CPI rising sequentially, Slowdown in Insurance, Aviation and more...

This Week In Data #80

In this edition of This Week In Data, we discuss:

August CPI remains low on YoY basis but is rising sequentially

US CPI moderates further

Forward premia on USDINR starts to rise

General insurance growth down to single digits

Life insurance policies sold declines in August

Aviation capacity rising faster than demand

FX Reserves approaching US$700bn!

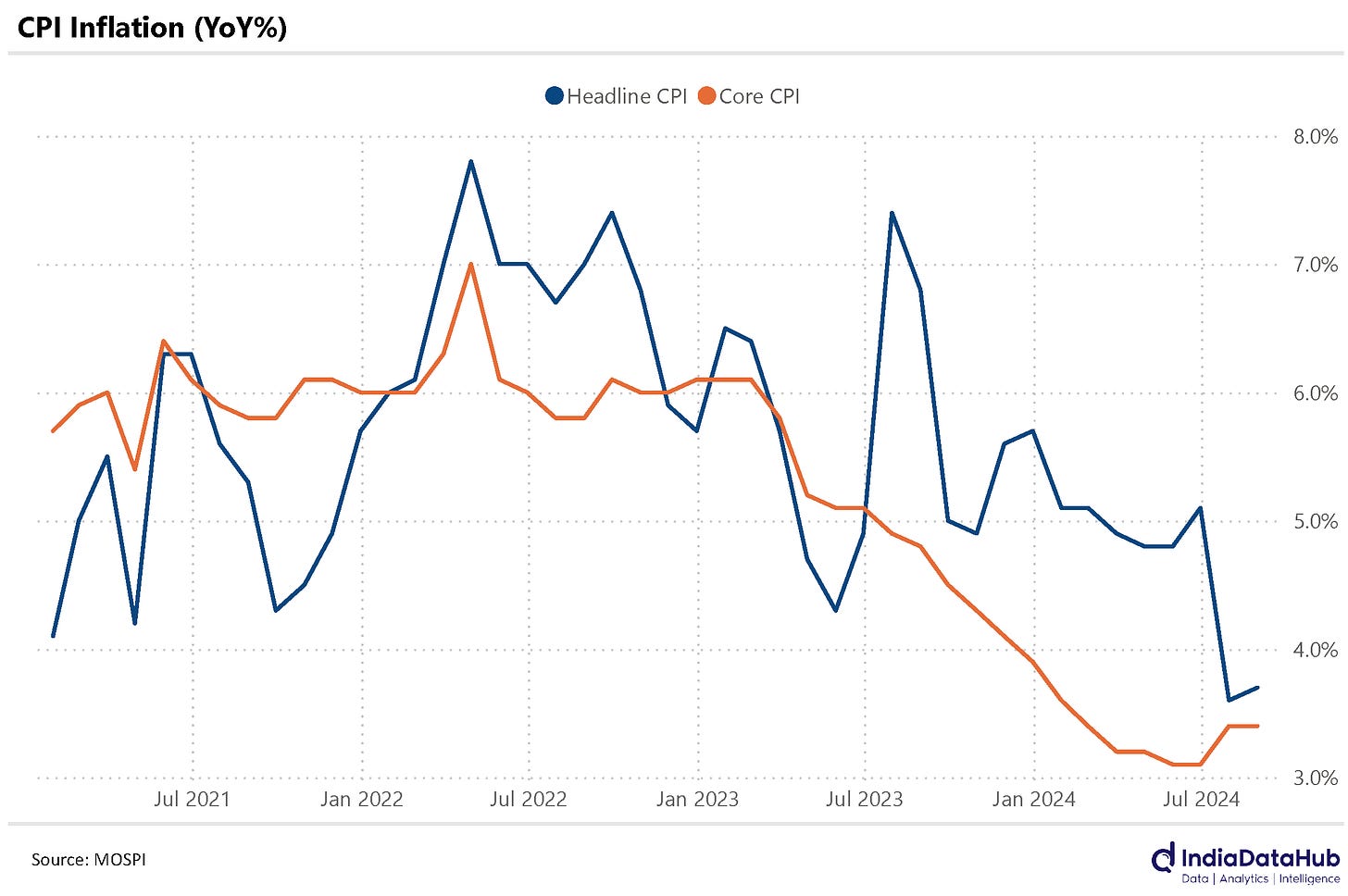

CPI Inflation was largely unchanged (ok, it rose 5bps) in August relative to June. And at 3.65% YoY, it was below the RBI’s target of 4% for the second consecutive month. This is the first time since 2019 that inflation has remained below the 4% mark. So this low inflation is a bit of a big deal. However, as we discussed last month, a fair bit of this decline in inflation in the last 2 months is due to the high base of last year. Recall that Vegetables and especially Tomatoes saw a big spike in prices last year during July-August. Core inflation, which excludes Food & Beverages and Fuel, has ticked up 20bps in the last couple of months.

More importantly, sequentially, Inflation has picked up. Adjusting for the seasonality using the X13ARIMA SEATS model available on IndiaDataHub, the annualised CPI Inflation over the past 3 months has been 7%. And even excluding Food & Beverages, the annualised rate of inflation has ticked up to 3.6% over the past 3 months, the highest in a year.

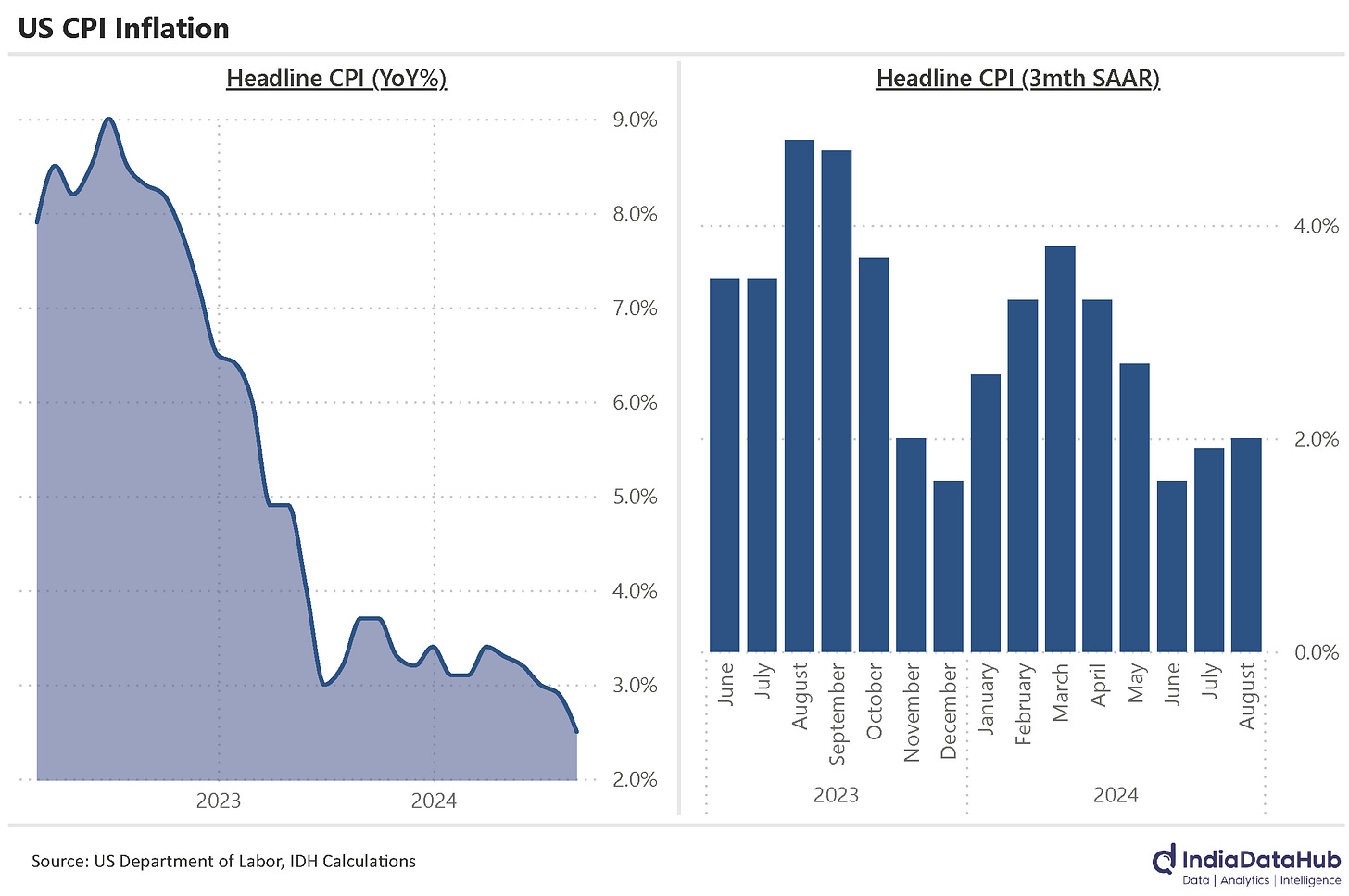

This is in sharp contrast to the US where even sequentially, the CPI Inflation has moderated (in addition to moderation in YoY terms) to ~2%. In August, for example, CPI Inflation fell to 2.5% on a YoY basis. This is the lowest since February 2021. But equally, even sequentially, the 3mth SAAR was 2%, well below the levels seen at the start of the year. Thus, while the YoY inflation trajectory is similar for both India and the US, the sequential trajectory is different. Thus it is no surprise that the US Fed is preparing for a rate cut next week while the RBI continues to maintain caution on inflation.

One way this divergence in the interest rate trajectory is manifesting itself is through an increase in the forward premia (the cost to hedge US Dollar exposure for domestic businesses). The 6-month forward premia has risen to 1.7% as of the first week of September – up 50bps since late June and is now the highest since October last year. Relative to history though this remains very low and if the gap between US and Indian interest rates reverts to the long-term average, the forward premia will also increase significantly. For reference, the 6-month forward premia has averaged 5ppt since 2011.

We discussed last month that the Insurance sector is seeing a slowdown. And that has continued in August. Overall general insurance sector grew by just 4% YoY. This is the slowest growth since August last year – thus slower growth in a low base. And while new business premiums (NBP) grew over 20% YoY for the life insurance companies, new policies sold declined in August on top of a low single-digit growth in July. Also, the growth in NBP is being driven largely by a low base – last year in August the NBP for the industry had declined 18% YoY.

August was a soft month for Aviation as well, as per the provisional data. The total domestic passengers carried grew by 5.7% YoY. This is a three-month low. More importantly, the Passenger Load Factor (PLF) declined on a YoY basis in August for all the large airlines – Indigo, Vistara, SpiceJet and Akasa. So August is likely to be the 5th consecutive month when domestic PLFs would have declined on a YoY basis. So capacity seems to be increasing faster than demand.

FX Reserves rose sharply in the first week of September. As of 6th September, India’s FX reserves stood at US$689bn, the highest ever. More importantly, FX Reserves now cover over 11 months of the estimated current year’s merchandise imports and 100% of current external debt. The level of FX reserves is thus now fairly comfortable on an absolute basis. India’s ability to deal with external risks is thus fairly strong. This is especially relevant as with global growth slowing down and monetary policy likely to change globally, there might be increased bouts of volatility.

Lastly, the ECB reduced its policy rate as expected. The rate on the deposit facility has been reduced by 25bps to 3.5% while the rate on the main refinancing facility has been reduced by 60bps to 3.65%. The US Fed meets next week and the market now expects a 100% probability of a rate cut with a 50% probability of a 50bps rate cut. So global monetary policy is sharply moving into reverse gear.

That’s it for this week. See you next week…