FY26 GDP, Sharp slowdown in Equity folios, Multi-year low US Trade deficit and more...

This Week In Data #151

In this edition of This Week In Data, we discuss:

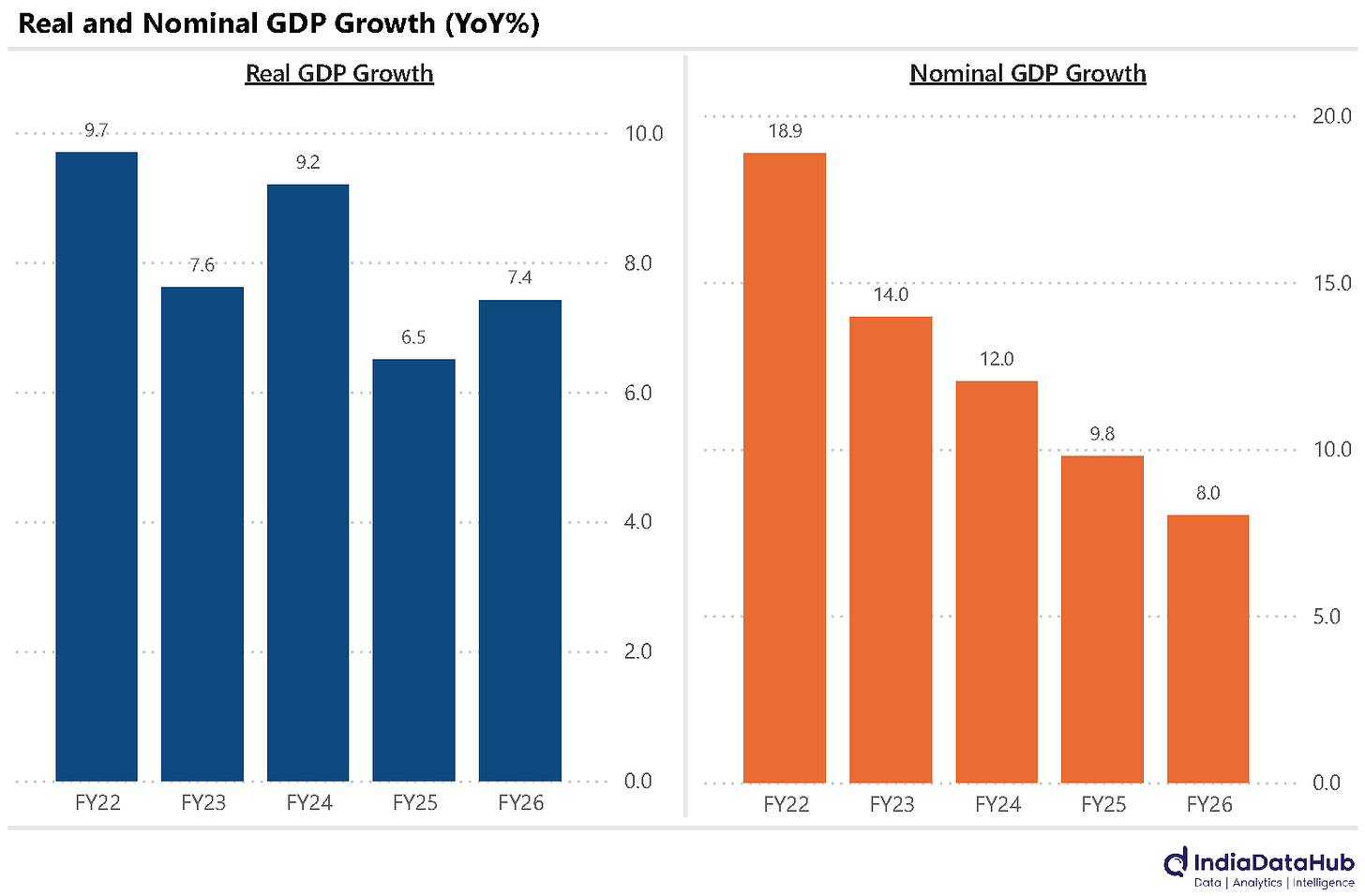

India’s GDP Growth is expected to accelerate to 7.4% in FY26

Nominal GDP growth will however slow to multi-year low

Why GDP growth does not matter!

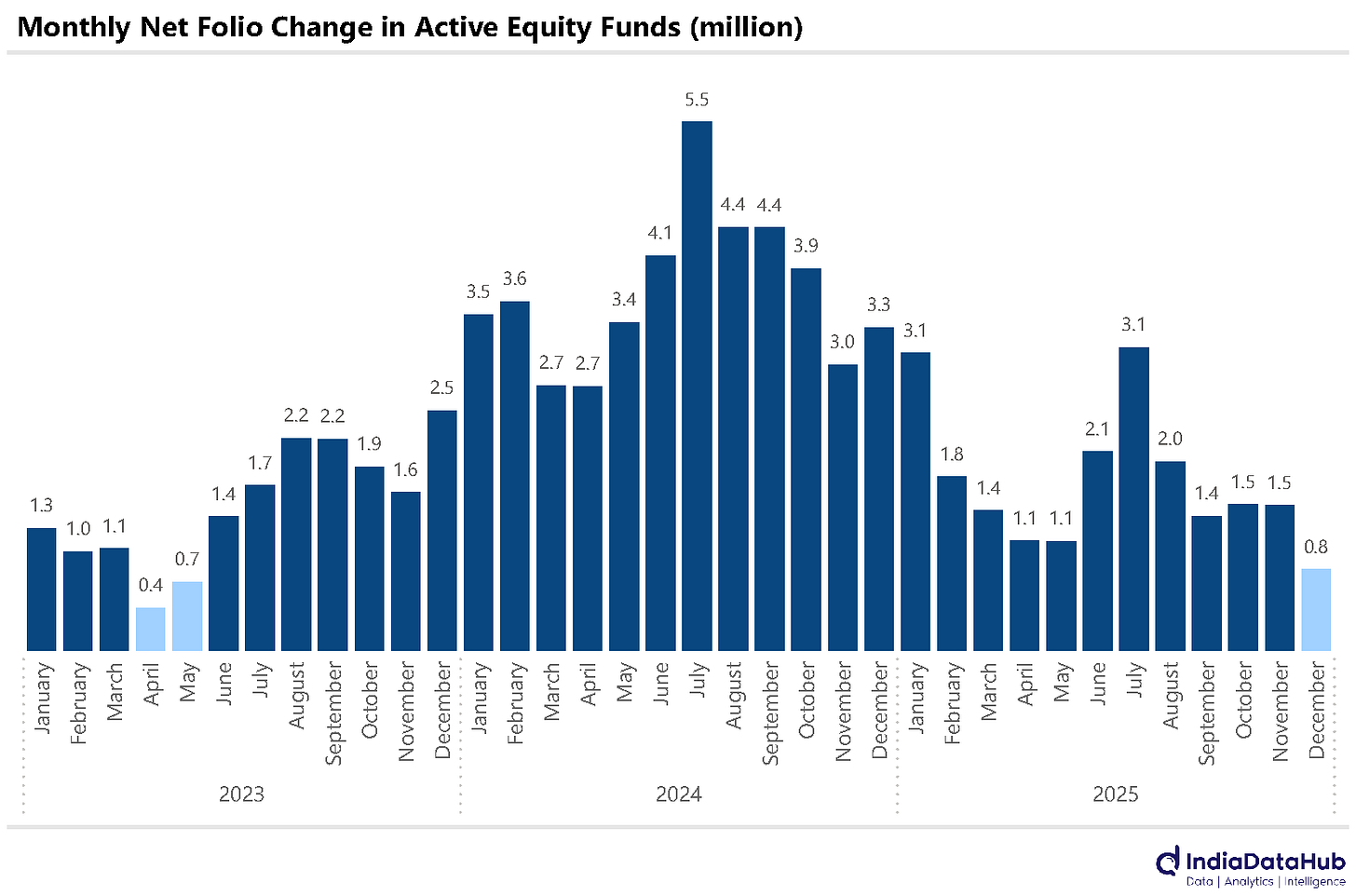

Domestic Equity funds continue to see strong inflows but folio additions has slowed down dramatically

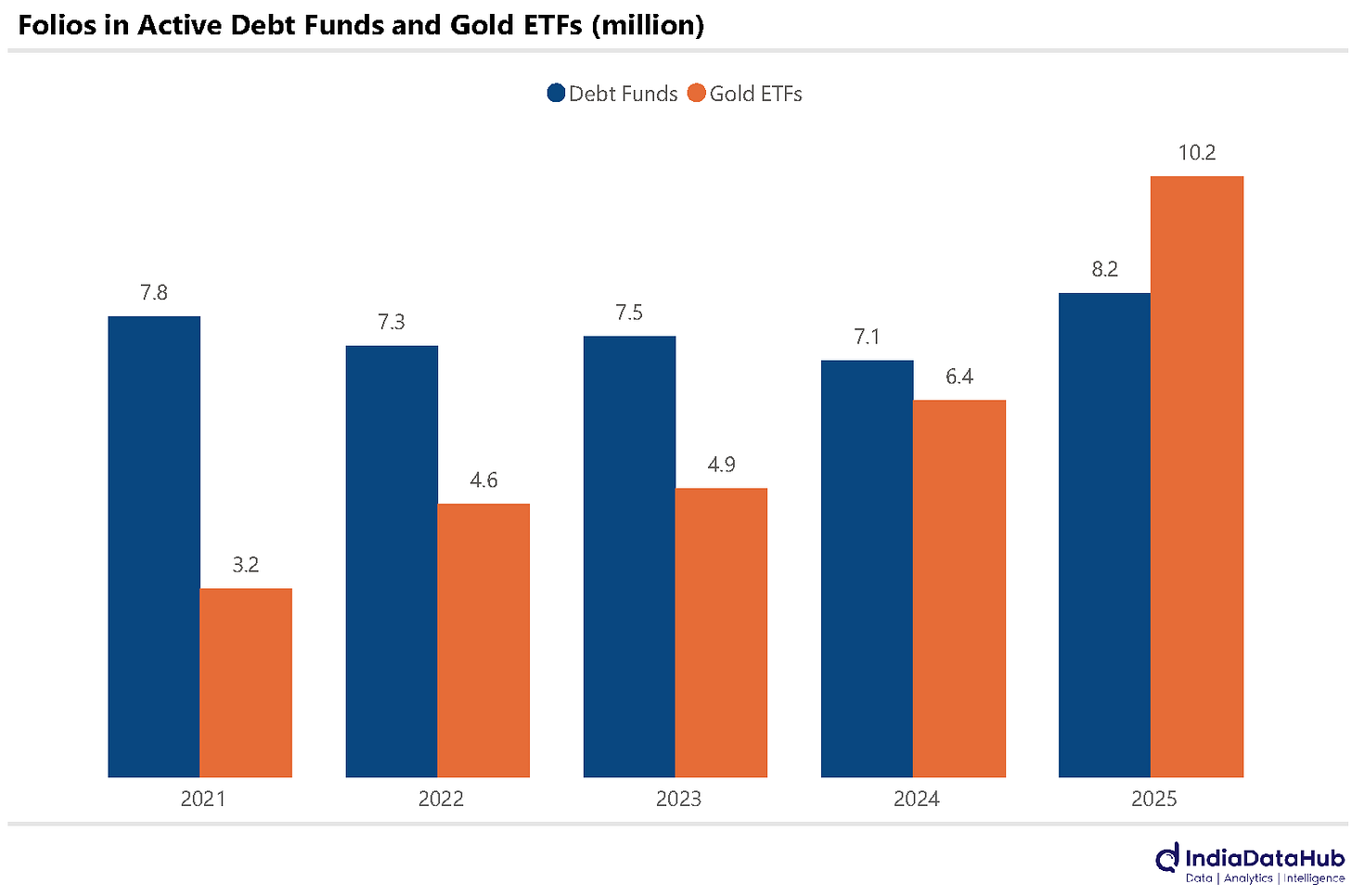

Debt funds have seen recovery in folios but have been overtaken by Gold funds

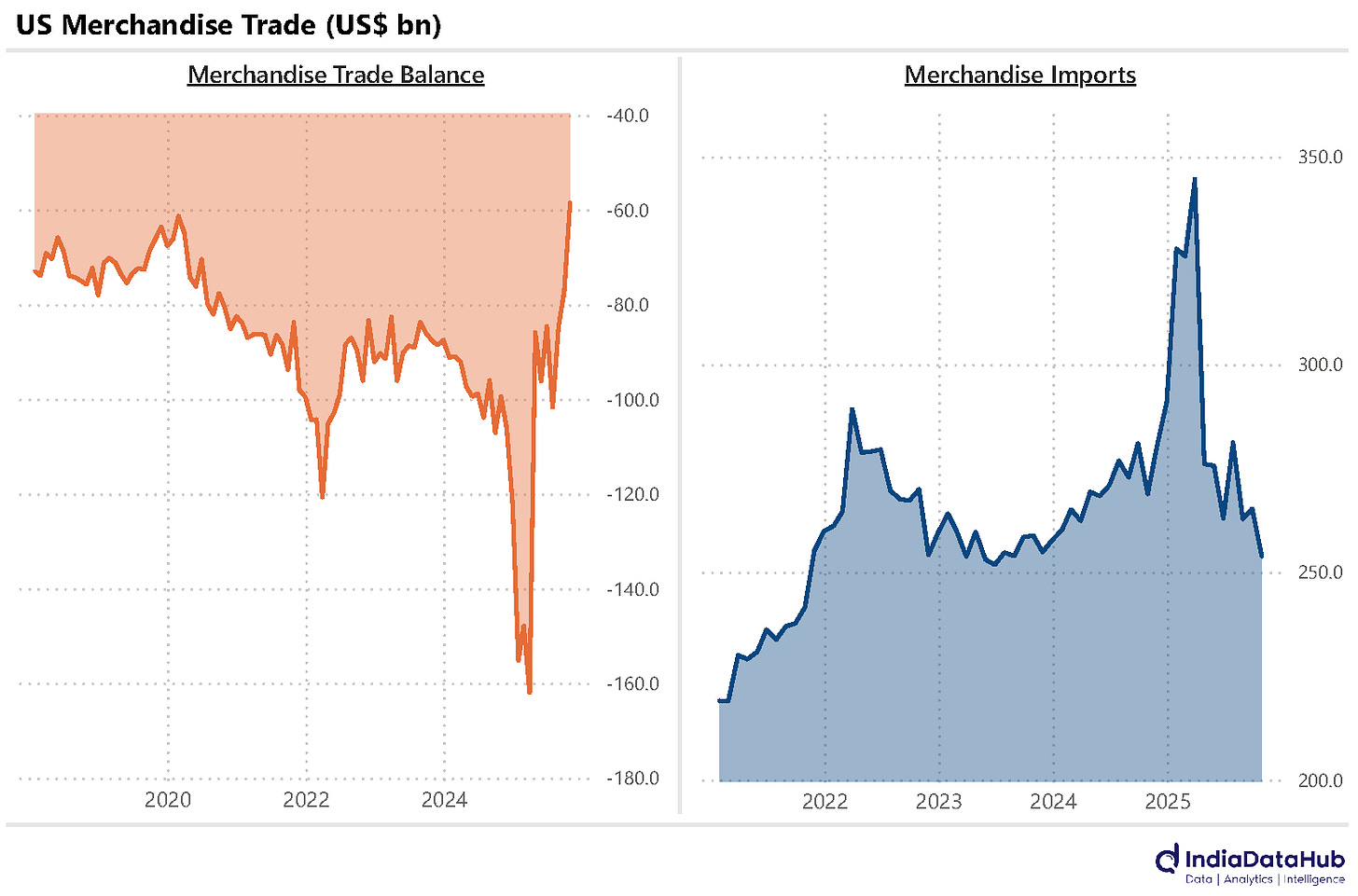

US Trade deficit falls to multi year lows in October as Imports shrink

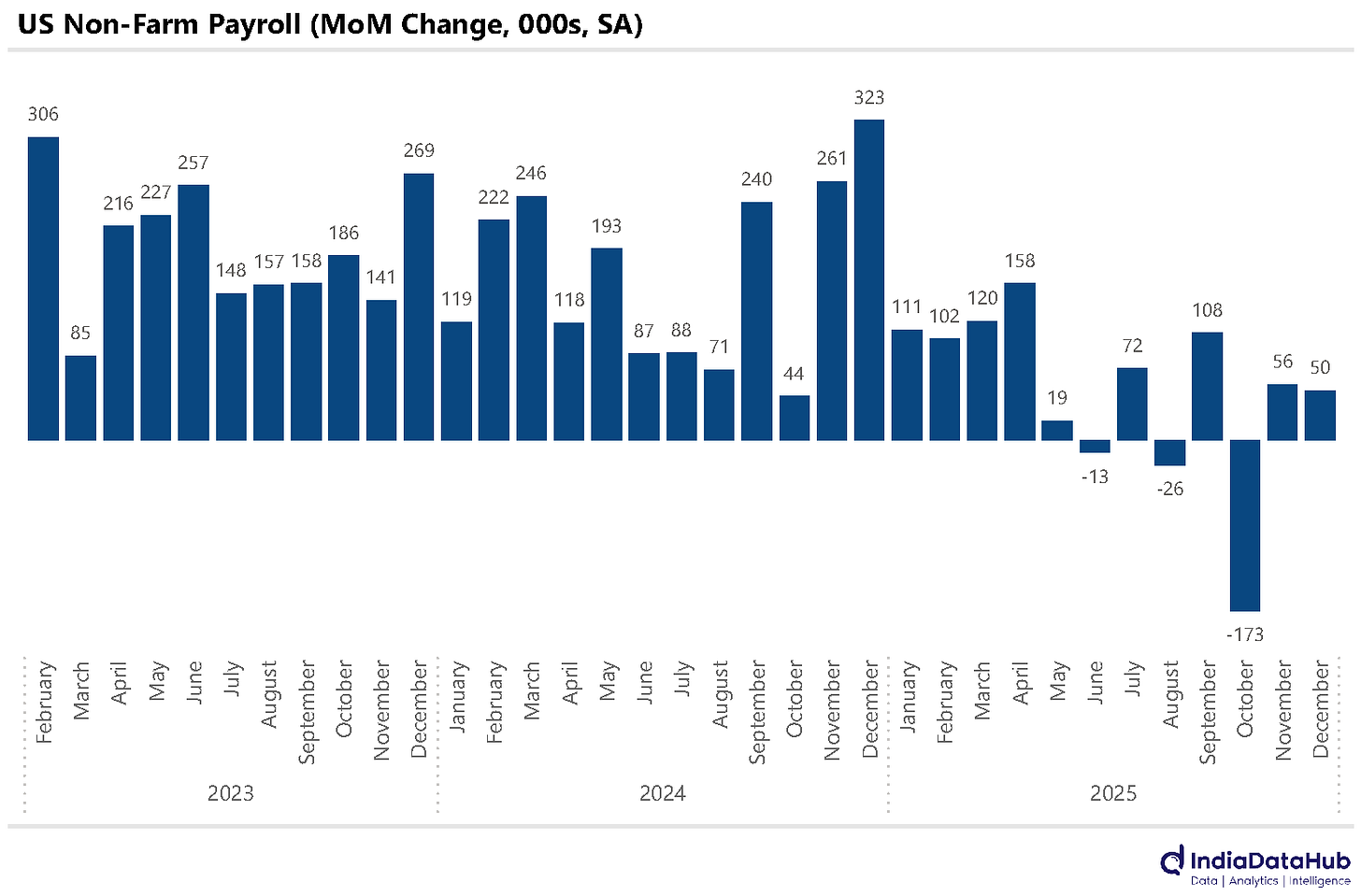

US labour market has softened considerably in last few months

According to the First Advance Estimate (FAE), annual real GDP is projected to grow by 7.4% in FY26, up from 6.4% in FY25, and is expected to surpass ₹200 trillion in FY26, compared to a provisional estimate of ₹187 trillion in FY25. Notably, nominal GDP for FY26 is estimated to grow at just 8% YoY, the slowest growth in the last few years, implying an economy-wide inflation or the GDP deflator of less than 1%.

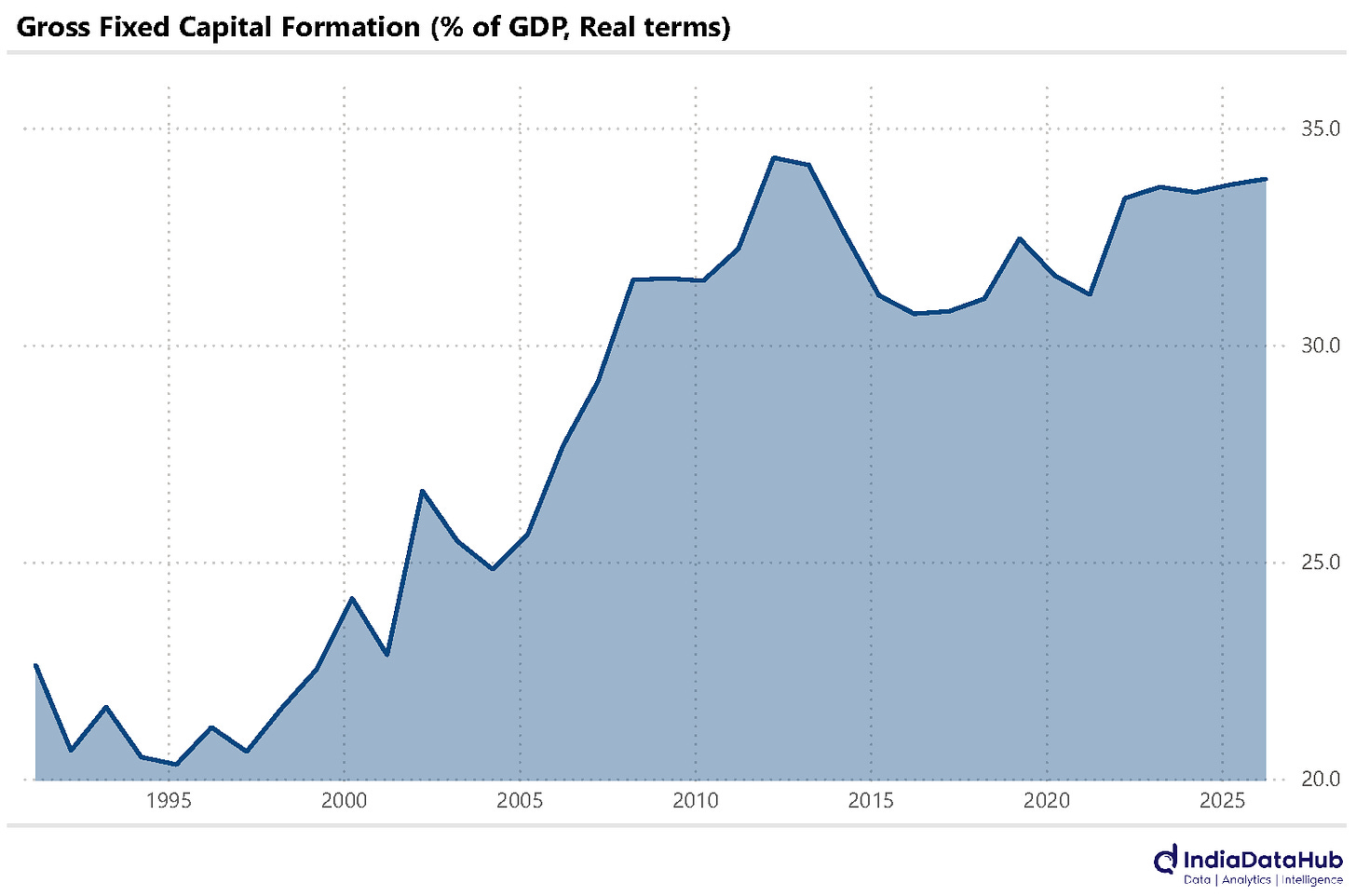

Real GVA is expected to grow by 7.3% YoY in FY26, higher than the 6.4% growth in FY25, so there is not much divergence between GDP and GVA growth. And internally, the growth drivers are expected to be fairly strong: the Services sector growth is expected to rise 190bps to 9.1% in FY26, while the Manufacturing sector is likely to see growth accelerate by 250bps to 7%. This will be offset by a moderation in the Agriculture sector to 3.1% (still reasonably strong) from 4.6% and in sectors like Construction and Electricity. And capex is expected to remain strong. The share of Gross Fixed Capital Formation in GDP is expected to rise further to a multi-year high of almost 34%. So much for the constant complaining about the lack of investments in the economy.

The big picture though is that the first advance estimate of GDP for FY26 is largely an irrelevant number. This is because by the time it is time for the second advance estimate of GDP to be published, at the end of February, we would migrate to the new GDP series with 2022-23 as the base year. And as is generally the case, when there is a shift of base year, there is likely to be a significant change in both the actual GDP number and its recent growth trajectory. So it is best to completely ignore this growth number and wait for the new series to start flowing in, and interpret the data and its implications.

Inflows into domestic equity funds continue to remain strong. December saw net inflows of ₹280bn, broadly the same pace as in the previous 3 months. That said, the breadth of inflows has narrowed quite significantly. The number of net new folios fell to below 1 million in December 2025, the lowest number since May 2023 and down more than 80% from the peak of almost 5.5 million net folios being added in July 2024.

Even as Equity funds have seen a massive slowdown in folio addition, debt funds have seen a pickup. In 2025, for instance, all debt funds saw the number of folios increase by over 1 million, after a cumulative decline of almost 0.8 million in the preceding 3 years. Most of this increase has happened in liquid funds, while the longer-duration funds have seen a decline.

Gold ETFs, though, have seen the strongest growth in folios in recent months. In the last 2 years, the number of folios in Gold ETFs has more than doubled, and as a category, they have more folios than all debt funds put together!

The U.S. goods trade deficit narrowed sharply in October, falling $18.6bn month-on-month to $58.6bn, and to its lowest level since 2019! This happened as imports dropped to their lowest level since June 2023, declining 5.5% YoY in October. Specifically, the consumer goods imports declined to their lowest since June 2020.

And on the other hand, exports rose to an all-time high, driven by record high exports to countries such as the UK, Switzerland and India. This data, though, pertains to October, so it is a bit dated (and running behind the normal publication schedule due to the still lingering impact of the recent Government shutdown).

Even as the trade data remains strong, the labour market data has markedly weakened. The US economy added 50,000 non-farm payroll jobs in December, a sharp slowdown compared with the 323,000 jobs added in the same month last year. Job gains for October and November were revised downward by a cumulative 76,000, with October revised to a loss of 173,000 jobs and November revised to a gain of 56,000. Effectively, the US economy has seen job losses in the last quarter of 2025, the first quarter of job losses since the pandemic. This is a significant deterioration in the US labour market. Will this change the Fed’s stance and drive a significant monetary easing in the US? The markets are not yet suggesting an imminent change.

That’s it for this week. See you next week…