GDP Growth, Effective interest rates, Recovery in services exports, Tax collections and more...

This Week In Data #45

In this edition of This Week In Data, we discuss:

Strong GDP growth for the September quarter

Lending and deposit rates of banks

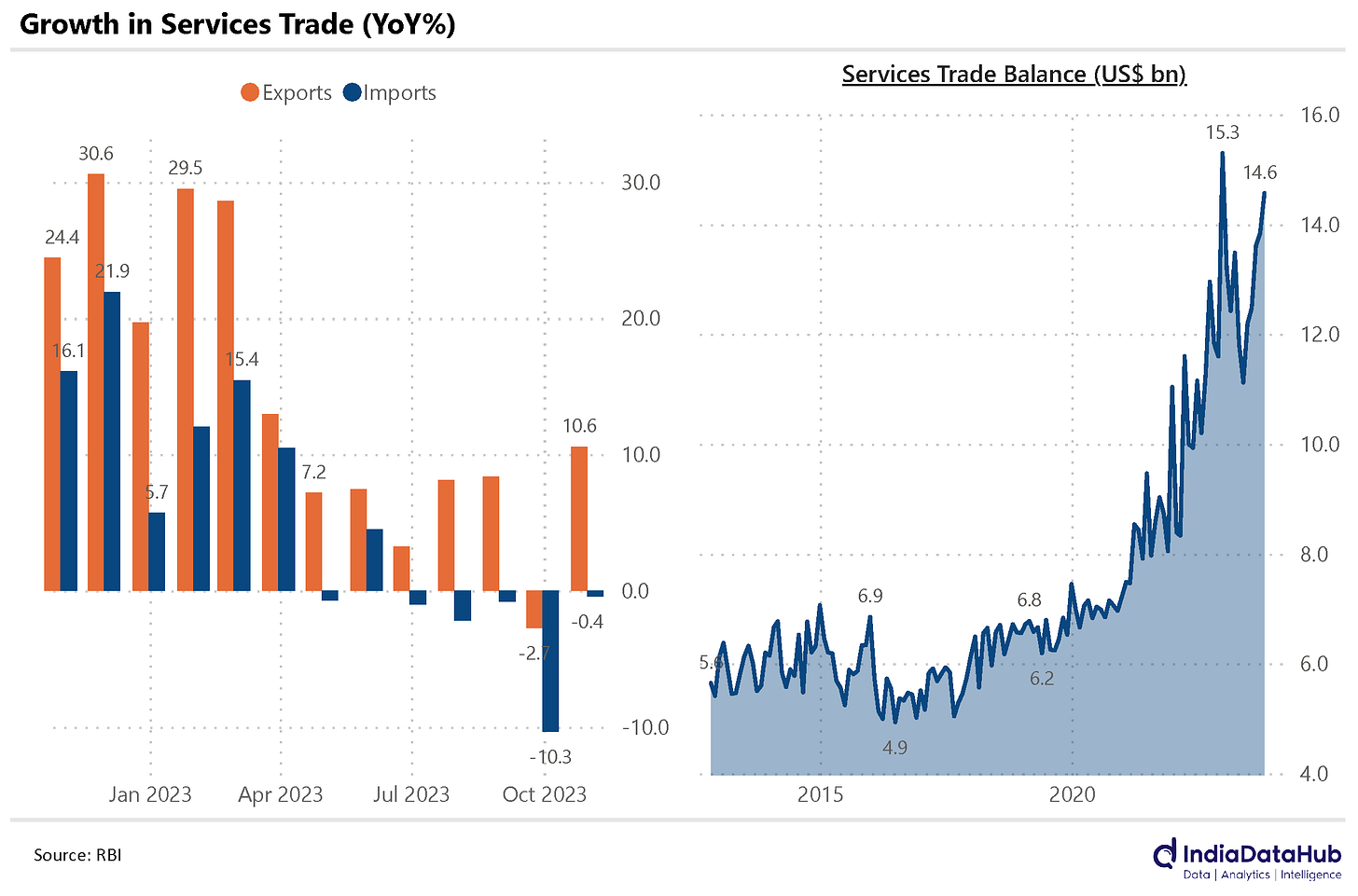

Recovery in services exports while imports continue to decline

Decline in tax collections in October after two strong months

Strong GST collections in November

In case you missed, we have revamped how search works on IndiaDataHub. You can now do free text search that allows searching for data across categories, and you can narrow by various filters such as category or frequency or tags. The category search is also redesigned, and, in both cases, you can now see the period for which data is available. Additionally, you can now lookup multiple indicators at the same time, and we have also enabled tabular view of the data in addition to graphical view! See this video for a quick rundown…India’s GDP grew 7.6% YoY during the September quarter, only modestly lower than the 7.8% growth in the preceding quarter. This was much higher than the market expectation. Also, this is the second consecutive quarter of close to 8% real GDP growth. Outside of the pandemic-driven recovery, this is the highest since 2018. So, it was a strong number. This will result in analysts upgrading their growth estimates for the remaining two quarters of the year and consequently also for the full year FY24. The current consensus estimate is for FY24 GDP growth to be just under 6.5%, it is quite likely that the full-year FY24 GDP growth estimates could now be closer to 7%.

The 7.6% GDP growth for India during the September quarter compares to just under 5% GDP growth for China and Indonesia. Among the emerging economies, only the Philippines has seen above 5% growth. Among the Developed economies, the US has seen 2.9% growth in GDP growth during the September quarter while the Euro area has seen just 0.1% growth. So, India’s economic performance stands well and truly above pretty much the entire rest of the world.

The RBI has been on a pause since February of this year when it last raised rates. And it is expected to remain on pause for at least another quarter or two. Since it began policy tightening in April last year, the RBI has raised the policy rate by a cumulative 250bps. But the policy rate of the RBI is in a sense abstract – it is not the rate at which borrowers can get a loan nor the rate at which savers can earn on their deposits. What matters is the real economy and given that the monetary side of the Indian economy is predominantly bank-driven, what matters is the lending and deposit rates of banks.

From the bottom, the term deposit rates of banks (on fresh loans) have also seen a ~250bps increase – from 3.8% at the end of 2021 to 6.3% as of October this year. But lending rates (on fresh loans) have increased by a lesser quantum (~200bps) – from 7.5% in April last year to 9.5% in October this year. This divergence reflects the faster growth in credit relative to deposits which have in a sense forced banks to shore up deposits by offering higher rates. Bank spreads have this narrowed – which is what one would expect during monetary tightening. But both lending and deposit rates have stabilised at current levels in the last few months and thus the interest rate cycle has stabilised. So, unless the mismatch between credit and deposit growth rates increases further, we’ve sort of hit a plateau in terms of effective interest rates in the economy as well.

After a decline in September, India’s services exports rose 10% YoY in October even as imports declined for the fifth consecutive month (albeit modest 0.4%). Consequently, the services trade surplus rose by over 20% to over US$14bn, the second highest on record.

Recall that October had seen the highest merchandise trade deficit on record at over US$30bn. So part of the reason why the currency did not wobble much was because the higher goods deficit was partially offset by higher services surplus.

After 2 months of strong growth in tax collections, October saw a decline in the Central Government’s tax revenues. This was largely due to a double-digit decline in corporate tax collections. But October is not a seasonally strong month for tax collections, so this does not impact the full-year trend significantly. Thus despite the decline in October, over the past three months growth in tax collections has averaged 27% YoY which is very strong.

This decline though was offset by a mid-teens decline in central government expenditure. Consequently, the fiscal deficit declined in October and thus the full-year fiscal deficit number remains on track.

GST collections grew almost 16% YoY in November. This is the highest growth since October last year. Given that GST is paid with a lag of one month, the collections in November reflect the business activity in October. So the impact of the festival demand on tax collections will be seen in next month’s collections. But both October and November have seen strong growth and thus this is another indicator of strong domestic consumption trends, at least in aggregate.

That’s it for this week. RBI policy meet is scheduled for the next week. This will most likely turn out to be a non-event since no change in policy rates is likely. And given the uptick in vegetable prices recently, the policy stance, the hawkish pause, is also likely to be continued. But we shall see…

This week saw the passing away of one of the great intellectuals of our time. Enough and more has been said about Charlie Munger, that there is not much left for us to add. But we do have a recommendation – take a look at the Charlie Munger manifesto by our friend Vishal Khandelwal of SafalNiveshek here. If you like it, and we are sure that you will, take a print and put it on your desk. It will be a useful companion whether you are into investing or not. Or better still, pick up the Poor Charlie’s Almanack. So long, Charlie...