Declining trade deficit, Rising FX intervention, Lower LRS outflows and more...

This Week In Data #50

In this edition of This Week In Data, we discuss:

Merchandise trade data for December

RBI’s rising FX intervention

Lower outflows under the LRS

Benign WPI Inflation

Merchandise Exports grew 1% YoY in December even as Imports declined almost 5% YoY as per the quick estimates. The merchandise trade deficit thus declined for the second consecutive month on a YoY basis to just under US$20bn.

Among the large categories of exports, Electronics Goods, Engineering goods, Gems & Jewellery and Pharmaceuticals all grew in double digits. This though was offset by a high teens decline in Petroleum product exports and also a decline in Textile exports. Electronic imports rose almost 50% YoY in December and Gold Imports rose over 100% YoY. This was almost fully offset by the almost 23% decline in Petroleum imports.

On a YTD basis (Apr-Dec), while Exports have declined 6% YoY, Imports have declined 8% YoY and consequently, the trade deficit has thus narrowed by almost US$25bn. The relative resilience of the rupee is in large part due to this.

However, another part of the explanation for the Rupee’s stability has been the RBI’s intervention in the FX market. While in absolute terms the RBI has been only a modest net seller of US Dollars, the total size of RBI’s intervention has become very large. In the last two months (Oct-Nov), the RBI sold, on a net basis, just over US$2bn cumulatively. This is modest.

However, the gross intervention (purchase + sale of USD) was over US$70bn each in each of the two months. Not only is this the highest ever, but it is 25% higher than the previous high intervention, which incidentally was in July last year. This is perhaps partly motivated by inflation worries.

The higher tax collection at source (TCS) rates on outflows under the LRS kicked in on 1st October. And not surprisingly, the outflows under LRS have moderated sharply in the last two months. While outflows totalled almost US$7bn during August and September, in the last two months (October – November) they declined to just US$4bn. Travel is the biggest component of LRS and not surprisingly this has seen the biggest decline. However, the decline has been across the board. Outward remittances under the head travel declined by US$1.3bn in the last two months (Oct – Nov) compared to the immediately preceding two months (Aug – Sep).

That said, it is quite likely that there was some preponement remittances to avoid the higher TCS rates and thus the level of outflows in Aug – Sep were likely overstated and similarly the level of outflows in the last two months, was understated. The data for the next few months will tell whether the higher TCS rates have fundamentally reduced the allure of an overseas vacation for Indians. Here’s to seeing more Instagram reels from Lakshadweep in 2024!

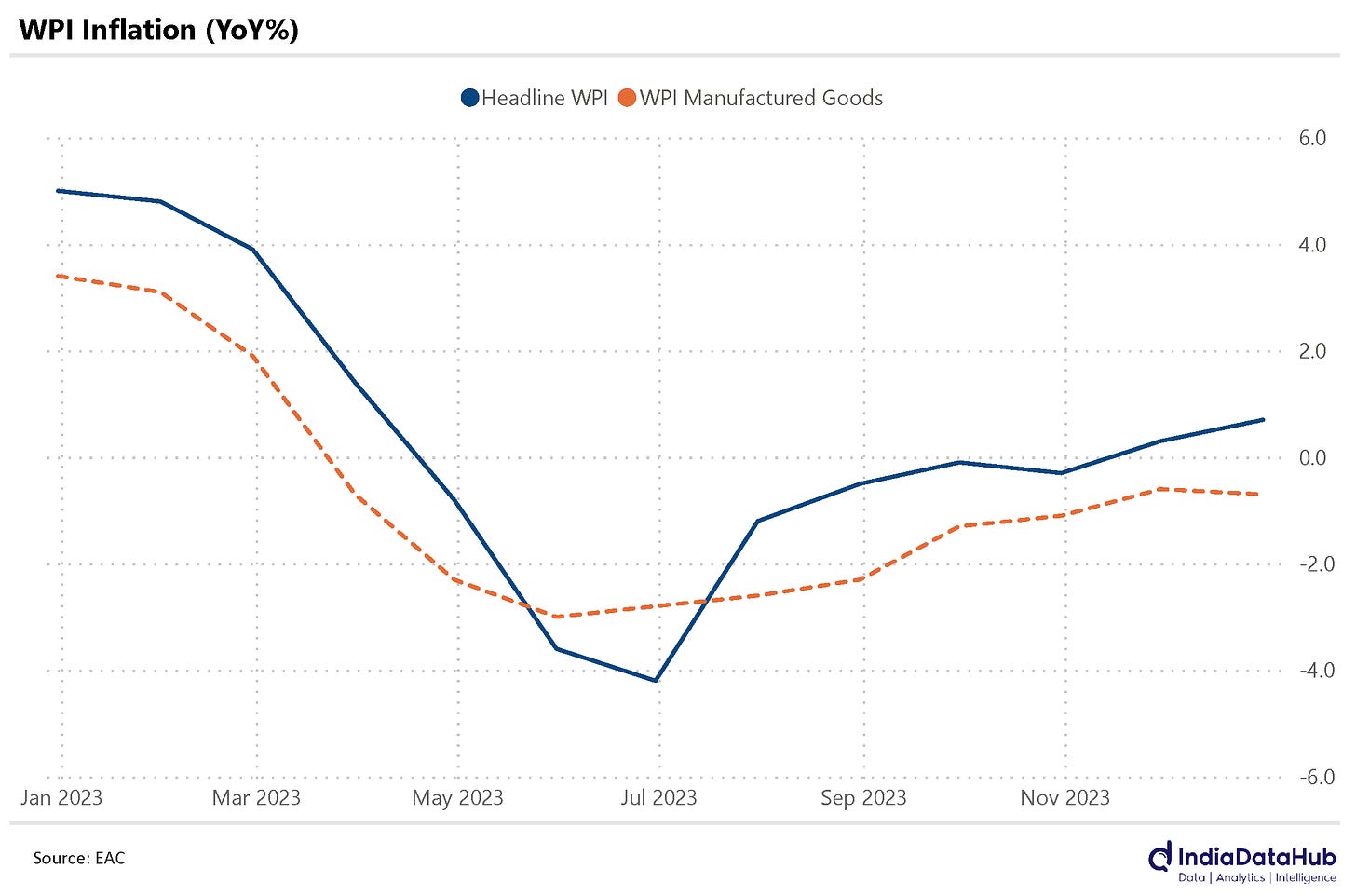

WPI Inflation remains benign, although it has edged into positive territory in the last two months. It was in negative territory between April to October 2023. However, in December it printed 0.7% YoY up from 0.3% YoY in November. Manufactured product prices remain in negative territory, although even here the pace of decline has moderated from 3% YoY in May to less than 1% as of December. WPI Inflation reflects the lagged impact of domestic and global commodity prices. And the continued benign inflation reflects the benign input cost environment for businesses. And this is partly what is driving the decline in the core CPI inflation.

That’s it for this for this week. A data light next week. And a curtailed week as well. But that gives ample opportunity to see Novak Djokovic gunning for his 25th Grand Slam and 11th Australian Open. As regular readers of this newsletter would know, we have made an open-ended forecast (or a wish) that Djokovic will win 30 slams before he calls it a day. Amen…