Exports decline, Rupee at record lows, Rising unemployment in USA and more...

This Week In Data #146

In this edition of This Week In Data, we discuss:

India’s exports decline sharply in October while Imports rise sharply

Trade deficit rises to a record high

Rupee is closing in on 90 to the US Dollar and has seen across the board decline

India’s inflation is now lower than in the USA!

Inflation has taken off in Japan long used to ZIRP!

US Unemployment rate is rising and so the Fed is expected to cut rates

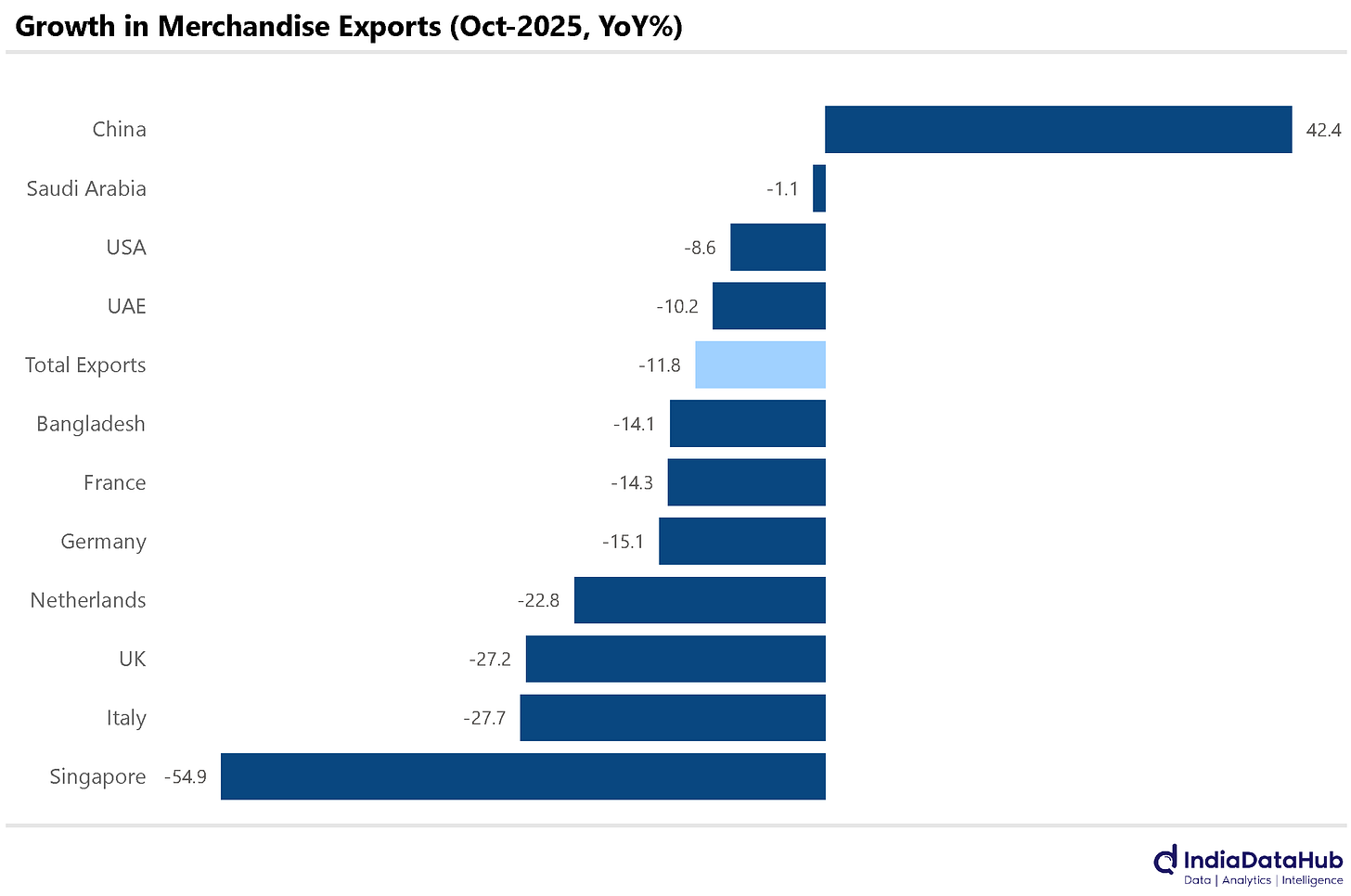

India’s exports declined a sharp 12% YoY in October after a few months of high single-digit growth. And surprisingly, this was not due to a decline in exports to the USA. Exports to the USA declined, but by only 9% YoY. Exports to Singapore declined by over 50%, accounting for more than a quarter of the overall decline in exports. Exports to several European countries also saw a sharp decline. Exports to the UK, Italy and the Netherlands, for example, declined over 20% YoY and those to Germany and France declined by ~15%. On the flipside, exports to China saw a sharp 40% increase. And even YTD (Apr-Oct), while overall exports are largely unchanged on a YoY basis, exports to China have grown by almost 25% YoY. China has overtaken the UK and Singapore to become the 4th largest export destination for Indian goods, very close behind the Netherlands.

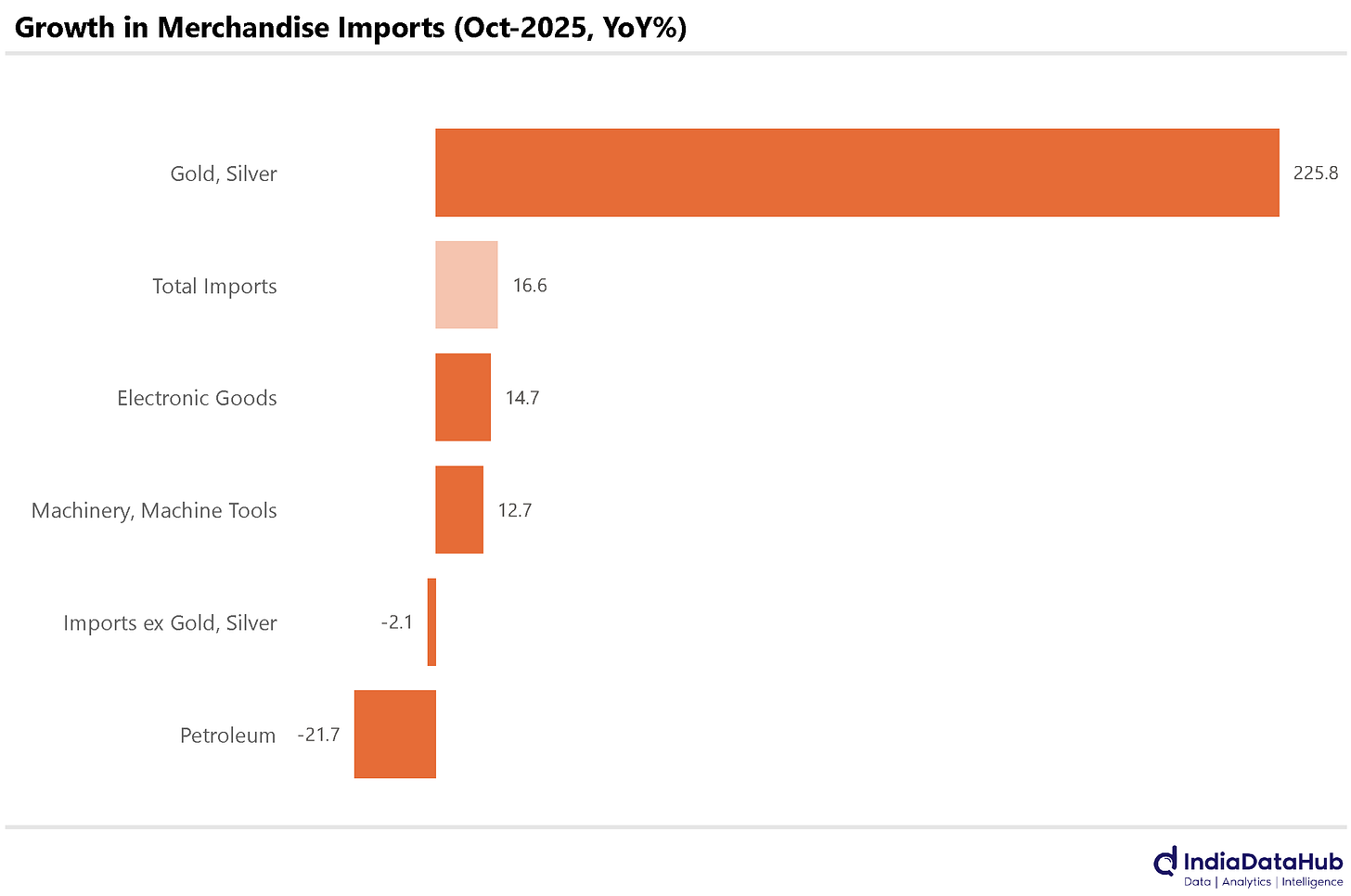

Imports meanwhile grew 17% YoY in October, the sharpest growth in recent months. This was driven largely by a near tripling of gold imports and more than quintupling of silver imports. Excluding these precious metals, imports declined 2% YoY. So the rise in imports is not broad-based. To some extent, there is also a seasonal angle to both the decline in exports and the increase in precious metal imports as Diwali was earlier this year compared to last year.

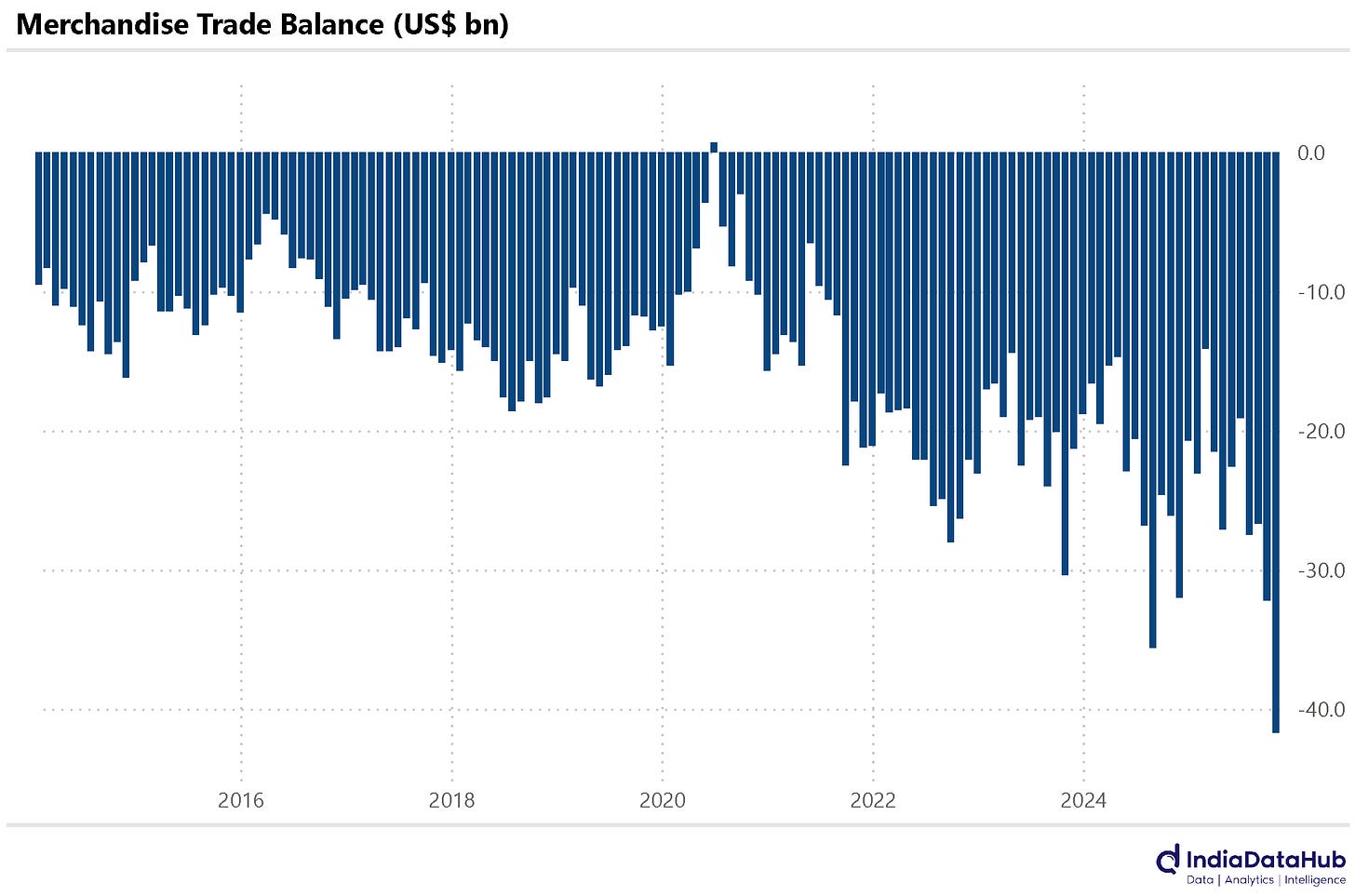

That said, the trade deficit widened to a record high of over US$40bn, almost a third higher than the previous record.

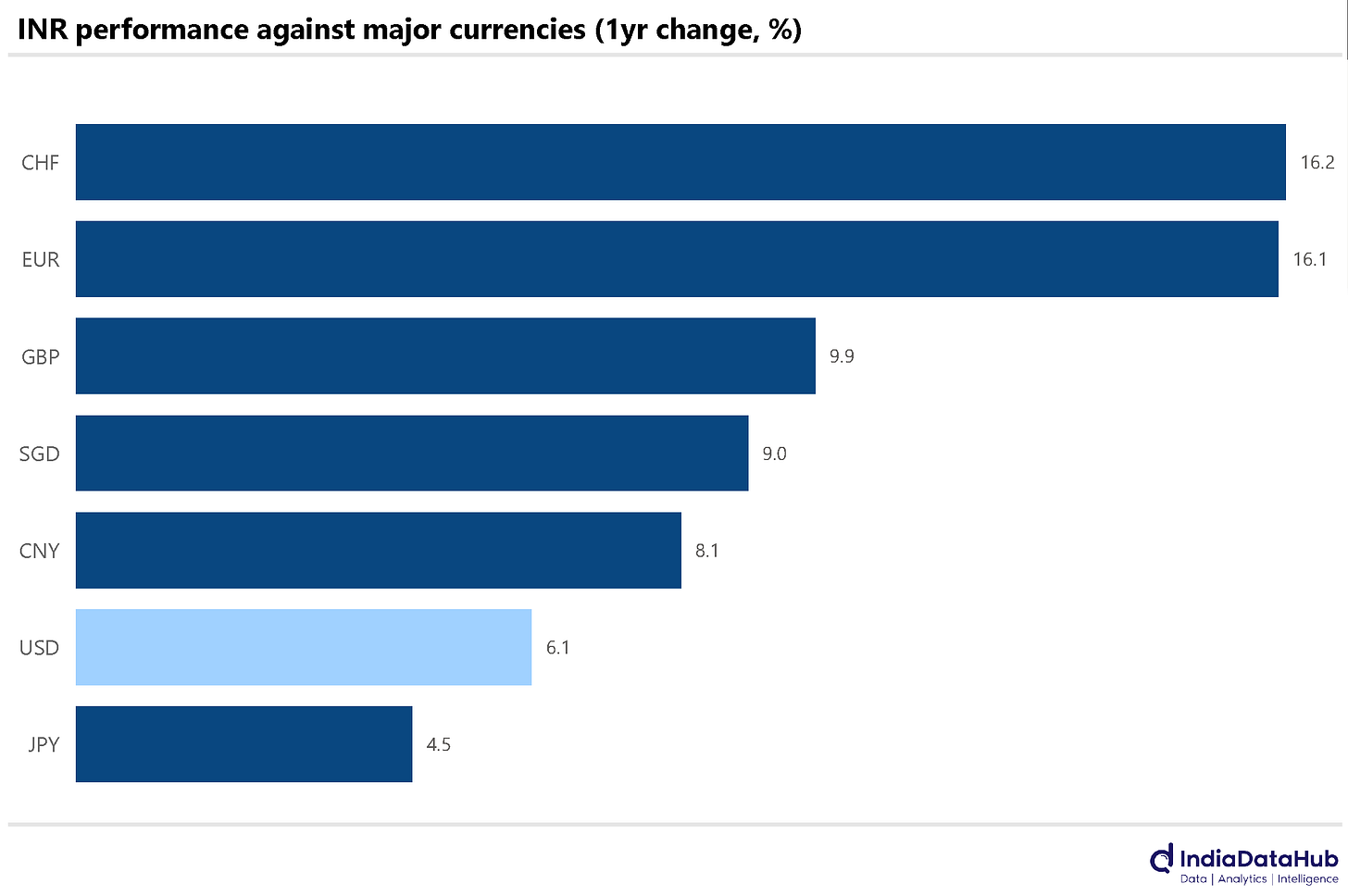

And this is also flowing through the rupee, which closed very close to the 90 mark against the US Dollar on Friday. Over the past few months, the INR has seen gradual depreciation against the USD and most other major currencies. The IDH INR Index has fallen ~8% over the past year as the INR has depreciated by 6% against the USD, 8% against the CNY, 10% against the GBP and 16% against the EUR during this period.

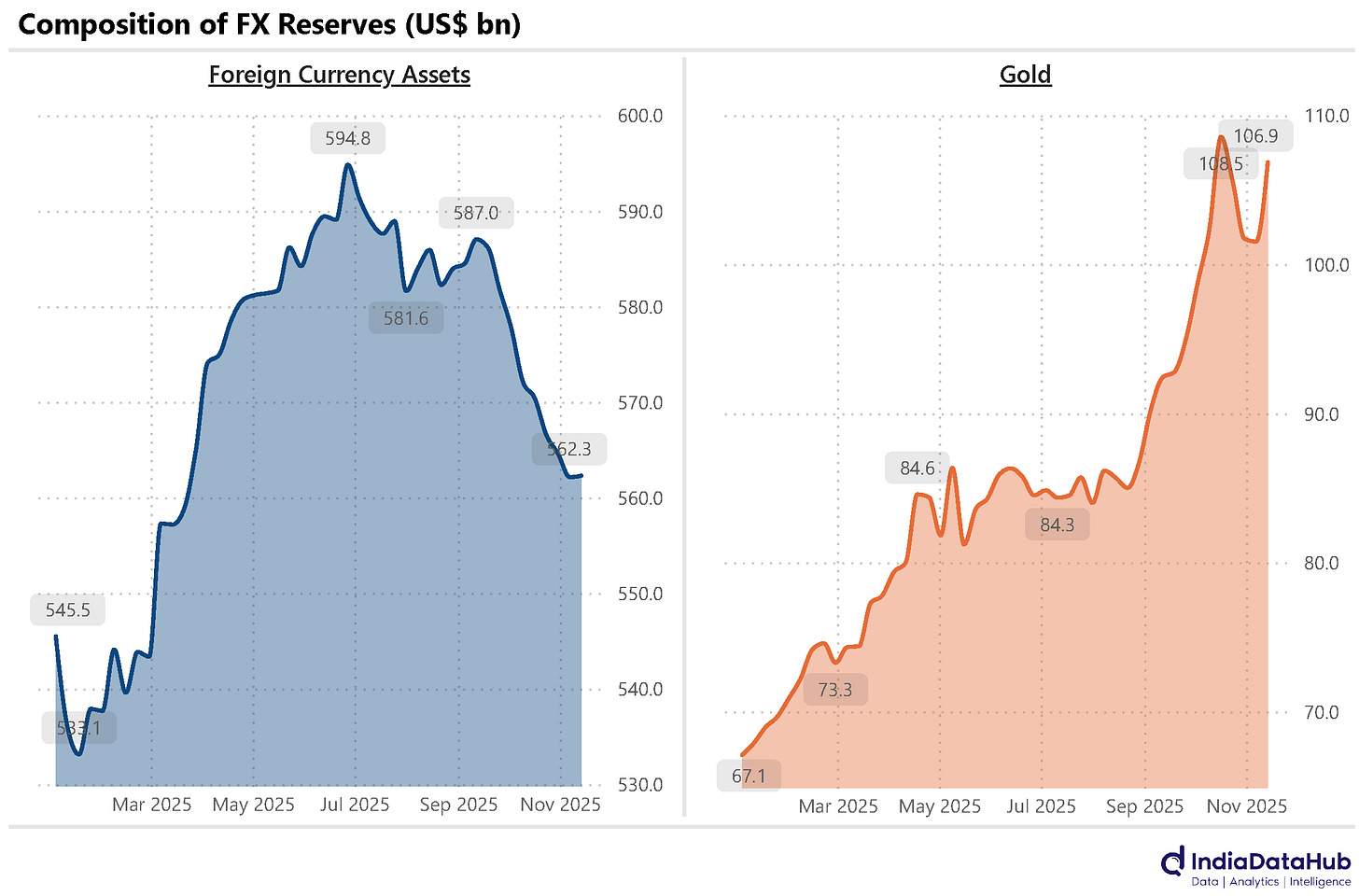

And the RBI continues to dip into FX reserves to support the Rupee. And as we have discussed a couple of times before, this intervention is not manifesting itself in total FX reserves, as the appreciation in the value of Gold is offsetting the decline in foreign currency assets. As of 14th November, the total foreign currency assets stood at US$562bn, down US$32bn since their level in late June. This decline has been almost fully offset by a US$22bn increase in the value of Gold holdings.

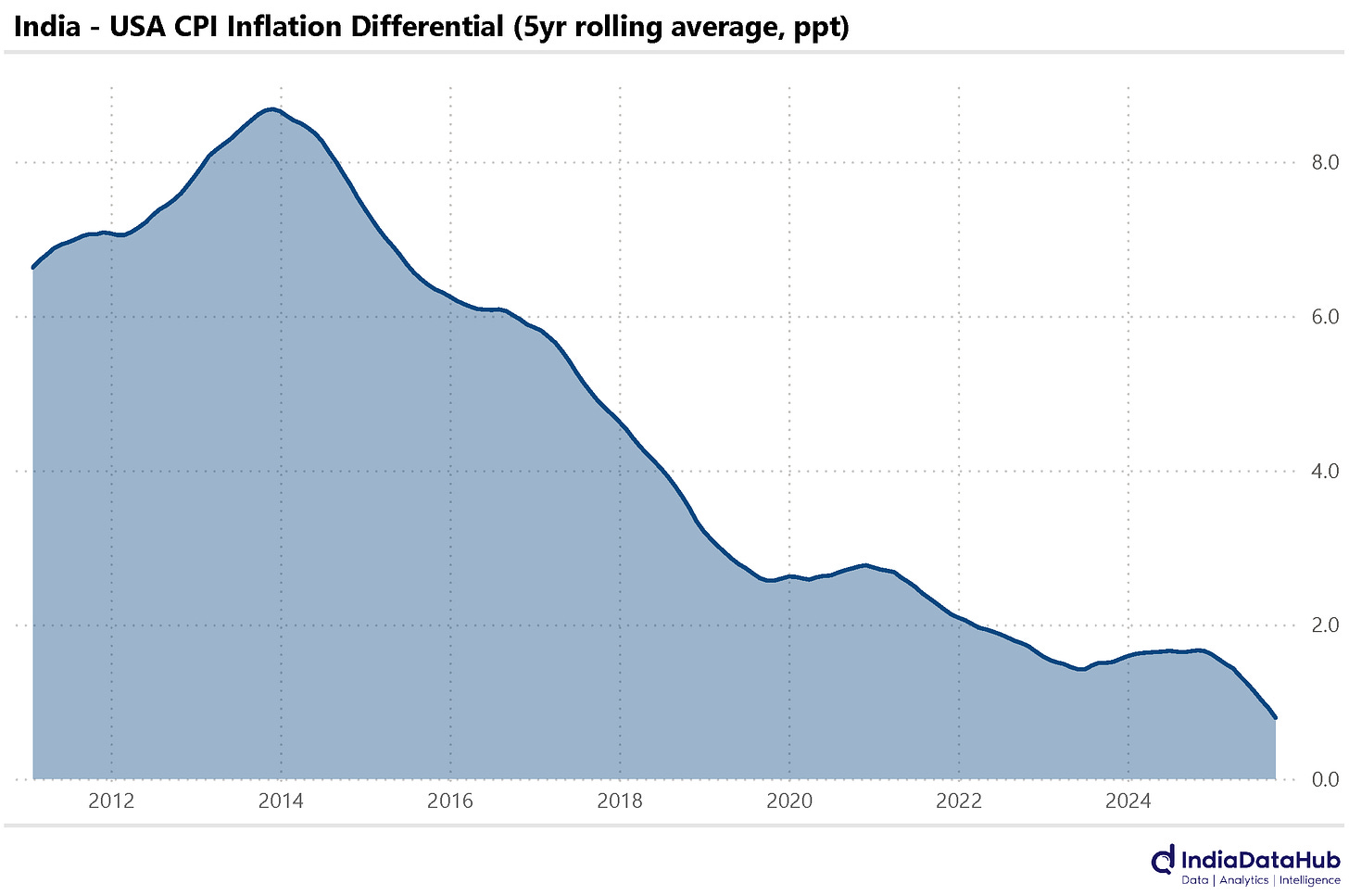

India’s inflation is now lower than that in the US. October will be the 5th consecutive month that the CPI Inflation in India will be lower than that in the USA. And while Inflation in India being lower is probably an exception, structurally inflation differentials seem to have moderated in the last few years. In the long run, it is the inflation differential that drives relative exchange rate movements, and thus if inflation differentials remain low, if not negative, this will be the biggest structural support for the INR against the USD. If inflation differentials remain low, that is…

In the short run, though, the persistent low inflation in India has opened up room for further rate cuts from the RBI. It now seems likely that the RBI will cut rates further in its next monetary policy meeting in early December, the rupee situation notwithstanding. If anything, a pick-up in growth pursuant to a loosening of monetary policy will support the rupee.

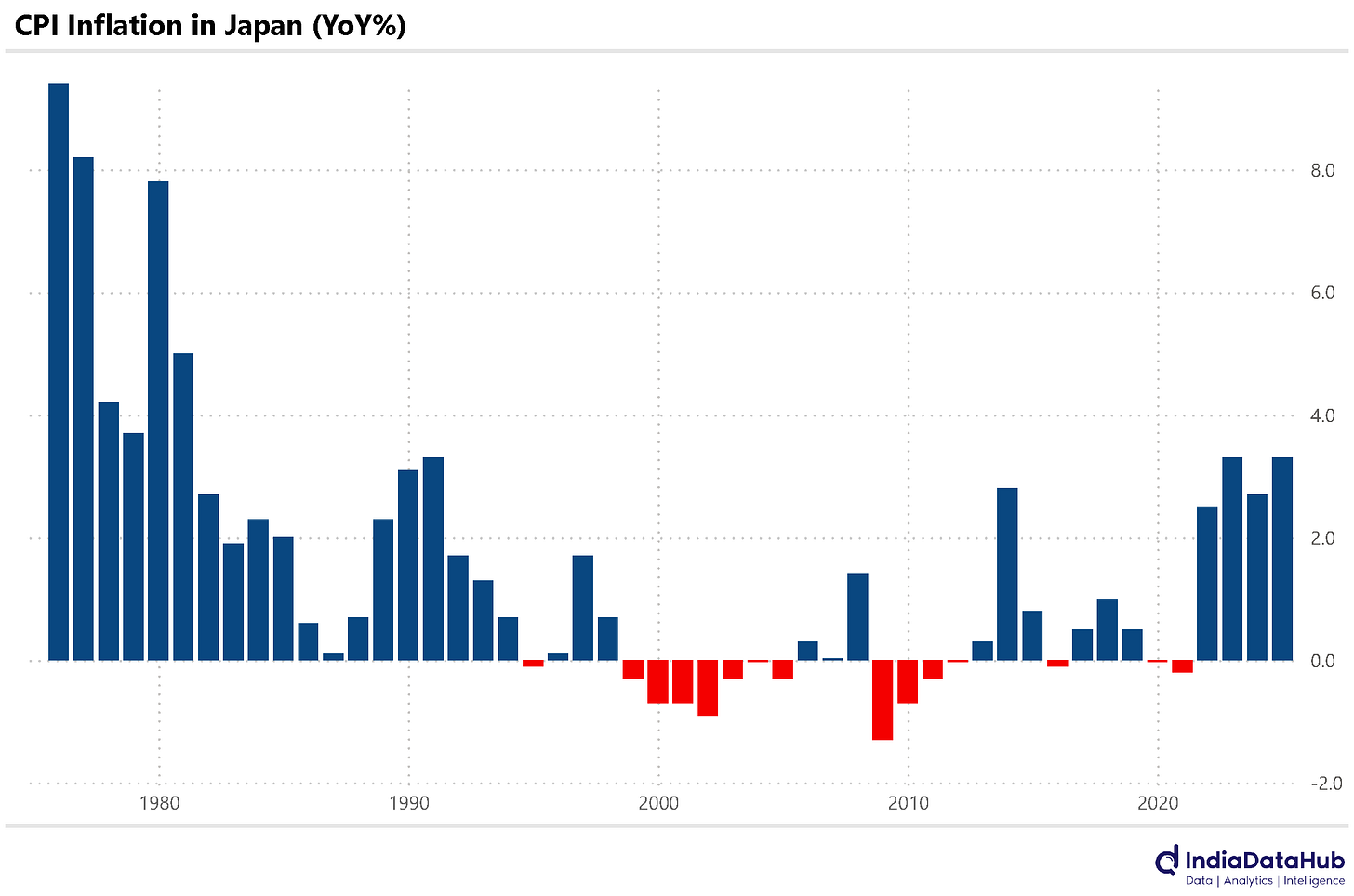

Inflation is rising in Japan. And the data released this week showed that CPI rose to 3% YoY in October, up 20bps over September and 80bps over the past year. A 3% inflation in Japan is as unthinkable as a 0% inflation in India. But that is precisely what we are faced with. Not surprisingly, interest rates in Japan, long used to ZIRP (Zero Interest Rate Policy), are rising.

CPI Inflation has averaged 3.3% YoY so far in 2025 (till Oct). Calendar year 2023 had similarly seen inflation average 3.3%. But before that, the last time inflation had averaged 3% or higher in Japan was in the year 1991! Between 1992 and 2021, a period of 30 years, the average annual inflation was 0.3% with 15 of those years seeing negative CPI!

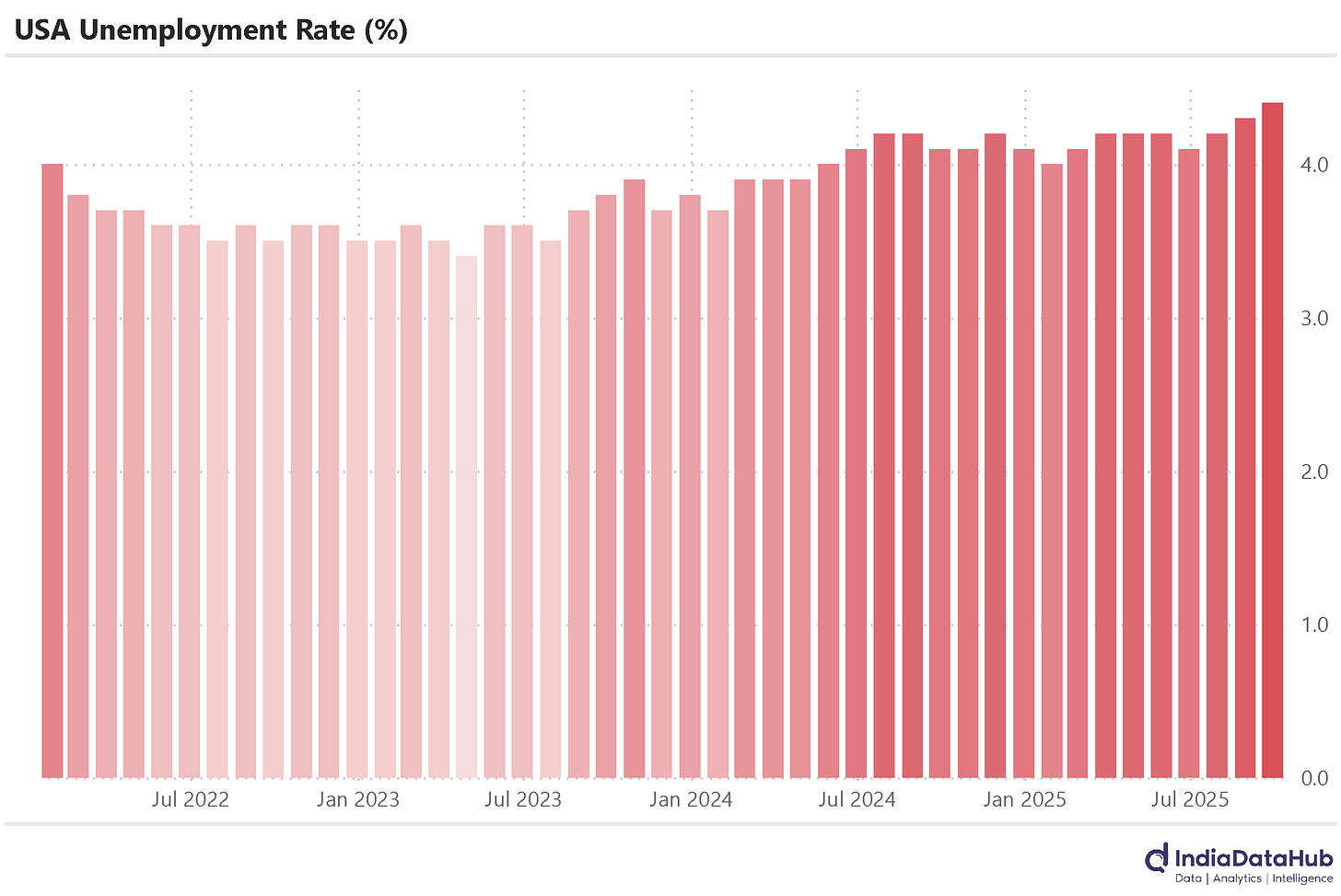

In the U.S., the Bureau of Labour Statistics (finally!) released the non-farm payroll data. But for September. Total non-farm employment increased by 119,000 in September. However, job gains for July and August were revised downward by a combined 33,000, with August’s figure revised to –4,000. The unemployment rate edged up slightly from the previous month to 4.4% in September—the highest level in four years. That said, at 4.4% it is still fairly low. For reference, at the peak of Covid as well as the GFC, the unemployment rate was ~10%.

Post this data release however, the markets which were wavering over whether the Fed will cut rates in December have now decisively moved towards a rate cut – Fed fund futures point towards a 71% probability of a rate cut on 10th December now, up from 45% a week ago. Markets are now also pricing in a ~50% probability of another 25bps rate cut in 1Q26. This then becomes an added factor in favor of the RBI cutting interest rates when it meets (although the RBI rate decision is due before the Fed rate decision).

That’s it for now. See you next week!

Good