India-UK Trade and a little bit more...

This Week In Data #133

In this edition of This Week In Data, we discuss:

India - UK bilateral trade is modest

Even in relative terms, bilateral trade is just ~2% of total trade for both countries

Sectorally, trade is skewed especially in Imports

China, ECB keep interest rates unchanged but Turkey cuts them by 300bps

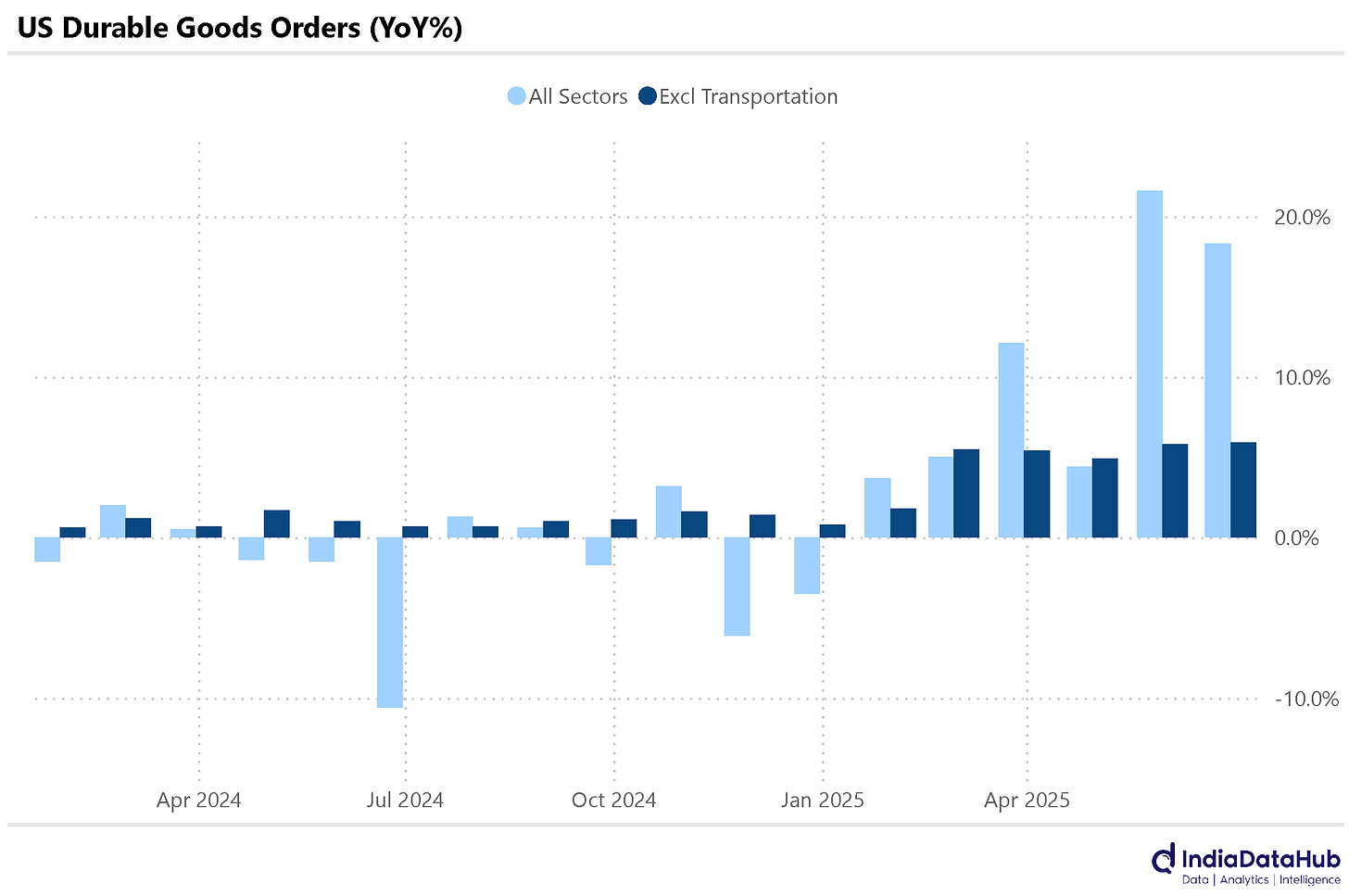

US durable goods remain strong for another month

A fairly data light this week for India. But something else happened. India and the UK signed a free trade agreement (FTA) this week. The expectation is that this FTA will result in a significant increase in trade between the two countries over the next few years. We begin by examining the nature of existing trade between the two countries, which, let's just say has been underwhelming.

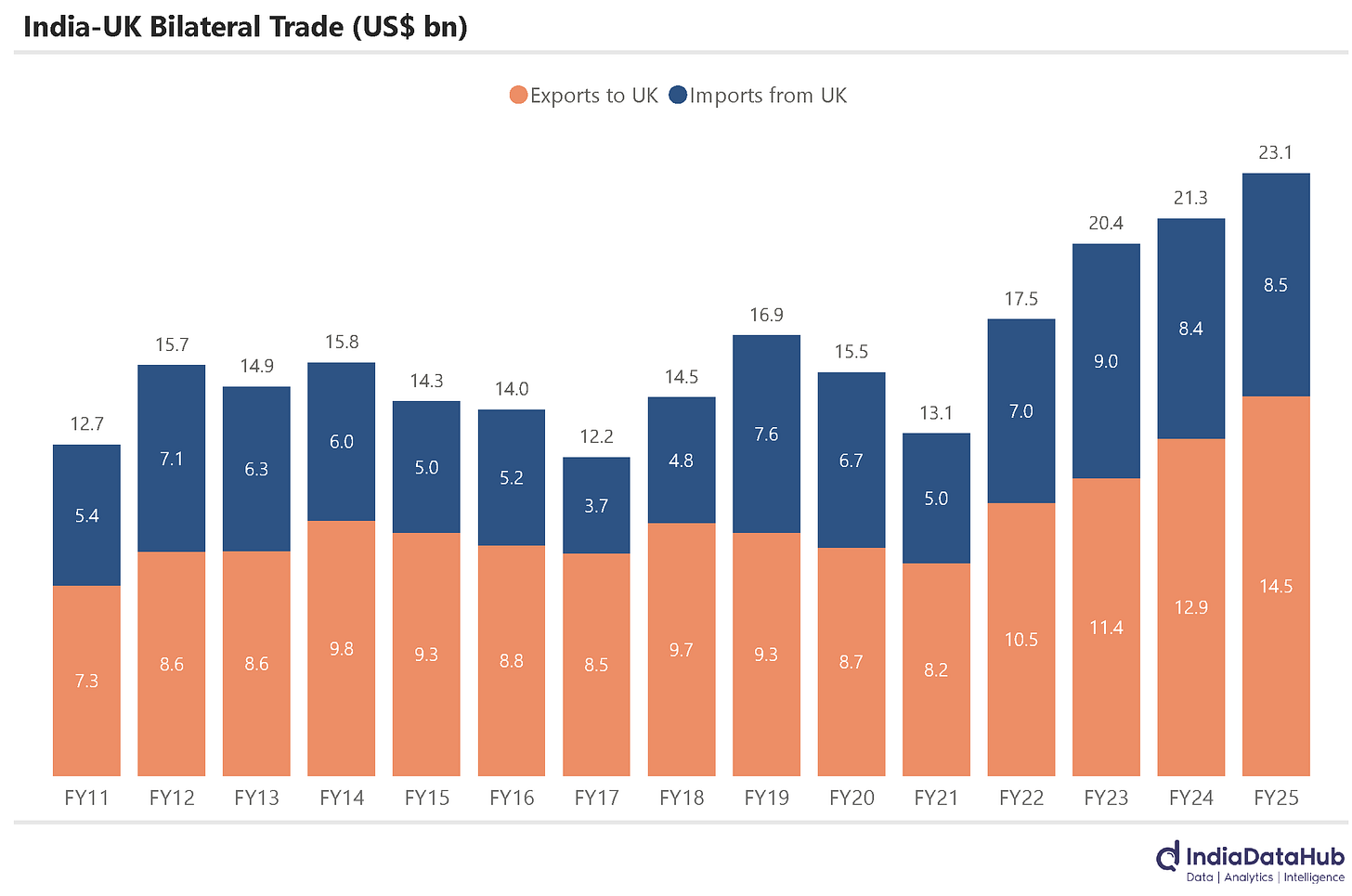

Last year, FY25, the total goods trade between India and the UK stood at US$23bn. This comprises US$14.5bn of exports from India to the UK and US$8.5bn of imports by India from the UK. So India had a trade surplus of ~US$6bn. While this seems advantageous from an India perspective, the problem is that the trade between the two countries has barely grown. In the past 10 years (FY15-25), total trade between the two countries has grown by a modest 5% Cagr. And both exports and imports have grown by ~5%. So neither have India’s exports to the UK seen strong growth, nor have India’s imports from the UK seen strong growth in the last few years.

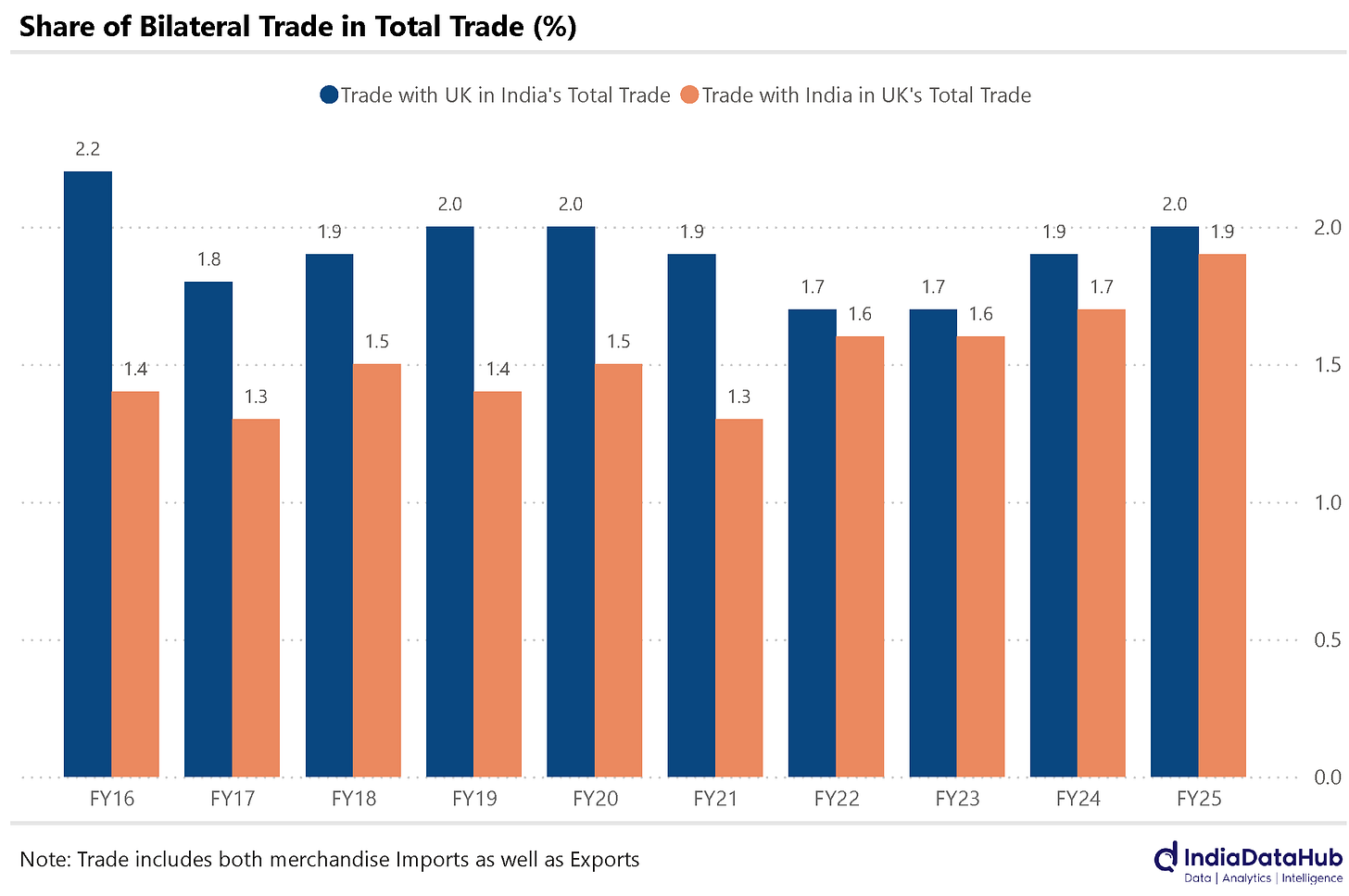

The other notable thing about bilateral trade is its relative size. India’s total trade with the UK totals approximately 2% of India’s total goods trade, and similarly, the UK’s total trade with India adds upto just under 2% of UK’s total trade. And that is because the total trade of both countries is roughly the same. The point being that neither country is an important trading partner for the other as things stand today. Of course the expectation is that this will change.

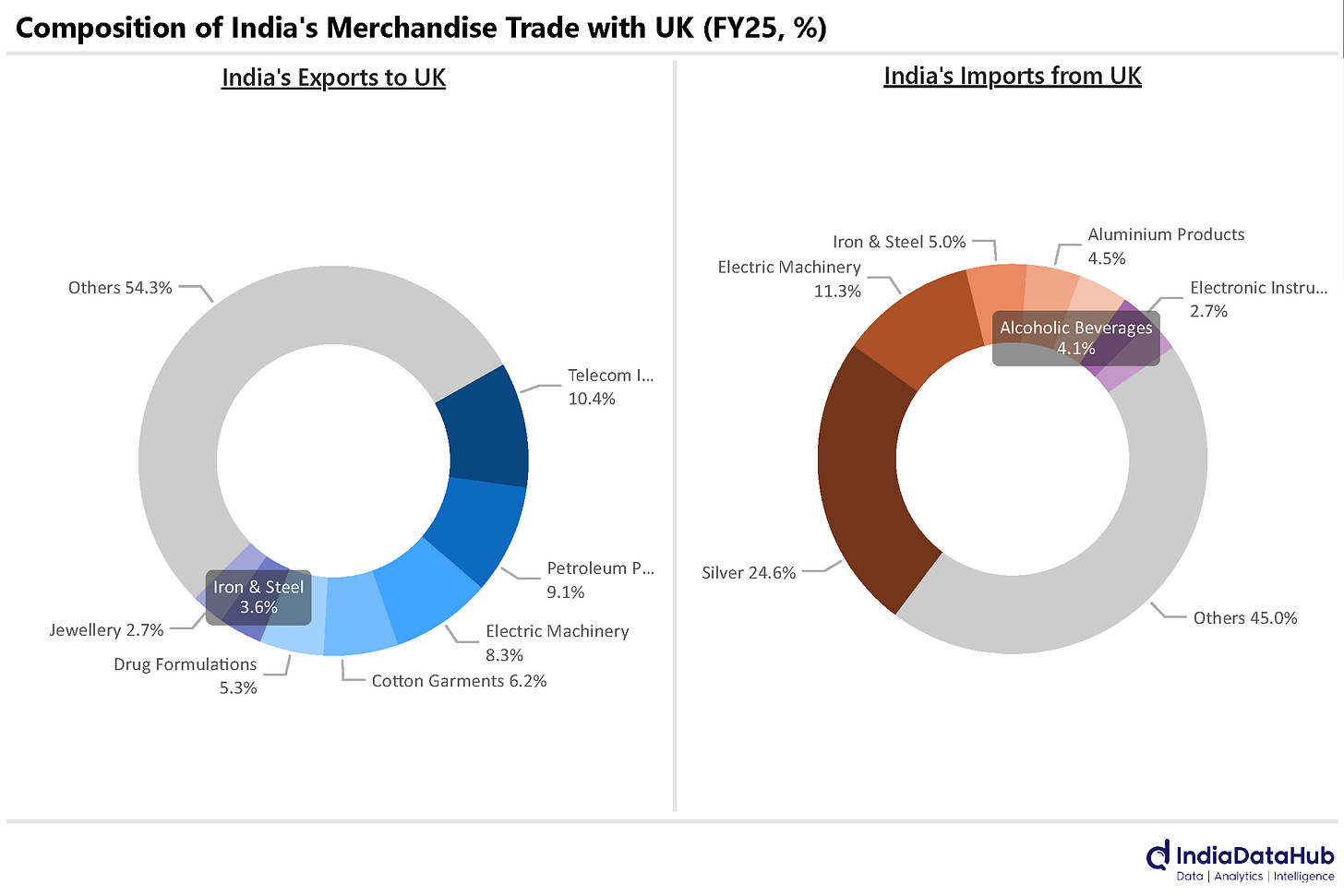

The other notable thing about India-UK trade is how narrow it is, especially the imports. In FY25, almost a quarter of total imports from the UK were just one item – Silver! Electric machinery made up another 11% of imports, with just 5 items making up almost half the imports. While alcohol, an important focus area of the FTA, makes up almost 5% of total imports, Automobiles, another important focus area of the FTA, are currently a negligible component of imports at less than US$100 million in FY25. India’s exports to the UK in comparison are slightly broad based with the top export item – Telecom Equipments – making up 10% of total exports with petroleum products a close second at 9% of total exports. Other large items of export include textiles, electric machinery and pharmaceuticals. The top 5 items make up about 40% of total exports.

Given that the duty reductions under the FTA will kick in gradually over the next few years, it is unlikely that there will be a dramatic increase in bilateral trade immediately. But for the FTA to have delivered the trade gains, one would expect bilateral trade in FY35 to have at say doubled from the FY25 levels, for reference, bilateral trade grew by 60% between FY15-25.

Globally a few central banks made their rate decisions this week. In China, the People's Bank of China (PBOC) kept the 1-Year and 5-Year Loan Prime Rates (LPR) unchanged at 3.1% and 3.5%, respectively. The European Central Bank also maintained all three key interest rates unchanged.

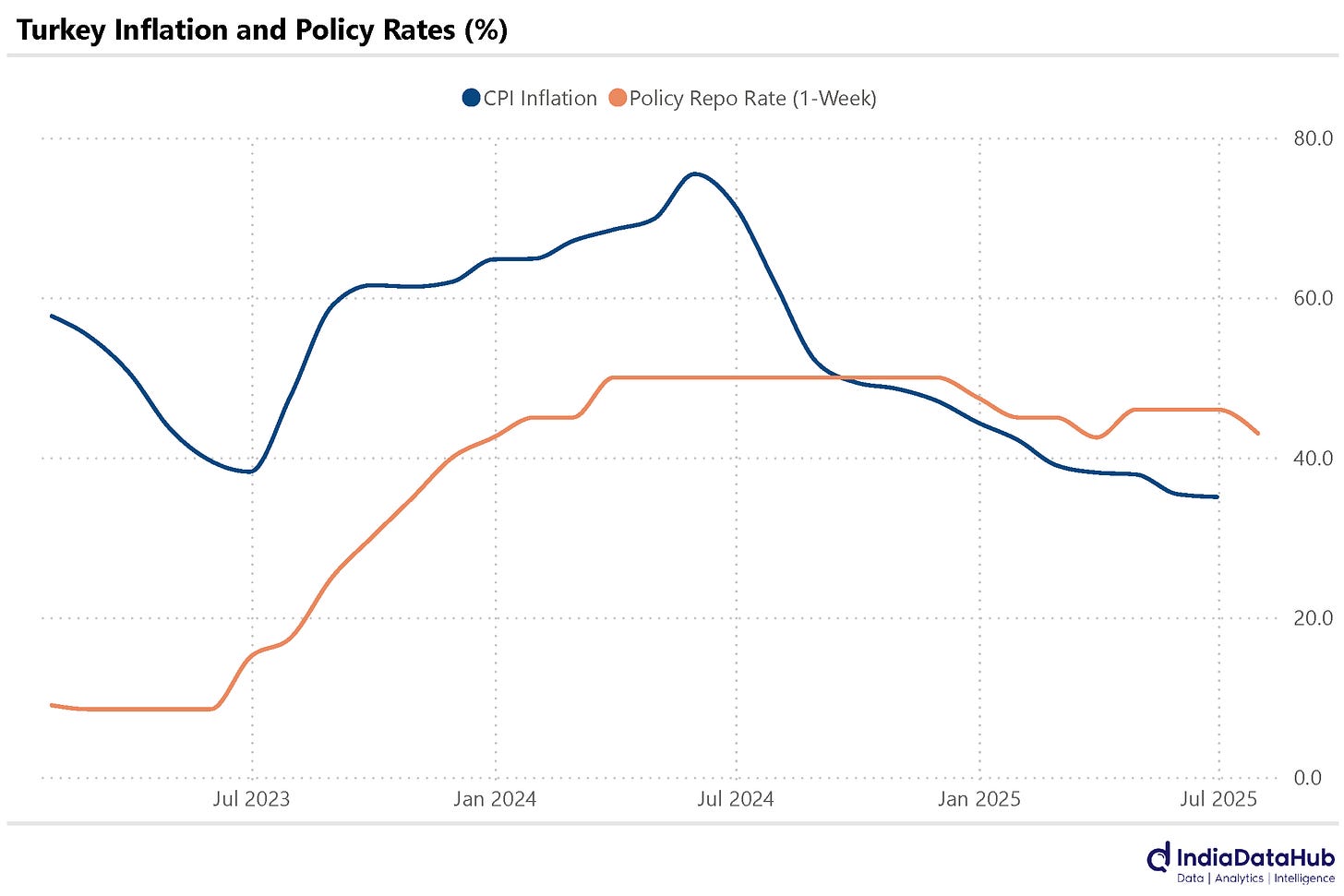

However, the Central Bank of Turkey lowered its policy rate by 3ppt. This rate cut comes as the underlying inflation trend has moderated. Over the past year, Turkey’s inflation has moderated from over 70% to 35%. Lastly, the Bank of Russia also decreased its policy rate by 200 basis points, bringing it down from 20% to 18%. This marks the second consecutive month of rate cuts for Russia.

In the US the Census Bureau released the durable goods data. New orders for durable goods rose by 18.3% year-over-year in June, marking the second consecutive month of double-digit growth. The growth however was largely due to transportation equipment (aircrafts) excluding which new orders grew by ~6% for the second consecutive month.

That’s it for this week. See you next week…