GDP Growth, House Prices, Record US Trade Deficit and more...

This Week In Data #114

In this edition of This Week In Data we discuss:

GDP Growth recovers during the December quarter, but only modestly

Full year FY25 GDP growth likely to see a miss

House price growth slows down to 2-year low

Corporate tax collections decline in Jan, but personal tax collections rise sharply

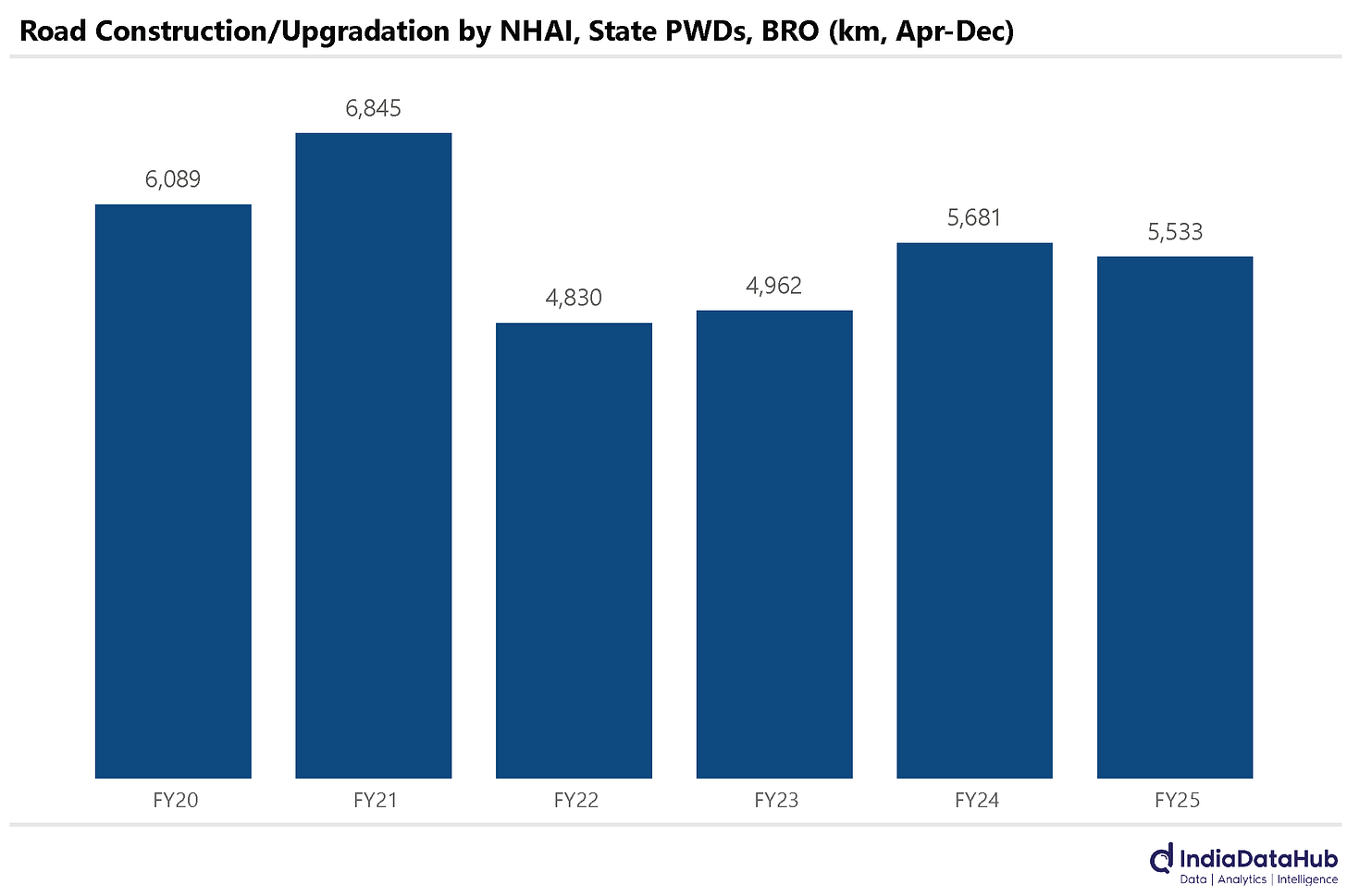

Road construction activity is subdued this year

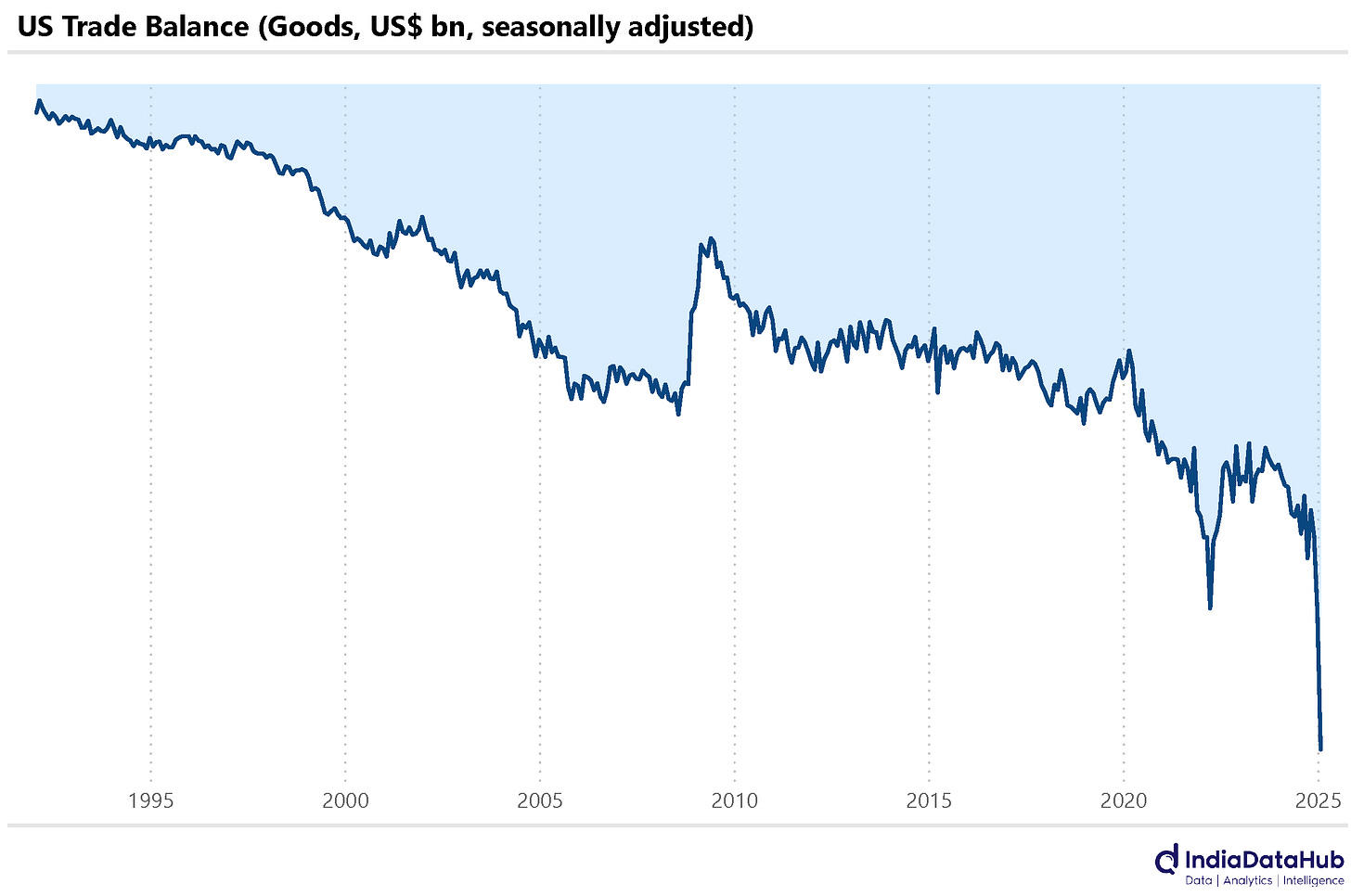

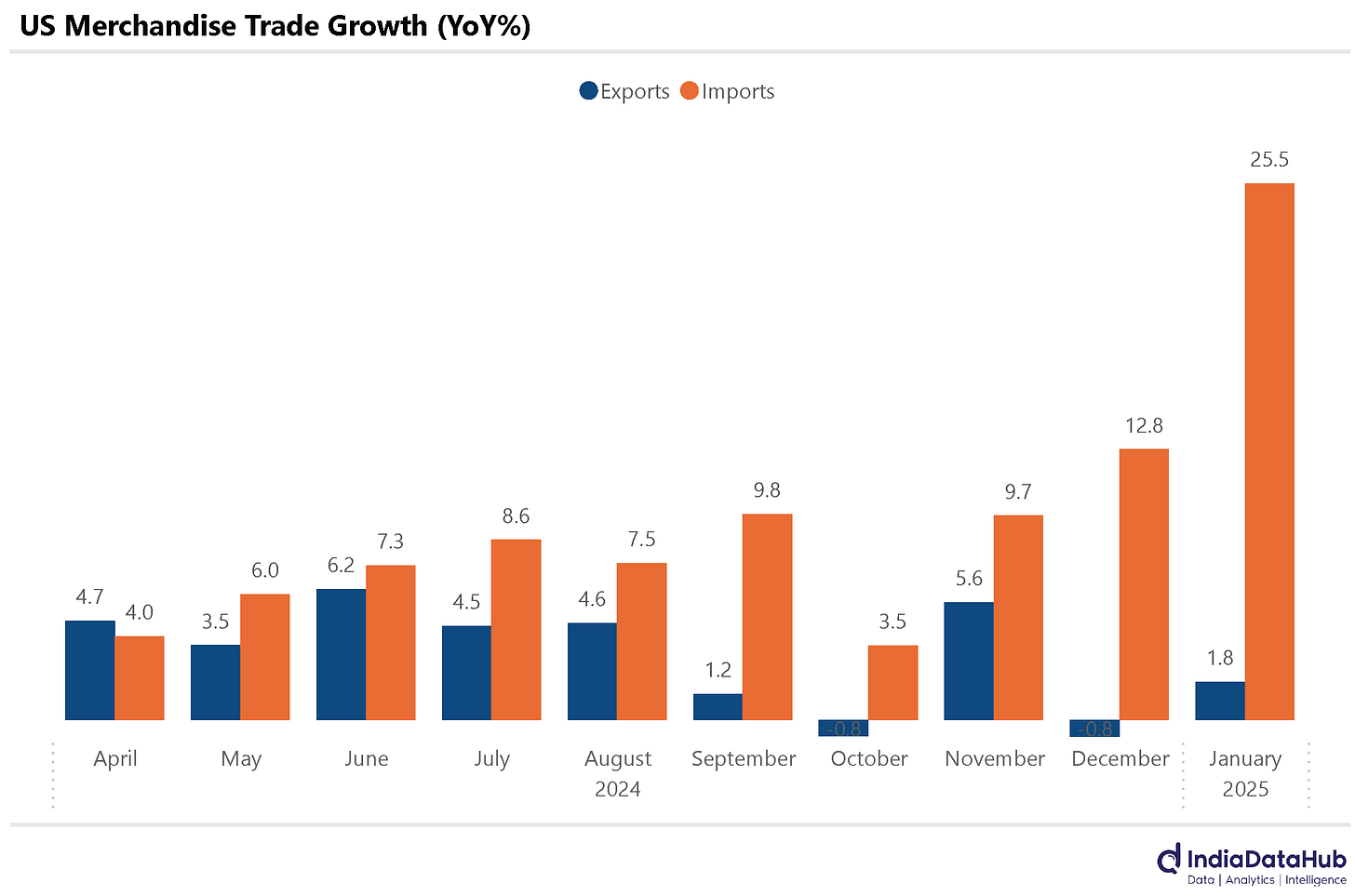

US Imports rise sharply pushing trade deficit to record high

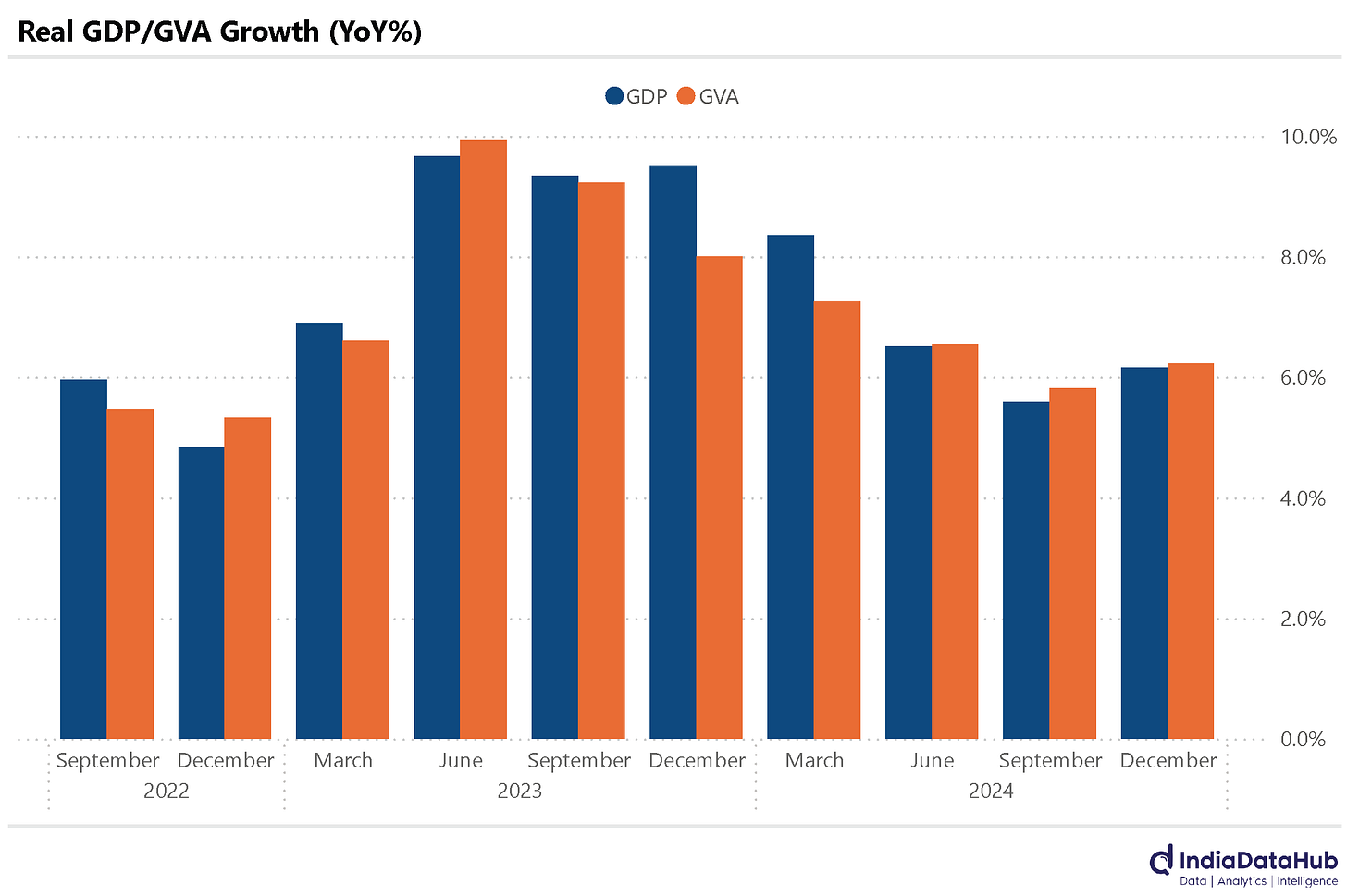

India’s GDP grew 6.2% YoY during the December quarter. While this is slightly above the 5.6% growth during the September quarter, it is still below the growth reported in the preceding few quarters. The picture is similar on the GVA side. Growth accelerated 40bps to 6.2% YoY during the December quarter but remained below that in the preceding few quarters. So a modest uptick in GDP growth, whichever way one looks at it, but that’s about it.

Along with the December quarter GDP data, the CSO also released the second advance estimate of GDP growth for the full year FY25. And the CSO now expects growth to come in at 6.5% YoY. While this sounds reasonable, it still implies that GDP growth ought to accelerate to over 7.5% during the current quarter. This suggests that the full-year FY25 GDP growth estimate is likely to come in slightly below 6.5% as things stand now. So, the December quarter data is also unlikely to drive any meaningful upgrades to the full-year GDP growth estimates. More importantly, the 6.5% growth itself is slower than the average growth in the last decade (which was closer to 7%).

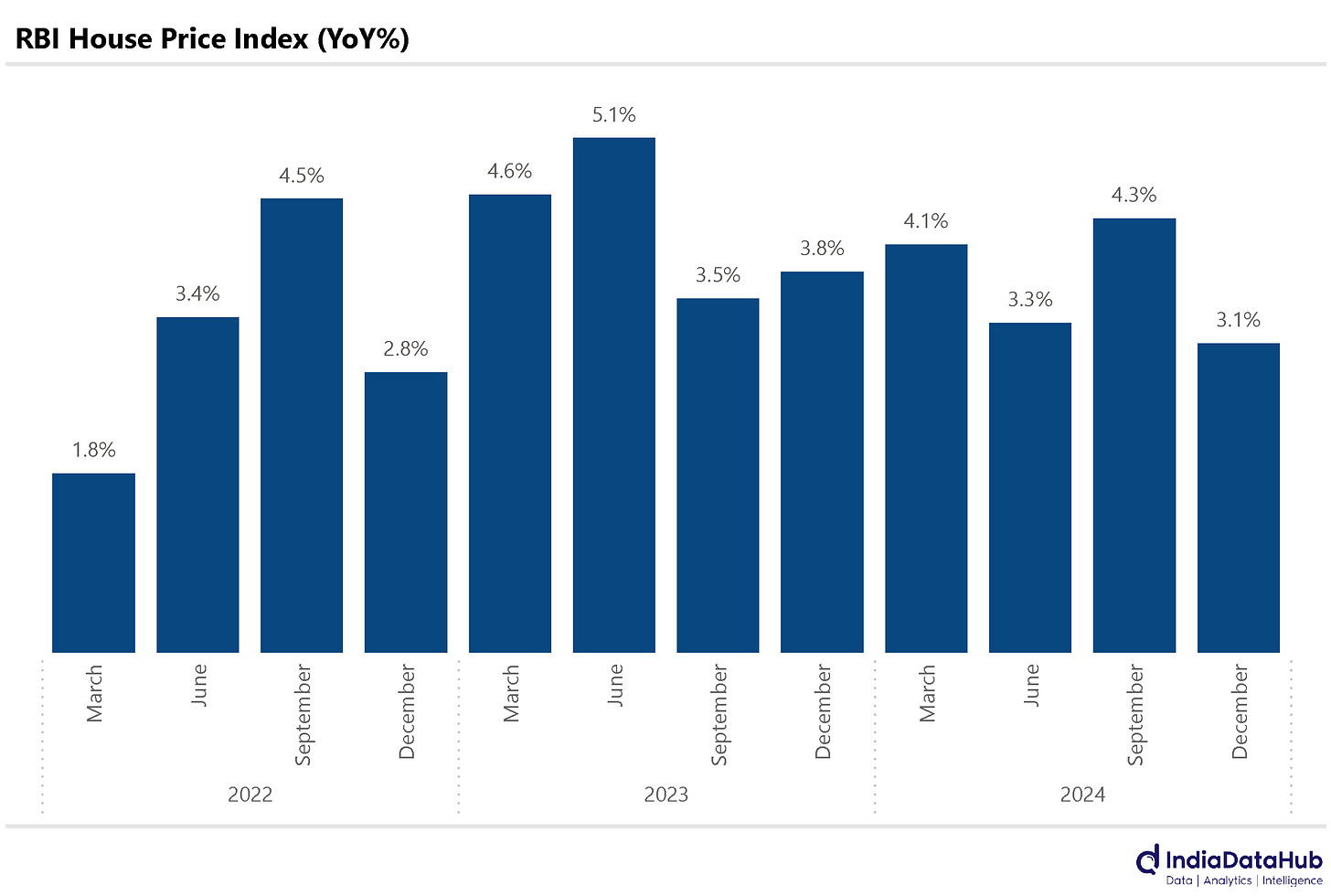

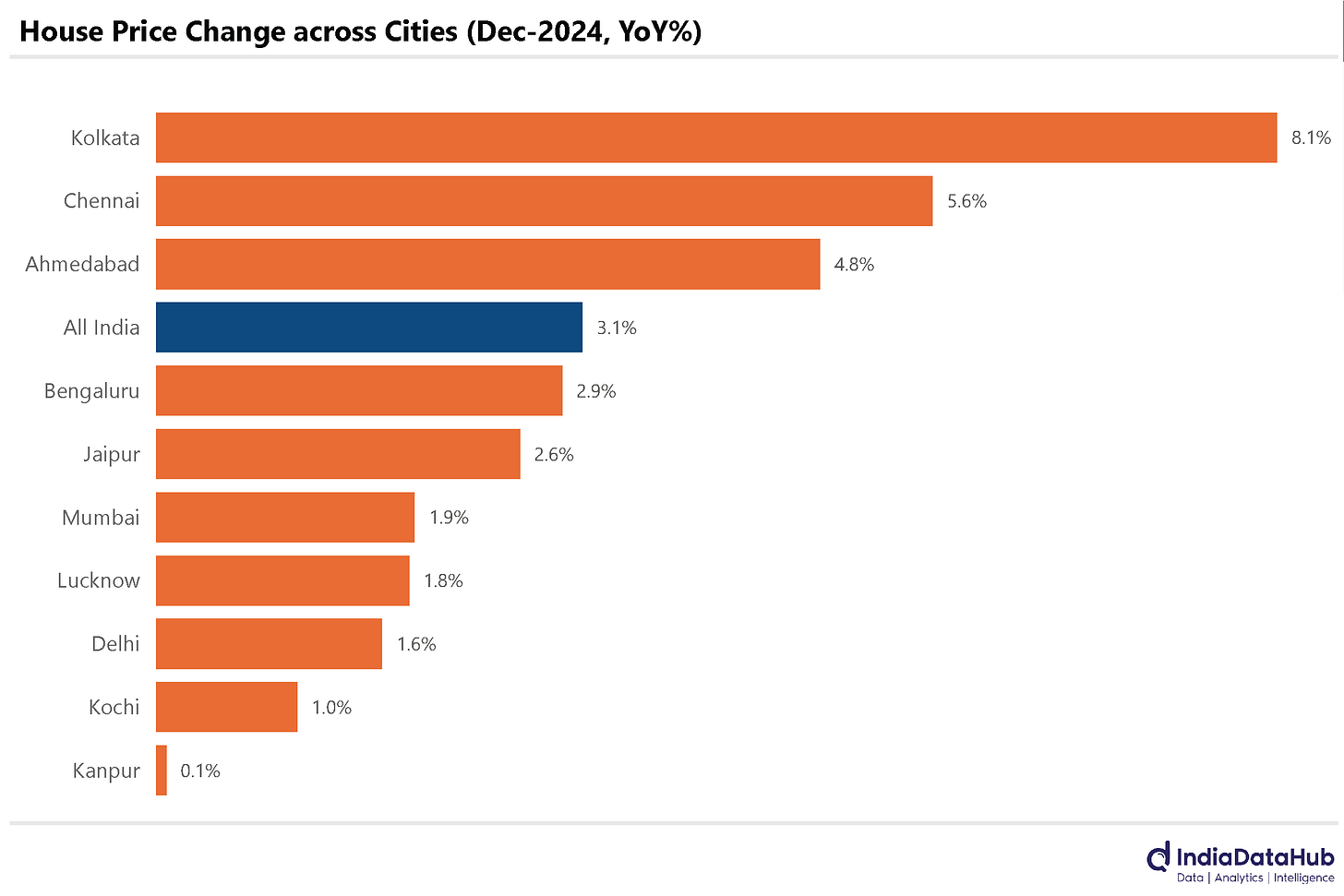

House prices in the 10 major cities grew by 3.1% YoY during the December quarter. This is the slowest growth in the last 2 years. Kolkata has seen the strongest growth in house prices at 8% followed by Chennai at 6%.

House prices have grown by an average of 3-4% in the last few years which is well below the rate of inflation. Effectively, real returns on house property (excluding rental yields) have been negative. Assuming a 2-3% net rental yield (net of expenses), property prices have barely generated any real returns in the last few years, going by this data.

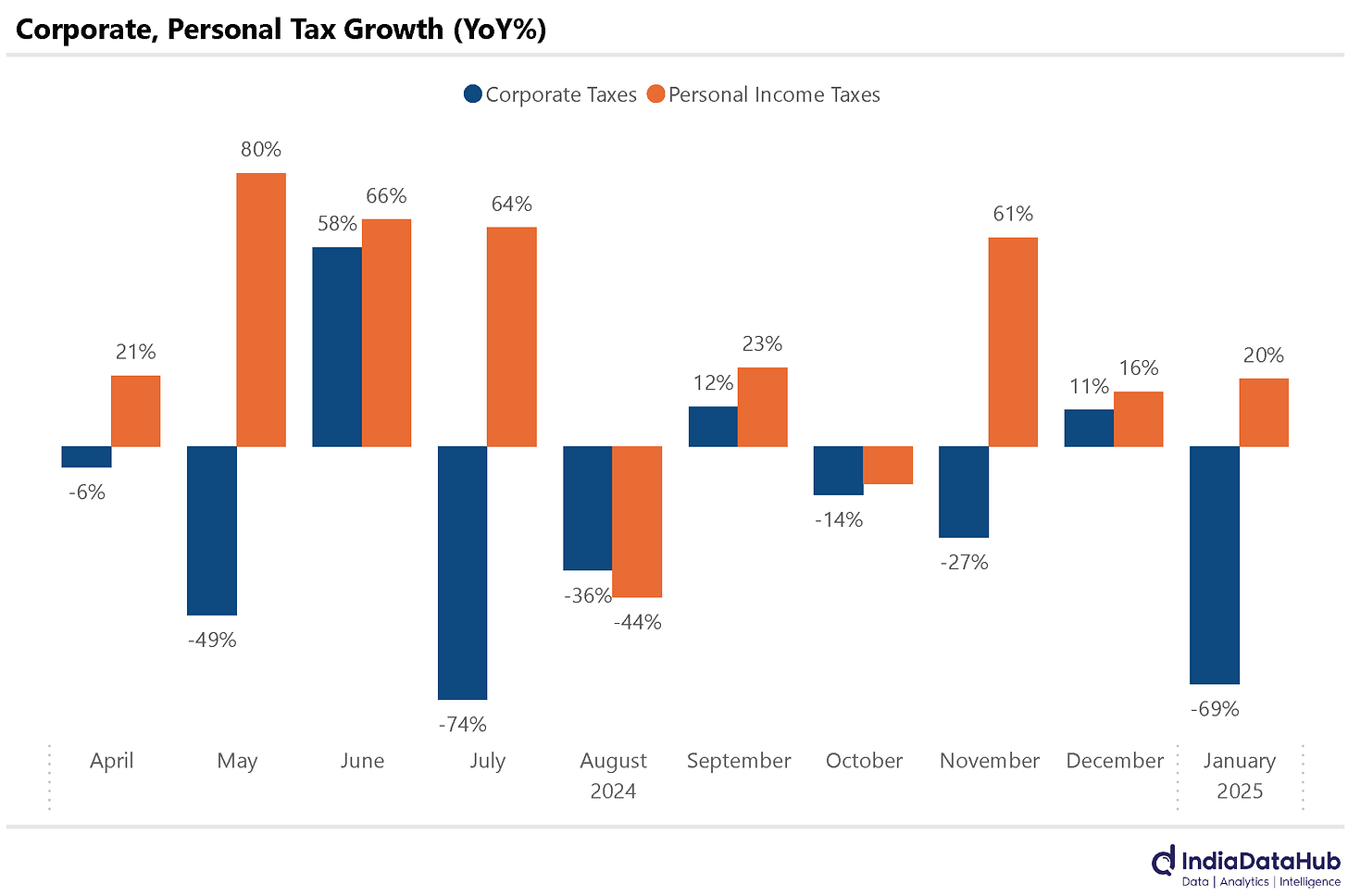

Corporate tax collections were weak in January also declining over 50% YoY. Consequently, YTD (Apr-Jan), corporate tax collections have declined modestly. The revised estimate for FY25 is for 7.5% growth in corporate tax collections and this would warrant corporate tax collections growing almost 50% in Feb-Mar.

A fairly tall order as things stands currently. Although there was a bunching up of refunds in February last year due to which collections were negative. If that does not repeat this year, then getting close to the revised estimate is a possibility. Personal Income tax collections however continue to remain strong growing 20% in January. Even YTD the growth has been over 20%. This sharp divergence between corporate and personal tax collections this year remains a bit of a conundrum.

Road construction activity has been soft this year. Between April - December this year the NHAI and the State PWDs and the BRO put together have constructed/upgraded 5500kms of highways. During the same period last year, however, almost 5700 km of highways were constructed/upgraded. While NHAI’s performance has been slightly better than last year, that of state PWDs and BRO has been weaker.

The US Bureau of Labor Statistics reaffirmed US GDP growth at 2.3% QoQ SAAR for the December quarter as per its second estimate. While this is a healthy growth rate, it is the slowest growth rate in the last three quarters.

More importantly, the US reported its highest-ever monthly trade deficit (goods) in January. As per the Census Bureau, the US had a trade deficit of US$153bn in January on a seasonally adjusted basis, up 25% MoM and 70% on a YoY basis. And this is not a one-off. December had also seen a 40% YoY increase in trade deficit to over US$120bn, the second highest on record.

While US Exports are almost flat on a YoY basis, Imports have risen sharply – almost as if businesses pre-empted the introduction of some of the tariff-related trade barriers. Imports rose 25% YoY in January, the highest in recent months.

That’s it for this week. See you next week.