CPI, Monetary Policy, US CPI, Exports and more...

This Week In Data #35

In this edition of This Week In Data, we discuss:

The fall in CPI in August and what it means for rates

US CPI has risen for two consecutive months. Implications for US Rates

Exports declined again in August. But Electronics exports continue to rise

Core import categories such as Machinery are still growing

Update on Kharif sowing

CPI Inflation fell in August, as expected. At 6.8% though it is still almost 200bps above the level in the first quarter of FY24. Both the rise last month and the decline this month were due to vegetable prices. Indeed, the slightly disconcerting trend is that CPI excluding Vegetables has risen in the last few months. It was 5.1% YoY in May and has risen to 5.5% YoY in August. This increase reflects the uptick in non-vegetable food inflation and the fuels basket since the core inflation has decelerated further.

The August CPI print will be the last print before the next MPC meeting in early October. While CPI remains above MPC’s target, it has moderated in August and likely will moderate further in September. The MPC will also take heart from the fact that core CPI has declined further and is now below 5%. The MPC will thus likely continue to remain on pause with a hawkish bias. The subsequent MPC meeting in early December will see two more inflation readings (Sept and Oct) and that becomes the key to assessing the path of interest rates. If inflation falls back to comfortably below 6% by then, as is quite likely, the MPC is likely to tone down its hawkishness and drop some of its guard on inflation.

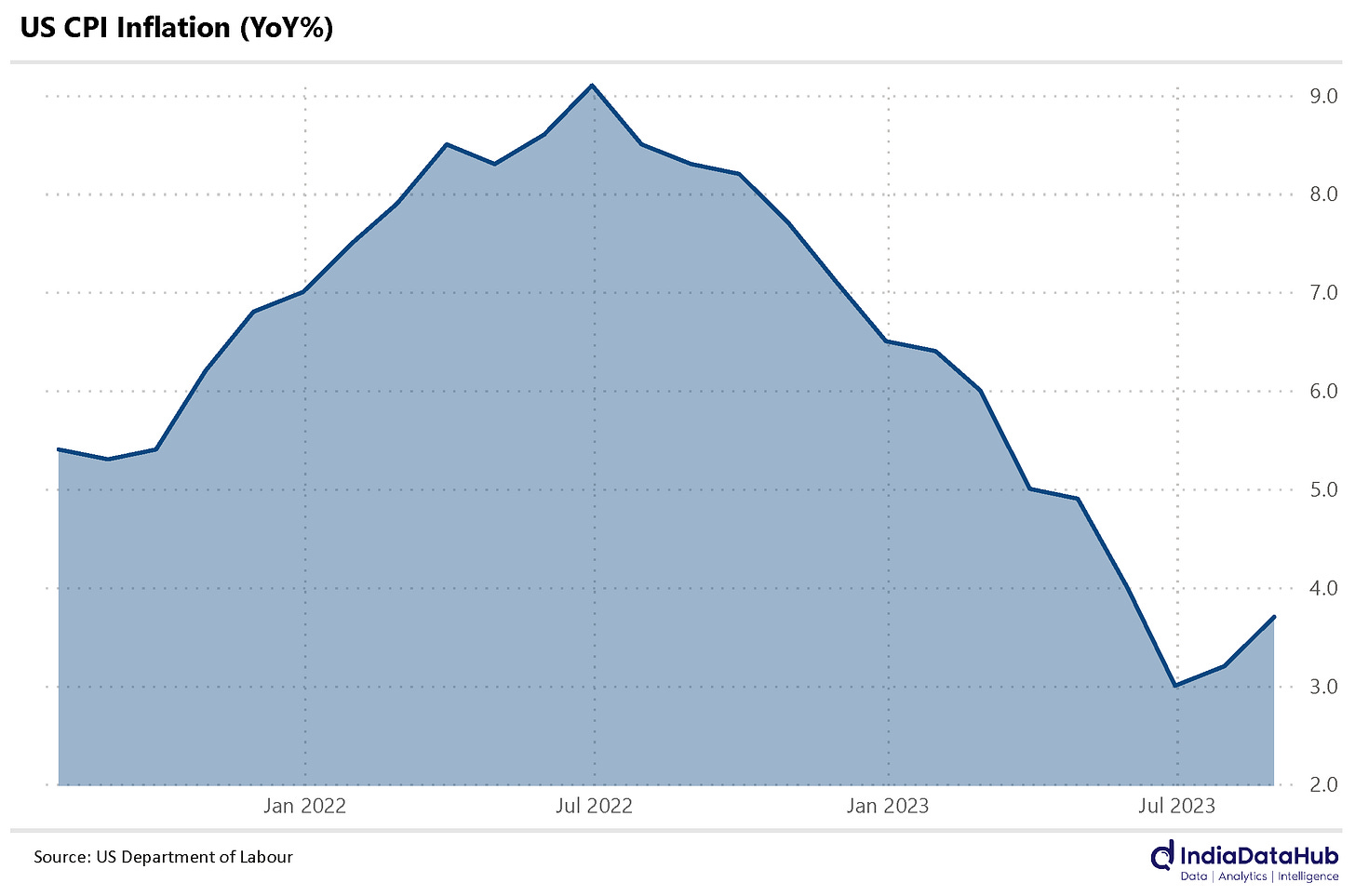

Oil prices have risen further. They are now in their 90s, some 30% higher than their level just a few months back. In addition to domestic factors, this will also be a factor that will play on the MPC’s mind. The US CPI also rose in August, to 3.7% YoY from 3.2% in July. This is the second consecutive month of an uptick in CPI. Gasoline prices rose sharply MoM and were a key driver of the increase in August. So higher oil prices have started to flow through to inflation.

And both these trends are happening amidst a generalised dollar strength. And that will complicate matters for India. We wrote here as to why the RBI is trying to defend the rupee due to its connection through the Yuan with domestic inflation. So, the rupee's stability is linked to monetary stability.

Post this higher US CPI, the expectations from the Fed have changed. A month back, markets were assigning a 22% probability for the Fed to cut rates by January next year. Post the higher CPI, markets are now assigning a near zero probability of a rate cut and they now believe there is over 35% probability that the Fed may have to raise rates further in the next 3-4 months.

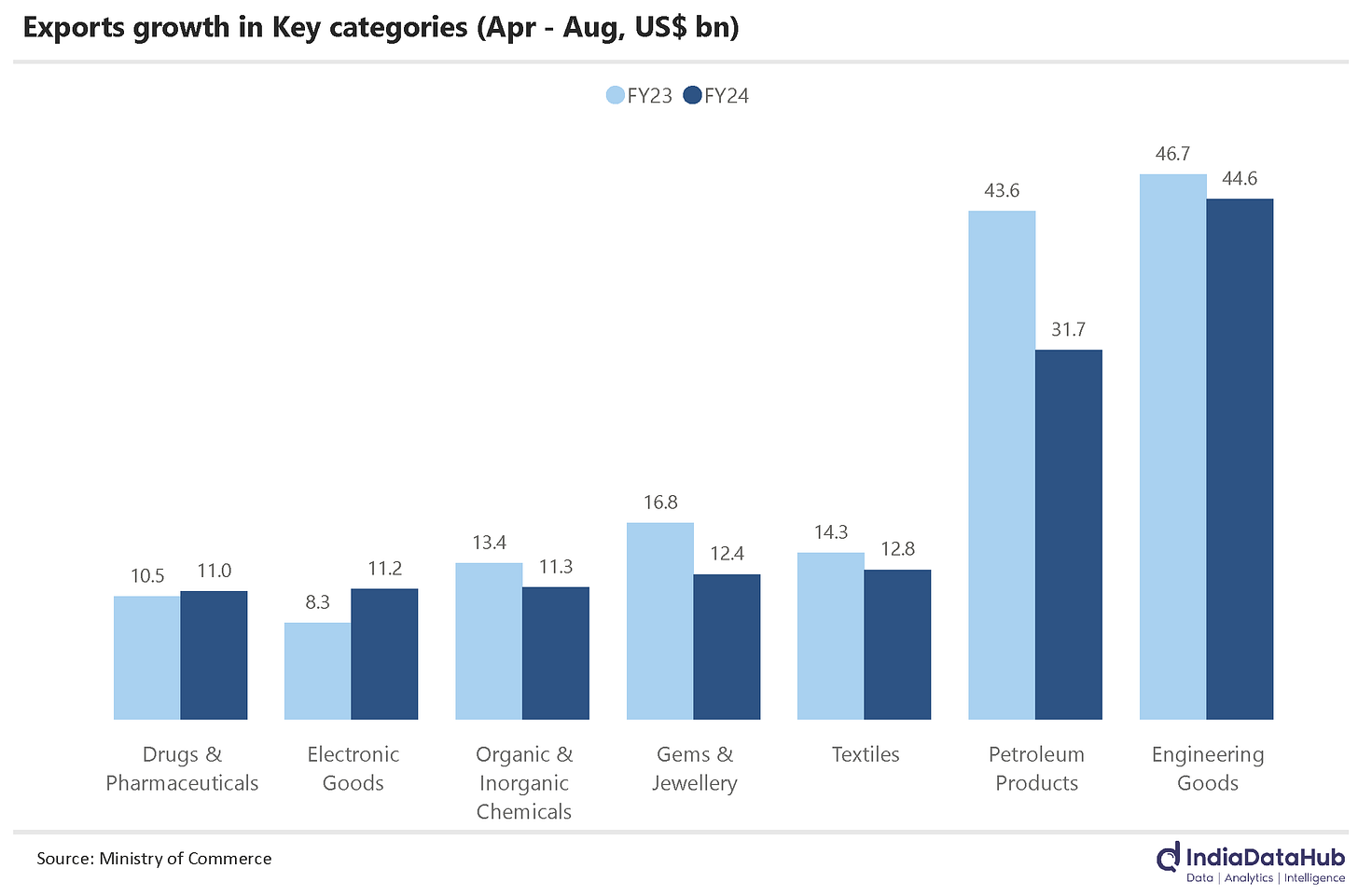

Merchandise exports declined almost 7% YoY in August and YTD exports have declined by almost 12% YoY. Electronics exports continue to see strong growth. They grew 26% YoY in August and have grown 35% YTD. Worth noting is that Electronics exports have crossed Drugs and pharmaceuticals in absolute value. YTD (till August), India’s electronics goods exports totalled US$11.2bn while those of Drugs & Pharmaceuticals totalled just under US$11bn. Textile exports have totalled just under US$13bn and at this pace, Electronics exports will cross Textile exports next year.

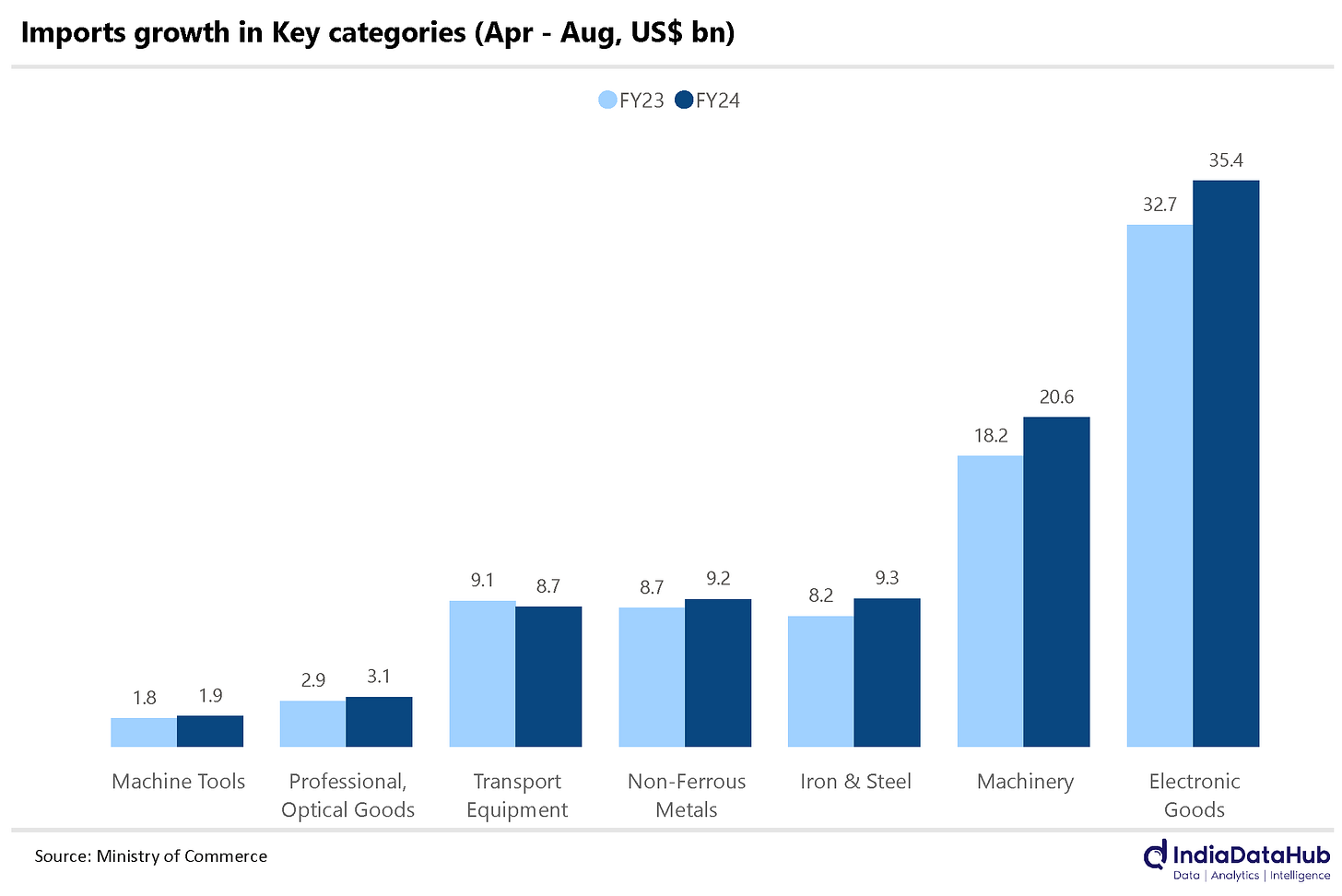

On the flip side, though electronic imports have also increased and given the size of imports, the YoY growth is modest. YTD Electronic imports have increased by 8.5% YoY. But in absolute terms, while YTD electronic exports have increased by US$2.9bn, imports have increased by US$2.8bn. So there is this also.

Even as overall imports are declining – YTD merchandise imports have declined 12% YoY – some core import categories are seeing double-digit growth. Imports of Iron and steel, a key proxy for the construction sector, have increased 13% YoY. Similarly, imports of Machinery have increased 13% YoY. Imports of machine tools, and professional & optical goods have also seen high single-digit growth. This is a positive and suggests ongoing resilient capex activity in the economy.

Lastly, a quick status check on the Kharif sowing as we are at the fag end of the sowing season. As per data released yesterday, overall Kharif sowing this year is 0.3% higher compared to last year. Sugarcane, not surprisingly (given the push towards Ethanol), has seen the biggest increase in acreage, almost 8% YoY. However, Rice and Coarse cereals have also seen an increase in acreage.

Pulses, Cotton and Oilseeds have seen a decline in acreage. And the lower Pulses acreage is a worry from an inflation perspective. Already, Pulses imports have doubled YoY till August and if the upcoming output is sharply lower, imports will have to rise and thus we will remain at risk of global prices. And if India turns into a large importer, there is only one-way prices are headed…

The Wimbledon setback notwithstanding, Djokovic did win the US Open and he remains on track to be the GOAT amongst the GOATs. And he remains on track to make it to 30 slams which will make him stand head and shoulders above the other GOATs. That’s it for this week. See you next week!