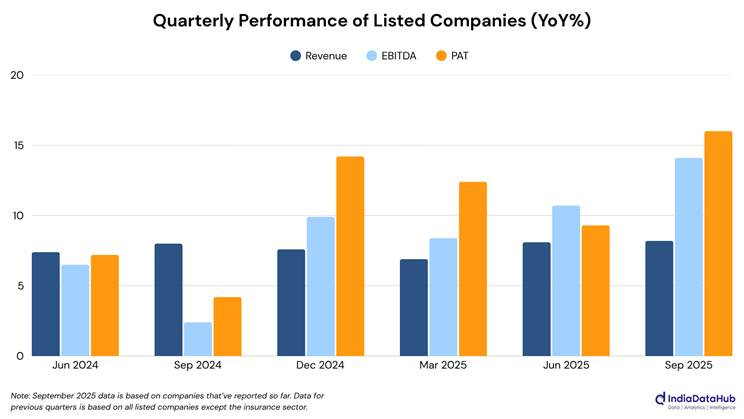

Welcome back to This Week in Earnings. We are almost at the end of the 2Q FY26 reporting season which saw a flurry of companies reporting. Over 3500 companies have reported the results, and the trends are now fairly representative. And the numbers reinforce just how broad the recovery has become. Aggregate revenues have risen 8.2% year-on-year, while EBITDA and PAT climbed 14.1% and 16.0%, respectively. Excluding Financial Services, profit growth accelerated to 22.5%, driven largely by margin gains rather than pure volume strength, a pattern that has defined much of this season so far.

This newsletter is structured into two sections:

The first section tracks aggregate and sectoral trends so far

The second dives into the standout company results during the last week

Want to dig deeper? Download the extended edition for full sector-wise company data and detailed performance notes.

Key Sectoral Trends

The week’s strongest impulses came again from Commodities, Energy, Healthcare, and Industrials, where both scale and margin leverage were the highlights.

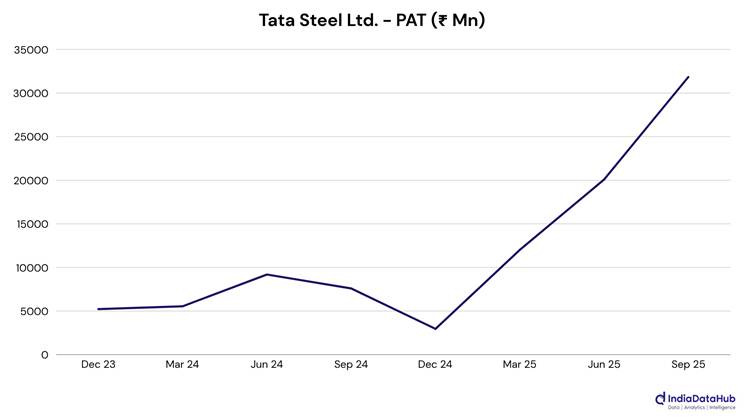

Commodities delivered one of the strongest performances of the week, with sector profits rising 44.1% and revenue up 13.4%. Metals and mining companies drove much of the surge: Tata Steel’s domestic delivery strength, Lloyds Metals’ volume-price combination, and Jindal Stainless’ mix improvements all fed into broader margin expansion across the pack. Fertilisers had a more mixed report: Rashtriya Chemicals & Fertilizers and EID Parry benefitted from firm demand, but National Fertilizers slipped into a small loss as rising gas costs overwhelmed subsidy support.

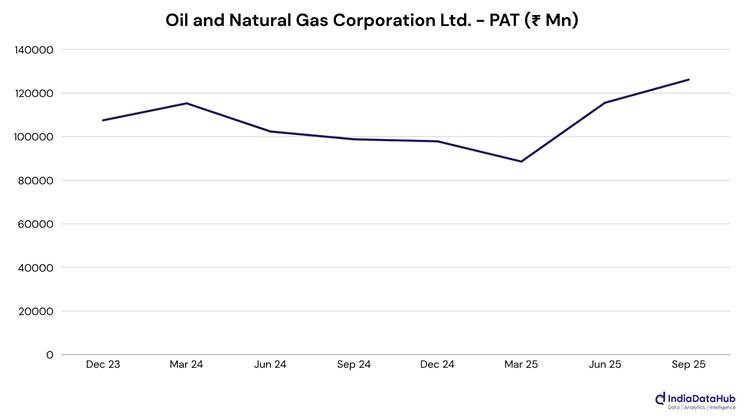

Energy remained a major driver of profitability, with PAT growing nearly 52%. Gandhar Oil posted one of the cleanest improvements this season, driven by stronger demand, a better mix, and tighter cost control. ONGC also delivered a strong profit jump despite flat revenue, helped by firmer gas prices and improved operational efficiency. City-gas players such as Gujarat Gas and IGL had a tougher quarter, with rising input costs clearly narrowing margins even as volumes stayed healthy.

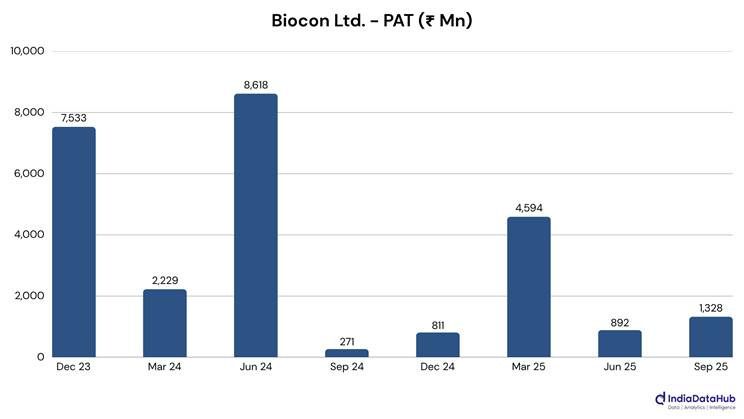

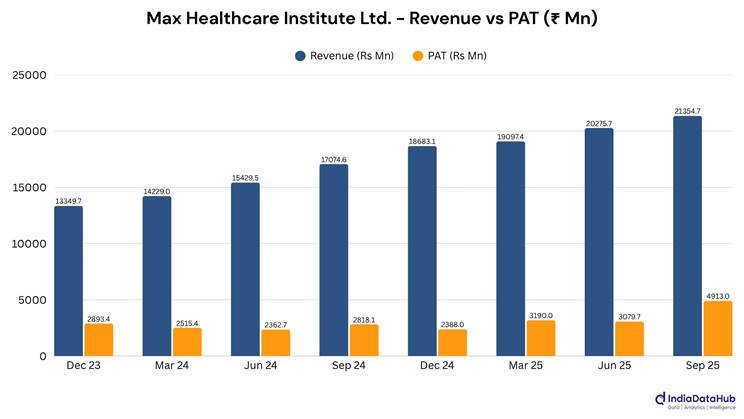

Healthcare sustained its multi-week outperformance, with profits up 16% and revenue up 13%. The breadth of strong prints stood out: Biocon’s biologics and biosimilars scale-up, Max Healthcare’s rising occupancy and higher-acuity case mix. On the pharma side, JB Chemicals, Emcure, Glenmark (excluding its large one-off), and Granules India delivered margin improvement through better global product sales and more efficient APIs.

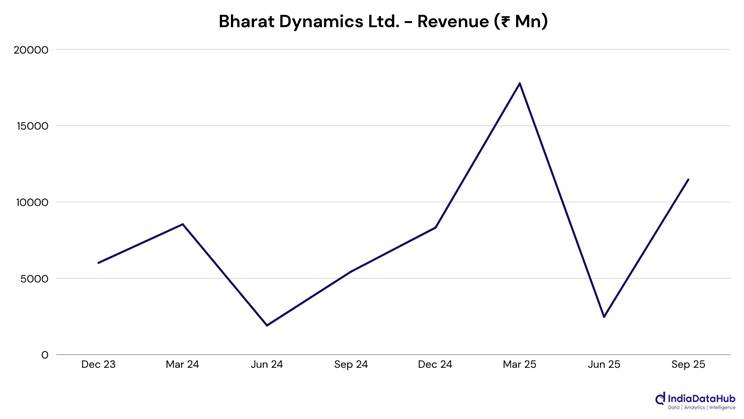

Industrials posted another balanced week with profits rising 18.7%. Defense and engineering drove the upside: Bharat Dynamics’ revenue more than doubled on missile execution, while KEC International reported nearly twice the profit thanks to strong margins and record order books. Syrma SGS showed the strength of broad-based demand, while traditional EPC names like Afcons and Cochin Shipyard saw margins squeezed by monsoons, delays, and execution bottlenecks. HAL and Ashok Leyland delivered steady but slightly softer prints on mix and cost pressure.

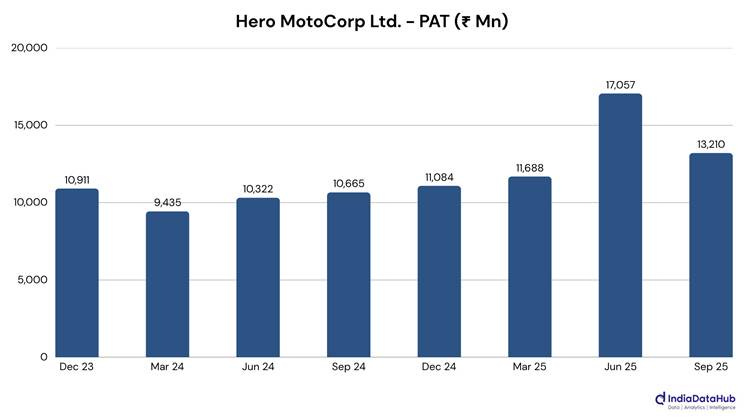

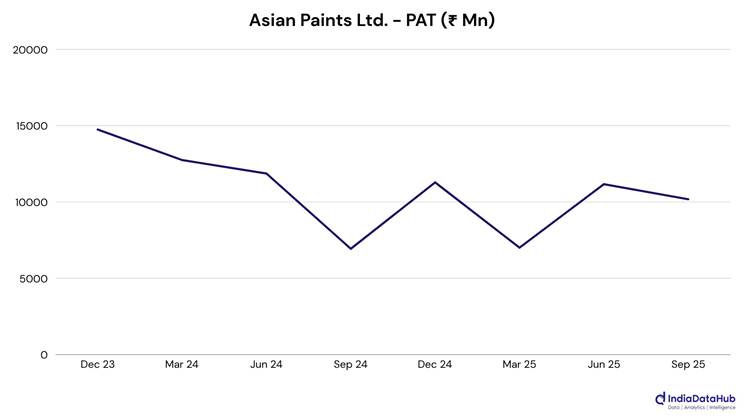

Consumer Discretionary grew 17.5% in profits despite highly divergent performances across the sector. Hero MotoCorp and PN Gadgil rode festive-season momentum and improving margins. Asian Paints turned modest revenue growth into a robust profit surge through mix upgrades and scale efficiencies. At the other end, Voltas struggled with a weak summer and higher spending, while Welspun Living faced the full weight of US tariffs and soft global demand. Autos, durables, and retail reflected a clear split between premium-led outperformers and those exposed to global or seasonal swings.

FMCG revenues have risen by 10%, but profit growth has stayed muted at 1.7%. Margin pressure persisted even among companies that delivered strong top-line prints. KRBL and Parag Milk showed the benefits of a stronger mix and overseas traction, while Gujarat Ambuja Exports and Marico saw higher raw material and brand-building costs squeeze profitability.

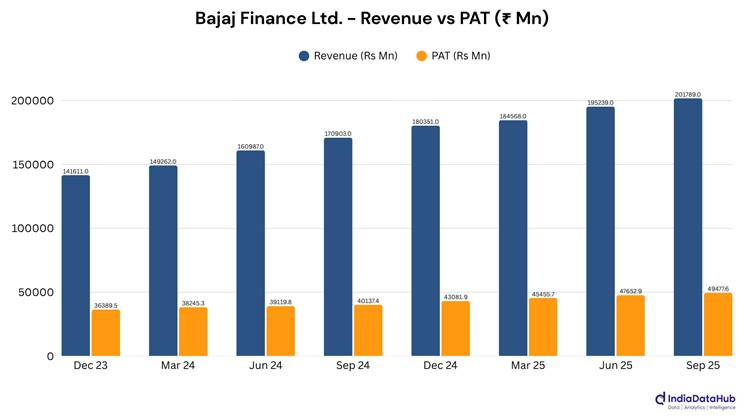

Financial Services have posted a 6.2% profit growth, consistent with the season’s stable tone. Bajaj Finance and Muthoot Finance continued to deliver broad-based strength, driven by loan growth, clean asset quality, and stronger NII and fee momentum. Infibeam Avenues reported a sharp revenue jump tied to scale and strategic repositioning, while Prithvi Exchange and Karnataka Bank weakened under narrower spreads, heavier taxation, and FX instability.

Telecommunication delivered the biggest statistical jump of the week, with profit up 143%, though most of the improvement came from lower finance costs and a stabilising operational base.

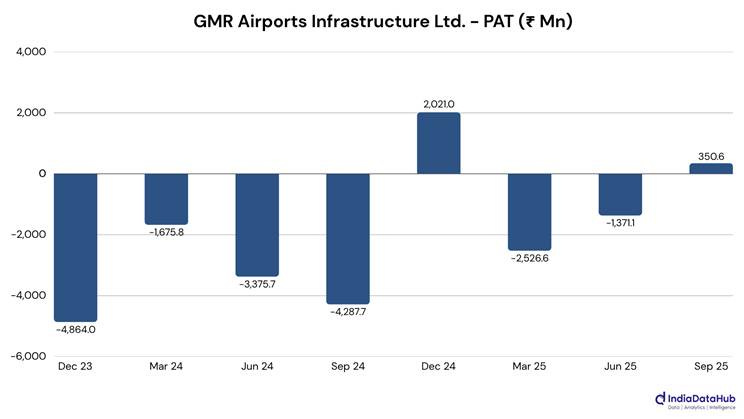

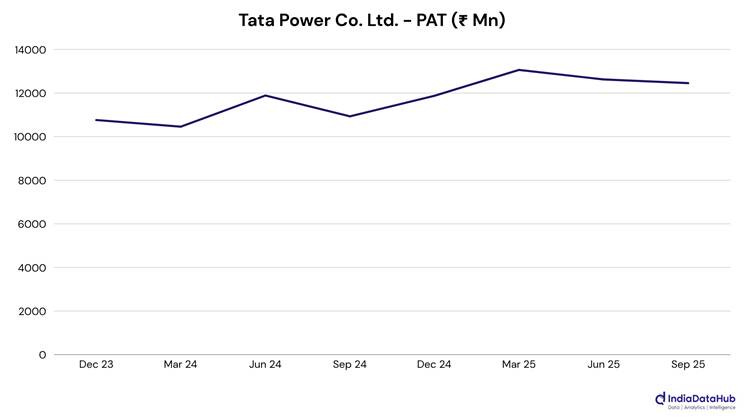

Services grew revenue by 14%, but PAT remained almost flat due to freight softness and integration-related pressures. Utilities saw profits fall 17%, reflecting cost pressures and last year’s high base, though Torrent Power and Tata Power posted strong underlying earnings.

Overall, this week’s results reinforce the season’s broader theme: margin gains, cost control, and mix upgrades are driving profitability more than top-line acceleration. Even where demand has been patchy (eg: consumer durables, capital-heavy infrastructure), disciplined execution has helped keep the earnings cycle on a firmer footing.

Key Results During The Week

Tata Steel Ltd. (Commodities): Posted a standout quarter, with domestic steel deliveries lifting the top line and a sharp profit surge powered by stronger India operations and cleaner overseas performance. Cost discipline and a better product mix helped margins open up meaningfully, while recent strategic moves in downstream businesses signaled a push toward a more balanced, higher-value portfolio. Despite a choppy global backdrop, the company’s steady execution at home did most of the heavy lifting this time.

Hero MotoCorp Ltd. (Consumer Discretionary): Logged record revenue and profit as festive-season demand stayed strong across bikes, scooters, and a growing EV line-up, with overseas markets also adding momentum and margins improving even while input costs and broader macro uncertainties remained in the backdrop.

Asian Paints Ltd. (Consumer Discretionary): Turned in an impressive print, with modest revenue growth translating into a sharp profit jump as decorative volumes stayed strong and margins widened on a better mix and efficiencies, even as monsoon disruptions and input-cost worries lingered in the background.

Bajaj Finance Ltd. (Financial Services): Delivered another strong quarter, with revenue and profit rising at a healthy clip as loan growth stayed broad-based, fees and NII picked up, and cleaner asset quality kept credit costs in check. Digital onboarding and product diversification continued to push the franchise’s usual momentum.

Oil And Natural Gas Corporation Ltd. (Energy): Reported almost flat revenue but a strong profit jump, as lower crude realizations were offset by slightly higher output, firmer gas pricing and tighter cost control, lifting margins and supporting a higher dividend.

Biocon Ltd. (Healthcare): Delivered a standout quarter, with healthy revenue growth turning into an outsized profit surge as biologics and generics gained scale, biosimilars lifted the mix, and last year’s one-offs fell out of the base. Stronger contributions from Syngene and steady regulatory approvals helped deepen operating leverage, resulting in a cleaner, more profitable print this time around.

Max Healthcare Institute Ltd. (Healthcare): Enjoyed a strong quarter with higher patient volumes, better occupancy, and rising revenue per bed, all pushing margins up. Diagnostics and home care are also adding significant weight, making the overall network look more balanced than before.

Bharat Dynamics Ltd. (Industrials): Delivered a standout quarter, with revenue more than doubling and profit jumping as missile programme execution picked up pace. Rising material costs followed the ramp-up, but order momentum still seems firmly intact. A thick defence order book and fresh missile contracts, such as the Invar deal, are likely to give Bharat Dynamics unusually clear multi-year visibility. If execution stays on track, that pipeline could smooth out year-to-year lumpiness and keep utilisation high.

GMR Airports Infrastructure Ltd. (Services): Posted a strong rebound, with traffic recovery and higher aero and non-aero income driving a sharp revenue jump and a clean swing to profit. Margins improved too, helped by smoother operations and new commercial initiatives across key airports.

Tata Power Co. Ltd. (Utilities): Turned in a solid quarter, with profit rising despite flat revenue as renewables, transmission, and distribution all delivered stronger earnings. New clean-energy capacity and a wider rooftop solar footprint kept momentum firm, even with a large arbitration matter still unresolved.

That’s it for this edition. There will be a few more results to analyse and unpack in the next week as the 2Q results season draws to a close. See you then…

Hi - Is the table for earnings simple average across all companies or market cap weighted - or something else? Thanks.