Formalisation, Weak Tax Collections, Improved Auto Sales and more...

This Week In Data #131

In this edition of This Week In Data, we discuss:

June quarter saw record new formal firms register

Tax collections remain weak

Auto sales recover in June

Power Generation declines in June

US labour market continues to remain strong

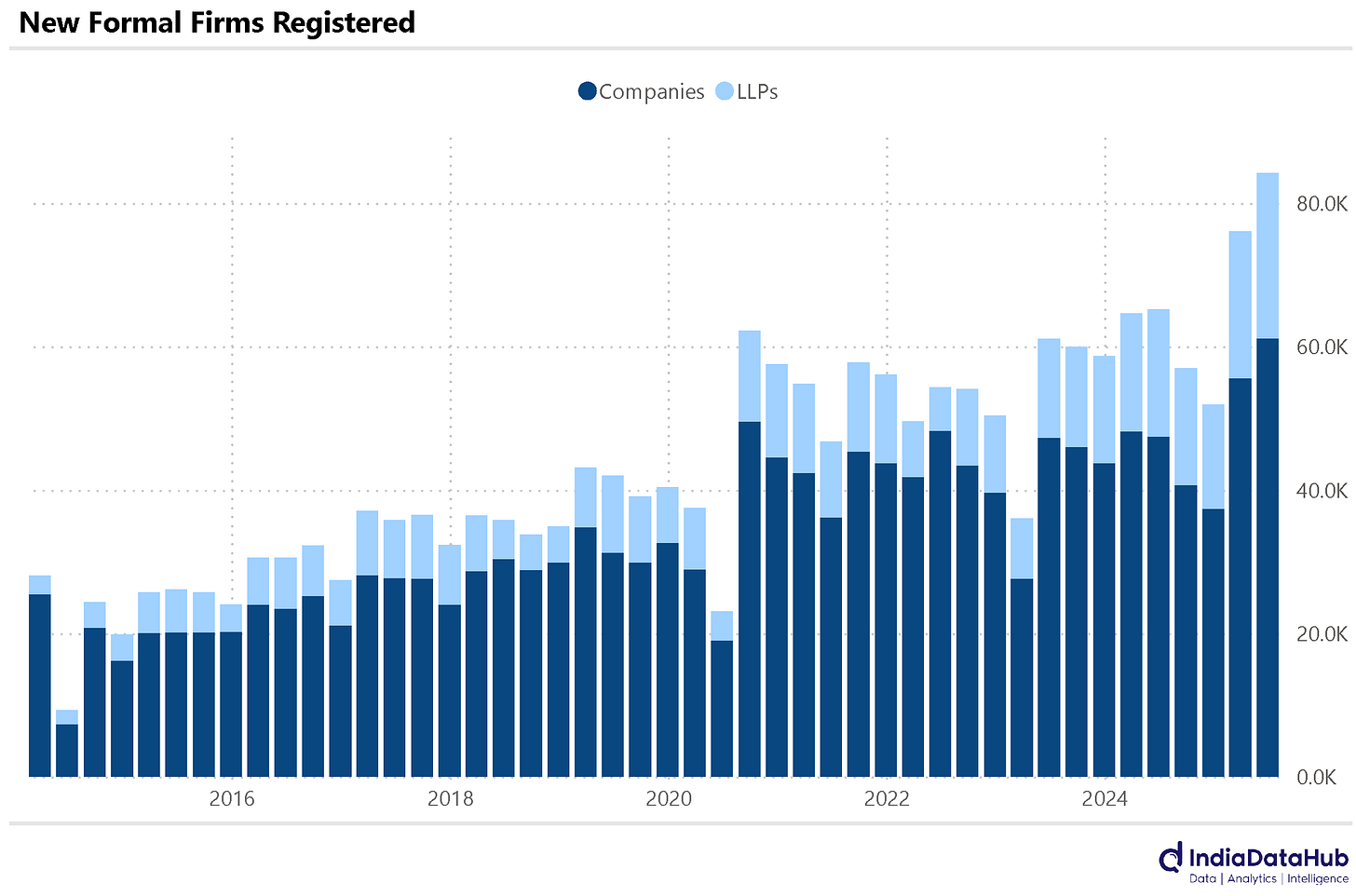

The June quarter of this year has been a record quarter for new company and LLP registrations. A total of 61,139 companies were registered during the quarter, along with ~23,000 LLPs for a total of ~84,000 new formal enterprises. The March quarter had seen ~76,000 new formal firms register, and this is the second highest on record. For reference, the calendar year 2024 has seen just under 240,000 formal firms register, and in just the first half of this year, we have seen over 160,000 firms, or 2/3rds of last year, register.

To set up a new firm requires a certain level of optimism about both the specific business and the general economic environment in the minds of promoters. And the record high number of firms getting registered suggests the optimism is currently fairly high!

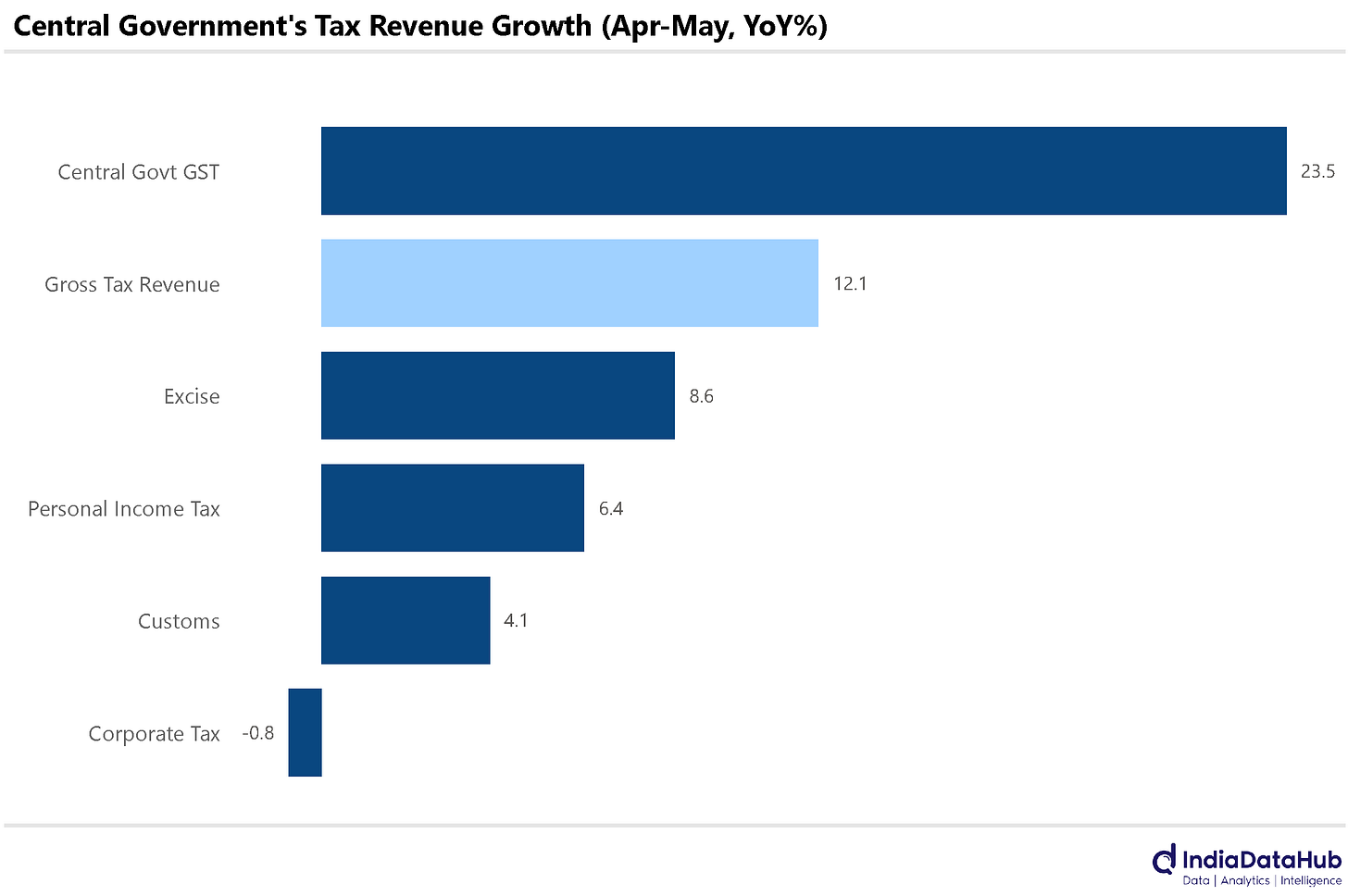

Gross tax collections grew by a healthy 12% YoY during April-May. This was, however, largely driven by GST collections. Customs collections grew in low single digits, and Excise collections also grew in high single digits. Corporate tax collections declined, and Income Tax collections grew in mid-single-digits.

Income tax collections would remain soft in the next few months. The significant enhancement of tax slabs has kicked in from April, and the due date for filing tax returns has been extended to September 15th (from July 31st). So, on a YoY basis, the data will most likely continue to remain soft for another couple of months.

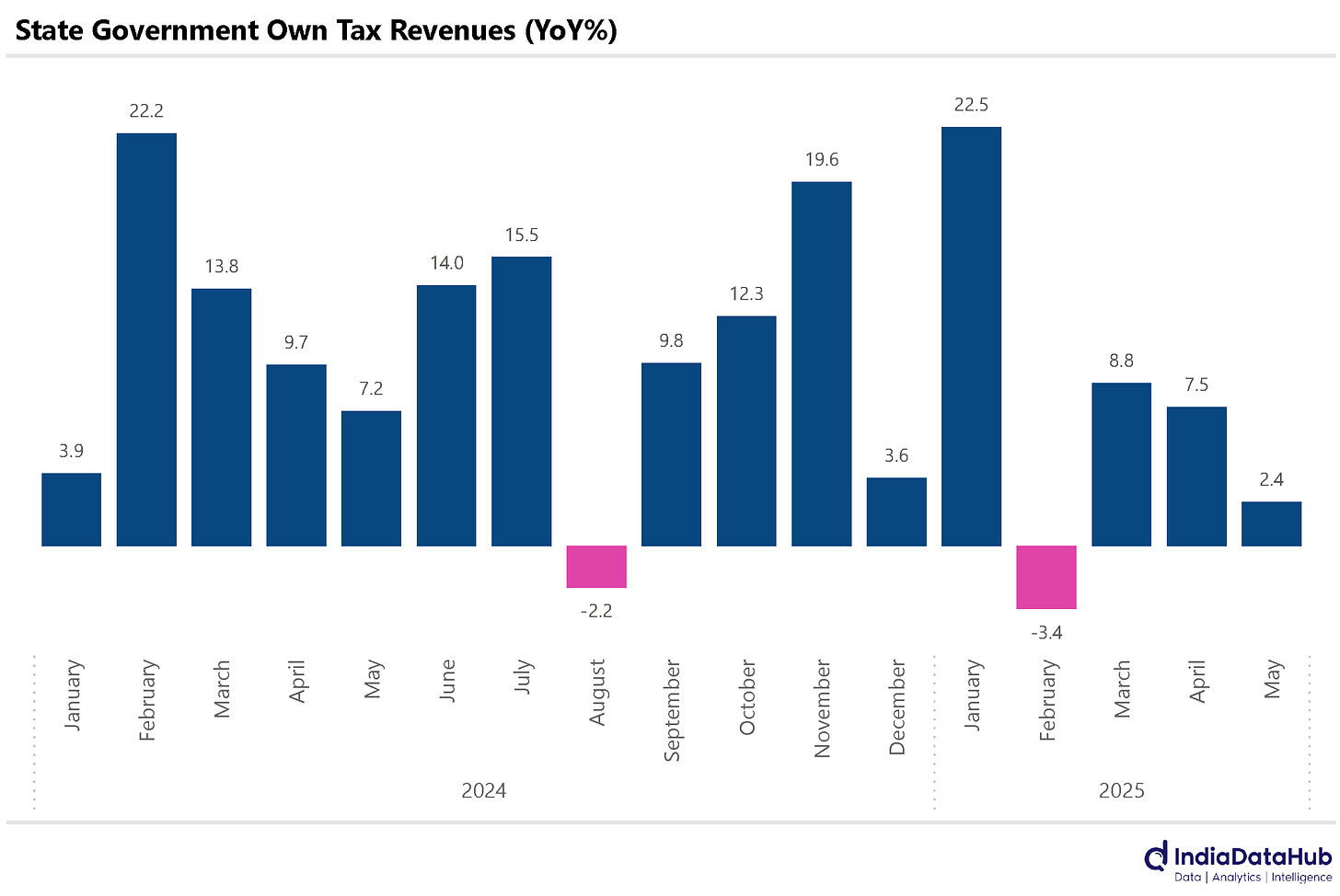

In contrast to this, the own tax revenues of the states have grown by a modest 5% YoY in the first two months of the year, with GST collections for States growing by just 1% YoY. This divergence most likely simply reflects the timing difference in the settlement of IGST. This drag from GST has, however, been partially offset by strong growth in stamps and registration fees (a crude proxy for real estate). Collections from stamps and registration fees have grown by ~12% in the first two months of the year, as against a 9% growth in the full year FY25.

Given that GST collections overall are slowing down – data for June shows collections grew just 6% YoY – the broad takeaway is that tax collections have got off to a soft start in FY26.

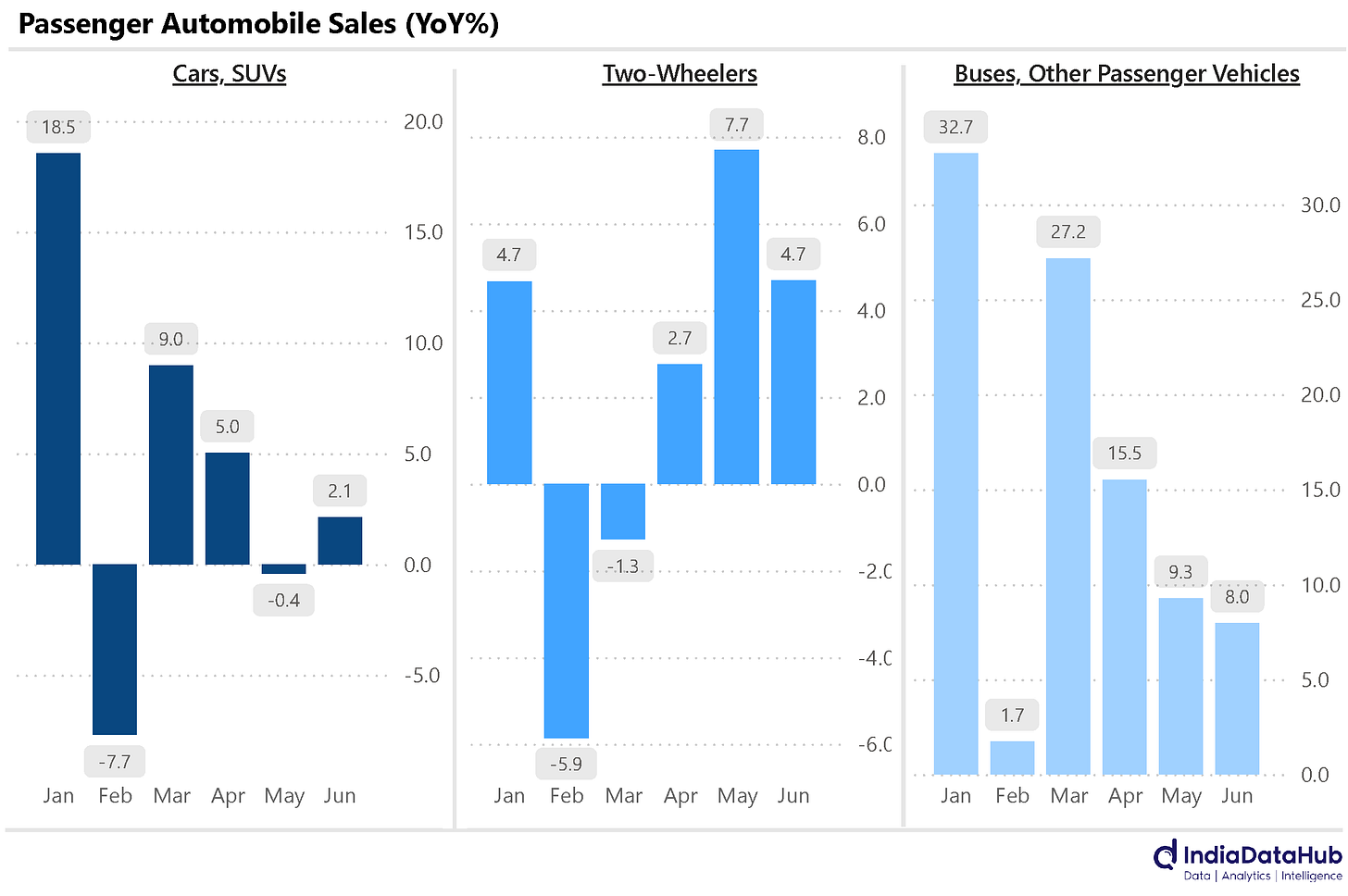

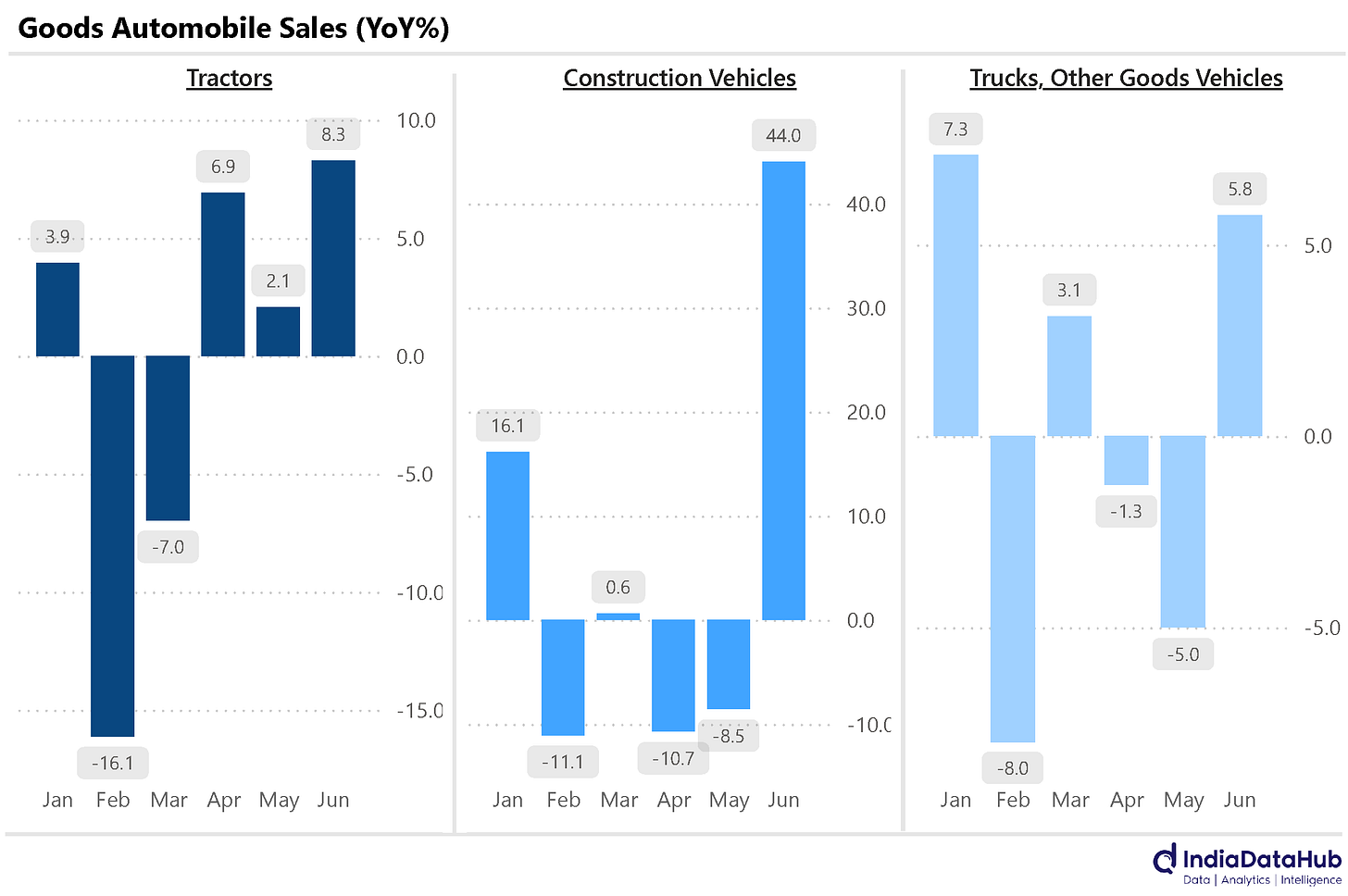

June saw a clear improvement over May for most automobile categories, especially in construction and commercial vehicle segments. Construction Vehicles witnessed a sharp turnaround, recovering from a significant decline of -9% in May to a strong 44% YoY growth. Trucks & other Commercial Vehicles saw a shift from a contraction of 5% in May to moderate growth of 6% YoY in June.

Sales of Cars & SUVs, however, saw only a modest recovery from -0.4% in May to 2% growth in June. Sales of 2Ws saw a moderation in growth from 8% in May to 5% in June. Tractors continued to maintain an upward trend, with sales growth improving from 2% in May to 8% in June.

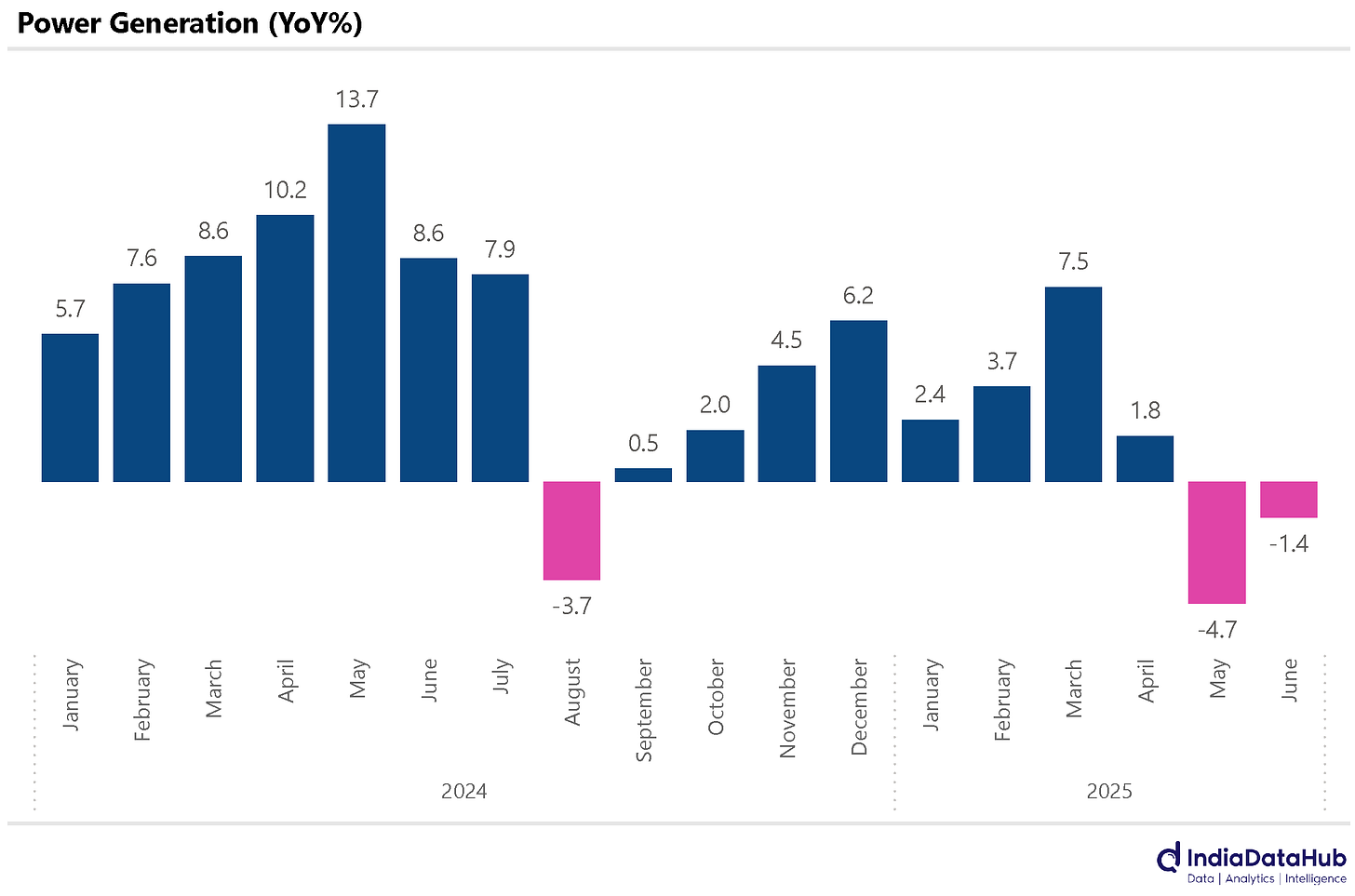

Power generation declined 1% YoY in June, the second consecutive month of decline. Power generation had declined by 5% in May. For the quarter, power generation declined by 1.5% YoY, the first decline since the start of COVID-19 in 2020. Renewable power generation continues to see strong growth, and in June, almost 19% of power generated came from renewable sources. In June 2024, the share of renewable power was just 14%.

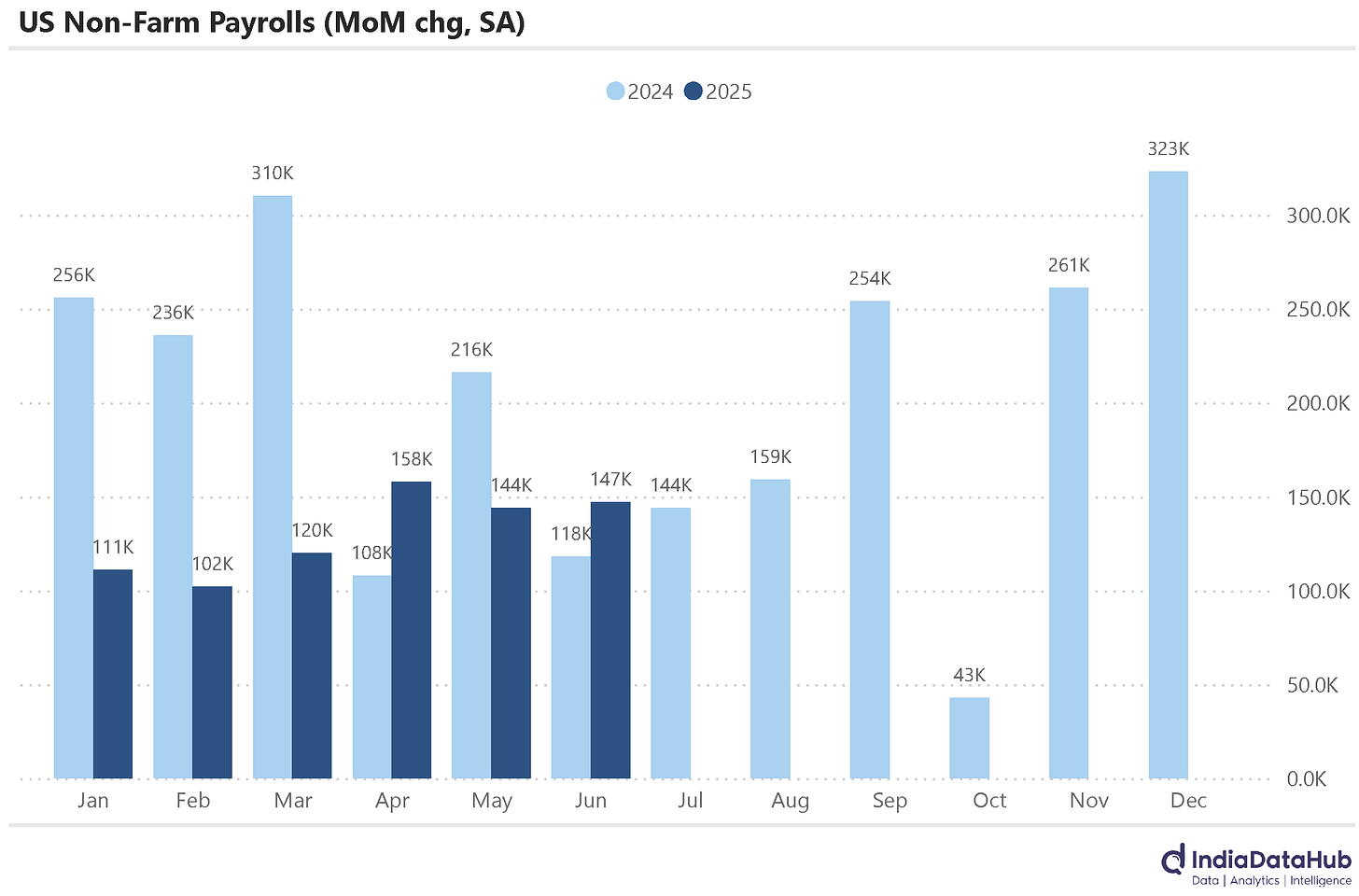

Lastly, the US Bureau of Labour Statistics (BLS) released non-farm payroll data this week. The US economy added 147,000 jobs in June, higher than the 144,000 jobs added in May. Job gains occurred in state government and healthcare, while the federal government continued to lose jobs.

Additionally, the payroll growth for April was revised up by 11,000, and for May by 5,000. Consequently, the job growth during the June quarter this year has been modestly higher than the June quarter last year. So all in all, another month of reasonably strong job growth in the US.

That’s it for this week. See you next week…