CPI Inflation, Stable Rural Wages, Feb Exports and more...

This Week In Data #57

In this edition of This Week In Data, we discuss:

Feb CPI Inflation

All-time low Services inflation

Stable Rural wage growth

Double digit growth in Feb Imports and Exports

Sharp rise in FX Reserves

Sticky US CPI

Headline CPI inflation remained largely unchanged at 5.1% YoY in February compared to January. Headline CPI has remained close to or above 5% since June last year. However, this stickiness in headline inflation hides a marked divergence in its components. While food inflation has remained sticky and was close to 8% in February, core inflation has moderated to a multiyear low of just over 3% in February. There has thus been a sharp disinflation in the sticky or the more durable components of CPI while the volatile components have remained elevated.

One way this divergence between food and core inflation is manifesting itself is the divergence between goods and services inflation. Services inflation has fallen to 3.1% YoY in February. This is the lowest print for the current series for which (YoY) data began in 2014. The low services inflation suggests a relatively benign labour cost environment. On the other hand, goods inflation has remained stable at just over 5.5% for the last few months. However, within Goods inflation, the non-food Goods component has fallen to 2.7% as of February, which again is at a multi-year low. Food thus remains the only near-term risk for inflation.

Rural wages have continued to grow at a steady pace in the last few quarters. As of January, they had grown by 6% YoY, broadly the same growth as in the whole of 2023. With inflation hovering just over 5% YoY, rural wages are growing in modestly positive territory in real terms. This is again broadly in line with the trend seen in 2023.

The rural wage data is thus broadly in sync with the inflation data which is also suggesting that there is no underlying labour cost pressure in the economy.

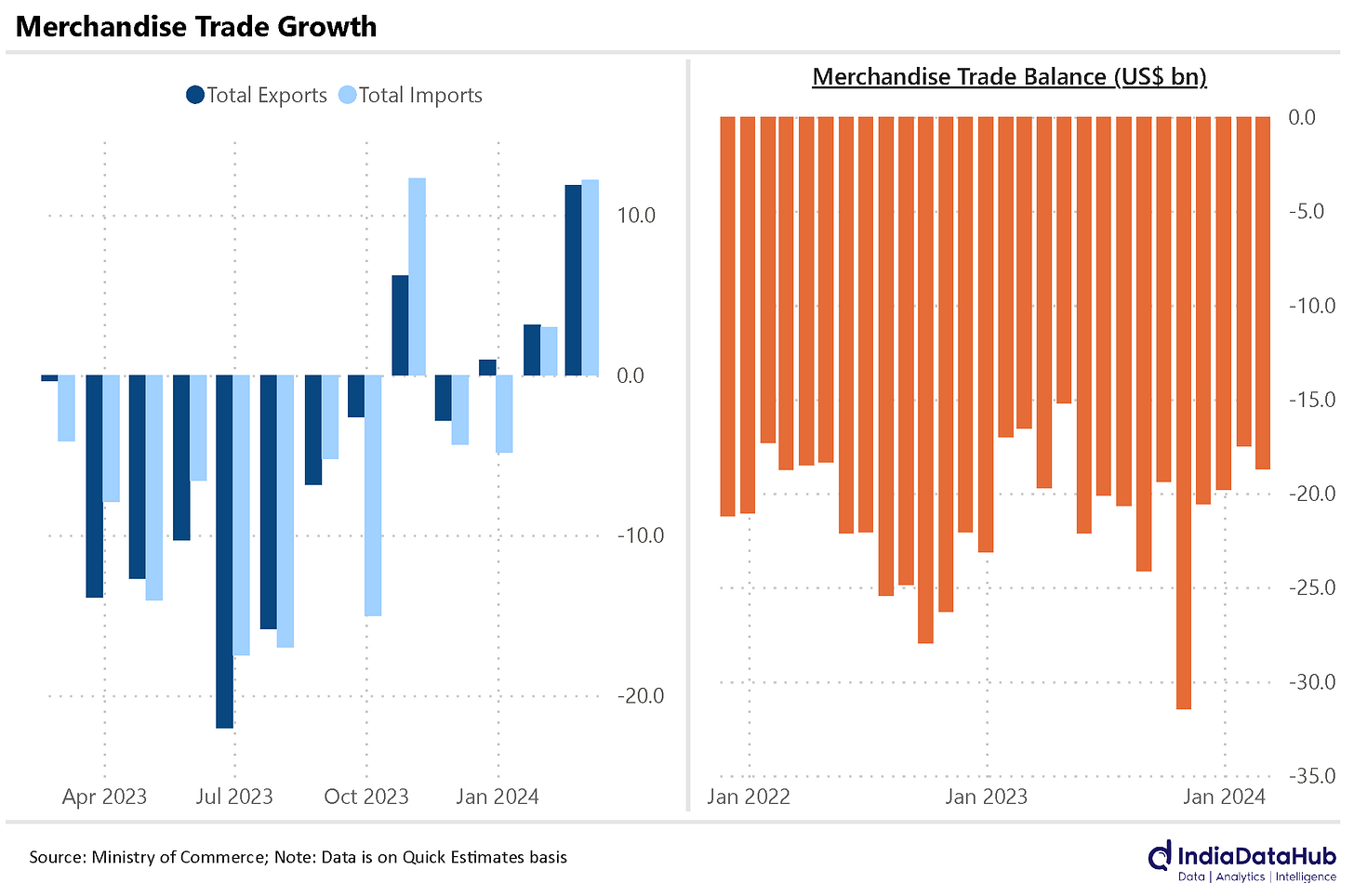

Both (merchandise) exports and imports rose by 12% YoY in February. Like with other high-frequency data, growth is overstated to an extent due to the extra day in February, being a leap year. More importantly, the trade deficit remained below US$20bn for the third consecutive month. This is partly behind the strength of the rupee.

After a few months of moderating growth, electronics exports accelerated growing over 50% YoY in February. Chemicals exports also grew strongly at over 30% YoY while Pharma exports grew over 20% YoY. The growth in imports was largely driven by consumption goods. Gold imports grew over 100% YoY and Electronics imports grew over 20% YoY. Almost 80% of the incremental imports in February this year were due to these two categories. In contrast, Machinery imports grew a modest 6.5% YoY.

India’s FX reserves are rising once again. In the first week of March, they grew by over US$10bn compared to the preceding week. And in the last week of February also they had grown by over US$6bn. Accordingly, as of 8th March, India’s FX reserves stood at US$636bn, the highest since November 2021.

The current level of reserves covers over 11 months of merchandise imports and thus the level of reserves is fairly comfortable from being able to face any sudden adverse global developments.

Ok, let's shift gears to the rest of the world. The U.S. Bureau of Labour Statistics (BLS) reported that CPI Inflation rose by 10bps to 3.2% YoY in February compared to January. As we have been highlighting, while inflation has fallen sharply from its peak in 2022, it has remained sticky at over 3% for the past few months. The Producer Price Index (PPI) in the US increased by 1.6% YoY in February, a 60 basis points increase from the previous month. PPI for Final Goods on an unadjusted basis increased slower than the 4.7% YoY increase in the same month last year. The core-PPI index remained unchanged from the previous month at 2.2% YoY in February.

Lastly, Indonesia's Exports declined by 9.4% on a YoY basis in February, the ninth consecutive month of decline. Non-oil and gas exports decreased by 10.2% YoY, with exports to China declining by 19.4% YoY. Meanwhile, Imports rose by 15.8% YoY, the highest increase Since Oct'22. Trade Surplus declined sharply from $5.4bn in Feb'23 to $0.9bn in Feb'24. So not all emerging market countries are currently seeing a revival in exports like India.

That’s it for this week. But there is a very important thing happening this weekend. Kung Fu Panda 4 is in town folks, and watching this cannot be recommended enough. Experience the awesomeness that is Po and learn how to find your inner peace. And while we are at it, relive the Wuxi finger hold. Skadoosh!