Flipside of low inflation, declining electronics imports, outward remittances and more...

This Week In Data #18

In this edition of TWID, we discuss:

The flipside of low inflation now that WPI has printed negative.

Electronics exports are rising but imports are declining.

Life insurance sector continues to witness a decline.

Outward remittances rose to a record high in March.

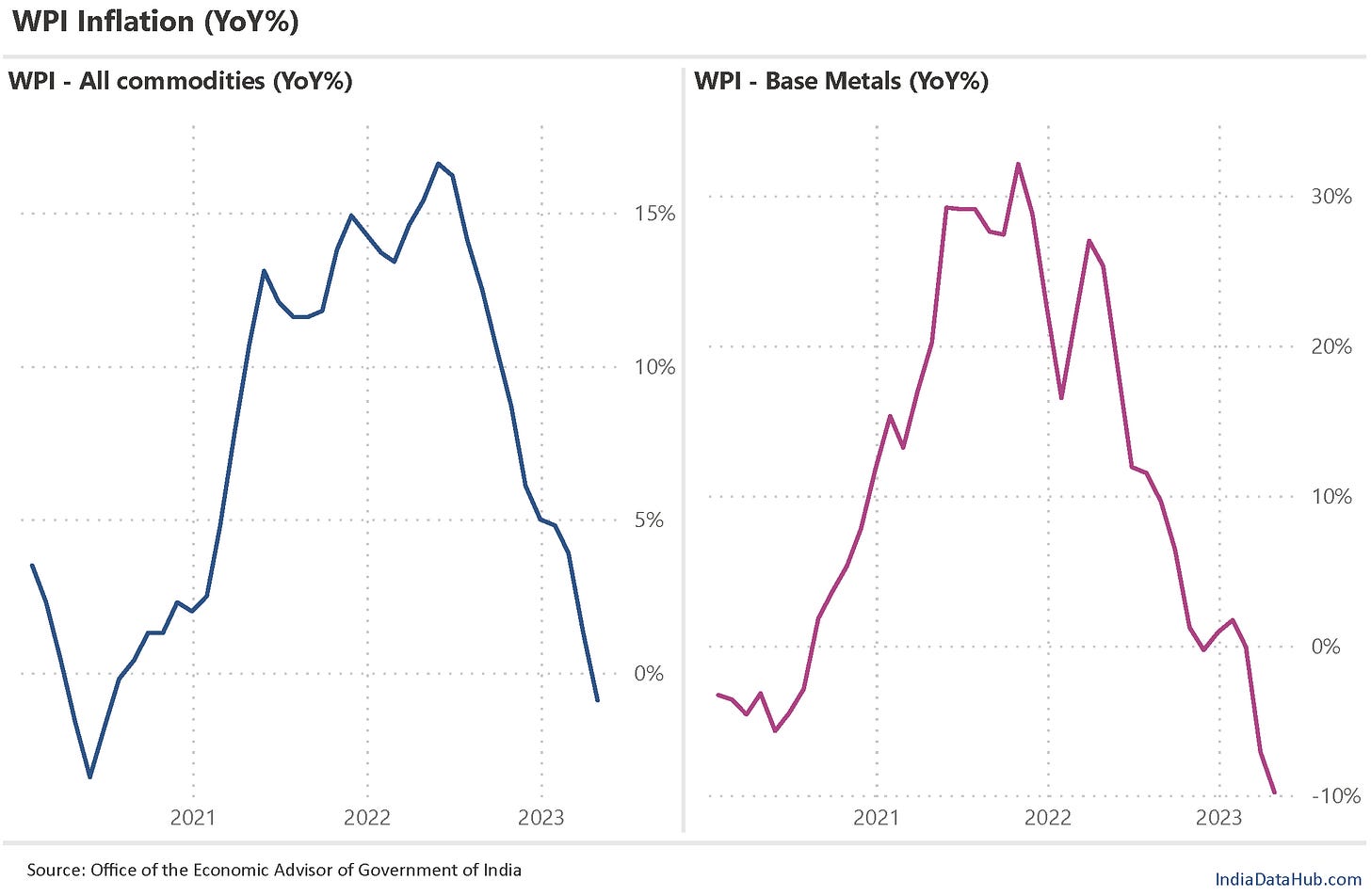

The next week is going to be pretty exciting for us. We will release our first Thematic report next week. It will be a data deep dive into what is driving the growth in Passive mutual funds. We will also be releasing the first episode of the second season of our DataSpot podcast on (next) Friday. While in the first season of DataSpot we focused on how data comes into being, in this season we will focus on more topical topics! Stay tuned…Following on from the sharp decline in CPI inflation in April, the WPI Inflation printed at a negative 0.9% YoY in April. This is the first time WPI has printed negative since July 2020. So, a negative print after almost 3 years. The primary driver of negative WPI is lower commodity prices. Base metals component of WPI for example printed at almost -10% YoY in April.

Now, the WPI inflation is largely irrelevant from an interest rate perspective given that it is the CPI that the monetary policy targets. So, a negative WPI by itself does not signal a deflation or weak economic activity and it does not, ipso facto, warrant a response from the RBI. Nevertheless, the WPI is an important indicator. And that is because WPI is a good proxy for the GDP deflator. As the chart below shows, over the past decade, the YoY change in WPI and the GDP deflator have had a correlation of almost 90%. Given that CPI inflation is also moderating, a negative WPI will imply close to 0% GDP deflator, if not a negative GDP deflator. And that will mean that nominal GDP growth will be equal to real GDP growth, and indeed it could be lower than real GDP growth.

Given the WPI’s trajectory and the base (WPI inflation peaked in May last year and it was in double digits till September), it is quite likely that WPI will remain in negative territory for the next few months. And thus, the GDP deflator will remain close to 0% or even negative for the first two quarters of this financial year. And even for the full year, the WPI is likely to average close to 0% and thus even for the full year, the GDP deflator will be in the low single digits at best.

What this means is that nominal GDP growth for the next few quarters will be close to real GDP growth or even lower than real GDP growth. For the full year FY24, real GDP growth is currently estimated at 6% and thus the nominal GDP growth for FY24 is unlikely to be materially different from 6%. Outside of the pandemic period, nominal GDP growth was last in single digits in the early 2000s – 2 decades back! So FY24 will, in a sense, be an unprecedented year.

And the reason nominal GDP matters is because a fair number of variables that investors track – from corporate revenues to tax collections to exports and imports to debt are all nominal variables. Most of them should moderate sharply over the next few quarters as nominal growth slows. Are the markets prepared for it?

The Government released the provisional merchandise trade data for April. And both exports and imports declined by double digits. As mentioned above, a large part of this decline is simply a reflection of lower inflation – especially in commodity prices. The World Bank’s commodity price index for example is down 25% YoY in April, the 4th consecutive month of decline. But the more interesting part of that data is what is happening with India’s electronics trade.

Electronics exports have continued to increase sharply even as electronic imports are now declining. In April for example, while Electronics exports increased 26% YoY, Imports declined 6% YoY. Electronics imports have now declined for 6 of the last 7 months. Consequently, the net electronic imports have reduced to a monthly average of just under US$4bn so far in 2023, from over US$4bn in 2021 and 2022. Is this the first sign of the tangible benefit of the PLI scheme?

The Life insurance sector continues to struggle. April was the third consecutive month of decline in new business premiums (NBP). Specifically in April, NBP declined 30% YoY with LIC seeing a 50% decline in NBP. This time last year, LIC was doing its IPO and the data thus suggests that there was a bit of growth on steroids around that time. The overall industry had seen an NBP growth of almost 40% YoY during Feb – Apr 2022 with LIC seeing over 50% growth. The decline this year thus is largely due to that high base of last year. Compared to 2021 for example, NBP in the last three months has been in double digits. So, most likely, a false alarm.

Lastly, one of the more interesting data released this week was on monthly remittances under the RBI’s Liberalised Remittance Scheme or the LRS. Remittances in April rose 40% MoM to almost US$3bn, an all-time high. The sequential increase in April was not due to a big jump in foreign travel, but rather due to heads such as overseas investments and deposits, gifts, and transfers to relatives.

With the government increasing the TCS rates sharply (and in some cases levying it for the first time) from the 1st of July, one would expect a big increase in overseas remittances before the higher rates kick in. That would mean a sharp increase in remittances during the current quarter and perhaps the increase in remittances in March simply reflects that, since the change in TCS was announced in February, in the budget.

That’s it for this week! Apart from the exciting things we mentioned at the start of this newsletter, there is not much to look forward to in terms of data release. But we will make sure we have something interesting to talk about. See you next week…