Global Rates, Domestic Rates, FDI and Remittances

This Week In Data #57

In this edition of This Week In Data, we discuss:

Central Bank rate actions this week and the changing interest rate environment

Domestic Interest Rate outlook

Strong FDI in January in an otherwise weak year

Outflows under LRS continue to recover

In case you missed, we introduced the analytics section in our Mutual Funds App. To begin with, there are two analytics features that be run on individual mutual fund portfolio - one allows you to compare multiple portfolios side by side and the other allows you to search for holdings by instrument across time and schemes. This video gives you a quick overview of these features. We have to start with global this week. As many as 10 Central banks were in action this past week. And while several of them did nothing, there was still quite a bit of action!

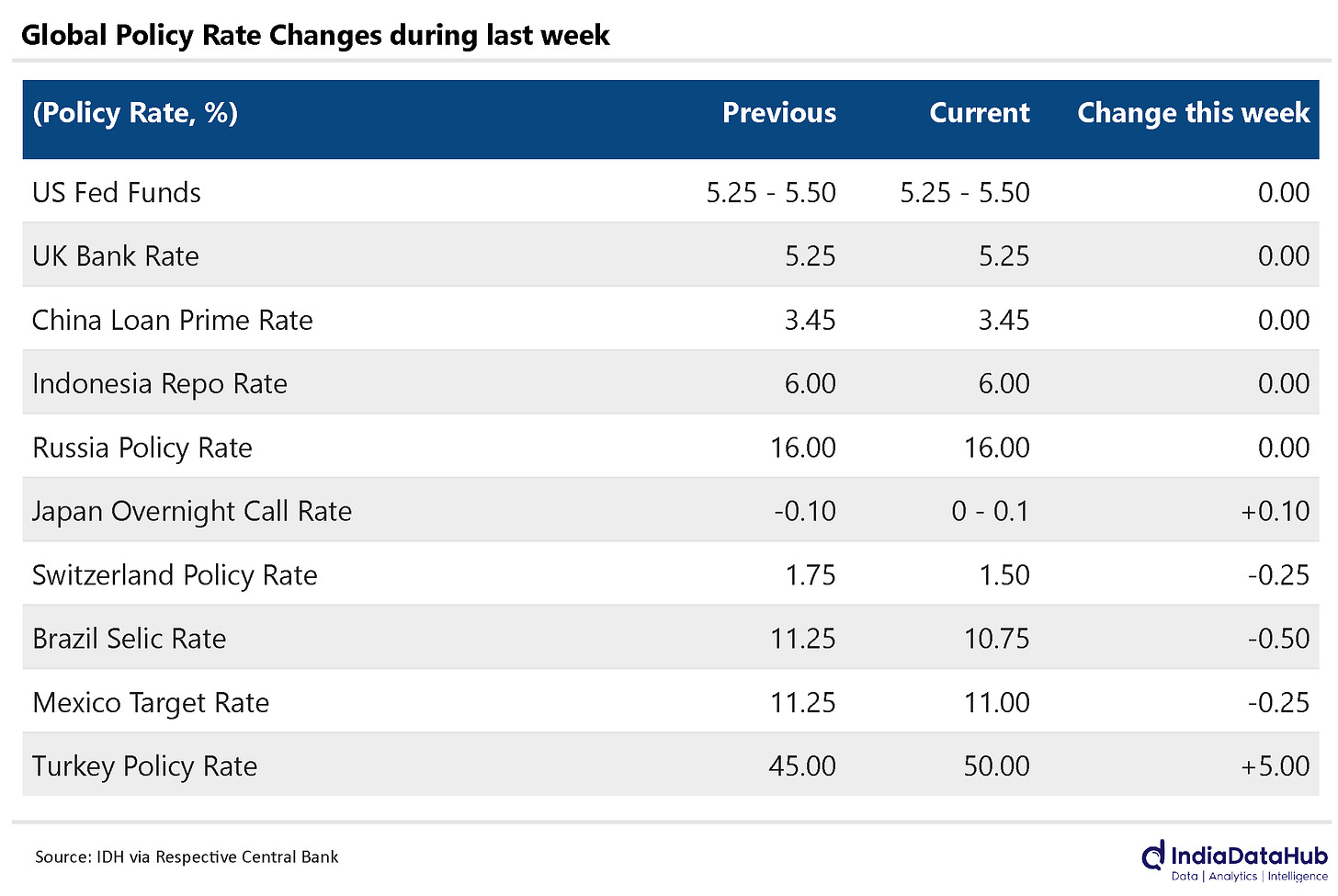

Starting with the US, the Federal Reserve decided to keep unchanged the target rate for the Fed funds rate at 5.25-5.5%. The US Fed has now remained on pause since July last year when it last raised interest rates. Several other central banks of several other large countries – China, the UK, Indonesia, and Russia – followed suit and kept policy rates unchanged.

The Bank of Japan raised its policy interest rate from -0.1% to a range of 0-0.1% marking the end of negative interest rates. The policy interest rate in Japan was at this level last in early 2016! Inflation in Japan accelerated to 2.8% YoY in February from 2.2% in January and it has remained above 2% since April 2022 or almost 2 years now. On the other hand, though, the Central Bank of Switzerland (Swiss National Bank or the SNB) cut its policy interest rate by 25bps to 1.5%. Inflation in Switzerland has fallen to the lowest in over 2 years to 1.2% in February. Brazil and Mexico also saw their central banks cut the policy interest rate by 50bps and 25bps respectively. Lastly, there is Turkey the outlier. The Bank of Turkey raised the policy rate by 5ppt to 50% (yes fifty per cent). And while this is high, inflation is running at over 60% and thus real rates are still negative!

So globally after a prolonged period of rising and then stable interest rates as the world economy came out of Covid, rates are starting to fall. To quote Bob Dylan: “the times they are a-changin.” The question is whether they are changing in India as well. And the answer most likely is a bit of yes and no. Yes, because given the inflation trajectory and some high-frequency data starting to suggest a bit of softening in activity, the RBI will have to start to downshift. Note that changes in monetary policy impact the economy with a big lag - as much as 4-5 quarters also. And so the RBI has to act before it sees decisive signs of activity slowing otherwise it might be a bit late. And no because, given the guidance in the last policy, the RBI will have to first shift to neutral gear in April and then follow it up with a rate cut in June. Things are not slowing that dramatically that the RBI has to abruptly change gears. So as things stand now, the most likely trajectory is for the RBI to prepare the market for a rate cut by signalling a shift in policy stance in April and then follow it up with a rate cut in June.

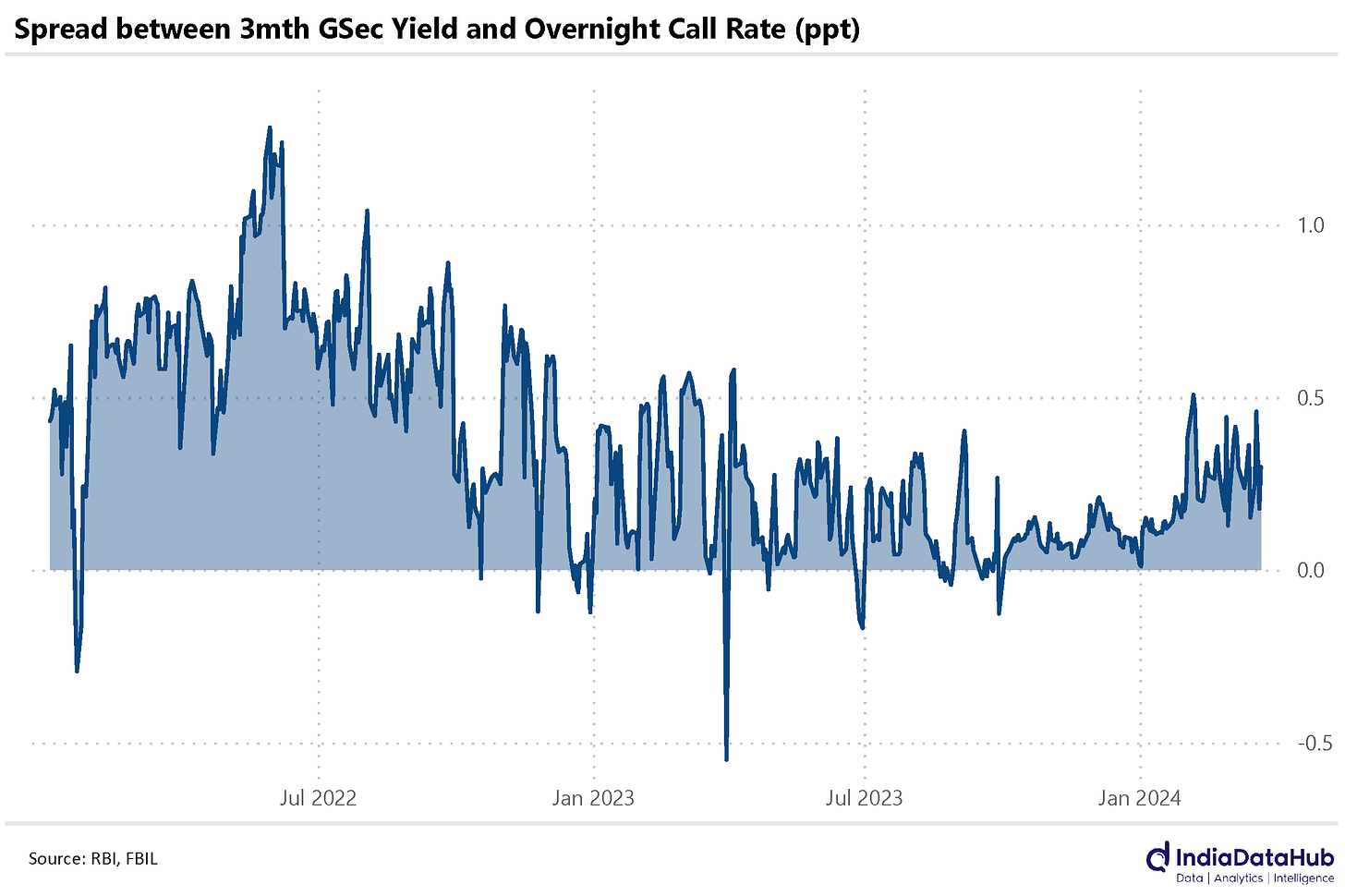

And this is broadly in sync with the current market interest rates – the 3mth GSec yield is 30-40bps above the overnight call rate and this does not suggest that the markets are expecting an imminent rate cut from the RBI. And for the record, the Fed funds futures are currently implying no rate cut from the Fed in its policy meeting in early May. They are expecting a rate cut in mid-June at the subsequent meet.

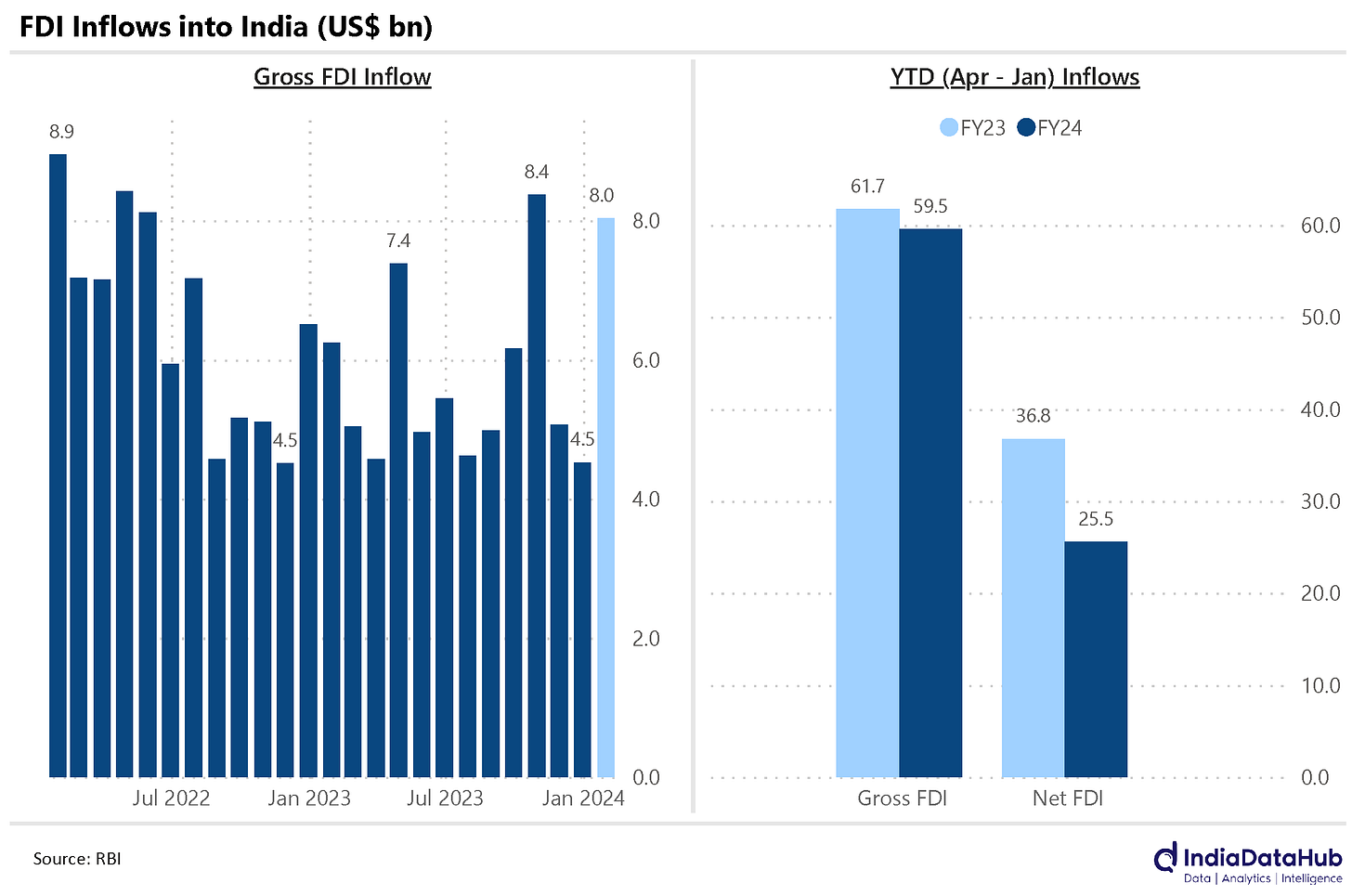

It was mostly quiet on the data front in India. But the more noteworthy among the data releases was FDI for January. And it was a strong month for FDI after an unusually weak December. January saw just over US$8bn of gross FDI inflow which almost fully compensated for the weak inflow in December.

However despite this on a YTD basis, FDI inflow in the current year (FY24) is tracking modestly below that in the previous year (FY23) on a gross basis. And after accounting for the large repatriation this year, net FDI so far this year is still 30% below that of last year.

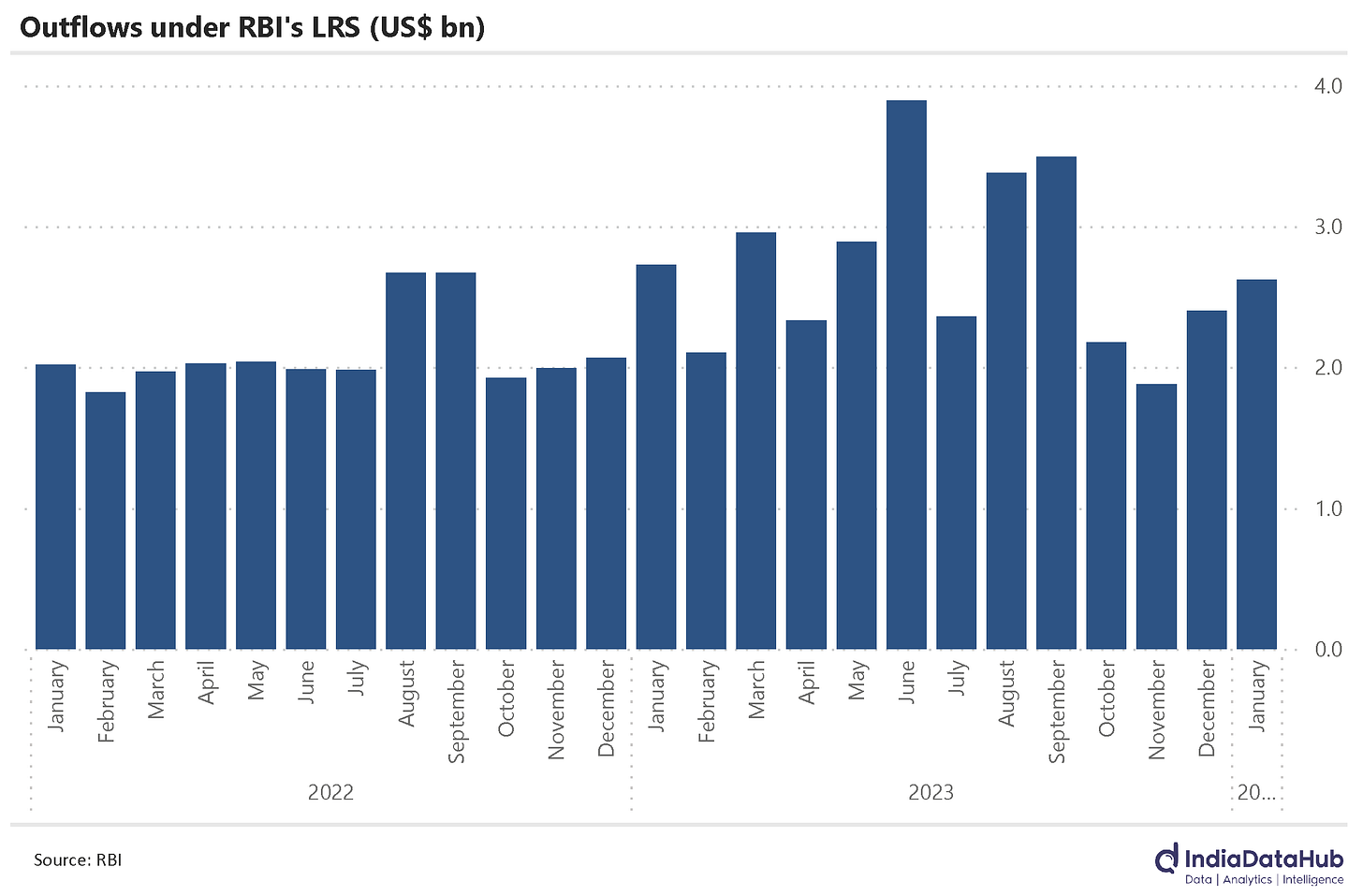

Lastly, the outflows under the RBI’s Liberalised Remittance Scheme (LRS) continue to grow despite the imposition of Tax collection at source (TCS). Outflows in January totalled US$2.6bn, the highest in the last 4 months and only modestly lower than the outflows during January last year when the TCS was significantly lower.

Before we close, here’s some food for thought. We quoted Bob Dylan’s song above. You can check out the full lyrics here. But that made us wonder, did Bob Dylan get inspired by Benjamin Graham’s Security Analysis when he wrote that song? For at the end of that song, a couple of lines read: “…The slow one now will later be fast…” and at the very start of Security Analysis, Benjamin Graham quotes Horace: “Many shall be restored that now are fallen.” Hmm…! Feel free to file this under correlation does not equal causation.

That’s it for this week. There will be a lot more to cover next week. So, see you then.