Welcome back to This Week in Earnings. The Q3 FY26 results season has seen 890 companies posting their results so far. Aggregate performance is going steady.

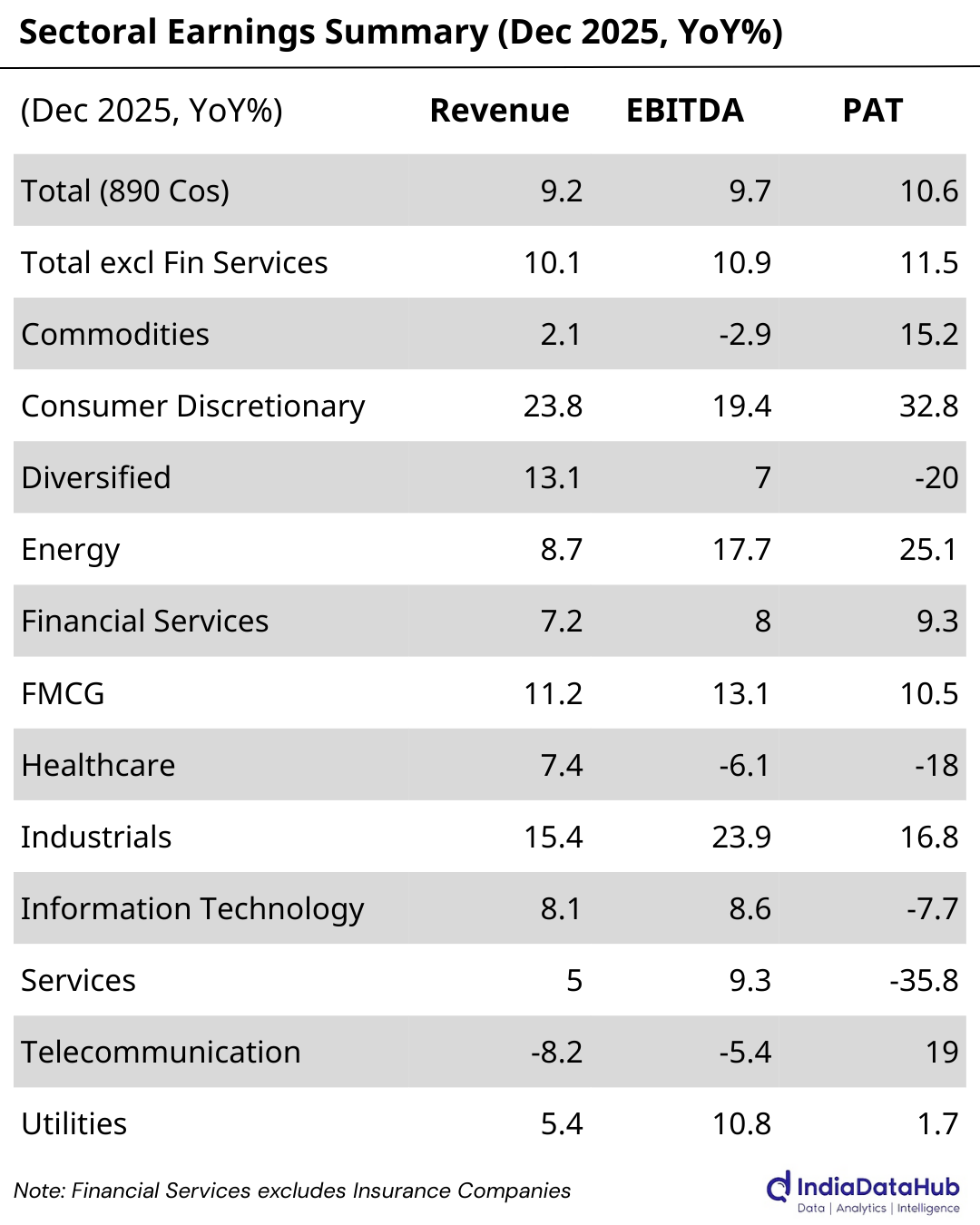

Revenues are up 9.2% year-on-year so far while EBITDA is up 9.7%, and PAT has grown by 10.6%. That said, growth metrics have decelerated compared to the past week. Excluding financial services, the picture looks a touch firmer across the board, with revenues up 10.1%, EBITDA up 10.9%, and profits up 11.5%, suggesting broader operating momentum outside the financial sector is still holding up well.

This newsletter is structured into two sections:

The first section tracks aggregate and sectoral trends, highlighting what’s propelling growth this week.

The second dives into standout company results shaping those numbers.

Want to dig deeper? Download the extended edition for full sector-wise company data and detailed performance notes.

Aggregate Trends

The results so far reinforce the familiar theme of healthy topline growth with sharply uneven profit outcomes by sector.

Consumer Discretionary remains the clearest outperformer, with revenue up 23.8% translating into 32.8% profit growth, highlighting strong demand conditions and operating leverage. Energy is another standout, where EBITDA growth (17.7%) and PAT growth (25.1%) are comfortably ahead of revenue growth (8.7%), pointing to strong margin support.

Industrials also looks robust, with broad-based strength across the P&L, and revenue up 15.4%, EBITDA up 23.9%, and profits up 16.8%, suggesting operating momentum remains strong even as cost intensity varies within the sector. The middle is more mixed. FMCG is steady, with double-digit growth across revenue and EBITDA (11.2% and 13.1%), while profit growth (10.5%) is holding up but not yet running far ahead.

Utilities is stable but subdued, with EBITDA up 10.8% but profits up just 1.7%, indicating weaker bottom-line conversion despite operating improvement. Financial Services continues its steady run, with profit growth (9.3%) broadly tracking revenue (7.2%).

Several sectors remain under pressure. Healthcare has seen margin compression, with EBITDA down 6.1% and profits down 18% despite revenue growth of 7.4%. Information Technology has slipped into a profit decline (-7.7%) despite modest operating growth. Services is the sharpest laggard on the bottom line, with profits down 35.8% even as EBITDA is up 9.3%, highlighting how costs, finance lines, or exceptional items are increasingly shaping outcomes.

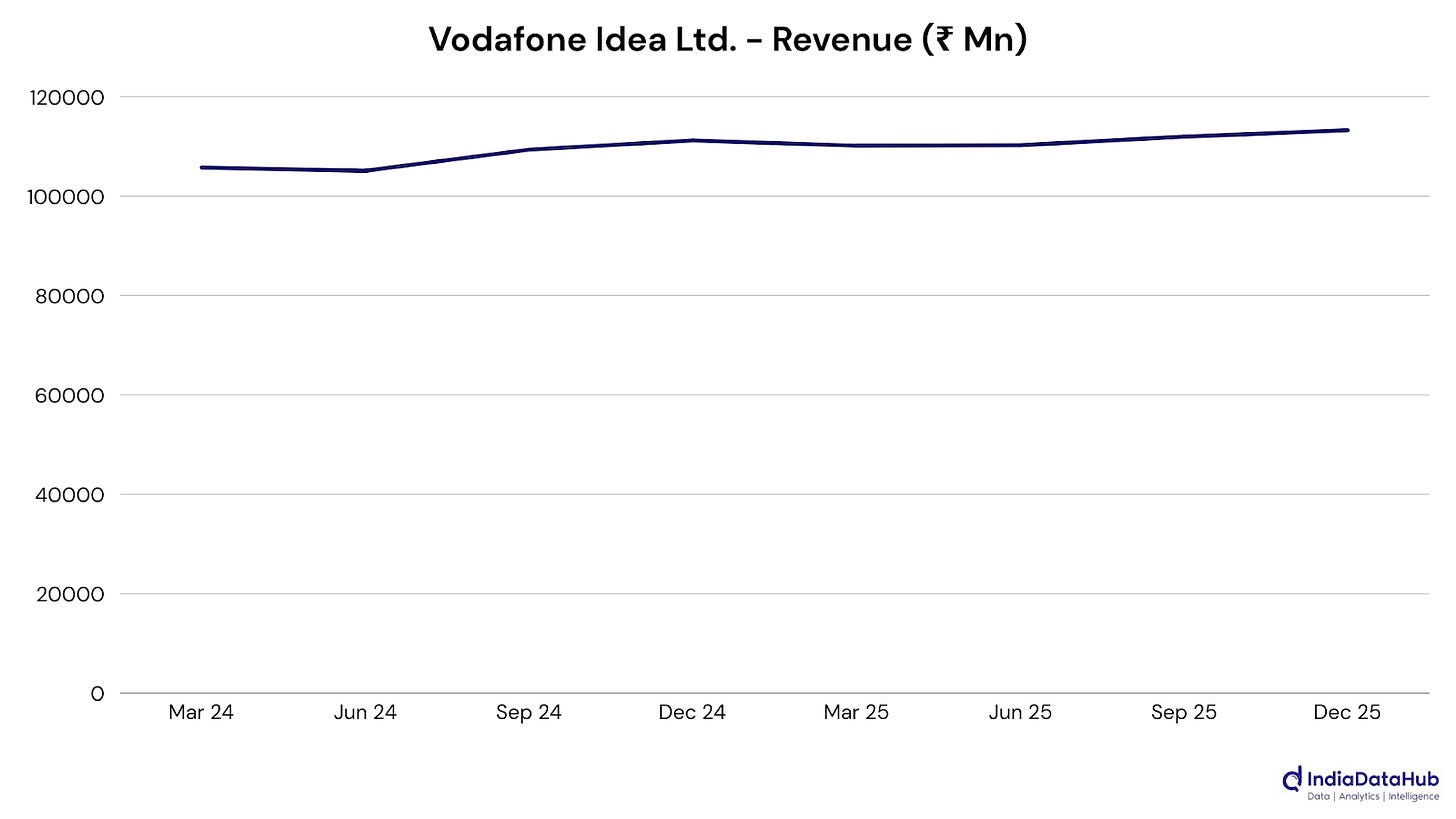

Telecom is the anomaly sector, as its revenues (-8.2%) and EBITDA (-5.4%) remain weak, yet profits are up 19%, suggesting the profit picture is being driven by factors below operating performance rather than a pure demand-led recovery.

Overall, Q3 FY26 continues to look like a quarter of stable demand but uneven profitability, where cost structures and margin discipline are doing more to separate winners from laggards than topline growth alone. As more results come in, the sector divergence, especially between operating performance and bottom-line conversion, should become clearer.

Company Spotlights

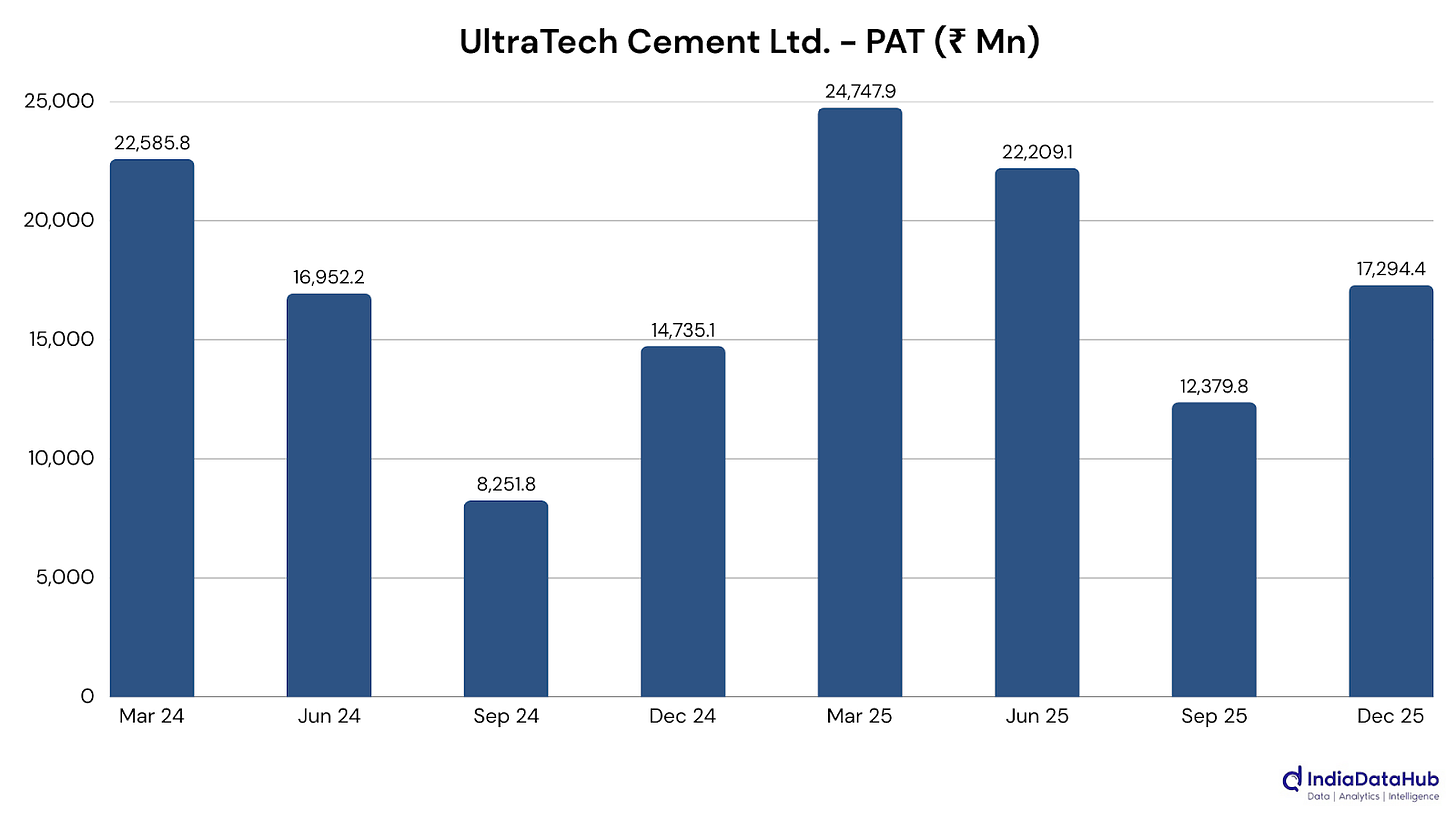

UltraTech Cement Ltd. (Commodities): Revenue jumped 27% YoY to ₹218,297 mn and profit rose 17.4% to ₹17,294 mn, driven by record volumes and EBITDA growth despite a labour-code provision. It may indicate scale-led operating leverage and early synergies from integration, helping cushion a still-competitive pricing backdrop.

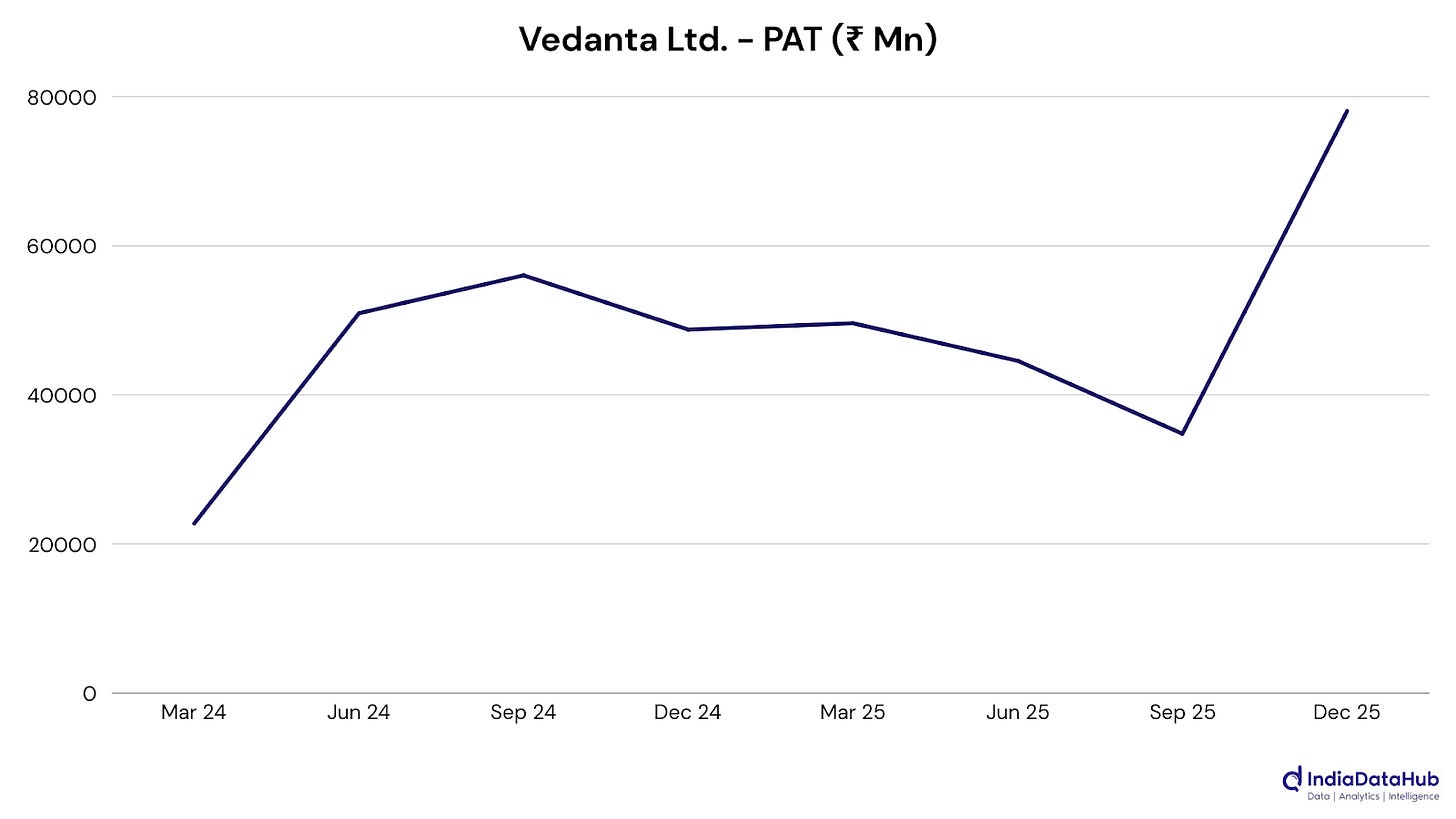

Vedanta Ltd. (Commodities): Revenue dropped 40.3% YoY to ₹233,690 mn, yet profit rose 60.1% to ₹78,070 mn, aided by strong EBITDA and record alumina/aluminium and zinc-silver output. It likely reflects richer realizations and forex tailwinds offsetting weaker oil & gas.

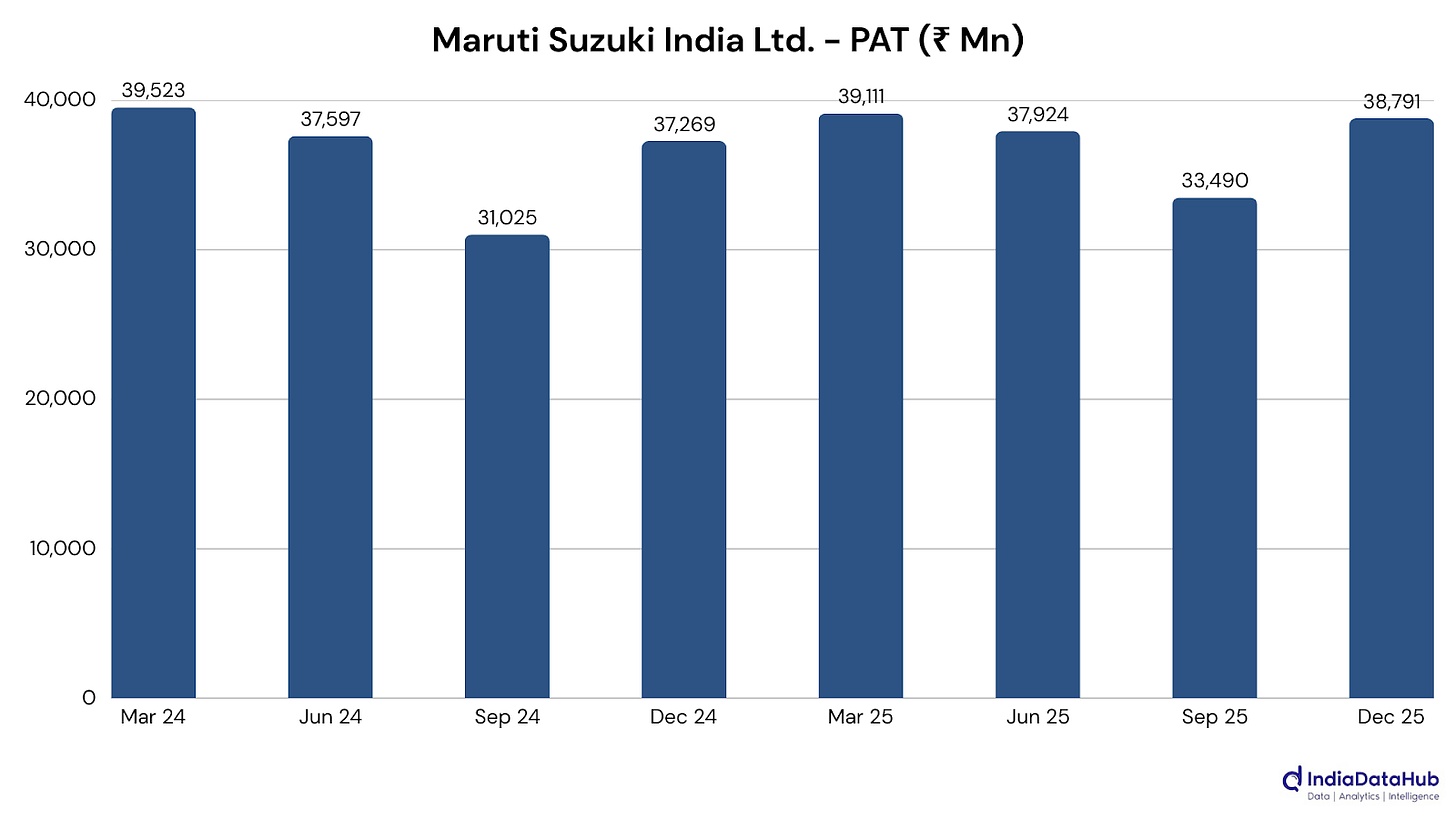

Maruti Suzuki India Ltd. (Consumer Discretionary): Revenue surged 28.7% YoY to ₹499,041 mn on record volumes, but profit rose only 4.1% to ₹38,791 mn as higher costs and a one-time labour-code provision squeezed margins. It hints that growth is coming through units, while profitability is being capped by pricing and mix.

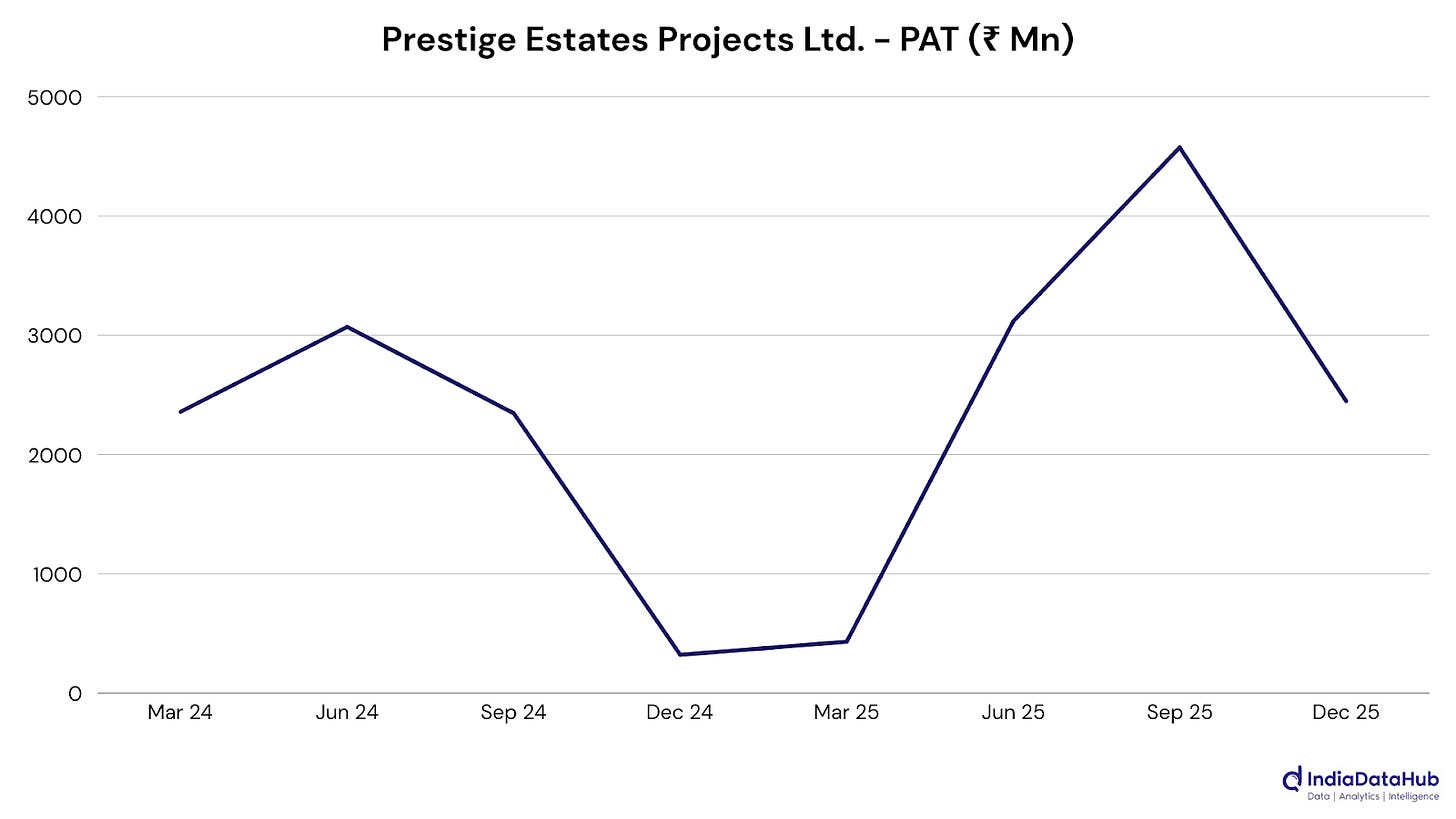

Prestige Estates Projects Ltd. (Consumer Discretionary): Revenue more than doubled to ₹38,726 mn (+134% YoY) and profit surged to ₹2,447 mn (+660% YoY), helped by faster project handovers plus strong pre-sales and collections. The spike could also reflect lumpy revenue recognition after timely completions and launches.

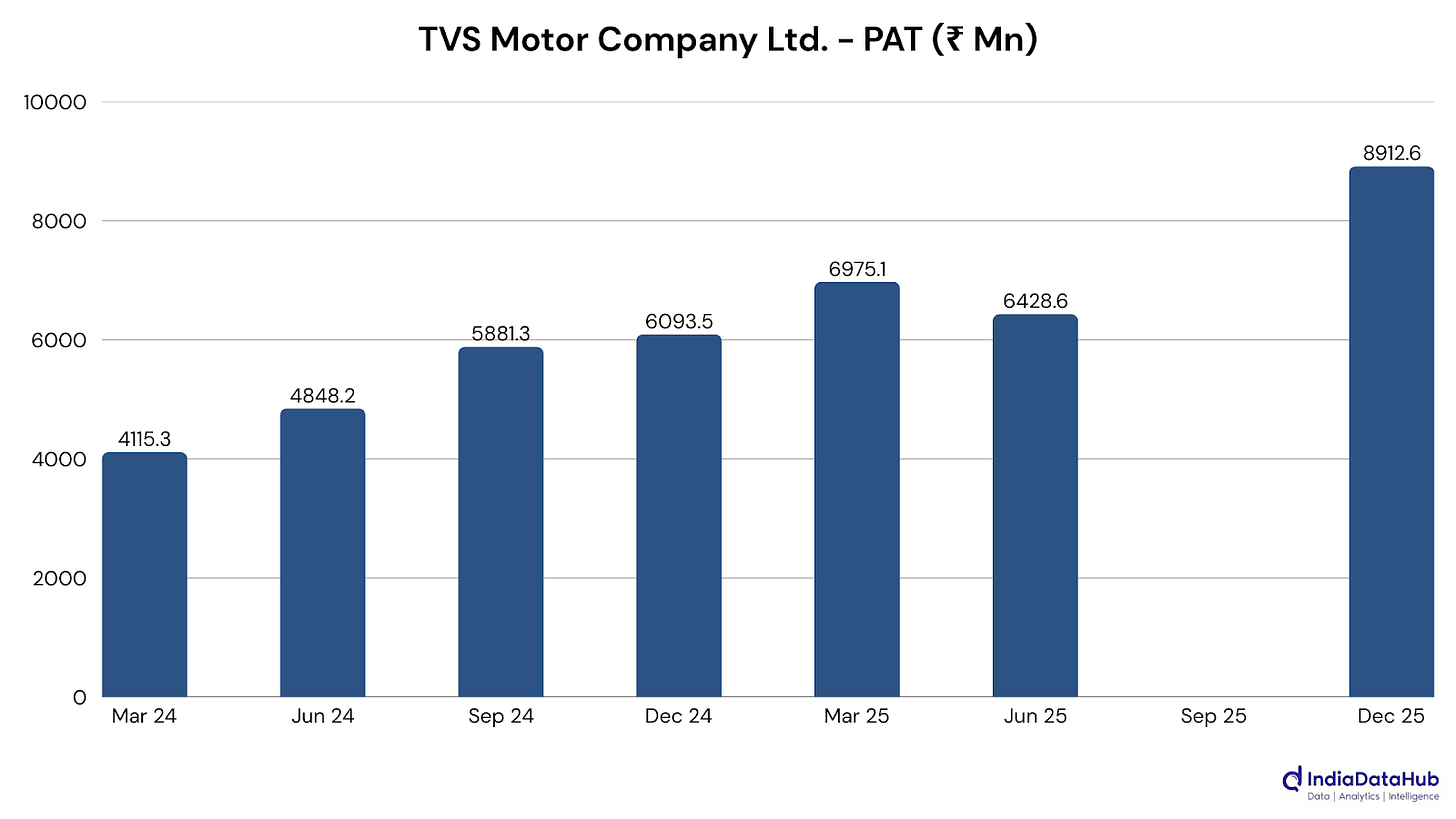

TVS Motor Company Ltd. (Consumer Discretionary): Revenue jumped 32.5% YoY to ₹147,555 mn and profit rose 46.3% to ₹8,913 mn, powered by record volumes, a sharp EV ramp, and strong exports. The margin lift suggests mix and operating leverage improved, not just unit growth.

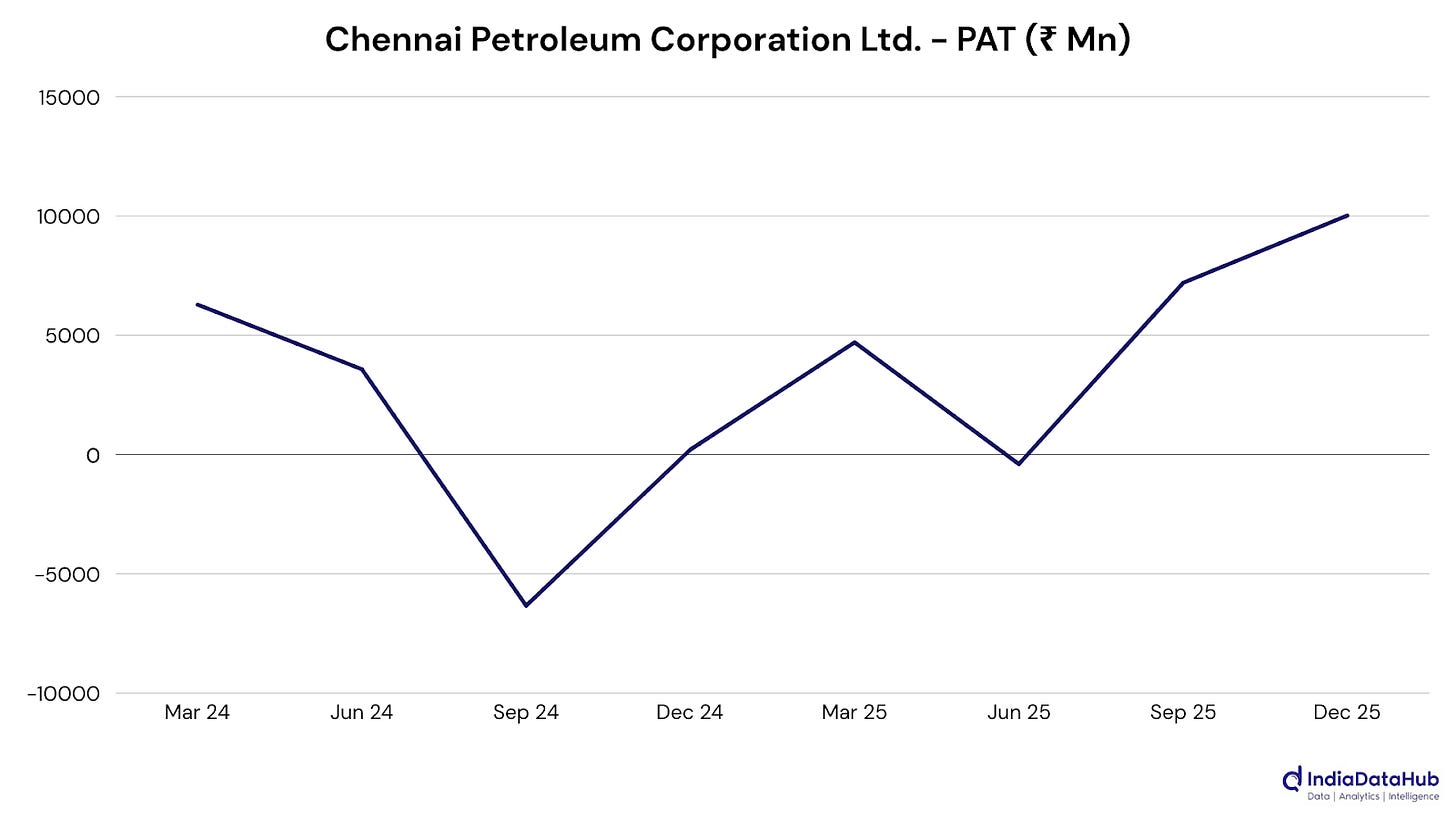

Chennai Petroleum Corporation Ltd. (Energy): Revenue rose 23.9% YoY to ₹194,384 mn, while profit jumped to ₹10,016 mn from a low base as GRMs improved sharply and throughput ran above nameplate capacity. This quarter seems driven more by margin cycle and product cracks than by pure volume growth.

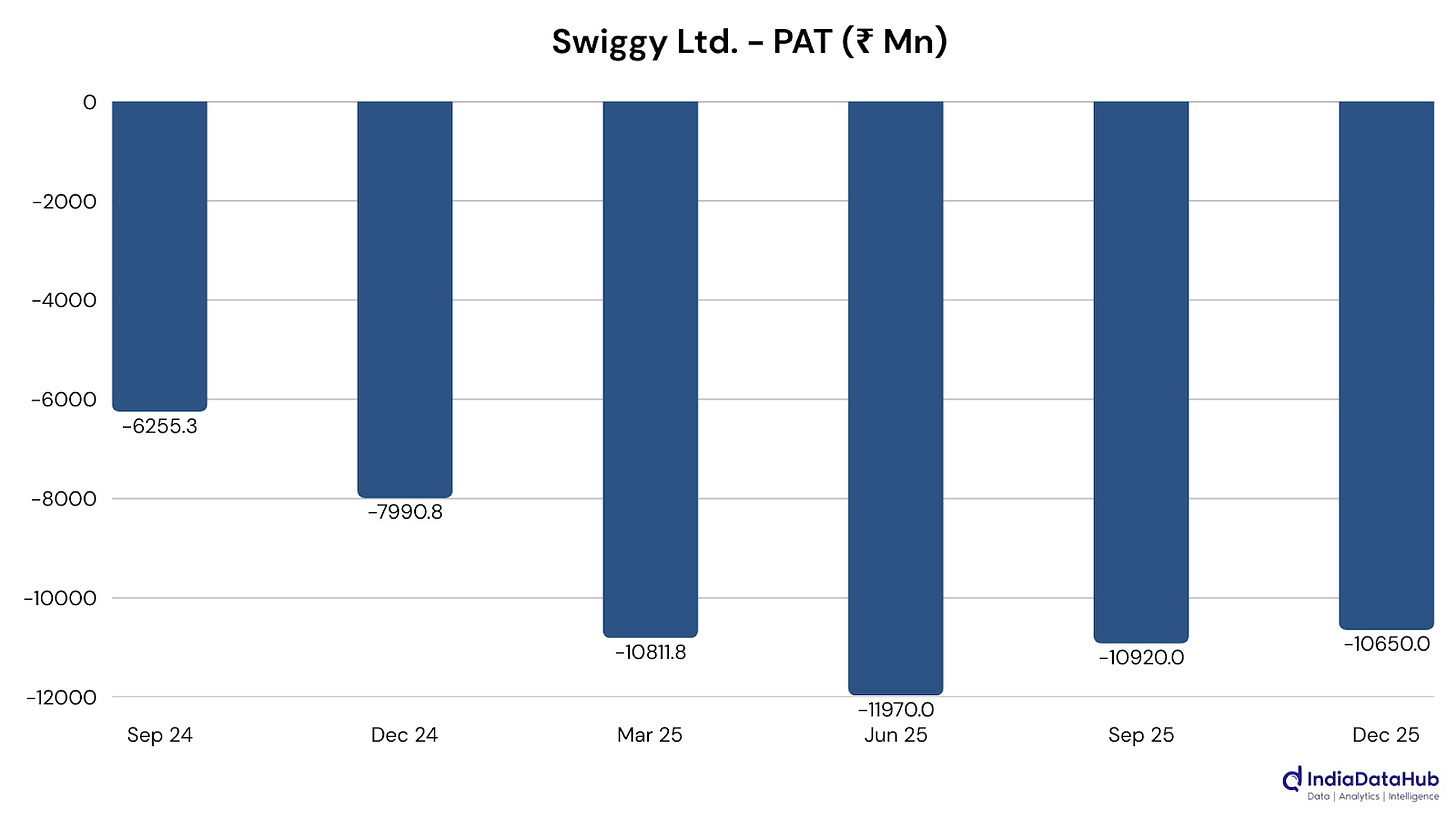

Swiggy Ltd. (Consumer Discretionary): Revenue surged 54% YoY to ₹61,480 mn, led by Instamart’s rapid scale-up alongside steady food delivery growth. Loss widened to ₹10,650 mn as spending rose on dark stores and fleet expansion, likely the near-term cost of pushing quick commerce harder.

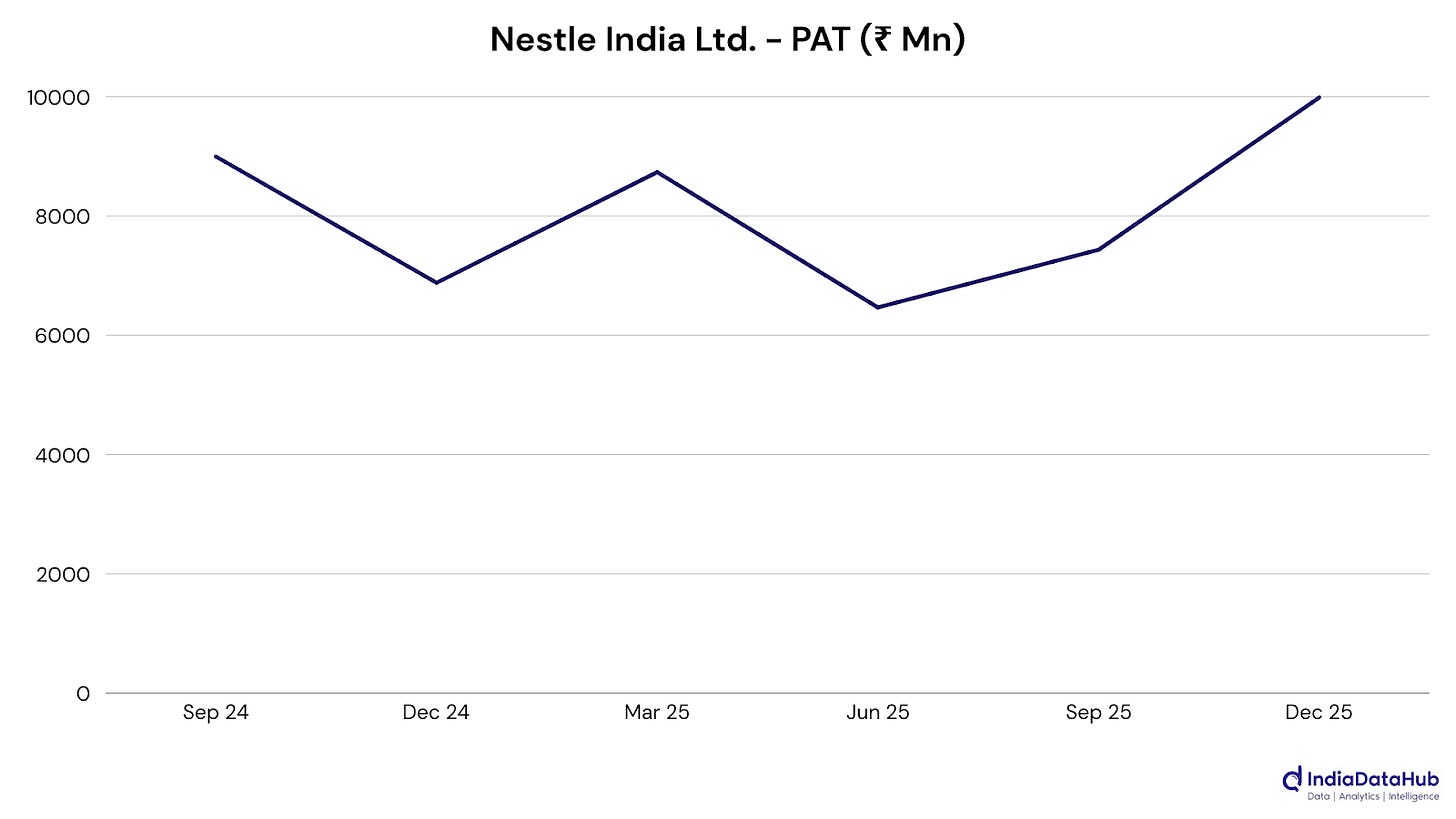

Nestle India Ltd. (FMCG): Revenue climbed 18.6% YoY to ₹56,670 mn and profit jumped 45.1% to ₹9,984 mn, helped by volume-led growth, strong confectionery/beverages, operating leverage, and a lower tax rate. This may point to steady brand pricing power and mix improvement.

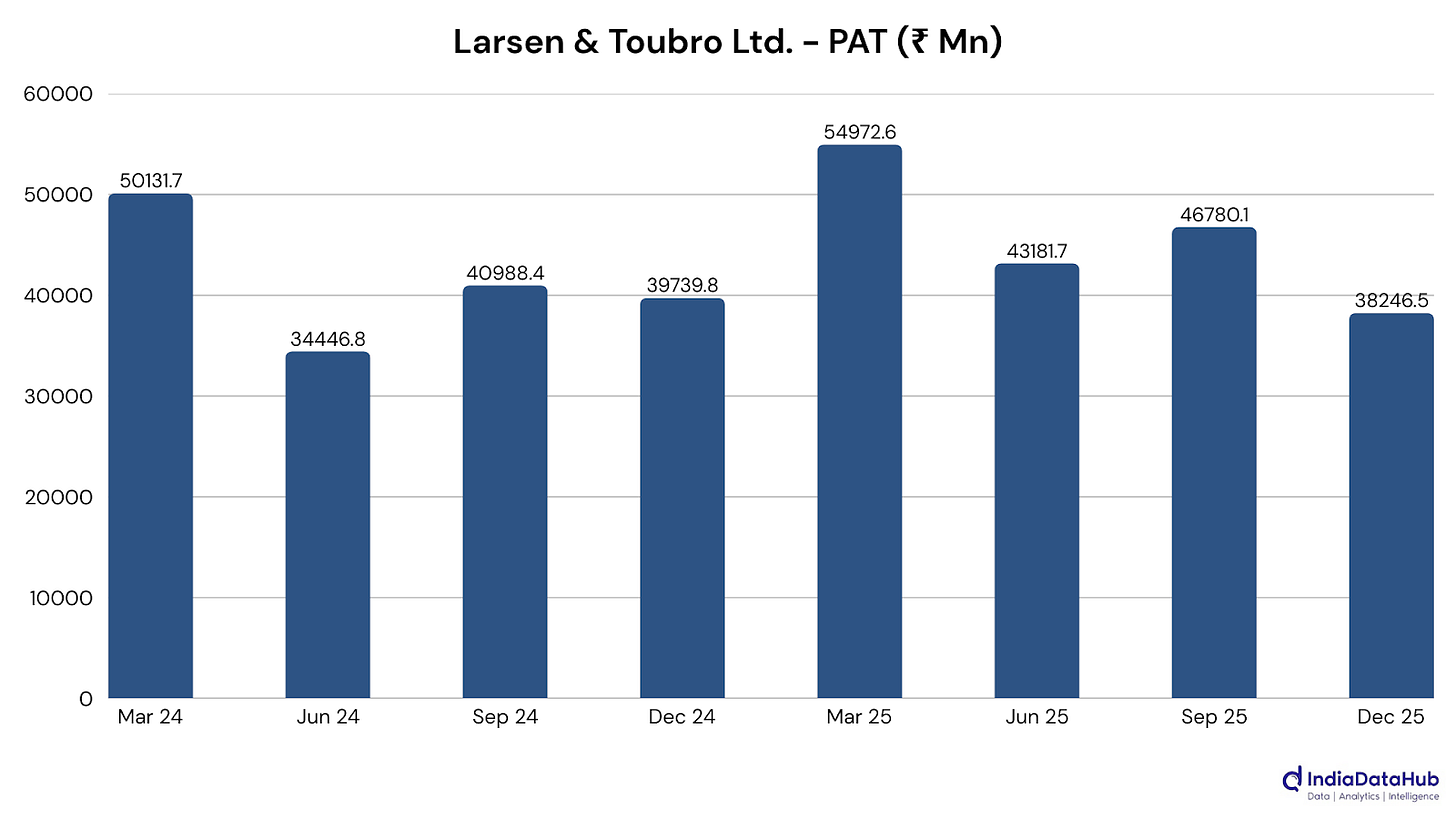

Larsen & Toubro Ltd. (Industrials): Topline stayed healthy. Revenue rose 10.5% YoY to ₹714,497 mn, and EBITDA improved, but profit dipped 3.8% to ₹38,247 mn due to a one-time labour-code provision. Strip that out, and the quarter seems more robust, backed by strong order inflows.

Vodafone Idea Ltd. (Telecommunications): Revenue nudged up 1.9% YoY to ₹113,230 mn, supported by ARPU at ₹186 and higher data use. Loss narrowed to ₹52,860 mn as EBITDA improved and finance costs softened; the interest-and-spectrum burden still seems to dominate the bottom line.

That’s it for this edition. A lot is yet to come, which we’ll be unpacking in the coming weeks; stay tuned!