GDP Growth, Tax Collections, House prices and more...

This Week In Data #65

In this edition of This Week In Data, we discuss:

Strong GDP growth during the March quarter

Buoyant tax collections but decline in corporate taxes

Stable credit and deposit growth but falling slack on bank balance sheets

CD market comes back to life

Anemic growth in house prices in major cities

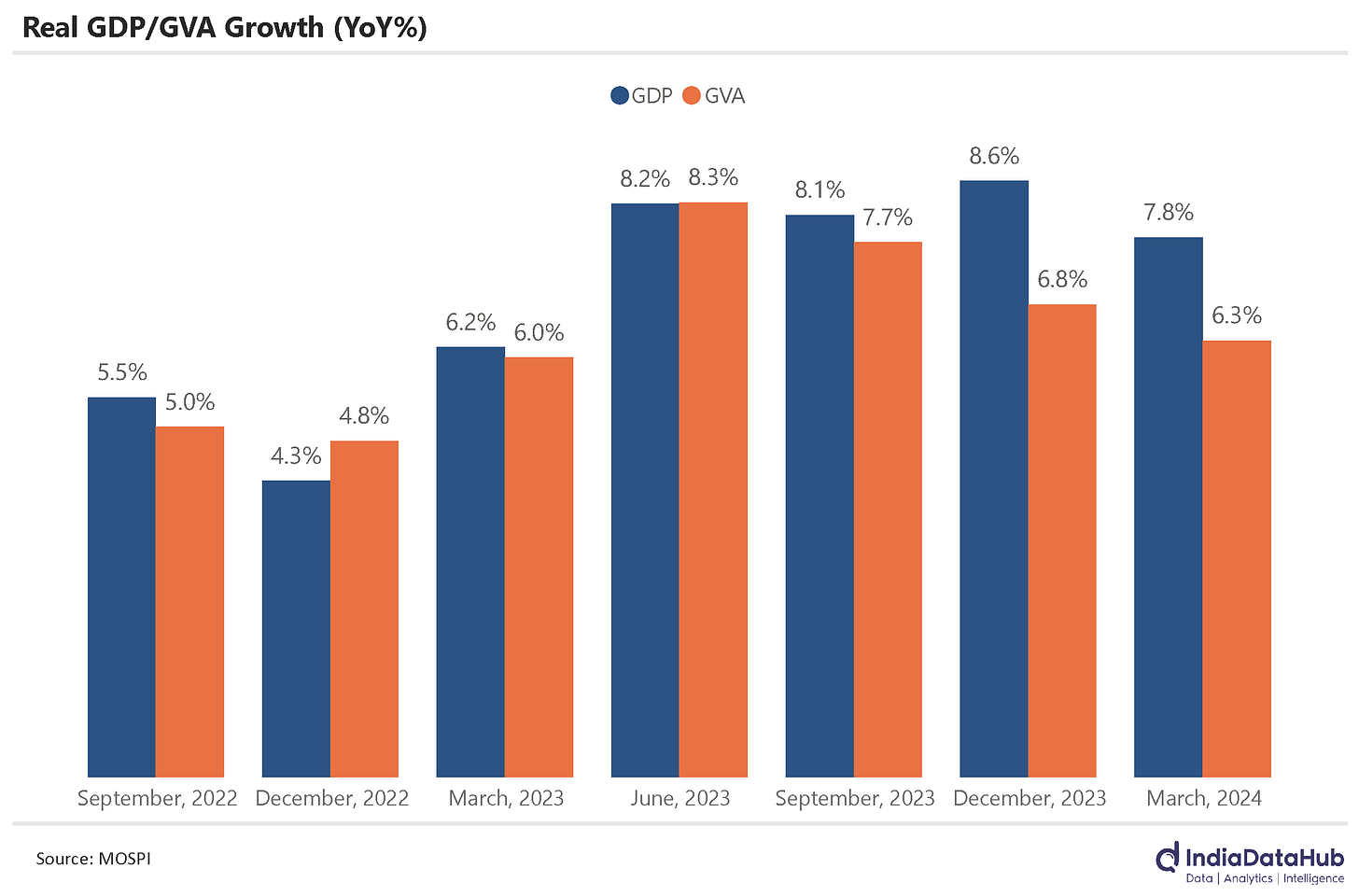

Lots of data releases to cover beginning with the GDP release yesterday. India’s GDP growth moderated to 7.8% YoY during the March quarter from 8.6% growth during December. That said, at close to 8% in absolute terms the growth rate is more than acceptable. More importantly what this means is that for the full year FY24, GDP growth was 8.2% YoY, 120bps higher than the growth in FY23. The exit growth rate in 4Q FY24 is higher than during 4QFY23. And even if we look at the GVA numbers, the picture remains the same – that FY24 was a stronger year for the economy than FY23 and 4QFY24 was a stronger quarter than 4QFY23. And this was despite the significant monetary tightening that we have seen.

Looking ahead into FY25, the current estimate is for the economy to grow by ~7%. While this implies a slowdown from the 8% growth in FY24, 7% growth is a healthy number. In the six years before COVID-19, India’s GDP had grown by 7.2% per annum on average and thus the economy has settled back into the pre-Covid trend. What this also implies is that a recession (or a sharp growth slowdown) is not the base case for most analysts. Let the good days continue!

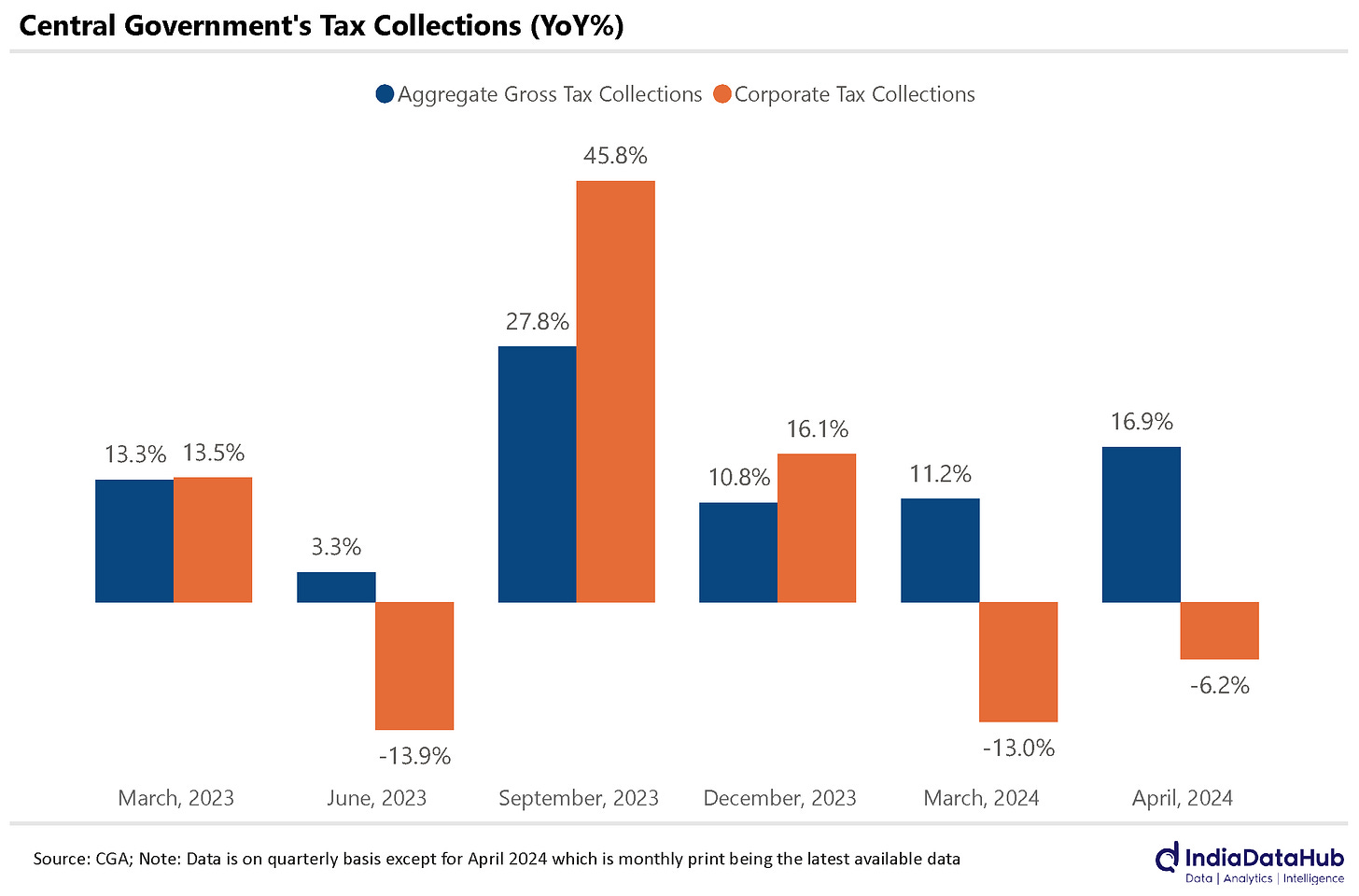

Tax collections continue to see robust growth with mid-teens growth in the last two months (Mar-Apr), after a decline in February. Personal income tax collections continue to see strong growth at almost 20% over the past three months.

What is disconcerting though is the double-digit decline in corporate tax collections over the past three months. Notably, in March, when companies true up their advance tax payments for the full year, corporate tax collections declined almost 15% YoY. Corporate profitability in many ways is a leading indicator for growth, especially investments and so this red flag needs monitoring.

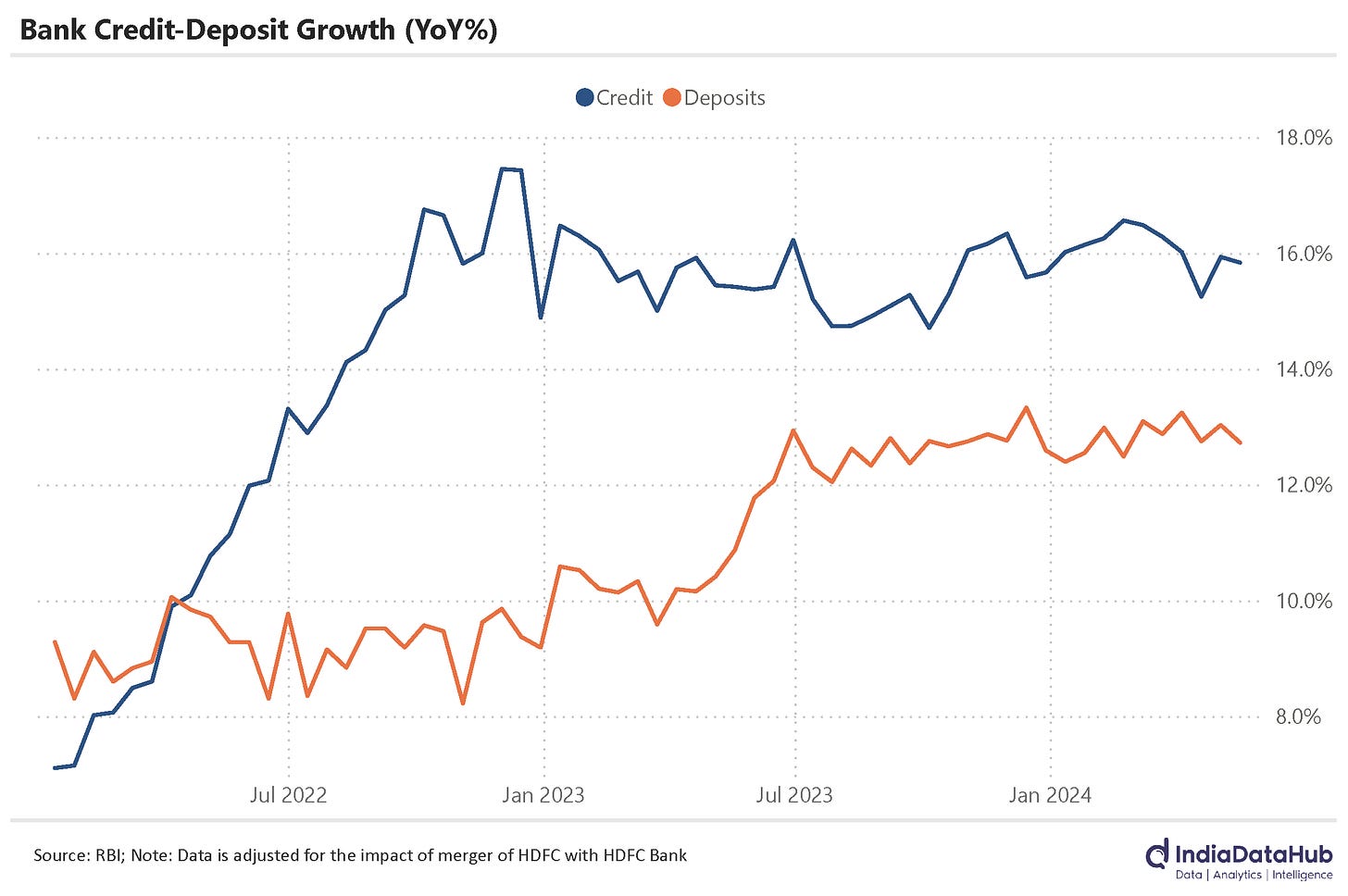

Credit growth has remained remarkably stable at ~15-16% for close to two years now. Deposit growth has also remained stable at ~12% for almost a year now. And this has meant that the system-wide Loan-Deposit ratio for banks has continued to edge up. As of mid-May, it has risen to almost 78% (adjusted for HDFC’s merger with HDFC Bank), 2ppt higher than last year and almost 4ppt above the long-term average.

Effectively, the slack on bank balance sheets is progressively reducing. And unless the RBI changes its stance on liquidity, this will result in domestic interest rates rising, even if the RBI does not raise the policy rates. Note in this context the recent move from SBI to raise deposit interest rates.

One of the consequences of this divergence between credit and deposit growth has been that the CD market has come back to life. CDs or Certificates of Deposits are almost entirely issued by Banks to meet their temporary liquidity needs. CDs are thus the perfect procyclical marker for liquidity. CD market expands during tight liquidity as deposits as banks, especially those with relatively weaker deposit franchises, look towards the money market to raise funds.

Annual issuance of CDs has increased over 6x in the last three years and the value of outstanding CDs has increased almost 4x in the last 3 years. Relative to bank deposits, the outstanding CDs are at their highest since 2018. With issuance growing over 20% YoY as against low double-digit growth in bank deposits, the CD market will continue to grow, and this is the mode through which tighter liquidity flows due to the higher cost of funding for banks.

Lastly, house prices. The median increase in house prices across the 10 large cities was a modest 1.7% YoY during the March quarter. This is the slowest growth in over two years. Prices rose by less than 1% YoY in Mumbai, Delhi, Lucknow and Jaipur (where they declined modestly). Ahmedabad saw the strongest growth in house prices at almost 12% YoY followed by Bengaluru at 9% and Kolkata at 8%.

This is already a lot to chew and digest. So, we will skip some of the less important releases for next week and call it stumps.

But by far the biggest event of next week will be the election results. Markets would dearly like continuity in the government and there is an overwhelming consensus that that is indeed what is likely to happen. We shall see. In the meantime, may the 4th be with you… 😊