Inflation, Interest Rates, House Prices and more...

This Week In Data #67

In this edition of This Week In Data, we discuss:

Further decline in May CPI, both headline and core

Decline in bond yields and MPC rate cut expectations

House Price expectations

Foreign trade for May

US Interest Rates

CPI Inflation continues to decline. It declined 8bps in May to 4.75%. This is the 5th consecutive month of decline in the CPI during which time it has fallen by almost 100bps - from 5.69% in December to 4.75% in May. Core inflation has fallen further and is now at just 3.1%. Food inflation however did not decline, and it remains elevated at 7.9% YoY. So, good news on the inflation front.

And in response to this bond yields have fallen. The 10-year GSec yield has fallen to 7%, the lowest in a year. What has also helped bond yields is that there are 2 dissensions in the MPC now. So the MPC is in a sense edging closer towards a rate cut. And while the latter is true, inflation is not an important factor in that decision. High inflation can make the MPC keep interest rates high or even raise them, but low inflation by itself is not sufficient for the MPC to cut rates. Unless of course, inflation is flirting with zero which is not the case currently.

So, what is going to drive the MPC to cut rates is Growth. Specifically, an expectation that growth could see a sharp deceleration. Otherwise, the current level of interest rates is not debilitatingly high. Indeed, one can argue that given the trends in asset markets – the level of retail participation in equities, the growing confidence in real estate (more on that later in this edition), and the rise in unsecured lending – the MPC ought to stay vigilant and from a monetary stability perspective keep real rates slightly higher than what it would otherwise want.

And while we generally talk of RBI and the MPC as being concerned with growth and inflation, monetary stability is an explicit mandate of the RBI. Note what the preamble to the Reserve Bank of India Act, which lays down its basic function states:

"…to regulate the issue of Bank notes and keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage; to have a modern monetary policy framework to meet the challenge of an increasingly complex economy, to maintain price stability while keeping in mind the objective of growth."

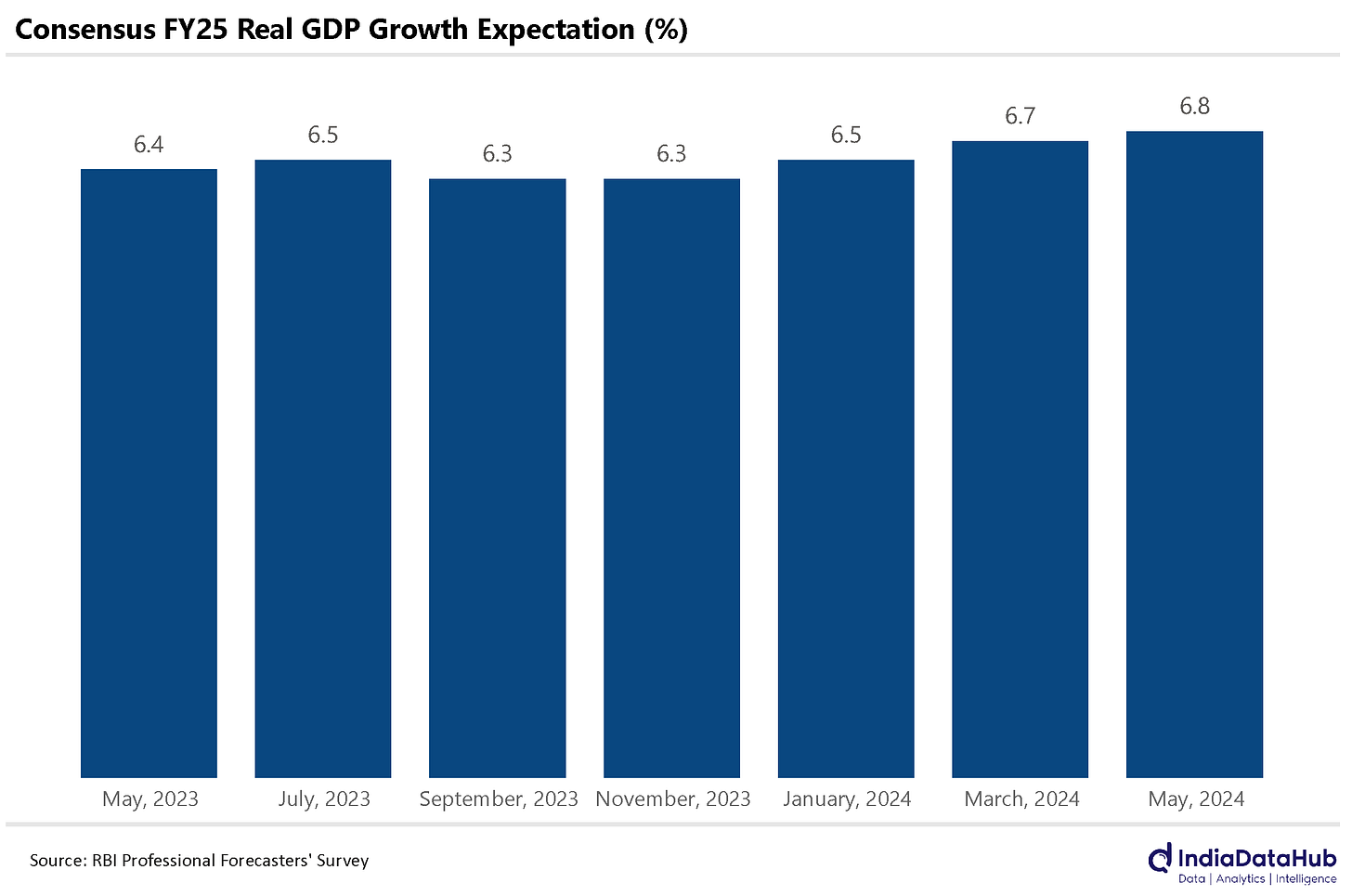

The job of a central bank is NOT to be a cheerleader, but someone who worries about risks. What the RBI and the MPC have to assess currently is whether the risk of monetary instability from the factors described above outweighs the risks of a slowdown in growth. And as things stand now, the expectations of GDP growth are only being revised upwards as the chart above shows.

We mentioned house prices above. And one of the important sentiment data for housing comes from the RBI’s Inflation Expectations survey which is conducted every alternate month in the major cities. One of the questions asked in the survey is about expectations of house prices 12 months out. The percentage of people who expect housing prices to rise faster than their current rate is the highest in over a decade. On the flip side, the percentage of people who expect housing prices to decline is the lowest in over a decade. So, it is not just the equity markets where there is a lot of optimism currently, it is the real estate market too.

Lastly, trade. India’s exports increased by 9% YoY in May while Imports increased by 8%. And while the trade deficit widened sharply on a sequential basis, it was largely flat on a YoY basis at ~US$23bn.

Electronics exports continue to remain the key drivers of exports. In May they grew by almost 23% YoY, broadly the same growth as in April. Petroleum exports also saw strong growth in the mid-teens in May. Engineering goods and Textiles saw exports grow in single digits while Gems & Jewellery exports declined modestly.

Import growth was almost entirely driven by Petroleum products which saw a 28% growth. Excluding petroleum, imports were almost flat compared to May last year. Notable among other categories was the sharp 30% growth in transport equipment. Gold imports declined in May while imports of Machinery were largely flat. Electronics imports also saw a modest 7% growth.

On a small base, Pulses imports have been seeing strong growth in recent months. On a YoY basis, May is the third consecutive month of over 100% growth in imports. This is in response to lower domestic production which has been manifesting itself through a double-digit increase in Pulses prices which is in turn impacting the food inflation.

The US Federal Reserve maintained interest rates unchanged, as expected this week. The markets are currently expecting the Fed to maintain rates in its next policy meeting on 31st July, and to begin the policy easing cycle in September and end the year with a total of 50bps of rate cuts. The Bank of Japan also kept interest rates unchanged this week, even as inflation remains elevated. Lastly, China's Inflation edged up to 0.4% in May, the fourth consecutive month of (positive) inflation.

That’s it for this week. Next week will be relatively quiet on the data front, both domestic and global. So, take it easy folks…