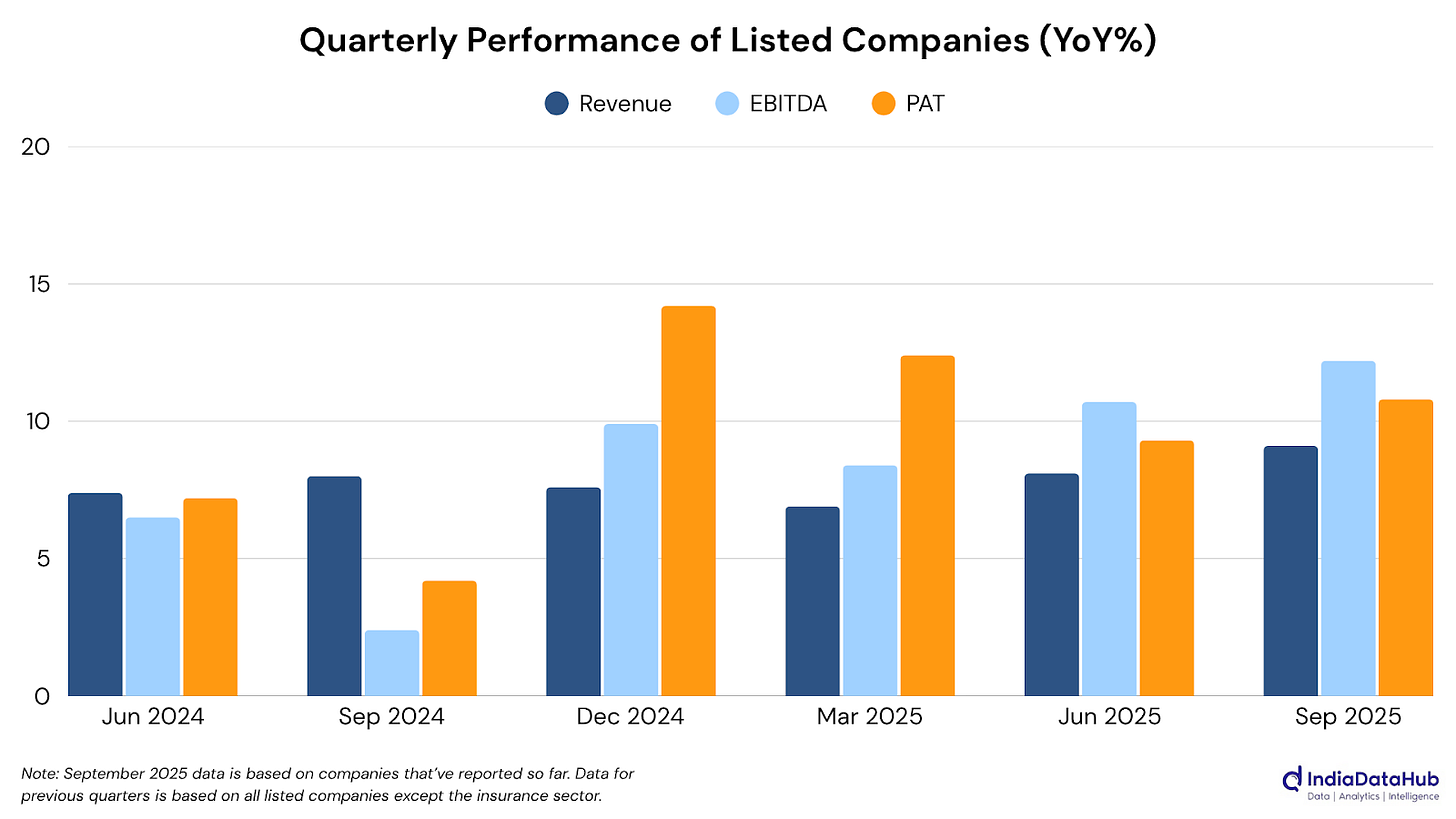

Welcome back to This Week in Earnings. The Q2FY26 results season has just got underway with 217 companies having reported so far, but early signs point to a strong opening. Aggregate revenues are up 9% year-on-year, EBITDA by 12%, and PAT by nearly 11%. Excluding financial services, profit growth accelerates to 14%, an indication that manufacturing & consumption-driven sectors are setting early pace.

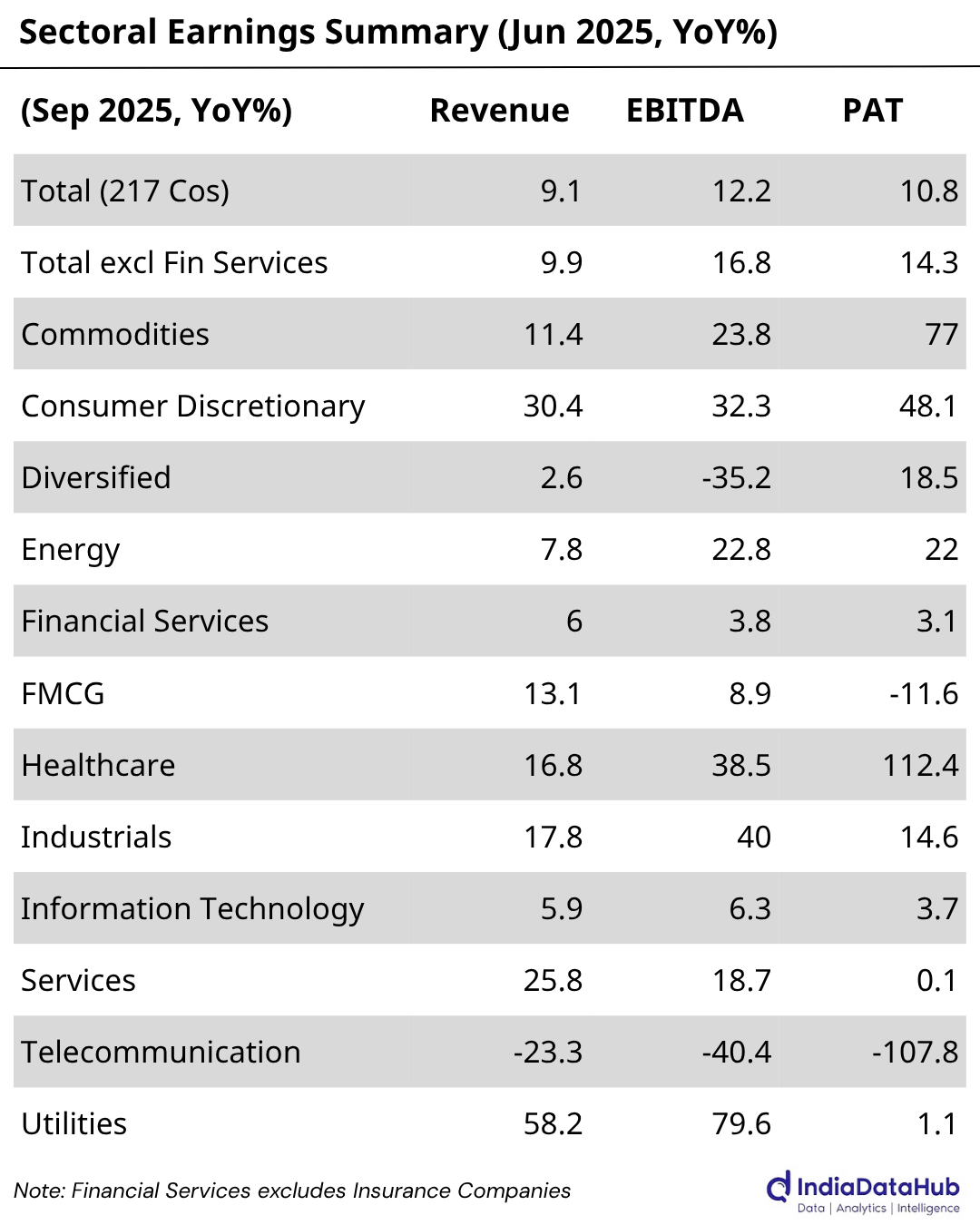

Key Sectoral Trends

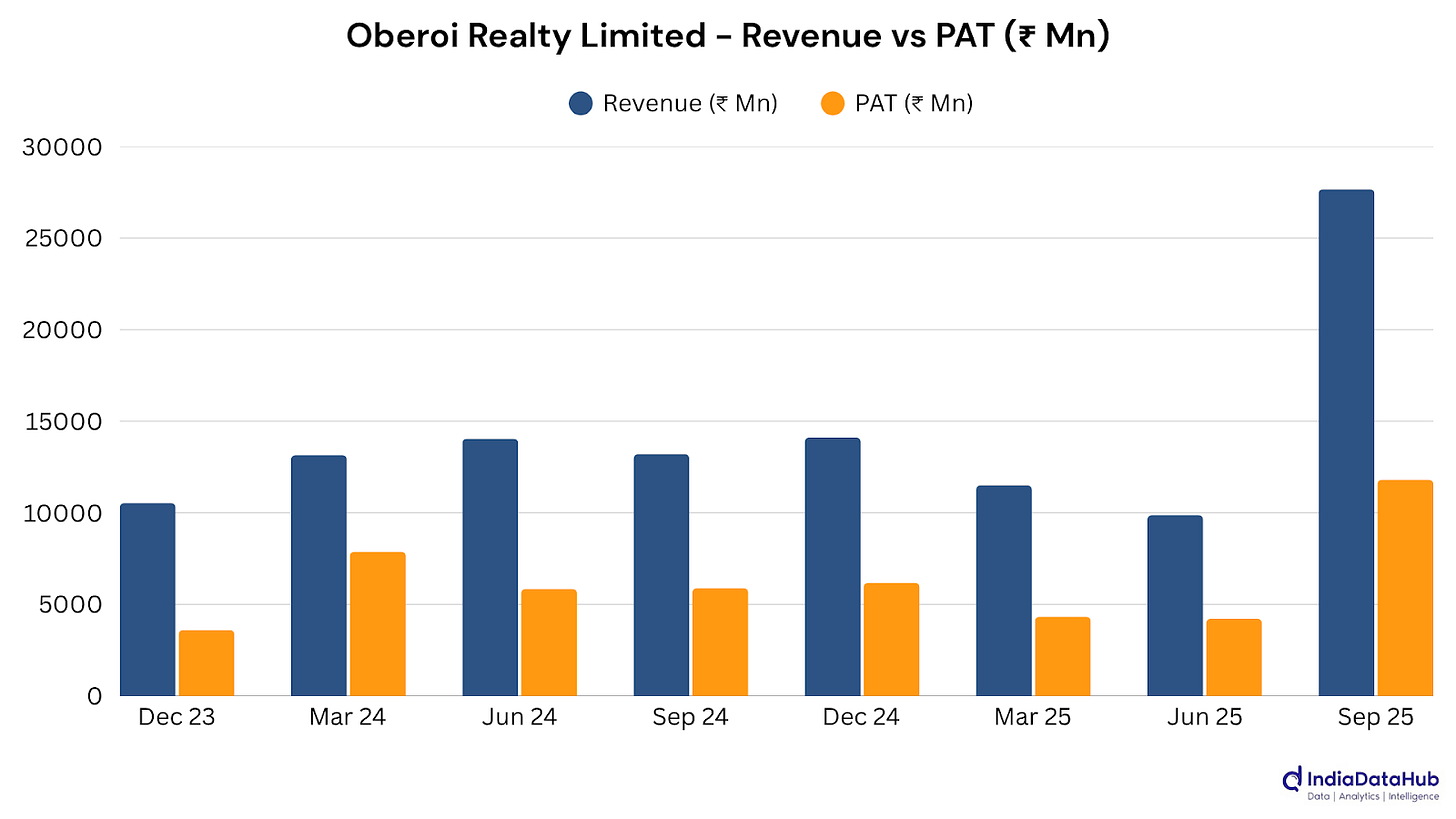

Healthcare and Consumer Discretionary have led the initial momentum, though from small samples. The early results from the six healthcare companies that have reported so far highlight sharp profit rebounds and margin recovery across pharma and diagnostics. Consumer names have seen over 50 companies reporting so far, and the tone there is distinctly upbeat. Dixon Technologies, Oberoi Realty, and Sobha delivered standout quarters, while PVR Inox and Avenue Supermarts showed that urban spending and premium housing demand remain stable.

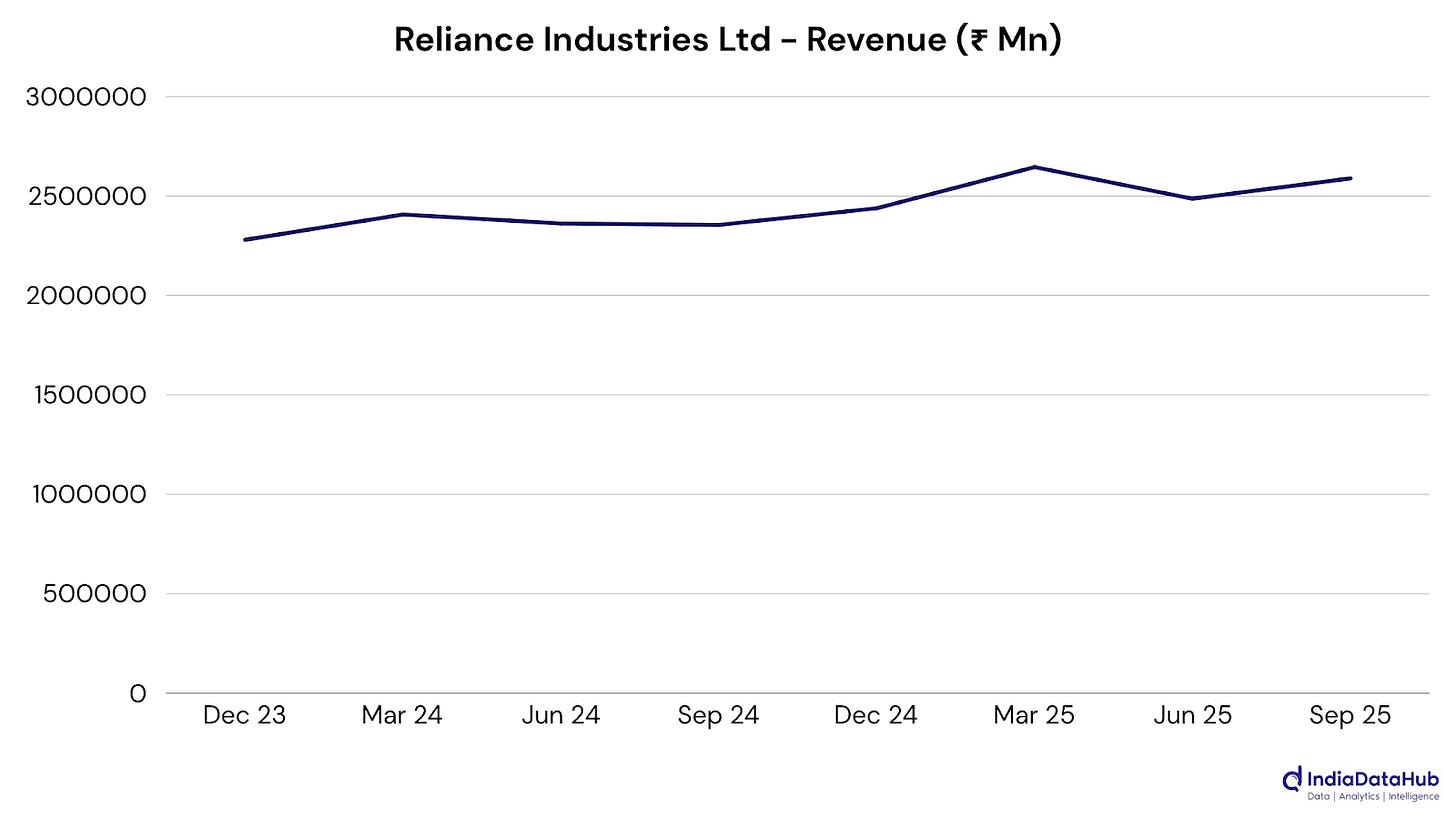

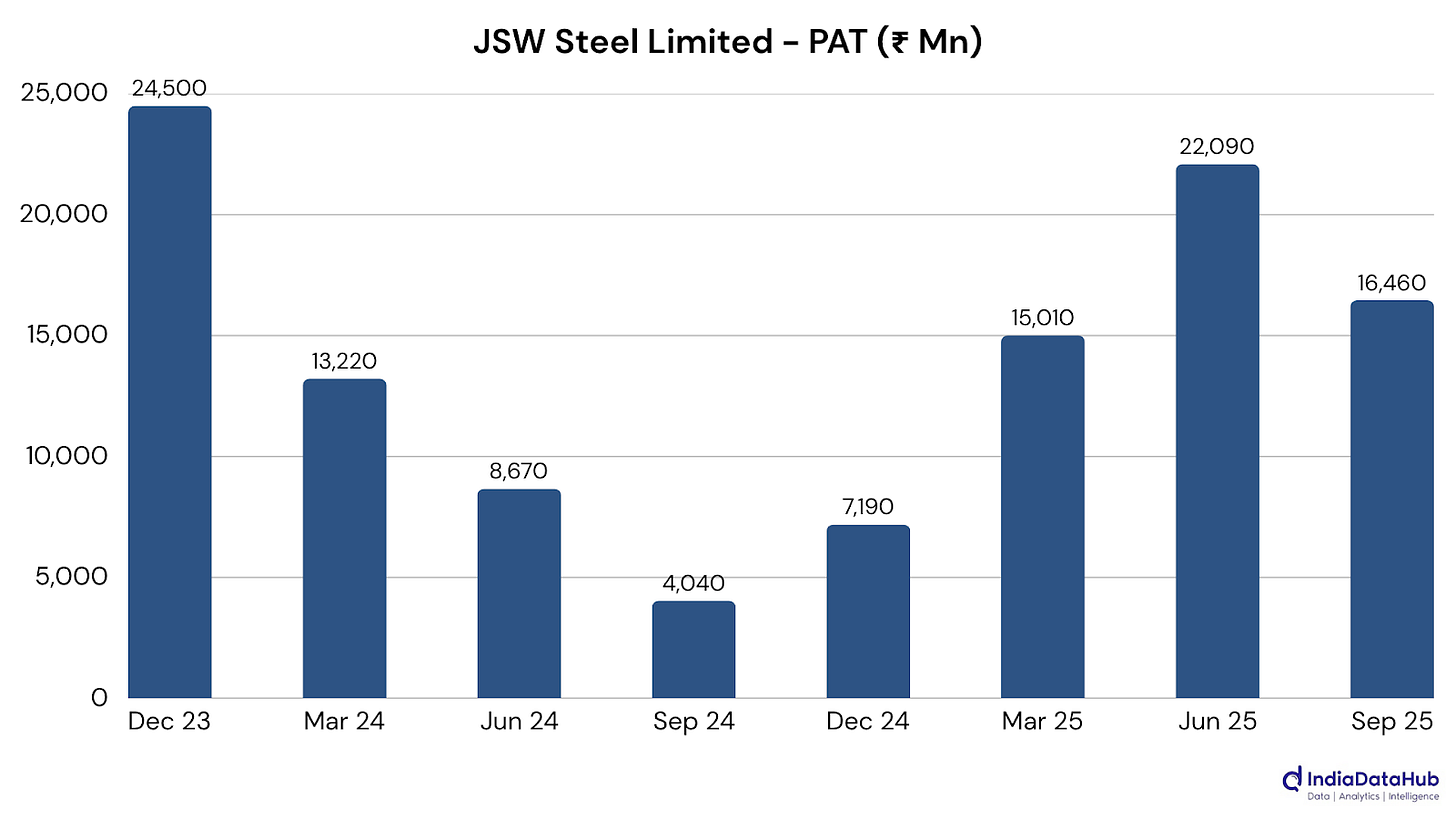

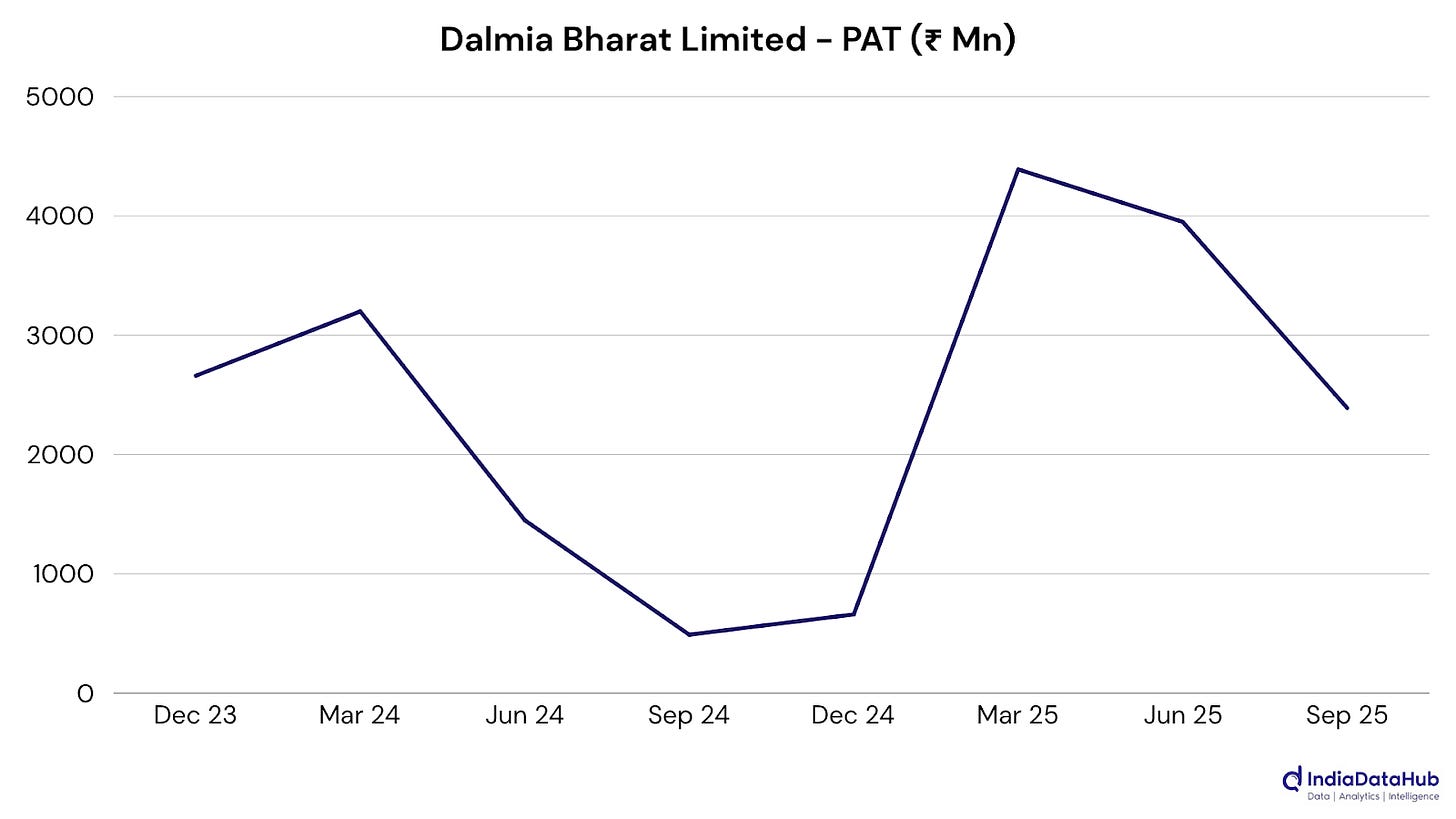

Commodities continued their steady run, posting 77% PAT growth on strong operating leverage. JSW Steel, Hindustan Zinc, and Dalmia Bharat exemplified a sector where cost control and domestic demand are easily outpacing global price softness. Energy stayed firm, with Reliance Industries and MRPL showing that diversified and integrated models still anchor earnings even in a volatile environment.

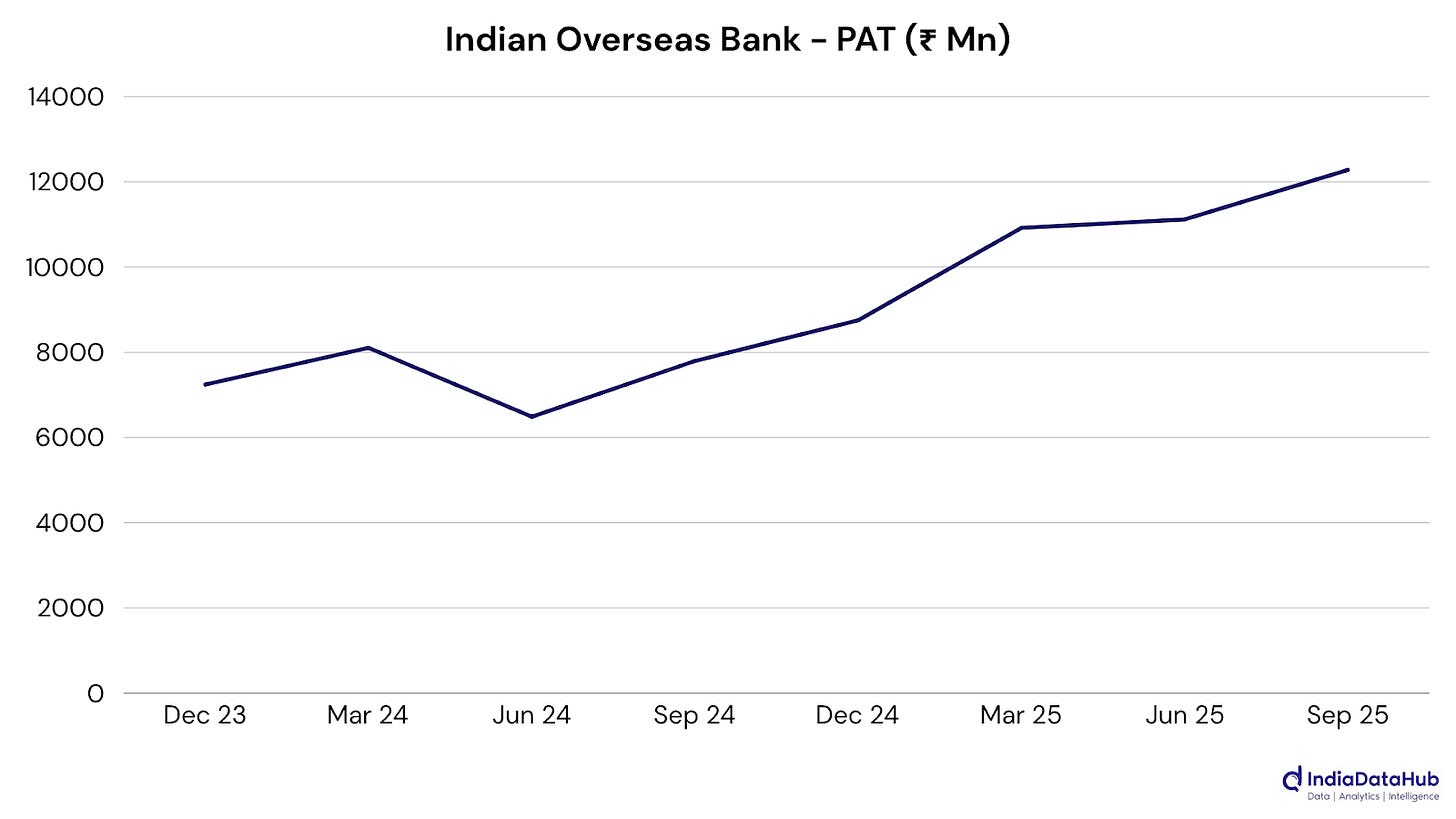

The larger picture is mixed, however. Financial Services showed modest 3% profit growth, a steady but slower print as provisions and flat margins offset healthier balance sheets at PSU banks and asset managers. FMCG has disappointed so far, with profits falling 12% despite double-digit revenue growth, weighed down by higher input costs and last year’s base effects. Telecom was the clear laggard, swinging sharply into losses again on heavy legacy drag, while Services barely stayed profitable.

Industrials (+15% PAT) and Utilities (+1%) rounded out the early sample with mixed results as toplines surged, but profits lagged, hinting that higher costs and ongoing investments are still muting returns.

It’s early days, but the first week of results sets a clear tone: growth is broadening, yet still uneven. Margins continue to define success more than demand does, and as more results roll in, the broader picture will get clearer.

Key Results During The Week

Reliance Industries Ltd: Profit rose over 14% as gains across oil-to-chemicals, digital, and retail kept earnings balanced. Strong refining margins, subscriber growth, and store expansion underpinned results, highlighting the strength of Reliance’s diversified growth engine.

JSW Steel: Profit soared more than threefold as new capacities kicked in and output hit record highs. Softer global prices didn’t bite much, with lower input costs and stronger domestic demand keeping margins comfortably ahead.

Dalmia Bharat Limited: Margins widened sharply, and profit jumped nearly fourfold with cost controls and better realizations. Even while commissioning a new clinker line, Dalmia kept profitability intact, a rare feat in cement. It’s now balancing expansion with pricing discipline, underlining a mature, efficiency-driven growth phase that could lift sector benchmarks if demand stays firm.

Dixon Technologies (India) Limited: Profits jumped over 80% as booming mobile and electronics demand powered another record quarter. Scale gains and new global contracts boosted margins, while fresh investments signaled a deeper push into component manufacturing.

Oberoi Realty Limited: Revenue and profit both doubled as premium housing sales and steady leasing lifted overall performance. Strong absorption in Mumbai projects and near-completion revenue recognition kept momentum firm despite slightly higher construction costs.

Vikram Solar Limited: Profit skyrocketed over 1,600% and revenue nearly doubled as module shipments soared, backed by India’s solar-manufacturing push. High utilization, expanding exports, and a swelling order book reflect serious scale momentum. With backwards-integration and PLI-linked expansion underway, Vikram Solar is shaping up as a key player in India’s bid to rival global solar giants, and this quarter was the best proof yet.

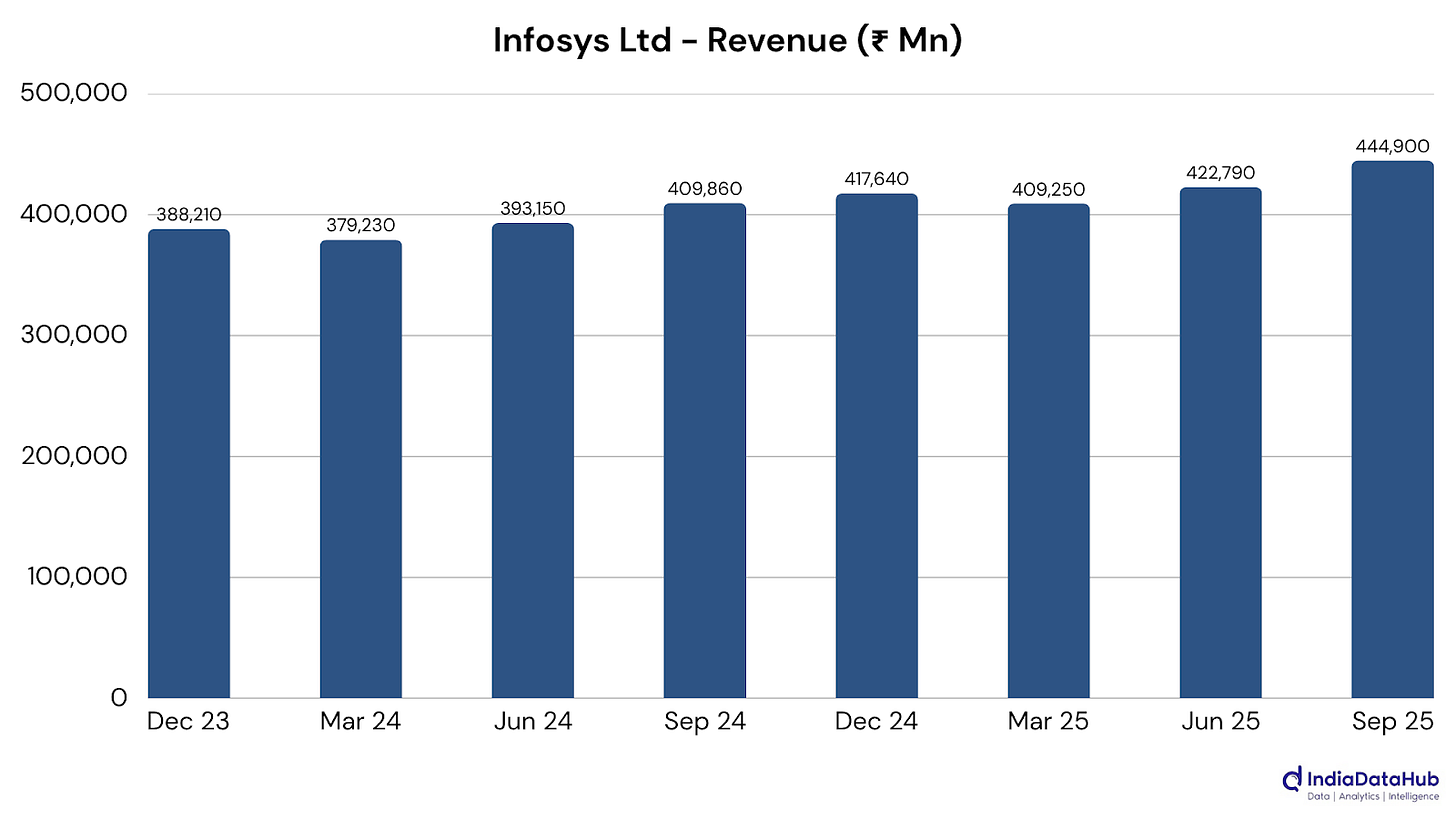

Infosys Ltd: Profit grew over 13% on steady digital demand and strong large-deal wins. Stable margins and an upgraded outlook reflected balanced execution, as Infosys continued to expand its AI- and cloud-led transformation pipeline.

Indian Overseas Bank: Profit surged nearly 60% on stronger lending margins and sharply lower provisions. Healthier asset quality and tight cost control led to a clear turnaround, hinting at steadier, more sustainable earnings momentum ahead.

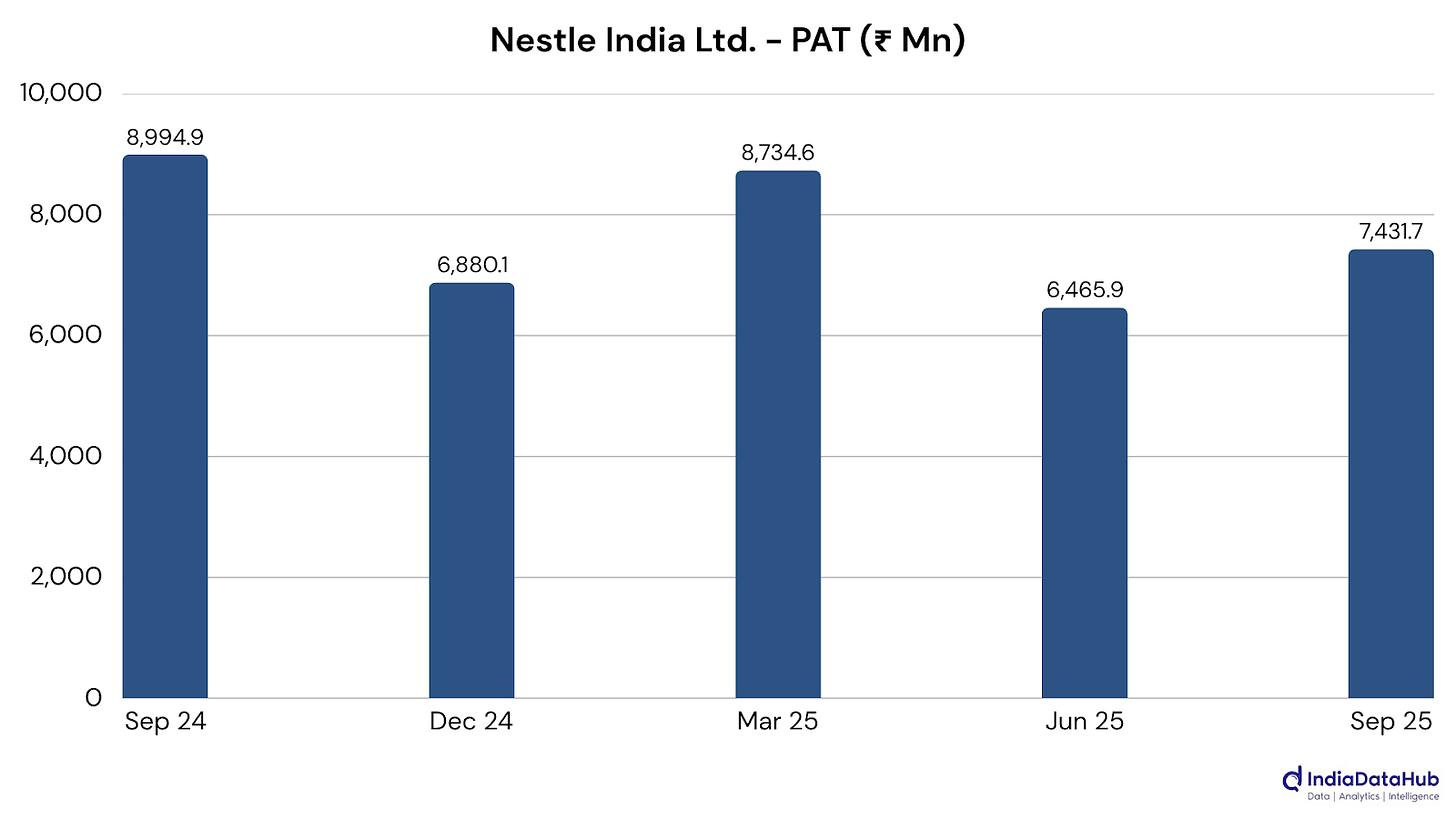

Nestle India Ltd.: Revenue rose over 10% on strong brand momentum and broad-based volume gains, though profit fell as higher input costs and last year’s one-offs weighed on margins. Core demand and brand strength kept growth steady.

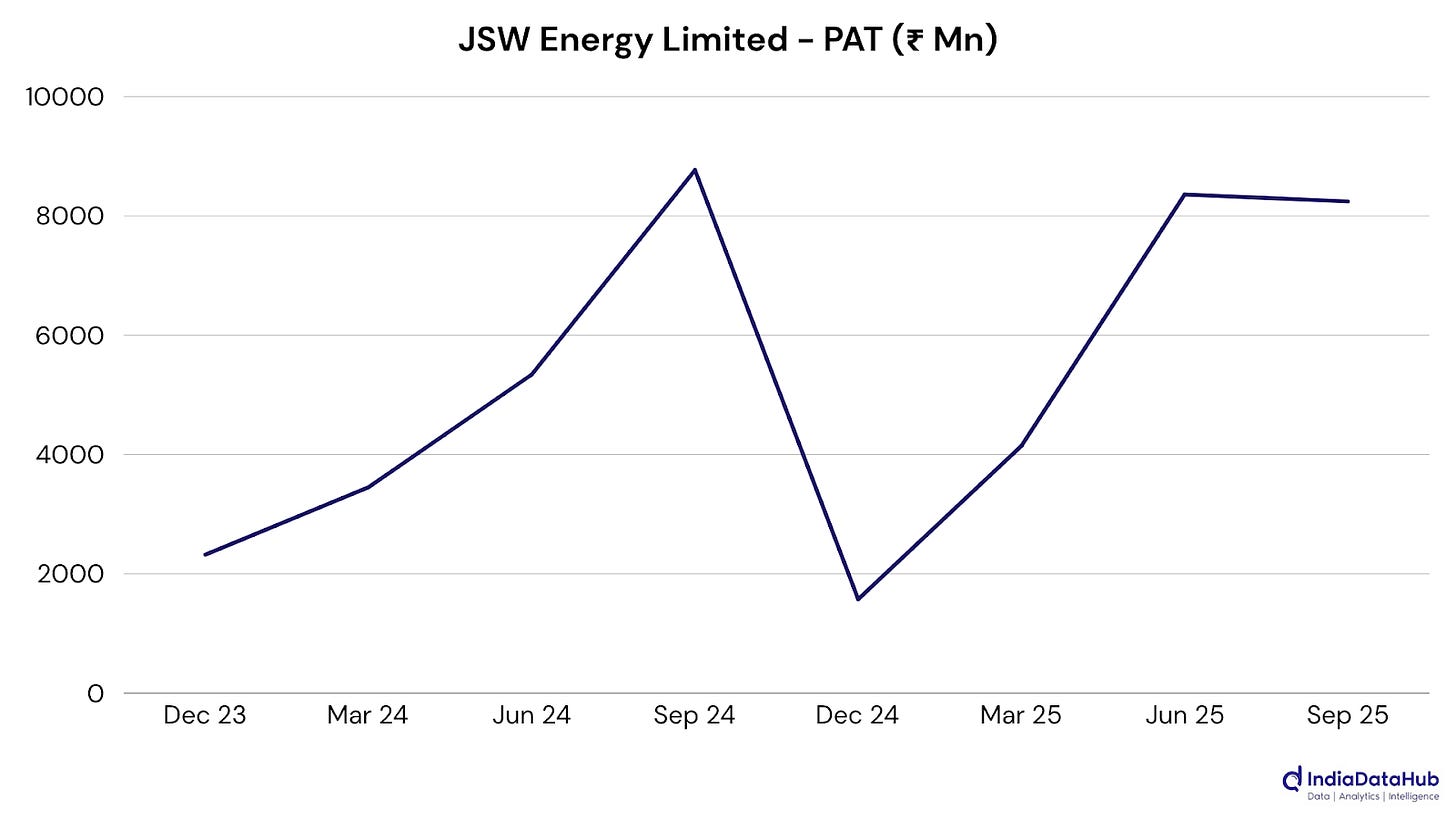

JSW Energy Limited: Revenue surged 60% on fresh renewable additions and higher generation, though profit eased on project-capitalization effects. Beneath that accounting dip lies a company in transition, building India’s next-gen power mix. With 13 GW now operational and aggressive targets for storage and green capacity, JSW Energy’s renewable pivot is fast becoming the backbone of its long-term growth story.

For more sectoral trends as well as company level details, please click to download the full PDF.