In this edition of This Week In Data, we discuss:

Union Budget continues the path of, slow, fiscal consolidation

Lower receipts drive lower capex, for both center and states

RBI keeps interest rates unchanged

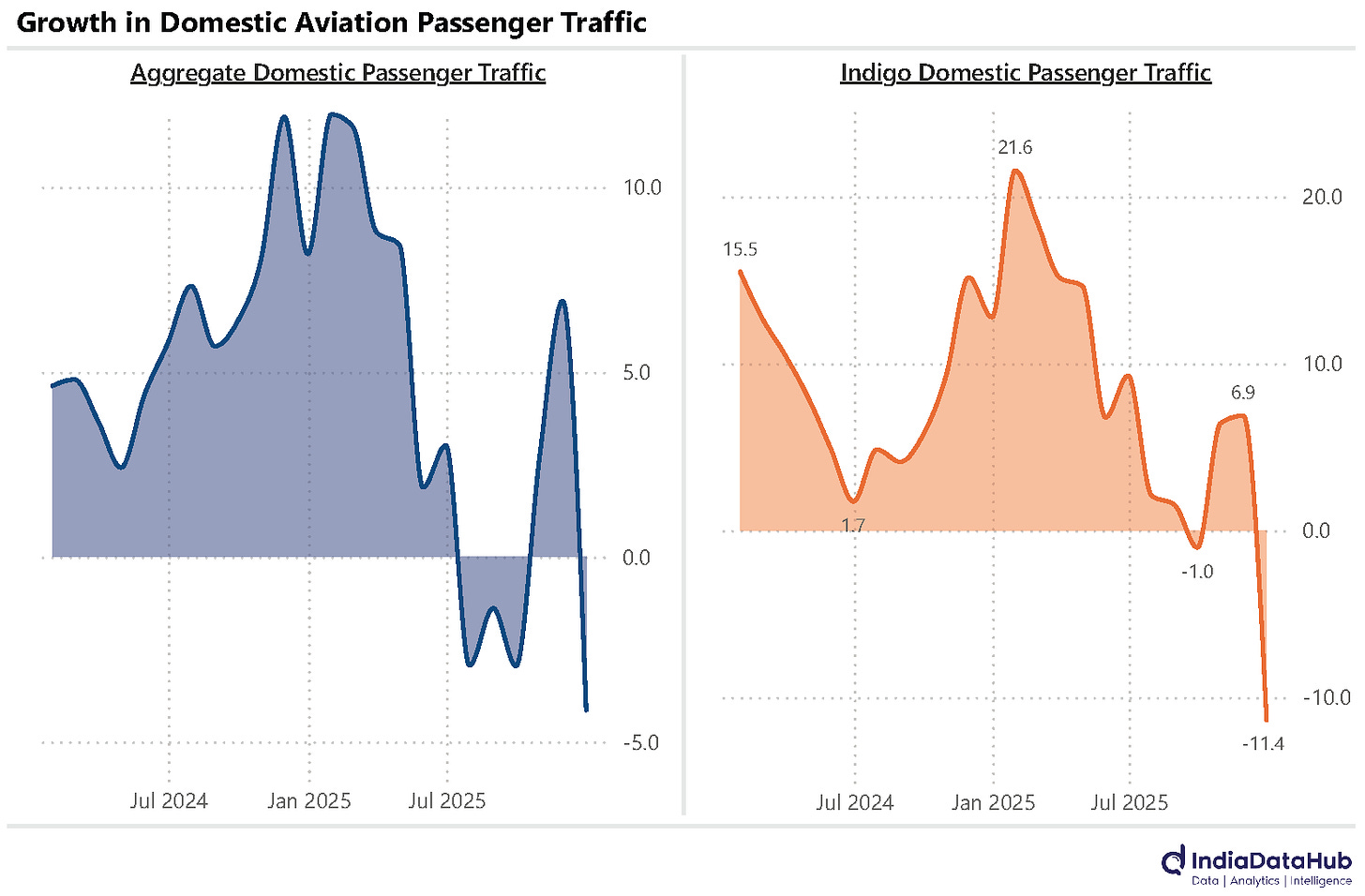

December sees 4% decline in Airline passenger traffic driven by 11% decline for Indigo

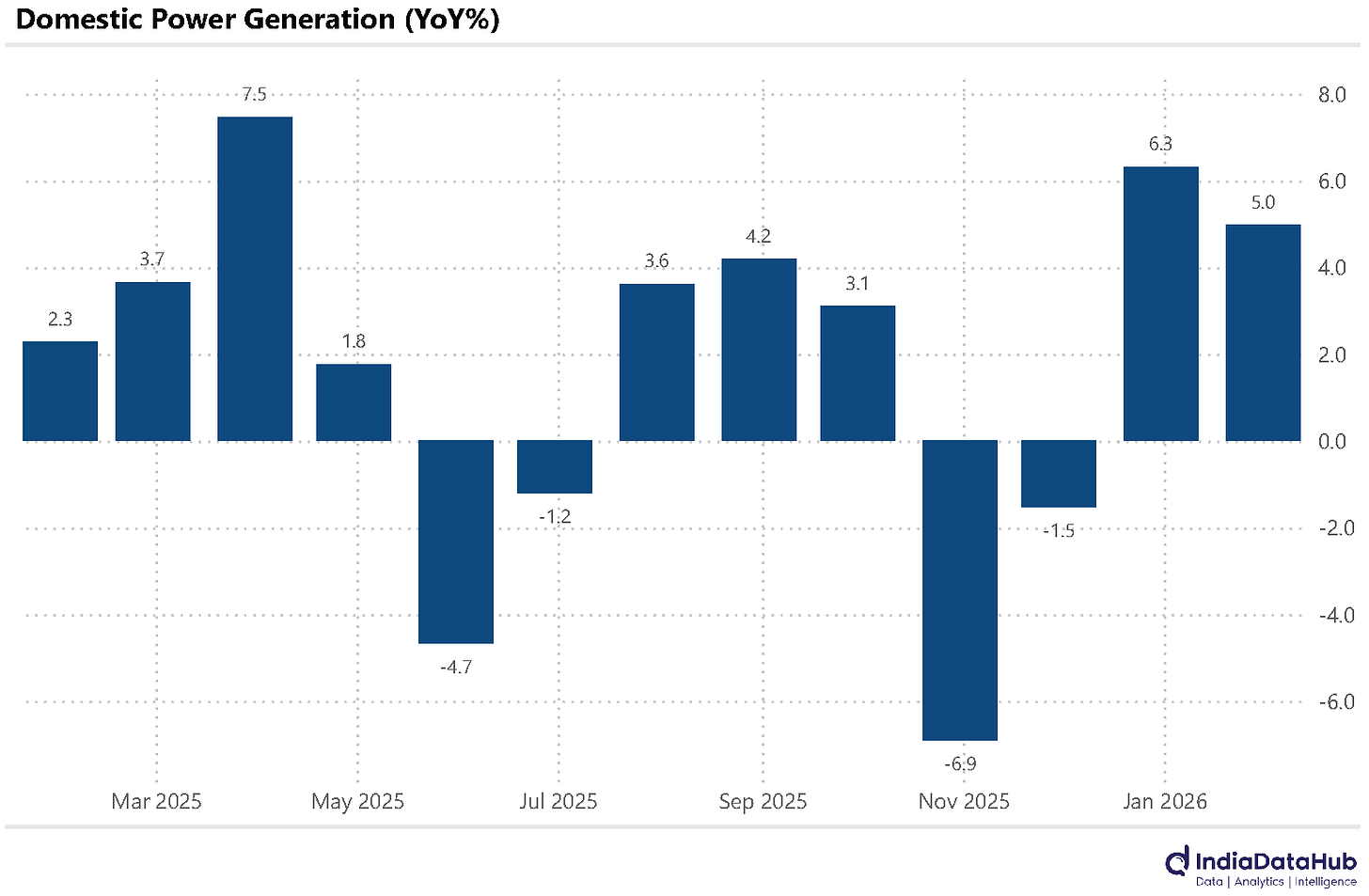

Power generation grows 5% in January on provisional basis

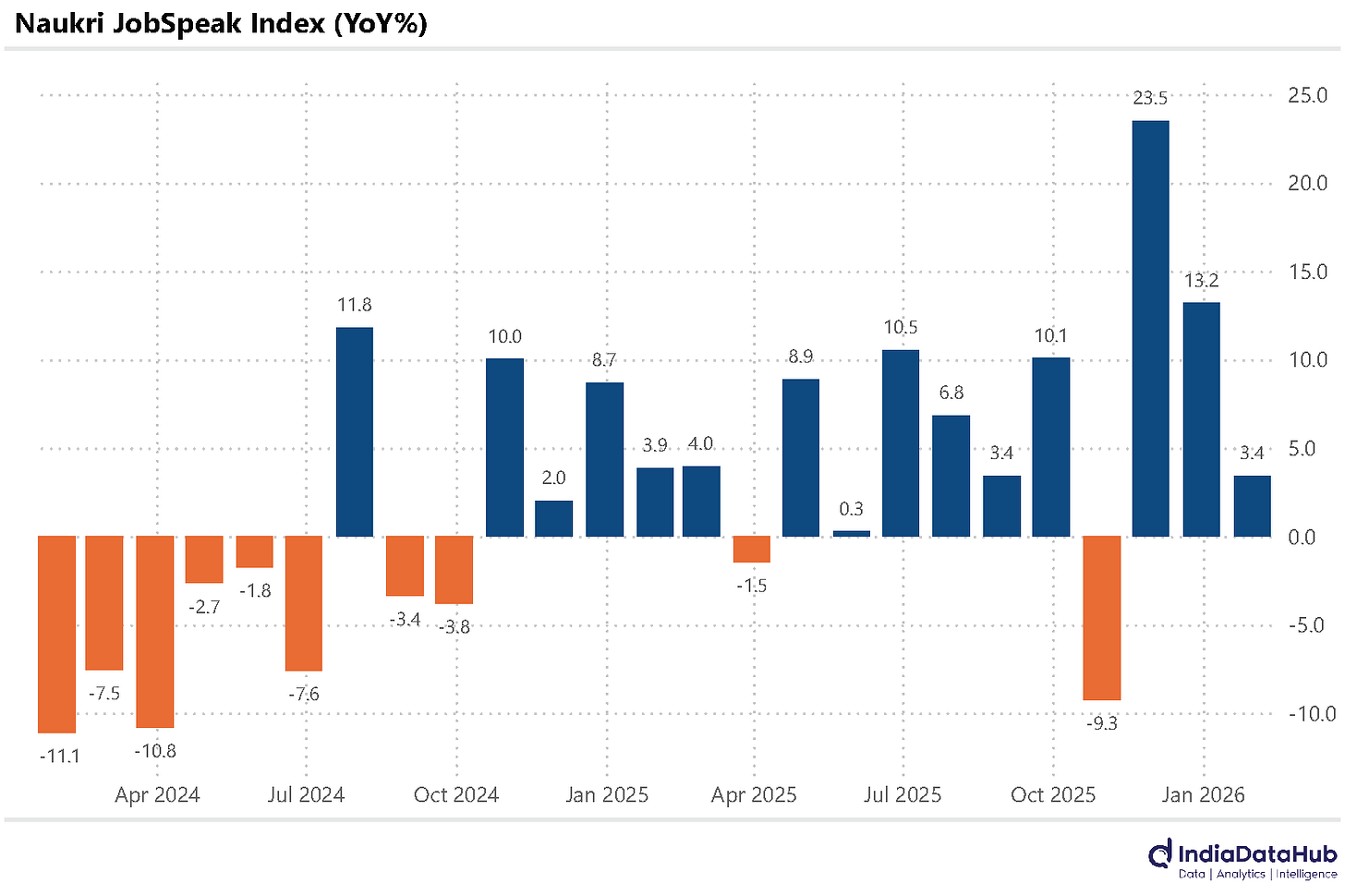

White collar hiring sees sharp slowdown as evidenced by Naukri JobSpeak Index

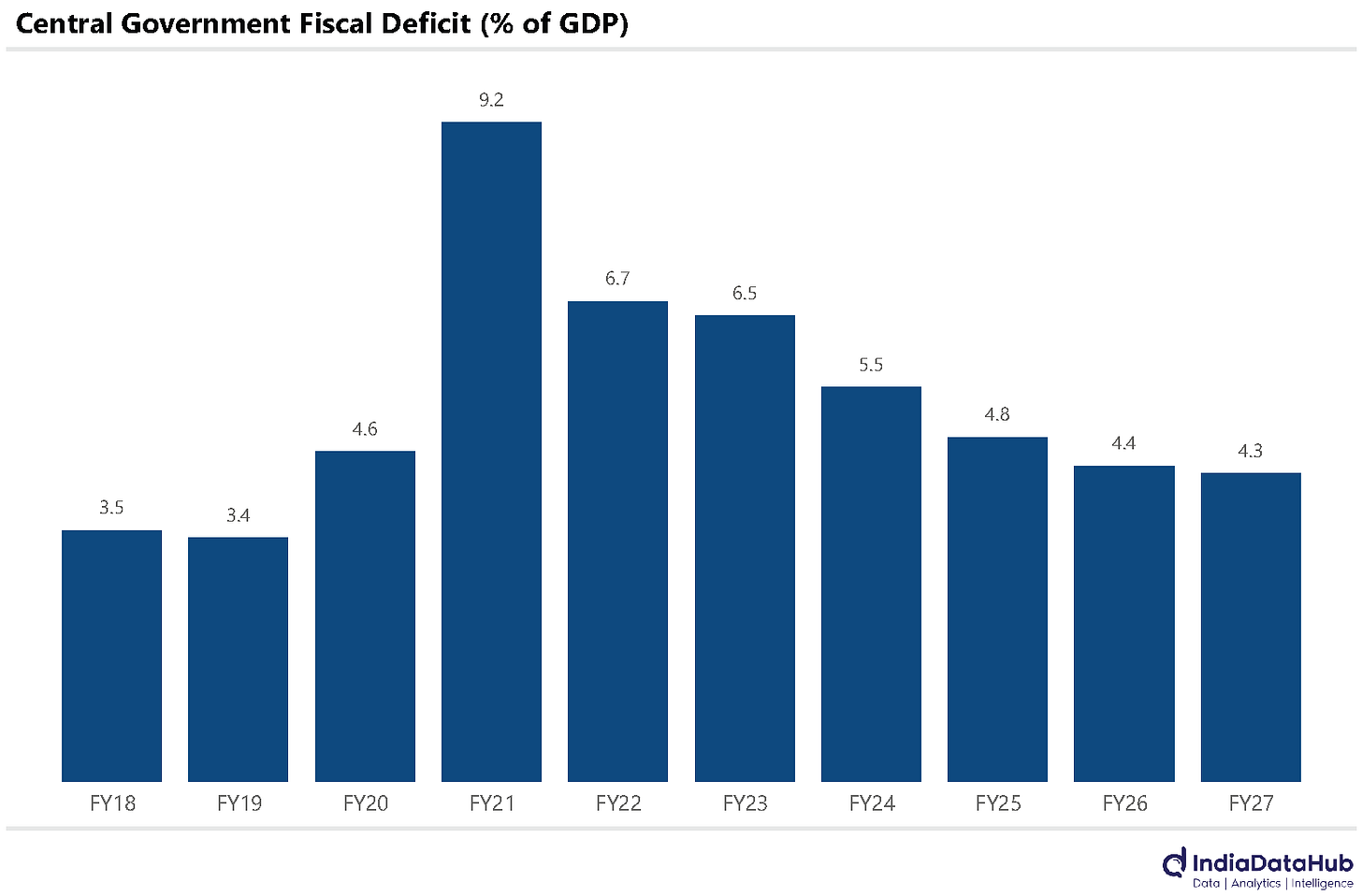

First, the budget. And at a high level, it did what budgets are generally meant to do – a simple statement of accounts. And the statement of accounts presented a reasonably good picture – the fiscal deficit is expected to decline 40bps this year to 4.4% of GDP, and as per the budget estimates, it will decline by a further 10bps next year. That said it is worth noting that despite the Covid19 pandemic having long ended, the fiscal deficit continues to remain well above the pre-pandemic levels.

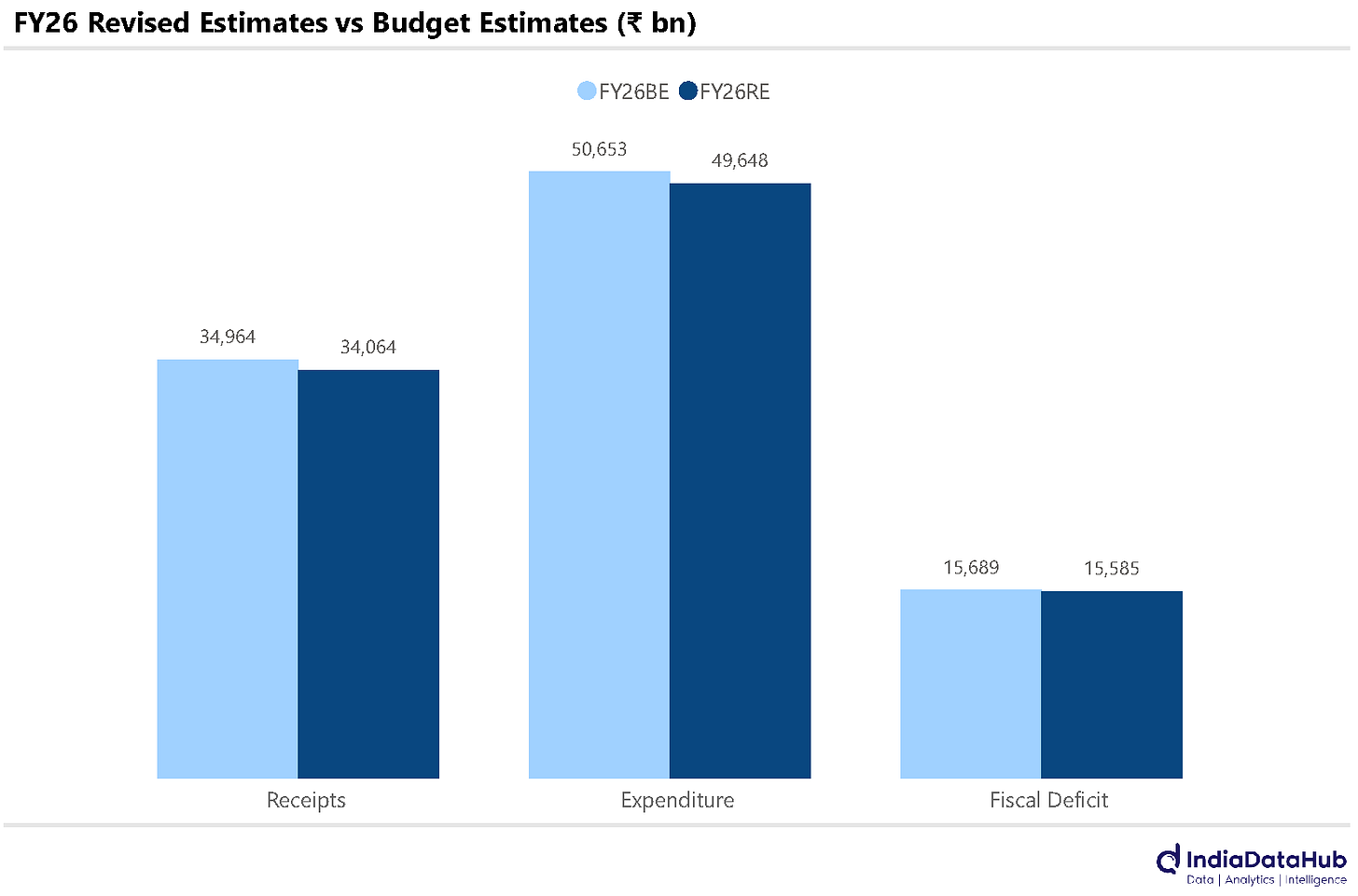

The interesting question, though, is how this fiscal consolidation is being achieved. In the current year (FY26), as per the revised estimates, revenues will miss budget estimates. But this has been more than offset by lower expenditure.

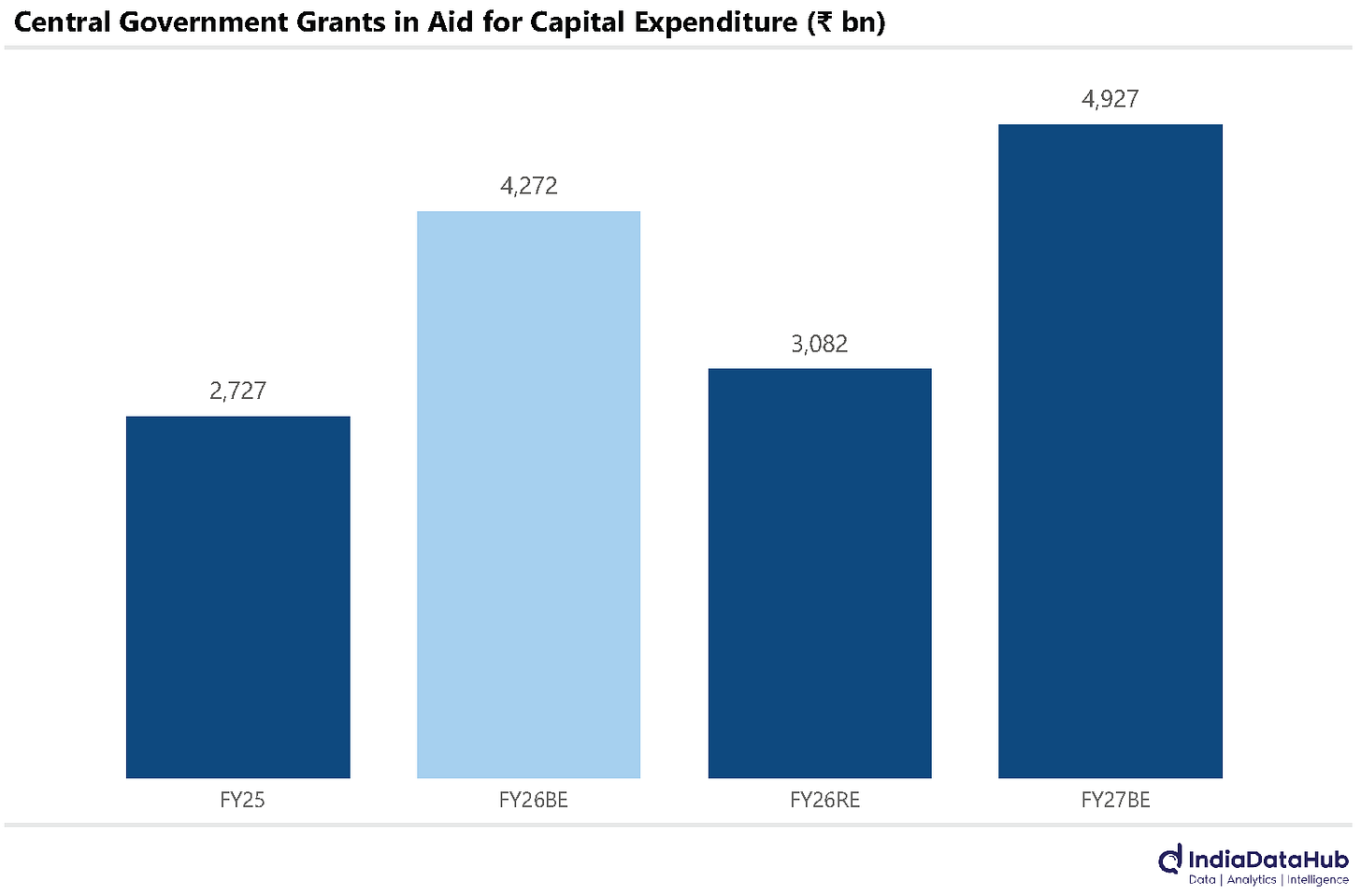

Total receipts for FY26 as per the revised estimates are likely to be lower than the budget estimate by ~₹900bn. In contrast, total expenditure is likely to be lower by ₹1000bn. And this entire shortfall (and some more) is due to lower grants (to states) for capital expenditure. The government had budgeted grants of ₹4,272bn as grants for capital expenditure in the budget last year. The revised estimate is almost 30% lower at ₹3,081bn. This will not have an impact on the Centre’s capital expenditure, which in any case, is independently expected to grow by less than 5% in FY26 as per the revised. But this will weigh on the state government’s capital expenditure. And the first few state budgets that have come in reflect this.

So the answer to the question of why investments in the economy don’t seem to be growing lies partly here. Of course, the budget estimates suggest that next year things will change. Capital expenditure is expected to be in double digits, and the Grants for capital expenditure will also see a sharp increase. But like this year, this will almost entirely depend on whether revenue estimates fructify. They did not this year. But some of that was due to the GST rate cuts which happened post the last year’s budget. So, unless some such external event occurs, government capex should recover next year.

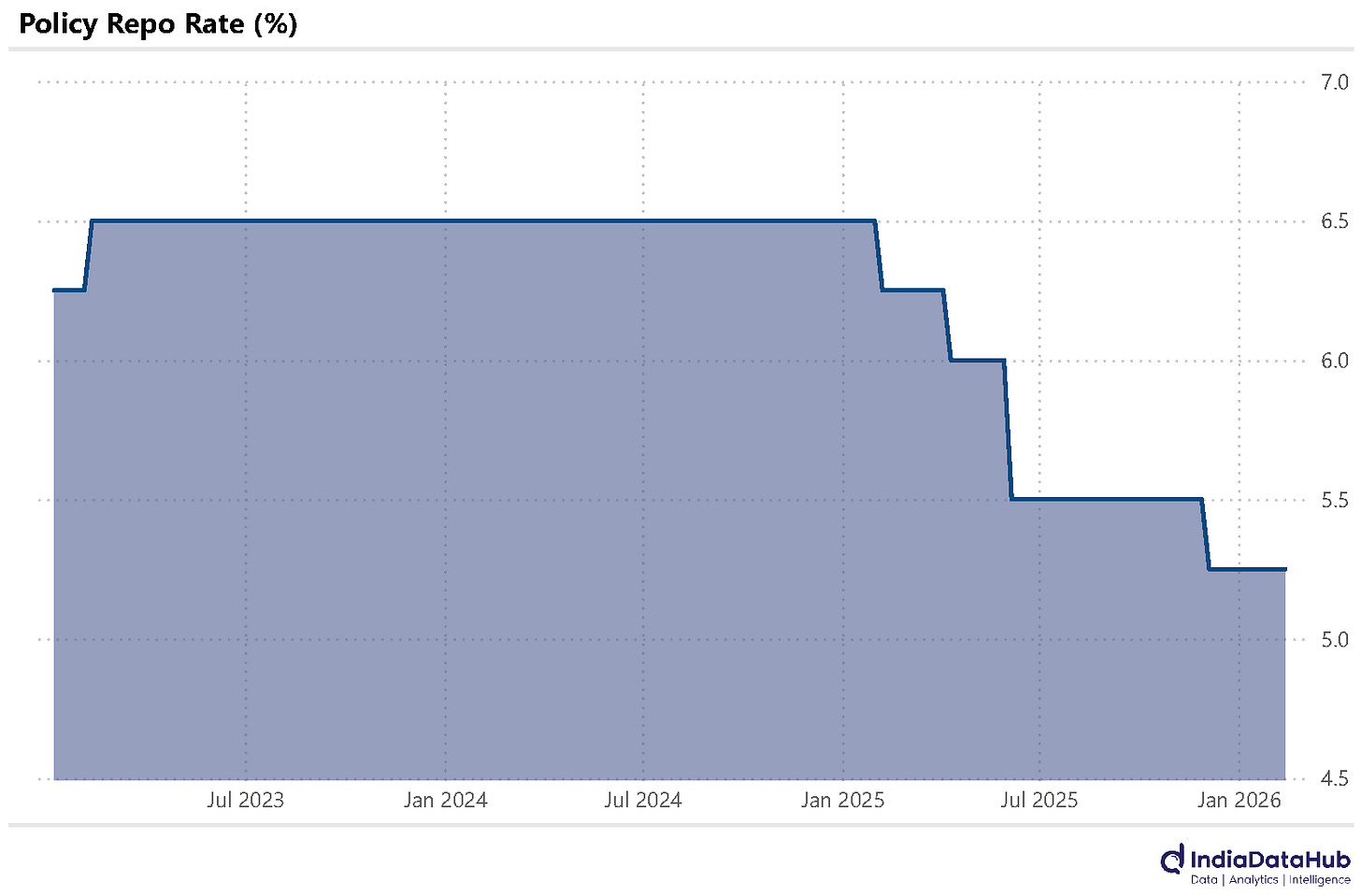

Following the budget, the RBI’s Monetary Policy Committee (MPC) decided to keep its interest rates unchanged this week. So, the Repo rate remains unchanged at 5.25% while the SDF and the MSF rates remain unchanged at 5% and 5.5% respectively.

What has driven this is growing confidence in the trajectory of economic growth. The MPC raised its forecast for near-term growth by ~20bps. While inflation remains low, it is expected to pick up and rise to 4% next quarter. And the MPC notes that the external sector headwinds have increased even though the overhang of high tariffs on US exports has gone away. Accordingly, the MPC reckoned that a rate cut was not warranted.

The domestic aviation data for December was released this week. And it was a weak month, as expected, given the scheduling issues faced by the airlines, notably Indigo. Overall passenger traffic declined by 4% YoY, the sharpest decline in recent months. Indigo saw passenger traffic decline 11% YoY, again the first decline in recent months.

The other carriers benefited from this decline. Air India group saw high single-digit growth in passenger traffic while SpiceJet saw domestic passenger traffic grow for the third consecutive month. Smaller airlines saw an even sharper increase in passenger traffic – Star, for example, saw over 70% growth in passenger traffic, although admittedly this is on a low base.

Power generation grew 5% YoY in January as per provisional data. This is broadly the same growth as in December and was at the upper end of the range of the past few quarters. Renewables continue to drive this growth, with power generation from renewable sources growing over 20% in January. In contrast, power generation from conventional sources grew by a modest 2%.

Lastly, White-collar hiring moderated in January, with the Naukri JobSpeak Index growing by a modest 3% YoY after a double-digit growth in the previous month.

Hiring intentions declined sharply in telecom, financial services, and electronics, contracting by 21%, 15%, and 12%, respectively. Meanwhile, IT/software and IT hardware services reported marginal declines of 2% and 4%, respectively. In contrast, accounting, taxation & finance, advertising, and architecture remained resilient, though momentum eased from the previous month.

That’s it for this week. See you next week…