Central Bank Assets, Weak Auto sales and more...

This Week In Data #115

In this edition of This Week In Data we discuss:

Central Bank assets are falling but they are still significantly higher than pre-Covid levels

China is a notable exception with central bank assets as multi year lows

Automobile sales were weak in February, even adjusted for lower number of days this February

Petroleum sales declined sharply driven by weaker consumption for both Petrol and Diesel

EWay bills growth decelerated in February but was broadly in sync with the growth during the December quarter

We start with Central bank assets. After the global financial crisis, the size of Central Bank balance sheets expanded sharply as part of various quantitative easing programs. These programs were being pulled back gradually in the second half of the last decade when Covid came upon us and resulted in another expansion of their balance sheets due to the significant monetary easing that ensued. And once again in the last couple of years, as central banks have resumed monetary tightening due to persistent high inflation, balance sheets are contracting. But where are we in this whole expansion-contraction cycle?

If we look at the US, as of December, the Central bank assets totalled 24% of GDP, down from a peak of 37% of GDP in late 2021 and early 2022 but still substantially higher than just before Covid. And almost 4x the size before the GFC when the US Fed’s balance sheet used to average 6-7% of the USA’s GDP. In absolute terms, the Fed’s assets totalled US$6.9 trillion as of December 2024, having declined from a peak of US$8.9 trillion in 1Q 2022. So while the Fed’s balance sheet has shrunk, it is still well above the ‘normal’ levels. And for reference, RBI’s assets total ~23% of GDP as of December.

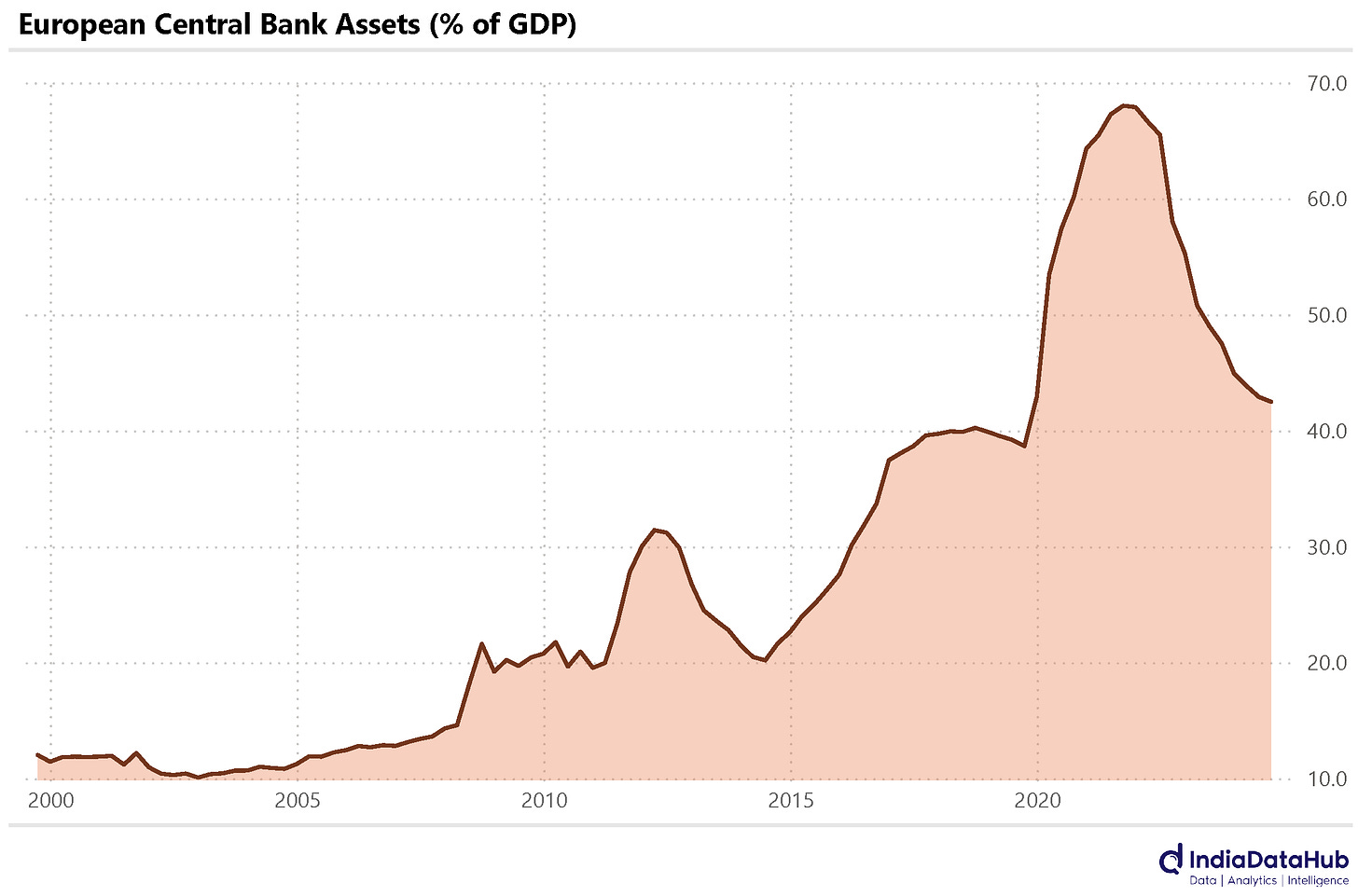

For the ECB, the numbers are even more dramatic. As of December, its assets totalled 43% of the Euro area’s GDP – almost 2x of the size of the US Fed’s balance sheet. But while the ECB’s assets are much higher, they have also fallen significantly in the last 3 years. In December 2021 its assets totalled 68% of GDP. For reference, pre-GFC the size of ECB’s assets used to average ~12% of the Euro area’s GDP.

The Central bank with the largest asset base is the Bank of Japan. As of December 2024, its assets totalled 123% of Japan’s GDP. And while they have declined post-COVID, the decline has been a modest 10ppt – from a peak of 133% in early 2021.

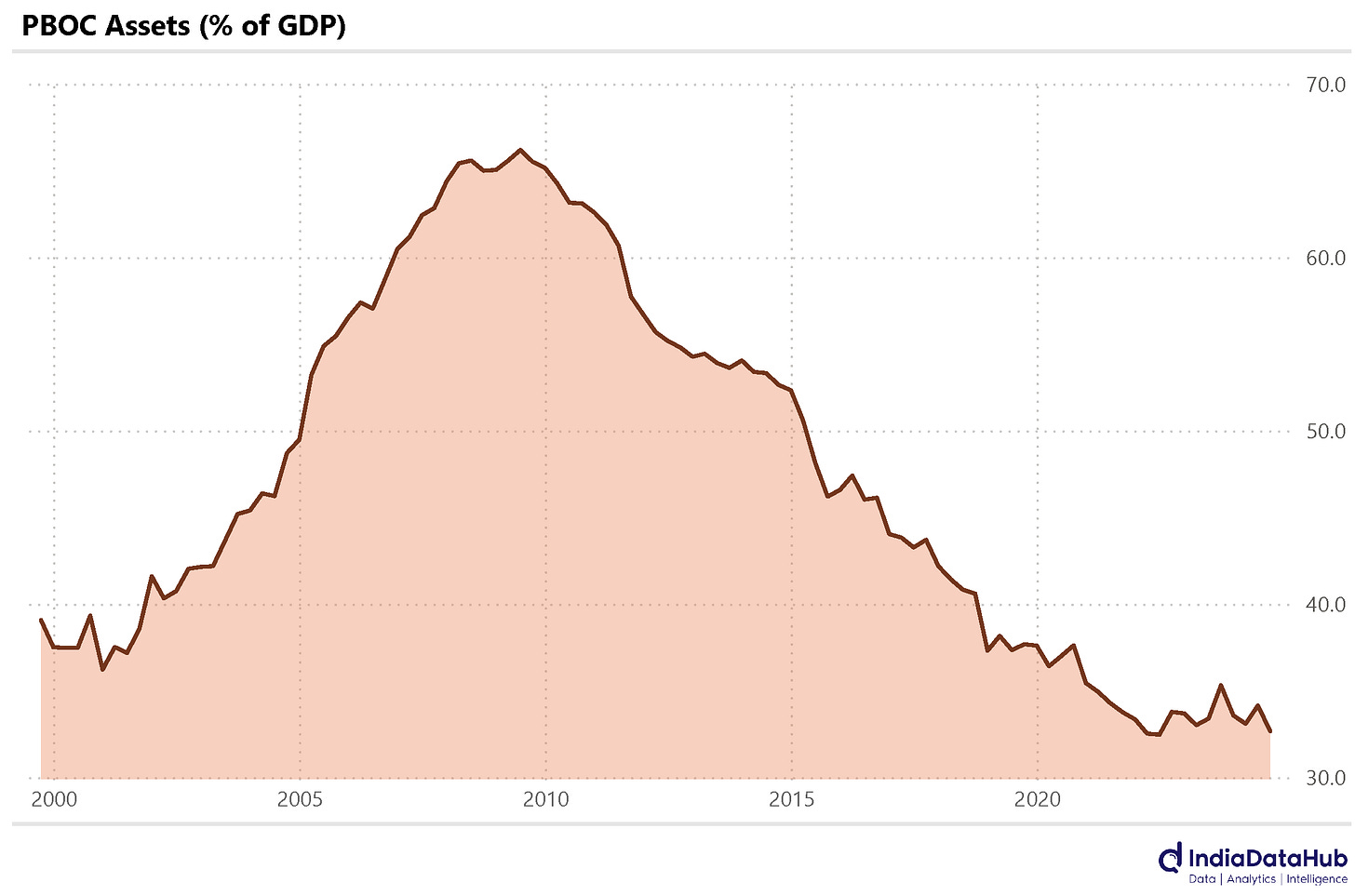

The other curious case is that of China. While for other large central banks discussed above, their asset base has expanded dramatically, for China its central bank’s asset base has declined secularly in the last 15-20 years. As of December, the Chinese central bank assets totalled 33% of its GDP, down from a peak of 67% of GDP in 2009. In fact the size of its balance sheet is even lower than in early 2000s and is the lowest in at least the last two and half decades. Most of the monetary stimulus in China came in the second half of the noughties, and it has reduced significantly in recent years, despite the pandemic.

Back home, the start of the month meant a host of high-frequency data to deal with. And by and large, the data was weak. To a large extent, this is a quirk in the data. Note that last year (2024) was a leap year and thus February had 29 days while this year February has 28 days. One lesser calendar day (and 2 fewer working days) has adversely impacted the reported YoY growth for most metrics. But barring Autos, growth in most metrics was in sync with the growth in January, adjusted for this effect.

After a recovery in January, February saw an across-the-board decline in retail automobile sales across all categories. Tractor sales saw a decline of 16%, while Construction vehicles, and Cars and SUVs, declined by 12% and 11%, respectively. 2Ws saw a 6% drop, and Trucks/other goods vehicles saw a 9% decrease. Buses and other passenger vehicles were the only exception, as their sales remained flat, but still sharply lower than the growth in January.

Consumption of petroleum products declined 5% YoY in February, the sharpest decline in the last few years. Both Petrol and Diesel consumption moderated sharply with Diesel consumption declining 1.3% YoY, down from 4% growth in January.

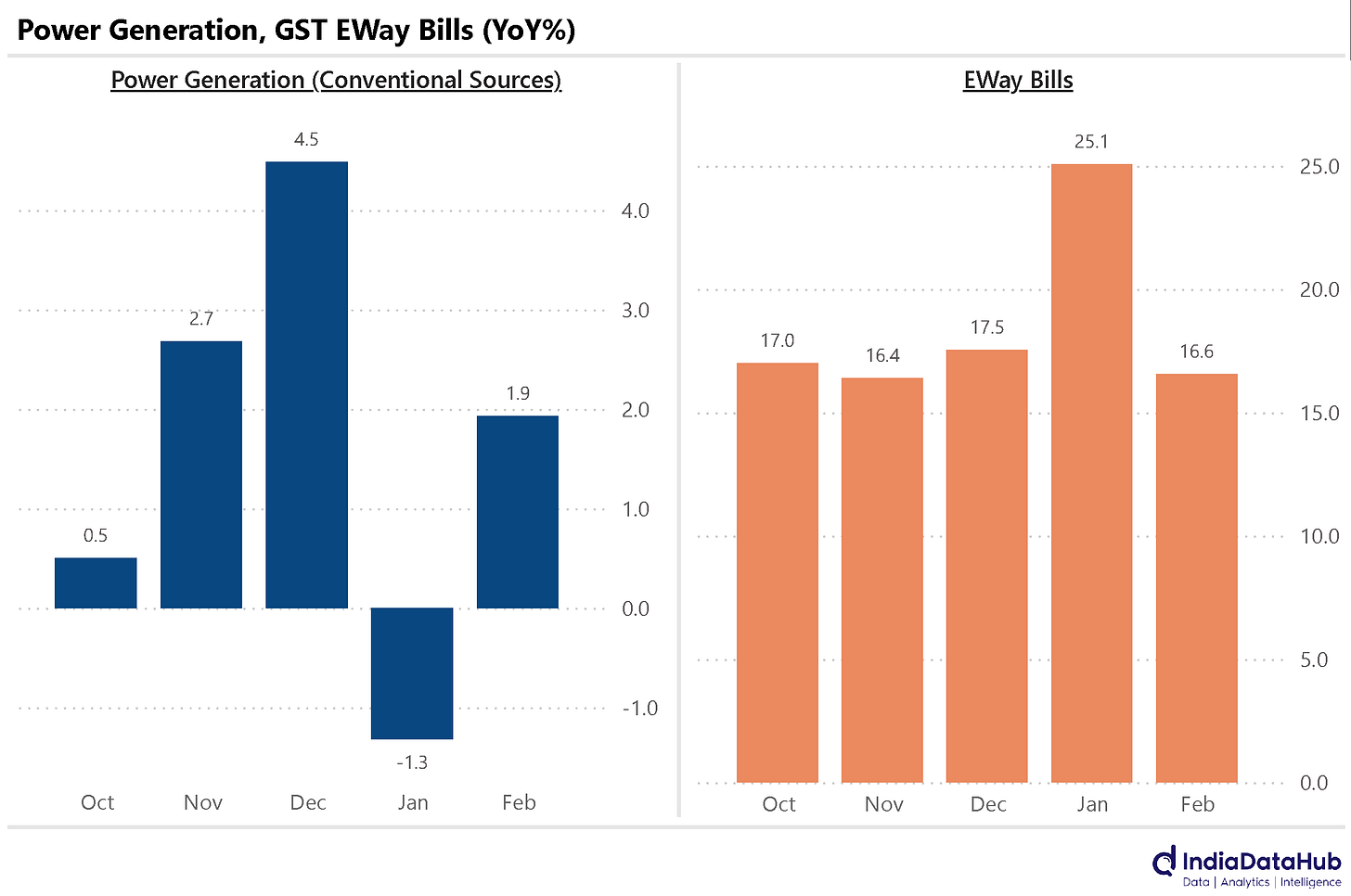

Power generation (conventional sources) grew 2% YoY in February after a modest decline in January. GST EWay bills grew 17% YoY in February, down from the 25% growth in January but if we adjust for the leap-year effect then the growth was broadly stable in February. Indeed growth in Eway bills in February is in sync with the growth during Oct-Dec quarter last year despite the leap year effect.

That’s it for this week. More next week including February CPI and Trade. See you then…

Shouldn't eway bill growth and petrol and diesel growth be in sync?