CPI, Dollar strength, FPI Flows and more...

This Week In Data #60

In this edition of This Week In Data, we discuss:

March CPI Inflation and implications for interest rates

Strength in US Dollar and the resilience of the Rupee

Strong FPI flows in equity and especially debt

Rising FX Reserves

Uptick in US CPI

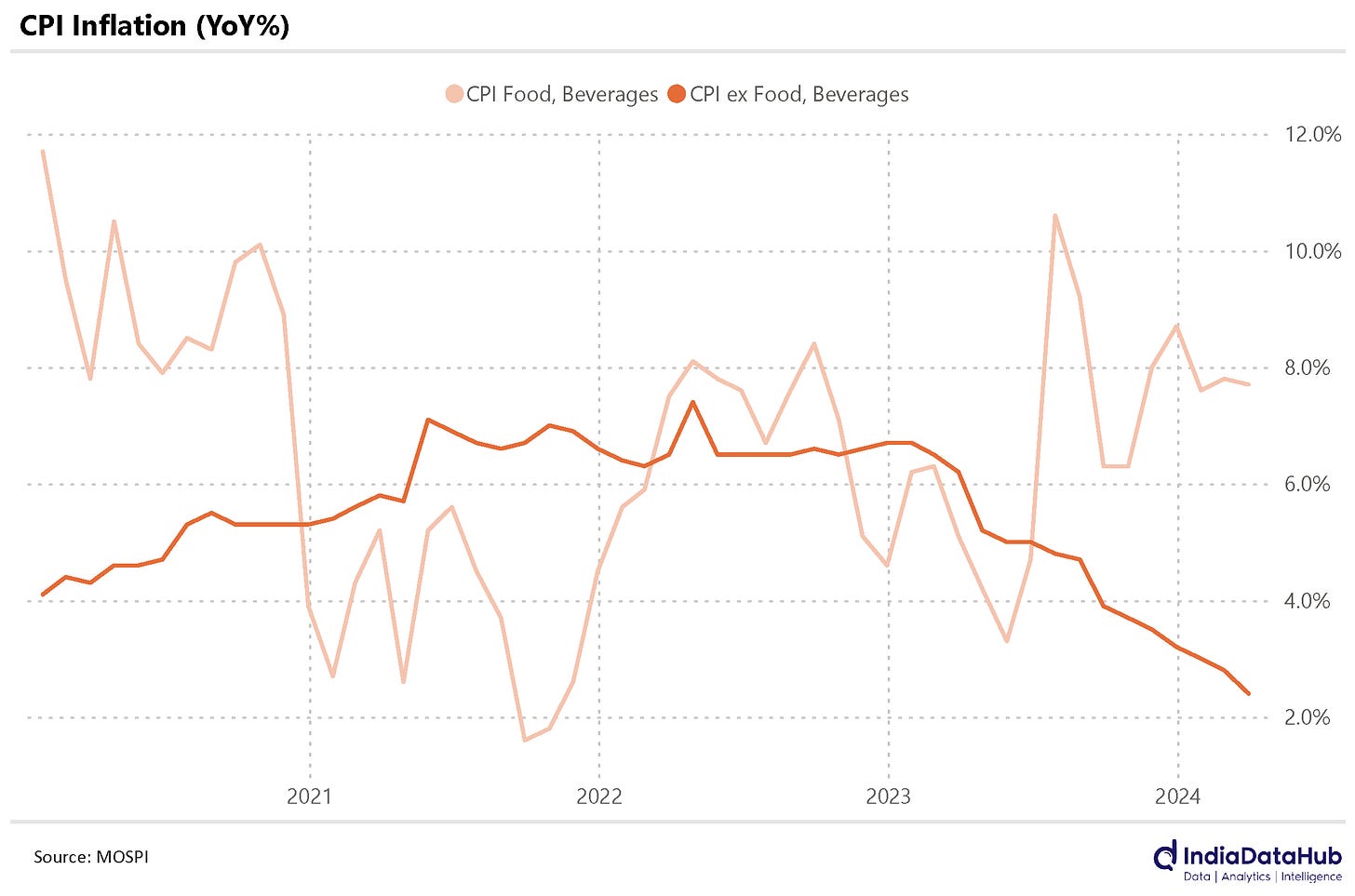

CPI Inflation decelerated to 4.85% in March from 5.1% in the preceding two months. At a second decimal level, this is the lowest print since May last year. More importantly, core CPI declined further by 10bps to 3.25% and is the lowest-ever print.

Food and Beverages continue to remain the key driver of CPI. In March it printed 7.7% YoY, broadly the same level as in the preceding two months. Cereals and Meat Inflation jumped in March and that offset the decline in other categories of Food inflation such as Milk, Pulses, Fruits and Vegetables. Excluding Food and Beverages, CPI Inflation is below even 3% currently.

With inflation continuing to moderate, one would expect it to logically flow through in terms of lower rates. However, the next MPC meeting is some time away (in June) and in the near-term global risks have only increased with the risk of widening the conflict in the Middle East and the concomitant impact on Oil prices. Accordingly, the exchange rate has become a bigger priority for the RBI currently than interest rates or liquidity.

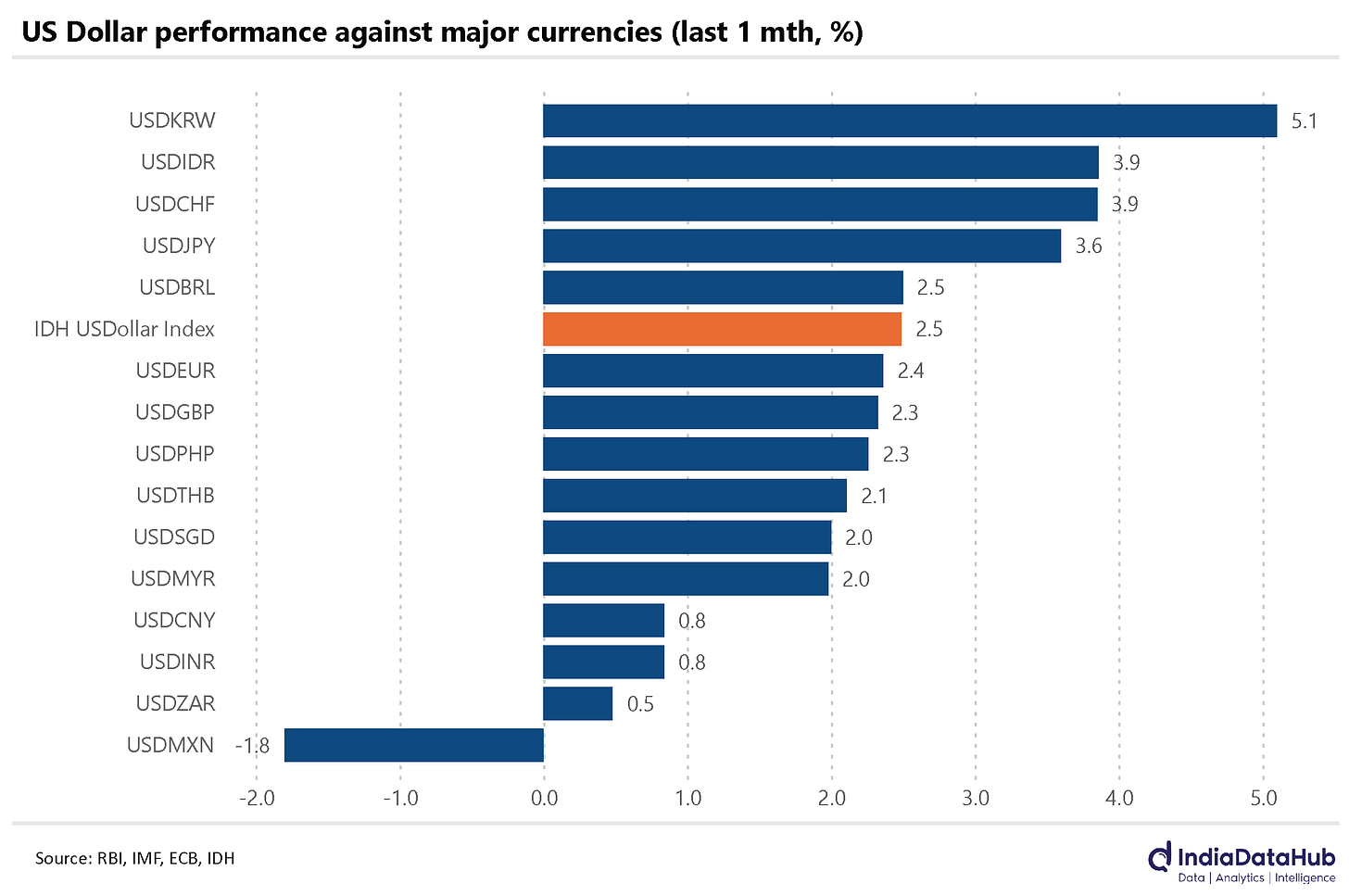

And as risk aversion increases globally due to rising tensions in the Middle East, it is not surprising that the US Dollar is once again strengthening. The IDH US Dollar Index has risen by 2.5% over the past month with the US Dollar strengthening against most currencies.

Asian currencies in particular have depreciated sharply against the USD. The Korean Won for example has depreciated by 5% over the past month while the Yen and the Indonesian Rupiah have depreciated by almost 4% over this period. While the Rupee has depreciated and is now at 83.5, it has depreciated by just 1% over the past month, outperforming most currencies. The Chinese Yuan has also depreciated by just under 1% during this period.

This relative outperformance of the rupee is in part due to strong capital flows, especially portfolio flows. FPI flows in the debt market have averaged US$2bn per month over the past 5 months (Nov 2023 – Mar 2024) totalling almost US$11bn during this period.

Equity flows have been volatile but cumulatively even they have totalled over US$10bn during this period. That’s over US$20bn of inflows, debt and equity combined, over the past 5 months. And so far in April, FPI flows have totalled almost US$2bn with less than half the month gone by.

Not surprisingly then, India’s FX reserves have continued to increase. Since mid-February and until early April, they have increased by more than US$30bn. As of early April, FX Reserves stood at just a shade below US$650bn, their highest ever level having increased by ~US$60bn over the past year.

India’s external debt stood at US$648bn as of December 2023. And while it is likely to have increased to ~US$660bn as of March, it still means that FX reserves cover almost 100% of the external debt. India’s external account thus remains very strong and the vulnerability to any sharp reversal in capital flows remains relatively low. In the context of the growing risk of the widening of the conflict in the Middle East, this becomes especially relevant.

Globally, the Bureau of Labour Statistics (BLS) released US CPI data. Inflation in the US increased by 30bps from the previous month to 3.5% in March. Energy prices increased by 2.1% in March, the first month of positive growth after being negative for the past 12 months. Food & Shelter Index increased by 2.2% and 5.7% on a year-on-year basis respectively, the same as the previous month.

The stronger-than-expected US CPI has thus pushed out the expectation of the first-rate cut from the US Fed (yes, once again!). Fed Fund Futures now indicate the first rate cut will only be in July and that too just a 55% probability of the rate cut. In sync with that the European Central Bank maintained its key main refinancing rate unchanged at 4.5%.

That’s it for this week. See you next week.