Bihar drives Auto sales in October, Record new company registrations, Aviation Slowdown...

This Week In Data #145

In this edition of This Week In Data, we discuss:

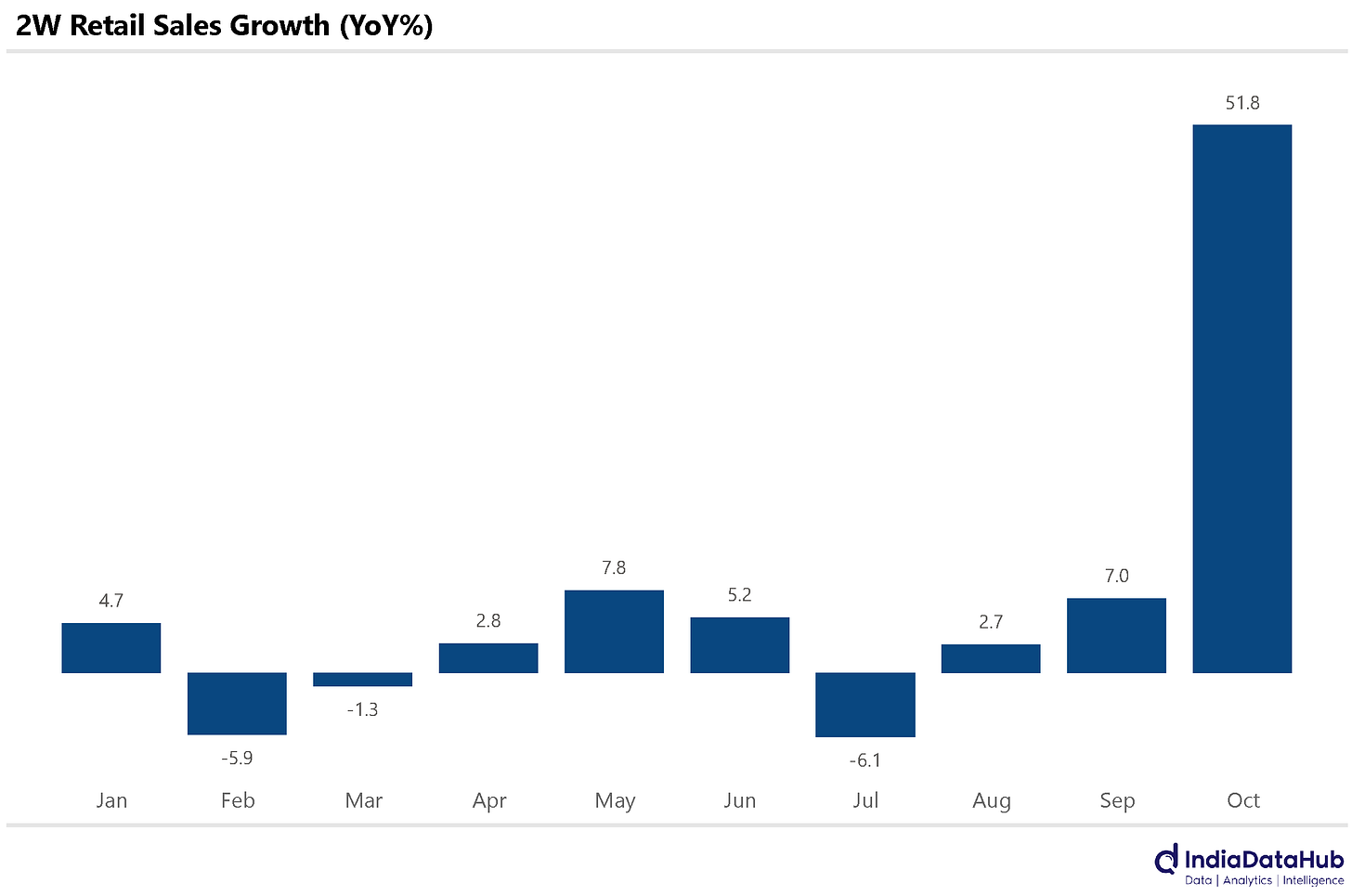

2W sales see sharp rebound in October but growth in Car sales remains modest

Bihar sees an across-the-board strong growth in Automobile sales

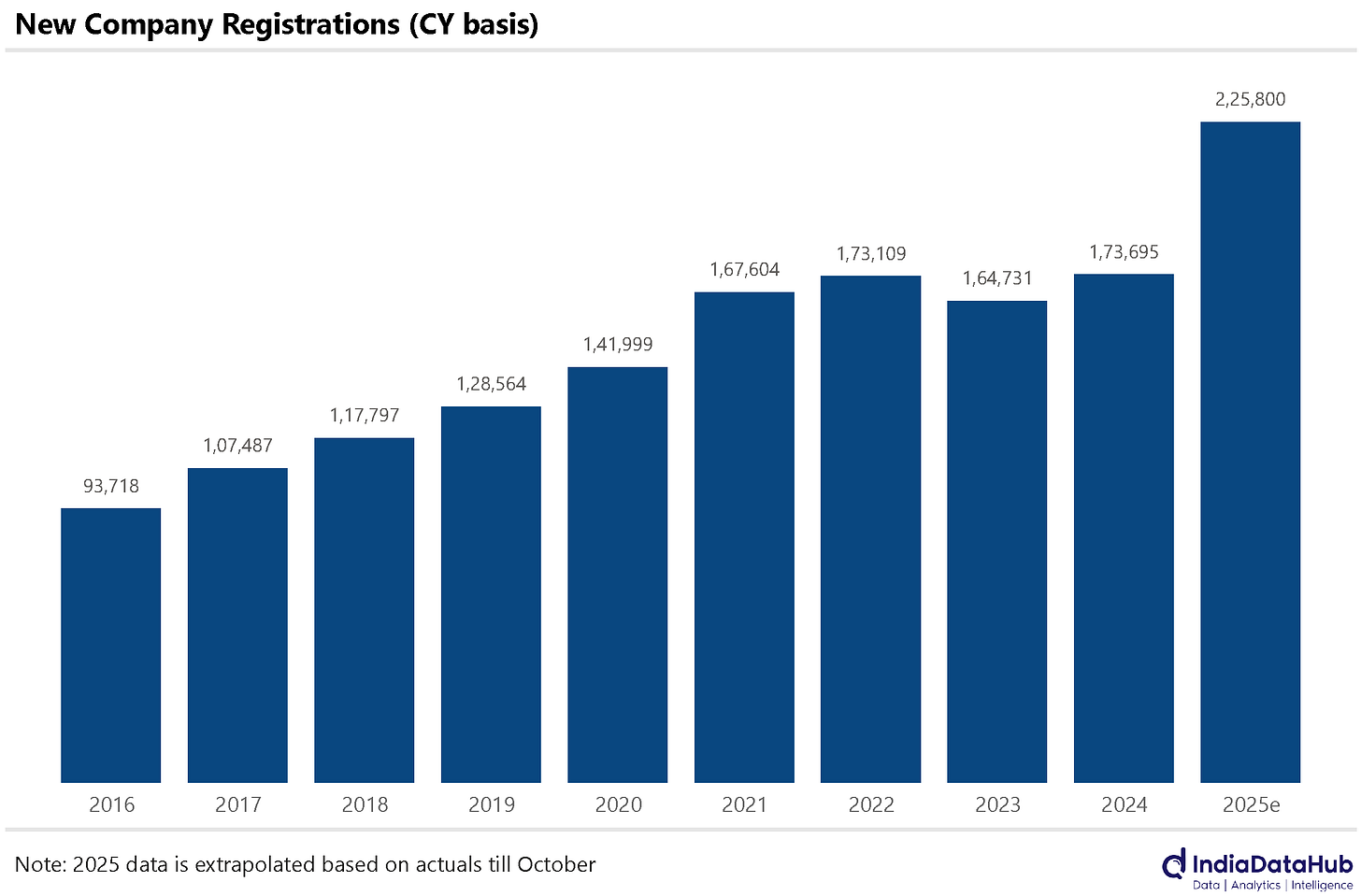

New company registrations are on track for record year in 2025

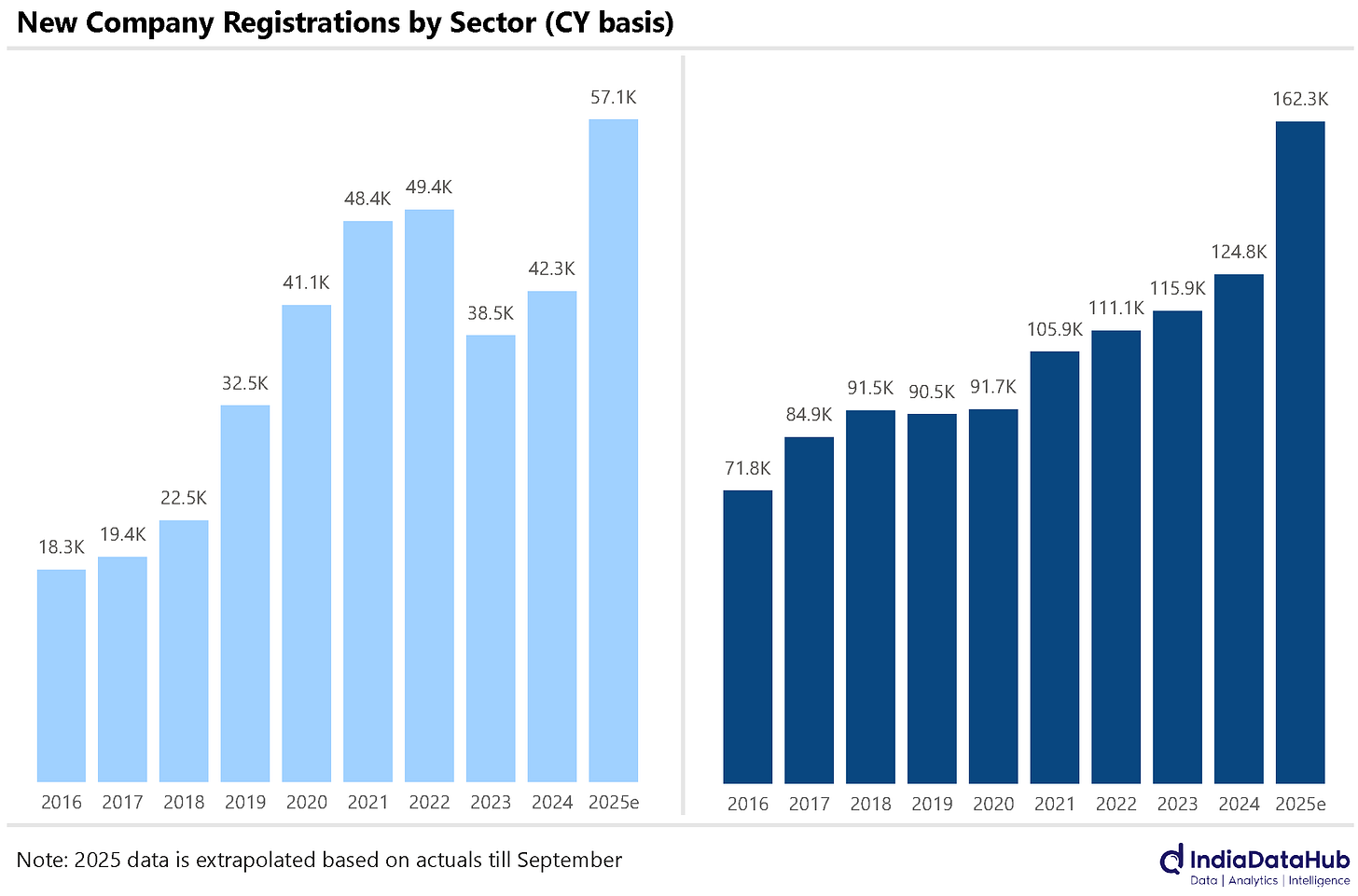

Services sector continues to attract new firms, despite the high base

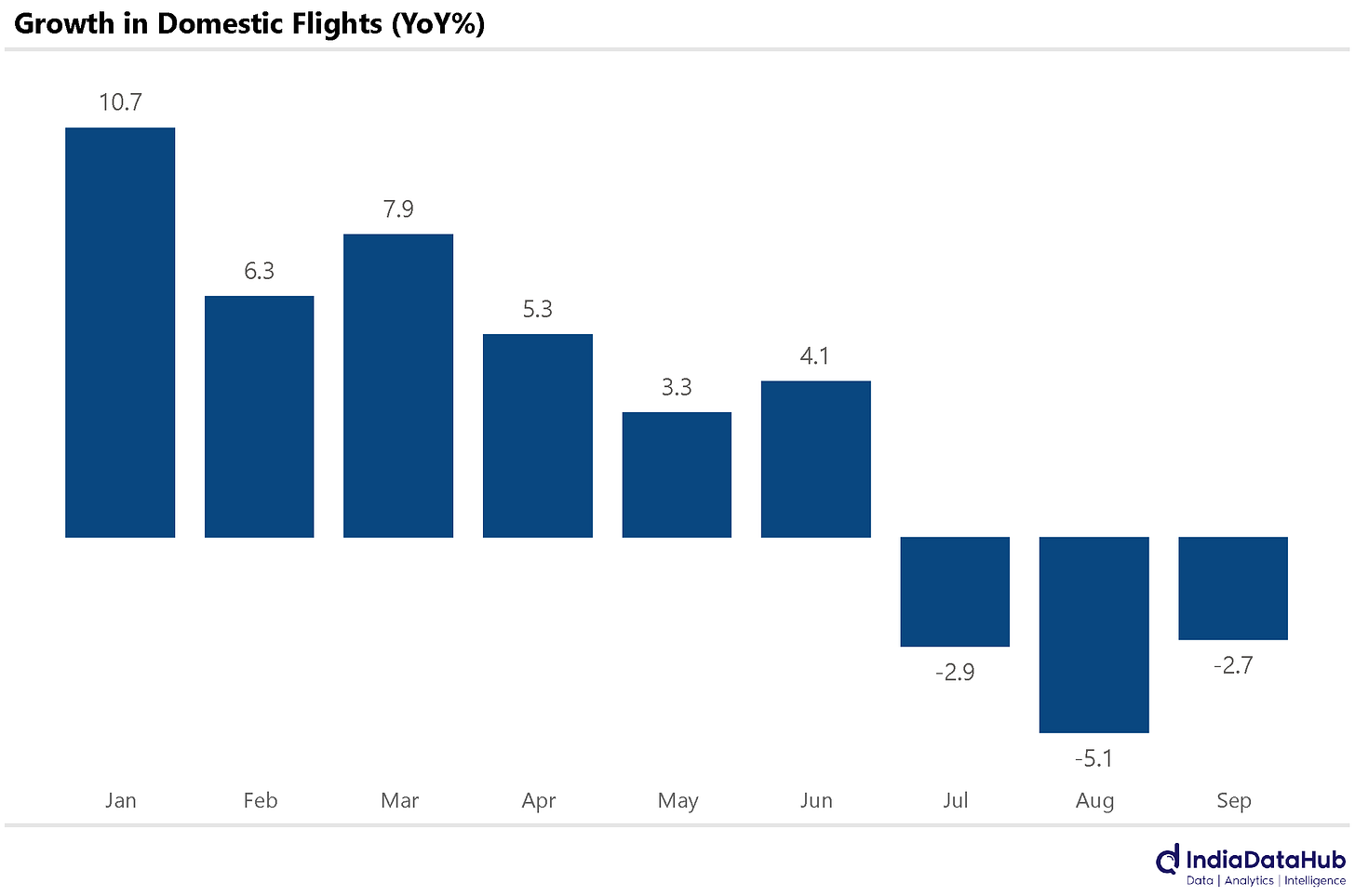

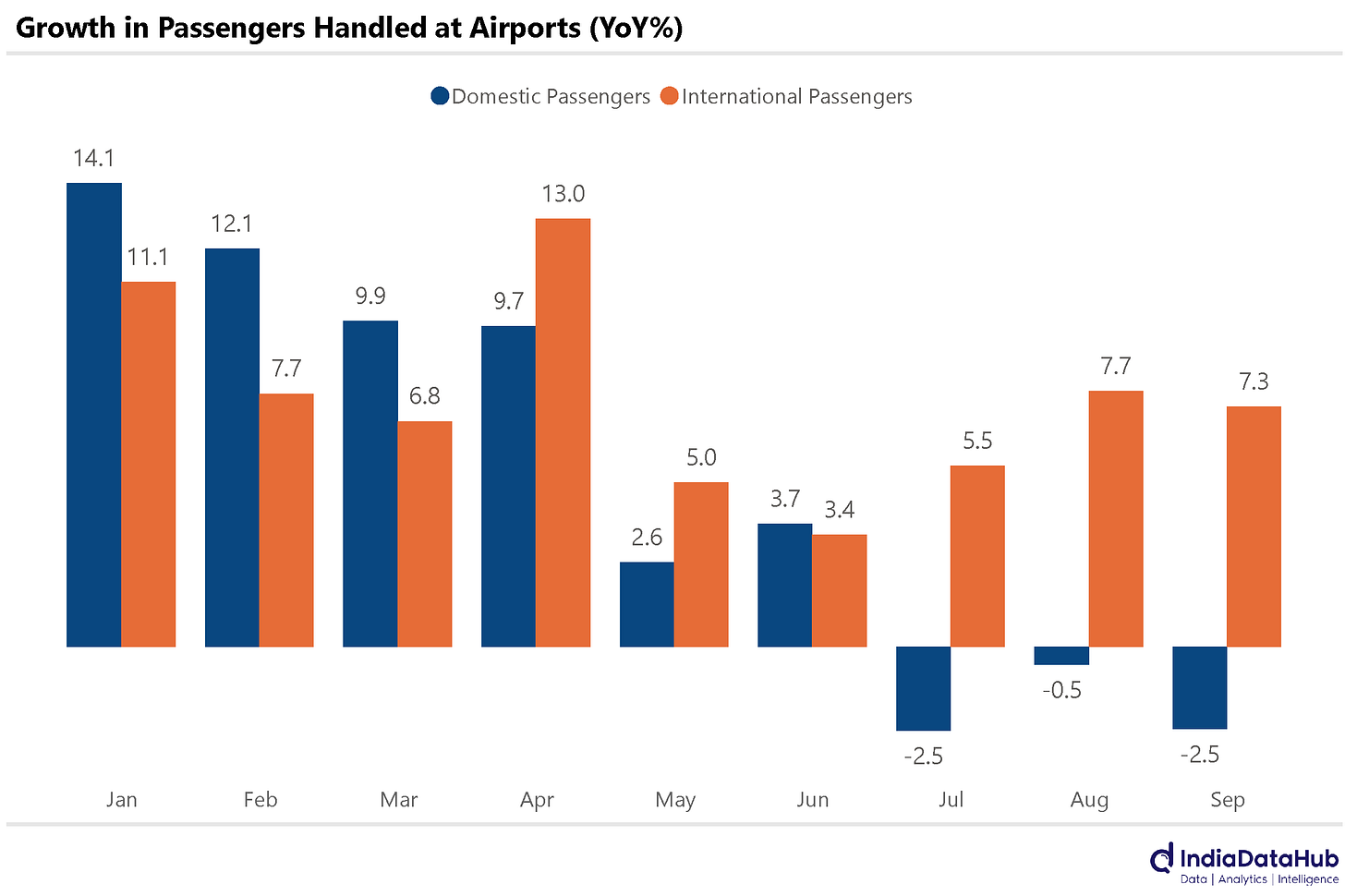

Domestic aviation sector is seeing a slowdown with domestic flights and passengers declining for 3rd consecutive month

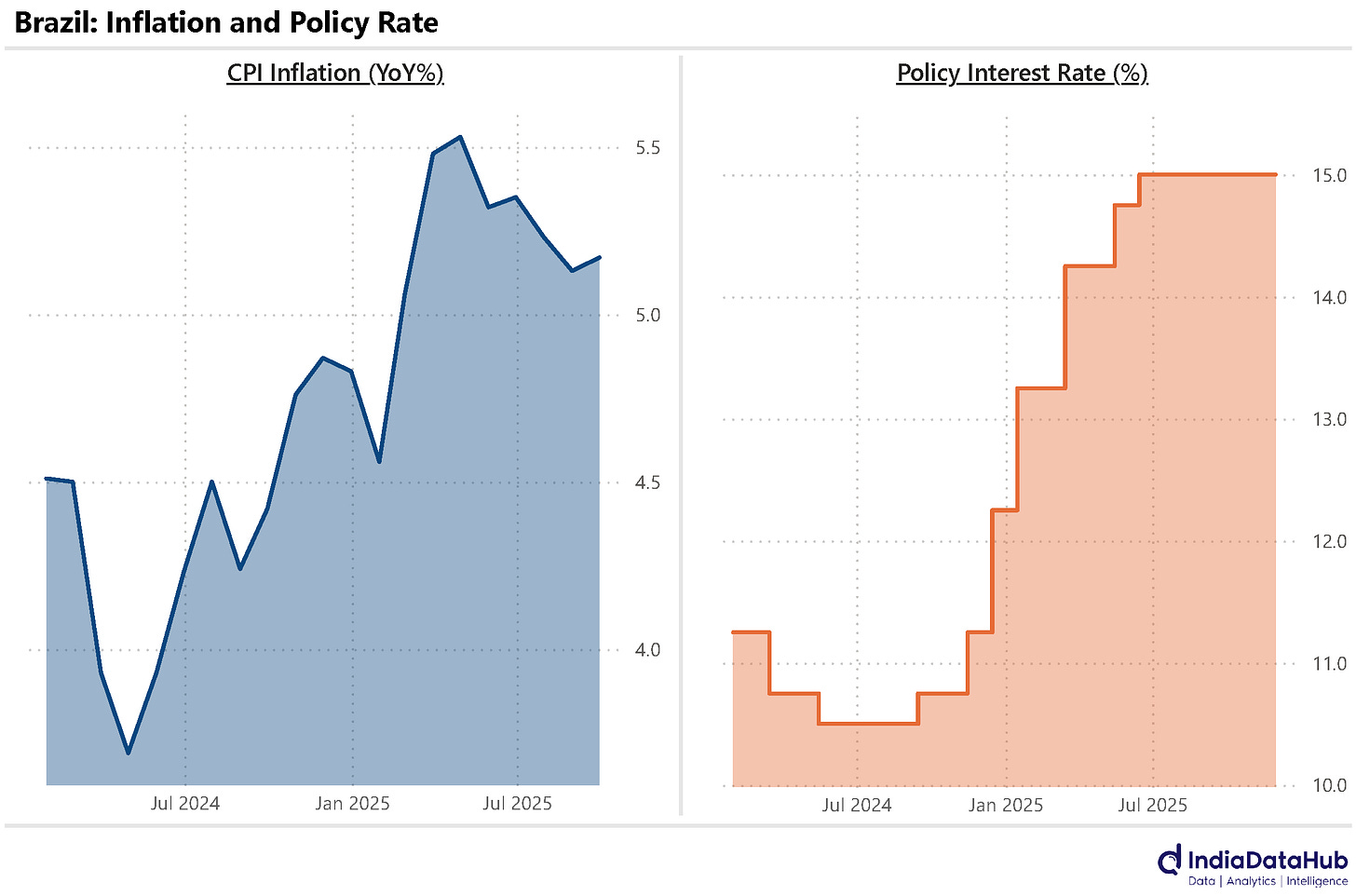

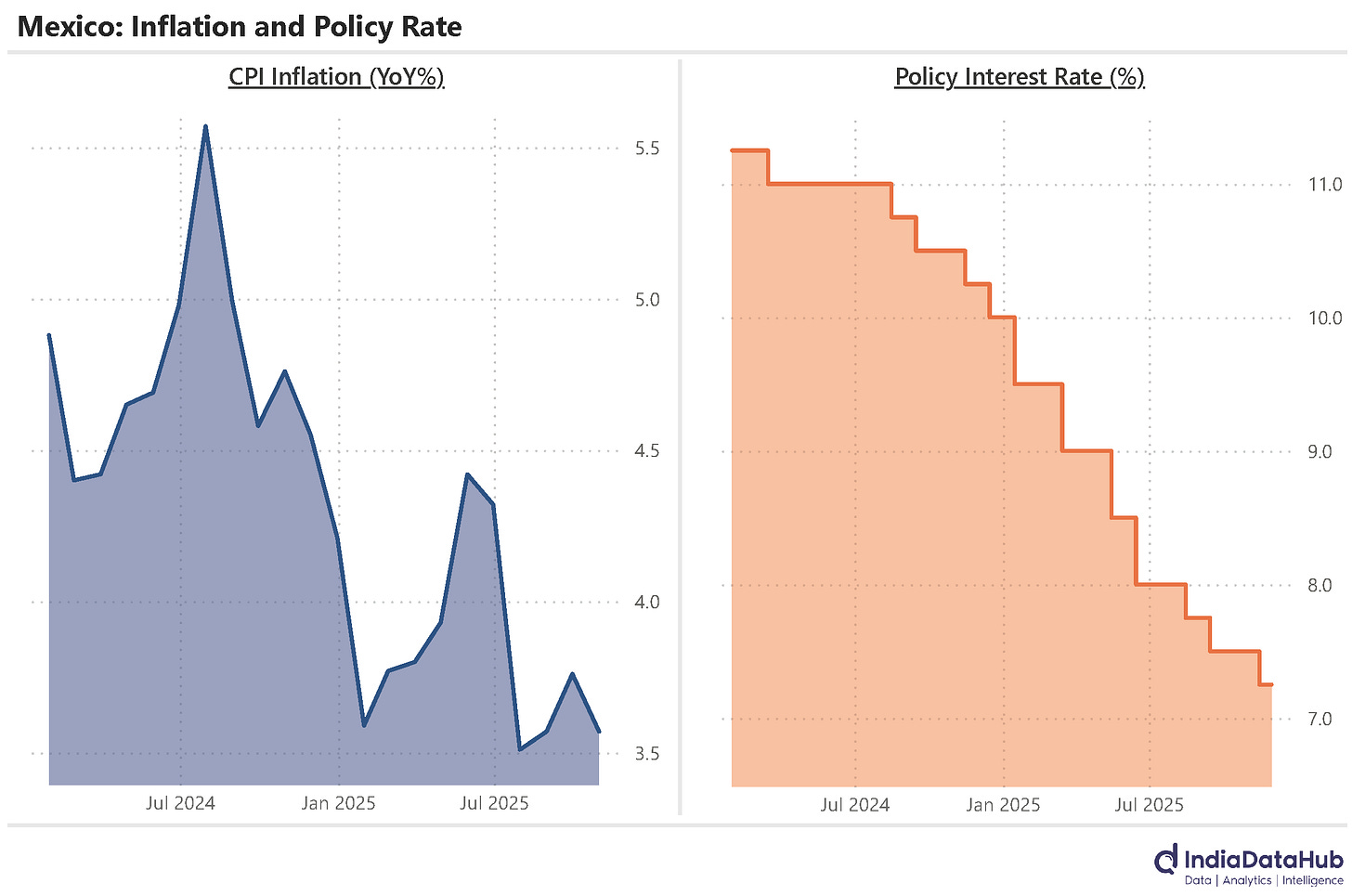

Central bank of Brazil keeps interest rates unchanged as inflation remains high but Bank of Mexico cuts interest rates as inflation moderates

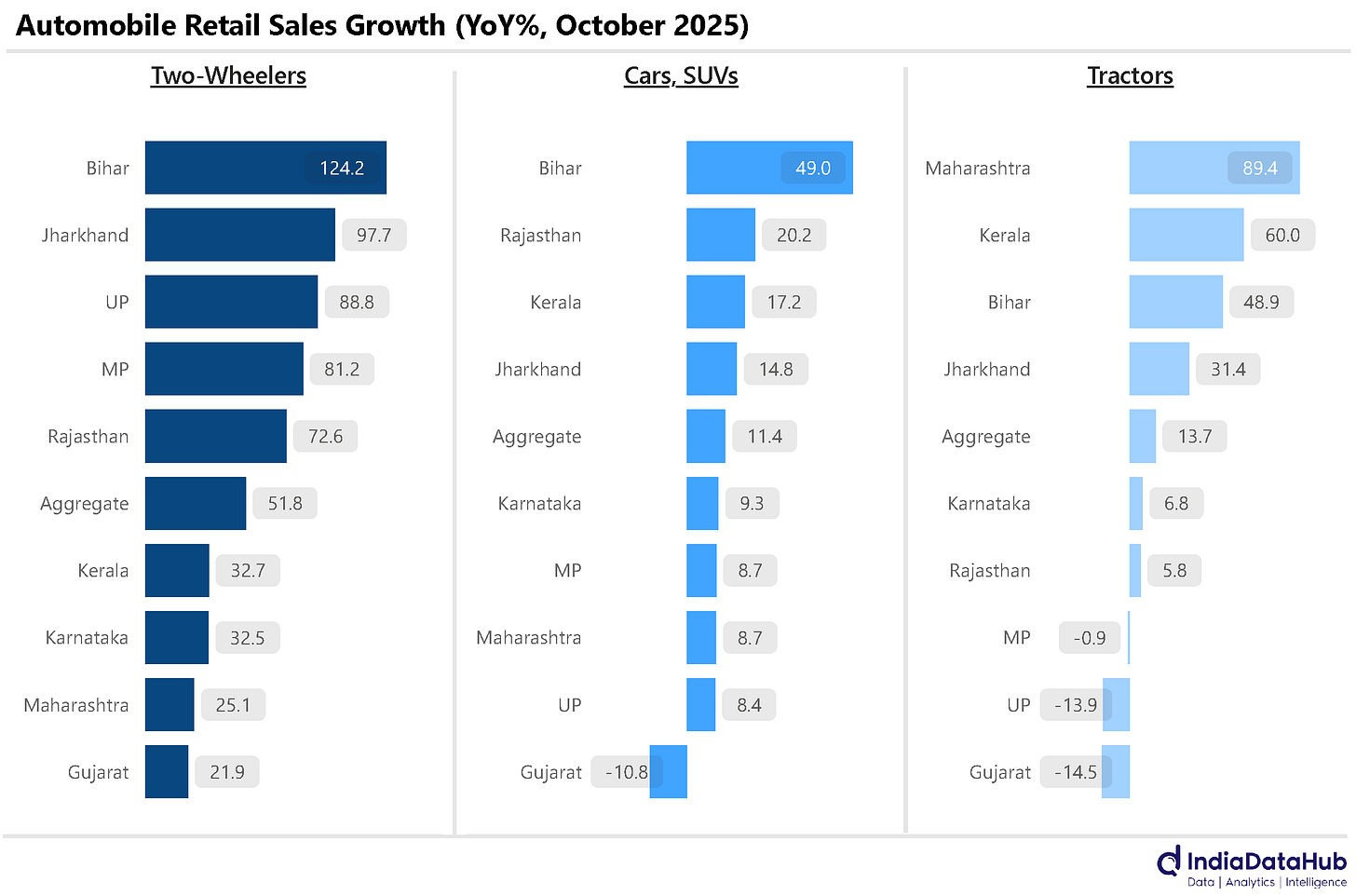

The recent reduction in GST rate on 2Ws has significantly buoyed their sales. In October, total retail 2W sales rose by over 50% YoY. Sales growth was strong in most large states, but was especially strong in the Hindi heartland. In Bihar, sales more than doubled, while in Jharkhand they rose almost 100%. UP and MP also saw 90% growth in sales. In contrast, sales grew by a relatively modest 20% in Gujarat, 25% in Maharashtra and just over 30% in Karnataka and Kerala.

This surge in 2W sales did not rub off on Passenger cars, where sales grew a modest 11% in October. But Bihar stood out even here with sales growing almost 50% YoY. But other large states in the Hindi heartland did not see any surge in sales. MP and UP, for instance, saw a modest 8-9% growth.

And yes, Tractors saw a similar trend. While overall tractor sales grew a modest 14% YoY in October, Bihar saw almost 50% growth. Jharkhand also saw a strong 30% growth in Sales, but sales declined in UP as well as MP. So, whether this pretty much across the board surge in sales in Bihar is entirely due to the reduction in GST rates or is there something more to it?

2025 is turning out to be a very strong year for startups (new company registrations). In the first 10 months of this year (Jan-Oct), a total of 192k new companies were registered in the country. This is an increase of 30% YoY. At this rate, a total of 225k new companies would get registered in India, the highest ever, and the first time over 200k companies would be registered in any year.

Most of this growth is being driven by Industrial sector companies, which have seen a 36% growth so far (till Sept), while the services sector has also seen a 30% increase. That said, the sharp growth in new Industrial sector companies is not a structural trend. While 2025 might see just over 55k companies being registered at this rate, the year 2022 also saw almost 50k industrial sector companies. The real story is in the services sector, which continues to see secular growth in new firms being set up, despite the large base.

Lastly, the aviation sector is seeing a slowdown. Especially the domestic sector. The number of domestic flights handled by the airports declined by 3% YoY in September. This is the 3rd consecutive month of decline in domestic flights. International flights have been growing at ~4% in the last few months, down from 8% growth at the start of the year.

In sync with this, the total domestic passengers handled by the airports declined by 2% YoY in September, the third consecutive month of decline. International passengers handled grew by in the high single digits for the second consecutive month; however, despite this, the total passengers handled at all the airports declined by 1% in September, the second time in the last three months that total passenger throughput has declined on a YoY basis.

Globally, several central banks announced their rate decisions this week. The Reserve Bank of Australia (RBA) maintained its policy rate at 3.6%, the second consecutive time it has kept rates unchanged. Similarly, both the Central Bank of Brazil and the Bank of England kept their policy rates unchanged. In Brazil, the Selic rate remains at 15%, which is almost 400bps higher than the level last year.

In contrast, the Bank of Mexico reduced its policy rate by 25 basis points, lowering it from 7.5% to 7.25%. Over the past year, the policy rate in Mexico has fallen by 300bps. In part, this is being driven by a sharp fall in inflation. In October 2025, Mexico saw CPI inflation print at 3.6%, down 20bps on a MoM basis but more importantly, down 120bps over the past year.

That’s it for this week. See you next week…

Good roundup!