GDP Growth, Monetary Transmission, Govt Capex and more...

This Week In Data #126

In case you missed, we have added lots of mathematical functions to interact and transform data with just a few clicks. The newly added functions include CAGR, Interpolation, Moving Averages, Rebase, YTD and MTD transformations, Year on Year as well as Period on Period change, HP Filter, Seasonal Adjustment, among others. Each of the functions have sub options (you can for example specify the interpolation logic or method of frequency transformation etc). To know more and see a quick demo, click here In this edition of This Week In Data, we discuss:

India’s GDP growth accelerates to 4 quarter high during the March quarter, both in real and nominal terms

Monetary transmission has started

Corporate tax growth has picked up but Income tax growth has moderated sharply

Last decade has seen corporate tax collections double but income tax collections more than quadruple

Central government’s capex saw sharp increase in March driving up overall Capex

India’s GDP grew by 7.4% YoY during the March quarter. This is a 4-quarter high and comes on top of 8.4% growth during the March quarter last year. Taken at face value, the picture that emerges is that India’s economy bottomed out in the middle of FY25 when the economy grew by 5.6% and has then rebounded by almost 200bps. This coupled with rate cuts that have already taken place and at least another 1-2 more rate cuts likely given the benign inflation readings implies that FY26 could be a fairly strong year for the economy.

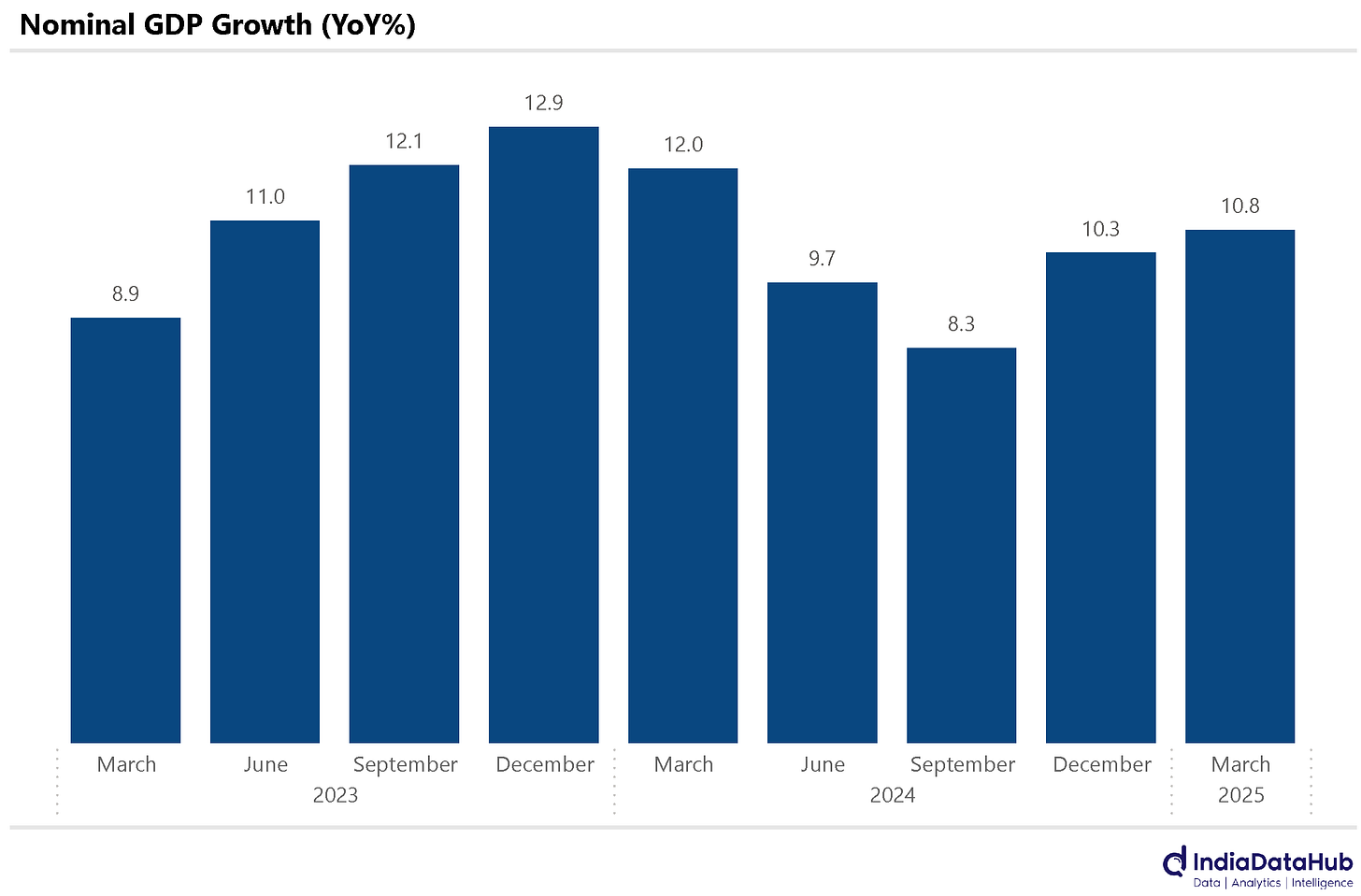

What is perhaps slightly more relevant than real GDP growth is the nominal GDP growth. Most of the metrics relevant for investors – corporate profits for instance – are nominal. And nominal GDP is estimated to have grown by 11% YoY during the March quarter. This is also the fastest growth in the last 4 quarters. But irrespective of whether we look at real or nominal trends, the big picture remains that growth in FY25 was slower than in FY24.

As things stand now, the current estimates are for growth to remain stable in FY26 relative to FY25. On one hand, the high-frequency data is fairly subdued. And on the other hand, as we highlight below, monetary transmission has begun. Then there is the global uncertainty from the uncertain trade policies. So, we shall see how these opposing factors impact growth in the next few quarters. The bottom line, it is best not to overinterpret the 4Q GDP growth and take growth for granted from a policy perspective.

Monetary transmission has begun. The weighted average interest rate on all outstanding loans given by the Banks has fallen by just over 20bps in the last few months. Note that the policy repo rate has seen a 50bps reduction since the start of the year. Term deposit rates have however not fallen and thus monetary easing far from being positive for bank margins has so far been negative.

Corporate tax collections have picked up in the last few months after remaining weak for most of FY25. The previous three months (Feb-Apr) have seen a 34% YoY growth in corporate tax collections, the highest growth in the last 18 months. In contrast, the personal income tax collections have seen a slowdown with growth decelerating to just 5% YoY. This is the second slowest growth in almost the last 2 years.

For the full year FY25, Corporate tax collections grew by a modest 8% YoY, the slowest in almost a decade (excluding the pandemic period). In contrast, the personal income tax collections grew by a healthy 17% YoY. One of the under-appreciated trends in recent years has been the sharp growth in personal income tax collections relative to corporate taxes. Ten years back, in FY15, Personal Income tax collections were just 60% of that of corporate tax collections. In FY25, they are 120% of corporate tax collections. This is partly due to weak corporate profitability but equally, it also reflects strong personal income tax buoyancy. Thus in the last decade while corporate taxes grew at a Cagr of 9%, personal income tax collections grew by 17% Cagr.

Lastly, the Central government’s capex rose sharply in March. This also partly aided the GDP growth since capital formation was a key driver of GDP growth. Central Government’s capital expenditure increased by almost 70% YoY in March or by ₹972bn. However, over half of this increase (₹516bn) came from the Ministry of Communication which mostly likely reflects the conversion of Vi’s spectrum dues into Equity – not a capital expenditure in a strict economic sense. One more reason to not over-interpret the quarterly GDP data and take growth recovery as a given.

That’s it for this week. See you next week…