Inflation, Growth and Interest Rates...

This Week In Data #128

In this edition of This Week In Data we discuss:

CPI Inflation moderates further but core inflation ticks up

Growth estimates is what will drive further rate cuts

Bank credit growth down to single digits

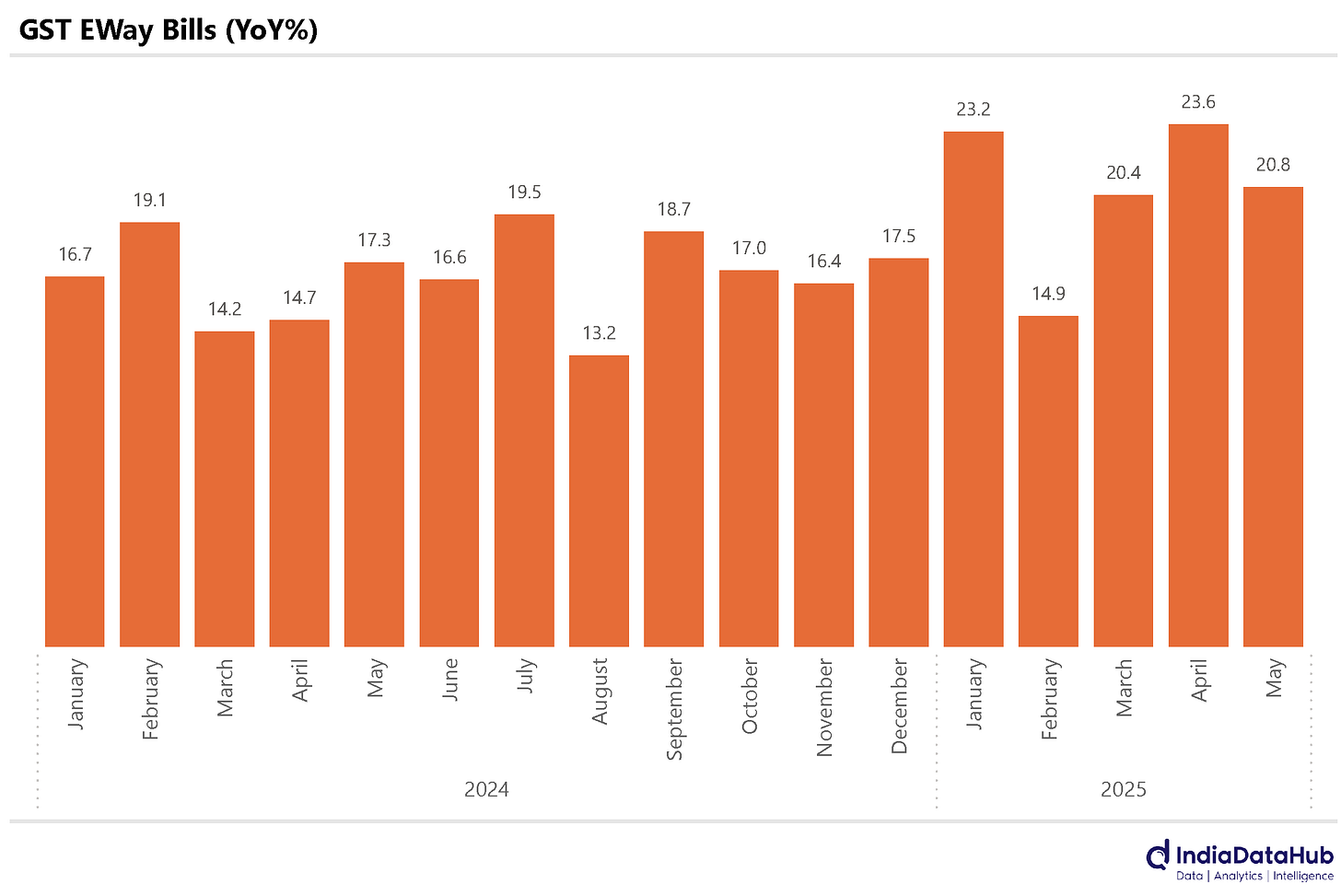

GST Eway bills continue to see robust growth

Petroleum product consumption remains soft in May

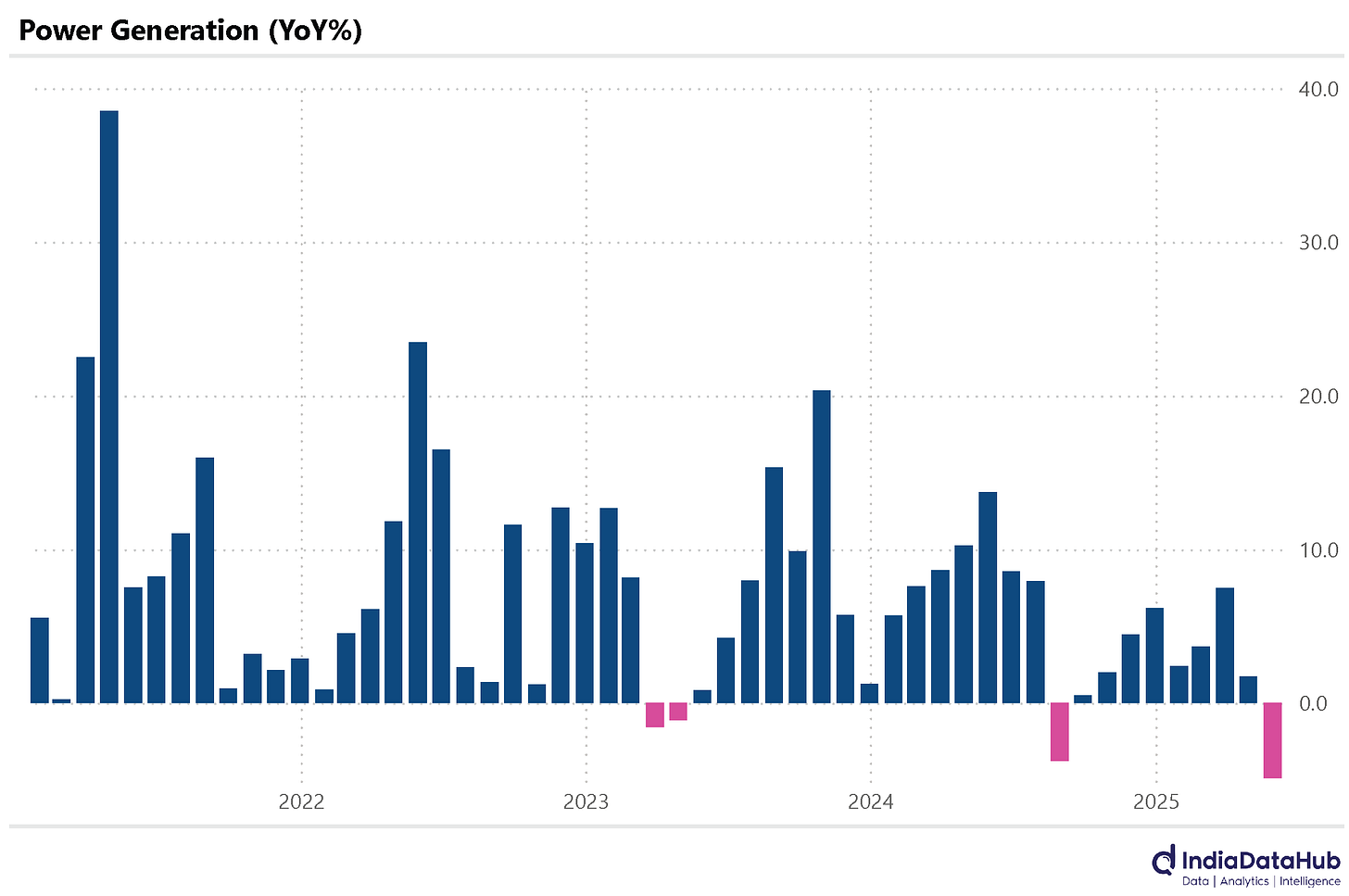

Power generation declines sharply in May

Automobile sales saw mixed trends in May

US CPI ticks up slightly in May and China’s inflation remains negative

CPI Inflation fell to 2.8% YoY in May from 3.2% in April. This is the lowest CPI print since early 2019. Core inflation continued to edge up reaching 4.2% in May, the highest since late 2023. However, a large part of this is due to higher Gold prices. Stripping out the retail fuel and precious metals prices, the core-core inflation was at 3.5% in May, though even this has been ticking up gradually.

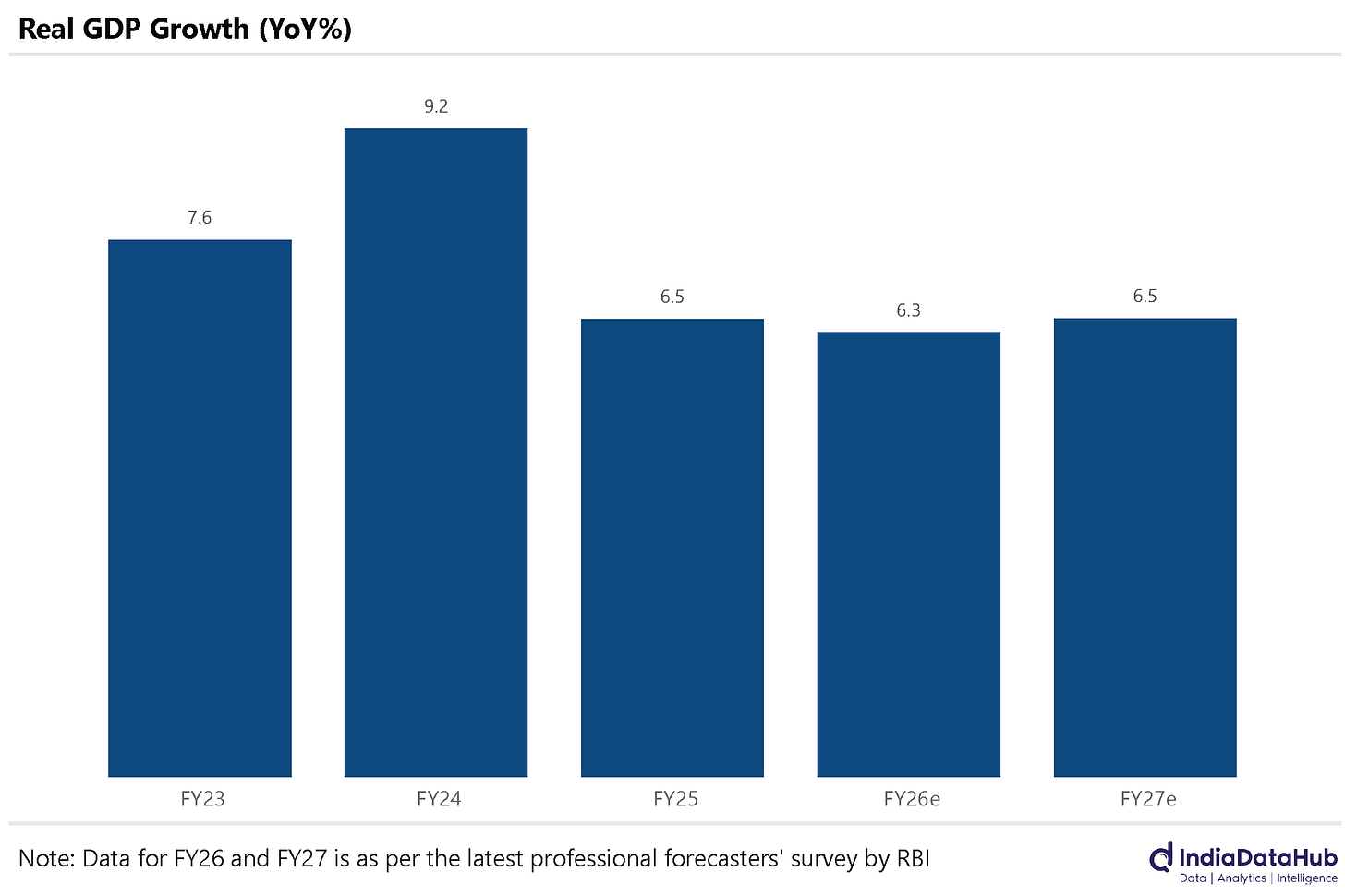

The big picture though is that given how low inflation is and the fact that despite rising core inflation is modest means that the RBI does not have to worry about inflation currently. It is growth that it is concerned about currently. GDP growth moderated last year and the current estimate is for growth to be around 6-6.5% this year and the next. While this is reasonable, it is not great. The low rate of inflation thus gives the RBI space to do its bit to support growth.

And while the RBI has indicated post the 50bps rate cut earlier this month that there may not be any further rate cuts immediately if inflation remains low, the space to cut rates further remains. The RBI may choose to pause in August but if inflation remains sub 4%, further rate cuts are certainly on the cards before the end of the year.

And talking of growth, the high-frequency data continues to be mixed. Credit growth has continued to moderate. As of the end of May, credit growth of the scheduled commercial banks has fallen to below 9% YoY, the slowest growth in the last few years and the second consecutive fortnight of single-digit growth. A year ago, credit growth was running at 15-16% so the last few months have seen a material moderation in credit growth.

Deposit growth has fallen to single digits but is (modestly) higher than the credit growth. Consequently, the Loan-to-deposit ratio has fallen 2ppt from the peak in February this year to ~77% currently.

May saw continued strength in sales of Two-Wheelers as well as that of Buses & Other Passenger Vehicles. Tractors saw moderate growth in sales while Construction Vehicles continued to see a decline in sales growth. Sales of Passenger Vehicles declined 3% YoY in May after two months of growth. Trucks & Other Commercial Vehicles are currently seeing the weakest trend with a 5% decline in May. This is the 8th month of decline in the past 12 months.

GST EWay bills saw 20% growth in May. This is the third straight month of over 20% growth. More importantly, EWay bills have seen a sharp uptick in the last few months. Between January to May this year, the EWay bills have grown by 20% YoY as against a growth of 17% during 2H2024.

Consumption of petroleum products grew by a modest 1% YoY in May. However, this comes after 0% growth in April and declines in February and March. So while in absolute terms the growth is weak, sequentially it is an improvement.

The improvement is largely due to LPG and Petrol. LPG consumption grew 10% YoY in May, the highest growth since July last year while Petrol consumption rose 9% YoY, the highest since December last year. On the flipside, Bitumen consumption declined for the 4th consecutive month in May.

Power generation declined by 5% YoY in May as per the provisional data. This is the sharpest decline in power generation since June 2020! The decline was largely due to a 10% decline in thermal power generation even as renewable power generation increased by 17% YoY. Almost 17% of the power generation in May was from renewable sources, the highest ever.

Lastly, globally there were a bunch of inflation releases. Starting with the US where CPI ticked up slightly to 2.4% YoY in May from 2.3% in April. Energy prices declined by 3.5% year-on-year, while the core CPI rose by 2.8% in May. China on the other hand continues to see deflation. May was the 4th consecutive month that CPI Inflation was negative on a YoY basis. Most of this though is due to food and fuel. Core CPI rose 0.6% YoY but it is still modest.

In Brazil, inflation fell by 20 basis points from the previous month, reaching 5.3% in May. This marks the lowest inflation rate recorded in three months. Similarly, Poland also saw a decrease in inflation, dropping from 4.3% to 4% month-over-month in May.

That’s it for this week. See you next week…