Benign CPI, Exports holding steady, Gold boosting FX Reserves...

This Week In Data #142

In case you missed it, we released IDH Report Assistant few days back. The report Assistant is an Add-in for Microsoft Word that allows you to build Charts and Tables directly into Microsoft Word (and later this quarter, PowerPoint). You can refresh these charts and tables from within Word. You can use raw data or apply any transformations or create complex series of your own. You can see a quick demo from here: IDH Report Assistant In this edition of This Week In Data we discuss:

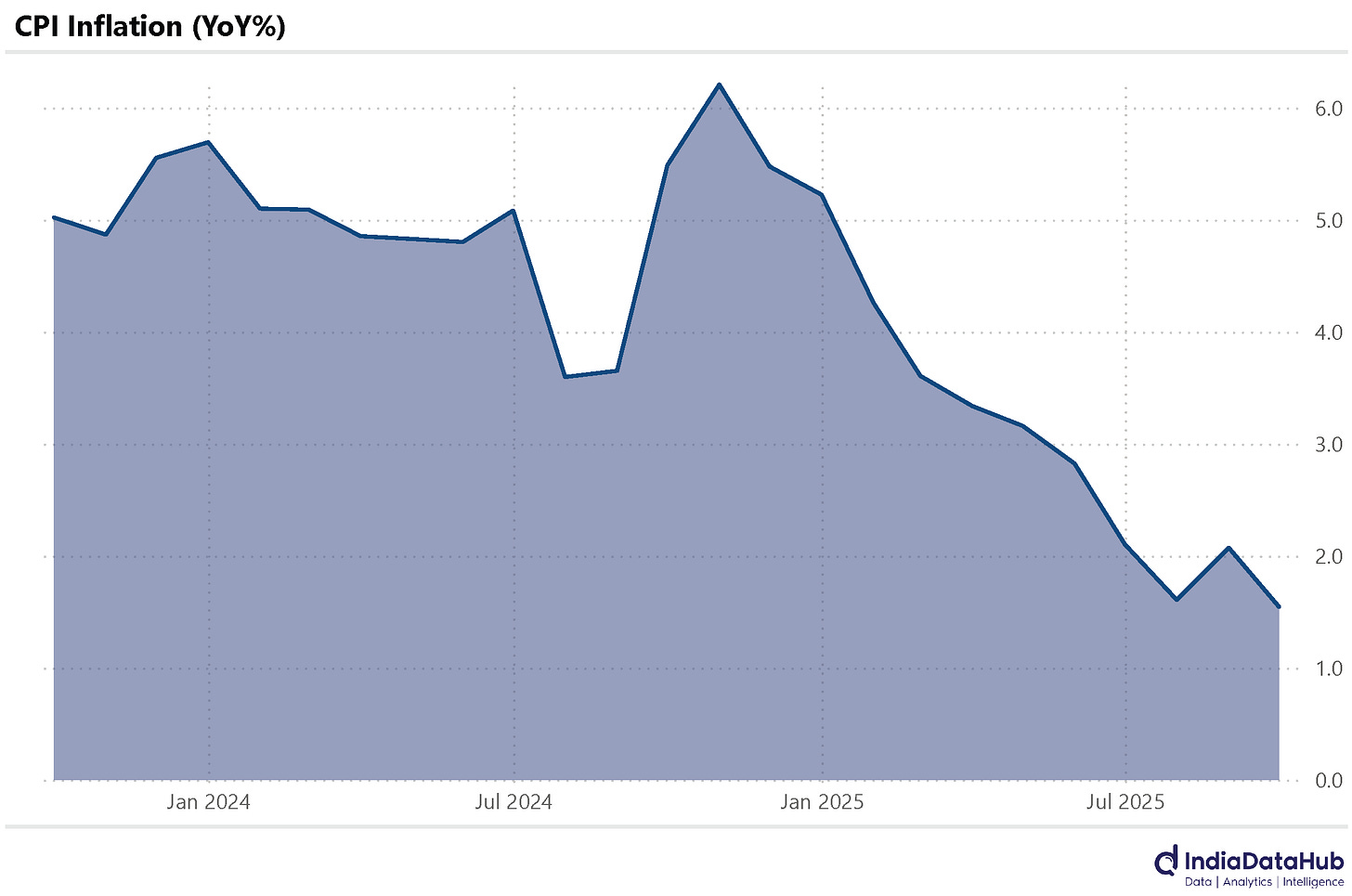

CPI Inflation fell to a 8-year low in September. Core inflation also remains benign. But this will not, ipso facto, cause interest rates to decline.

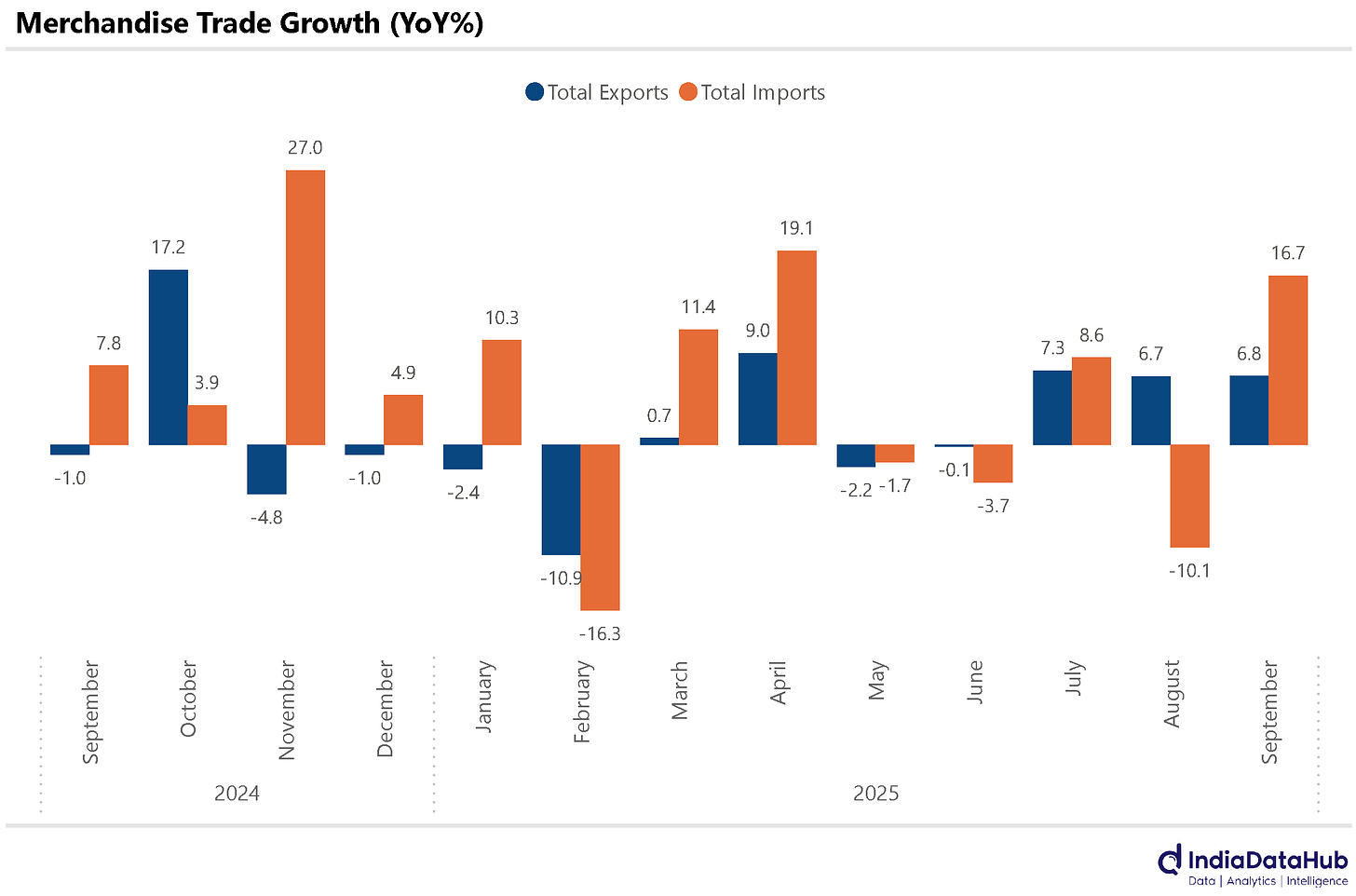

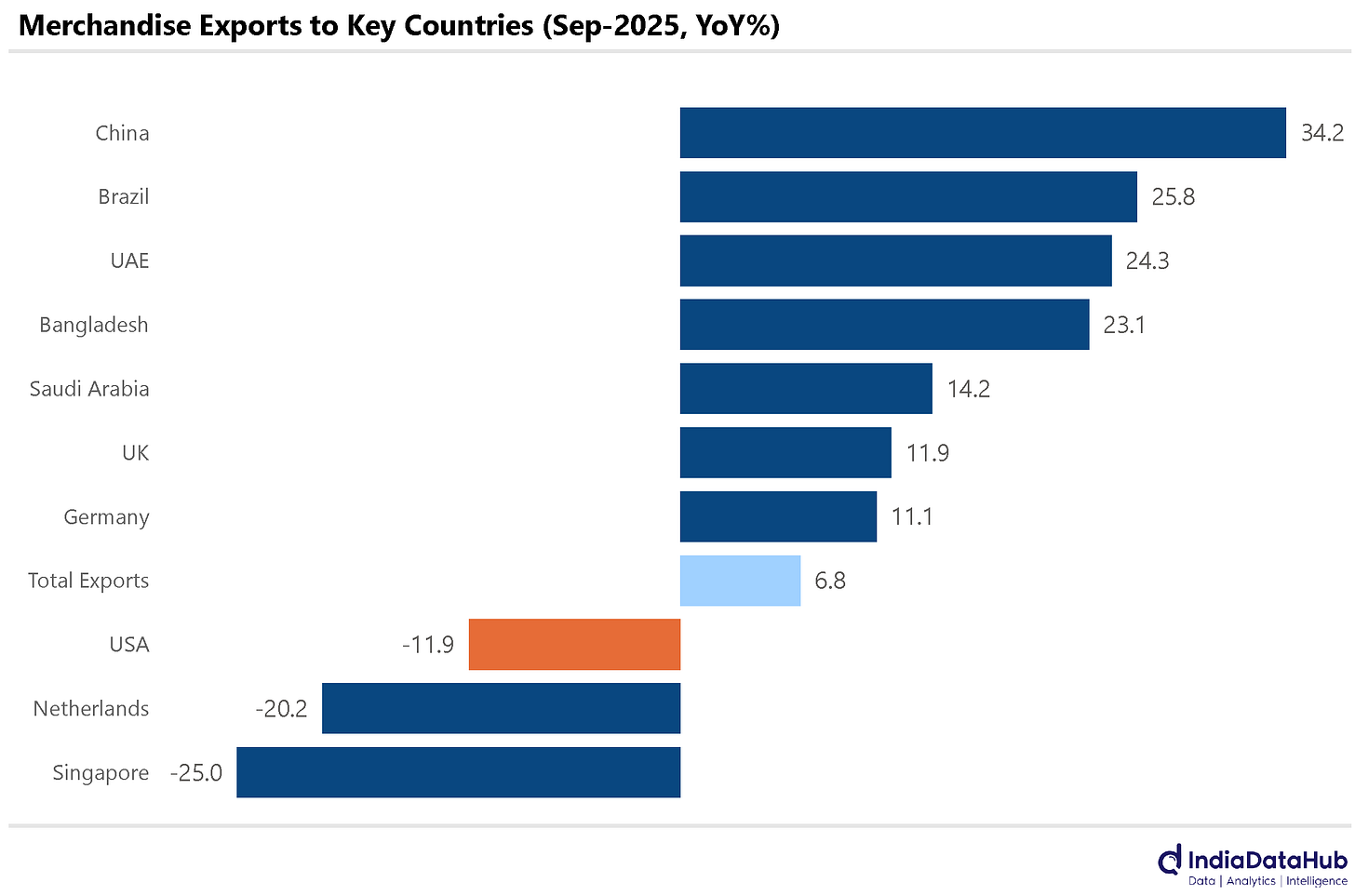

Exports continue to grow at 6-7% despite the full impact of US tariffs coming into being

Imports saw a broad-based growth pushing the trade deficit to the highest in recent months

FX Reserves have remained stable in recent weeks. But that is largely due to the increase in Gold prices

CPI Inflation moderated to a multi-year low of 1.5% YoY in September. Lower food inflation remains the key driver of the decline in headline inflation. Food and Beverage inflation printed at a negative 1.4%, the lowest in recent months and the third time in the last four that the Food and Beverages component printed below zero per cent.

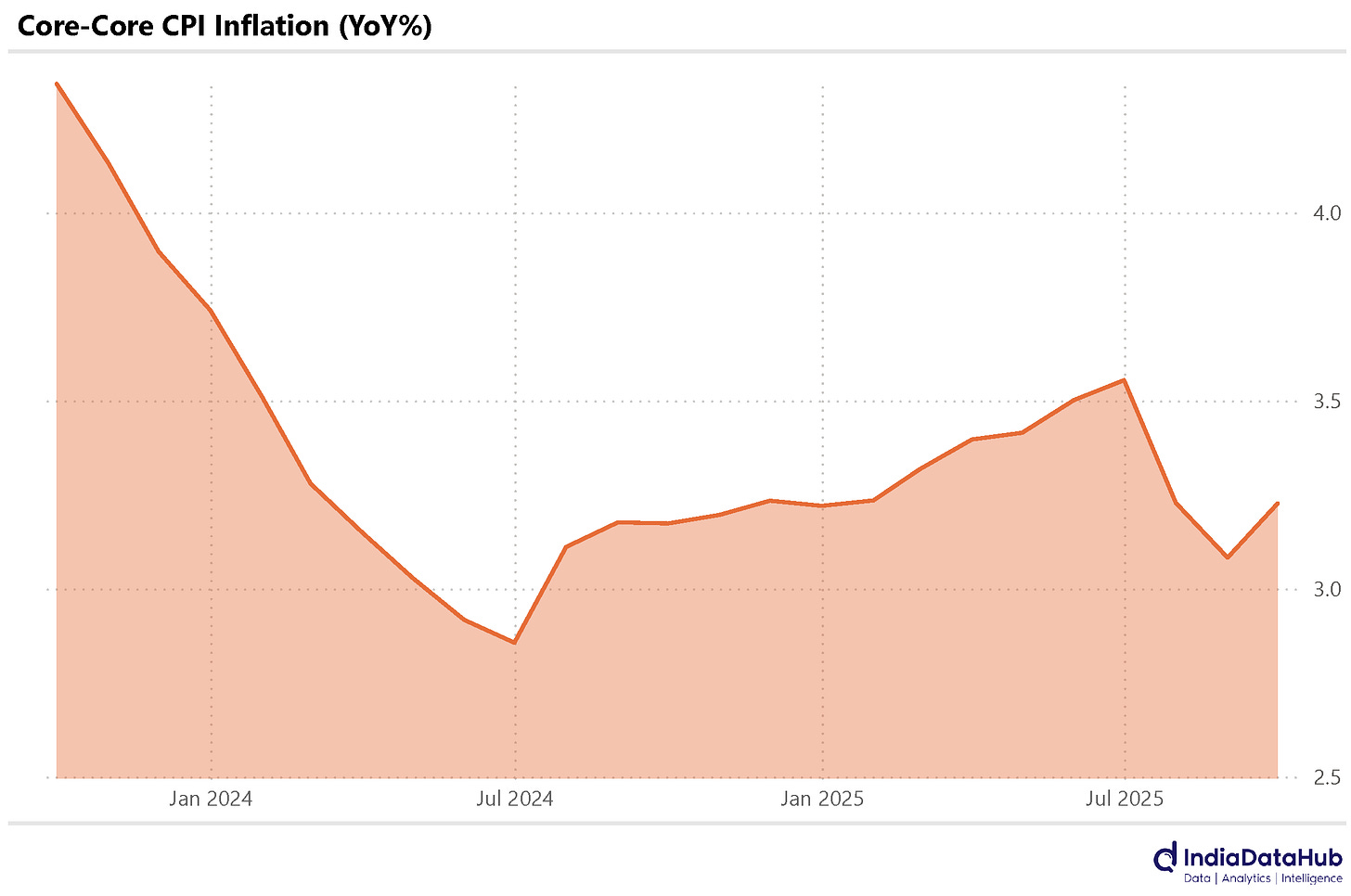

While core inflation ticked up, at 3.2%, the core-core CPI (which excludes food, fuel, and precious metals) remains benign and has averaged 3.2% for the September quarter, the lowest since the same quarter last year. So, both the headline and the core inflation continue to remain fairly benign. Indeed, the headline CPI has averaged less than 2% during the September quarter. While it is very unlikely to happen, if the inflation remains below 2% for another 2 quarters, the RBI Governor would have to write to the finance minister explaining why inflation is so low and what they are doing to take it back up to the target of 4%!

But as we have discussed before, low inflation is not by itself a sufficient reason to cut interest rates. Low inflation ought to be negatively impacting growth for interest rates to be cut, and the RBI just recently raised its growth estimate. So, as things stand, unless growth momentum starts to show signs of weakening, the RBI is unlikely to cut interest rates.

India’s exports grew 6.8% YoY in September, broadly the same pace as in the previous couple of months. Electronic goods saw a 50% increase in exports and were the biggest driver of export growth. Almost 2/3rds of the incremental growth in exports in September was from these two categories.

September was the first full month after the US tariffs took effect. And accordingly, exports to the USA declined by 12% YoY. But that has been offset by growth in exports to other countries. Exports to the UAE, for example, grew by 25% YoY, and those to China rose by over 30% YoY. So at least in the immediate short run, exports have not been impacted by the tariffs.

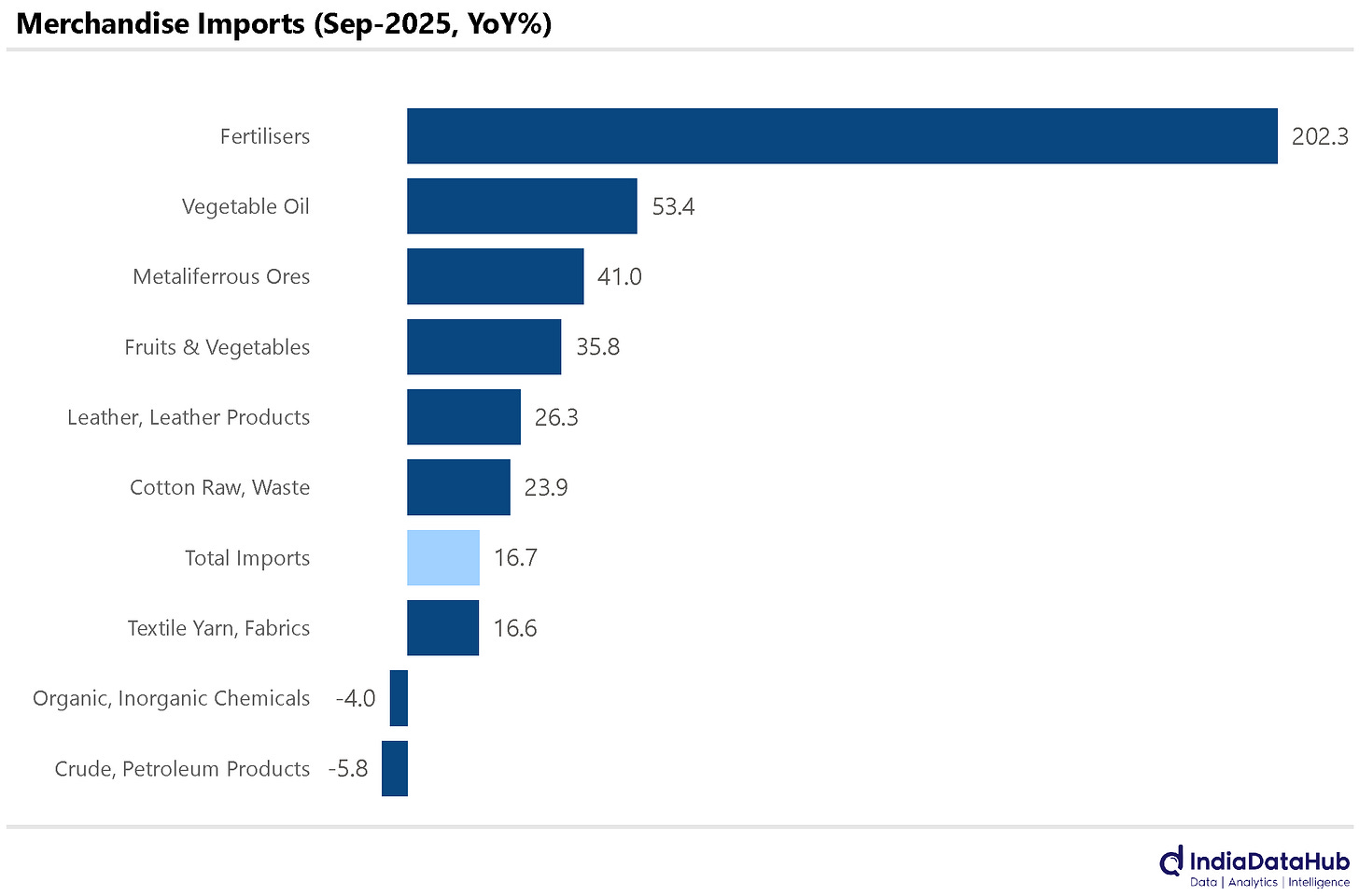

Imports saw a sharp 17% growth in September. And the growth was broad based. Fertiliser imports tripled to US$2.4bn during the month. Both Gold and Silver imports doubled. Vegetable oil imports also rose over 50% YoY. And imports of Ores, mostly Iron ore, rose by 40% YoY. And while the absolute amounts are small, Imports of Raw Cotton (incl. Waste) and Fruits & Vegetables also rose sharply.

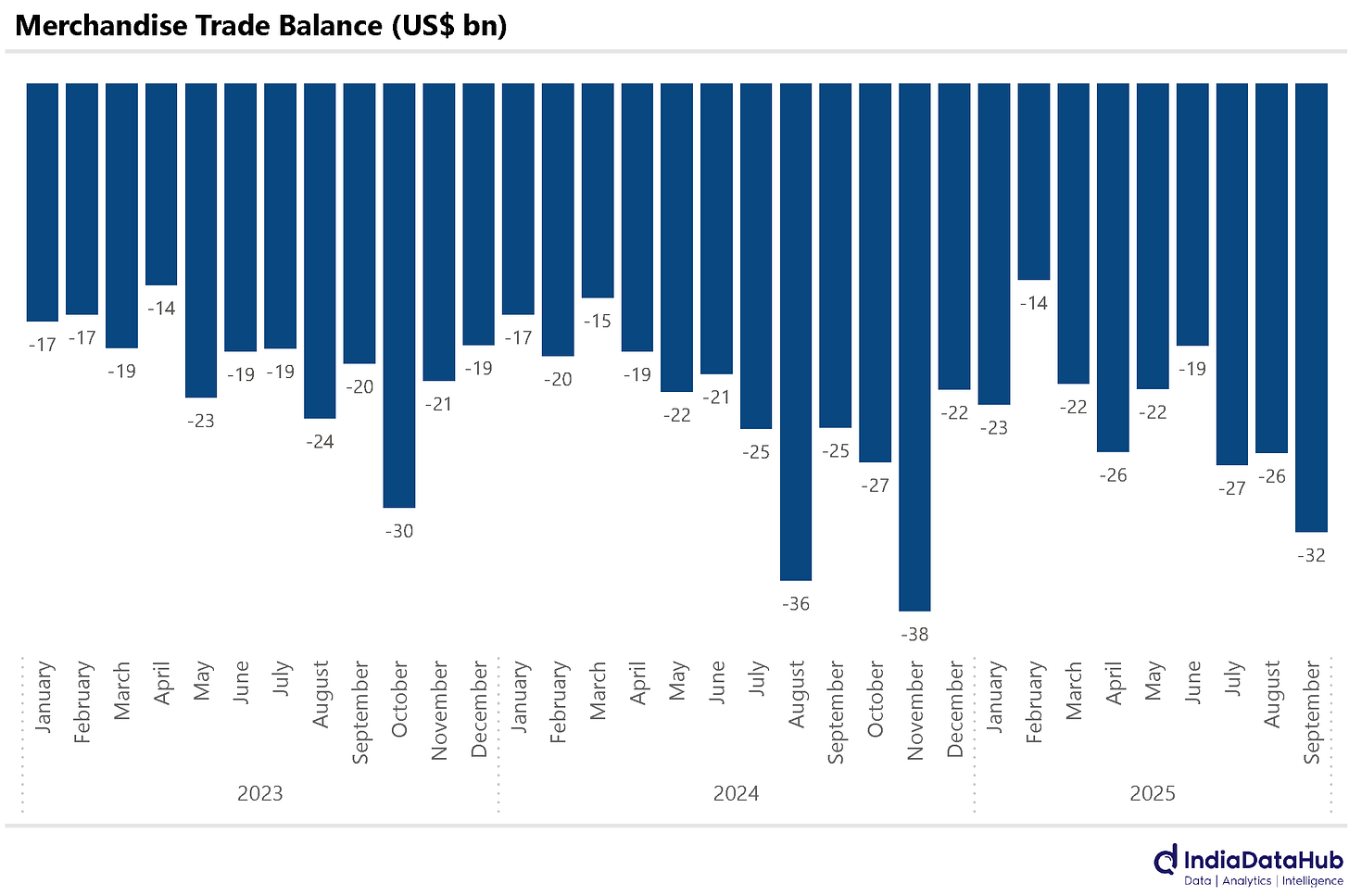

The faster growth in imports relative to exports meant that the merchandise trade deficit rose sharply to US$32bn, the highest since November last year and the third highest ever. There is some element of seasonality in the rise in imports, and so the September trade deficit is likely not representative of the trade deficit for the rest of the year. Accordingly, the trade deficit has seen only a 7% increase YTD (Apr-Sep) despite the 30% increase in deficit in September. The full-year deficit is also likely to see only a single-digit growth.

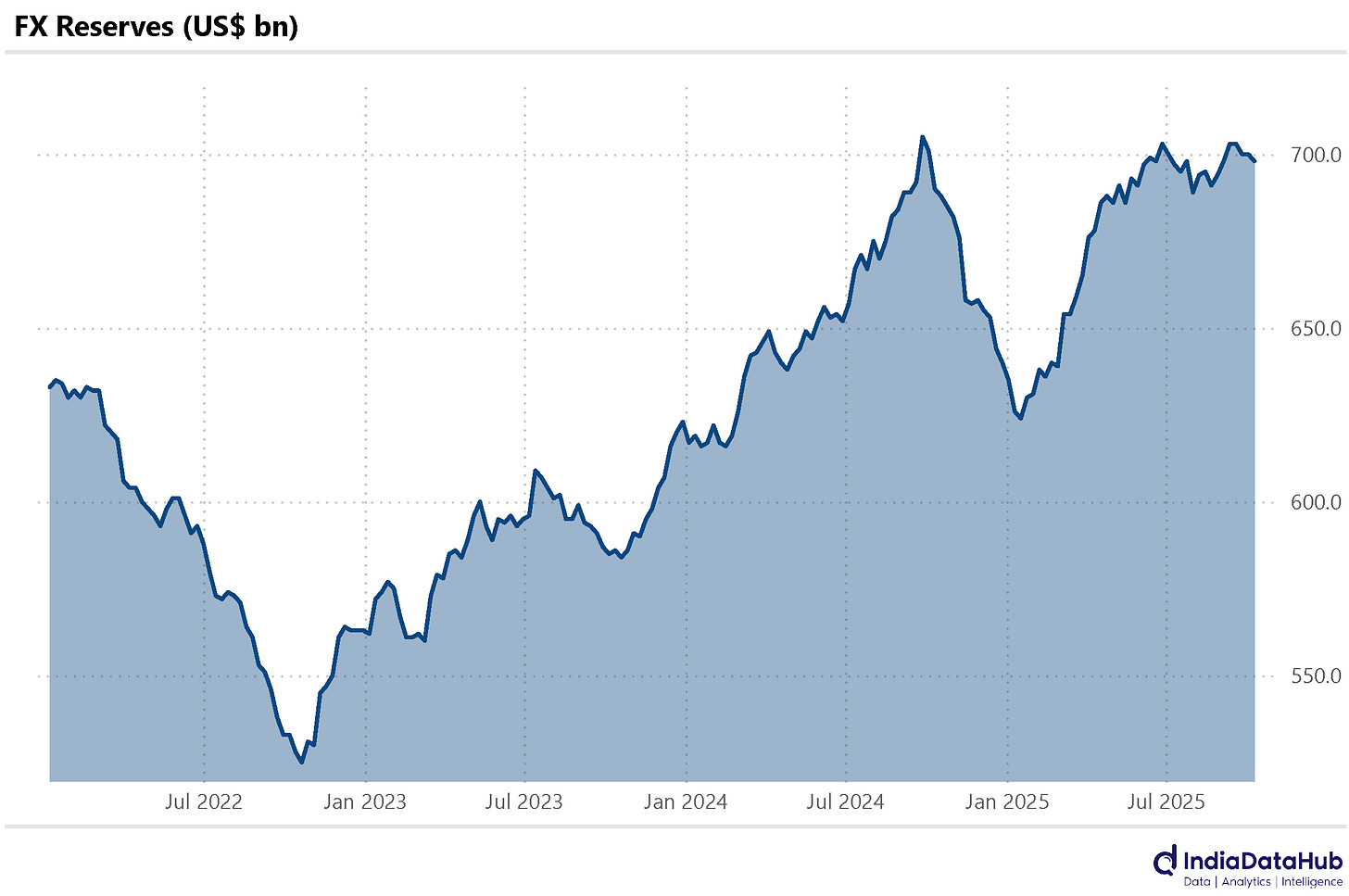

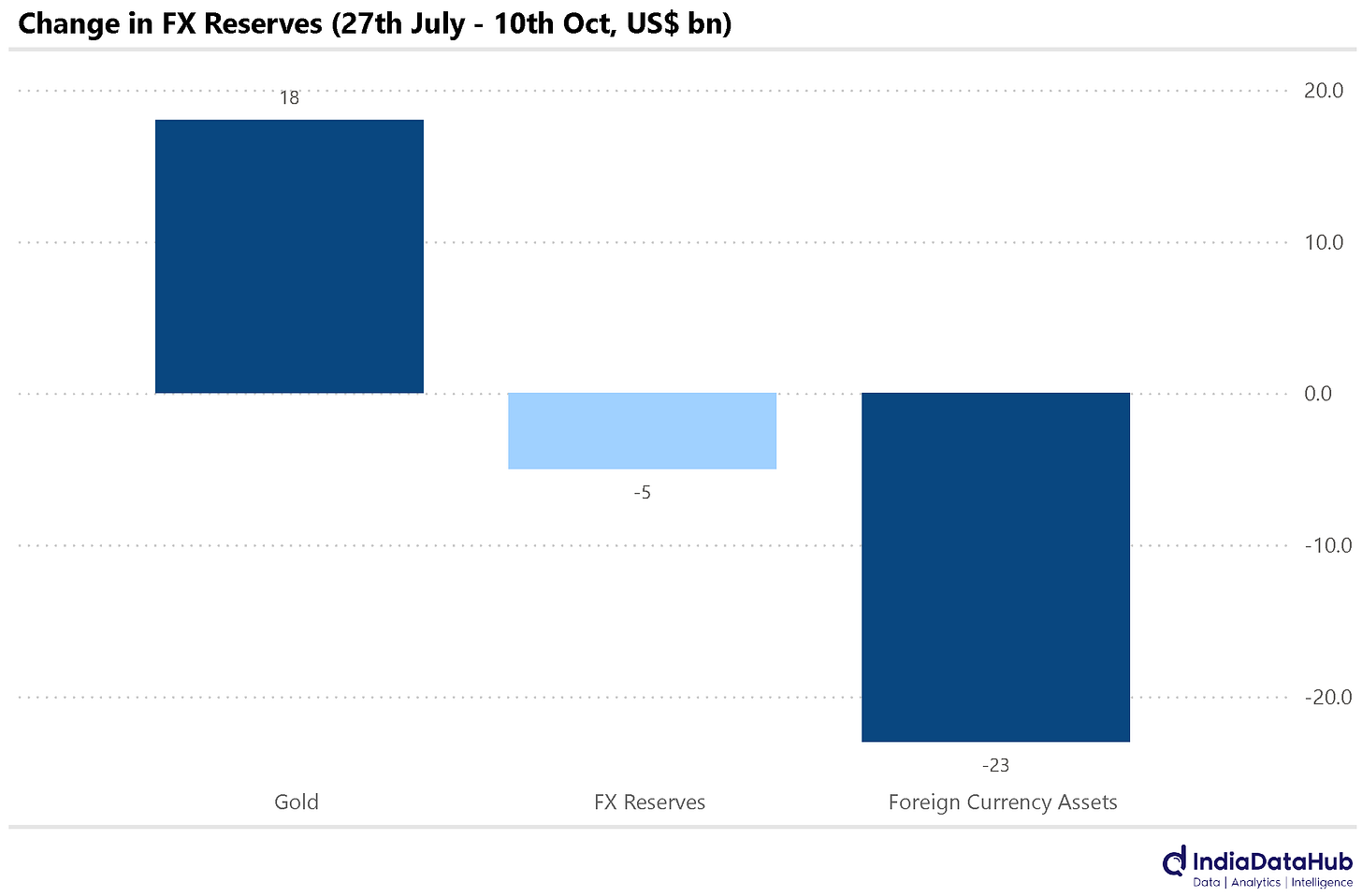

Lastly, FX Reserves. India’s FX reserves have remained largely stable in the last few weeks. But the headline data does not tell the full story. On the last Friday of June this year, India’s FX reserves stood at US$703bn. And as of October 10th, the reserves stood at US$698bn – a modest decline of US$5bn or less than 1%. But the reason reserves have remained largely stable is due to the increase in the price of Gold and the consequent revaluation of gold holdings of the RBI.

During this period, the value of RBI’s foreign currency assets (balances with other central banks, checking accounts, short-term investments in treasury securities, etc) has declined by almost US$23bn or by 4%. But this has been almost fully offset by an increase in the value of gold holdings. During this same period, the value of RBI’s Gold holdings has increased by 21% or US$18bn. And this increase is broadly in sync with the change in international gold price – so the RBI does not appear to have bought physical Gold by selling some financial assets during this period.

Bottom line is that the RBI is defending the rupee, which has depreciated against the US Dollar as well as other currencies. But that defence is not manifesting itself in a fall in FX reserves due to the rising price of Gold. This is not to suggest that the level of reserves has fallen sharply; they remain comfortable. But this is something worth keeping a track of…

That’s it for this week… Wishing everyone reading this a very happy and prosperous Deepawali. See you next week…