FDI Slump, Sluggish Small Savings, Telcos gaining back subs and more...

This Week In Data #143

In this edition of This Week In Data we discuss:

FDI slumps in August but continues to remain healthy YTD

ECB Inflows are sharply lower YTD as are inflows from NRI Deposits

Gold valuation gains continues to mask the fall in FX reserves

Wireless telcos are gaining all the subscribers lost last year and then some

India’s Fixed line subscriber base has increased 50% in the last 2 years

Small savings inflows remain muted despite interest rates having not declined

Globally interest rates are either falling or remaining stable

US CPI is rising even as Fed has started to cut interest rates

August saw a sharp slump in the FDI received by India. The Gross FDI received by India was a modest US$6bn, down almost 50% from July and also down 30% on a YoY basis. Month-to-month FDI flows, though, are expected to be volatile, and thus, this is not unduly perturbing at this stage. What is relevant is that despite the weak August, YTD (Apr – Aug) Gross FDI is up almost 20% YoY to US$44bn. And repatriation of existing FDI is tracking down on a YoY basis. Consequently, the net FDI received by India is tracking 50% higher on a YoY basis as of August. Admittedly, this growth is off a low base.

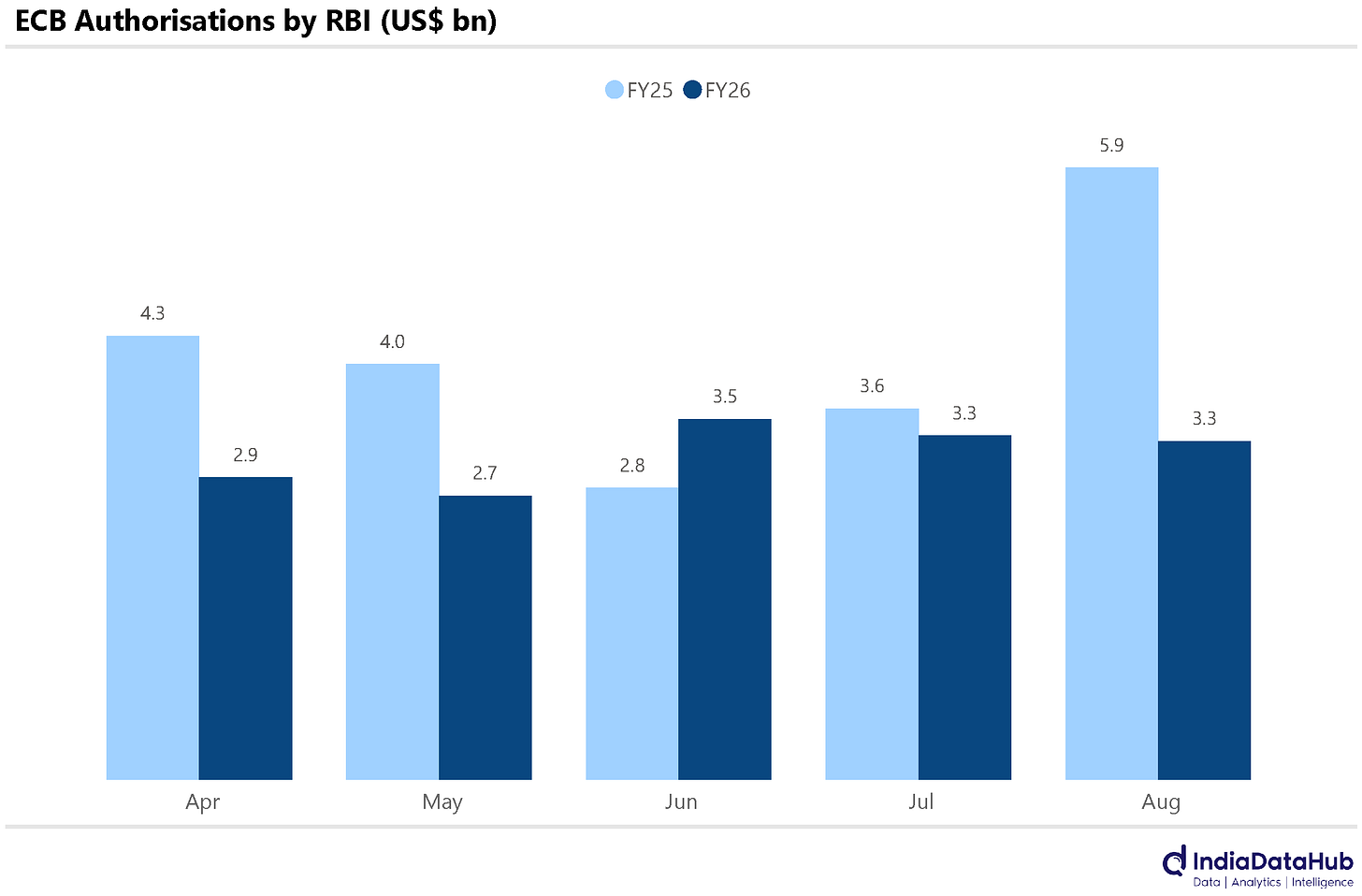

Overseas debt flows are, however, struggling this year. In the first 5 months of this year, the total amount of external commercial borrowings approved by the RBI was just under US$16bn, which is almost 25% lower on a YoY basis. Inflows under the various NRI deposit schemes are down by over 20% in the first four months of this year. Lower domestic interest rates and a depreciating rupee have clearly made the interest rate arbitrage trade less attractive.

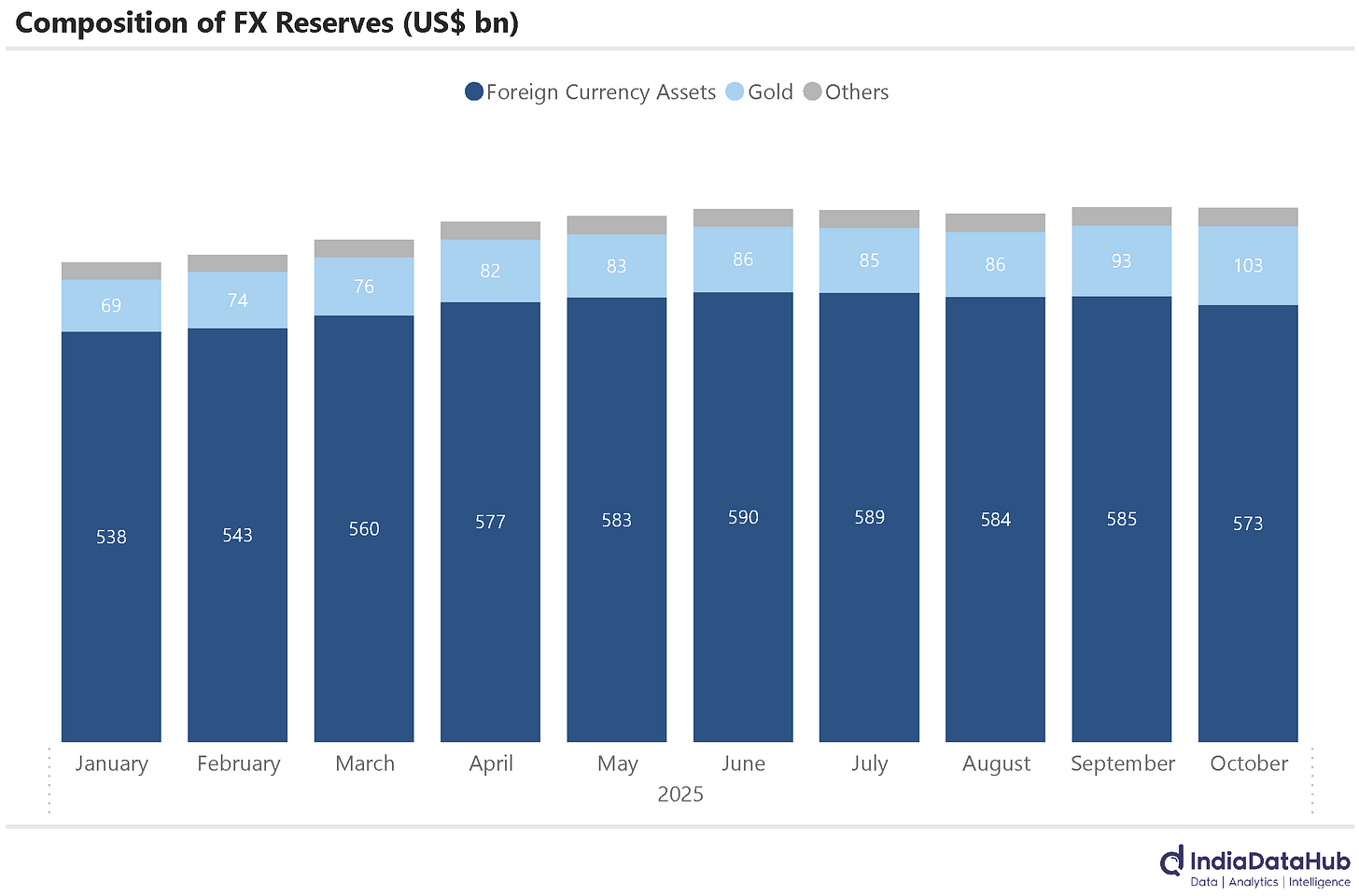

Last week we discussed how, while FX reserves have remained unchanged, their composition has changed. While foreign currency assets have declined, overall FX reserves have remained unchanged due to the gains from the increase in the value of gold holdings. The RBI’s FX market intervention by using its reserves to defend the rupee is being masked due to the increase in value of its Gold reserves due to higher gold prices.

And this past week’s data saw this trend continue. Overall, FX reserves rose by US$4.5bn, but foreign currency assets declined by US$1.7bn since the value of Gold holdings appreciated by US$6bn! At US$570bn, RBI’s foreign currency assets are at their lowest level since the last week of March, but overall FX reserves are almost US$40bn higher!

The wireless telecom operators are seeing subscriber gains this year. Last year, if you recall, the wireless operators lost subscribers when they took price hikes around July. However, the lost subscribers (or maybe new ones) are coming back. In the first five months of FY26, the wireless operators added 10 million subscribers. This more than makes up for the subscriber loss in the last year – in FY25, the wireless operators had lost 8.5 million subscribers.

And the fixed line segment is also seeing strong growth in its subscriber base. YTD (Apr – Aug), they have seen over 9 million net new subscribers being added! And on a base of less than 40 million subscribers at the start of the year, that’s a more than 25% increase in the subscriber base. In just the last two years, the fixed line subscriber base in the country has increased by 50% - admittedly, it pales compared to the wireless subscriber base…

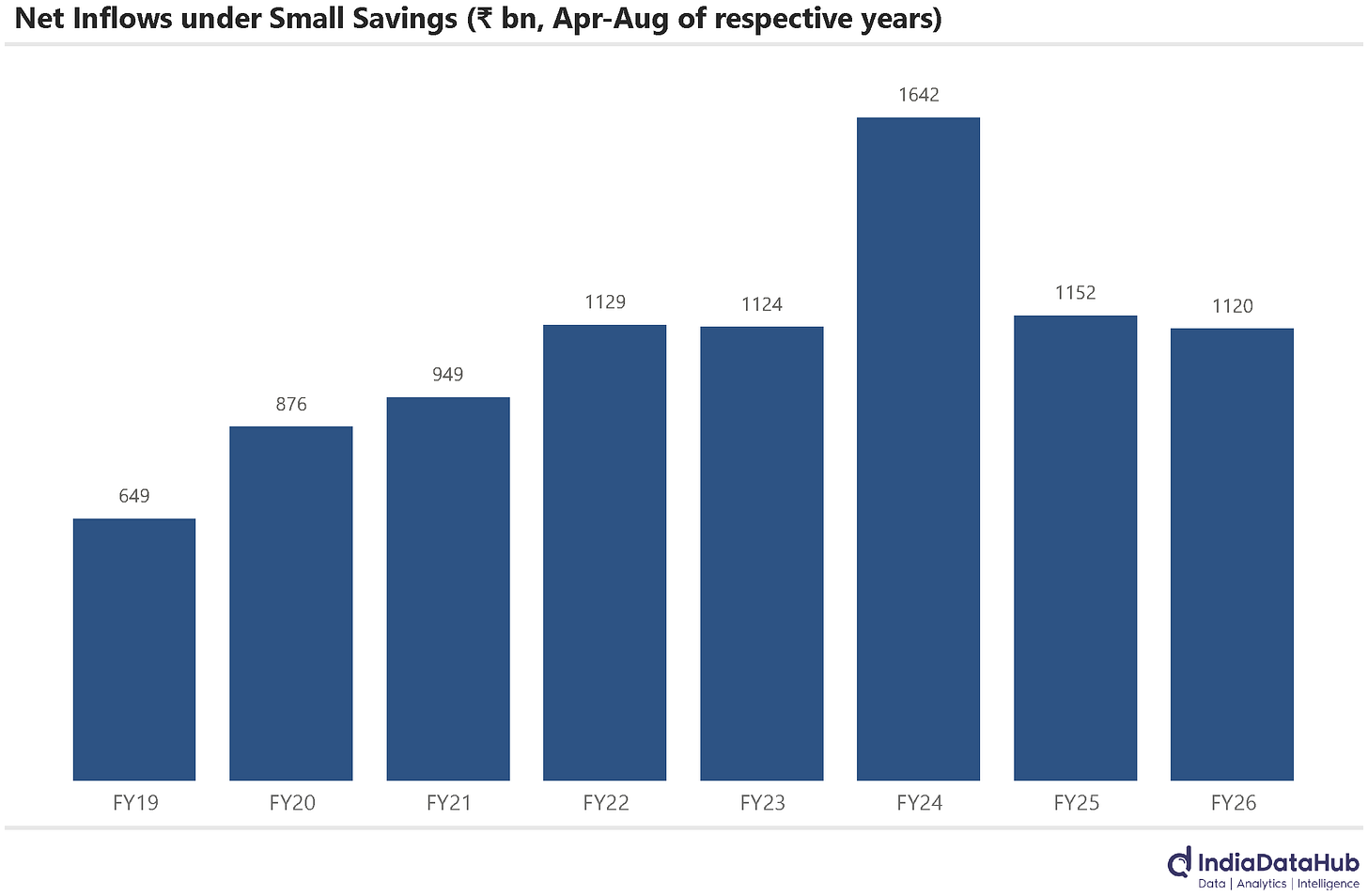

Even as mutual fund inflows remain strong, inflows under the small savings schemes continue to struggle for the 2nd consecutive year. Net inflows under all the small savings schemes totalled ₹1120bn in the first 5 months of this year. This is down 3% compared to inflows received during the same period last year. And the inflows last year themselves were down 30% YoY. Inflows in the first 5 months of this year are the lowest in the 5 years.

While it is tempting to attribute this to the falling interest rates, it is pertinent to note that the interest rates on small savings schemes are regulated by the Government. And the Government has not changed (reduced) interest rates in the last 2 years. Falling interest rates are thus not a driver of weak small savings inflows. So, what gives?

Globally, this week began with several key central bank policy decisions. And in general, policy rates are either being maintained or being cut. The People’s Bank of China, for instance, maintained its 1-year loan prime rate at 3% and the 5-year rate at 3.5%. Interest rates have remained unchanged in China since May.

Similarly, Indonesia’s central bank also kept its benchmark rate steady at 4.75% after having lowered it by 25 basis points in the previous month. In contrast, the Central Bank of Turkey reduced its repo rate by 100 basis points from the previous month to 39.5%, the third consecutive policy rate cut. A year ago, policy rates in Turkey were 50%! The Bank of Russia also lowered its key rate from 17% in September to 16.5% in October.

Moving to inflation data released this week, Canada experienced a slight uptick in inflation, with the consumer price index (CPI) rising from 1.9% in August to 2.4% in September—higher than the 1.6% recorded in the same month last year. South Africa also saw a marginal increase in inflation to 3.4% in September, although this remains lower than the 3.8% recorded in September 2024.

Meanwhile, the U.S. Bureau of Labor Statistics reported that the U.S. CPI rose by 2.9% in September, up from 2.7% in August. Core CPI rose by 3.1% YoY in September, up 5bps from August. Both headline and core CPI are the highest since January of this year. So even as the Fed has started to cut interest rates, inflation has started to rise.

That’s it for this week. See you next week…