Interest Rates, Consumer Confidence and more...

This Week In Data #127

A quick heads-up. The first edition of our Fiscal Matters Handbook, a comprehensive reference book on India's public finances releases next week. In over 100 pages, this publication gives trends in government finances both the central government and the state governments and also highlights some of the key big picture trends based on the FY26 Union and State budgets. Stay tuned…In this edition of This Week In Data, we discuss:

RBI cut policy rates by a surprise 50bps and also the CRR by 100bps

Further rate cuts though may not flow through immediately

Consumer confidence over incomes and expenditure has increased, especially in rural areas

Kharif MSPs have seen a modest increase which should not impact inflation

ECB cuts interest rates as Euro area CPI falls below 2%

US labour market continues to generate jobs even as the pace of job growth keeps on moderating

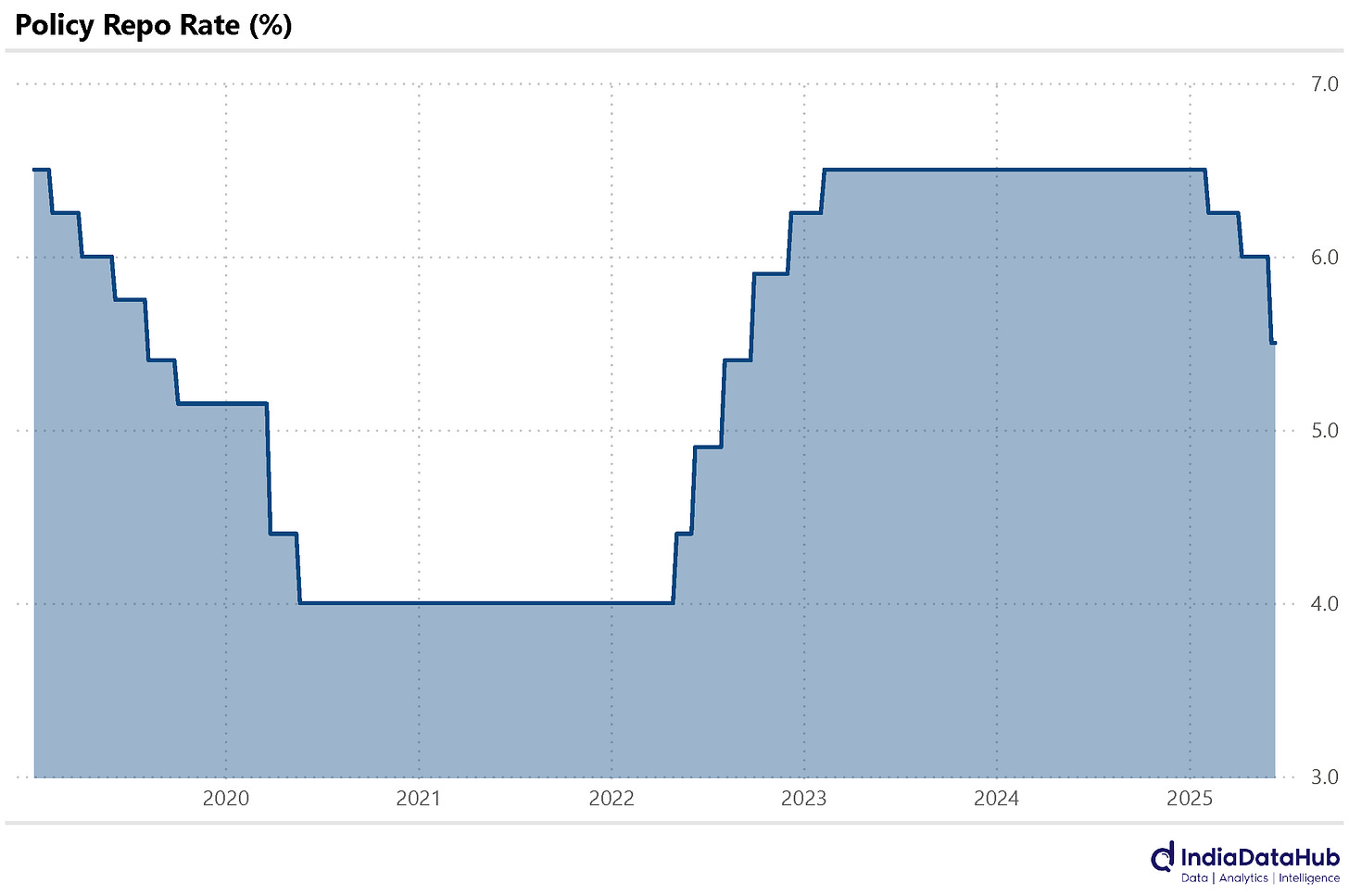

So we got a 50bps rate cut from the RBI’s Monetary Policy Committee this week. This is higher than the consensus expectation of a 25bps rate cut. From the start of the year, we have seen a 100bps reduction in the policy rates from the RBI.

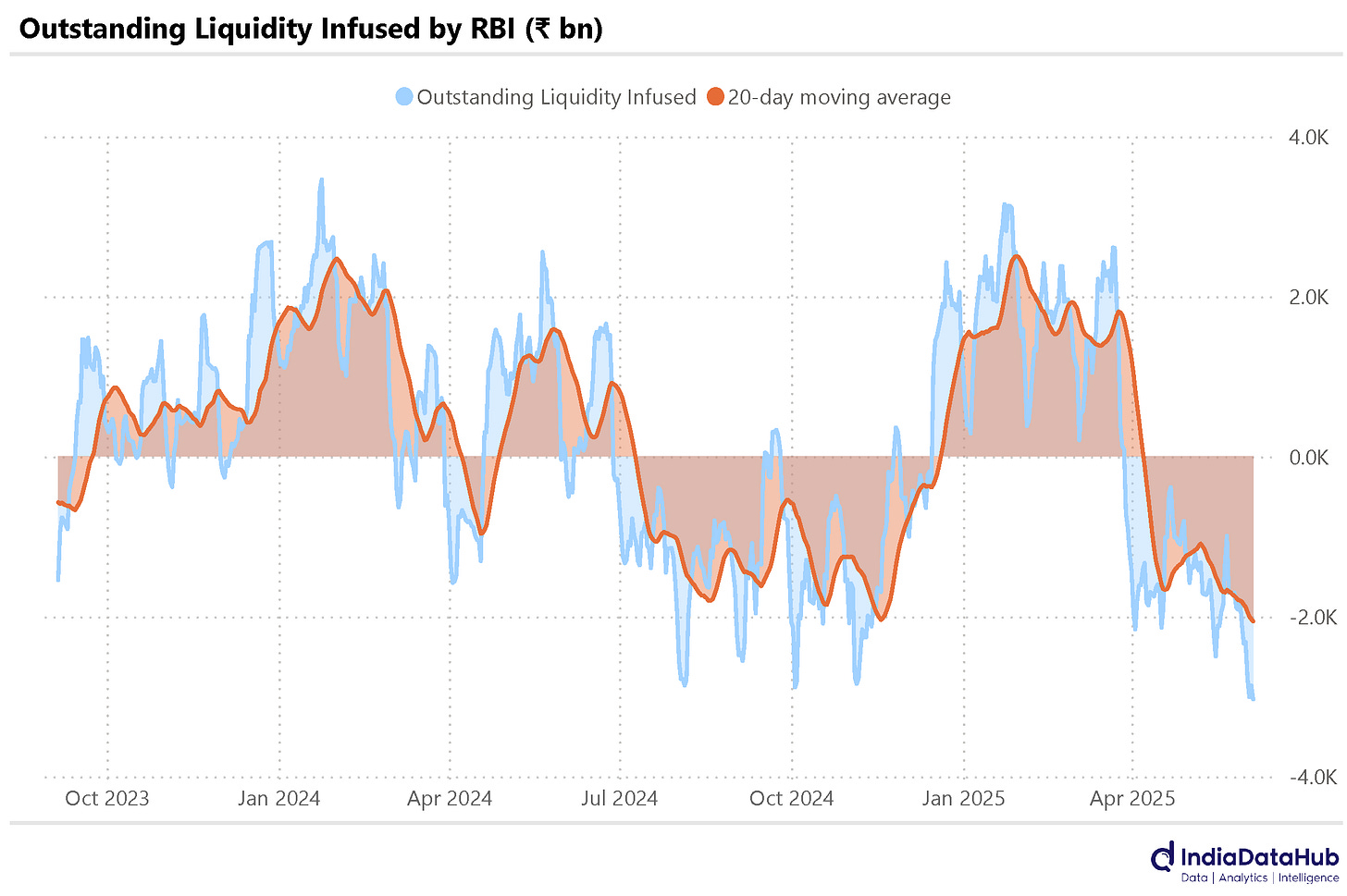

Moreover, we also got a 100bps cut in the CRR – although the CRR cut is effective only from September in a staggered manner (which does beg the question as to why it was announced in June when it could have been announced in August).

The most important thing though is that the MPC has changed its stance from accommodative to neutral and explicitly mentioned:

“After having reduced the policy repo rate by 100 bps in quick succession since February 2025, under the current circumstances, monetary policy is left with very limited space to support growth.”

Effectively, the MPC is saying that unless circumstances change significantly (effectively, growth turns out to be weaker than expected), expect no further rate cuts from us in the foreseeable future. So the additional 25bps rate cut this week was more a bringing forward of the rate cut that might have otherwise happened in August.

As we discussed last week, the rate cuts so far have just started to get transmitted to the real economy via the banking system. However, the 50bps rate cut this week coupled with the strong messaging on liquidity through the CRR cut would result in faster monetary transmission, both on the credit and also deposits side.

Consumer confidence both in rural and urban areas seems to be increasing and that bodes well for growth. As per the RBI’s latest consumer confidence survey in rural areas, almost 60% of the respondents felt that their incomes would increase over the next 12 months. Also, almost 70% of the respondents felt that their non-essential (non-discretionary) expenditure would increase over the next 12 months. Both percentages are the highest since the survey began in Sept-2023.

On the urban side, where we have a longer history of data, we see similar optimism. In the latest survey in May, 58% of the respondents felt that their incomes would rise in the next 12 months. On the non-essential expenditure side, however, urban respondents are less optimistic than rural respondents. Only 38% of them said their non-essential expenditure would increase in the next 12 months. Although both percentages are the highest since mid-2019!

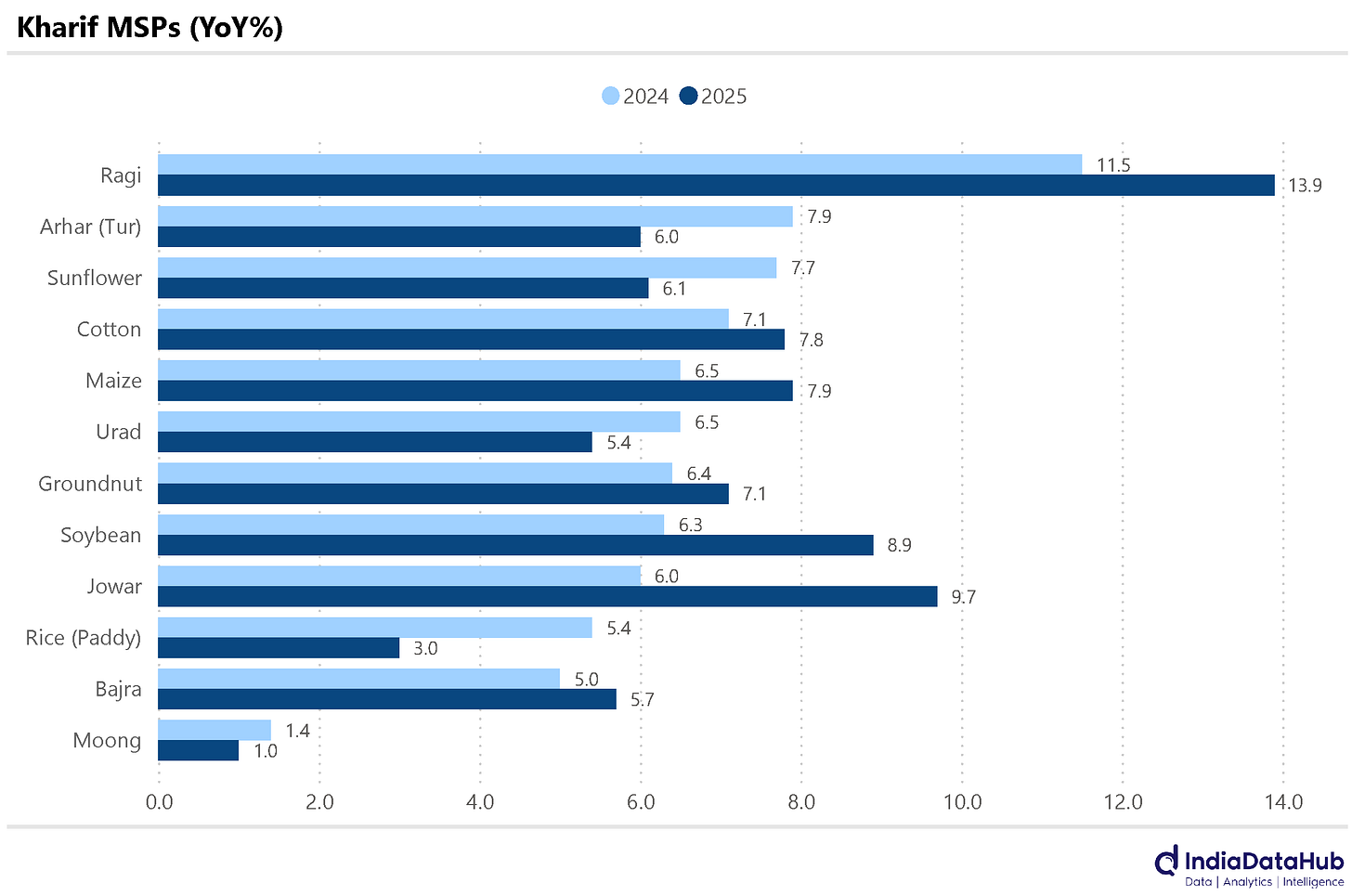

The government announced the Kharif MSPs recently and in general the increases have been modest. For Rice and Pulses, the increase in MSP this year has been lower than last year while for Coarse cereals the increase has been higher than last year. Ragi has seen the biggest increase in MSP this year at 14% on top of a 12% increase last year. Jowar and Soybean are the other two crops that have seen a big increase in the MSP this year. Given how low food inflation is currently, this relatively modest increase in MSPs will probably not adversely impact food inflation.

Globally, the European Central Bank (ECB) cut its key policy rates by 25 basis points, as inflation has reached the central bank's target of 2% amid ongoing trade tensions with the US. The Euro Area's HICP fell by 30 basis points from the previous month to 1.9% in May, driven in part by a 3.6% year-over-year decline in energy prices.

The new interest rates, effective from June 11, 2025, will be 2.00% for the deposit facility, 2.15% for the main refinancing operations, and 2.40% for the marginal lending facility. In Russia, the Bank of Russia also reduced its key interest rate by 100 basis points to 20%(!).

Lastly, the Bureau of Labor Statistics (BLS) released the US Non-Farm Payroll data yesterday. Non-farm payroll employment increased by 139,000 jobs in May, which is slightly lower than the 147,000 jobs added in the previous month, but higher than the average of 110,000 during the March quarter. The unemployment rate remained largely unchanged at 4.3% in May. So while the labour market is slowing down, the economy continues to generate jobs.

That’s it for this week. Its Alcaraz vs Sinner in the French Open final tomorrow. Promises to be a cracking one. Don’t miss it…

good