All-time high market cap to GDP, strong debt flows and more...

This Week In Data #79

In this edition of This Week In Data, we discuss:

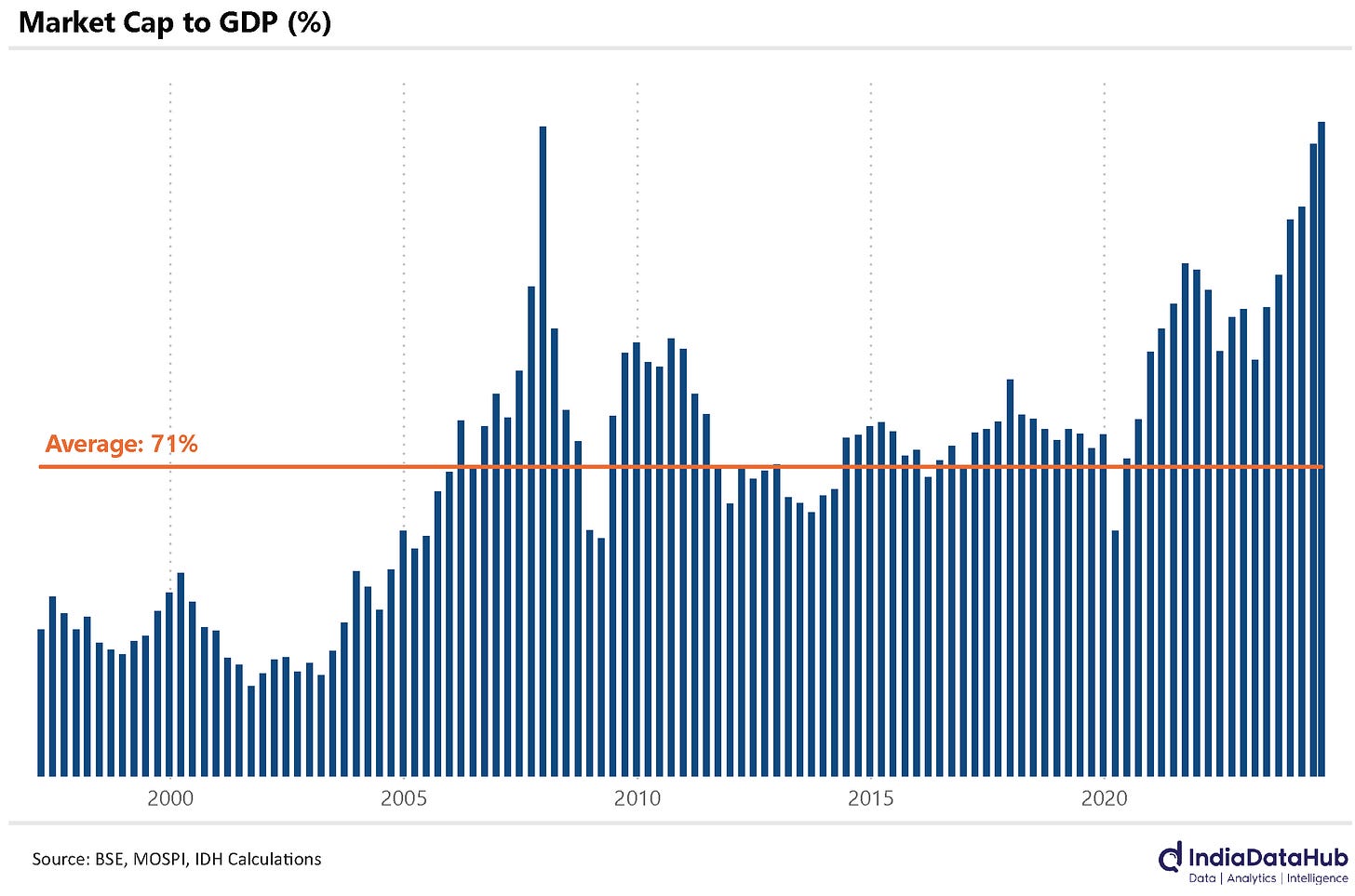

India’s market cap to GDP crosses the 2007 peak of 149%

Strong FPI Flows in debt in August

Decline in power generation and petroleum consumption in August

Decline in coal production in August

Weak Automobile sales except for 2W

US Labour market continues to soften

Aggressive monetary easing expected from the Fed

TWID comes to you on a Sunday this week due to Ganesh Chaturthi yesterday. Normal service resumes from next week.India’s equity market capitalisation has touched Rs465 trillion (or US$5.6 trillion) as of the end of August. Over the past year, the market capitalisation has increased by almost 50%, driven by new listings and an increase in stock prices. India’s market capitalisation has now touched 150% of India’s GDP (extrapolating the GDP for the September quarter using the June quarter growth). This is modestly higher than the previous peak of just under 150% reached in December 2007! Many people track this metric (market capitalisation to GDP) as a broad valuation measure. And this metric is now flashing red.

August was another strong month for FPI inflows into Debt. Total inflows during the month totalled just over US$2bn. Since October last year, FPI flows into Debt have been strong, averaging just under US$2bn per month – except in April this year when there were outflows. Cumulatively, over the past 9 months, net FPI inflows into debt have totalled ~US$17bn.

FPIs now own US$65bn worth of debt securities in India, up a third over the past year. In absolute terms though, FPI ownership of debt securities pales in comparison to their ownership of stocks – as of August FPIs own US$900bn of Indian equities, more than 10x of their ownership of debt securities.

Both power and petroleum sectors saw a decline in August. Consumption of petroleum products declined 2.6% YoY driven by a 2.5% decline in consumption of Diesel, Naphtha and Bitumen as well as moderation in Petrol and LPG consumption. Power generation similarly declined almost 5% YoY, the sharpest decline since June 2020 (the first lockdown).

A fair bit of this decline is seasonality though. After seeing heat-wave-related seasonality impacting economic activity during May-June we are now seeing monsoon-related seasonality impact growth. August last year had seen very low rainfall in the last 15 years while this year has seen the third highest rainfall.

And lower rainfall means farmers have to use pumps for irrigation which increases electricity and diesel consumption. Lower rainfall also means more construction activity which otherwise comes to a standstill in many parts of the country during monsoon. This seasonality also impacts sectors like mining. Accordingly, Coal production declined 8% YoY in August this year. In August last year, Coal production had increased almost 20% YoY.

This seasonality (or the heat-wave-related seasonality earlier in the year) does not change the medium-term growth trend. Indeed good rains, which is what we have seen this year, is positive from a medium-term growth perspective. However, this seasonality will impact reported growth data for 2Q.

Automobile sales were generally weak, perhaps also impacted by the monsoon seasonality. 2W sales grew 6% YoY but Car sales declined 4%. Slightly disconcertingly though, Tractor sales have continued to remain weak. August was the third consecutive month of a double-digit decline in Tractor sales. Goods carriers and Construction equipment also saw sales decline by almost 10% YoY in August.

Lastly, the US labour market continues to slow. August saw 142k non-farm jobs being added to the US economy. This is lower than the market expectation of 164k job addition. Furthermore, job addition for both June and July was revised down sharply.

Markets are now assigning a 100% probability of a 25bps rate cut from the Fed later this month and a 30% probability of a 50bps cut. By the end of this year, markets are currently assigning a 90% probability of a 100bps rate cut which will mean at least 1 50bps rate cut in the 3 meetings the Fed has between now and the end of this year.

That’s it for now. See you next week.