Current Account Surplus, Remittances, US Trade Balance and more...

This Week In Data #130

In this edition of This Week In Data we discuss:

India’s current account returned to a surplus during the March quarter

Despite lower CAD, FY25 saw a BoP deficit

Non-Resident Remittances saw strong growth in FY25

Domestic aviation sector saw a sharp slowdown in May

US Exports rose sharply in May while Imports saw modest growth

US Durable goods orders saw sharp uptick in May due to aircraft orders

US Personal income as well as expenditure declined in May

US GDP growth for March quarter revised downwards

India’s current account turned into a surplus during the March quarter. At 1.3% of GDP, the current account surplus was the highest in over 15 years (excluding the pandemic year of 2020 when imports had collapsed sharply). Capital flows, however, turned negative during the March quarter, the second consecutive quarter of outflows. Consequently, the BoP surplus was a modest 0.9% of GDP (though better than the -3.7% of GDP during the December quarter).

For the full year FY25, India’s current account deficit was a modest 0.6% of GDP, down from 0.7% of GDP in FY24 and well below the long-term average of 1.7% of GDP. Weak capital flows however meant that for the second time in the last 3 years, India had a BoP deficit – a modest 0.1% of GDP.

A notable trend is the continued rise in the remittances by non-resident Indians on an already high base. In FY25 gross inward remittances stood at US$135bn, up almost 15% YoY. Remittances alone covered almost 50% of the large goods trade deficit that India runs. In FY25 remittances totalled 47% of the merchandise trade deficit.

The domestic aviation sector saw a sharp slowdown in May. The number of passengers carried by domestic airlines on domestic routes grew by a modest 2% YoY in May, down from high single-digit growth in the preceding few months. This was most likely almost entirely due to the impact of Operations Sindoor which necessitated suspension of civilian aircraft movements at a number of airports in North India. With normal operations resuming in June, growth should likely revert to the trend.

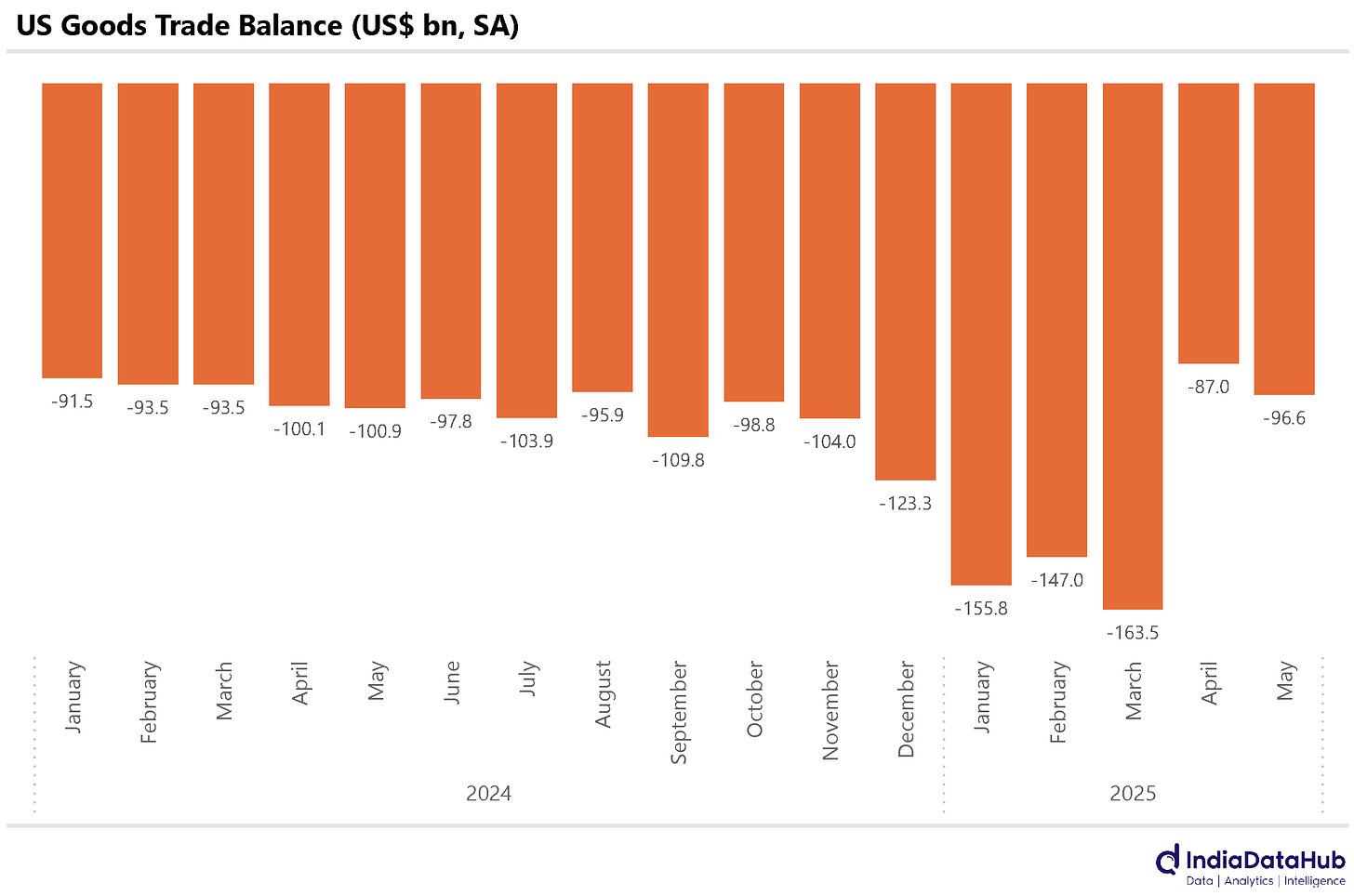

A whole host of US data was released last week. We will start with the trade data where the Census Bureau published its advance estimate for May. US (goods) exports rose by 5.8% year-on-year in May, the slowest growth in the past three months. All key categories saw a rise in exports except for automotive vehicles, which saw an almost 15% decline. In contrast to this, Imports rose by a modest 0.6% YoY. Capital goods saw a sharp 16% year-on-year increase. The trade deficit widened by US$9.6 bn MoM reaching US$96.6 bn in May on a seasonally adjusted basis. On a YoY basis though the trade deficit was down 4% in May.

Durable goods orders (the leading indicator for investments) saw strong growth in May. New orders for manufactured durable goods rose by 21.4% YoY, and by 16.4% on a MoM basis, in May. This is the steepest MoM increase in new orders since June 2014. The sharp sequential growth was driven largely by new orders for transportation equipment, particularly a 230% increase in new orders for non-defence aircraft and planes. However, excluding Transportation, the growth in new orders was much more modest at 0.5% MoM in May.

In May 2025, U.S. household finances showed signs of softening, marked by a 0.6% month-over-month decline (seasonally adjusted) in disposable personal income. This is the first time personal income has declined since January 2022. That said, on a YoY basis income growth was still strong at 4.1% YoY. Personal expenditures also declined by 0.3% MoM indicating a slight pullback in consumer spending. And on a YoY basis, consumer spending grew by just 2.2%, the slowest since February last year.

Lastly, we also had the third estimate of US GDP this week. The Bureau of Economic Analysis (BEA) downwardly revised the March quarter GDP growth to a decline of 0.5% SAAR, from the prior estimate of a decline of 0.2%. This marks the weakest quarter for GDP growth since 1Q 2022.

That’s it for this week. See you next week.