Interest Rates, Falling Rupee, Monetary Transmission and more...

This Week In Data #135

In this edition of This Week In Data, we discuss:

RBI keeps interest rates unchanged as growth-inflation outlook remains stable

Rupee depreciated sharply against the Chinese Yuan posing risks to core inflation

Monetary transmission has been fairly strong in the last few months

Kharif sowing has been fairly strong so far but dominated by Rice

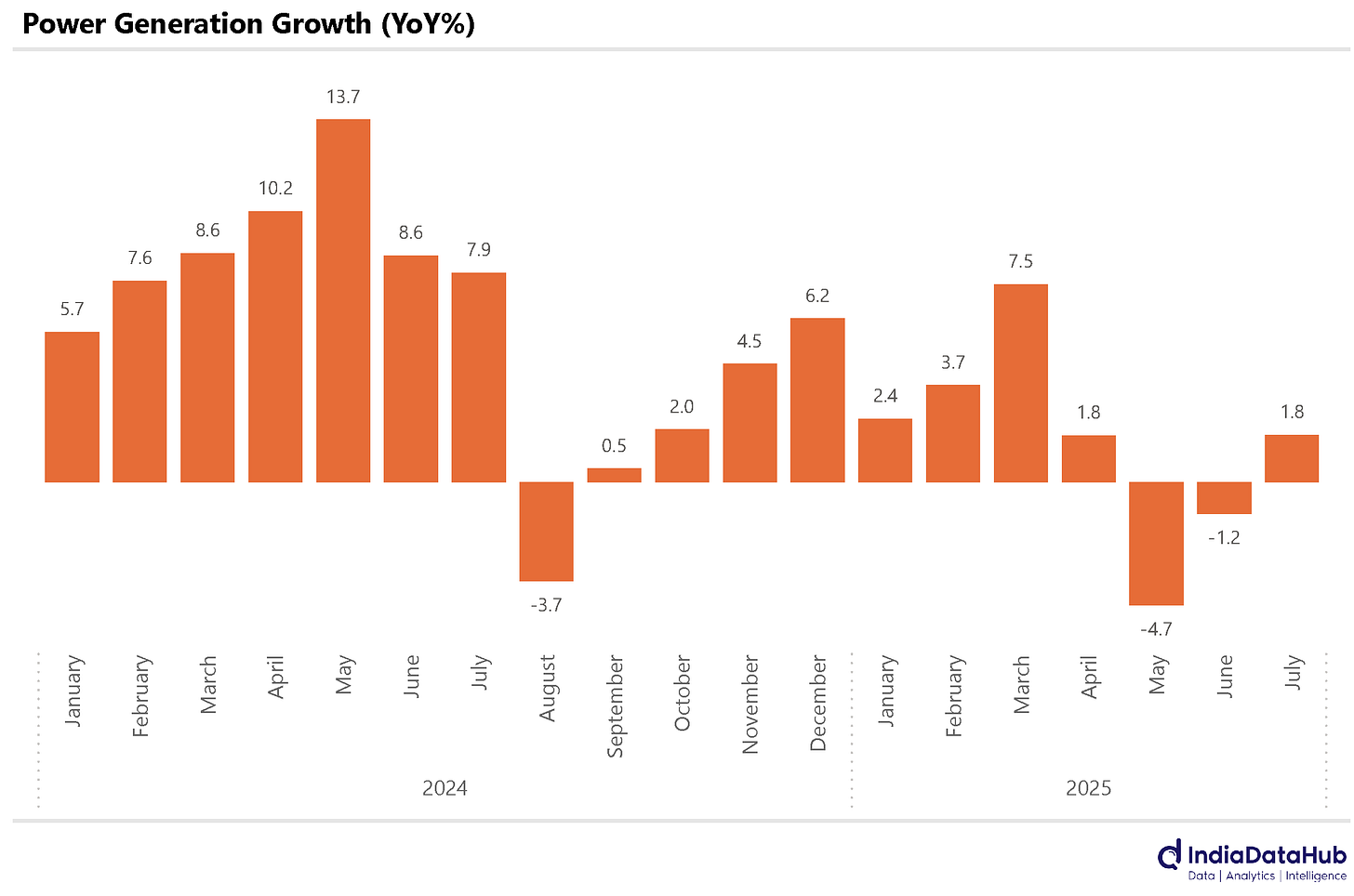

Power generation has been especially weak in the last few months

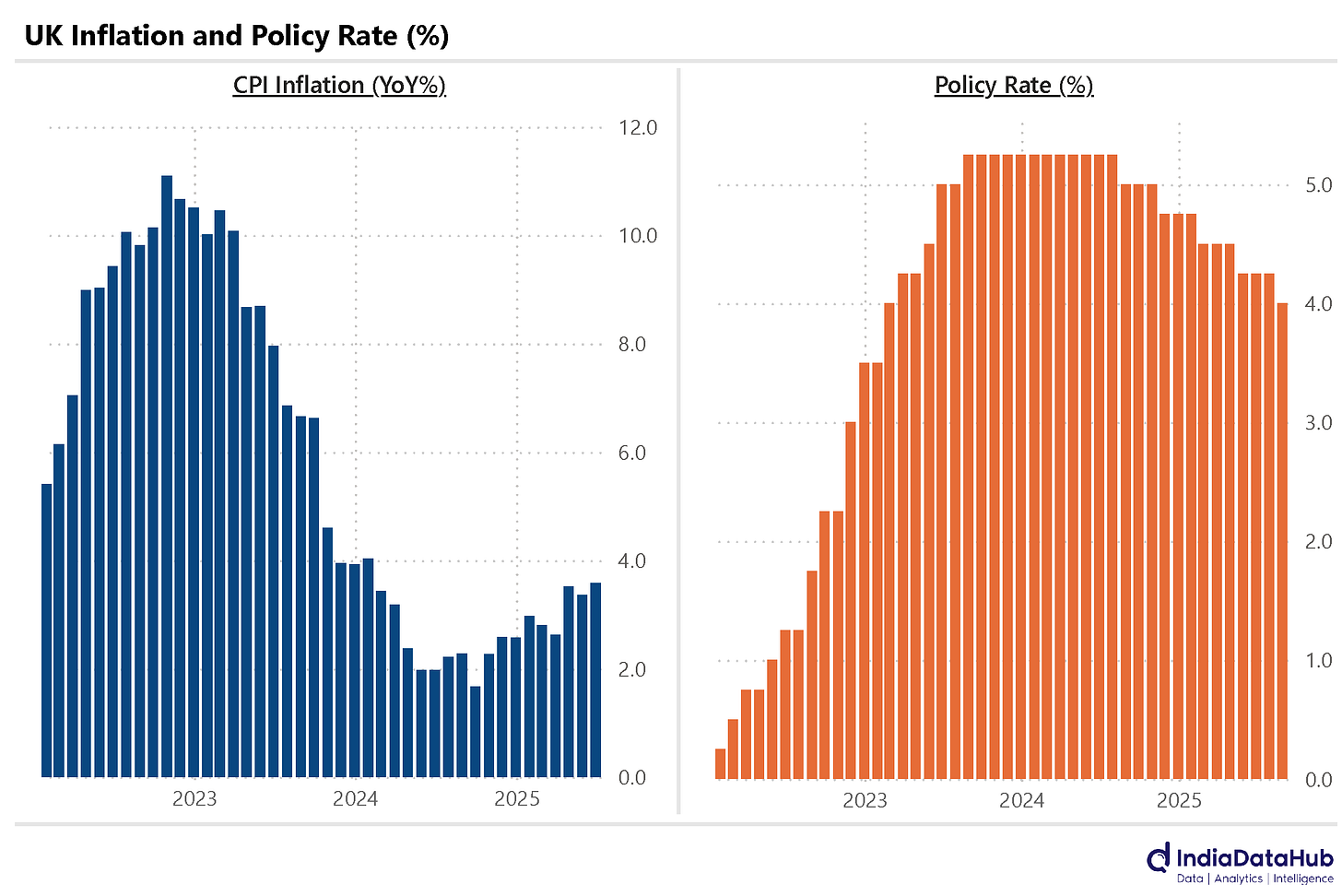

UK cuts policy rates despite inflation picking up

US likely to see monetary easing in the next couple of months

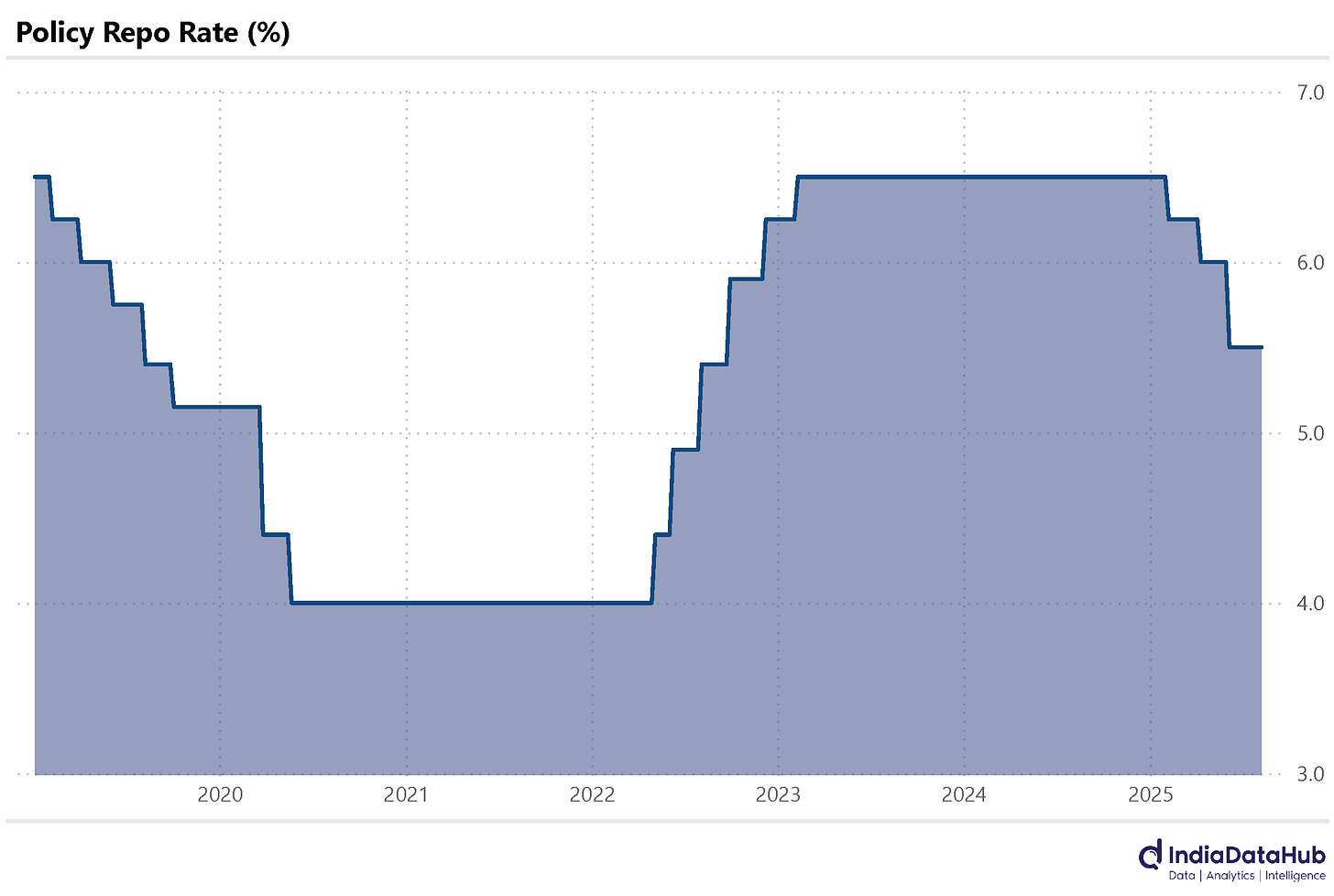

So, as expected, the RBI’s Monetary Policy Committee (MPC) kept the policy rate unchanged. The repo rate thus remains at 5.5%. The recent fall in headline inflation to 2% YoY (in June) had raised some prospects for a rate cut. But as we noted last week, the 50bps of rate cut in June had, in a sense, brought forward the 25bps rate cut of August.

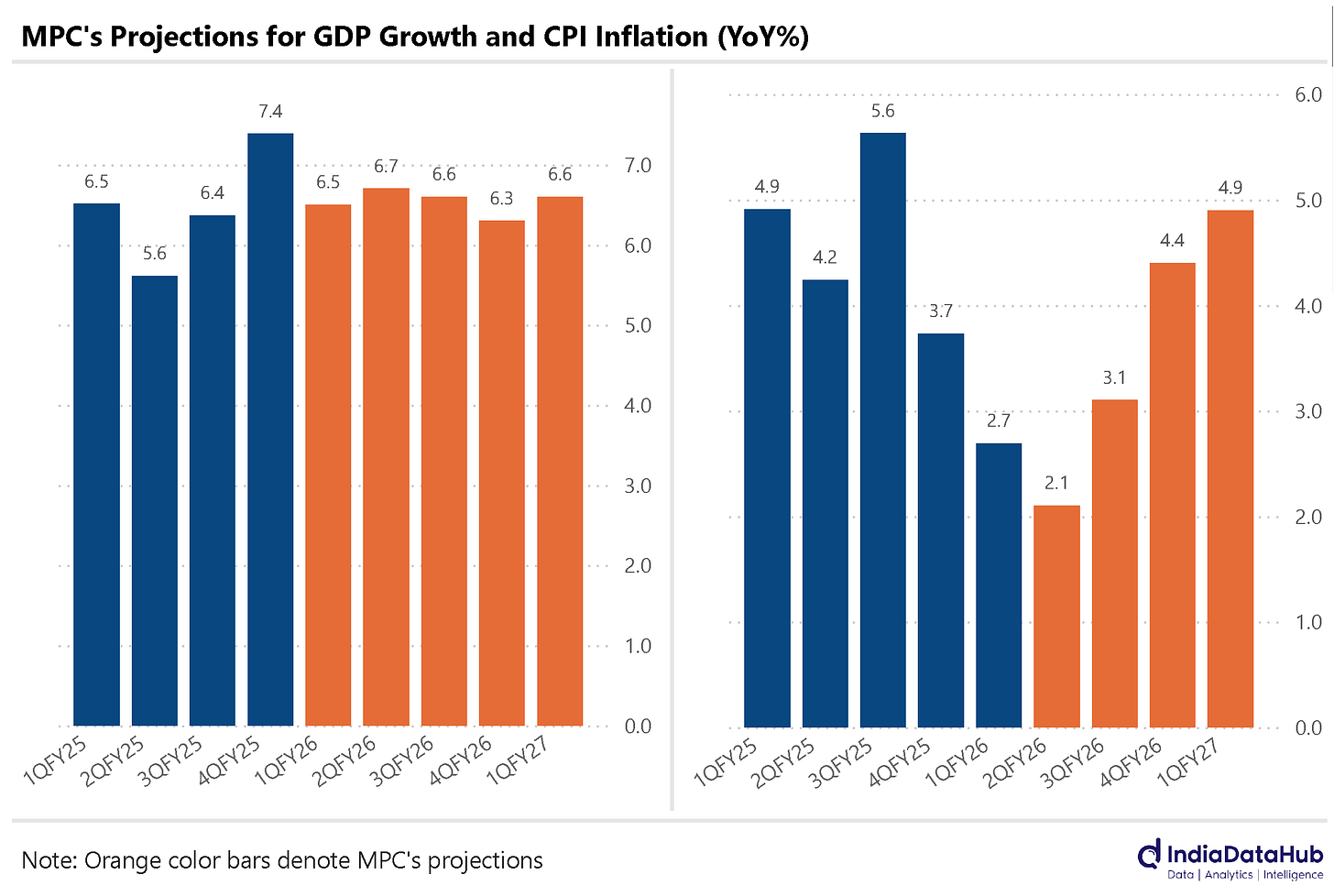

More importantly, what matters from a monetary policy perspective is not current inflation but inflation a few quarters down the line. And the RBI expects inflation to go back above 4% towards the end of this (financial) year. And worth noting in this context is that almost the entire decline in inflation in recent months was due to lower food inflation, which remains an extremely volatile component of inflation. While core inflation has been trending upwards, crossing 4% in June.

The other relevant metric is growth, and the MPC is not particularly worried about growth as of now. It noted that domestic growth remained ‘resilient’ and that it is broadly tracking along their assessment. Accordingly, it has maintained its FY26 real GDP growth estimate at 6.5% and expects growth of 6.6% in 1QFY27. So, with inflation likely to trend back above 4% and growth remaining reasonable, there is no material change in the growth inflation dynamics after the last monetary policy when the MPC had shifted stance to ‘neutral’. It was thus perfectly logical for it to maintain the status quo on rates, and unless the growth-inflation dynamics change materially, it is likely to maintain the status quo on rates.

And while we are on this topic, we noted above that core inflation has been trending up. A major driver of core inflation is import prices, and they in turn are influenced by India’s exchange rate vis-à-vis the Chinese Yuan, given the high share of imports.

And the Rupee has depreciated against the CNY in recent weeks - since the start of May, the Rupee has depreciated by over 5% against the CNY, and it is now close to the all-time low level.

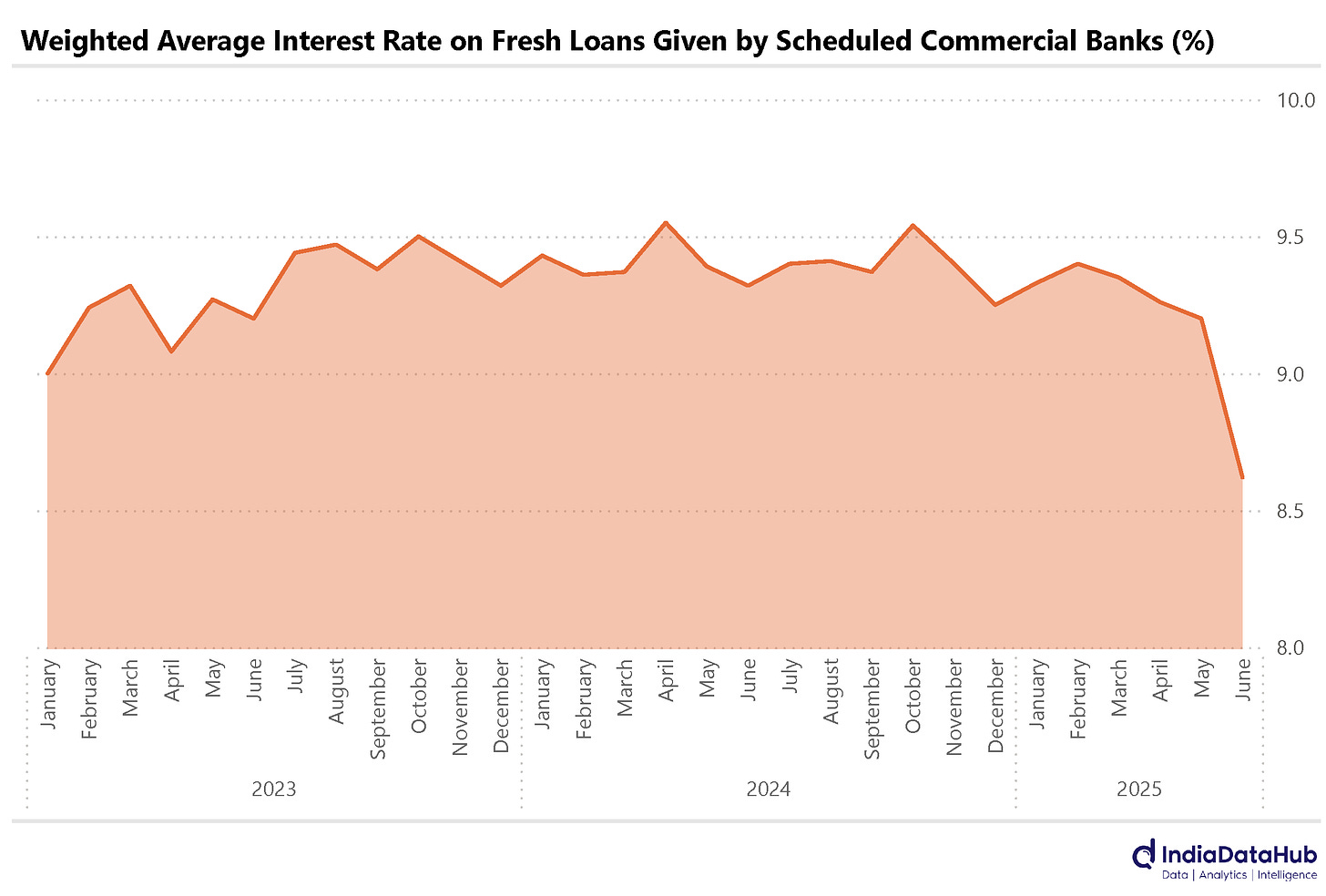

That said, the 100bps of policy rate cut so far has got transmitted to lower borrowing costs. Since late last year, the incremental weighted average lending rate of all banks has declined by 80bps.

Incremental deposit rates have declined by almost 100bps in the last few months. So a fairly large quantum of monetary transmission has already taken place.

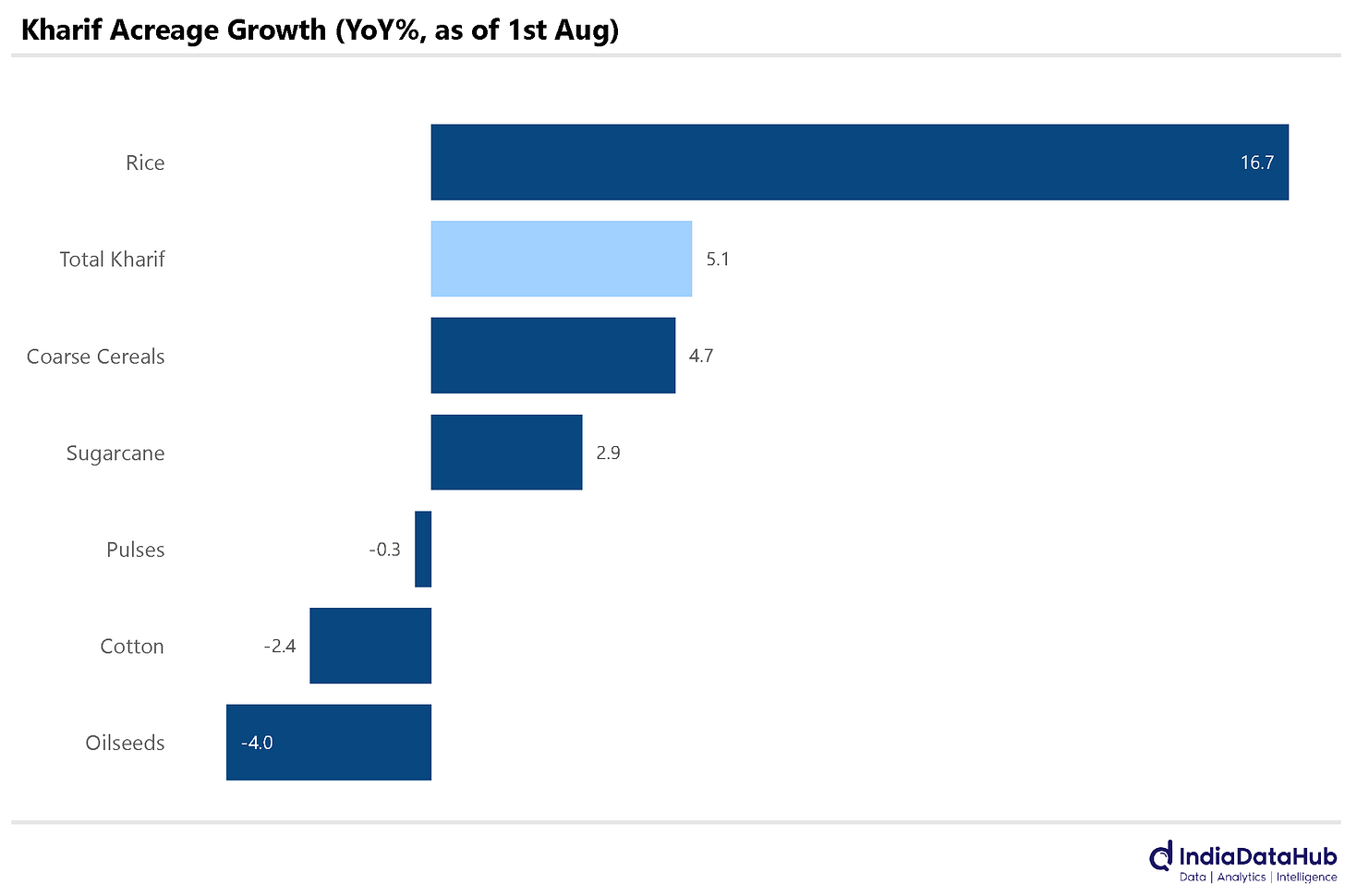

Kharif sowing continues to progress well. As of 1st August, over 90% of the normal area has been sown, and overall Kharif acreage is up 5% YoY. Rice, the principal Kharif crop, has seen over 10% growth in acreage while Coarse cereals have seen almost 5% increase in acreage on a YoY basis.

However, acreage of Pulses, a key swing factor in food inflation, is unchanged so far from last year, while Oilseeds and Cotton have seen lower acreage so far. So a mixed bag so far.

One of the most disconcerting data points on growth is that of power generation. Power generation grew modestly in July. However, the average growth in the first four months of the year (Apr-Jul) is -0.6%. In contrast, the growth during the last quarter of last year (Jan-Mar 2025) was 4.5% and during 3QFY25 (Oct-Dec 2024) was also over 4%. What gives?

Globally, the Bank of England and the Bank of Mexico both cut their policy rates in response to easing inflation. The Bank of England cut its policy rate, the Bank rate, by 25 basis points to 4.00%, signalling a cautious shift towards a more accommodative stance. This is even as inflation has increased to a 17-month high of 3.6% YoY in June.

Similarly, the Bank of Mexico reduced its policy rate by 25 basis points to 7.75%. Worth noting is that the Fed fund futures are now pricing in an almost 90% probability of a 50-bps rate cut from the Fed between now and the end of the year. So global monetary easing is likely to gather pace in the next few months.

That’s it for this week. See you next week…