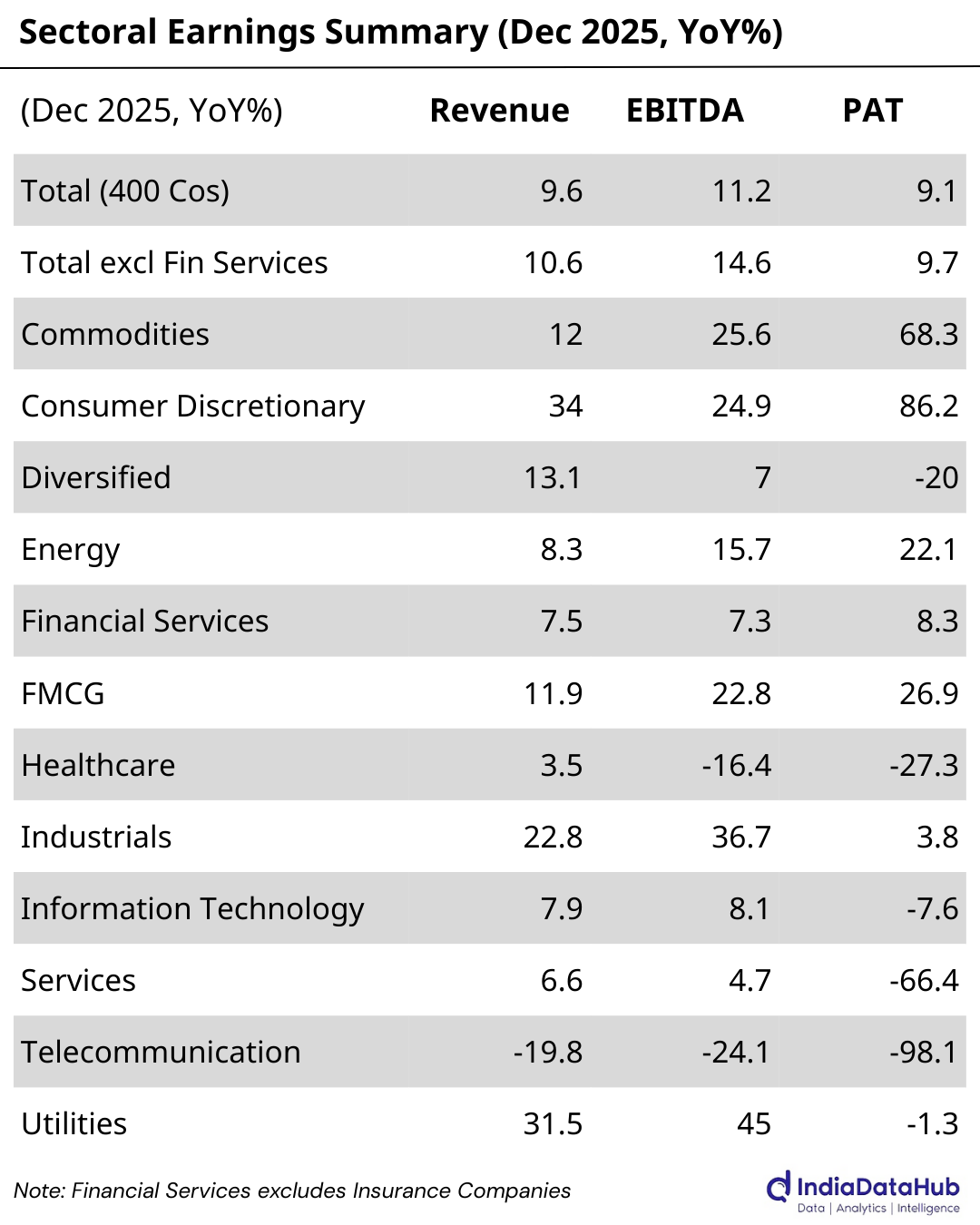

Welcome back to This Week in Earnings. The Q3 FY26 results season already has 400 companies reporting in. Aggregate performance remains steady: revenues are up 9.6% year-on-year, EBITDA has grown 11.2%, and PAT is higher by 9.1%. Excluding financial services, the picture looks marginally stronger on operating metrics, with EBITDA growth accelerating to 14.6% and profits up 9.7%, suggesting that margin dynamics outside the financial sector are doing more of the heavy lifting so far.

This newsletter is structured into two sections:

The first section tracks aggregate and sectoral trends, highlighting what’s propelling growth this week.

The second dives into standout company results shaping those numbers.

Want to dig deeper? Download the extended edition for full sector-wise company data and detailed performance notes

Aggregate Trends

The results so far point to a widening divergence across sectors. Consumer Discretionary is a clear outperformer, with strong revenue growth translating into sharp profit expansion, reflecting favourable demand conditions and operating leverage. FMCG has also delivered a positive surprise, with profits growing faster than revenues, indicating meaningful margin recovery.

Commodities continued to post outsized profit growth, supported by strong EBITDA expansion, underscoring the impact of cost discipline and operating leverage even as pricing tailwinds soften. Energy remained stable, with profit growth comfortably outpacing topline growth.

The picture is mixed in other sectors. Industrials and Utilities reported strong revenue and EBITDA growth, but profits have lagged, pointing to cost pressures and ongoing investment weighing on bottom-line conversion. Financial Services continues to show steady but unspectacular performance, with profit growth broadly tracking revenues.

Several sectors remain under pressure. Healthcare has seen a sharp contraction in margins and profits so far this quarter. Information Technology and Services have slipped into profit declines despite modest revenue growth, while Telecom remains the clear laggard so far, with revenues, margins, and profits all sharply lower.

Overall, Q3 FY26 is shaping up as a quarter of stable demand but uneven profitability. Margin discipline and cost structures are increasingly determining outcomes, even where topline growth remains healthy. As more results come in, the contours of this divergence should become clearer.

Key Company Highlights

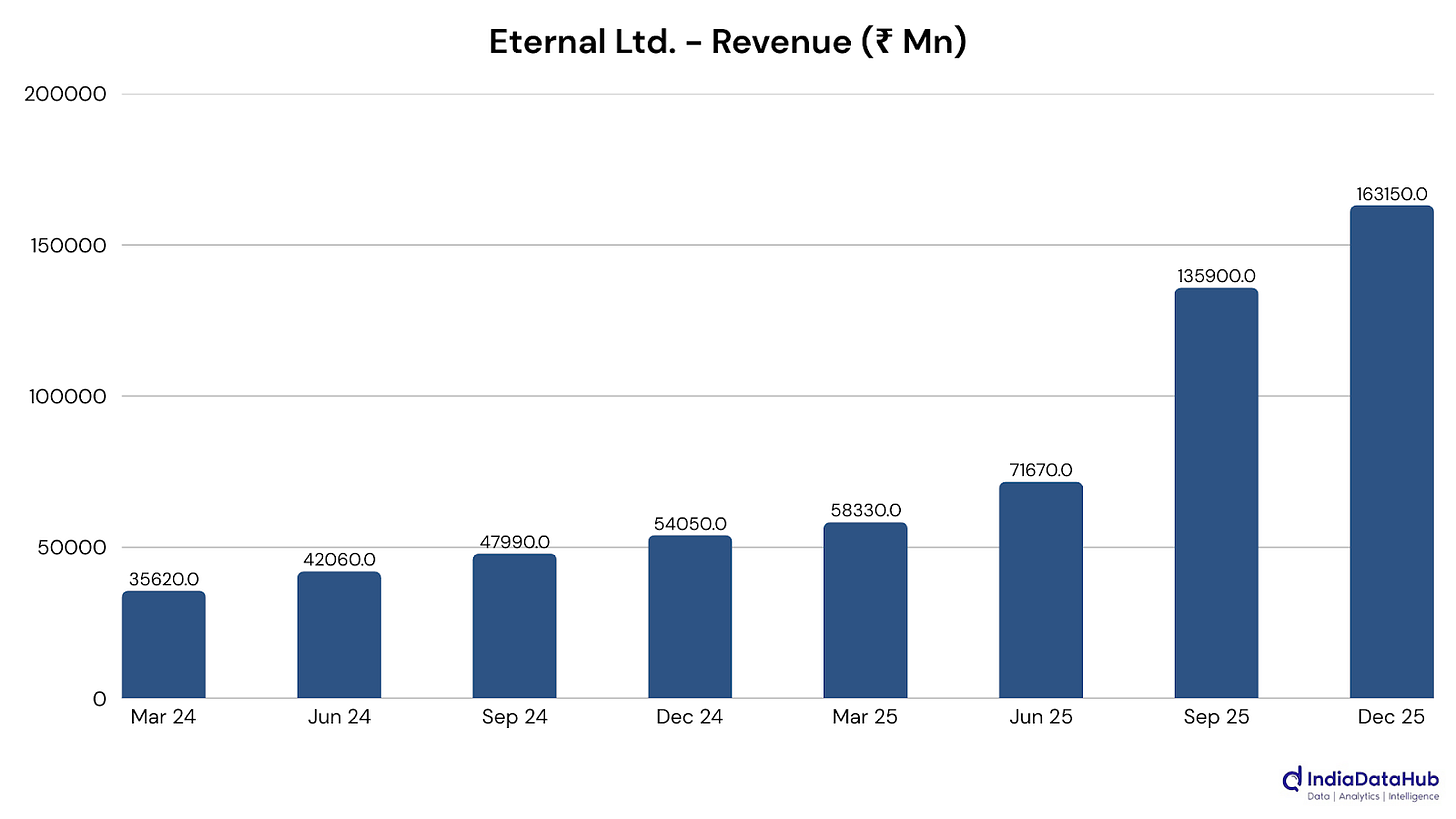

Eternal Ltd. (Consumer Discretionary): Numbers were exceptionally strong as revenue tripled and profit rose 73%, powered by Blinkit’s rapid scale-up and strong Hyperpure growth. Profitability also improved at the EBITDA level, showing the quick-commerce expansion is getting more efficient.

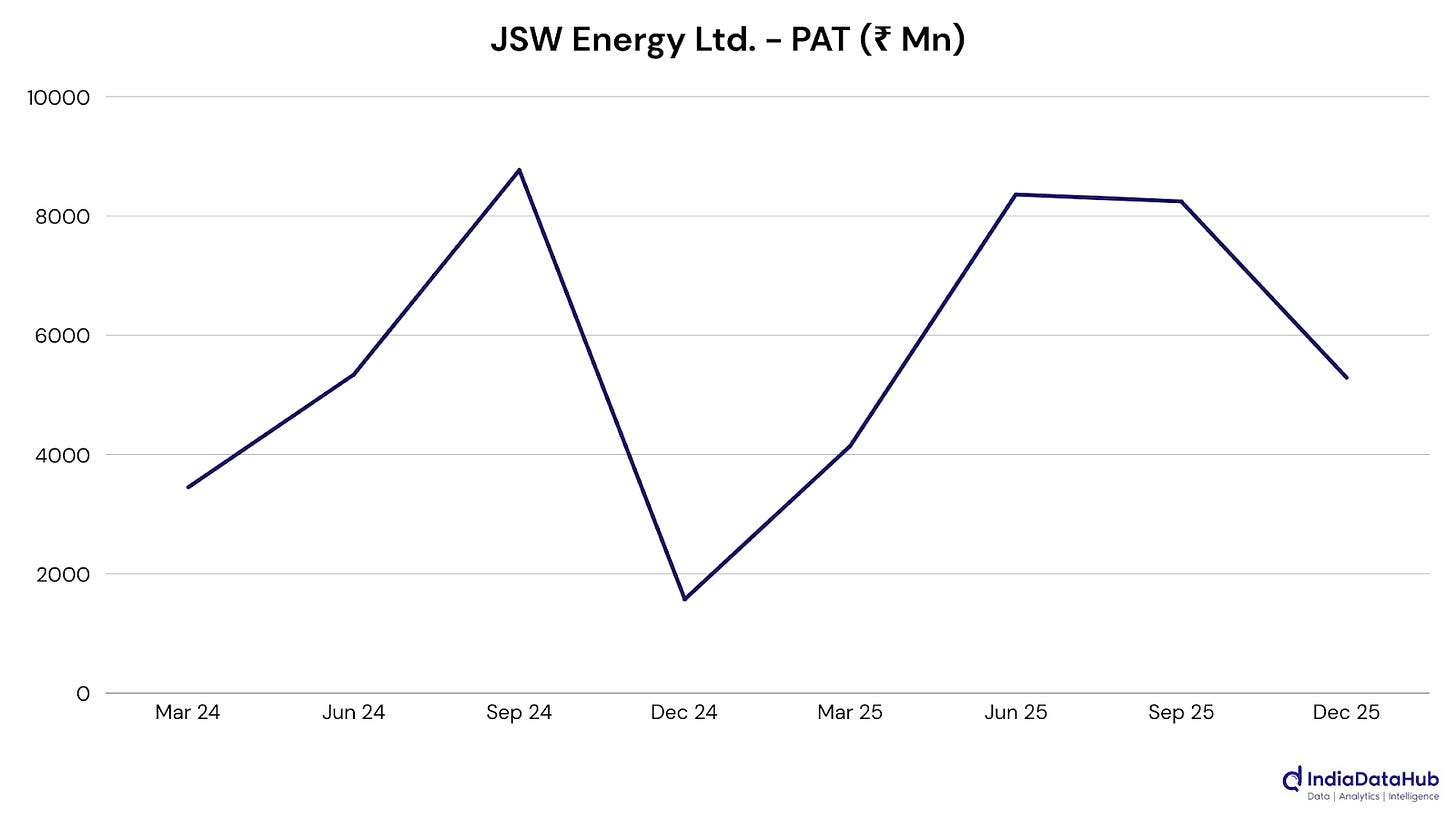

JSW Energy Ltd. (Utilities): Quarter was driven by scale. Revenue jumped 67% and profit more than tripled as generation rose sharply across thermal and renewables. New capacity and acquired assets are showing up in the numbers, with margins expanding alongside volumes.

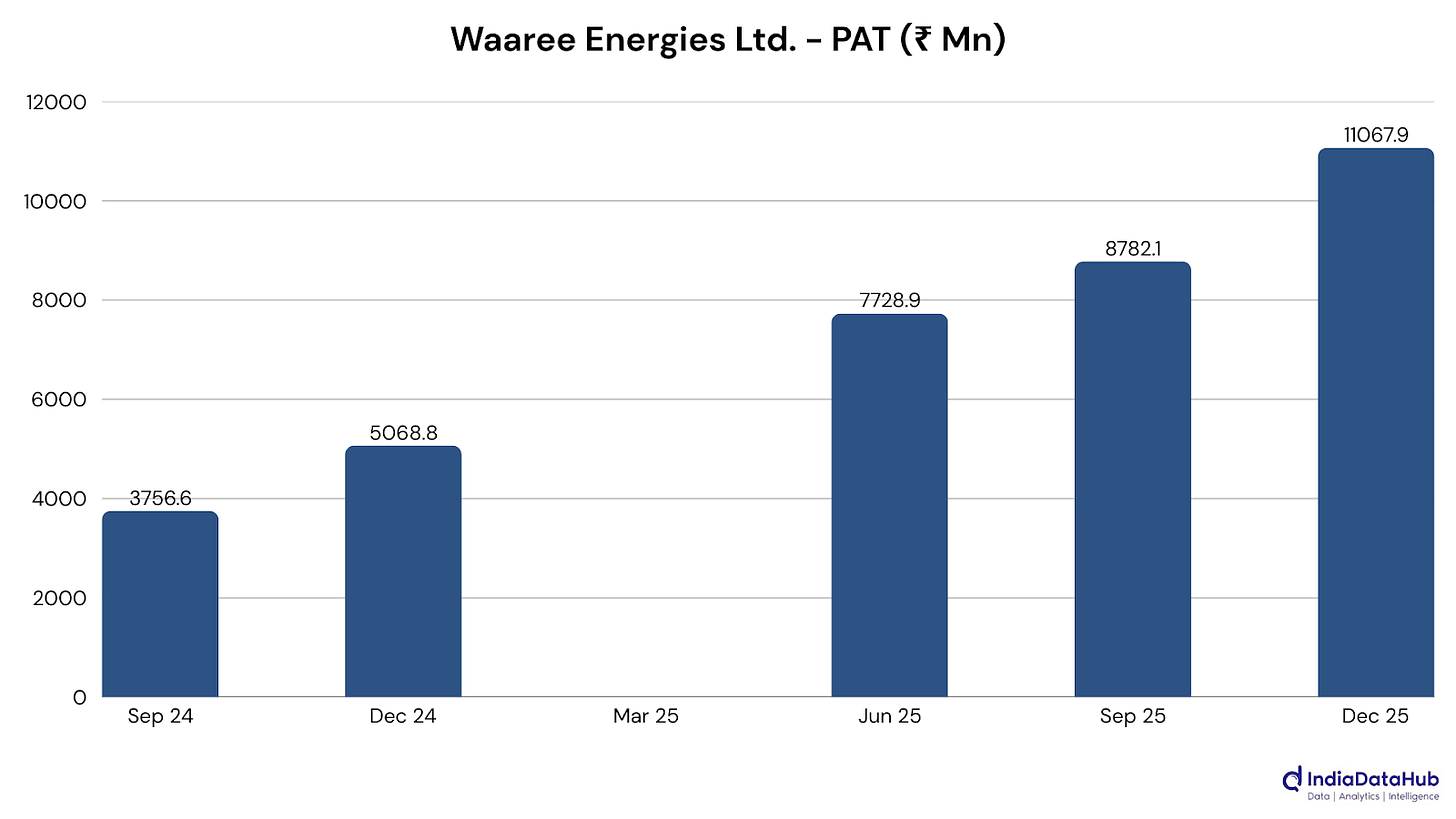

Waaree Energies Ltd. (Industrials): A headline quarter with revenue and profit more than doubling as module output and sales ramped sharply. A large order book supported high utilisation, while strong margins showed the scale-up is feeding through to profitability.

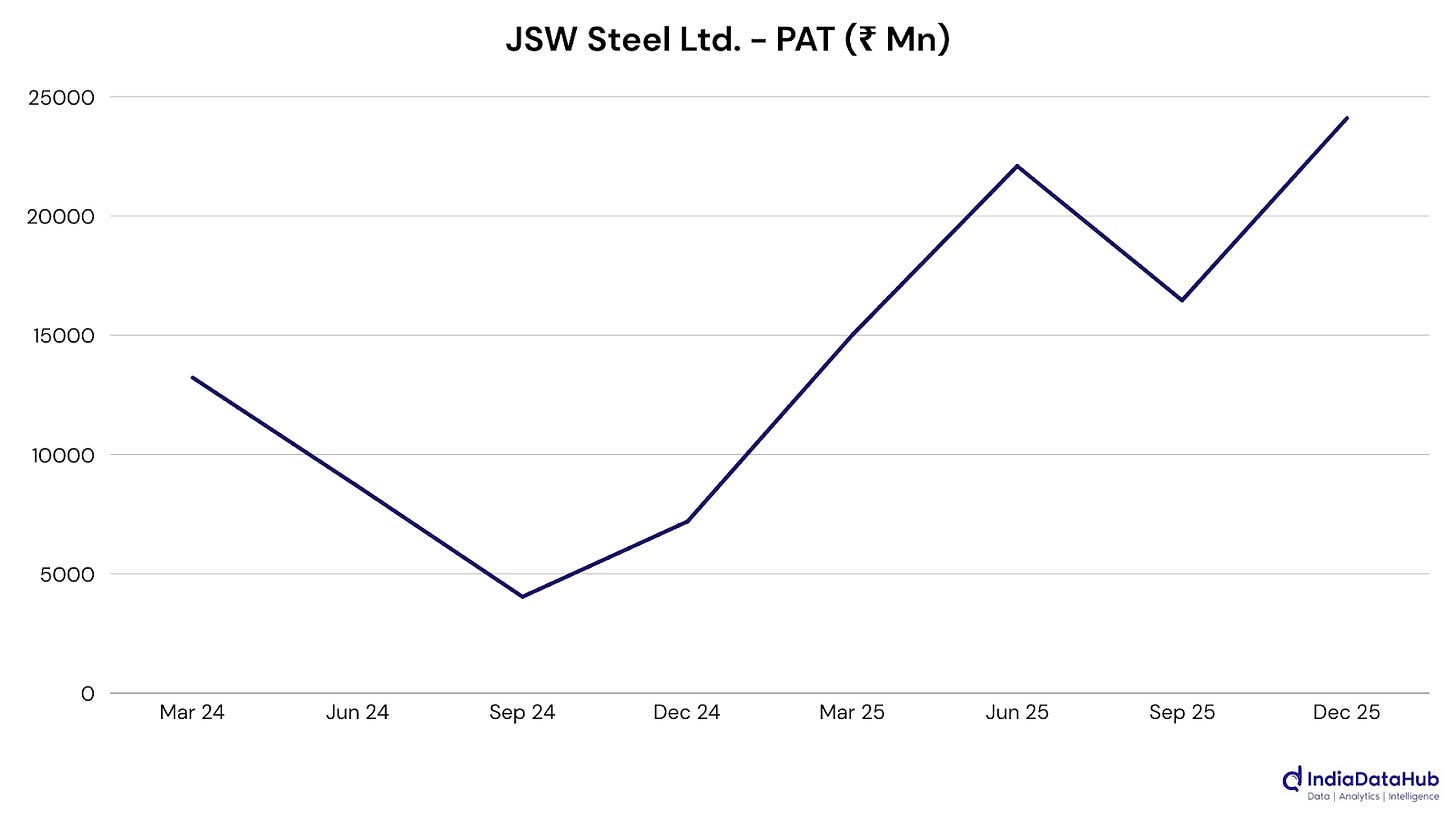

JSW Steel Ltd. (Commodities): Profit spike is flattered by a large one-off deferred tax credit tied to the Bhushan Power & Steel stake sale. Beneath that, volumes were strong, and EBITDA improved, showing operations did their part, too.

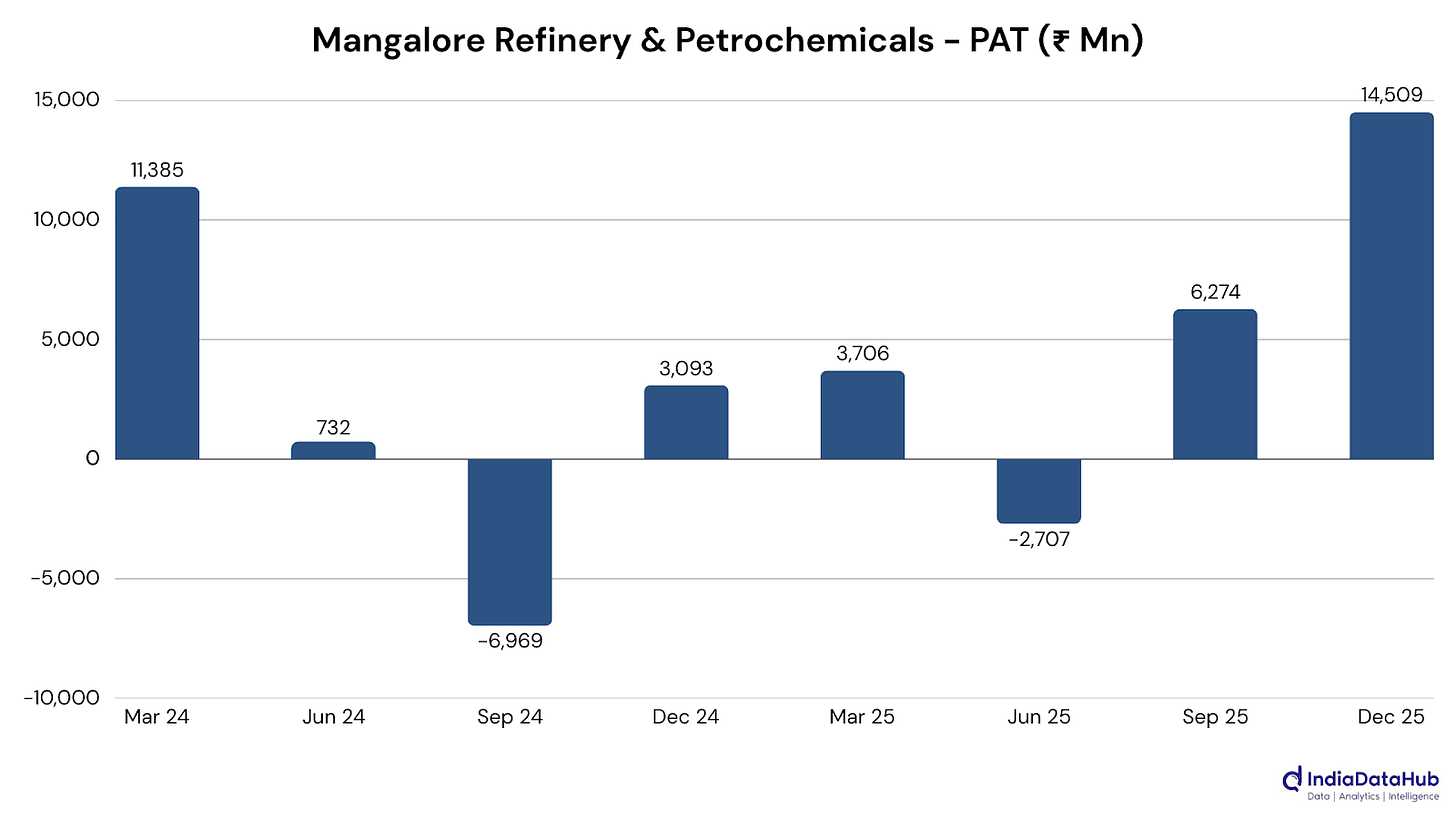

Mangalore Refinery & Petrochemicals (Energy): Turned in a standout quarter, with refining margins and high utilisation driving a sharp profit rebound. Inventory gains and lower debt amplified operating strength, making the refining cycle work decisively in its favour.

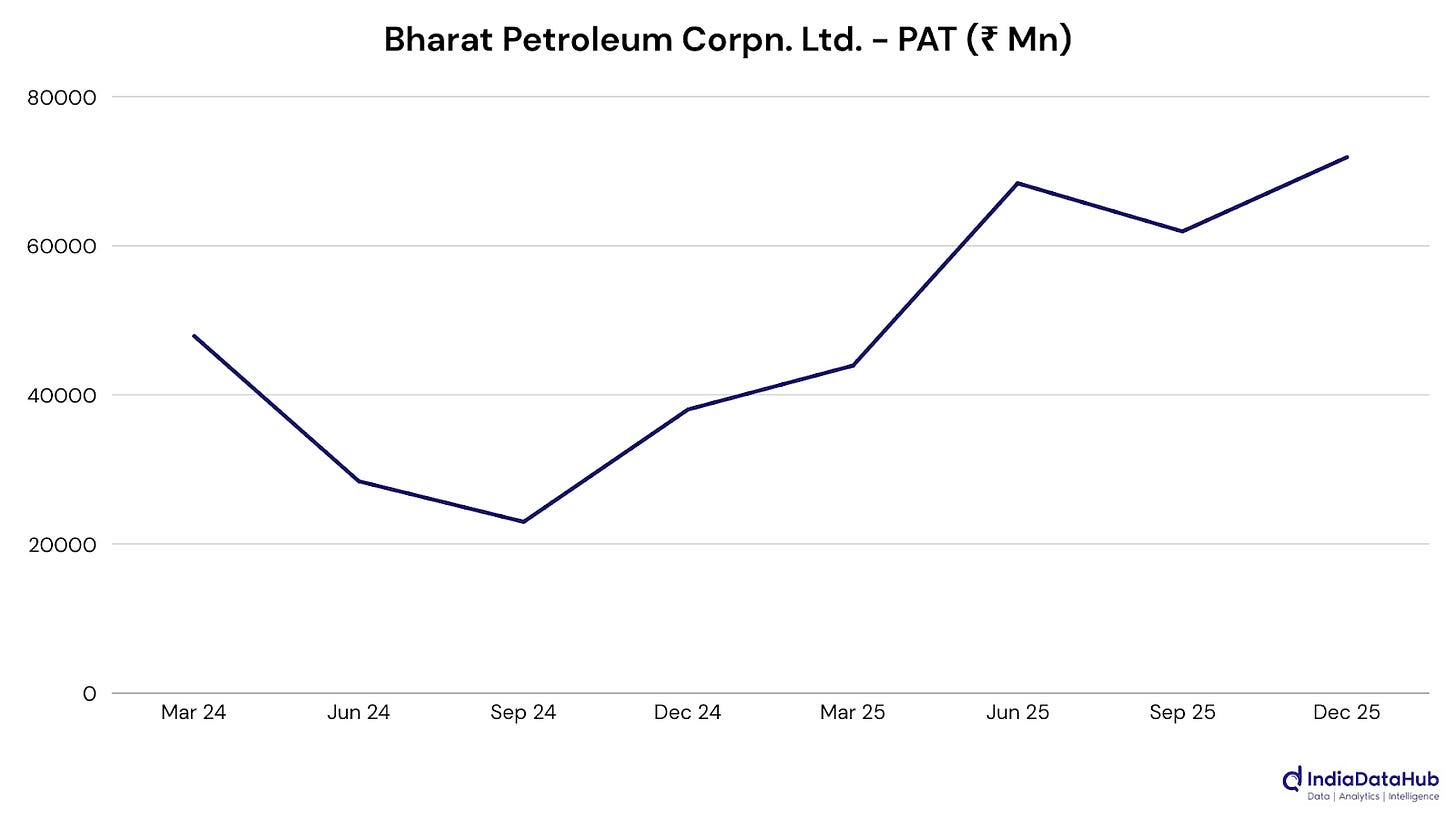

Bharat Petroleum Corpn. Ltd.: Had a standout quarter, with profit nearly doubling as refining margins widened sharply and throughput improved. Strong domestic fuel demand and better product spreads more than offset the still-steady, competitive marketing environment.

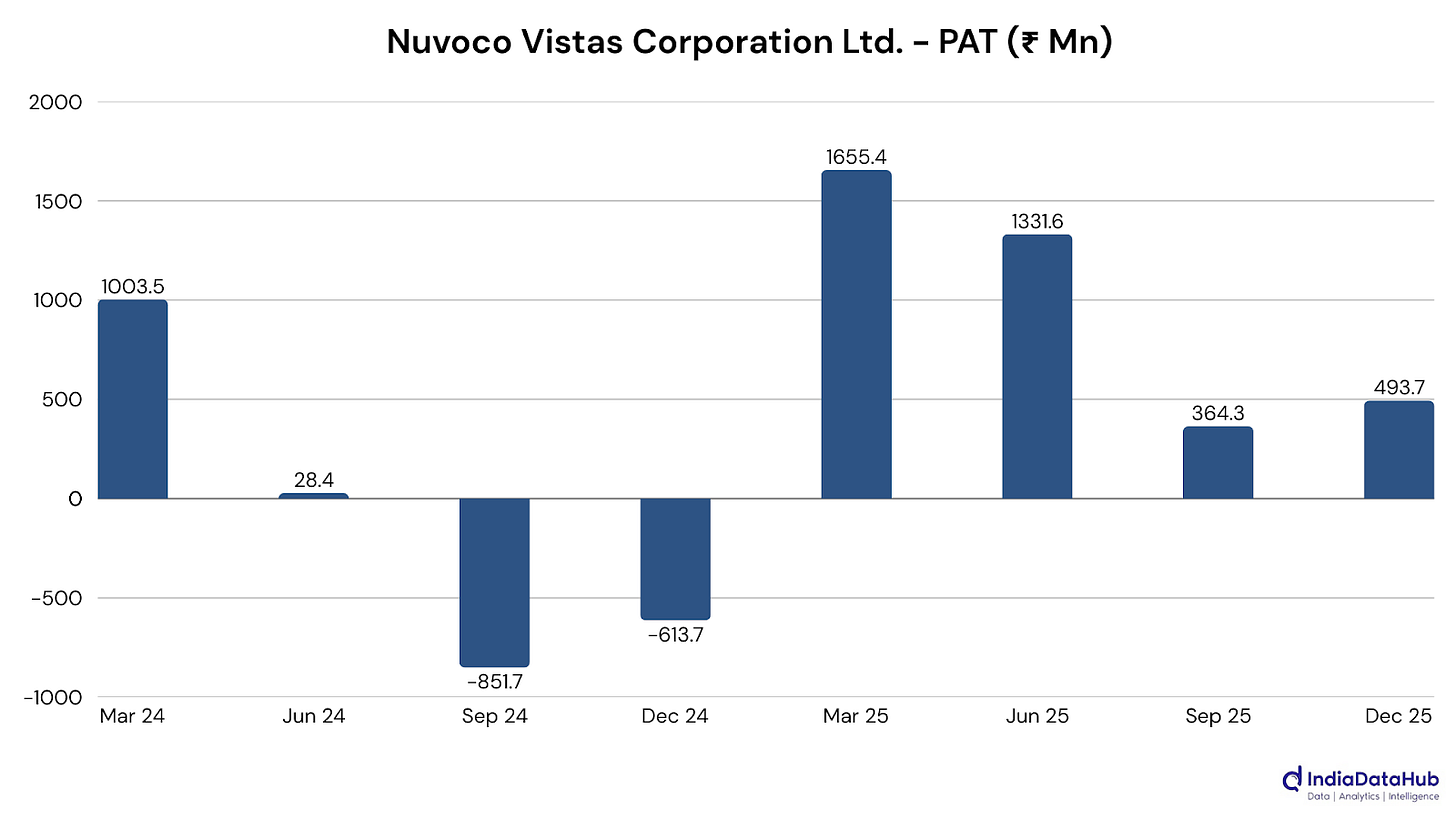

Nuvoco Vistas Corporation Ltd. (Commodities): Had a clean turnaround quarter, with higher volumes and tighter cost control pushing it back into profit. Premiumisation and lower fuel costs amplified operating leverage as cement demand firmed toward the end of the quarter.

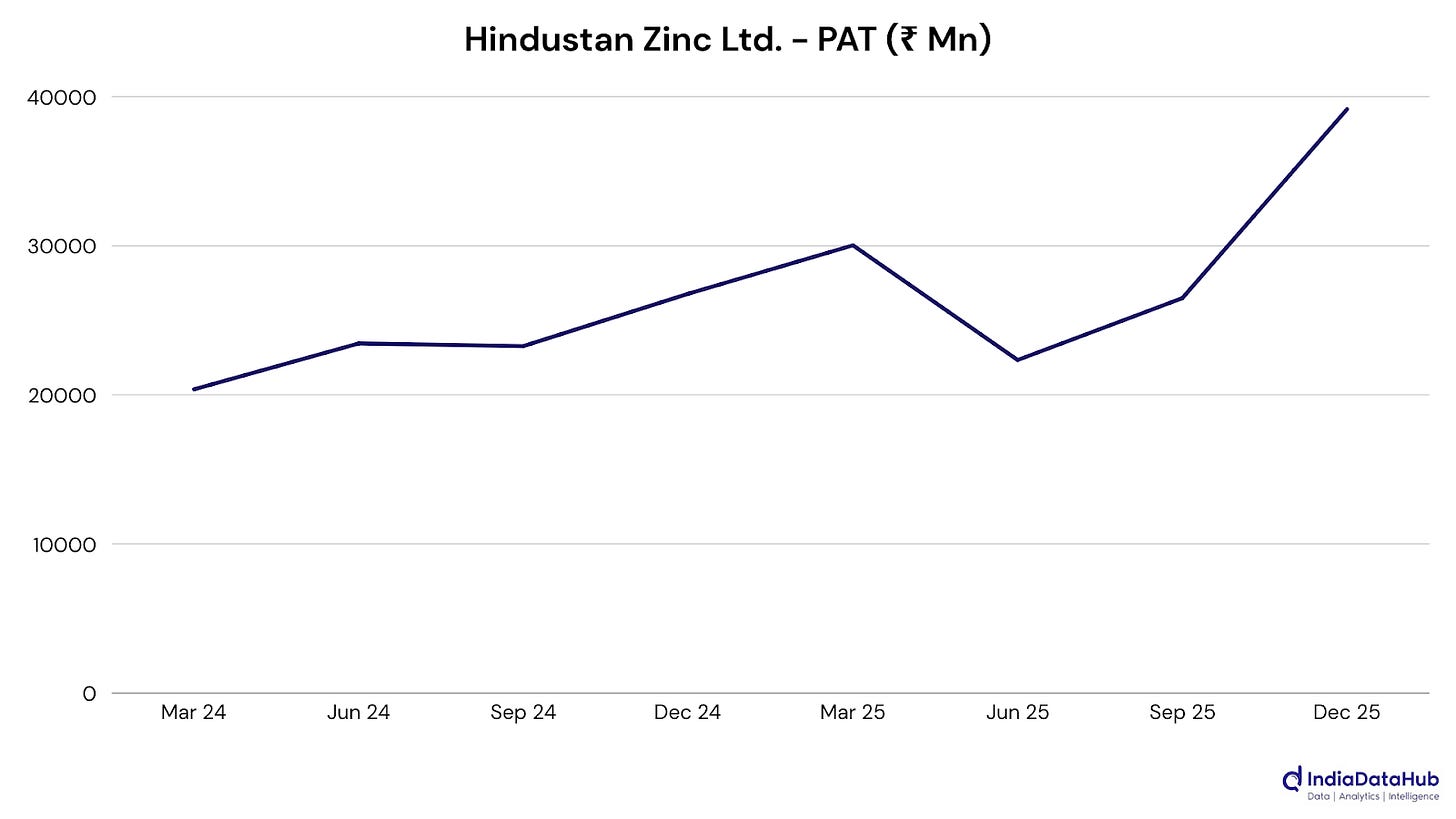

Hindustan Zinc Ltd.: Had a very strong quarter as revenue rose 28% and profit climbed 46% as mined metal output hit records and costs stayed exceptionally low. Silver volumes also helped, keeping margins very high even as commodity prices added to profitability.

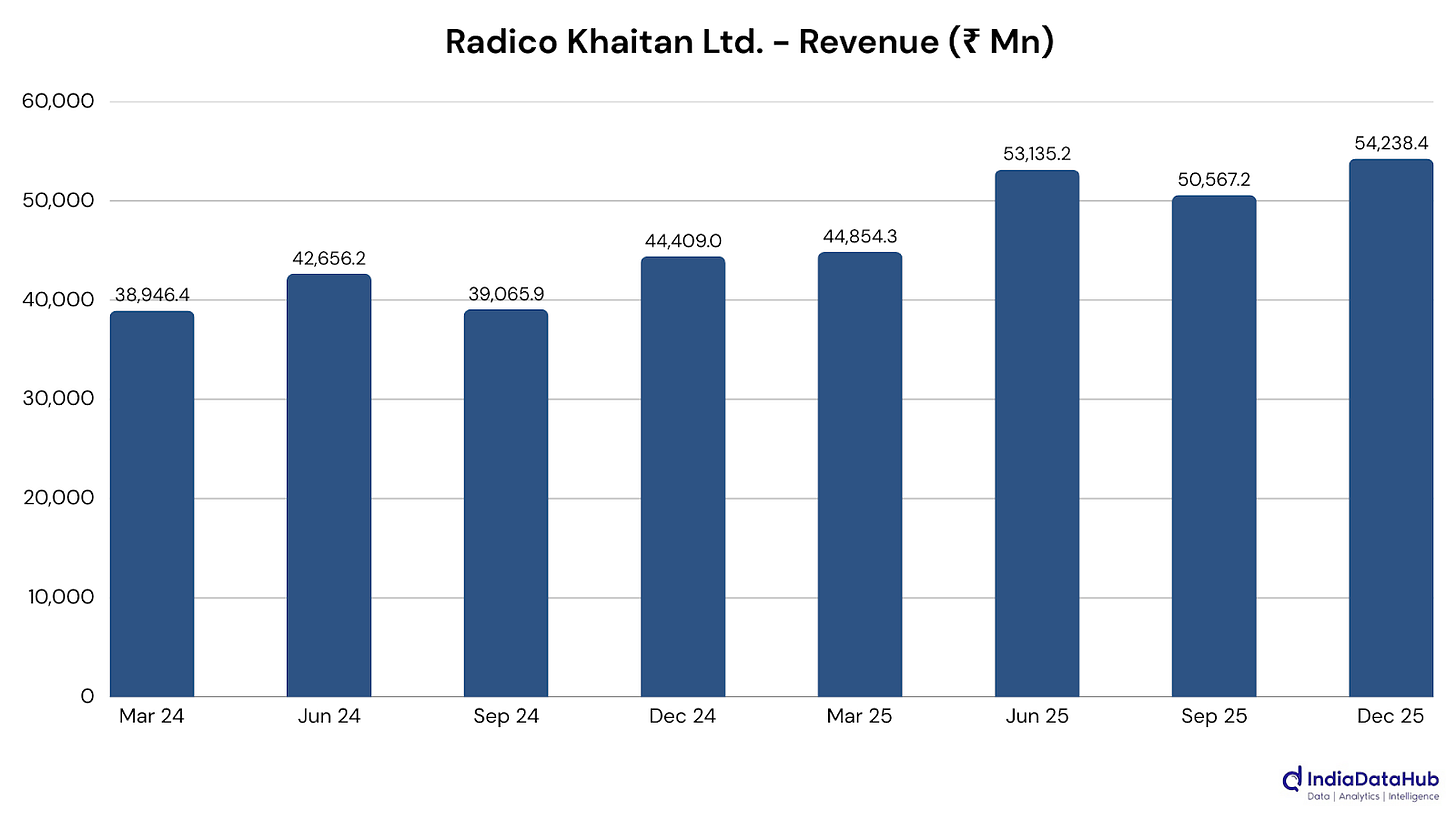

Radico Khaitan Ltd. (FMCG): Had a strong festive-quarter showing: revenue jumped 22% and profit rose 62% as premium spirits volumes grew faster than the base business. A richer mix and steadier input costs helped margins widen meaningfully.

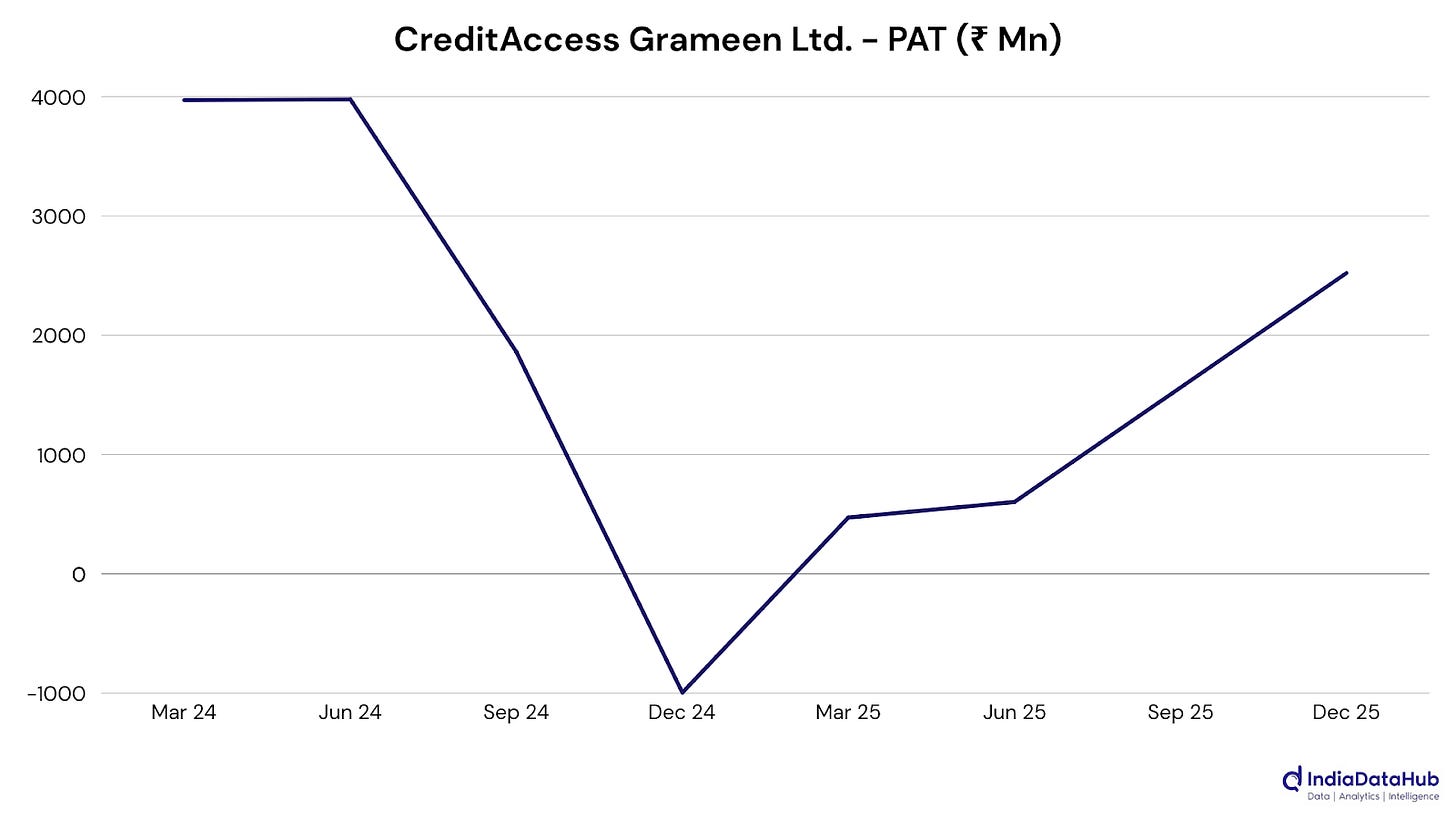

CreditAccess Grameen Ltd. (Financial Services): Swung back to profit as credit costs more than halved, signalling that last year’s microfinance stress is easing. Disbursements picked up, AUM grew steadily, and early delinquency trends (PAR) improved. making this feel like a clean, provisioning-led recovery.

That’s it for this edition. A lot is yet to come, which we’ll be unpacking in the coming weeks; stay tuned!

Love your content

Very insightful posts, covering exactly what is needed to know.