Welcome back to This Week in Earnings. The third quarter of FY26 earnings season has (almost) come to an end with over 4000 companies having already reported their December quarter results.

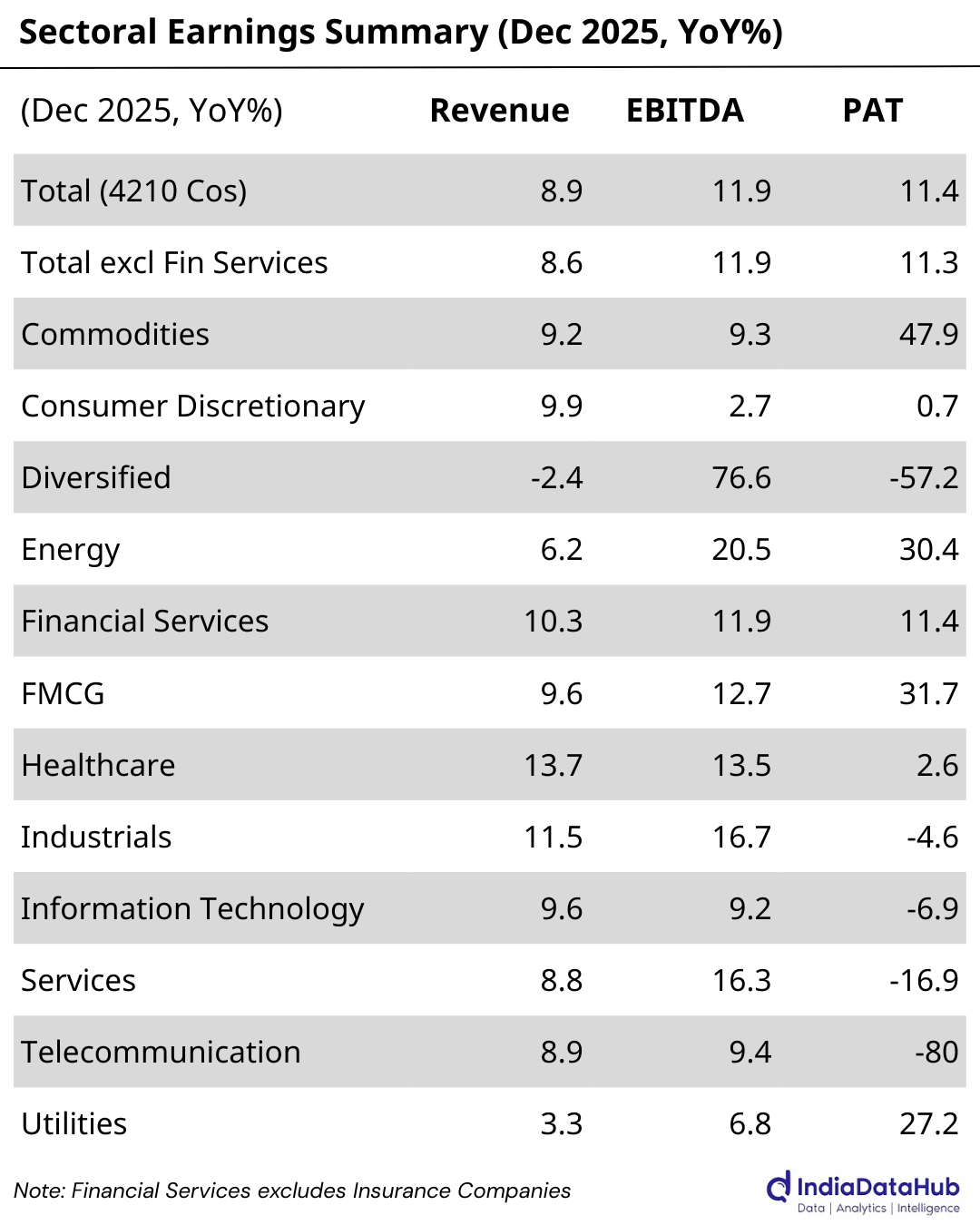

For the quarter, revenues have grown by ~9% YoY. While slower than last quarter, this is the second highest growth in almost the last 3 years. Operating profits (EBITDA, ex financials) have seen double digit growth (~12%). And once again while growth was slower than last quarter, operating profit growth is the strongest in the last 2 years. Below the line items dragged down profit growth to 11%. Depreciation expense in particular has been a drag on profitability.

This newsletter is structured into two sections:

The first section tracks aggregate and sectoral trends, highlighting what’s propelling growth this week.

The second dives into standout company results shaping those numbers.

Aggregate Trends

Commodities is the standout on reported profit growth, with revenue and EBITDA both growing around 9% while PAT surged 47.9%, thanks to cost control and operating factors. Energy and FMCG are the clearest margin-led pockets. Energy posted 6.2% revenue growth, but EBITDA and PAT grew much faster at 20.5% and 30.4%, pointing to pricing discipline and operating strength. FMCG shows a similar pattern, with revenue at 9.6%, EBITDA at 12.7%, and PAT at 31.7%. When several sectors are struggling to convert topline into profit, both sectors stand out for stronger earnings transmission.

Consumer Discretionary remains mixed. Revenue growth of 9.9% indicates demand remains strong, but EBITDA growth is slow at 2.7%, with PAT nearly flat at 0.7%. Healthcare shows the same divergence in a sharper form. It is the fastest-growing sector in revenue, with EBITDA growth nearly as strong at 13.5%, yet PAT is at just 2.6%. So, while sector demand and execution appear strong, net profit is lagging due to non-operating or one-off factors.

Industrials and Services also fit the “activity strong, profits weak” pattern. Industrials posted 11.5% revenue growth and 16.7% EBITDA growth, but PAT declined 4.6%. Services tells a similar story, as revenue grew 8.8% and EBITDA 16.3%, yet PAT fell 16.9%. In both sectors, the operating layer looks far better than the bottom line, which makes EBITDA a cleaner signal than PAT.

Information Technology and Telecom remain the weakest pockets in profit conversion. IT delivered 9.6% revenue growth and 9.2% EBITDA growth, but PAT declined 6.9%. Telecom is the most stressed print in the set. Revenue and EBITDA growth are both near 9%, but PAT is -80%, indicating severe pressure below the operating line.

Financial Services is comparatively steady and, importantly, not distorting the overall earnings picture. Revenue, EBITDA, and PAT growth are all tightly clustered at 10.3%, 11.9%, and 11.4%, making it one of the cleaner sectors in terms of earnings conversion. Utilities, meanwhile, shows modest revenue growth at 3.3% but much stronger PAT growth at 27.2%.

Overall, with this week’s earnings added, our pattern is further reinforced. Growth remains broad-based, but profit quality is uneven across sectors. The aggregate numbers are healthy, yet sector dispersion is still high, and in several cases, EBITDA is telling a materially better story than PAT. The key takeaway, then, goes beyond the fact that revenues are growing; it is more about which sectors are actually converting that growth into durable profitability.

Company Spotlights

ABB India Ltd. (Industrials): Revenue hit a record quarter with broad traction across electrification, motion, and automation, while profit momentum stayed softer as margins narrowed on input and labour costs. This appears tied to strong capex demand, with cost pressures still passing through.

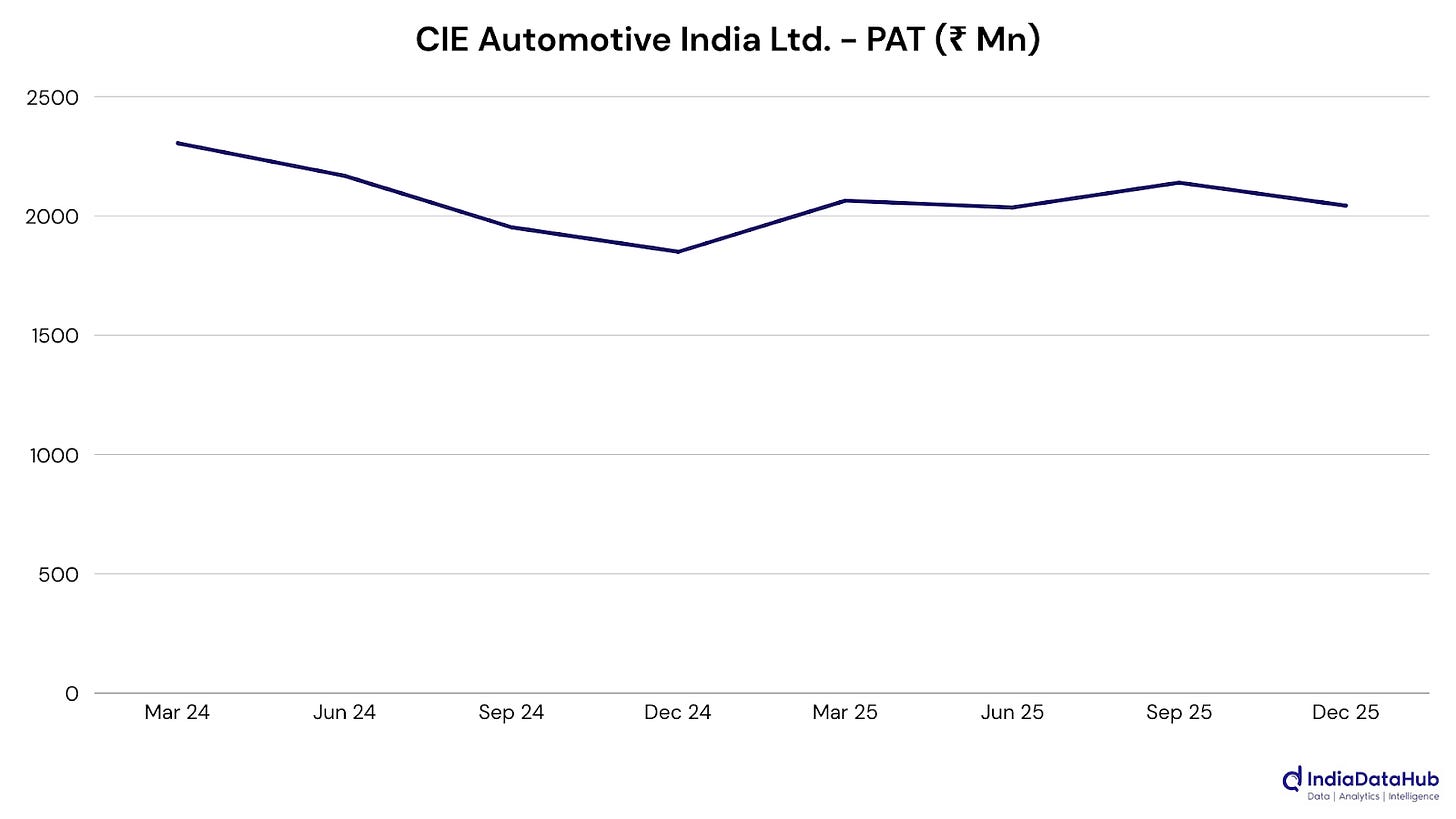

CIE Automotive India Ltd. (Consumer Discretionary): Revenue stayed strong on healthy OEM demand and volume growth, but profit rose at a slower pace as margins tightened under higher input and personnel costs. That mix seems to reflect solid scale, with cost pressure still weighing.

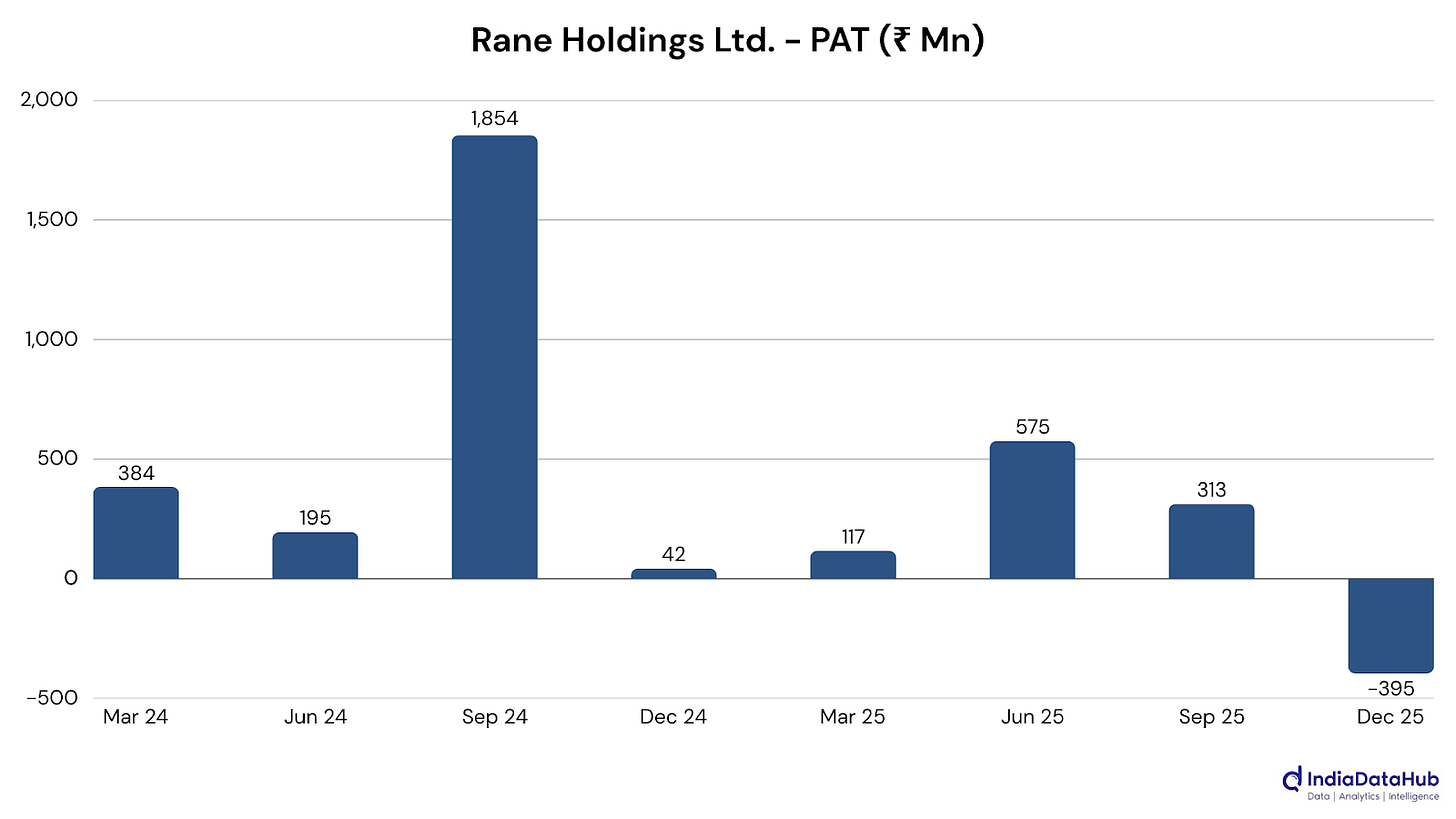

Rane Holdings Ltd. (Financial Services): Revenue grew strongly, and operating performance improved, but the quarter slipped into a loss after a large warranty provision tied to a JV recall. The underlying business looks steadier than the headline profit print suggests.

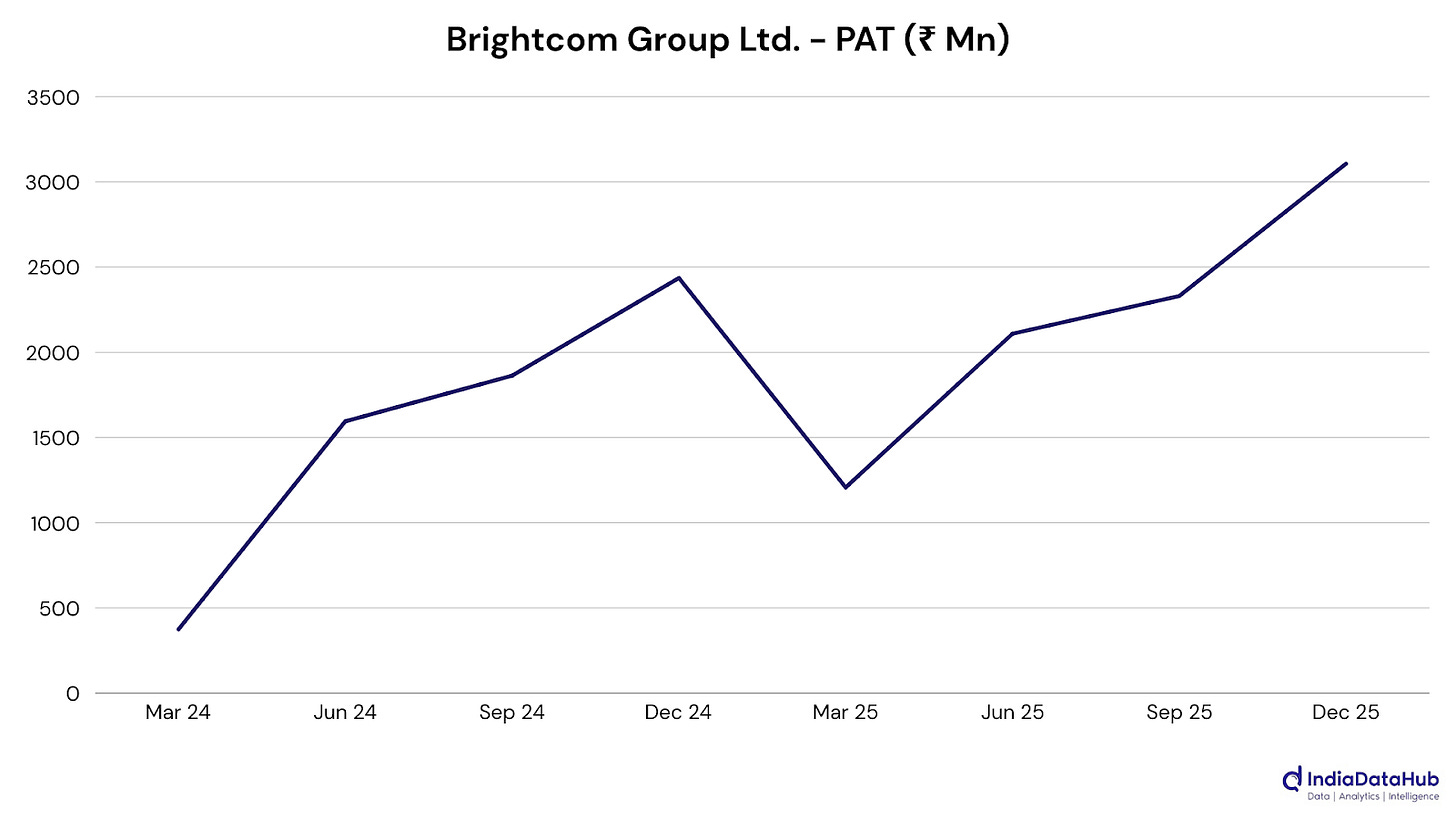

Brightcom Group Ltd. (Information Technology): Topline and profit growth were strong, helped by higher digital ad volumes and platform integrations, though margins narrowed as costs rose. That pattern may point to scaling-led expansion, with investment intensity still running high.

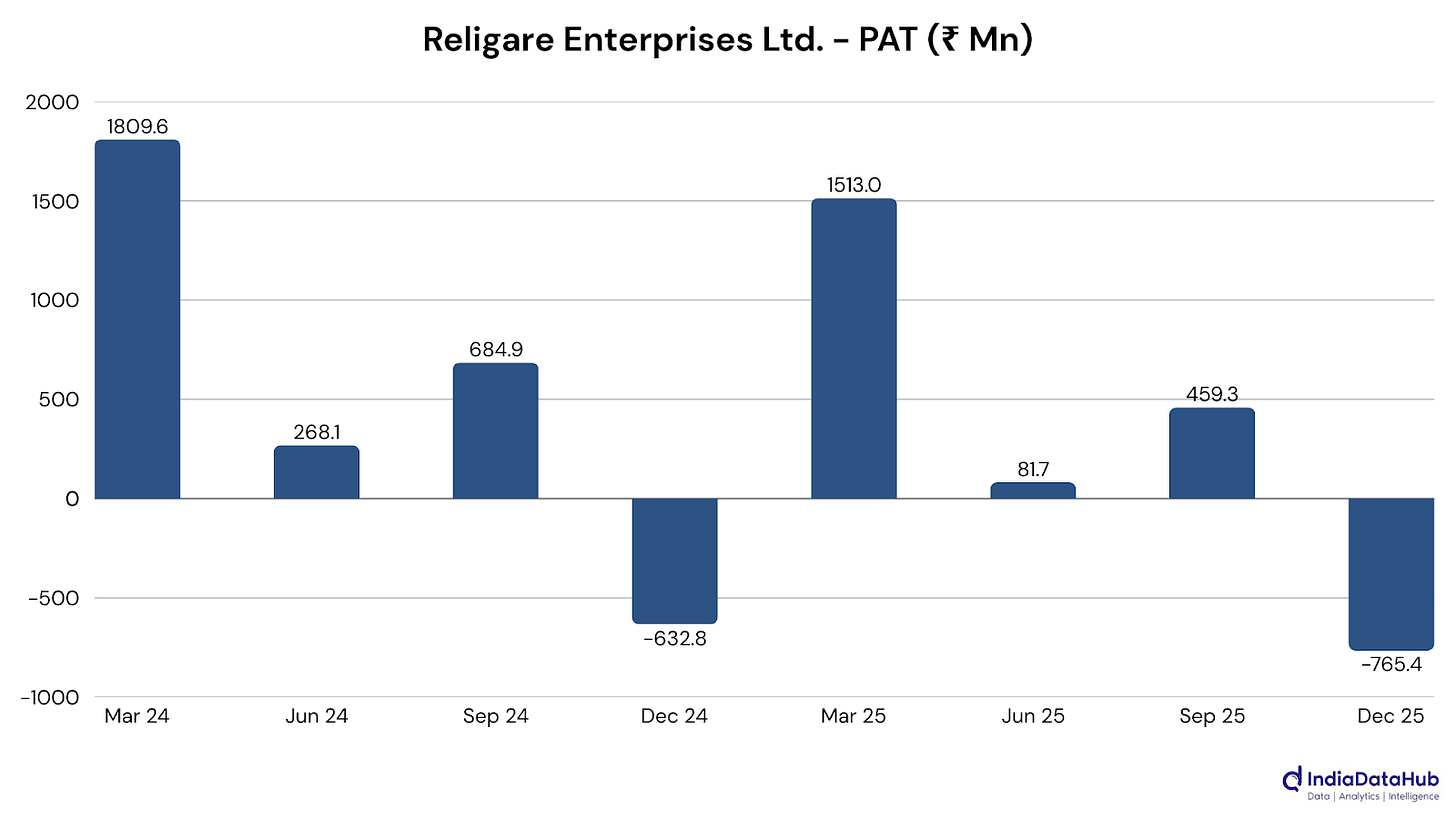

Religare Enterprises Ltd. (Financial Services): Income growth remained strong, led by insurance and broking, but the loss widened as claims and operating costs ran ahead of topline expansion. This seems to reflect a business still scaling through restructuring pressure.

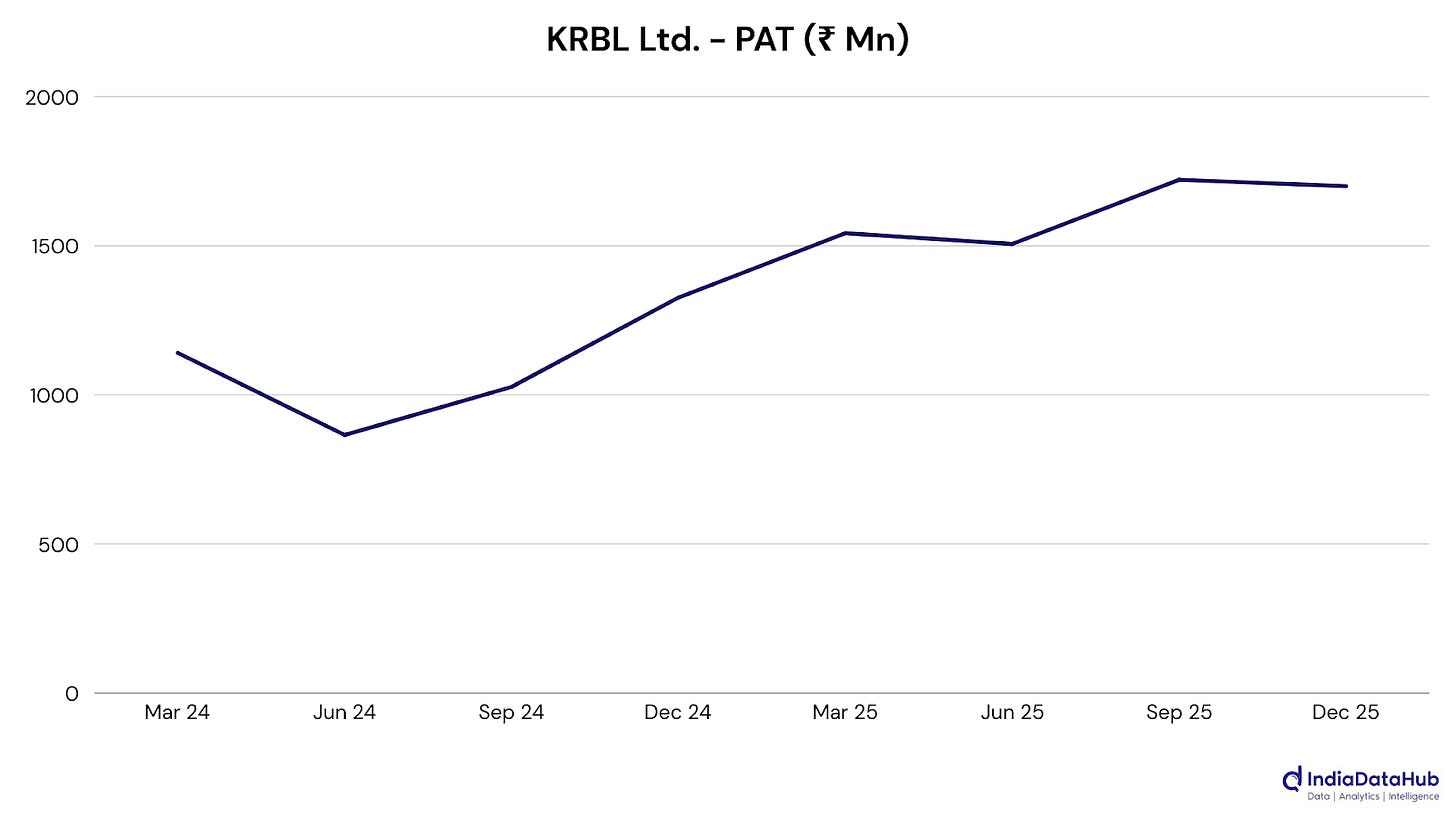

KRBL Ltd. (FMCG): Revenue fell on weaker exports, but profit climbed sharply as margins expanded and costs stayed disciplined. It looks more like a margin-led quarter than a demand-led one, with export volatility still hanging around.

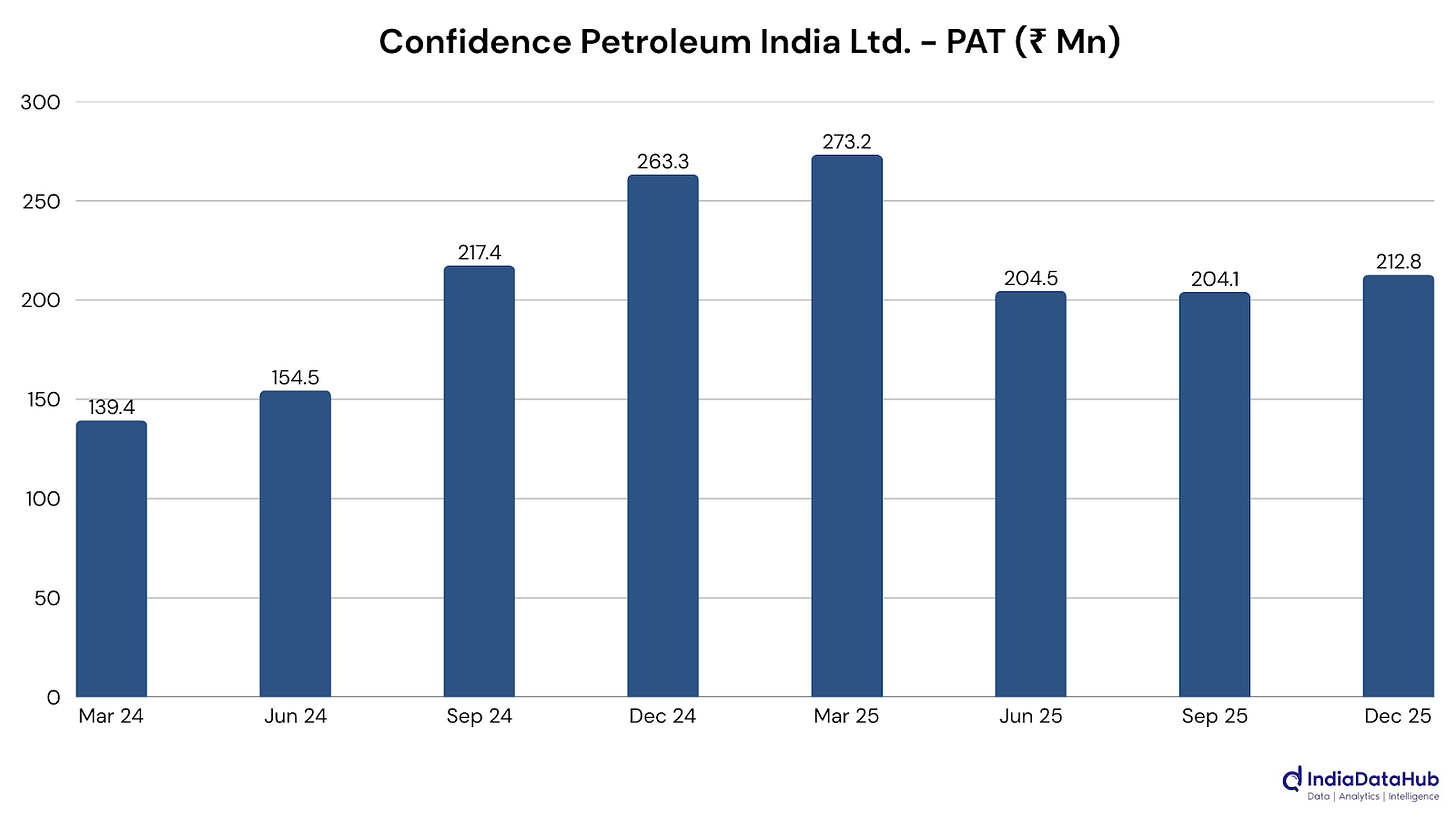

Confidence Petroleum India Ltd. (Energy): Revenue nearly doubled on LPG growth, but profit fell as costs rose faster and margins compressed. This likely reflects a scale-heavy expansion phase, where volume growth is accompanied by a much larger cost bill.

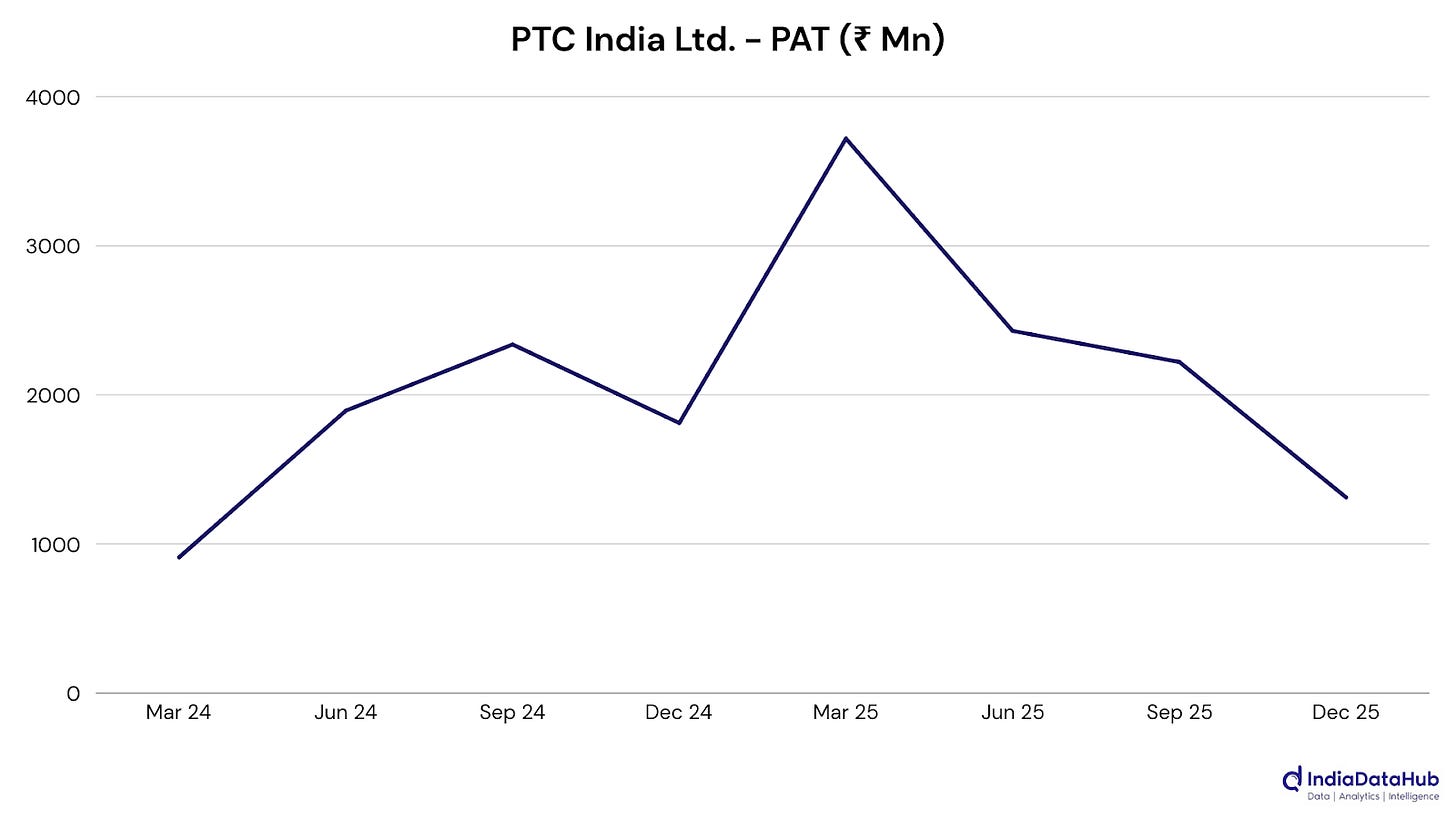

PTC India Ltd. (Utilities): Revenue was broadly flat, and trading volumes edged up, but profit dropped sharply as operating margins weakened and consultancy income softened. It seems the core power-trading business is facing tighter spreads, even with support from non-operating income.

The earnings quarter is almost at its end, and we’ll be taking a broad overview of this earnings season soon. Stay tuned!