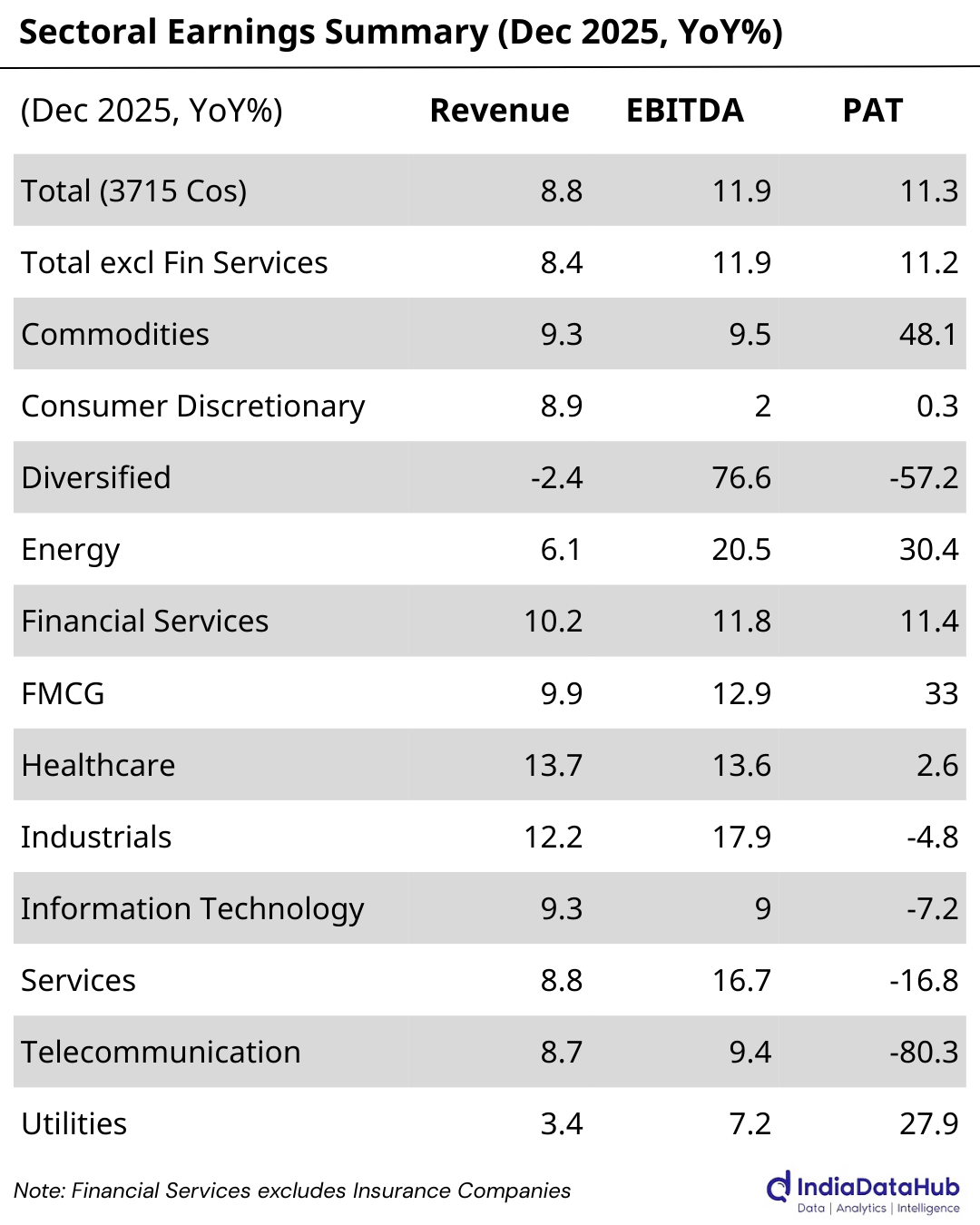

Welcome back to This Week in Earnings. With 3,715 companies reported so far, we are almost at the end of the 3QFY26 reporting season. And the broad picture is broadly this: Revenue growth continues to be sluggish at 9% YoY but profit growth is slightly better at 11%. With nominal GDP growing at ~10%, corporate results are broadly tracking it. Effectively, profit share of GDP continues to remain broadly stable.

This newsletter is structured into two sections:

The first section tracks aggregate and sectoral trends, highlighting what’s propelling growth this week.

The second dives into standout company results shaping those numbers.

Want to dig deeper? Download the extended edition for full sector-wise company data and detailed performance notes.

Aggregate Trends

The major theme currently is profit quality: how much of PAT growth is operating, and how much is exceptional-led. One thread runs across multiple sectors, i.e., labour-code implementation charges and other one-offs are repeatedly distorting reported profits. Hence, EBITDA trends are often healthier than PAT trends, and this is the gap to take notice of.

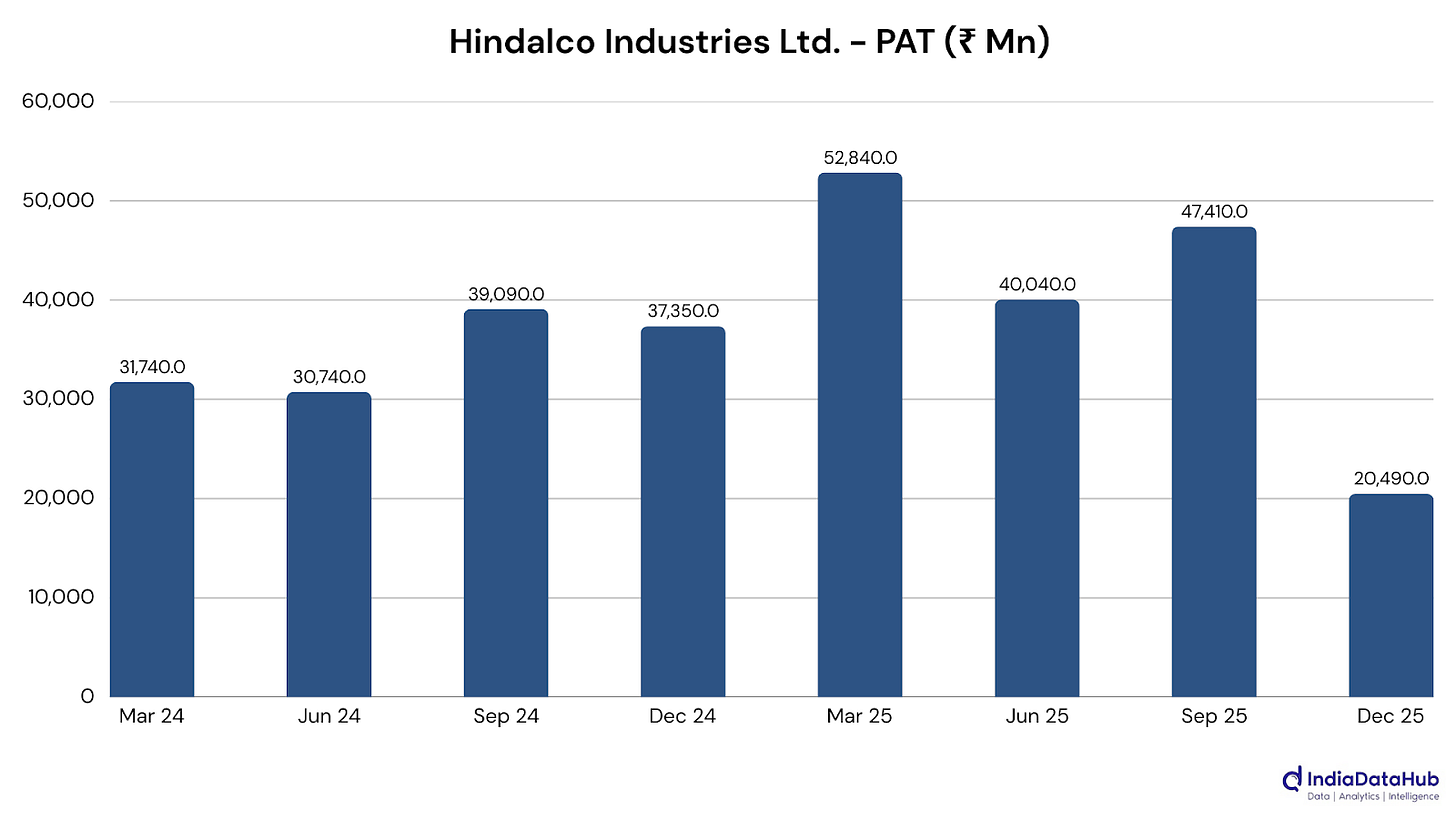

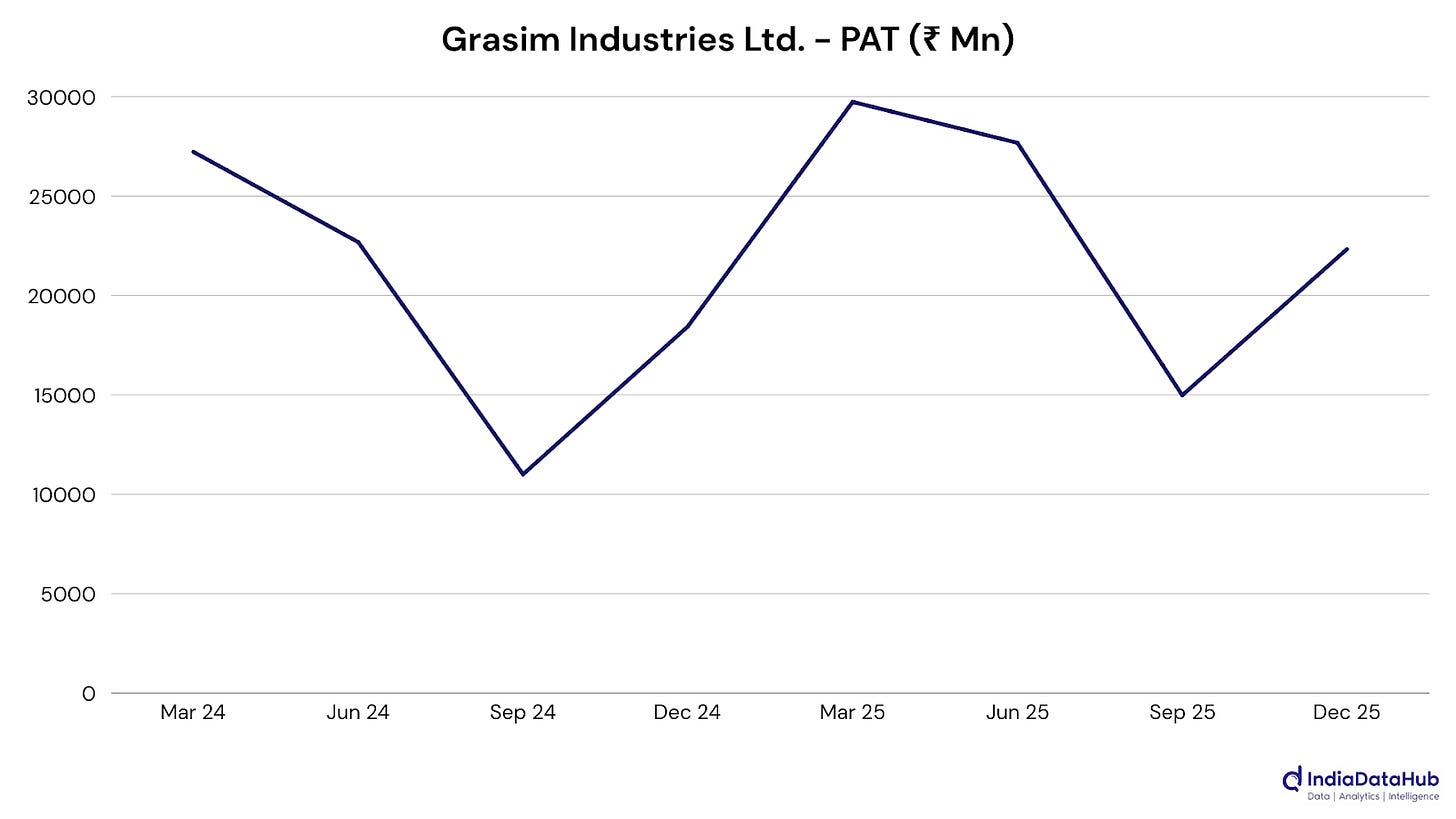

Starting with Commodities, which is the standout sector and reads like operating leverage plus cost control (in some cases, portfolio mix doing the work). Grasim is a good example of “mix helps momentum.” At the same time, the sector numbers are not a straight-line demand story. Hindalco shows how idiosyncratic events can overwhelm an otherwise decent operating quarter. In EID Parry, the sugar cycle remains choppy, but the non-sugar portfolio is cushioning results. As is often the case, stability increasingly comes from diversification.

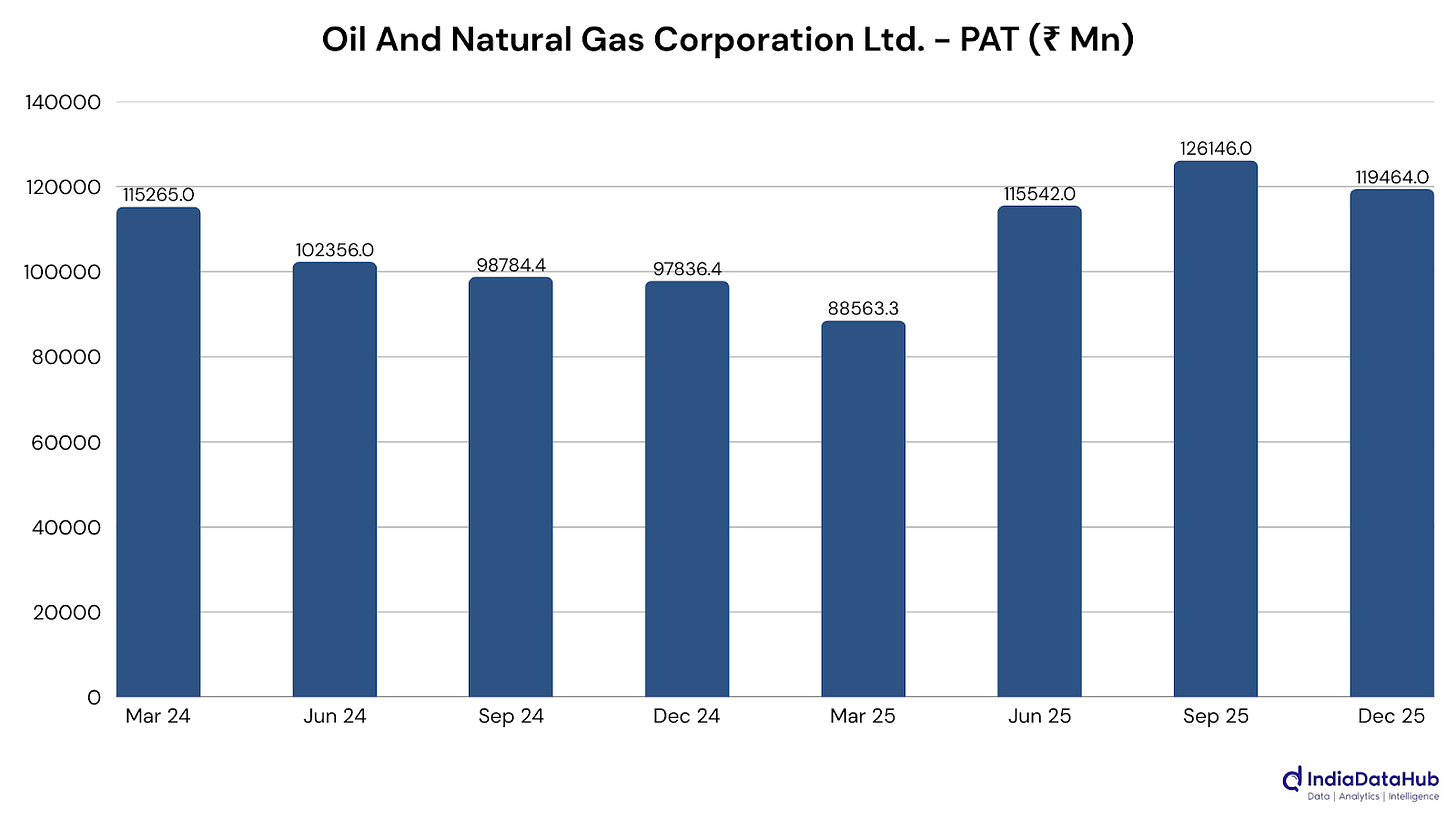

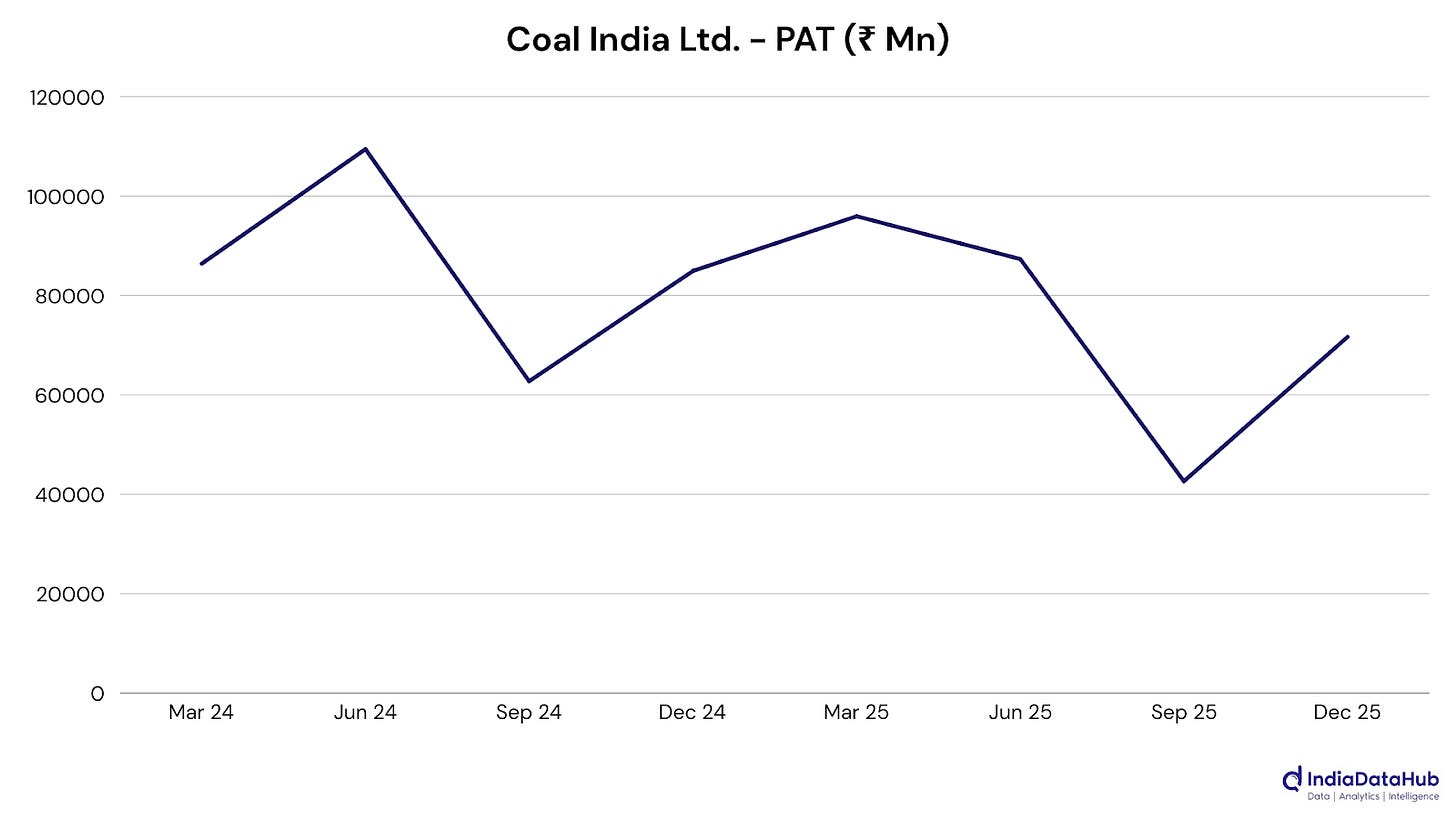

Energy is another margin-led pocket, the dispersion arising from pricing and cost discipline. ONGC managed profit growth despite weaker crude realizations, suggesting steadier gas pricing and support from subsidiaries/JVs. IGL shows the steadier side of the demand picture, with volumes up 3–4% and selective CNG price hikes helping realizations. On the flip side, Coal India suffered from realizations softening simultaneously with rising costs: an uncomfortable combination if demand doesn’t re-accelerate.

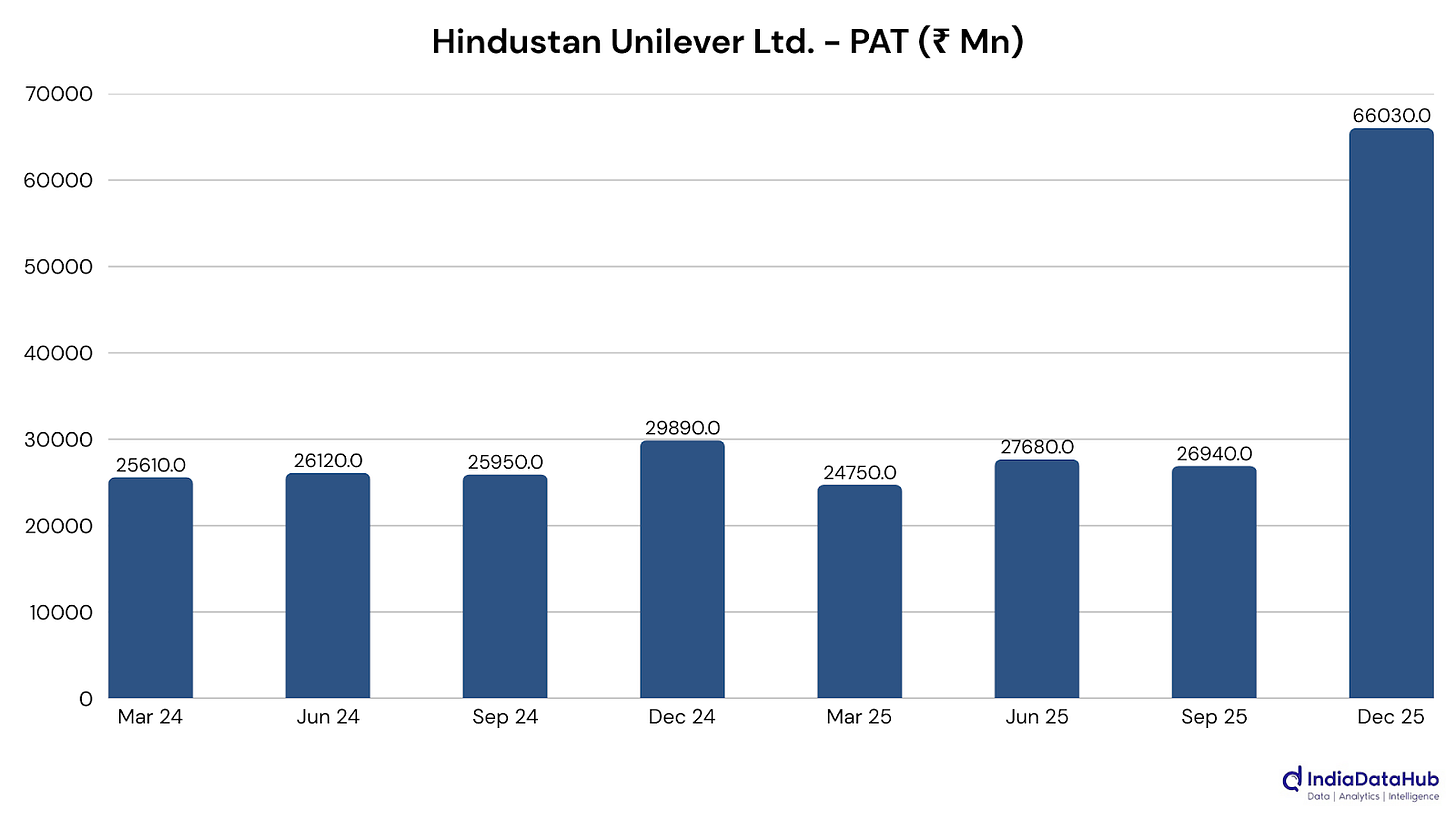

Within FMCG, HUL’s headline profit surge was heavily boosted by an ice-cream demerger gain; the operating business underneath looks far more muted, with margins compressed as brand investments rose. The cleaner FMCG signals this week came from Britannia (profits growing faster than revenue as margins improve) and United Breweries (premiumisation and cost work lifting gross margin meaningfully). Patanjali Foods sits in the middle, with mix-driven improvement in FMCG/HPC scaling, but also a tax write-back flattering PAT.

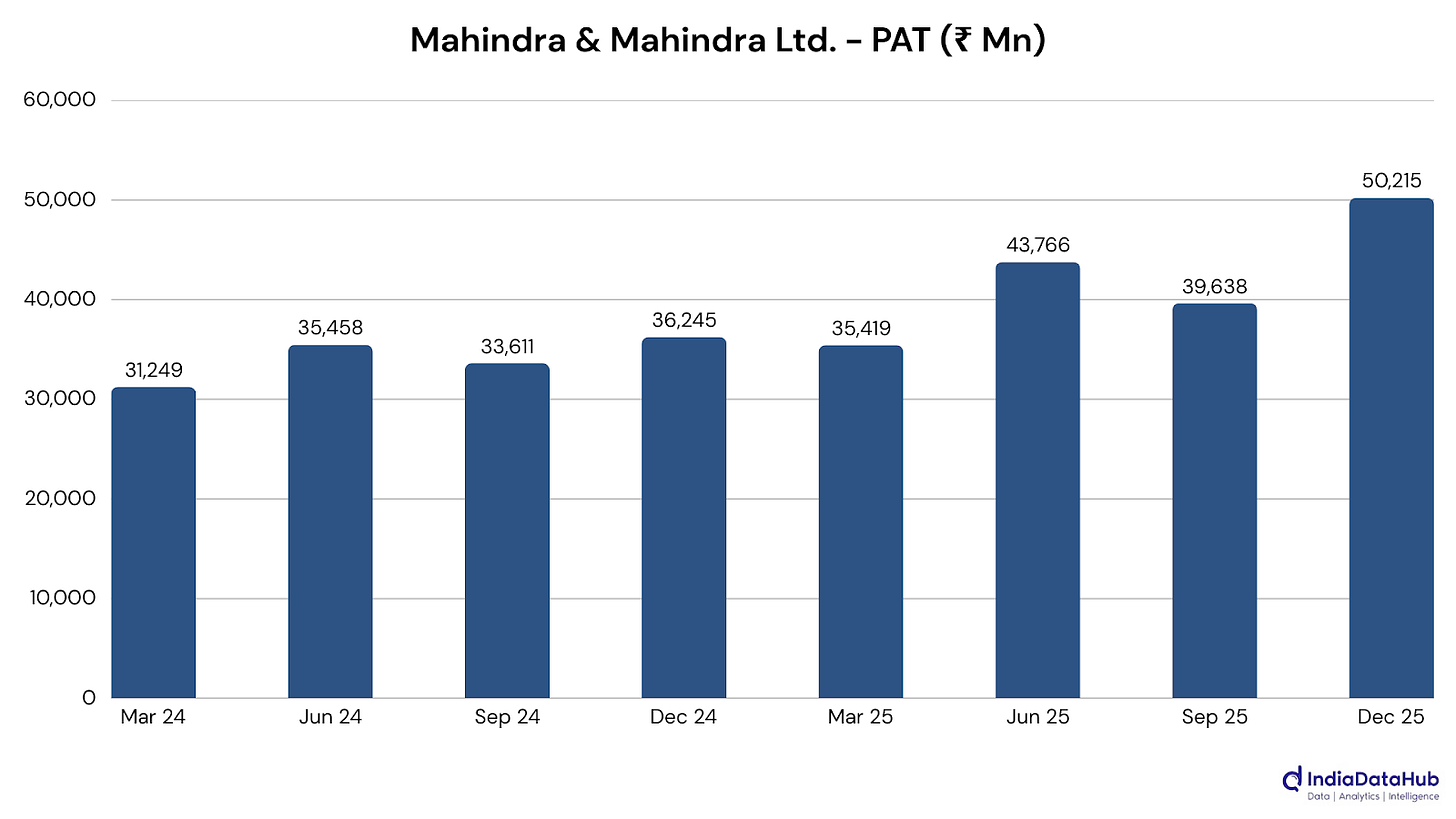

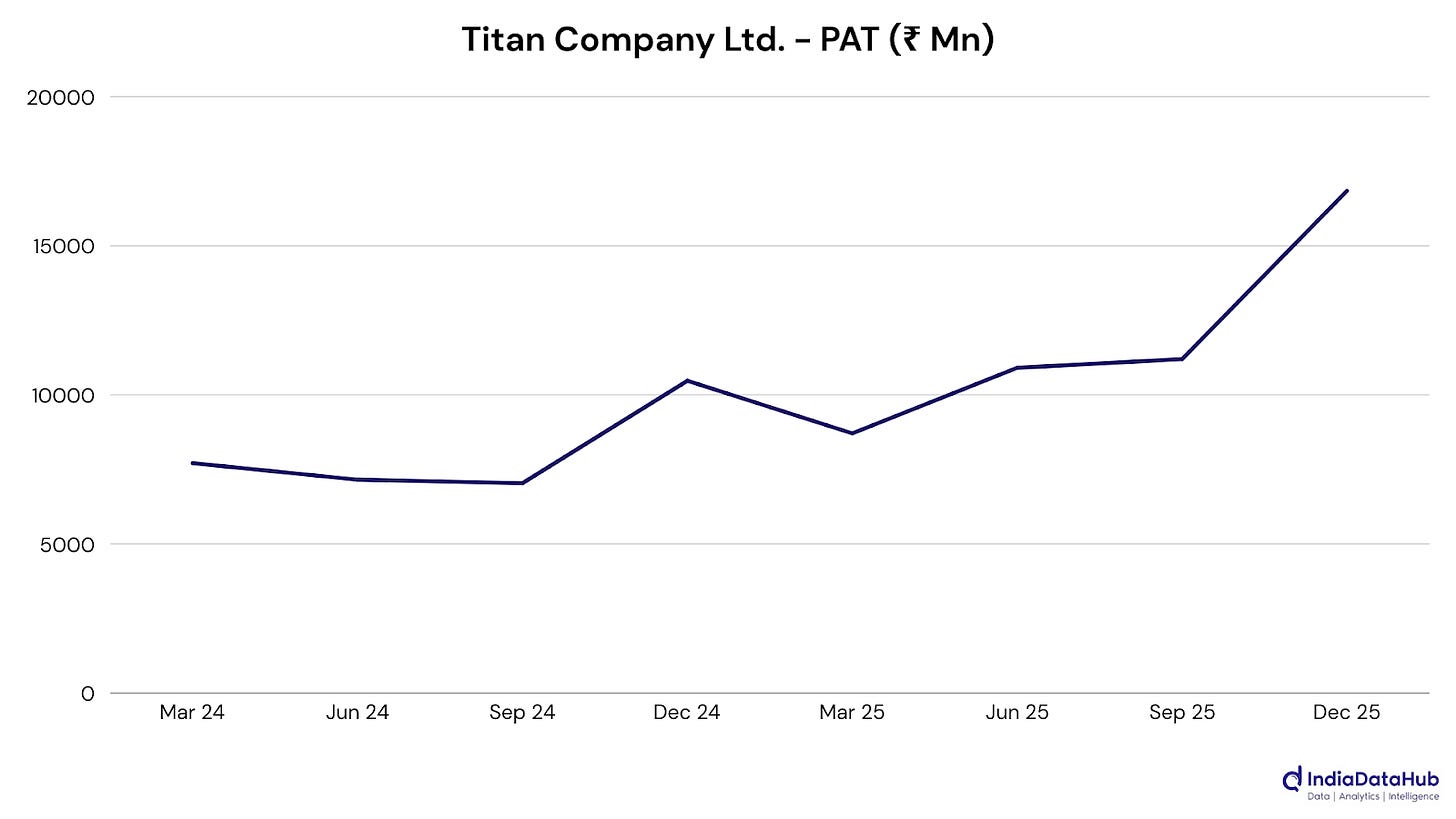

Consumer Discretionary seems to be the most mixed sector in this quarter so far, with revenue +8.9% while PAT is essentially flat. Demand is clearly present, but it’s not consolidating into sector-level profit growth because results are being pulled in opposite directions. At one end, the festive/organised shift is obvious. Titan and PN Gadgil’s results read like peak-season operating leverage plus strong conversion and premium mix, even in a high gold-price environment.

Travel and hospitality are similarly buoyant: Indian Hotels converted a 12% revenue rise into a 51% profit jump with record hotel EBITDA and lofty margins. In autos and mobility, M&M and Eicher delivered strong volume-led quarters with margins holding up, suggesting mix and scale are still cushioning costs. But the sector’s flat PAT can be explained by charges and exceptionals. For instance, Amber Enterprises swung into a small loss on impairments and labour-code/Sidwal-related charges despite strong AC demand and improved EBITDA.

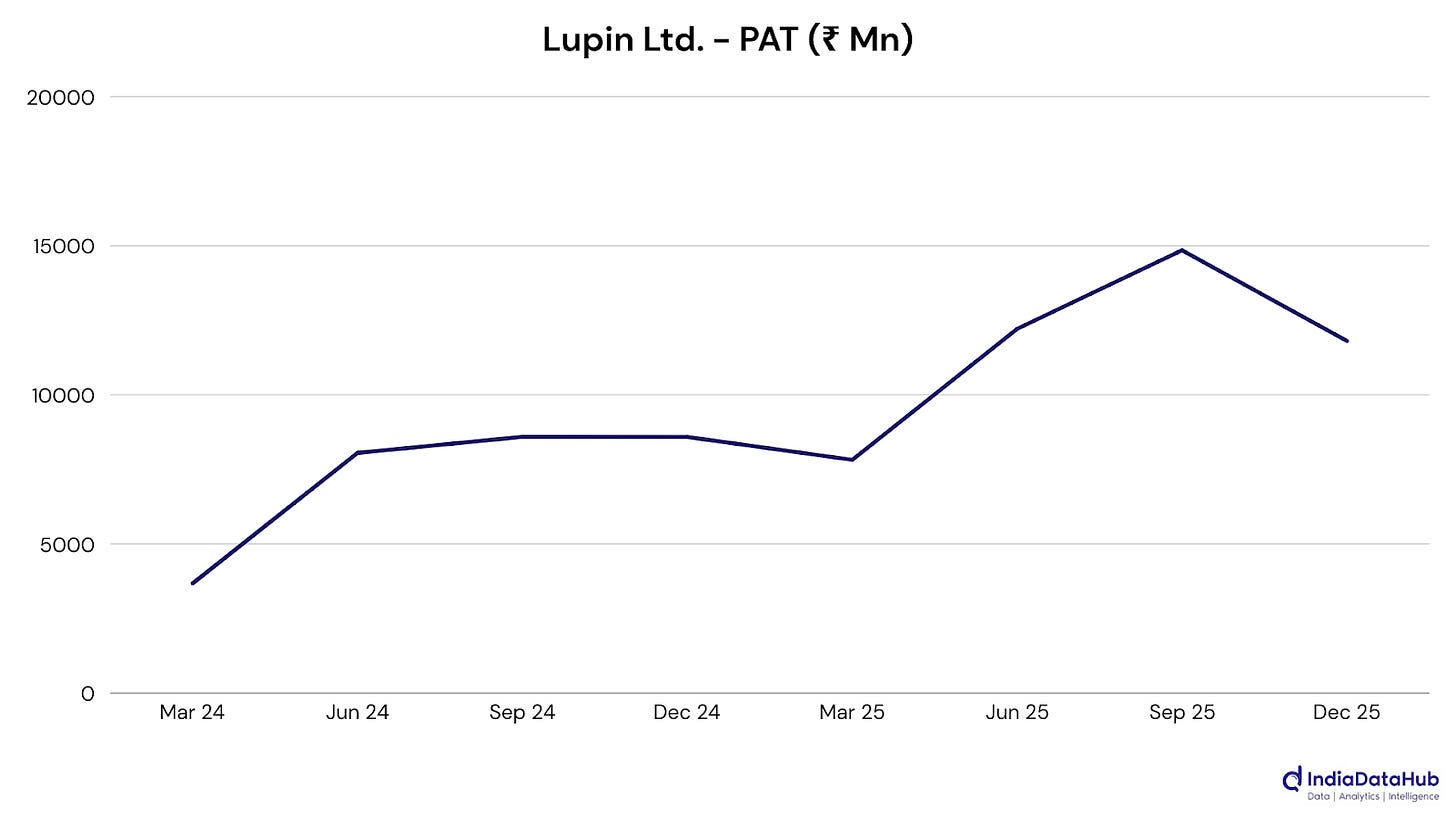

In Healthcare, the topline is the strongest of all sectors, but PAT is barely up. Execution is visibly strong at Lupin (US surge, sharp margin expansion), Torrent Pharma (broad-based geography strength with margins holding), and Apollo Hospitals (ARPOB/mix-led growth with integrated efficiency). But reported profits are clipped by labour-code liabilities and acquisition/consolidation costs at players like Zydus and Biocon.

The pressure points are clearest in the remaining sectors: Industrials, IT, Services, and Telecom. Industrials show high activity, but bottom lines are getting clipped by one-offs and financing burdens (labour-code charge at Ashok Leyland, leverage stress at Uflex). Services show strong operational growth at big operators like GMR Airports, but expansion-related interest and depreciation keep PAT under pressure. IT looks stable on revenue, but profit softness persists, with one-time charges still showing up even in otherwise steady quarters (e.g., Black Box). Telecom remains the clear laggard, whose revenue growth is not translating into profits at all. Finally, Utilities has a low topline but strong profit conversion via efficiency and regulatory tailwinds, as seen in Torrent Power.

Put together, the season PAT is being shaped as much by accounting/exceptionals as by demand. The most investable signal is often hiding in the spread between revenue, EBITDA, and reported profit: who’s converting growth cleanly, who’s buying growth via costs, and who’s merely reporting noise. As we approach the end of this season, the remainder of the results will highlight whether margin resilience remains the dominant driver or whether demand finally starts doing the heavy lifting.

Company Spotlights

Hindalco Industries Ltd. (Commodities): Sales climbed 14%, and EBITDA inched up 5%, but profit slumped 45% after a large exceptional hit tied to Novelis’ Oswego fire disruptions. The damage looks more like a one-off US execution than weak Indian aluminium/copper demand.

Grasim Industries Ltd. (Commodities): Record revenue rose 27%, and profit grew 21% as cement volumes and VSF exports held up, while Birla Opus scaled and financial-services AUM expanded. EBITDA climbed 33% despite a labour-code charge; the portfolio’s mix seems to be supporting momentum.

Mahindra & Mahindra Ltd. (Consumer Discretionary): SUVs and tractors both posted ~23% volume growth, pushing revenue up 26% and PAT up 39%. The margin hold at ~14.7% (despite the labour-code hit) hints that mix and scale are helping. Momentum seems to be coming from stronger SUV traction and a firmer rural backdrop; the next tell will be whether pricing and input costs stay supportive as volumes normalise.

Titan Company Ltd. (Consumer Discretionary): A big festive quarter: revenue up 43% and profit up 61%, led by jewellery’s 42% growth across Tanishq/Mia/Zoya and CaratLane. Margin expansion suggests operating leverage; the shift toward organised, premium jewellery may be helping despite high gold prices.

Oil And Natural Gas Corporation Ltd. (Energy): Topline was basically flat, but profit rose 22% even with crude realizations down ~15% and production steady. That resilience seems tied to tighter costs, steadier gas pricing, and help from subsidiaries/JVs.

Coal India Ltd. (Energy): Revenue slipped 2% and profit fell 16% as offtake and output softened and realizations eased; pay-revision provisions pushed employee costs up, crimping EBITDA. The pattern may hint at weaker demand and a tougher cost base.

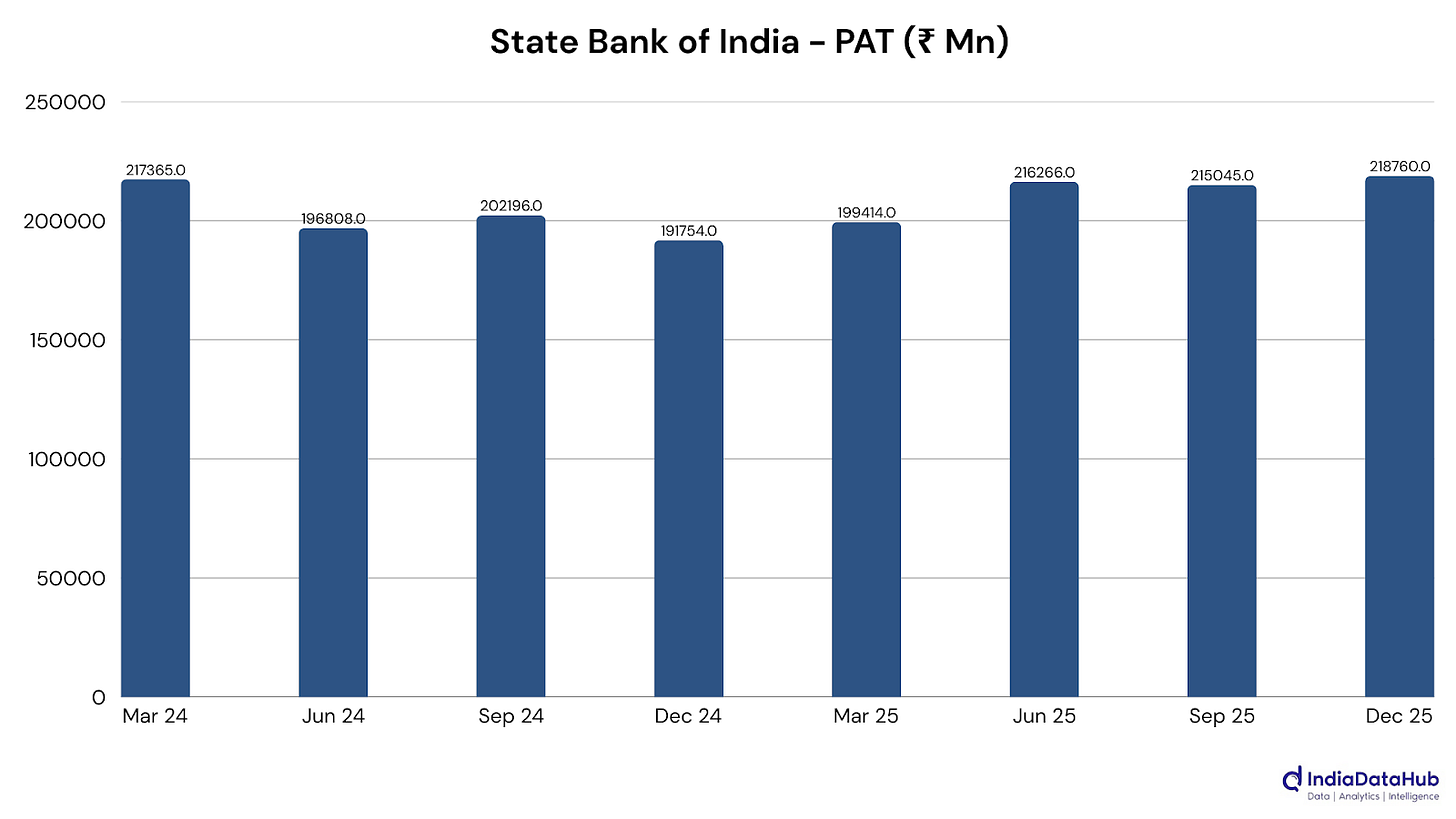

State Bank of India (Financial Services): Profit rose 14% on modest income growth, helped by stronger NII, better asset quality, and lower credit costs. The quarter was also boosted by non-recurring items like YES Bank stake-sale income and forex profits.

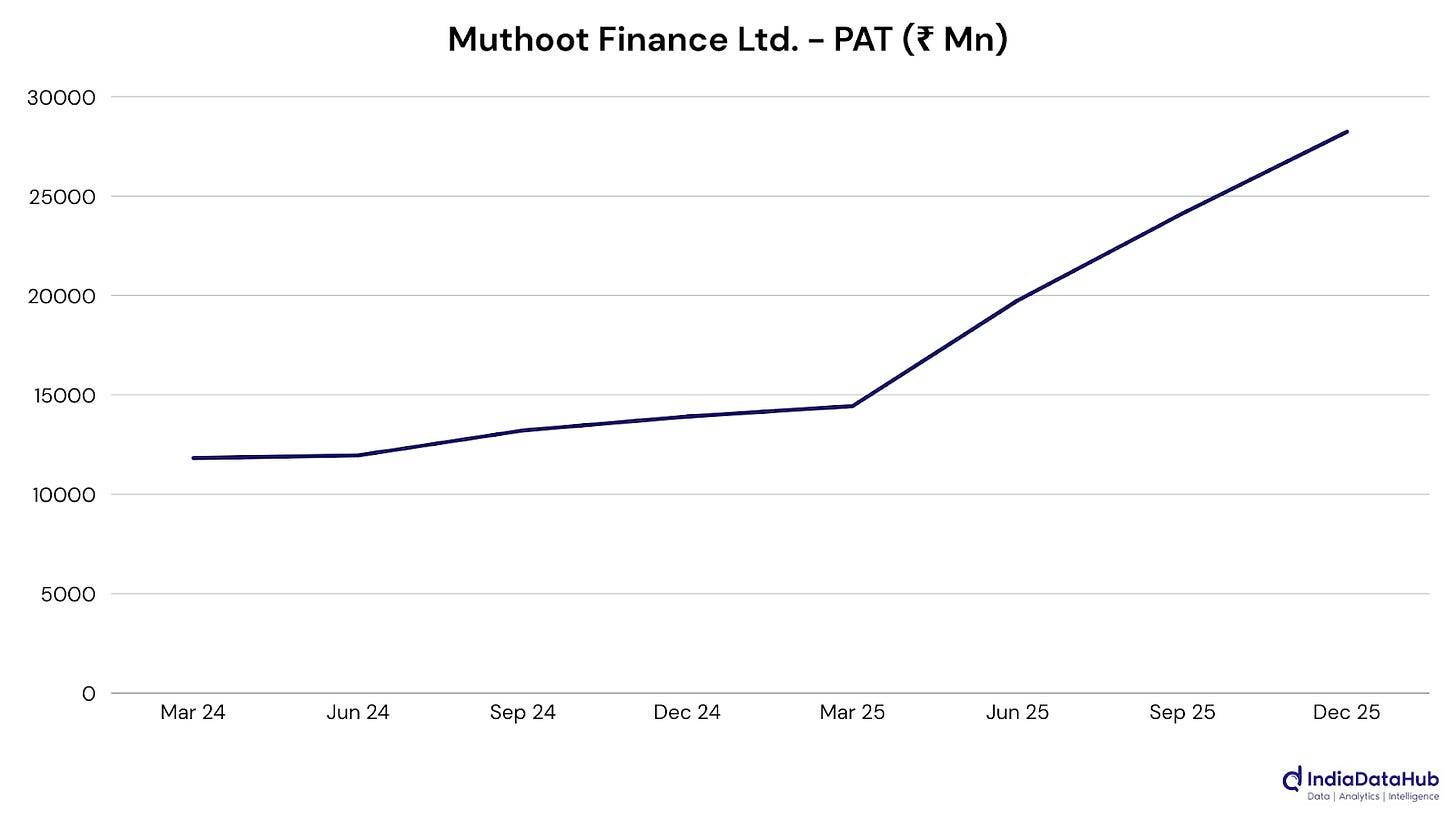

Muthoot Finance Ltd. (Financial Services): Profit more than doubled as gold-loan AUM expanded ~50% and NII jumped 64%, lifting revenue 58% YoY. Momentum may have been boosted by higher gold prices and festive demand, with easing funding costs adding a tailwind.

Hindustan Unilever Ltd. (FMCG): The headline print (profit surging 121%) is doing a lot of heavy lifting via the ice-cream demerger gain, so it’s worth separating the two stories. The operating business looks much more muted: low-single-digit revenue growth with steady volumes, but profitability appears under pressure as margins compressed and brand investments rose. The next few quarters hinge on how quickly pricing actions and cost inflation settle, and whether volume growth can stay resilient without leaning on promotions, because without the exceptional item, earnings momentum seems far less dramatic.

Lupin Ltd. (Healthcare): A standout quarter as revenue jumped 24%, and profit rose 38%, with the US business surging 54% and margins expanding sharply (EBITDA margin ~33.5%, up 840 bps). This looks like a launch-led US run plus a healthier mix and execution.

That’s it for this edition. We still have some key companies in the remaining weeks before the season comes to an end! See you in the next one.