Welcome back to This Week in Earnings. The Q3 FY26 results season has crossed the halfway mark, with 1,666 companies reporting so far. At the aggregate level, while broadly the trends remain stable, revenue growth is trending down.

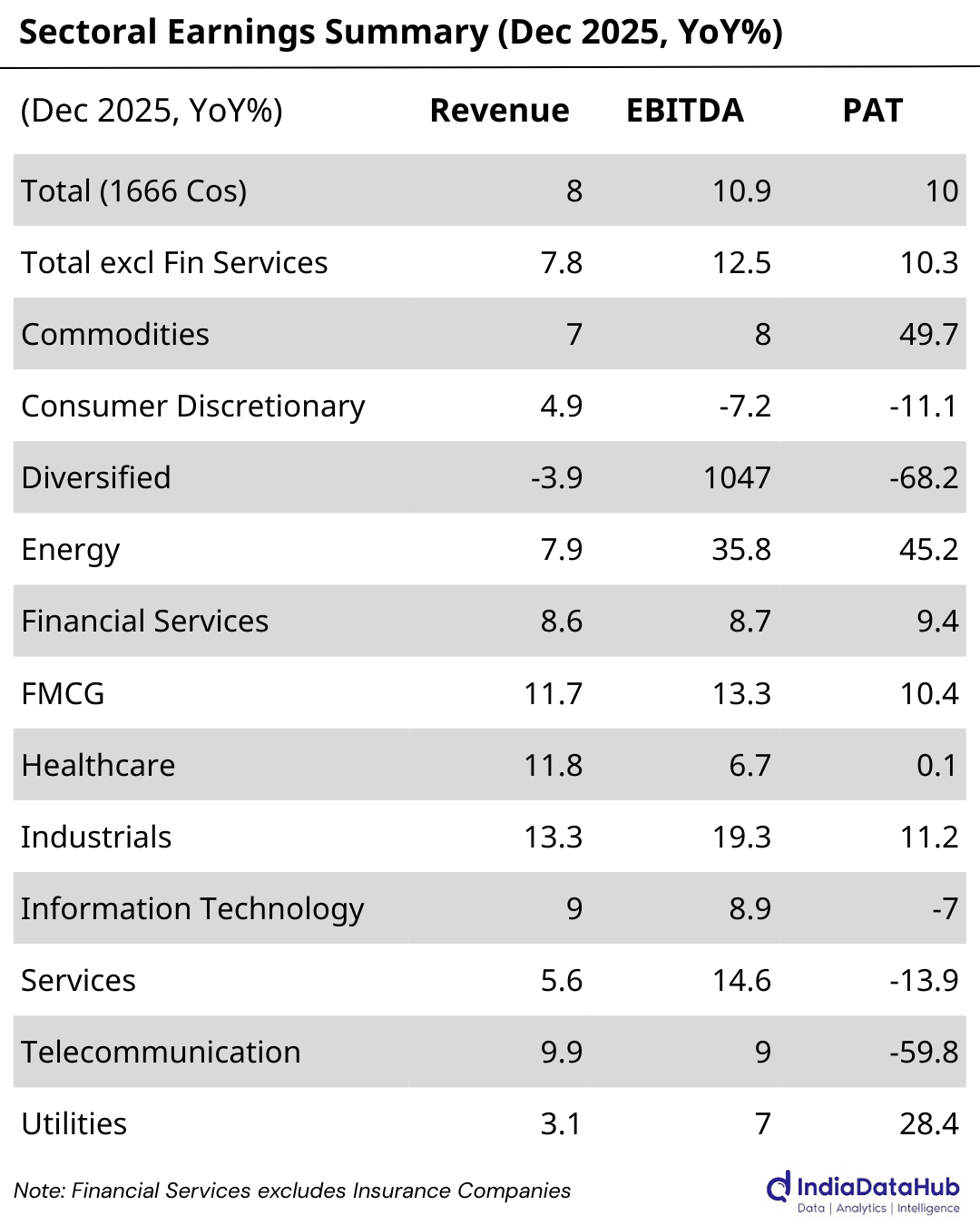

As of yesterday, revenue growth is running at ~8% YoY, down from over 9% as of the last week. Growth in operating profits (EBITDA) has however ticked up to almost 11% YoY, as against less than 10% as of last week. Excluding financial services, operating profit growth is slightly faster but revenue growth is even weaker. This continues to point towards margin management than demand acceleration as the key driver of corporate performance.

This newsletter is structured into two sections:

The first section tracks aggregate and sectoral trends, highlighting what’s propelling growth this week.

The second dives into standout company results shaping those numbers.

Want to dig deeper? Download the extended edition for full sector-wise company data and detailed performance notes

Aggregate Trends

The results so far reinforce the familiar theme of healthy topline growth with sharply uneven profit outcomes by sector.

Beneath these steady headline numbers, however, sector divergence has widened. Energy is now the clearest outperformer, with EBITDA and profit growth far outpacing revenue, supported by improved refining economics and stable fuel demand. Industrials continues to deliver one of the cleanest growth profiles this quarter, with strong topline expansion translating into healthy operating and profit growth.

The Commodity complex tells a more nuanced story. While profits have surged, aided by cost actions, domestic mix benefits, and occasional one-offs, revenue growth remains modest. In contrast, Consumer Discretionary has weakened sharply, with margins and profits coming under pressure despite positive revenue growth, reflecting disruption-driven volatility and fixed-cost absorption challenges.

Several large sectors continue to show a disconnect between operating performance and bottom-line outcomes. FMCG remains steady, with double-digit growth across revenue and EBITDA, but profits are largely tracking rather than accelerating. Healthcare has seen margin pressure cap profit growth despite strong topline expansion. Information Technology and Services both report operating growth, yet profits have slipped, highlighting the growing influence of provisioning, finance costs, depreciation, and exceptional items.

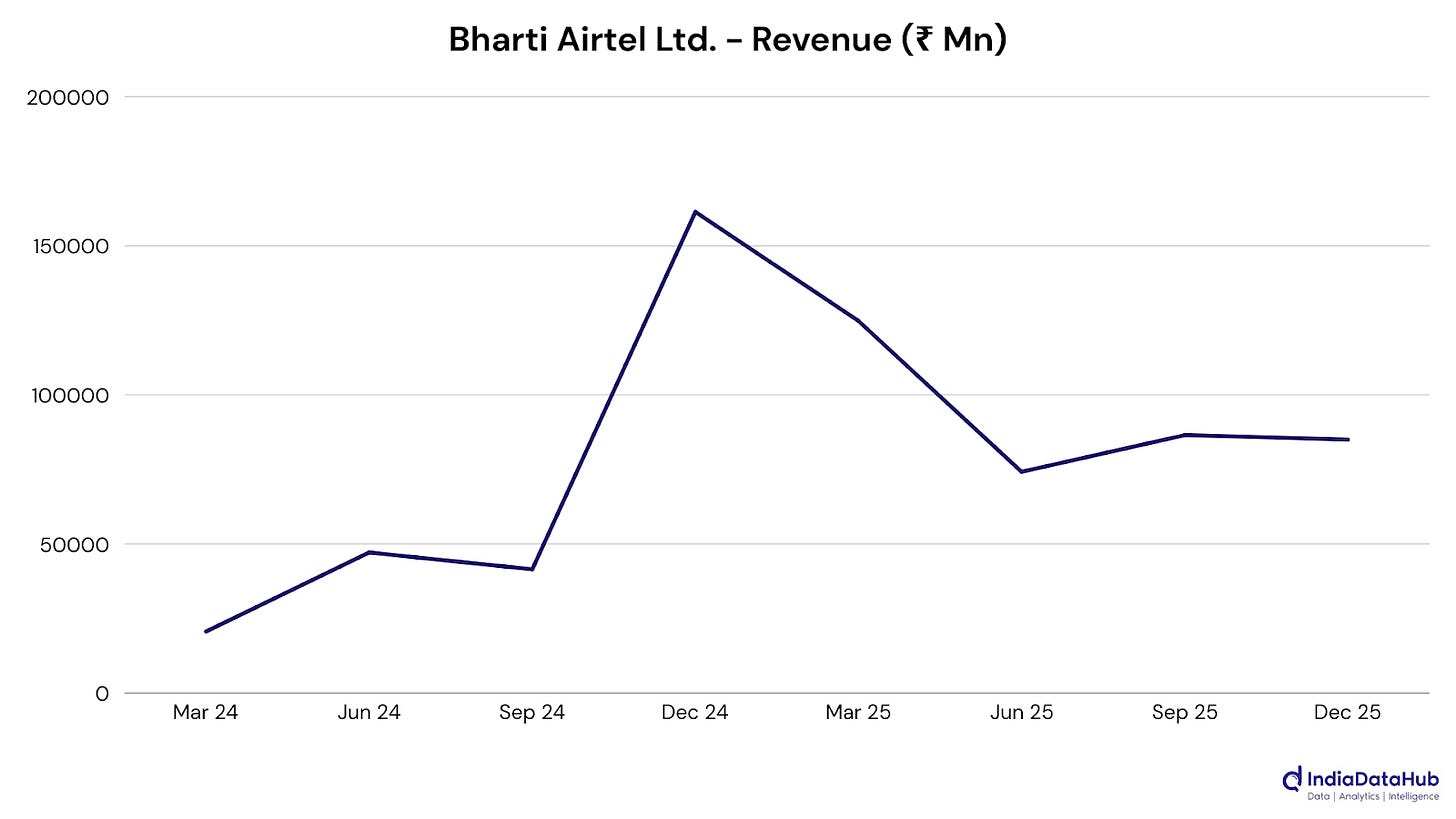

Telecommunications remains the anomaly. Revenues and EBITDA continue to grow strongly on ARPU gains and network scale-up, but profits have fallen sharply as depreciation and statutory costs from heavy investment cycles weigh on reported earnings.

Overall, Q3 FY26 is shaping up as a quarter of stable demand but increasingly uneven profitability, where cost structures and capital intensity are separating reported winners from underlying momentum. As more results flow in, the gap between operating strength and headline profit outcomes gets harder to ignore.

Company Spotlights

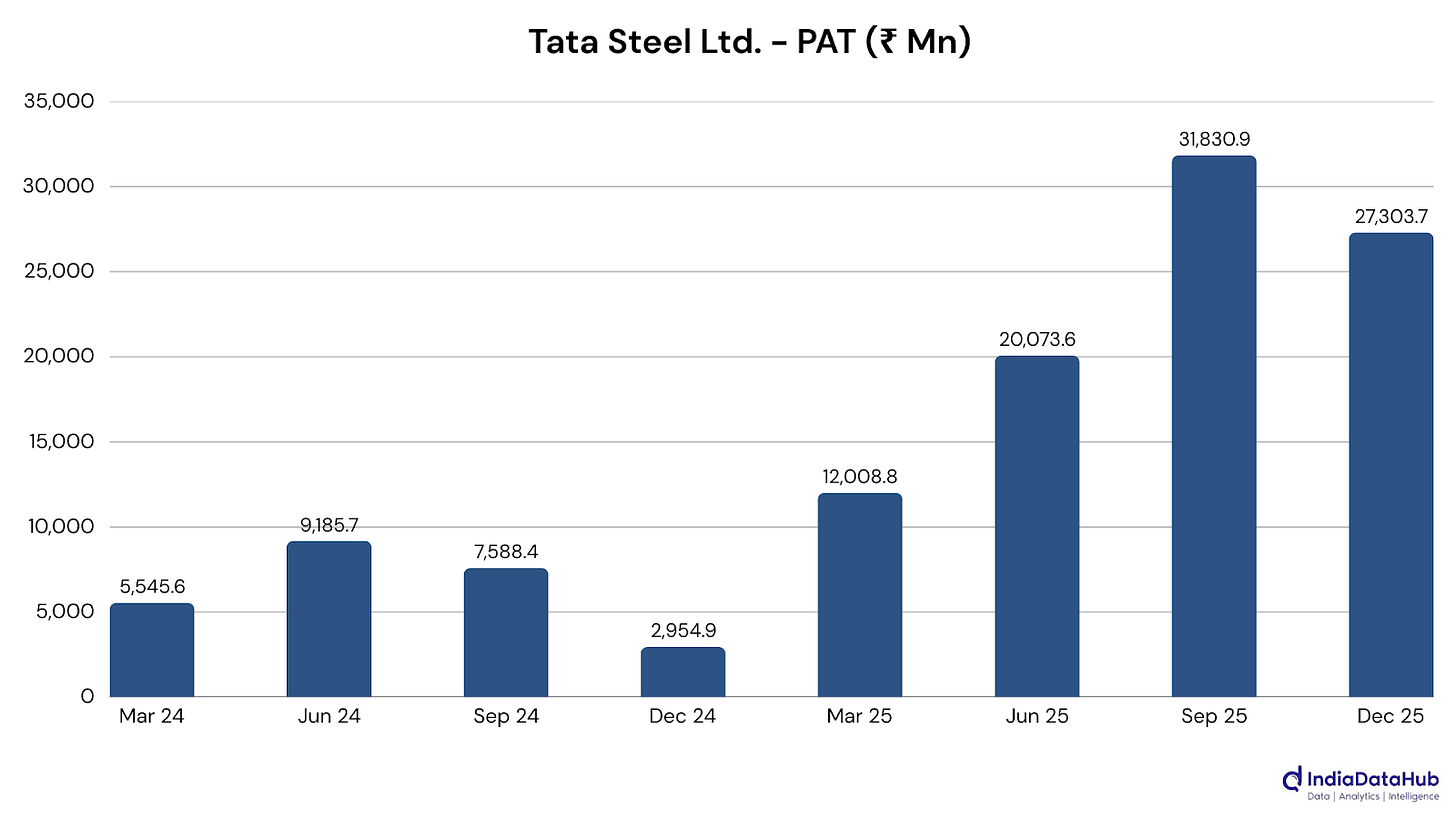

Tata Steel Ltd. (Commodities): Revenue rose 6%, while profit surged on stronger India deliveries, wider EBITDA margins, and transformation-led cost savings, with a tax-related one-off also helping the headline. The jump seems rooted in domestic mix and volume resilience despite softer overseas conditions.

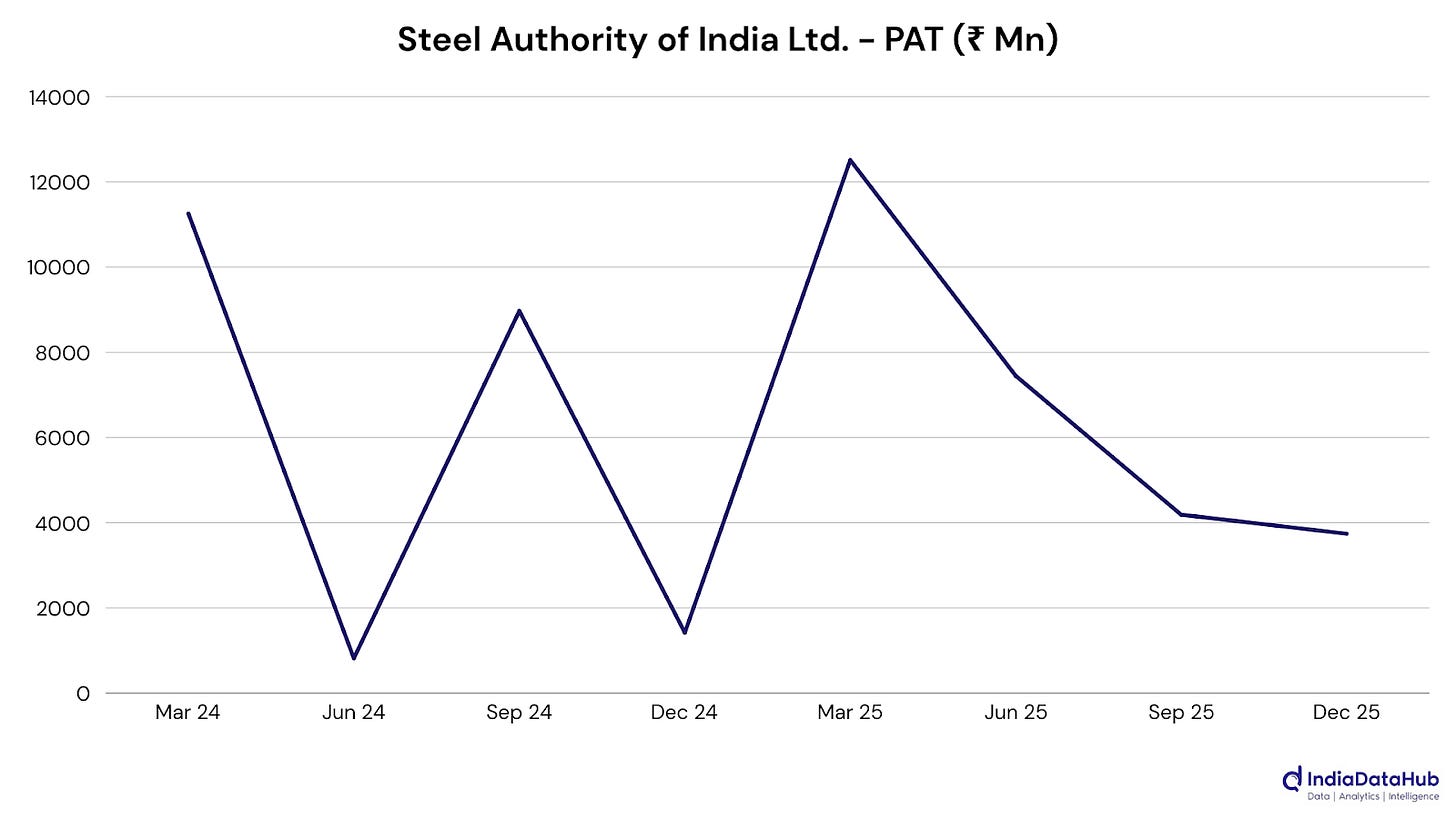

Steel Authority of India Ltd. (Commodities): Revenue rose nearly 12% on higher sales volumes, while profit rebounded sharply as cost controls and lower finance charges took effect. The improvement seems linked to operating leverage and inventory clean-up, even as margins remain sensitive to steel-cycle swings.

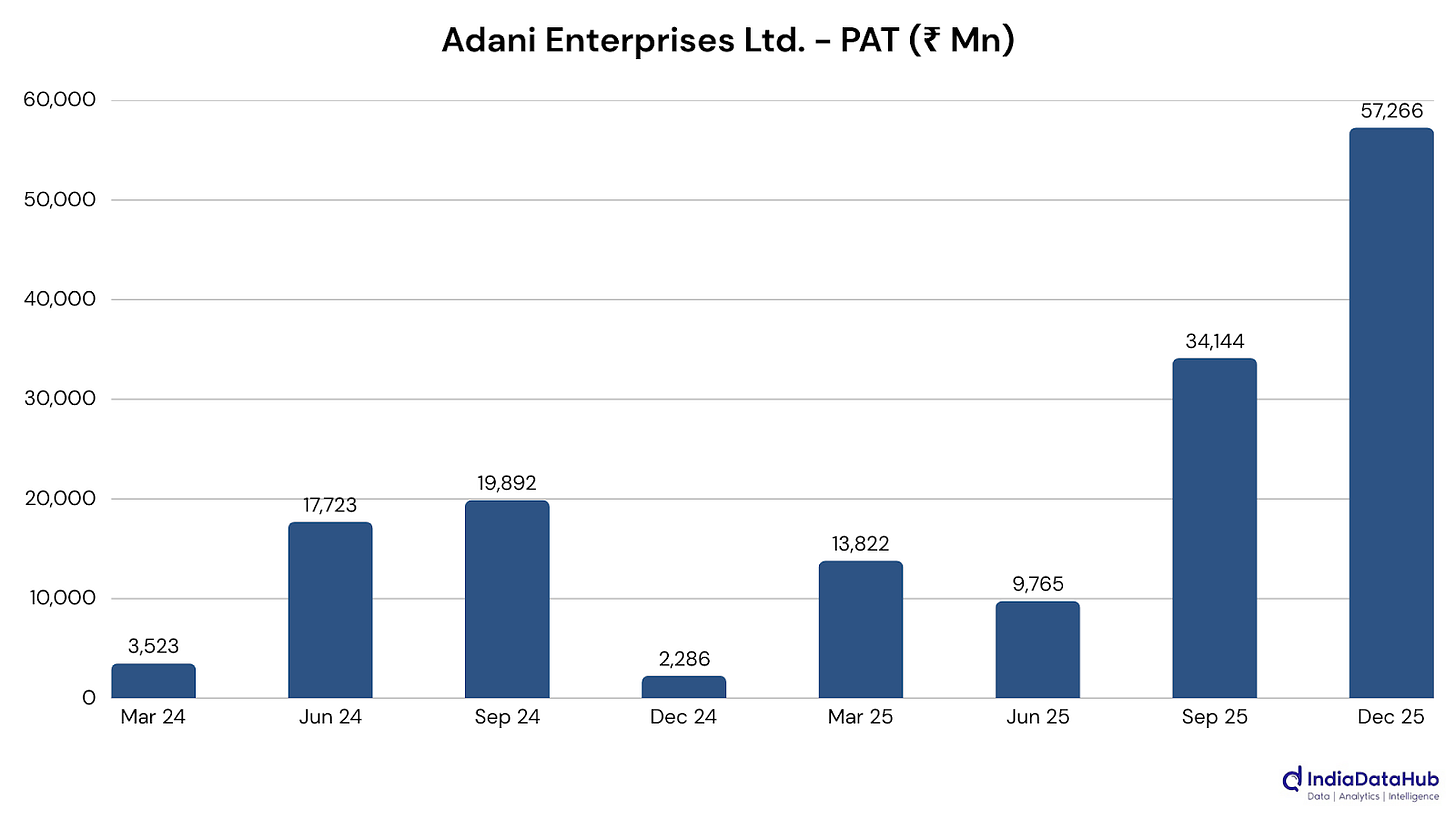

Adani Enterprises Ltd. (Commodities): Revenue grew in high single digits, while profit spiked mainly because of a large one-time gain from asset/stake sales. Underlying operations appear steadier, with airports and new-energy businesses contributing to EBITDA growth.

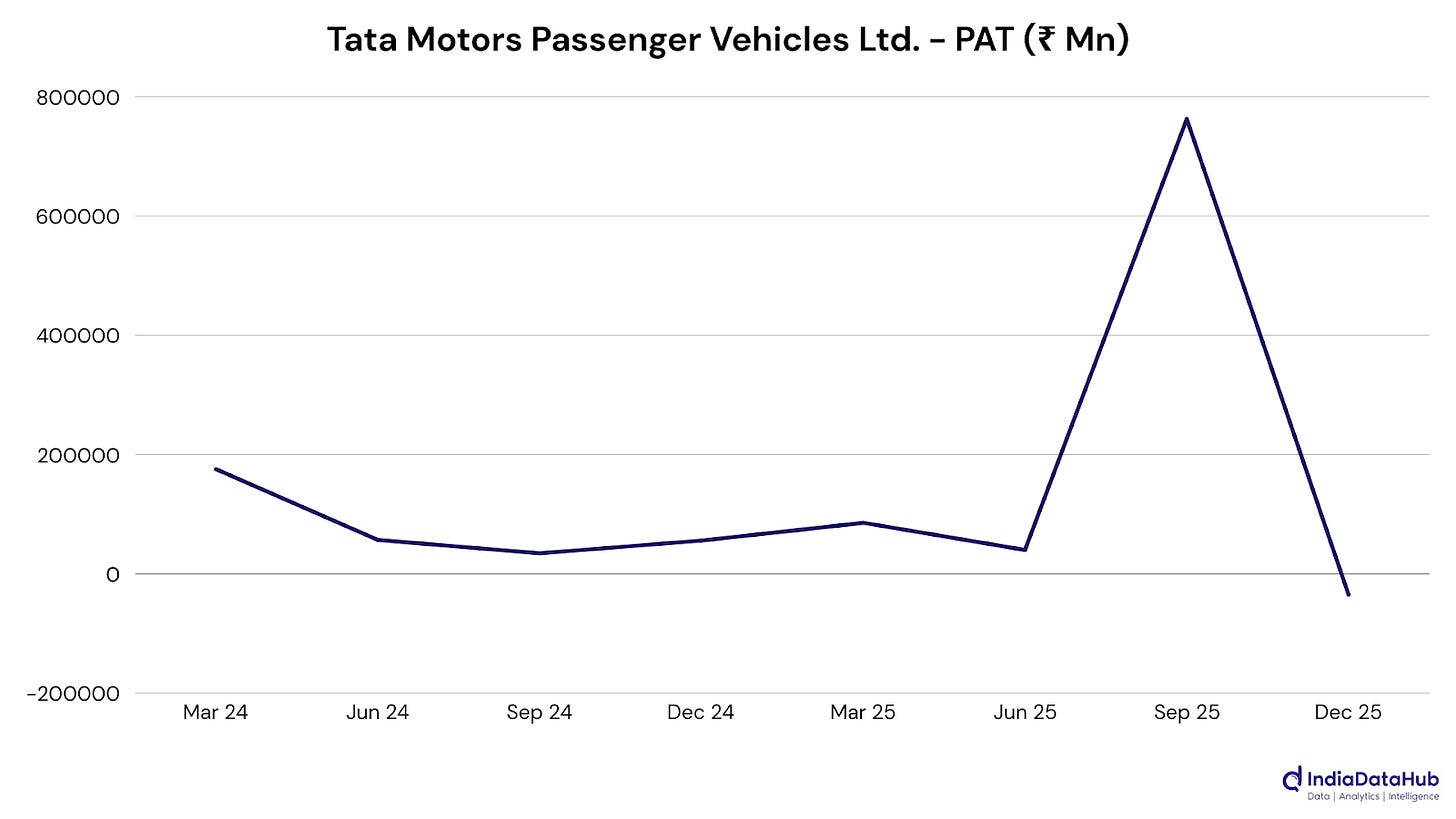

Tata Motors Passenger Vehicles Ltd. (Consumer Discretionary): Revenue fell sharply and the quarter swung to a loss, largely reflecting JLR production disruption from the cyber incident and sizeable exceptional charges. The extent of the decline appears amplified by weaker realisations and fixed-cost absorption, even as domestic PV volumes held up better.

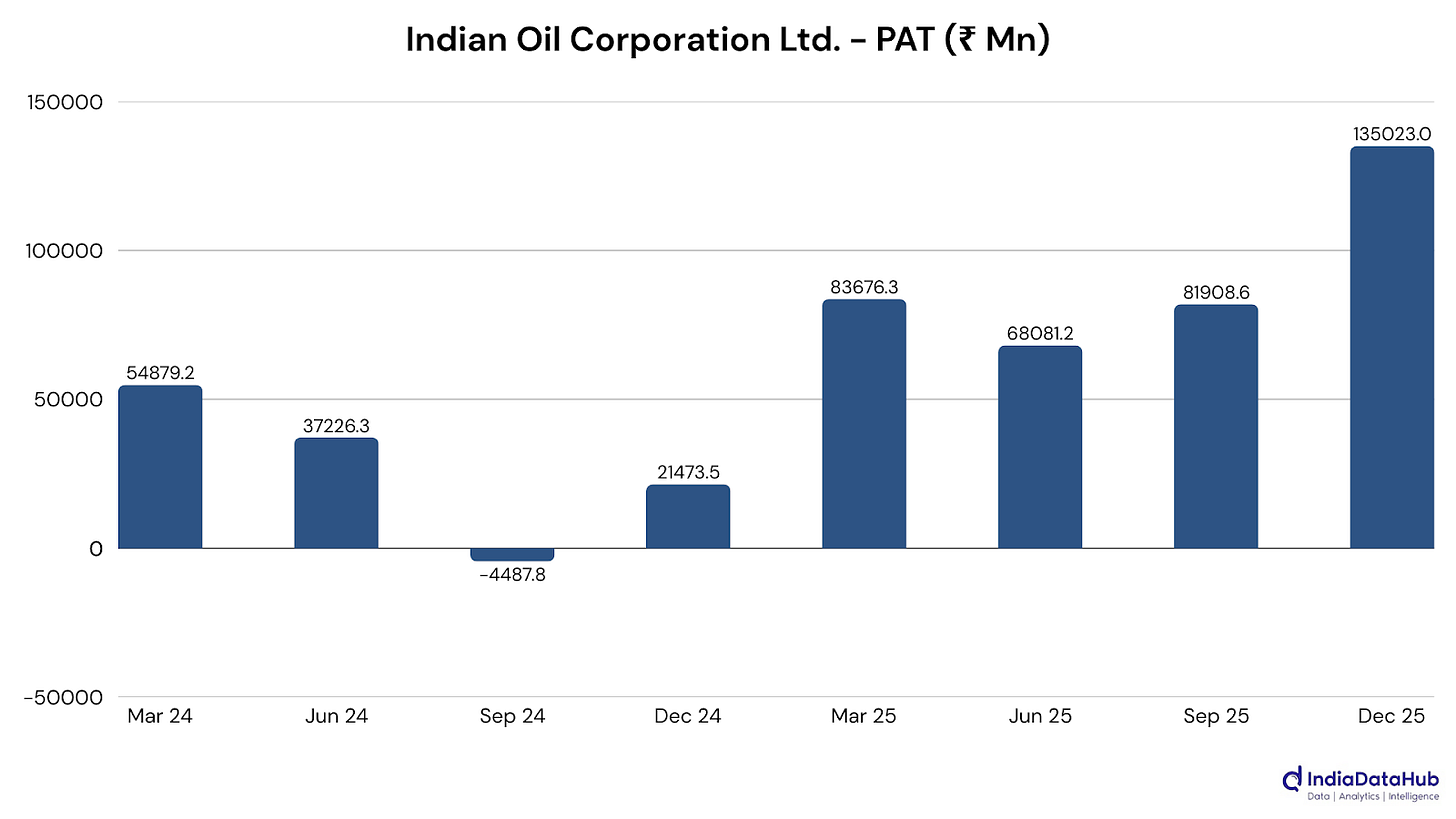

Indian Oil Corporation Ltd. (Energy): Revenue rose about 8%, while profit rebounded sharply as refining margins improved materially and throughput stayed strong, with LPG compensation also supporting the quarter. The scale of the swing seems tied to more favourable refining economics alongside resilient domestic fuel demand.

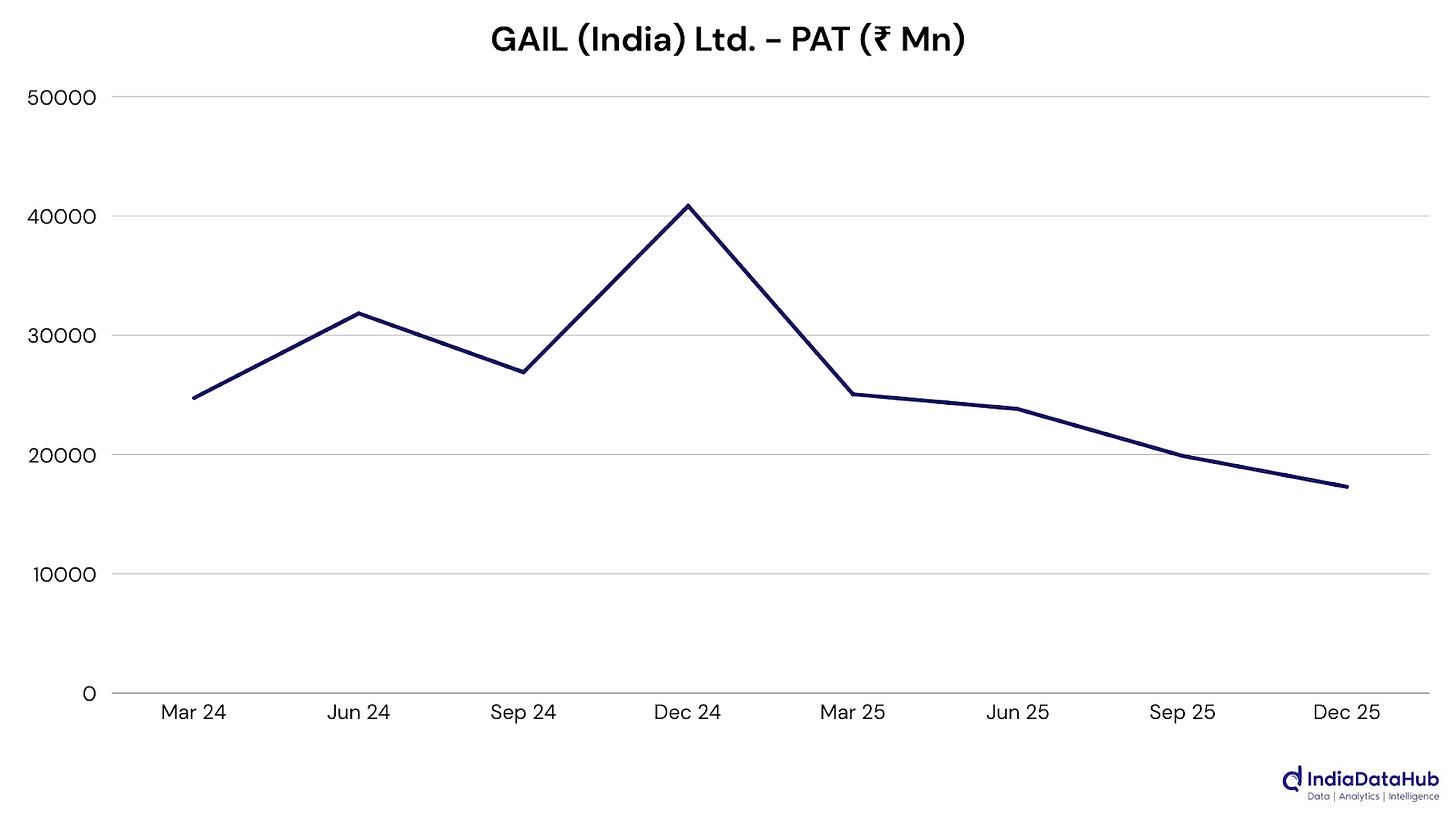

GAIL (India) Ltd. (Energy): Revenue slipped mid-single digits, while profit dropped sharply from a high base as gas marketing margins and petrochemicals weighed on the quarter. The result appears influenced by spread volatility and higher depreciation, even as transmission earnings stayed comparatively steady.

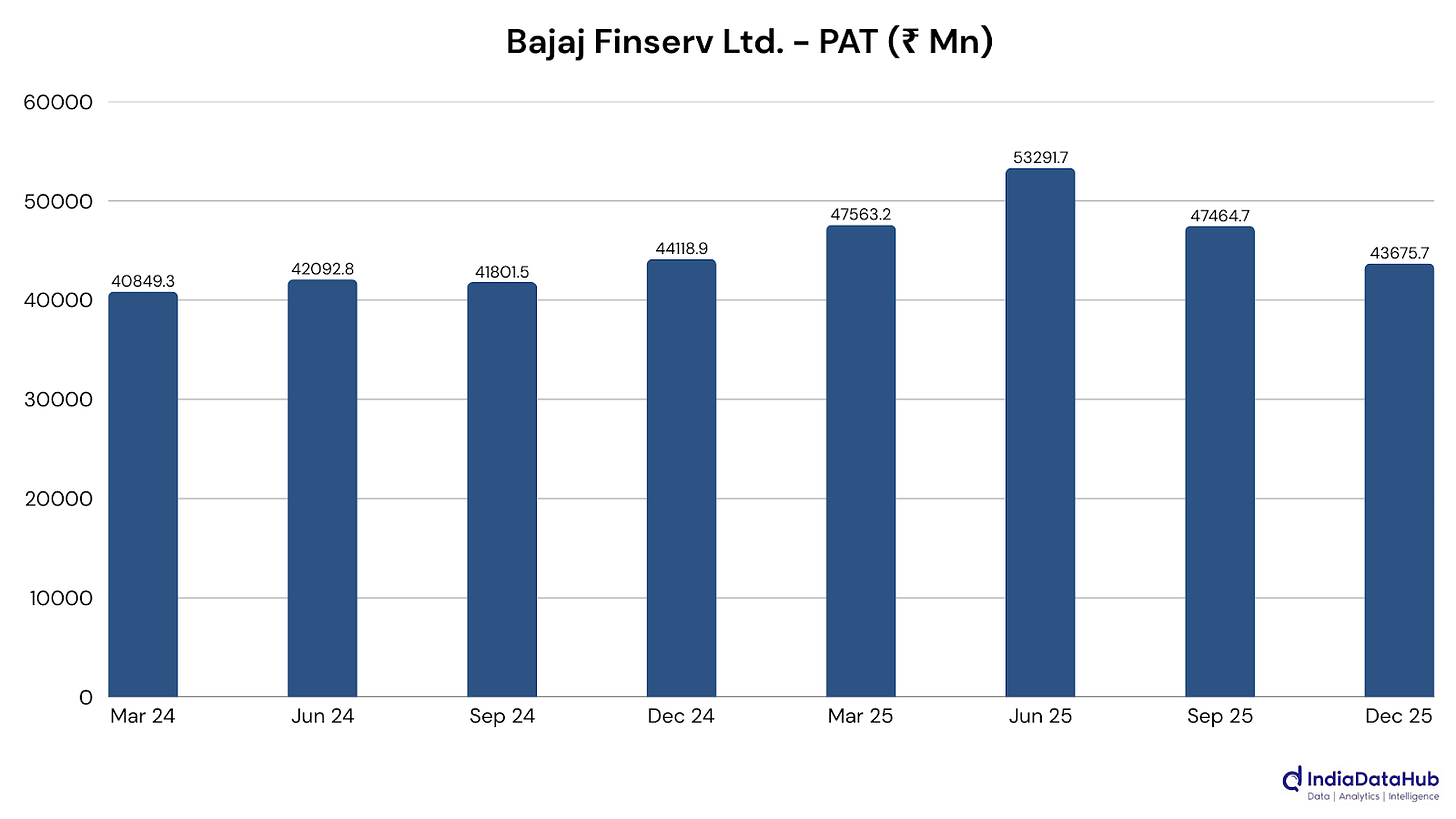

Bajaj Finserv Ltd. (Financial Services): Revenue grew about 24%, but profit was broadly flat as higher credit provisions and one-time labour-code costs offset strong underlying momentum. The outcome seems consistent with a quarter focused on strengthening buffers, even as lending and insurance engines continued to expand.

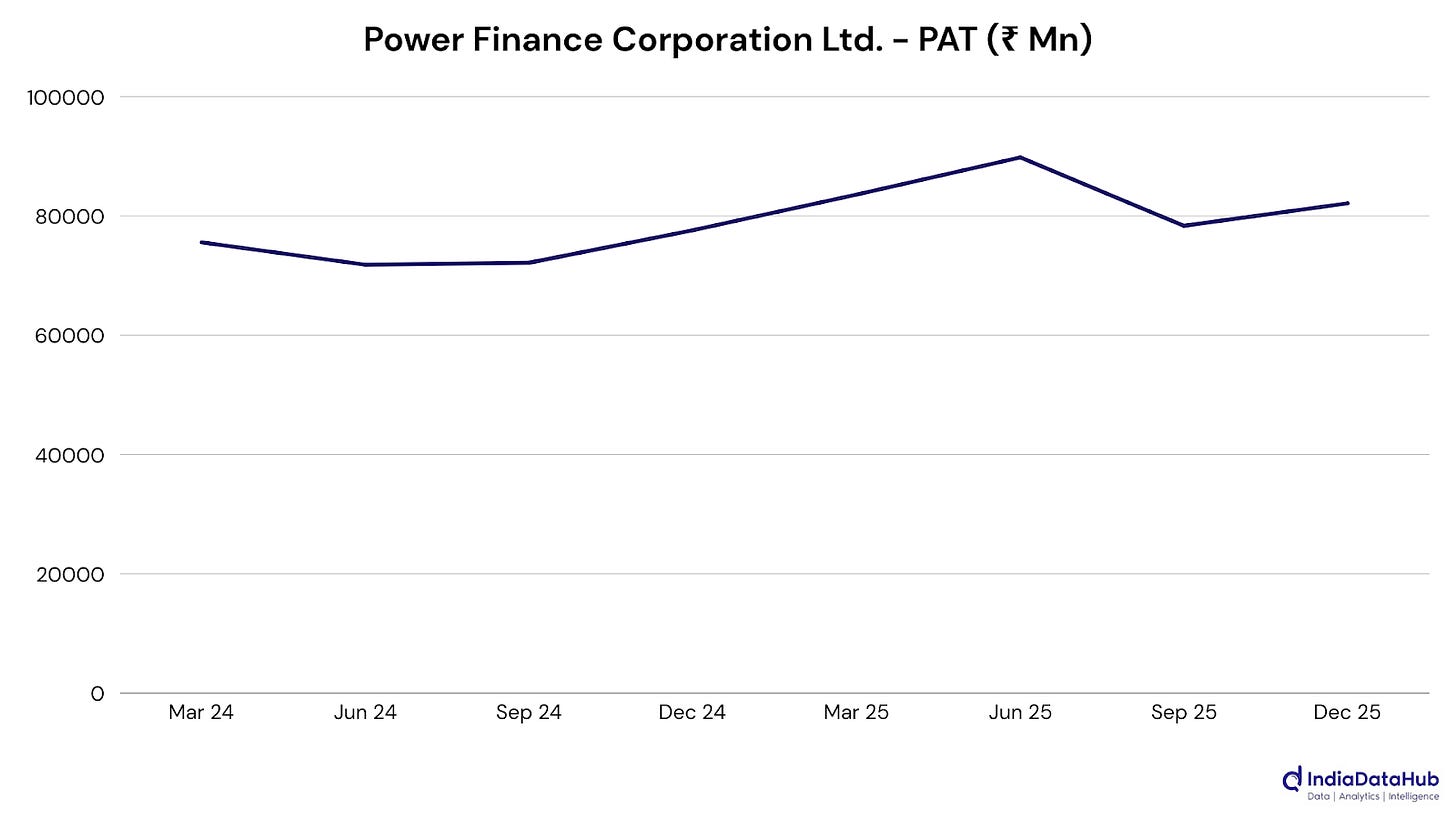

Power Finance Corporation Ltd. (Financial Services): Revenue rose in high single-digits, and profit grew in mid-single digits, supported by steady loan book expansion and stable asset quality. The trajectory appears aligned with continued power-sector funding needs. especially renewables, though competitive lending could keep spreads from widening materially.

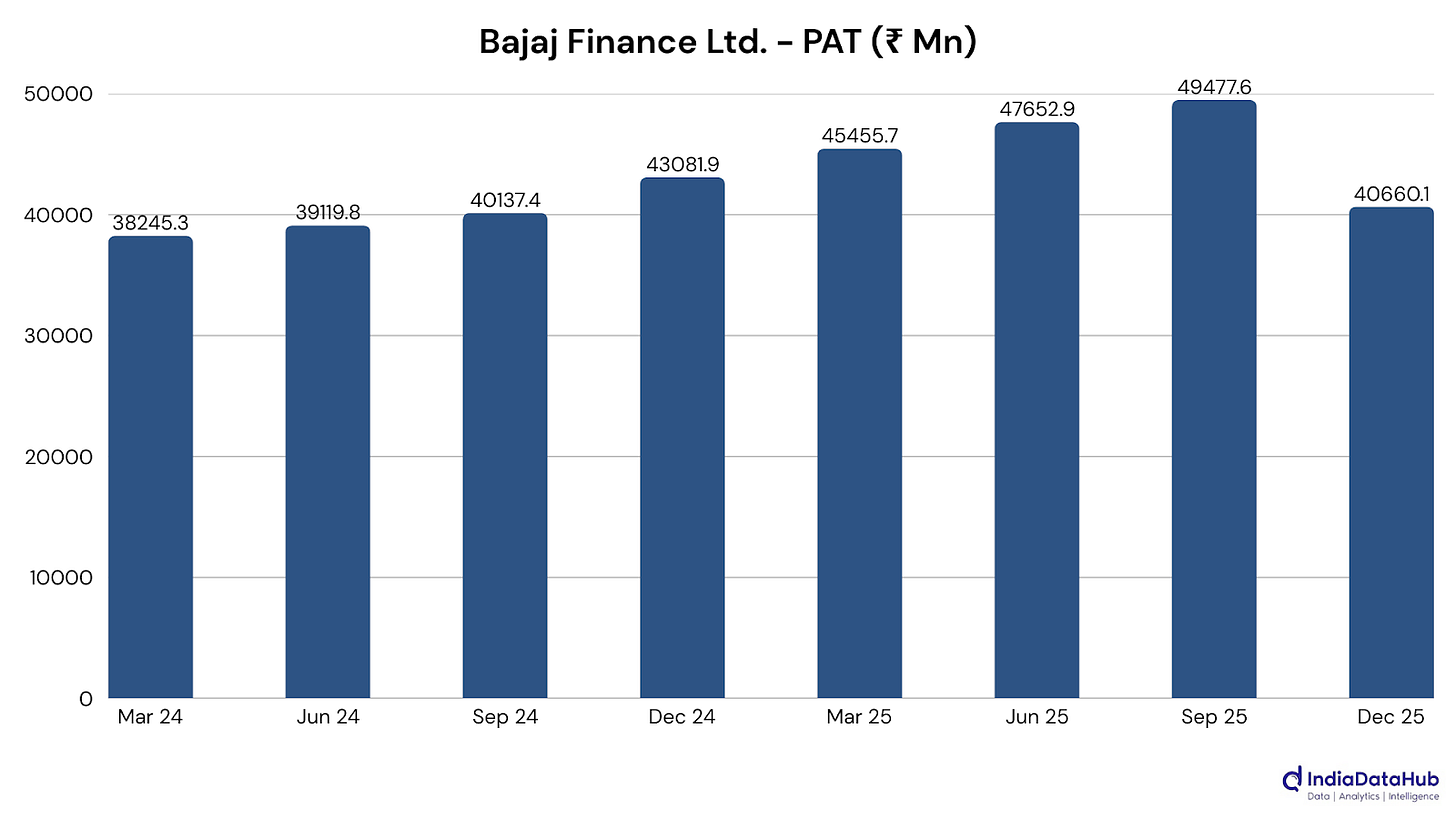

Bajaj Finance Ltd. (Financial Services): Revenue grew nearly 18%, but profit fell mid-single digits as accelerated credit provisioning and a labour-code charge weighed on the reported figure. The underlying picture looks stronger, with AUM and loan growth continuing to support core earnings momentum.

Bharti Airtel Ltd. (Telecommunications): Revenue rose nearly 20%, and EBITDA expanded, led by stronger India and Africa operations and continued ARPU improvement. Profit fell sharply, reflecting higher depreciation and statutory costs from network rollout; the investment cycle appears to be weighing on reported earnings.

That’s it for this edition. We’re only halfway yet, and a lot to look forward to, which we’ll be unpacking in the coming weeks! See you next week.