Global concerns, CPI-WPI divergence, Export decline and more...

This Week In Data #10

In this edition of This Week In Data we discuss:

Global concerns and its fall out on India

Divergence between CPI and WPI

Decline in Exports but improving trade balance

We must start with global developments. Last week was SVB and this week was Credit Suisse. Equity markets have fallen and estimates of interest rate hikes from the Fed have been pared. From an Indian perspective, there is no direct impact of these global developments. However, we are tightly integrated into global trade as well as finance. And thus, any sustained dislocation in financial markets will impact India, as we saw during the global financial crisis. And financial markets are reflexive, so a sustained dislocation in financial markets will impact the real economy – both abroad and in India. And this bout of financial sector stress comes in the midst of (or perhaps due to) the steepest monetary tightening cycle in at least the last few decades.

So, the question for the central banks is whether the banking issues in the banking sector are likely to become a full-blown crisis (and 2008 is the parallel here) or whether it is just a storm in the teacup. If in their judgement, it is the latter it is possible to treat this mini-crisis as a liquidity issue and treat it with dollops of liquidity (or extend deposit insurance like what was done with the SVB) while at the same time continuing to hike rates and increasing the cost of capital which will pressure risk assets. And it is pertinent to note in this context that a day after the Credit Suisse issue came to the fore, the ECB delivered a 50bps increase in the policy rate. The Fed funds futures rates suggest that markets have pared down their expectation of a rate hike in the next week - a week ago the fed fund futures were suggesting a 40% probability of a 50bps hike and a 60% probability of a 25bps hike. As of today though, they are suggesting a 88% probability of a 25bps hike and a 12% probability of no increase.

But we still have a few days to go before the Fed meeting. And if a lot can happen over (a cup of) coffee, then a few days is time enough for several cups of coffee 😊

Back home, we got both the CPI and WPI data for February this week and they both point in different directions. The CPI inflation remained elevated at 6.4% (~10bps decline from January) while the WPI inflation declined sharply to a 25-month low of 3.9% YoY in February from 4.7% in January. While the CPI inflation remains close to its recent highs (7.8% in August last year), the WPI inflation is down more than 12ppt from its recent peak (16.6% in May last year). So, what to make of this divergence?

Consumer prices are thus currently rising faster than wholesale prices. This reflects two things. Firstly, the pass-through of the increase in commodity prices to consumers is still incomplete. And second, factors other than global commodity prices (such as domestic food prices) are also currently driving consumer prices. The lower WPI inflation will feed into lower nominal GDP growth, and this is also one of the factors that will weigh on credit growth. Nominal GDP growth is thus likely to be in the single digit during the current quarter and decelerate further to mid-single digits during the June quarter.

The CPI data is a bit tricky. On a standalone basis, the two CPI prints since the Feb rate review have been negative and core inflation remains sticky at over 6%. Given the hawkish guidance in the Feb policy, the case thus remains for another 25bps rate hike in April, and possibly more in June. However, as discussed above the global backdrop has changed. Oil prices have declined sharply, and the risk environment has deteriorated. And things may change again between now and early April when the MPC meets. So, the rate decision by the RBI will largely depend on how the global situation evolves and what the Fed does next week.

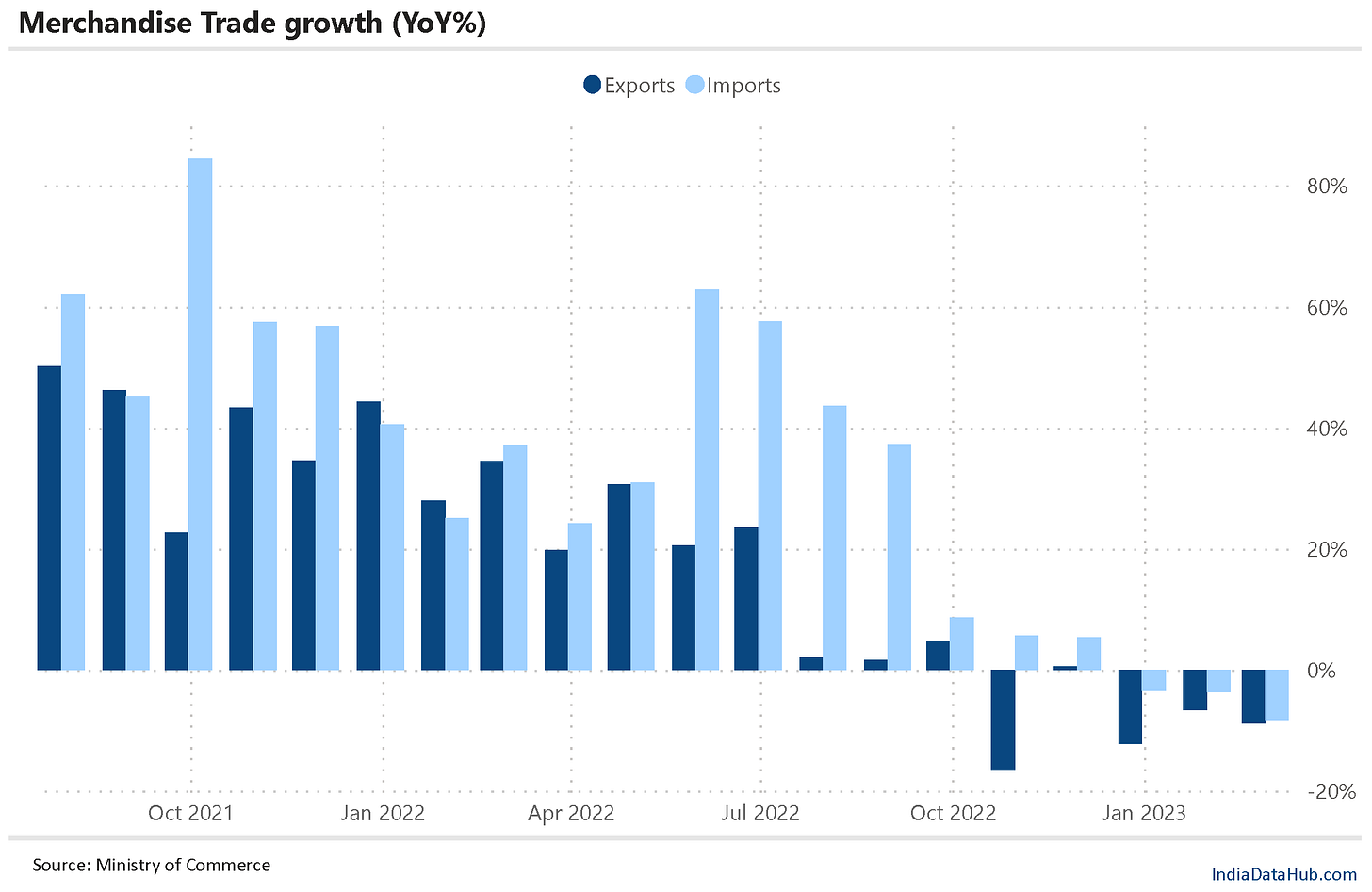

Merchandise exports declined 8.8% YoY in February as per the quick estimates against a 6.6% decline in January. This is the 4th month in the last 5 that exports have declined. The decline in exports is pretty much across the board. Of the 30 quick estimate categories, only 13 categories have seen a growth in exports in the last three months. And these 13 categories total up to less than 20% of exports. Petroleum products and Textiles are the biggest contributors to this decline. They have seen exports decline almost 20% YoY in the past three months. Among the other large categories, engineering goods have seen a 10% decline while Gems & Jewellery and Chemicals have seen a 6-7% decline. Electronics goods remain the bright spot for exports growing 40% YoY over the past three months.

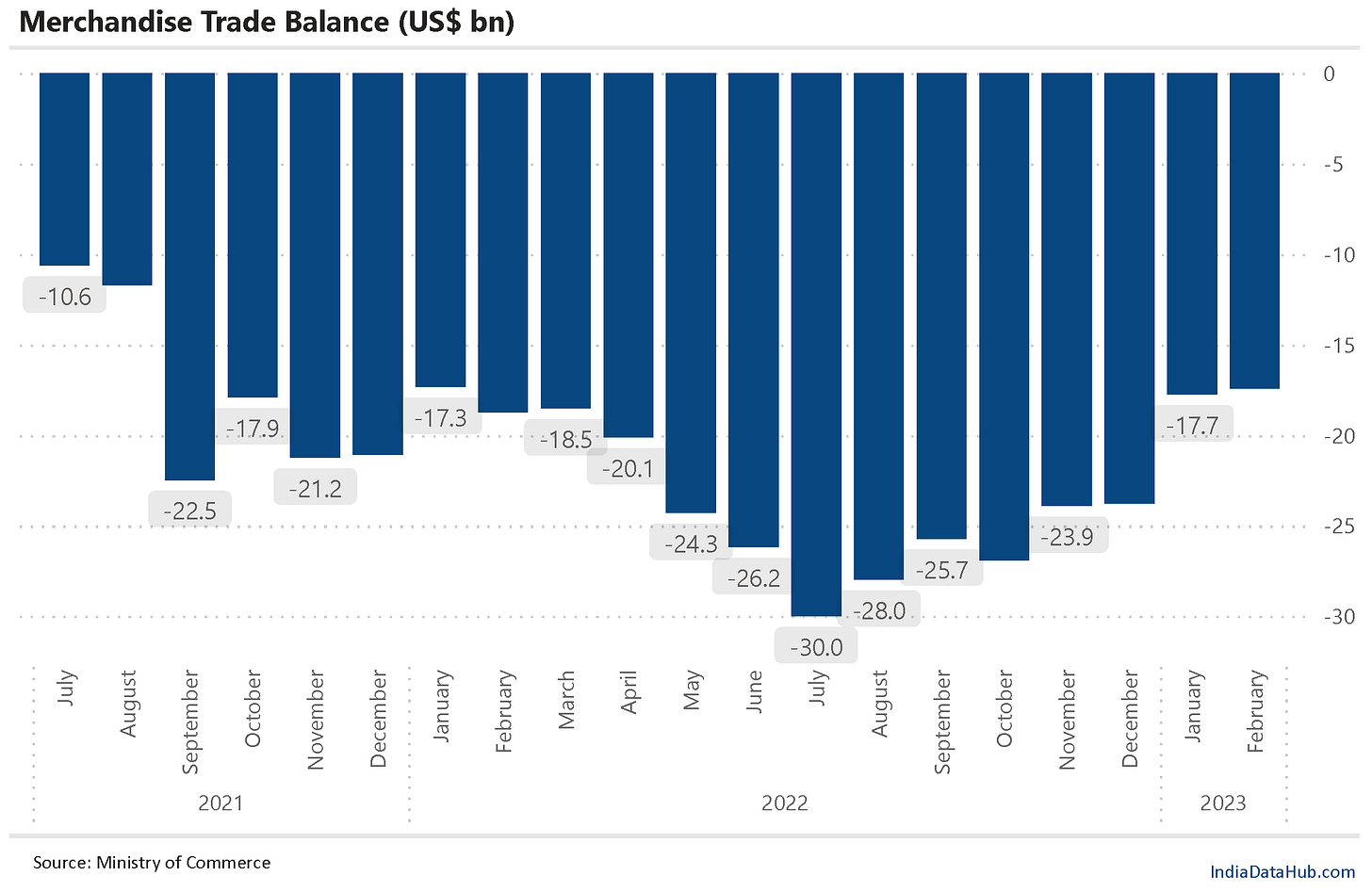

The good news though is that even merchandise imports are declining and thus the trade balance has narrowed significantly – from a peak of US$~29bn in July last year to just over US$17bn in February. Indeed, the trade deficit declined on a YoY basis in February for the first time since June 2021! So, the moderation in the trade deficit, even before the recent decline in Oil prices will take some pressure on the currency even if capital flows turn a bit wobbly due to the recent global events.

Imports declined over 8% YoY in February and have declined by 5% over the past 3 months. A large part of this decline in imports is due to lower Gold imports – gold imports declined over 60% YoY in the last three months. The other categories that have seen a double-digit decline in imports are Gems & Jewellery, Electronic goods, Fertilisers and Chemicals.

That’s it for this week. Next week will be the all-important Fed meeting. And that will set the stage for what the RBI might do in April. Fingers crossed…