Dollar strength, Rupee strength, FPI flows, Oil prices and more...

This Week In Data #34

In this edition of This Week In Data, we cover:

Recent strength in US Dollar

The resilience in Rupee

FPI flows

Rise in Oil prices

Power generation

Petroleum demand

NREGA demand

How time flies! This is the 60th edition of this newsletter. We originally started this as an email and then subsequently migrated here to this Substack. Sixty consecutive weeks. No breaks. Phew!In case you missed, we released a new update this week. Custom dashboards! This allows you to build your own dashboards by choosing the indicators and the functions and the layout. You can check this video for a quick overview.We must start with currencies. Because the Dollar is strengthening. Since mid-July, the US Dollar has appreciated ~5% against major currencies. Currencies like the Aussie Dollar and the Yen have fallen 6-7% against the USD in this period. The Asian currencies (ex JPY) have remained relatively stable. The Philippine Peso is amongst the worst-performing Asian currencies with a 4% decline during this period. Other Asian currencies have declined a modest 2-3%.

And while the Indian rupee has also fallen against the US Dollar crossing 83 recently, it has been amongst the more stable currencies in recent weeks. Since mid-July, the INR has declined by a modest 1% against the USD and it has appreciated against the other major currencies such as the Yen (+5%), Euro and GBP (~+4%) and the Swiss Franc (~+2.5%). The IDH INR Index which tracks the performance of INR against a basket of six currencies has gained by 1% since mid-July (implying rupee has, on balance, appreciated).

Part of this is due to large portfolio inflows. Since mid-July and until a couple of days back, net FPI inflows into both debt and equity totalled just over US$5bn. But this may be changing. FPIs have been net sellers in equity markets for the last 4 consecutive days and net selling has totalled almost US$900mn. The debt market has not seen much selling so far.

And that brings us to our second point. Oil prices. They have risen sharply in recent weeks. In the first week of September, the Indian basket of Crude oil averaged almost US$90/bbl. This is 20% higher than the price in June.

Given that the RBI is on a hawkish pause, further rise in Oil prices can change interest rate expectations which in turn could impact capital flows, especially debt flows and in turn impact currency which can in turn impact inflation. The reflexivity of markets! Bond yields have remained stable in the last few weeks and the yield curve remains reasonably flat implying that the bond markets are not, as yet, looking for any change in the monetary policy. Bottomline, oil prices, FPI flows, and the Dollar are something to keep a close watch on.

With the first week of the month having just been completed, we had a host of data releases. And the incoming data has been mixed (isn’t that almost always the case?). Power generation grew in the mid-teens in August, the highest growth in over a year. However, a fair part of this would be due to the severely deficient rains in August which would have pushed up demand – both from households and especially from Agriculture where farmers would have had to use pumps. So it isn’t the case that the higher power generation is ipso facto a sign of strong underlying demand.

Similarly, the consumption of petroleum products picked up growing 6.5% in August which is the highest in 3 months. However, growth in petrol consumption decelerated and in diesel, the uptick was modest (and some of that would be from Agriculture). The uptick then was largely due to LPG and other Industrial products such as Naphtha and Petcoke.

On a side note, consumption of Kerosene has started to rise again. It had been steadily falling for the last few years. In the last two months, consumption has doubled on a YoY basis. While the scale of consumption is very low, the bears will point to this being an indicator of a downtrading in the economy. This is especially true when correlated with NREGA demand.

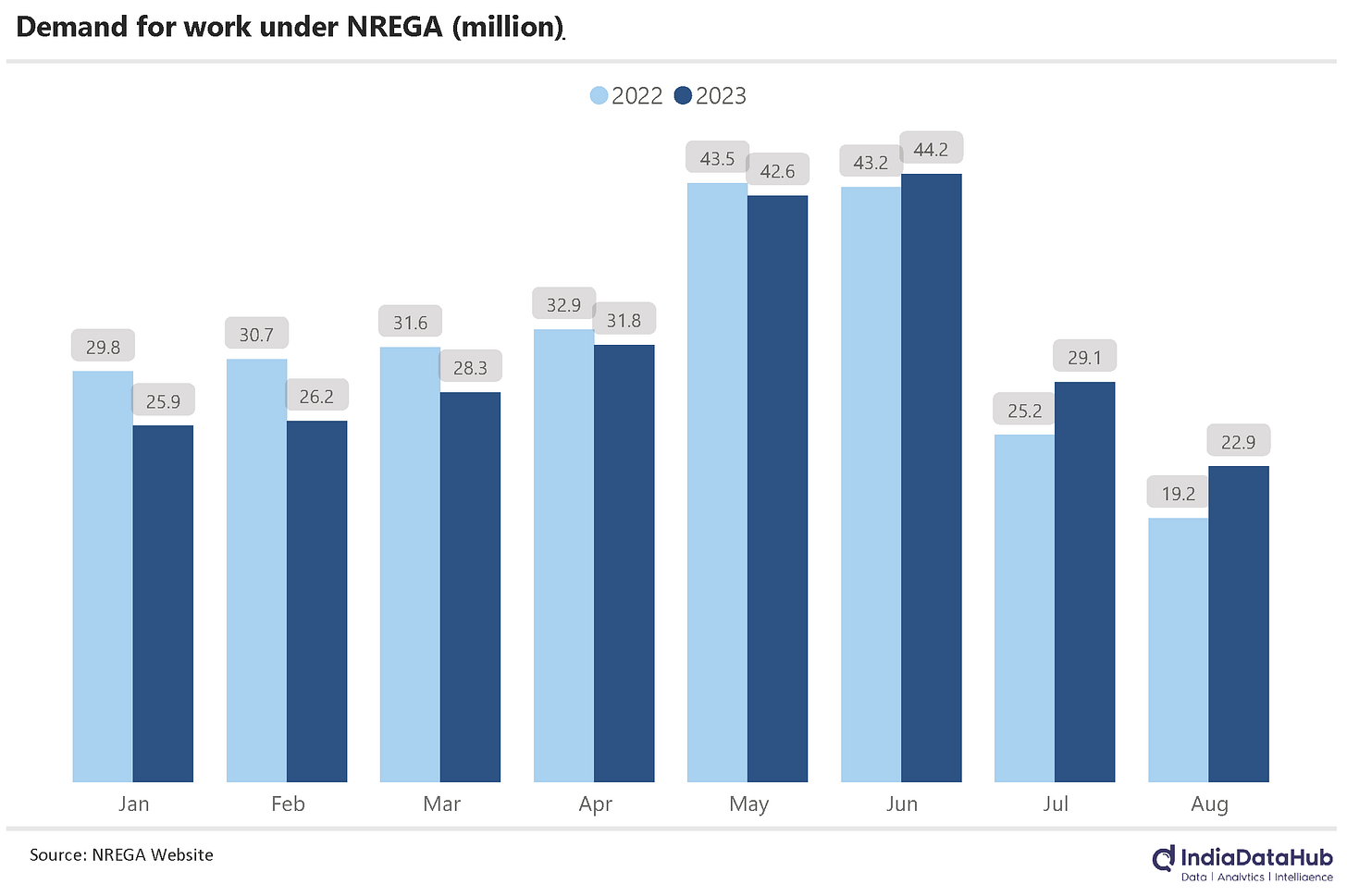

And this brings us to NREGA. Demand for work under NREGA rose almost 20% YoY in August. This is the second consecutive month of double-digit growth. And demand is coming from relatively strange places.

West Bengal for example has completely stopped NREGA. So, it is seeing a big decline in demand (almost 100% YoY). But a state like Gujarat for example which historically has not been a big state for NREGA works, has seen a 200% increase in NREGA demand in the last two months. Andhra Pradesh has seen a 70% increase in demand while Maharashtra and Tamil Nadu have seen ~50% increase in demand.

And that’s it for this week on this slightly downbeat note. Hopefully, there will be some sunshine (of the philosophical kind, we need rains, so not actual sunshine) next week.