In this edition of This Week In Data, we discuss:

India’s GDP growth accelerates in real terms but decelerates in nominal terms

Fisc is in a spot of bother

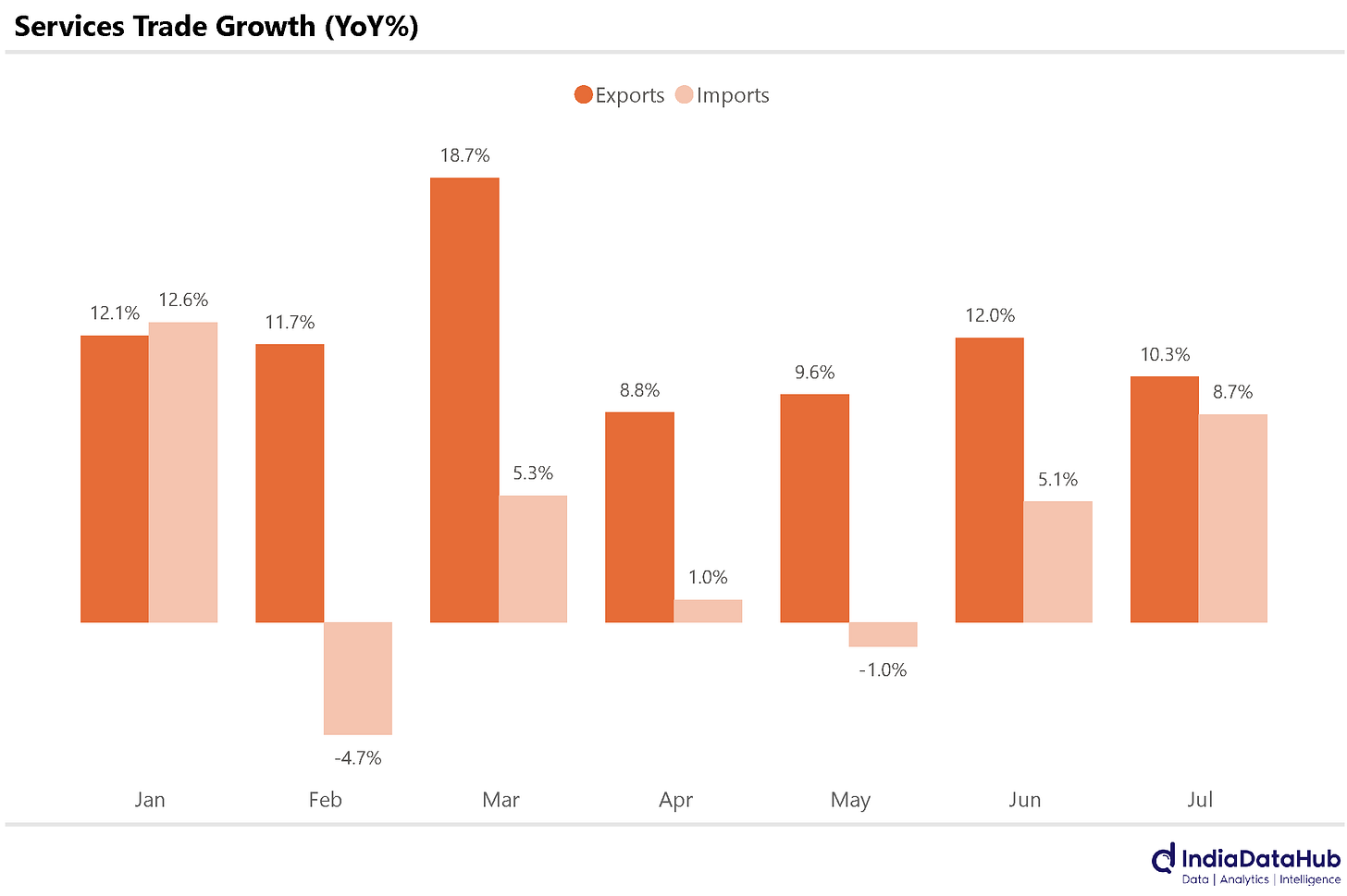

Services exports continue to see strong growth

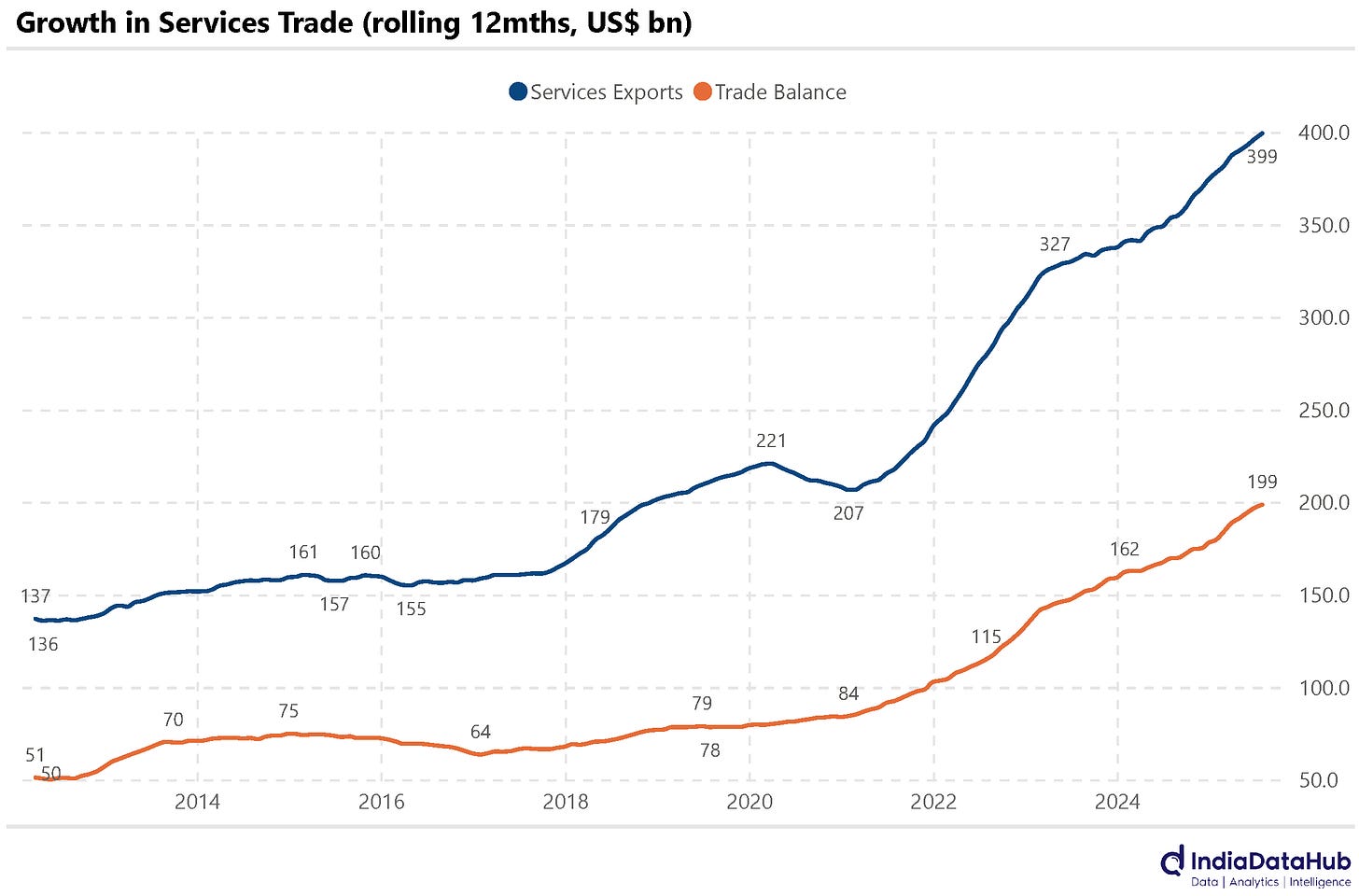

Services exports approaching US$400bn & surplus US$200bn on rolling 12m basis

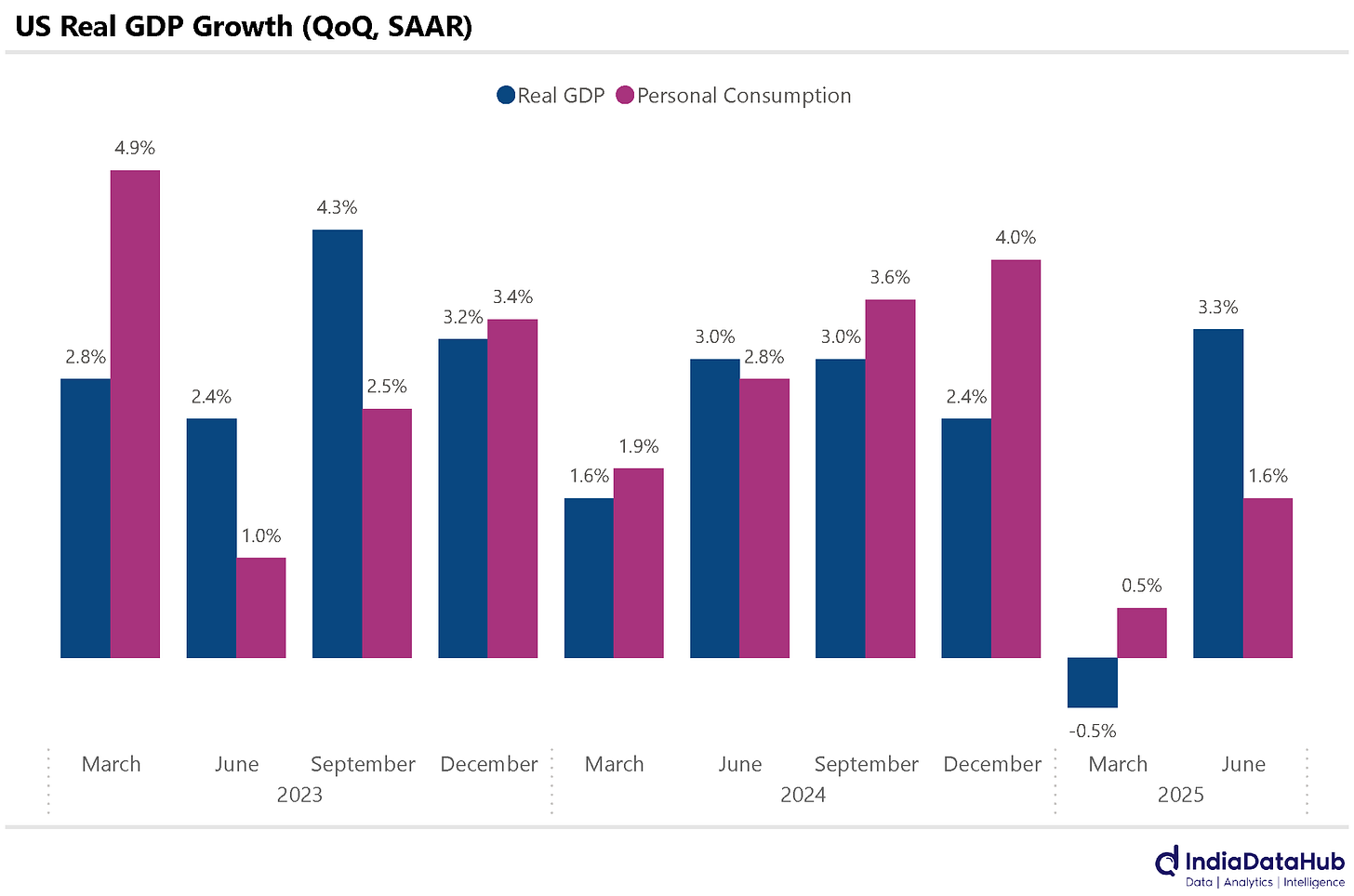

US Real GDP growth gets revised upwards but consumption remains weak

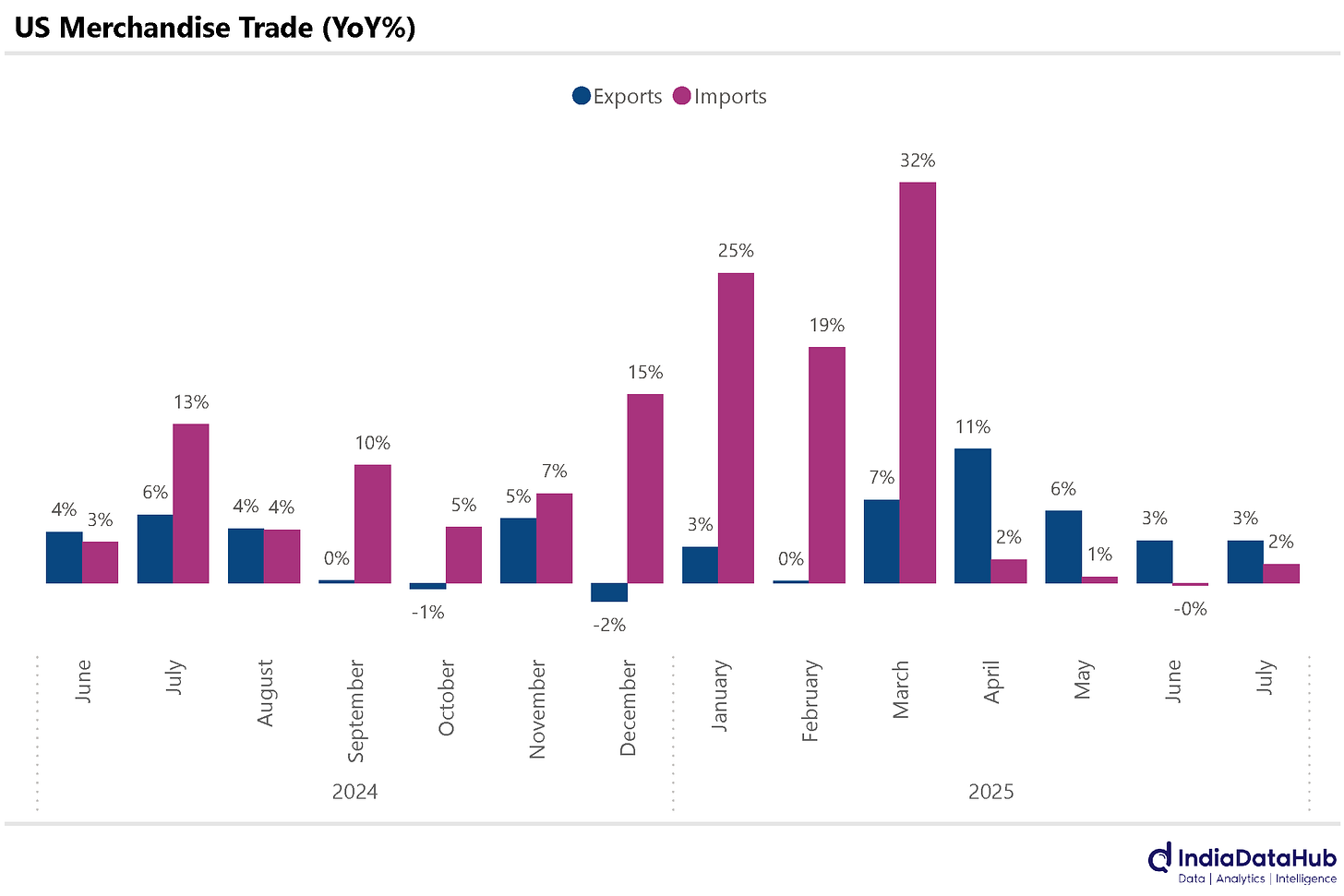

US exports rise modestly in July and trade balance contracts modestly

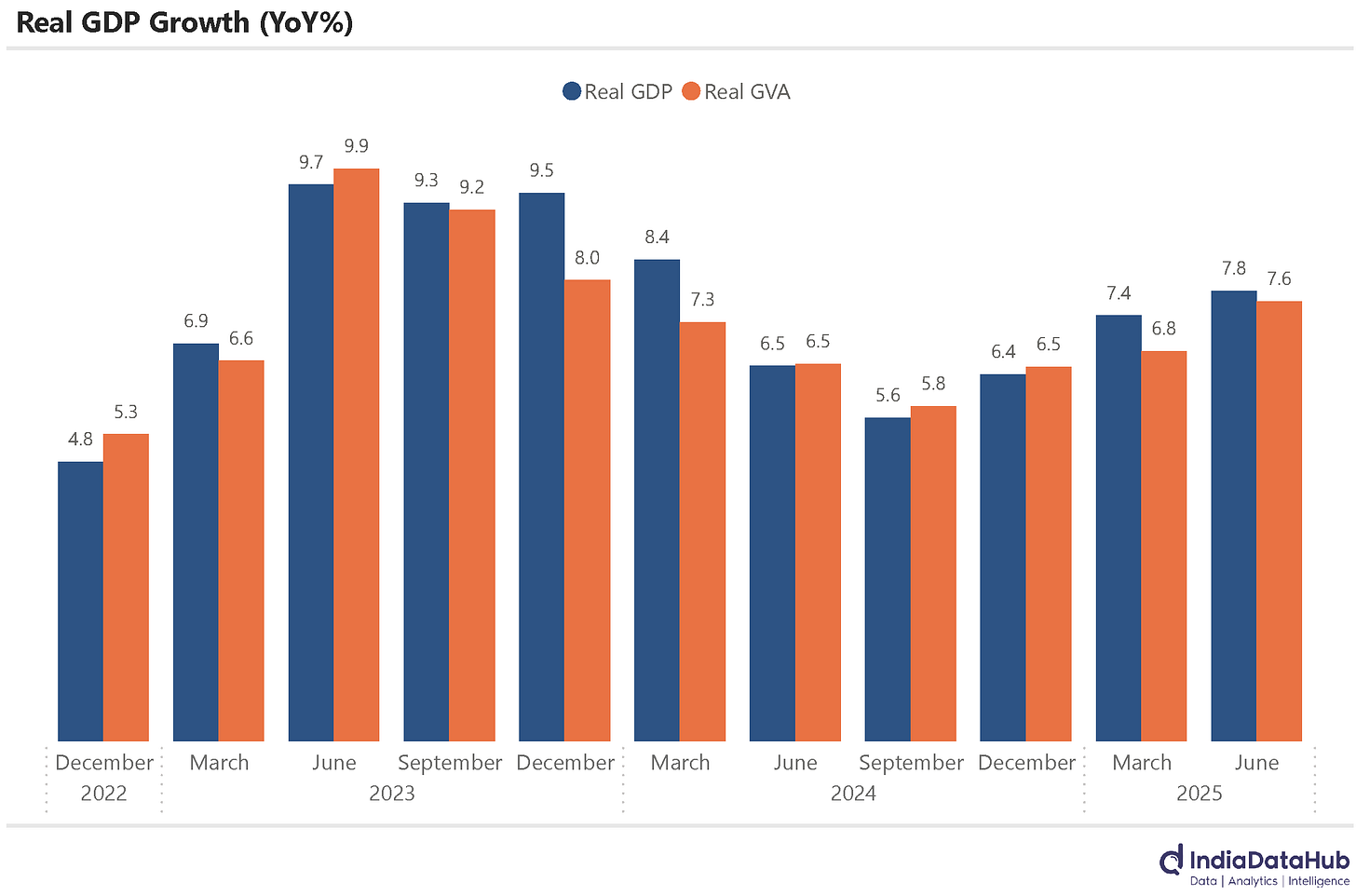

India’s GDP grew 7.8% YoY during the June quarter. This is the highest growth in the last 5 quarters and is much above what the consensus expectation was (~6.6%). Real GVA also grew at over 7% and so the gap between GDP growth and GVA growth, which has been large on some occasions recently, was a modest 20bps.

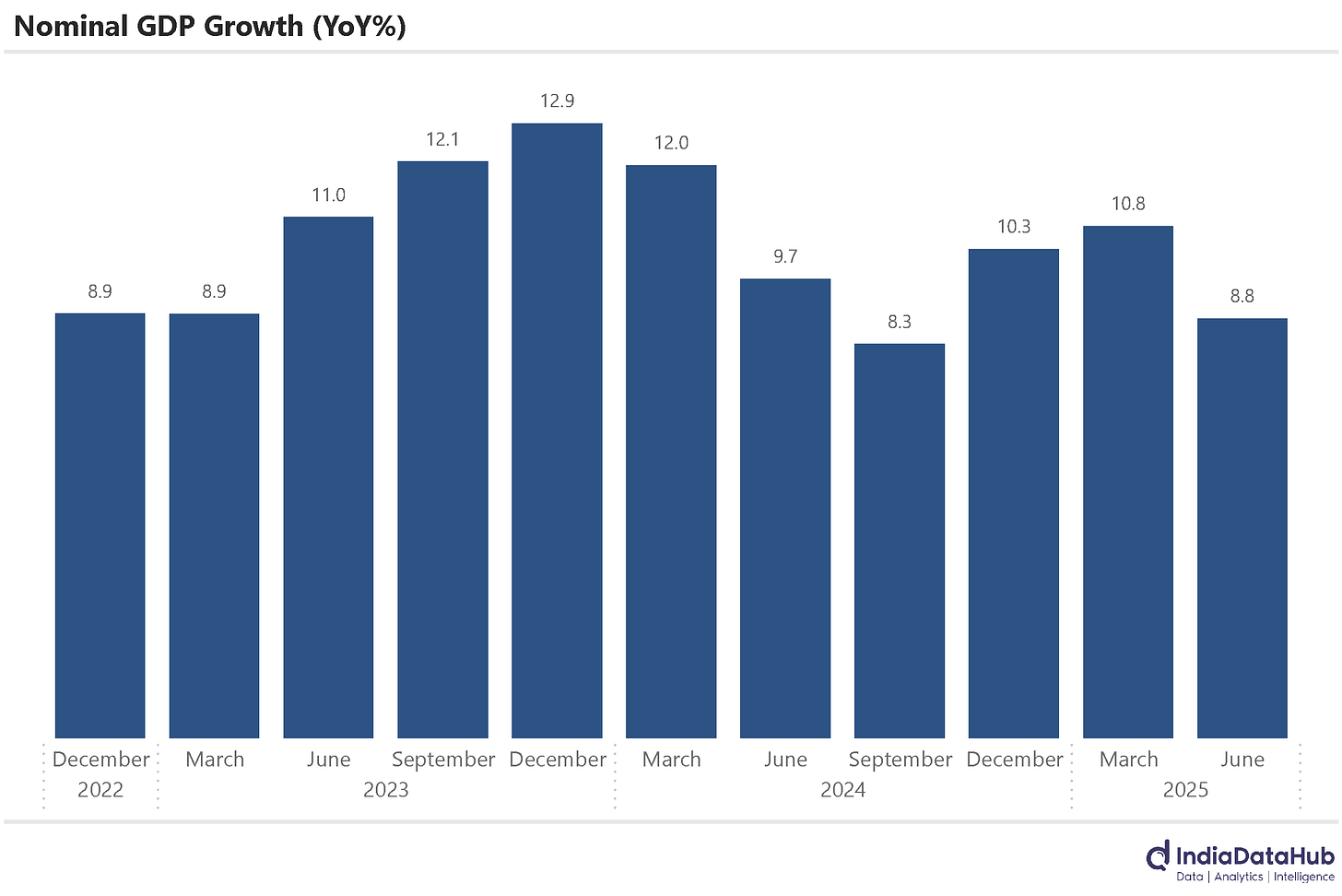

While growth accelerated in real terms, in nominal terms it decelerated by almost 200bps. In nominal terms, GDP grew at 8.8% YoY during the June quarter, as against 10.8% growth during the March quarter – effectively the GDP deflator was very close to zero. And a lot of the metrics investors track, such as corporate revenues & profits, or tax collections, or Bank credit & deposit, exports & imports, are all expressed in nominal terms. So while CSO’s models suggest that GDP growth was fairly strong, it does not ‘feel’ as if the economy is growing at ~8%.

The higher growth in 1Q will flow through to a pretty much across-the-board full-year FY26 GDP growth upgrade by ~20-30bps. However, growth estimates for 2Q-4Q are unlikely to see material across-the-board upgrades. That said, the one unknown at this point is the fiscal situation. As we discuss later, the central government seems to have front-loaded the expenditure and tax collections are likely to miss estimates. The consequent fiscal situation (lower expenditure growth in 2H or higher deficit), apart from impacting rates, will also impact growth.

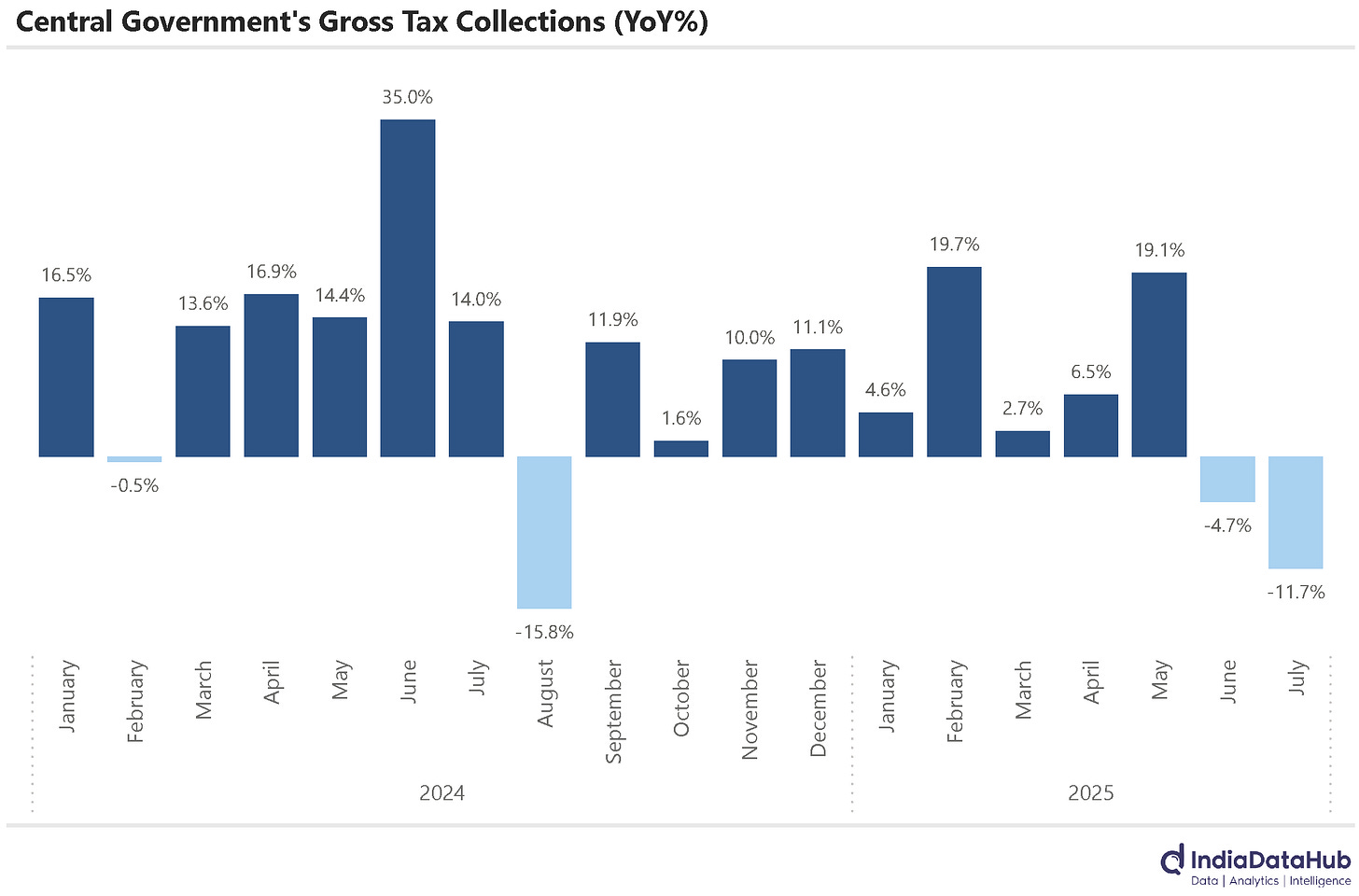

Central Government’s Gross Tax Collections declined for the second consecutive month in July. Gross Tax Collections declined 12% YoY in July following a 5% decline in June. Personal Income Tax Collections are the primary drag. They dropped 35% YoY in July and 12% in June. Excluding Personal Income Tax, overall tax revenues grew 6% YoY in July.

The decline in Personal Income Tax Collections is primarily due to two factors. On one hand, the tax slabs have seen significant relaxation this year, which will impact advance tax and monthly TDS collections. And on the other hand, the due date for filing tax returns for Individuals was extended to 15th September, which normally tends to be 31st July. So there is an element of shifting of timing of tax collections (due to a change in due date) and also a decrease in tax liability for individuals.

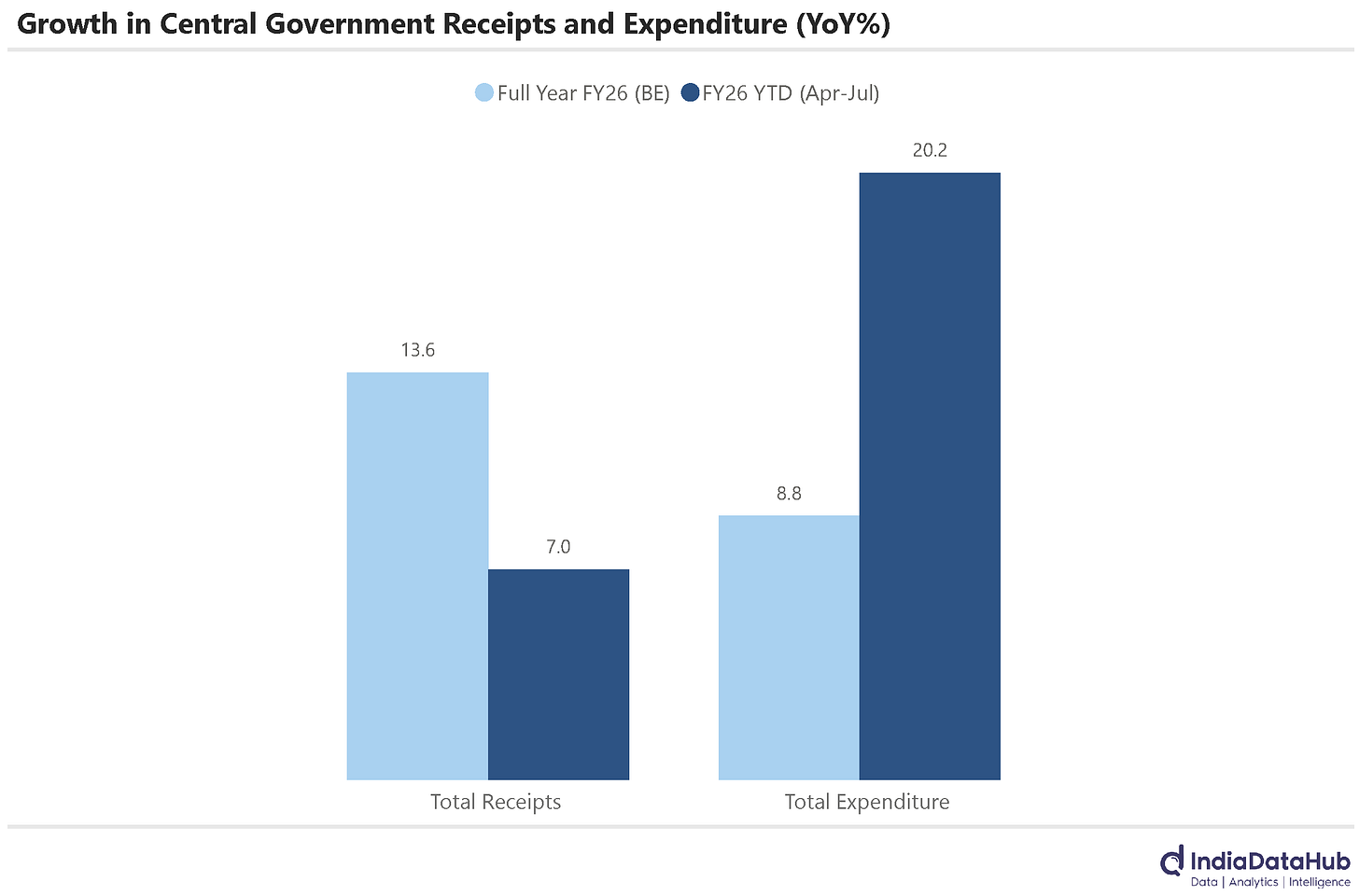

Till July, Gross tax revenues have grown by less than 1% and even excluding the personal income tax collections, tax collections have grown by 7% YoY. Total receipts have grown by 7% including the large dividend from the RBI. Furthermore, the announced reduction in GST rates will only add to the revenue loss in the second half of the year. Therefore, the key takeaway is that, as things stand now, the government’s full-year budget estimate of a 12.5% growth in tax revenue and 14% growth in total receipts looks optimistic. Government expenditure, in contrast, has expanded by over 20% YoY, as against a budget estimate of high single-digit growth. And thus, unless the revenue trajectory improves substantially, the government will have to either significantly slow down expenditure growth in 2H or run a higher fiscal deficit and concomitantly higher market borrowings, further straining the debt market.

Services exports rose 10% YoY in July, while imports grew 9% YoY. This is the 6th consecutive month that services exports have grown faster than imports. Consequently, the services trade surplus continues to expand in double-digit terms – July saw a trade surplus of US$16.4bn.

The more interesting thing to note is that on a rolling 12-month basis, Services exports were just shy of US$400bn as of July, and the services trade surplus was just shy of US$200bn. Both exports and the trade surplus will cross these thresholds in August. Just six years back, the services trade surplus was less than US$80bn, so there has been a 2.5x growth (16.5% CAGR in USD terms) in the last six years. Pretty impressive!

The US Bureau of Economic Analysis revised its Real GDP growth estimate for Q2, reporting a 3.3% annualised increase—up from the initial 3.0% seasonally adjusted estimate released last month. This is the highest growth since 3QCY23. Growth in personal consumption however grew at a modest 1.5% QoQ SAAR, the second lowest growth since 3QCY2023.

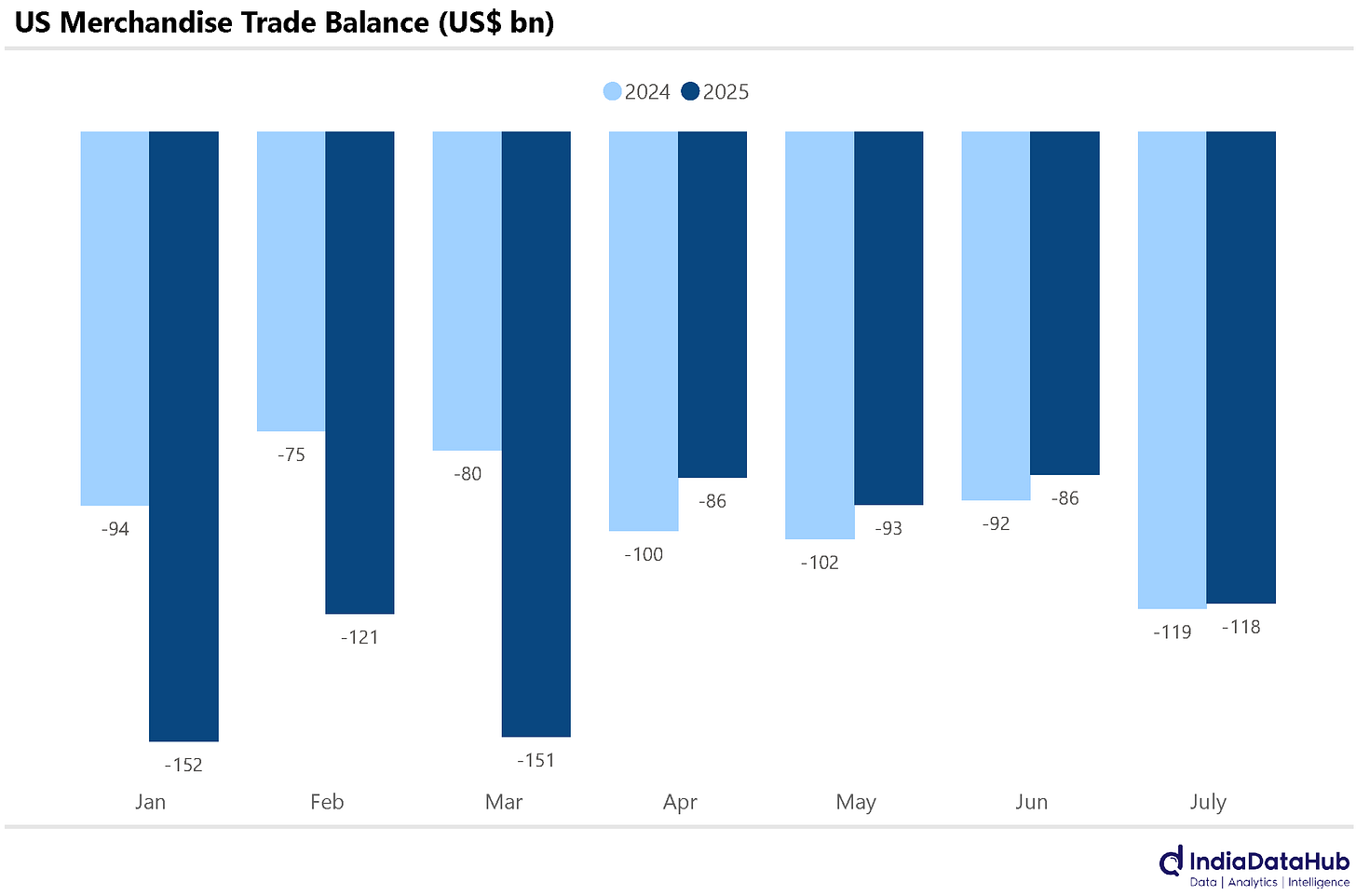

And on the trade front, the U.S. Census Bureau published its advance trade estimates last evening. In July, U.S. goods exports rose 3.4% year-on-year, while imports increased by 1.5% over the same period. Trade deficit was largely unchanged on a YoY basis (down ~2%) at US$118bn.

YTD, however, US exports have increased by 5% YoY while imports have risen by 11% and consequently the trade deficit has expanded by over 22%. This largely reflects the front-loading of imports into the US at the start of the year, in anticipation of the imposition of tariffs, the effect of which does not seem to have yet been fully offset.

That’s it for this week. See you next week…