Deceptive fall in CPI, Fed rate hike, Weak Exports, Strong Credit growth and more...

This Week In Data #25

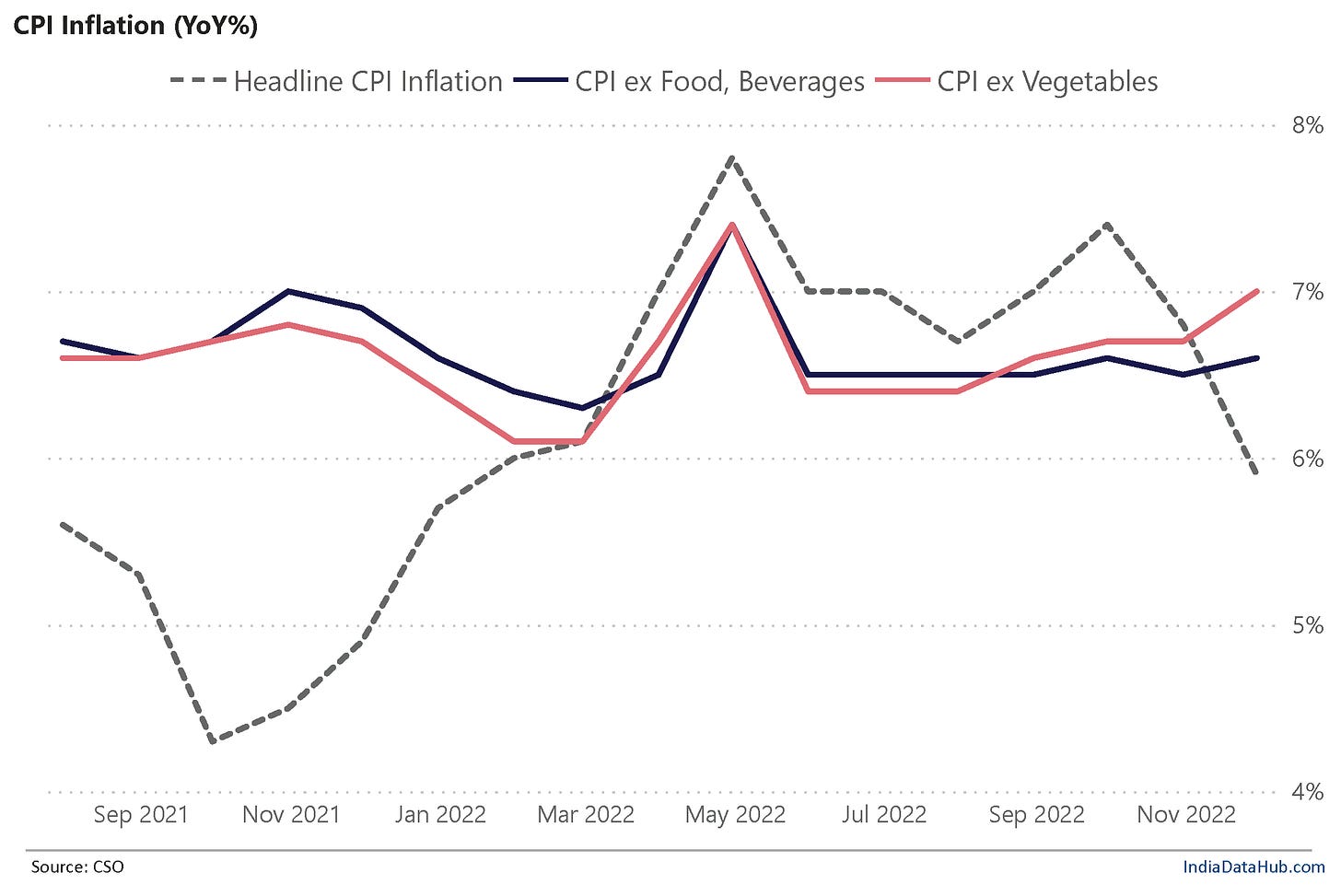

We said in the last week’s newsletter that a lot can happen between then and the next MPC policy meeting in February. And indeed, a lot has happened already! The CPI inflation moderated sharply in November with the moderation being much sharper than consensus expectation. At 5.9% YoY in November, the CPI inflation is now below the 6% threshold – the first time since December last year.

But as we explained in detail in our report, the devil lies in the details and the details were nowhere as benign as the headline numbers suggested. The entire moderation in Inflation is due to lower food and specifically lower vegetable price inflation. As the chart above shows, excluding Food, inflation has remained unchanged in the last few months. And excluding Vegetable inflation in November was the highest since April. So, there is not much comfort to take from the low headline CPI reading.

The other important event last week was the US Fed meeting. US CPI also had a positive surprise earlier in the week, but the Fed followed through with a 50bps rate hike. The Fed’s guidance suggests another 50bps rate hike in the first quarter of 2023 in two 25bps steps, before a pause. That will mean the peak US Fed funds rate at around 5% while the repo rate is likely to peak at 6.5% in India (that is some really modest rate differential!). While the rate hike and the Fed’s guidance were broadly along expected lines, the market reaction suggests (SPX fell sharply post the policy) that it interpreted the policy as being a tad hawkish.

India's Exports rose in November, albeit slightly (<1%) after having declined in double digits in October. The timing of Diwali distorts the YoY comparison. But, for October-November together, Exports declined ~9% YoY. Thus, the key takeaway is that exports are now struggling, at least in value terms. That said growth in imports has also decelerated to single digits and thus the trade deficit is moderating on a sequential basis, though it is still running higher on a YoY basis.

Industrial Production declined 4% YoY in October. And that might suggest a weakness in domestic growth. But one, the data was for October and this year Diwali was in October as against November last year and thus there were fewer working days in October this year than last. But second and more importantly, the IIP is not a growth metric that analysts give a lot of weight to – due to several issues with the data.

The other growth data we got in the last week all suggest continued strong domestic economic activity. Non-food credit for example grew 18% YoY as of 2nd December. Credit growth has remained in the high teens despite the sharp moderation in commodity price inflation (WPI Inflation for example has fallen to 6% from 16% in recent months). Rural wage growth has also ticked up to 5.8% YoY in October, from 5% in the preceding two months. So, barring exports, not much to point to in terms of weak economic activity so far.

Have a good weekend folks…