Inline GDP growth, strong Auto sales, weak debt issuance and more...

This Week In Data #28

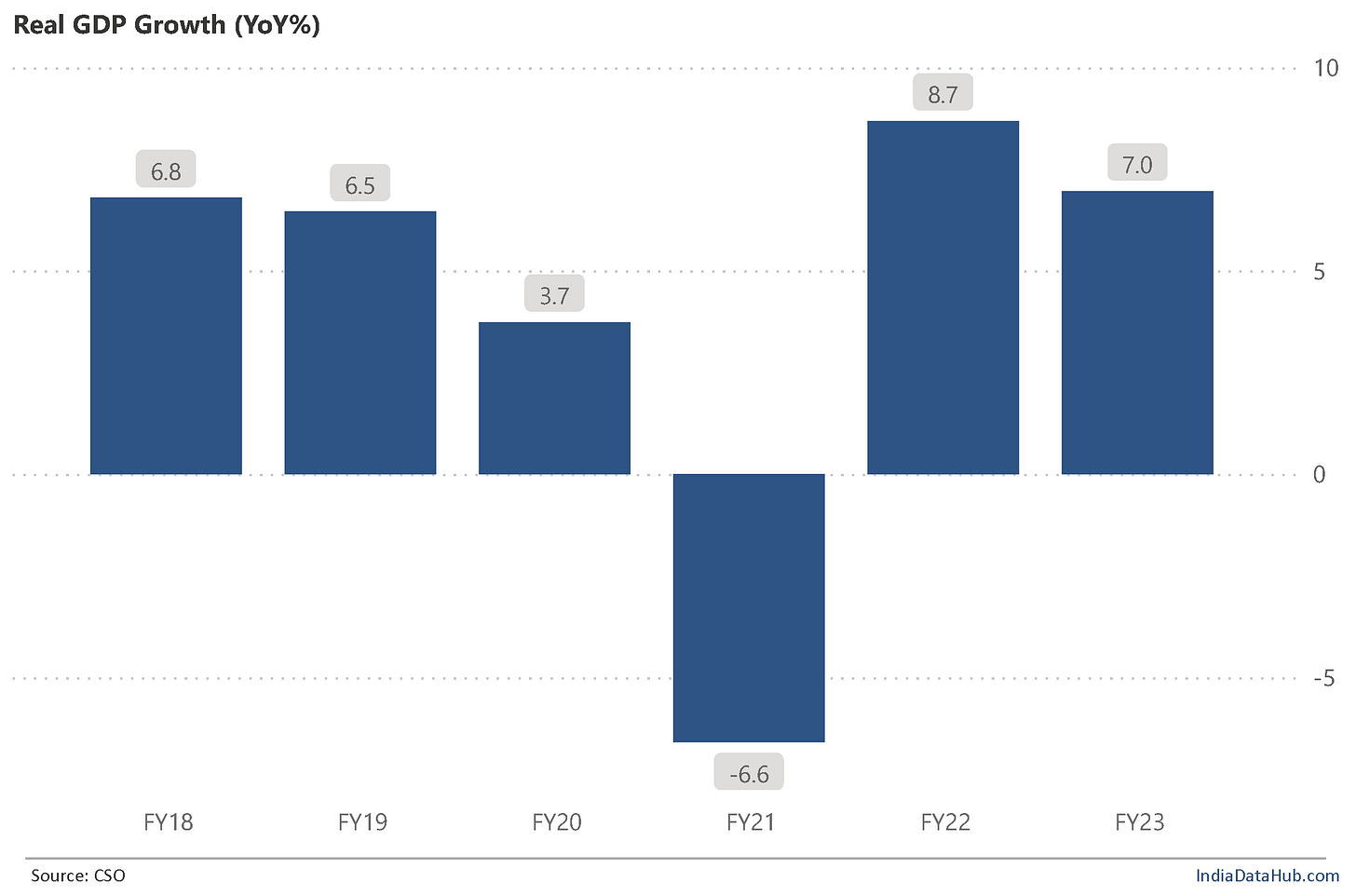

Wouldn't it be cool to have key global indicators in one place? From GDP to Unemployment. From Inflation to Interest rates. Exports to Industrial Production. And more. Coming soon, on IndiaDataHub...The Indian economy is expected to grow by 7% in the current financial year. This is as per the first advance estimate of GDP released yesterday by the CSO. This is slower than the 8.7% growth in the previous year but broadly in line with the consensus estimate. In absolute terms, the level of real GDP in FY23 is expected to be ~10% higher than in FY20 – the pre-pandemic year.

However, given that this is an advance estimate – the estimate has been made even before the year has ended – it will get revised multiple times as more data becomes available. Last year for example the first advance estimate projected GDP growth of 9.2% for FY22 and this has seen a downward revision to 8.7% as of today.

The CSO’s yesterday’s estimate is basis data available till November. If the data for December – March turns out to be stronger, then the growth is likely to see an upward revision and vice-versa if the data for the remaining months turns out to be softer. And the data flow has generally been positive.

With the start of a new month, we are getting a raft of high-frequency data for December. Auto sales were mixed in December. While 2W sales declined 7% YoY after four consecutive months of growth, Car sales continued to see growth for the 5th consecutive month. They grew 11% in December. Tractor sales have also seen double-digit growth in December, the third such consecutive month. Commercial vehicle sales (goods carriers) have seen YoY growth every month in 2022. And 2W sales even though they declined in December, have seen over 20% growth in the last three months. So, Automobile sales data has generally been strong in the last few months.

Against the turn of play, while exports are struggling and growth in imports has also moderated sharply, Cargo traffic at major ports saw a 10% growth in December. This is higher than the low single-digit growth seen in the preceding couple of months. The growth in December was due to a big jump in Iron ore (export) and Coal (import) shipments. However, this did not flow through into a corresponding jump in railway freight traffic which saw low single-digit growth, the same growth as in the preceding couple of months. This divergence would suggest a weaker domestic economy, which is contrary to recent trends. But this is just 1-month data and there is no point in over-interpreting the divergence.

As one would expect in a tightening monetary policy environment, demand for credit moves to the banks. And in sync with it, the overall issuance of money market credit (Bonds + CPs) has been declining. In December it declined 20% YoY. The decline is more in CPs (again not surprisingly given that short-term rates have increased more than long-bond yields) where issuances are down over 50% for the last two months. Bond issuances have been mixed – they have seen strong growth in the last two months but had declined in the preceding three months.

That’s it for this week. Next week will be more data-heavy with the all-important CPI release – both in the case of India and the US. Have a good weekend!