Inflation, Exports, Data Consumption and more...

This Week In Data #47

In this edition of This Week In Data, we discuss:

The uptick in Inflation in November

Decline in exports and imports in November

Sectoral composition of Export and Import growth

Strong momentum in mobile data consumption

Narrowing gap between postpaid and prepaid consumers

US Interest Rate outlook

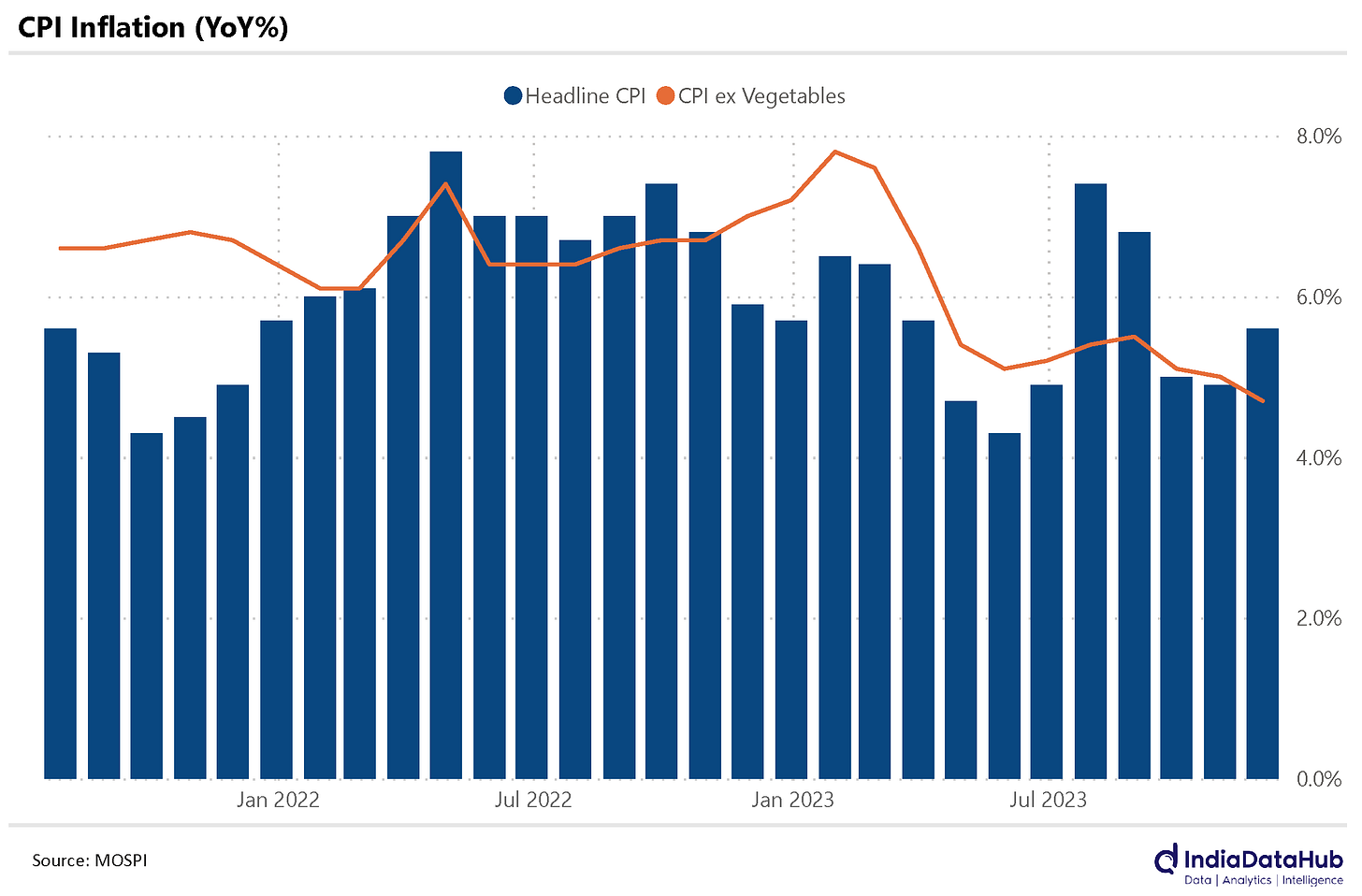

In case you missed, we released our new Payments dashboard. The Dashboard now covers fairly granular data such as issuer & category wise data for credit card and debit cards as also for payment wallets and UPI. You can get a quick overview from this video.Headline CPI Inflation rose 70bps to a three-month high of 5.6% YoY in November. Food inflation rose 170bps to 8% and was responsible for the entire uptick in CPI. Vegetable inflation rose to a 14-month high of 18% YoY. Excluding food, CPI declined 20bps to 3.5% YoY. Core inflation also declined further to 4.1% and is now at the lowest in the last few years.

This increase in headline CPI was expected due to the spurt in Vegetable prices. And given this, the uptick in November CPI is largely inconsequential. Indeed, headline inflation could rise further in December since Vegetable inflation had decelerated sharply in December last year while they are on an uptrend this year. However, it is quite likely that vegetable prices will start to moderate in 1Q2024 and that will pave the way for headline CPI to also moderate. The expectation then that we will see rate cuts in the first quarter of next financial year continues to hold.

India’s exports and imports declined in November. While exports declined just under 3% YoY as per the quick estimates, imports declined just over 4% YoY. Consequently, the trade deficit moderated to just over US$20bn in November. Recall that October had seen a record high trade deficit of over US$30bn as per the quick estimates. We had written in this newsletter that this was likely a reflection of the Diwali timing issue and unlikely to be sustained. The November trade deficit is broadly in line with the trend of recent months.

Gold has been a key driver of imports this year – in November Gold imports rose 6% YoY and YTD they have risen by over 20% YoY even as overall imports have declined 9% YoY. Electronics is the other key category with strong growth in imports this year – YTD imports of electronics goods have grown by 11% YoY. This increase though continues to be offset by a faster growth in electronics exports. YTD Electronic goods exports have grown by 24% YoY.

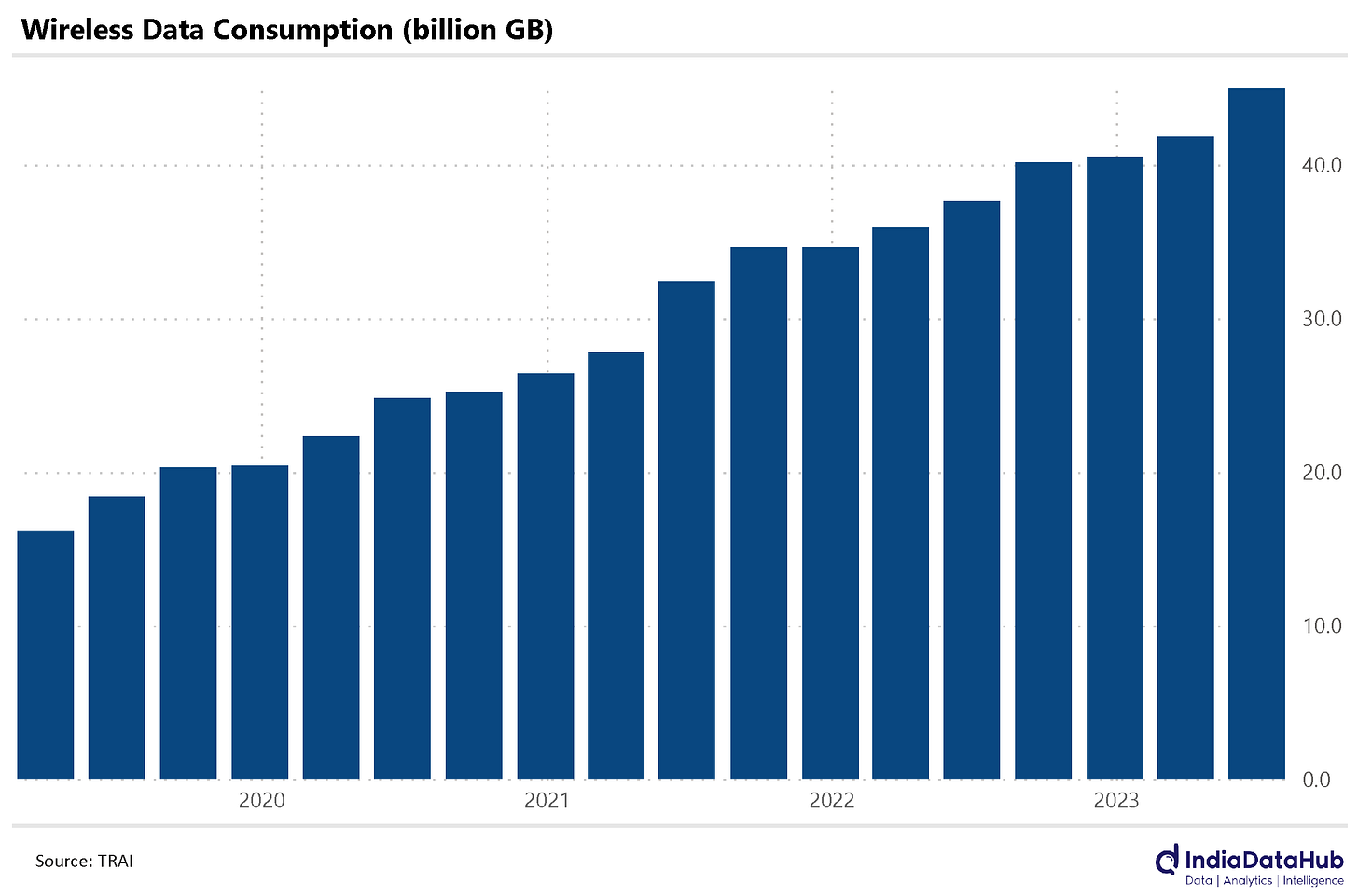

TRAI recently released the June quarter (yes, June!) data for the Telecom sector. And two interesting trends in the data. Firstly, the momentum in data consumption continues to be sustained. The overall wireless data consumed in the country rose to 45 billion GB during the June quarter, up almost 8% QoQ. This is the sharpest QoQ growth in the last 2 years. The average monthly data consumption per wireless subscriber is now north of 16 GB!

Secondly, the ARPU for prepaid and postpaid subscribers are rapidly converging. During the June quarter, the postpaid ARPU was 15% higher than that for prepaid subscribers. Two years back, postpaid ARPU was over 2x of that of prepaid subscribers. And this convergence is happening through a combination of increasing ARPU for prepaid subscribers and declining ARPU for postpaid subscribers. With ARPU now largely a function of data consumption (and data pricing coming down) given that voice is largely free, this convergence likely reflects a combination of two factors - growing data consumption for the prepaid subscribers pushing up their ARPU on one hand and the other hand lower yield on data consumption for postpaid subscribers dragging down their ARPU.

It was the case that the postpaid subscribers were the affluent and business customers with heavy data consumption. If our hypothesis is right, it appears that the gap between the data haves and the have-nots is rapidly converging 😊.

Globally it was a week of status quo for the major central banks. First, the US Fed kept its policy rate unchanged at 5.25% - 5.5%. The momentum in the job market (with non-farm payrolls being the proxy) gradually moderated and inflation itself has fallen to 3.1% in November this year from 7.1% in November last year. Following the Fed, the ECB kept its main refinancing rate unchanged at 4.5%. The Bank of England also kept its bank rate unchanged at 5.25%.

With this, the markets are now looking for policy easing and the Fed fund futures are currently suggesting the first rate cut from the Fed to happen as early as March next year. If this were to materialise, then a rate cut from the RBI in April is on the cards.

That’s it for this week. A quiet week awaits us next week. So, we will try and do some crystal gazing for the next year. See you next week!