Auto sales recover, Soft energy demand, Slowing credit growth and more...

This Week In Data #100

In this edition of This Week In Data, we discuss:

Automobile sales recover in October. Except for Tractors.

Energy consumption remains weak in October

GST collection growth down in single digits

Bank credit growth moderate further and is now below deposit growth

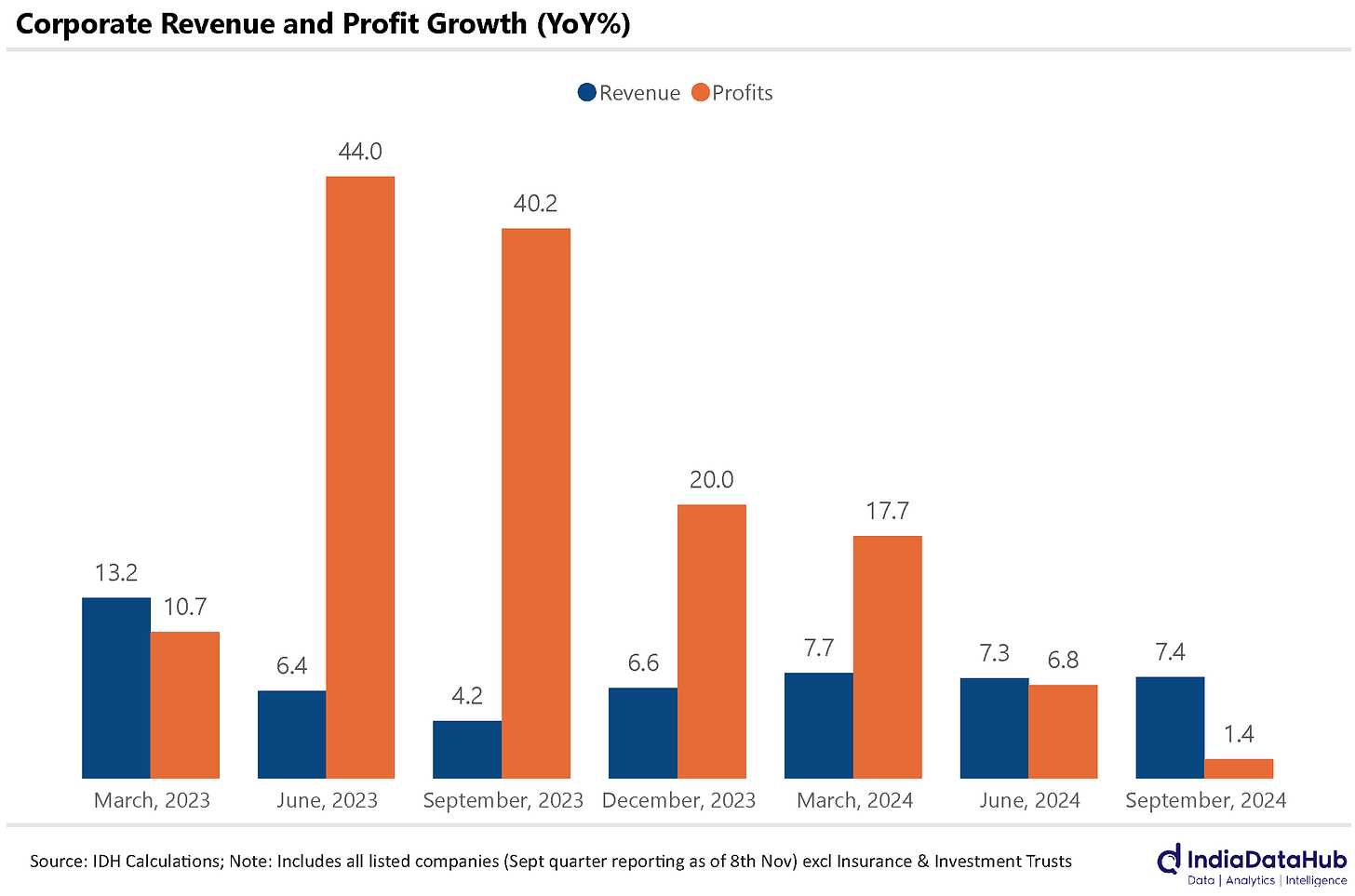

Corporate profitability is subdued in the September quarter

FY25 GDP growth likely to see downward revision?

US Interest rates head down as do those in UK but not in Brazil

As expected, Automobile sales saw a pretty much across-the-board improvement in October. Two-wheeler sales surged by 36% YoY, while Cars and SUVs posted a robust 33% growth. Construction vehicles, Goods vehicles and other Passenger vehicles also saw a rebound in sales growth. Tractors were the big exception as they saw a sharp moderation in growth.

That said, this recovery in growth was largely due to the festival season being earlier this year compared to last year. For example, Dhanteras was on 10th November last year while it was on 29th October this year. Growth will moderate in November due to the same reason. Thus, the cumulative growth during October-November will be a good gauge of consumption trends. The strong growth in October may be a bit of a mirage.

Petroleum demand recovered in October, but consumption still grew by a modest 3% YoY as against a decline in the previous two months. Diesel consumption was largely flat YoY (+0.1%), after two months of decline. Power generation was also weak in October, growing at under 1% YoY for the second consecutive month. Thus, energy demand in general (petroleum and power) has seen a slowdown in the last few months.

GST collections grew in single digits in October for the second consecutive month. Over the past three months, GST collections have grown by just over 9% YoY, the slowest growth in any three months since early 2021 (when COVID was impacting data).

That said, EWay bills continue to see strong growth. Indeed, growth has picked up. Overall EWay bills grew by almost 19% YoY in October, the same growth as during September but 2.5ppt higher than the growth during the June quarter. An uptick in GST EWay bills even as tax collections moderate suggests better compliance with EWay bill requirements rather than stronger economic activity.

Bank credit growth slowed down to below 12% as of mid-October. This is the slowest growth in almost two and a half years. For reference, at the start of this financial year bank credit was growing above 16%.

Deposit growth has also moderated but only modestly. And so as of mid-October, deposits have grown FASTER, albeit modestly, than credit. Remember all that discussion as to how bank credit is growing faster than deposits due to money flowing into the stock market just a few months back? That attribution was a whole lot of bunkum. And now it has become moot.

We discussed the September quarter results last week. And a week on with just a week to go for listed companies to report, the picture has not changed dramatically. Revenue growth remains in single digits and overall profit growth is in the low single digits (as against a decline as of last week).

Effectively, all of this points to the September quarter being another weak quarter of growth. GDP growth had slipped to below 7% during the June quarter and the CSO will report the September quarter data on the 29th. It is quite likely that September quarter GDP growth will see a further deceleration to closer to 6%.

The current consensus estimate is for FY25 GDP growth of just under 7% and the RBI estimates it at 7.2%. Realising any of these estimates will require a material acceleration in growth in 2H and if that is not seen likely, growth estimates will see a sharp downward revision. And this will cascade to the financial markets – a change in the monetary policy from the RBI, earnings downgrades for equity markets to deal with and so on.

Globally, also there was a lot of action this week. First off, the US Fed cut the Fed Funds Target Rate by 25bps to a range of 4.5-4.75%. The Bank of England also cut its policy rate, the Bank Rate, by 25bps to 4.75%.

On the other hand, the Central Bank of Brazil, raised its policy rate, the Selic rate, by 50bps to 11.25%. Inflation in Brazil had reached a 12-month high of 4.8% in October. Inflation continues to remain subdued in China printing at 0.3% in October down from 0.4% in September. This is not surprising given how anaemic economic growth currently is in China. Lastly, Inflation in Turkey dipped below 50%, phew…

That’s it for this week. See you next week.