Auto sales, Port traffic, NREGA, Tomato prices and more...

This Week In Data #25

In this week of This Week In Data we discuss:

Auto sales growth for June

Weak Port traffic data

Petroleum product sales

Uptick in NREGA demand

US Non-farm payrolls

Rise in tomato prices

Several high-frequency data got released this week, being the first week of the month. Automobile sales was among the more notable among them. Both Car and 2W sales growth moderated in June but remained broadly in sync with the growth in the preceding 2-3 months. So steady as she goes.

Petroleum product consumption also decelerated in June and the growth was the second lowest since March last year. Diesel consumption also moderated sharply and given that June had seen deficient rainfall, one would have expected diesel consumption to rise as farmers would have used diesel to power their pumps for irrigation. So that’s a bit disconcerting.

The other disconcerting data was port traffic. Overall cargo traffic at the major ports grew just 0.4% YoY in June. This is the slowest growth since February last year. More importantly, container traffic, which is a marker of discretionary or consumer goods, declined 6.5% YoY. This is also the sharpest decline in over a year.

NREGA data continues to be a bit perplexing. Demand for work under NREGA rose 2% YoY in June. This comes after 12 consecutive months of YoY decline. More importantly, the number of people demanding work under NREGA in June was almost 25% higher than the pre-pandemic period. In the first five months of this year, it had on average been 13% higher.

But even as NREGA data is suggesting stress in the labour market, Tractor sales grew almost 40% YoY in June. Strong tractor sales normally suggest a tight market for farm labour.

Globally we got the much-awaited US Non-farm payrolls (NFP) data. After the ADP data on Wednesday, it was expected that the NFP would also be strong. But the NFP data was below expectation.

The US economy added just over 200k jobs in June, the lowest since December 2020. And the NFP data for April and May saw a downward revision of just over 100k (cumulatively). So, some bit of softness in the US labour market. Something that the Fed will welcome. And it is also something that will cheer the markets as it will reduce the need for the Fed to keep hiking rates to rein in inflation.

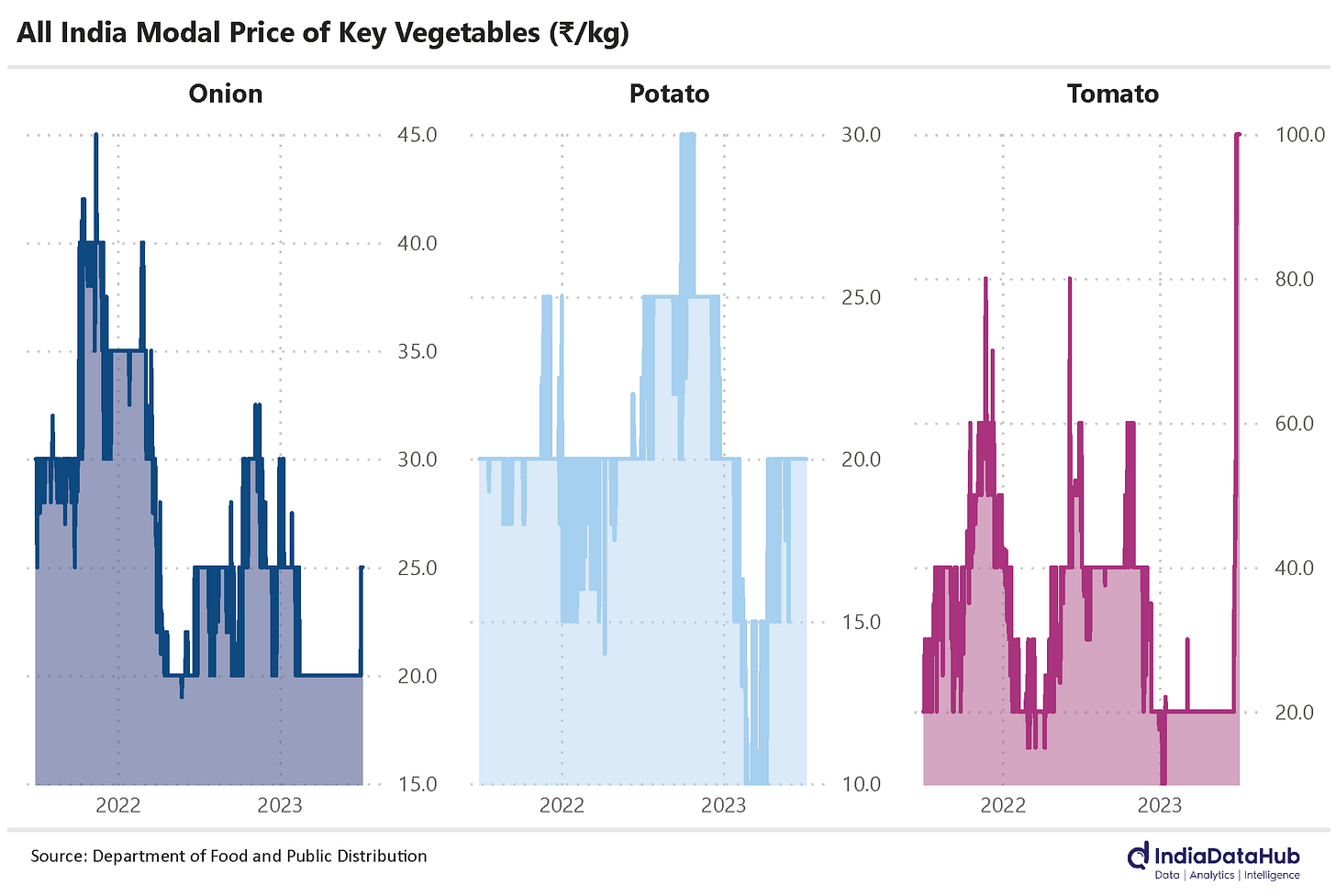

Lastly, Tomatoes. The increase in tomato prices has been making headlines. The all-India modal price of Tomato has risen to ₹100/kg currently. It was just ₹20/kg a few weeks back. So, the rise has been pretty sharp. This links back to inflation. And there is both good news and bad news.

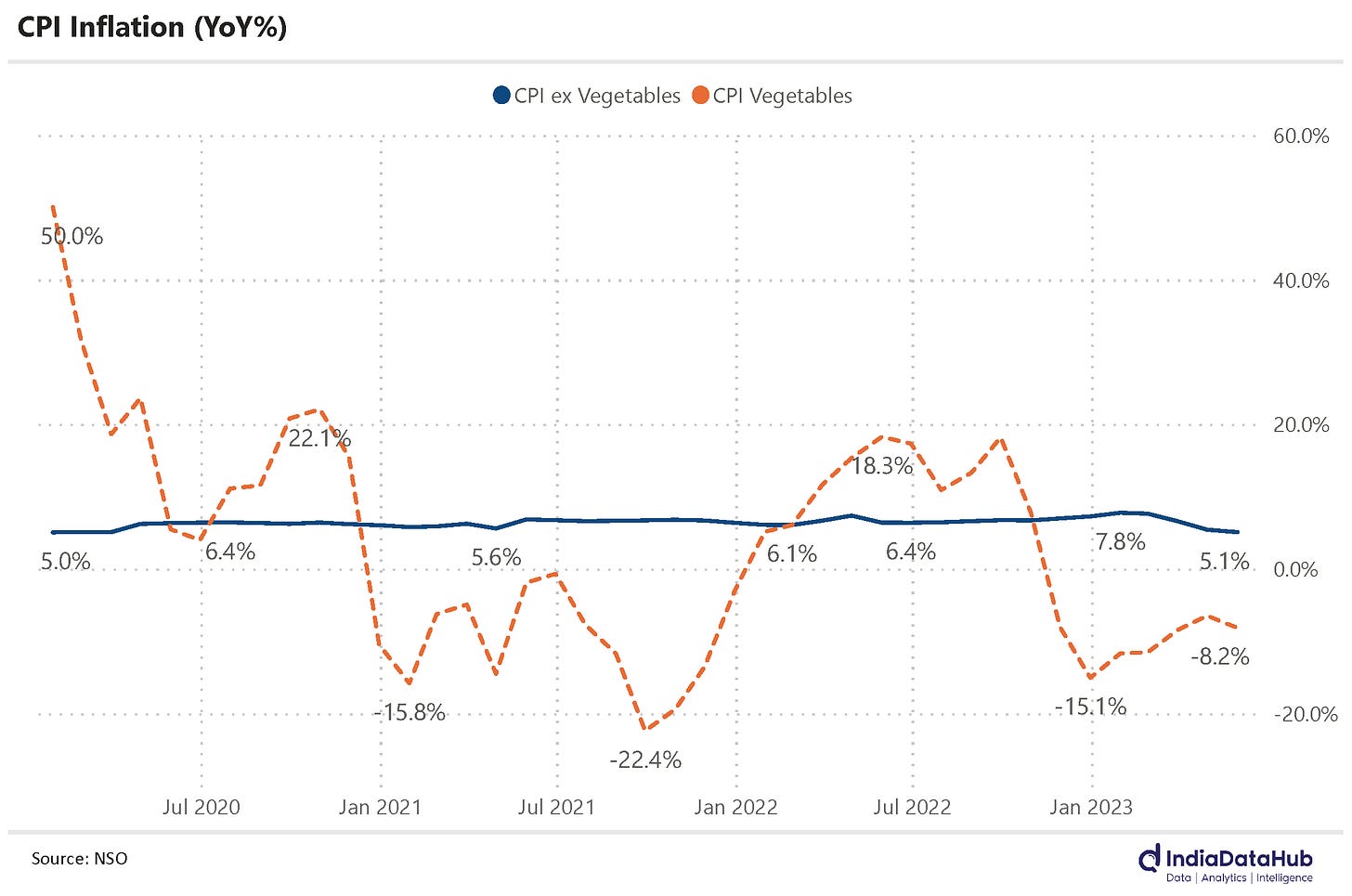

The good news is that Onions and Potatoes which have the biggest weight in the Vegetables basket have not seen any price increase recently. Their all-India modal price has remained unchanged in recent days. Vegetables have a 6% weight in the CPI basket and Onion and Potato account for 1.6% or just over 25% of the weight. The bad news is that the prices of several other vegetables have also increased. And the big picture is that Vegetable price inflation has been in negative territory for seven months now. Over the past decade, vegetable inflation has averaged (+)6%. So the negative print had to get corrected. A kind of mean reversion. But this mean-reversion, especially in the case of Vegetables, generally tends to happen through sharp swings. And looks like one of those swings on the upside is likely to happen now.

The headline CPI inflation is currently being dragged down ~80bps by the negative Vegetable inflation (currently running at -8%). If Vegetable inflation were to rise to +8%, ceteris paribus, CPI inflation will rise by ~1ppt. But the headline CPI inflation printed at 4.3% in May, so a rise to 5.3% will not unduly perturb the RBI. The bottom line, therefore, is that as long as the other inflation components do not see a change in trajectory, a normalisation of Vegetable price inflation will not unduly perturb the RBI.

But it seems what has made people sad is that Mcdonald's seems to have taken tomatoes off its menu. Or so media reports suggest. To those missing tomatoes in their burger we say, switch to the humble Vada Pav. It's quite literally, finger lickin good!

That’s it for this week. Don’t miss the British Grand Prix tomorrow. It promises to be the least one-sided race of this season. As a long-time Ferrari fan, and only a recent convert to Red Bull, it would be nice to see the Prancing horse be the first to the chequered flag…