GDP revisions, Bond issuances, Auto sales and more...

This Week In Data #8

In this edition of This Week In Data, we cover:

GDP growth data release for FY23 and prior year revisions

Trends in Corporate Bond and CP issuances

Slight uptick in GST collections but deceleration in Power generation

Uptick in 2W sales growth but a deceleration in Car sales growth

So the big topic of the week was the GDP data for the December quarter as well as the revised but, still advance estimate of GDP for FY23 and the revised estimate of GDP for FY20 to FY22. That’s a lot of data revisions to deal with!

First things first, let us cover the headline data. For the full year FY23, the CSO is projecting that the GDP will grow by 7% YoY. This is unchanged from the projection it made in early January. Pretty straightforward stuff.

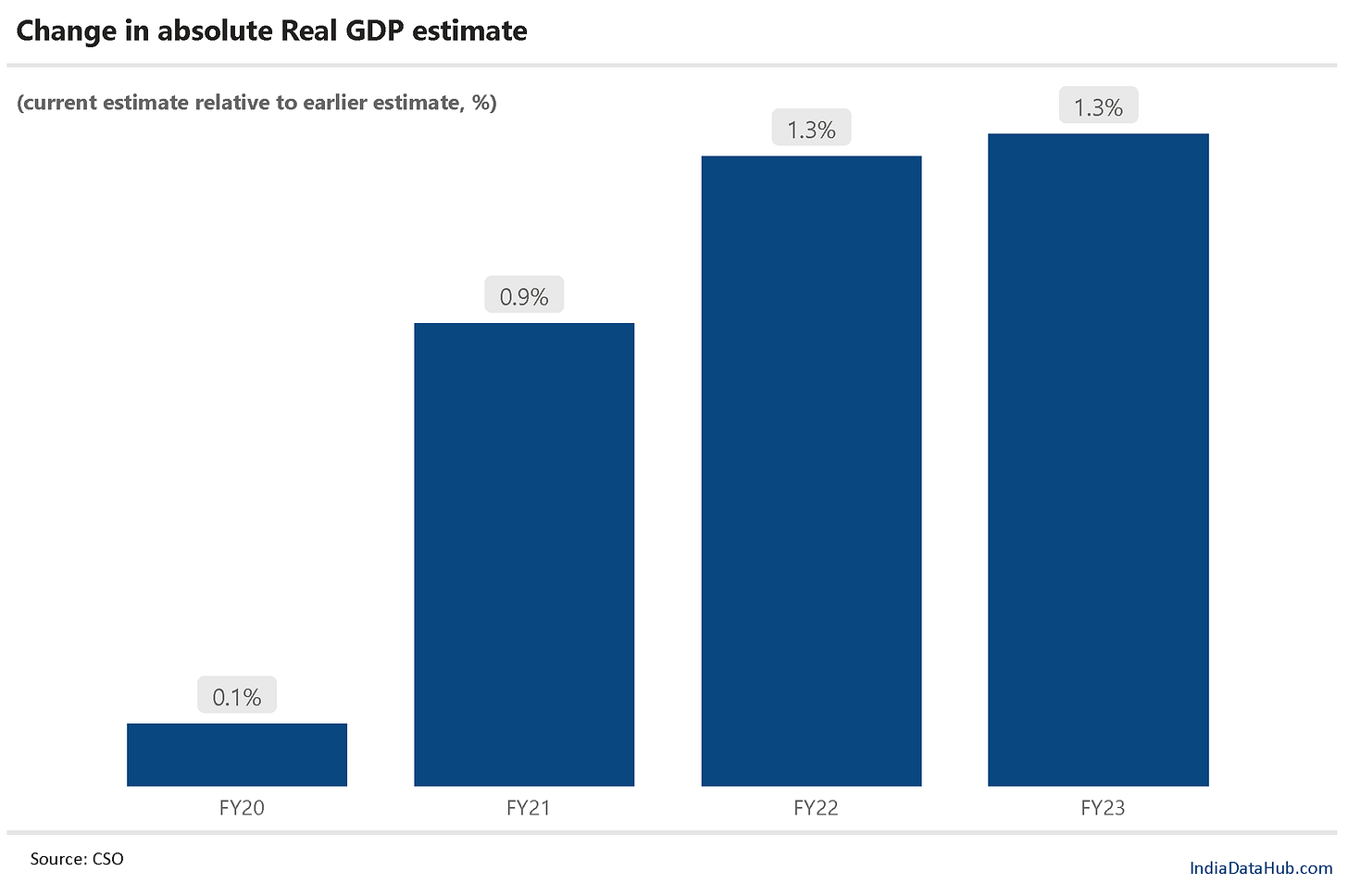

But what complicates this data is the revisions to historical data. To be sure, this is par for the course. The FY22 GDP (level) has seen an upward revision of 1.3%. And the FY21 GDP has seen an upward revision of 0.9%. Effectively what this means is that in FY21 and FY22, the pandemic impacted years, the economy was doing better than what was earlier anticipated.

So, while the growth projection for the current year has remained unchanged, it is on top of the upward revisions in the prior years. Think of it as profit growth in the latest year remaining unchanged but the company revising the previous couple of years' profits. That is a positive thing, agree?

The problem though is that the implied growth in the current quarter (last quarter of FY23) is only 5%. And this will suggest that as we enter FY24, the economy has lost a fair bit of the post covid momentum. But then again, this 5% is a projection even before the year has ended. This number will also see multiple revisions (with the first revision being in May). And the final print could be higher than 5%. And this brings us to the key point: GDP growth is a good proxy for economic progress in the medium-long term. But in the short term, it is too abstract and imprecise a number to be of much practical relevance.

Ok, now onto the other key data releases during this week.

Bond issuances grew almost 20% YoY in February. This is the 4th consecutive month of growth in bond issuances. YTD bond issuances have grown 13% now. The financial sector continues to be the largest issuer of bonds accounting for almost 70% of the issuances YTD. However Commercial Paper (CP) issuances continue to decline. In February issuances were down 6% YoY, the 5th consecutive month of decline. YTD, CP issuances have declined by over a third. Given that short-term rates have risen sharply in the last few months, even as long bond yields have remained stable, this is not surprising.

We got some early read into activity in Feb and the data is a bit mixed. GST Collections grew 13% in Feb, slightly higher than the growth in Jan. However, power generation grew slower – just over 8% YoY in Feb compared to almost 13% in Jan. 2W sales grew almost 15% YoY in Feb, up from 10% growth in Jan. But Car sales growth more than halved to 11% YoY in Feb from 23% in Jan.

In general though, we are expecting data to decelerate in Feb given that January data was boosted by the Omicron base. So, if the February data is not across the board decelerating, then that is a positive sign from a growth perspective. And stronger than expected February and March data will mean a possible upward revision to the GDP growth estimate!

That’s it for this week. We will get more insights into the economy next week with more high-frequency data getting released. That will put us in better shape to assess the state of the economy. Have a good weekend folks!