3Q Results, e-com slowdown, Tale of two tantrums and more...

This Week In Data #109

In this edition of This Week In Data we discuss:

Early 3Q results seem better than previous few quarters

Electronic exports recover

Sharp slowdown in online credit card payments

PhonePe and Google Pay continue to dominate UPI but two new fast growing entrants

Wireless subscriber trends returning to normalcy

FX Reserves decline further, now 5ppt more than during Taper tantrum

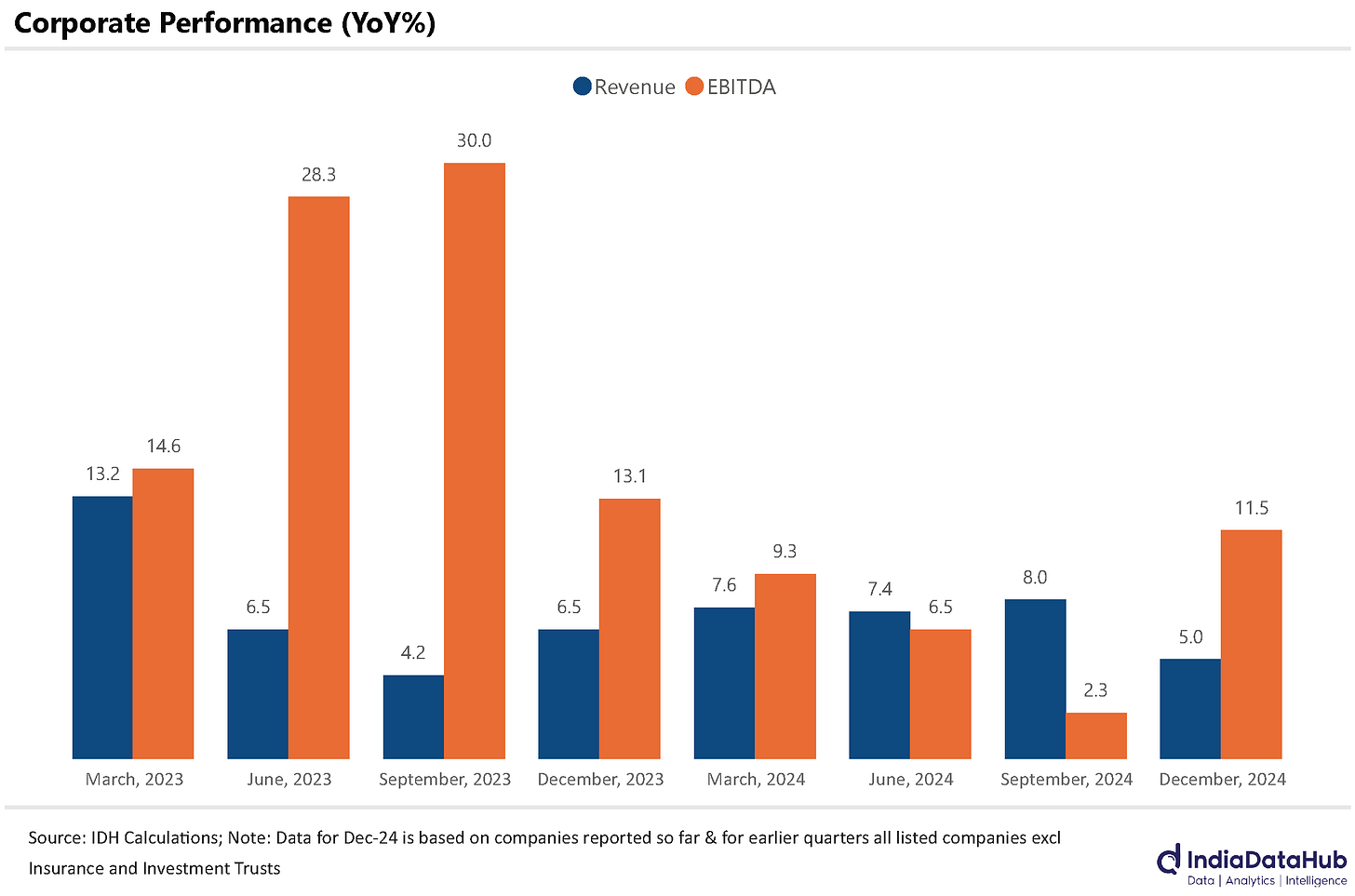

The early results so far seem to suggest that this quarter might be better for corporate profitability compared to the last few quarters as margins seem to have expanded. Overall revenue growth is currently tracking only 5% growth YoY which is the second-lowest growth in the last few years. However, EBITDA growth is currently tracking 12% growth YoY, the highest growth since the December quarter of 2023.

This is broadly in sync with top-down data which is also suggesting that the December quarter was stronger for the economy compared to the extremely weak growth reported during the September quarter. However, a significant majority of the companies are yet to report so these numbers can change, but we will keep track of them every week.

India’s electronic exports have resumed their growth after a couple of months of softness in the middle of the year. In December electronic exports grew almost 40% YoY after almost 50% YoY growth in the preceding two months. At ~US$3.5bn each in the last two months, electronic exports are now 10% of total merchandise exports. Just five years back in 2019, electronic exports were just 4% of total exports. In absolute terms, electronic exports have tripled during this period while overall exports have increased by just over a third!

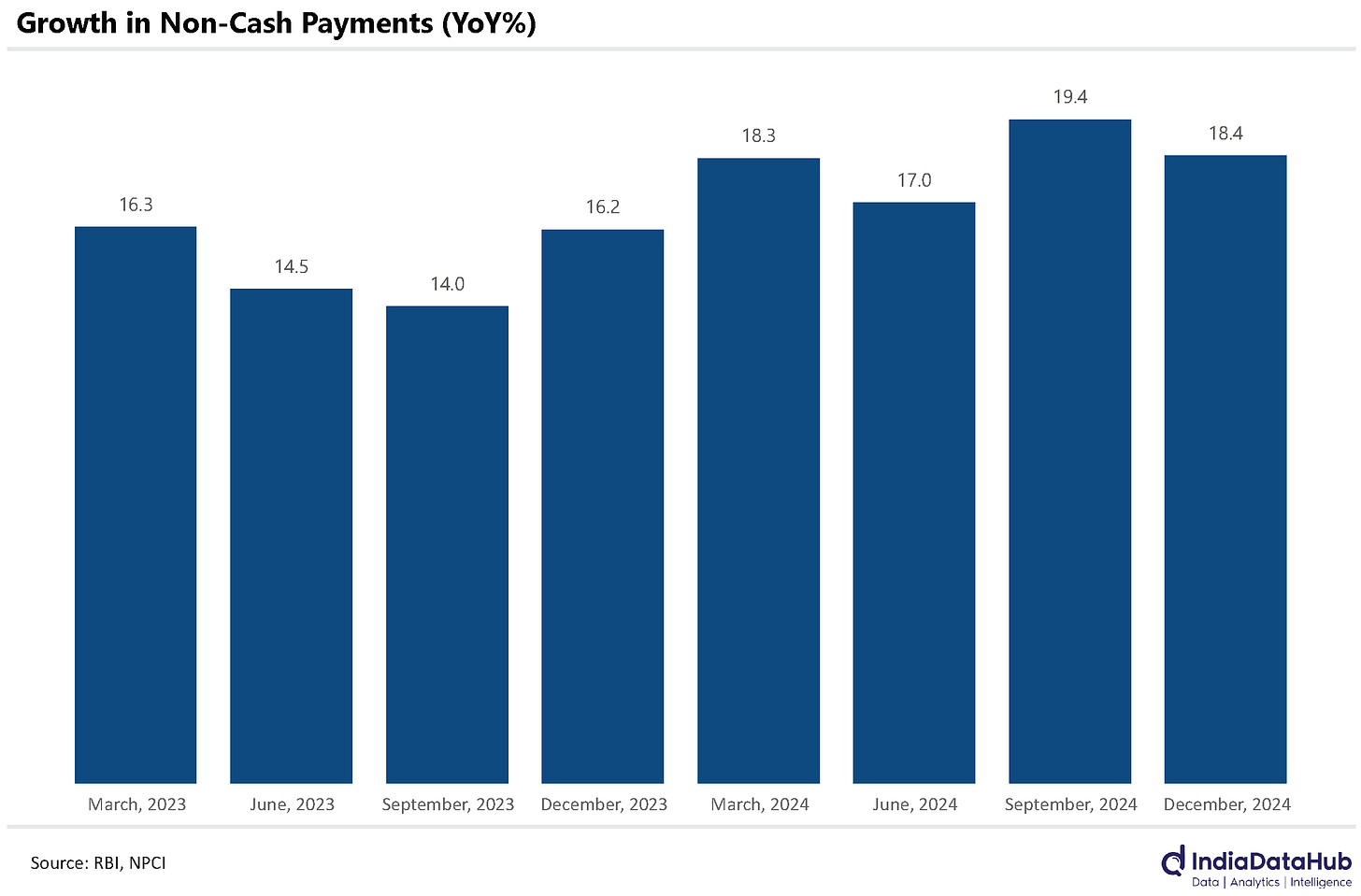

Overall growth in payments recovered in December from the slowdown in November (which was largely due to the timing issue with the festival). Total payments grew 19% YoY in December, up from 9% growth in November. Over the quarter, however, growth has remained largely stable with overall payments growing 18% YoY during the December quarter, broadly the same pace as during the preceding few quarters.

The one notable trend though is the sharp slowdown in credit card payments and within that online payments. Overall domestic credit card payments saw a modest 11% YoY growth during the December quarter, down almost 8ppt from the September quarter.

This slowdown is entirely due to online payments (or non-POS-based payments to be precise). Online payments grew just 3% YoY during the December quarter, the slowest growth in many years. POS-based payments have seen a sharp uptick growing 26% YoY during the December quarter. POS-based payments have grown faster than online payments for 3 consecutive quarters now. Does this corroborate the narrative of the rise of offline trade at the expense of ecommerce?

UPI continues to grow faster than overall payments growth. But in absolute terms, the growth rate has moderated to the 20s in the last couple of months from the 40s last year. PhonePe and Google Pay continue to dominate the UPI ecosystem. The two apps combined see ~86% of the total UPI payments, a share that has remained fairly stable over the past few years. PayTM is a distant third app and its share has fallen (from 10% to 7% currently) post the regulatory issues the company has faced.

However, there is a new app at the number 4 place. Navi UPI app which was launched in the middle of last year saw over 200 million UPI transactions in December. This is 40% more than Cred which hitherto was the 4th largest app. And Flipkart-backed super.money which was launched in August this year has in a very short time risen to the 7th place, overtaking Amazon pay along the way. It saw over 100 million transactions in December, 10% more than Amazon pay.

The wireless telecom market is finally getting back to normalcy after the flux it has been in since July when the private operators raised tariffs. While the industry continued to lose subscribers, the pace has moderated. In November, the operators lost 1.8 million subscribers, the 5th consecutive month of subscriber loss.

However, Jio gained 1.2 million subscribers in November after having lost subscribers in the previous 4 months. And BSNL which had been consistently gaining subscribers in the past few months, lost 0.5 million subscribers. The one thing that did not change was Vi continuing to lose subscribers – it lost 1.5 million subscribers in November.

Lastly, FX reserves. They declined further in the most recent week (17th January) by almost US$2bn. Reserves have declined in 15 of the last 16 weeks with a cumulative decline of US$80bn or almost 12% of starting reserves.

For reference during the taper tantrum in 2013, the peak decline in FX reserves from late April to early September was just US$22bn or 7% of starting reserves. And during this period the rupee had depreciated over 20% against the US Dollar. In this phase, the rupee has depreciated by a relatively modest ~5% against the US Dollar.

That’s it for this week. See you next week, after the Union Budget…

This is interesting !! VAPT - Comments without any authentication ??