FDI, Capital Flows, Liquidity, China GDP and more...

This Week In Data #72

In this edition of This Week In Data we discuss:

FDI is recovering but from a low base

Highly concentrated nature of FDI in India

Capital flows in general remain strong

RBI’s liquidity management given strong capital flows

Electronics now third largest component of exports

China GDP continues to remain sluggish

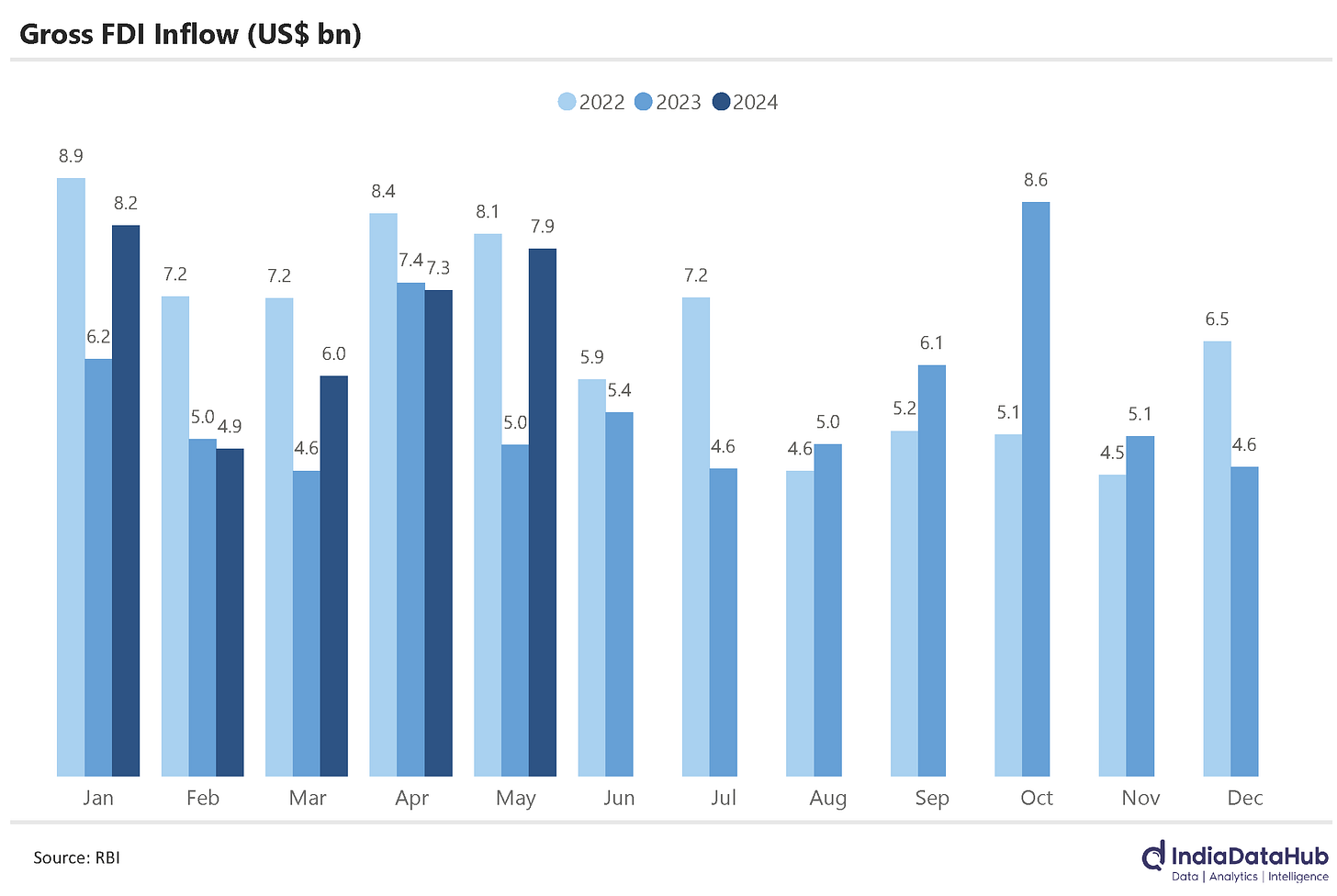

FDI flows have ticked up in recent months. Gross FDI has grown over 20% YoY in the first two months of this financial year, and it had grown by 20% during the March quarter as well. That said, the uptick largely reflects the decline in the last year. FDI in the first 5 months of 2024 is still almost 15% below what was received in the same period of 2022 and only modestly (6%) above the FDI received during the same period of 2021.

On the topic of FDI, it is worth noting how regionally concentrated FDI flows into India are. India received just over US$200bn of FDI in the last 4 years (FY21-24). However, over 80% of this has come into just 4 states - Maharashtra, Gujarat, Delhi and Karnataka. The top 7 states account for almost 95% of the FDI (Haryana, Tamil Nadu and Telangana, in addition to the top 4 mentioned above) received in the last 4 years. So, the rest of the states, including large states like UP, West Bengal, or Punjab, barely receive any FDI. Not a very good statistic.

Other capital flows into India continue to remain fairly strong. Inflows under the NRI Deposits totalled US$1.6bn in May, taking YTD (Jan-May) inflows to US$8bn. This is the highest inflow since 2015 and 2x of last year’s inflows during the same period. ECB flows have also been strong with ECBs in the first 5 months at over US$20bn, being 10% higher than last year. FPI flows have also been strong totalling just under US$5bn so far this month alone.

What all of this means is that Capital flows this year are likely to comfortably exceed the current account deficit. India’s current account deficit is estimated to be ~US$40bn in FY25, up from US$23bn in FY24. However, at the current run rate, capital flows will comfortably exceed last year’s total of ~US$85bn. India is thus likely to see a BoP surplus of over US$60bn even during the current year.

Now, with such large excess capital flows, the RBI has an important decision to make. It can either allow the rupee to appreciate, which has implications for competitiveness of the domestic businesses. Or it can use the excess capital flows to build its FX reserves. As things stand now, the RBI seems to be building FX reserves rather than allowing the rupee to appreciate. FX reserves have increased by US$15bn in the first two weeks of July.

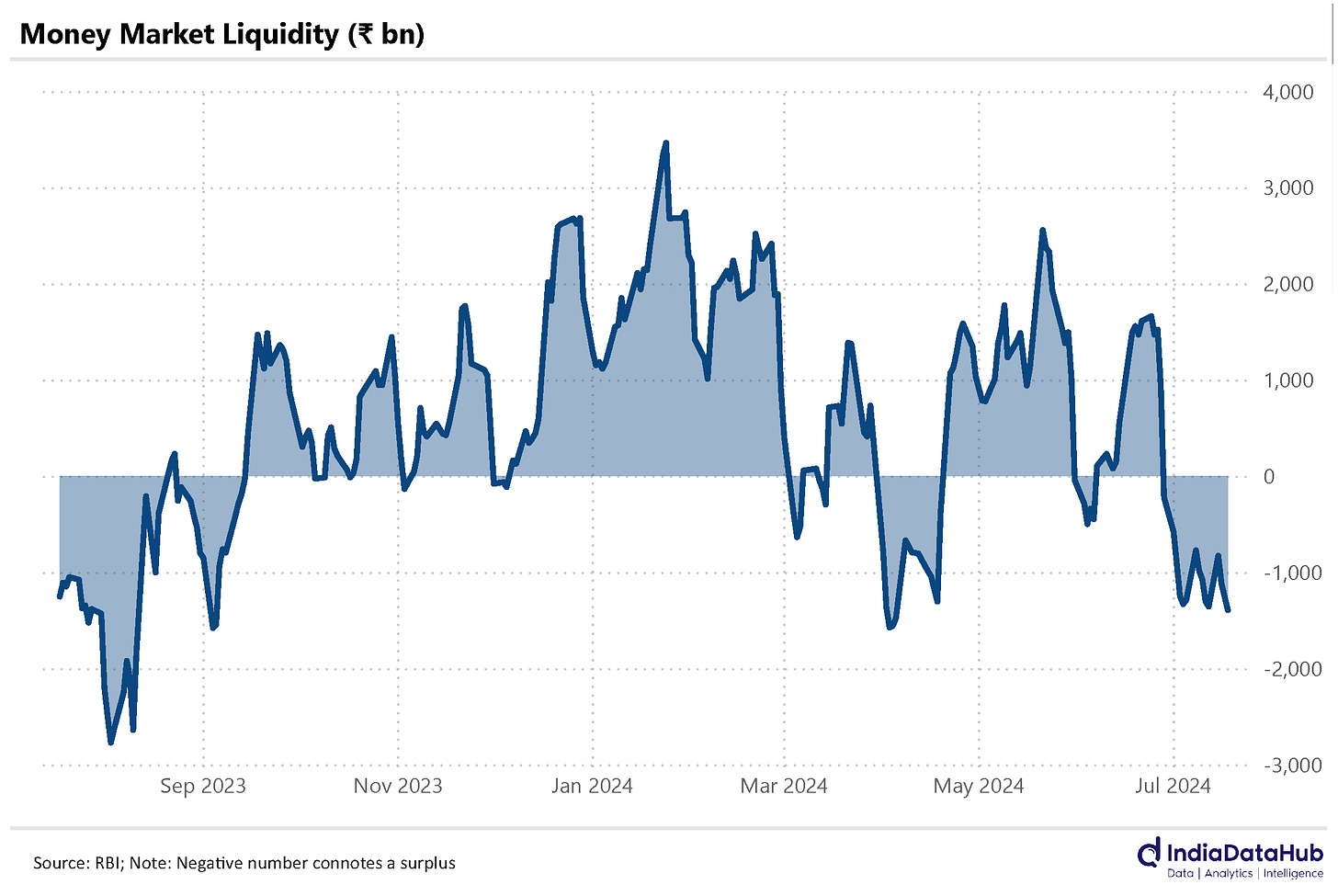

At US$667bn, India’s FX reserves are still below 12 months of import cover (India’s merchandise imports are likely to be ~US$700bn in the current year), which is generally regarded as a comfortable level of reserves for emerging markets. So, one can justify RBI building FX reserves from a risk management perspective. The flip side of this is that FX intervention from the RBI increases money market liquidity (because the RBI is buying dollars from banks and giving them rupees) and not surprisingly, money market liquidity has turned into a surplus since the start of July and the overnight call money rate has now dipped (modestly) below the policy repo rate.

If however the capital flows continue to increase, the RBI will need to sterilise this excess liquidity through tools such as Open Market Operations (OMOs) or issuance of Cash Management Bills (CMBs) or Market Stabilisation Scheme (MSS). But each of these tools comes with a cost – for example, OMOs will involve RBI selling its holding of government securities to banks which results in lower interest income for the RBI. CMBs or MSSs involve the issuance of fresh government securities which increases the government’s interest expenditure.

As the saying goes, everything is good, but in moderation, so is the case with capital flows. While we may cheer large capital flows, and the confidence in the India growth story that it connotes, if the capital flows are significantly above what the economy can absorb, they do impose real costs on the economy.

This brings us to trade and as per the data released this week India’s exports and imports grew in low single digits in June with imports growing slightly faster than exports resulting in the trade deficit growing 10% YoY.

Electronic goods remain the key driver of exports. They have grown over 20% in the first quarter accounting for almost a quarter of the incremental exports in the June quarter. All other large export categories have seen single-digit growth in exports. Electronic goods have now overtaken Textiles and the Gems & Jewellery category and are now the third largest component of India’s exports after Petroleum products and Engineering goods.

Globally, the key data released this week was the China GDP for the June quarter. As per preliminary data, Chinese GDP grew by 4.7% YoY in 2QCY24 which was lower than the expectation of ~5% growth. This is also the slowest growth in the last 5 quarters. The real estate industry was the key drag on growth with almost a 5% decline.

The current market expectation is for India’s GDP to grow just under 7% during the June quarter. So, this will be yet another quarter when India’s GDP would have grown faster than that of China.

That’s it for this week. See you next week…