Interest Rates, Strong FPI flows, Weak Auto sales and more...

This Week In Data #95

In this edition of This Week In Data, we discuss:

Money market interest rates have fallen in recent weeks

The yield curve is inverted at the short-end

MPC composition is changing but it does not matter as much

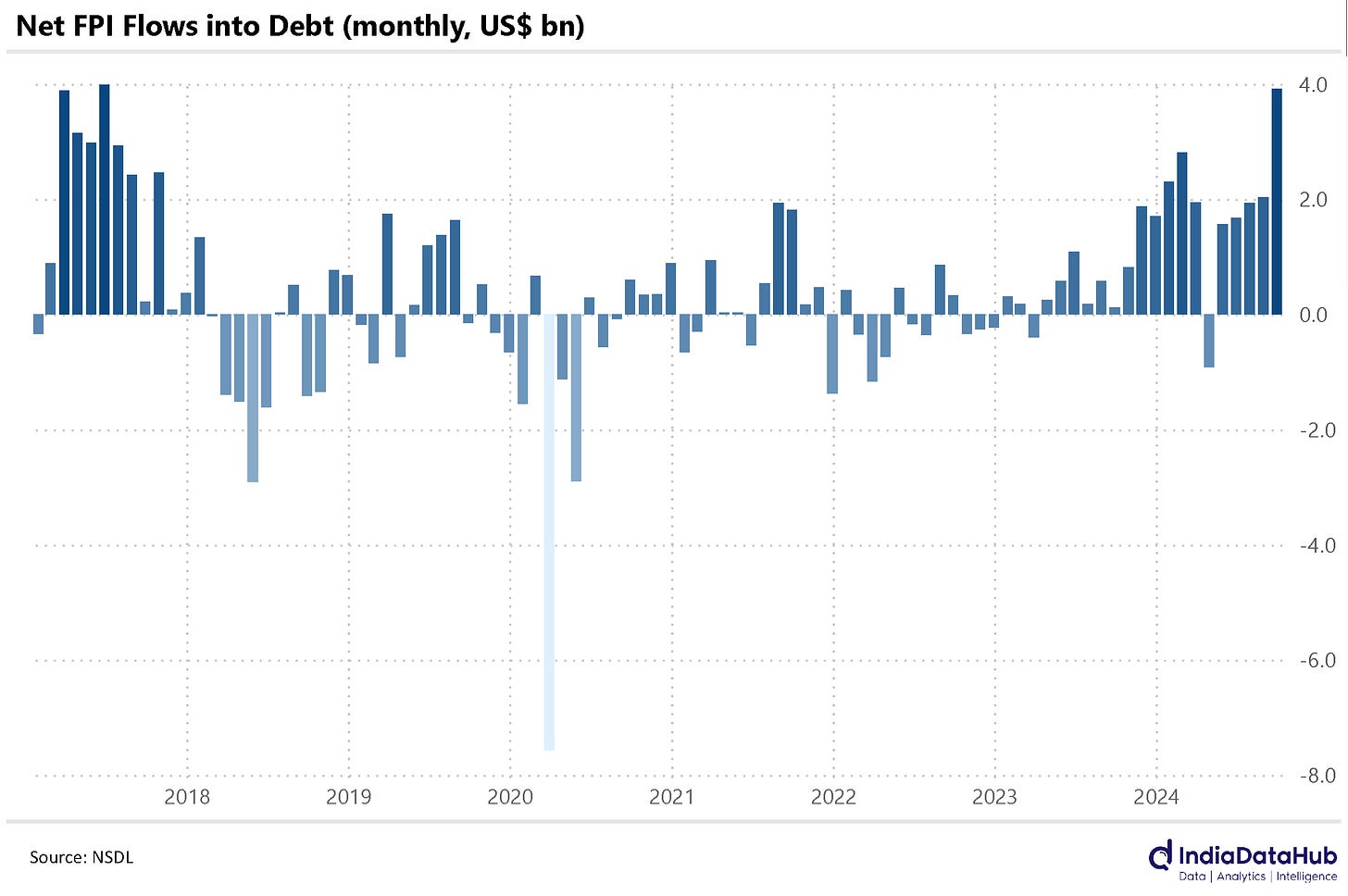

Near record FPI flows in Debt but weak start to October for Equities

Weak Auto sales in September except for Tractors

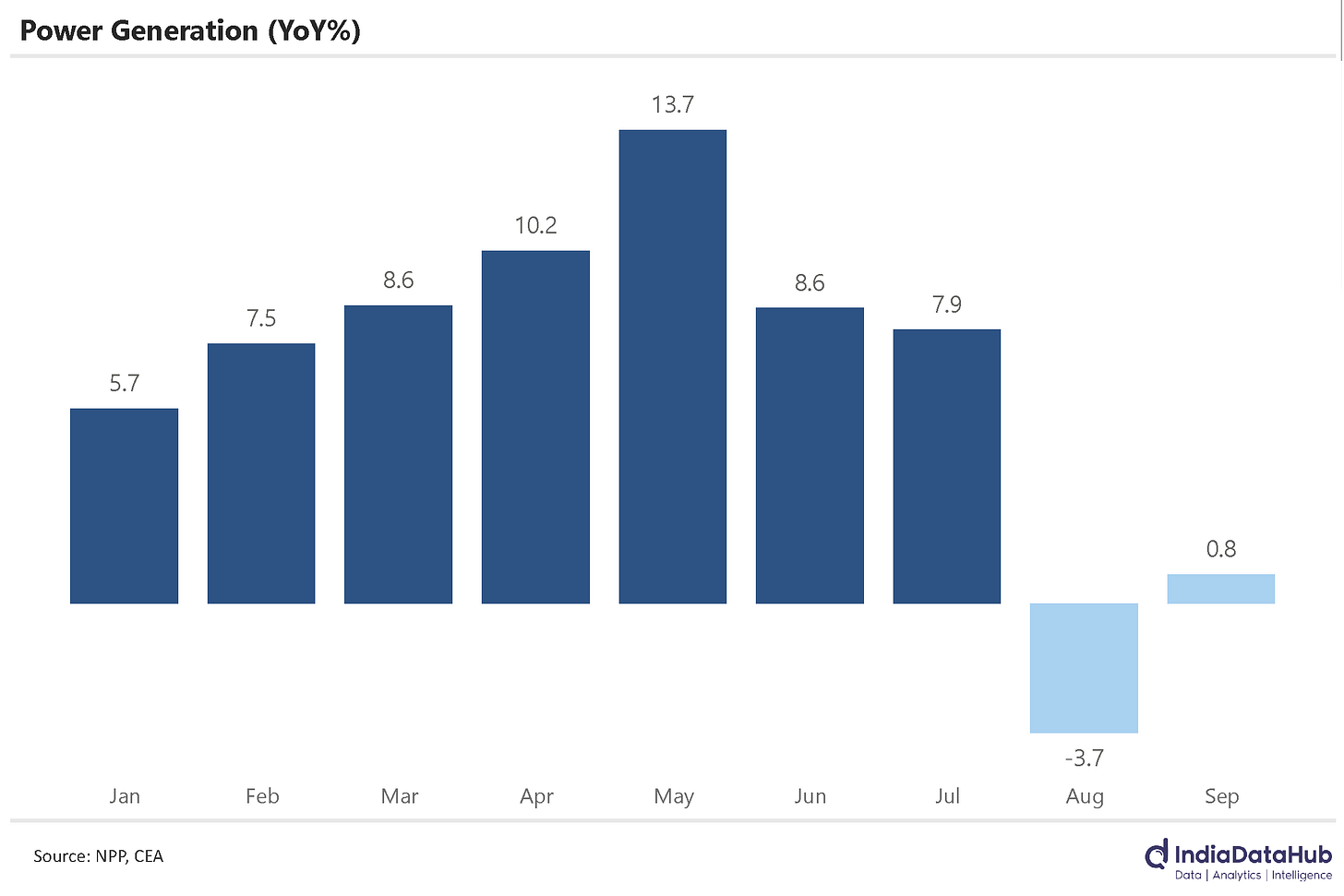

Weak power generation growth in September, following August

Euro Area CPI finally below 2%

Strong job growth in US in Sept moderating rate cut expectations from Feb

Domestic money market interest rates have declined further in recent weeks. The yield on the 3-month GSec has fallen to 6.4% and is now 10bps below the repo rate. The yield on the 10-year GSec has fallen to 6.8% and it is now only 30bps above the repo rate. Both have fallen 25-30bps in the last 3 months, even as the policy rate has not changed. The yield curve is thus inverted at the short end and extremely flat at the long end. This suggests the markets are pricing in a rate cut in the not-too-distant future. The domestic liquidity has also moved back into (a large) surplus and that has also helped rates, especially at the short end of the curve. Accordingly, the overnight inter-bank call rate dipped below the repo rate this week.

Pertinent in this context is the change in the external members of the MPC. The term of the 3 external members of the MPC expired after the last monetary policy meeting and 3 new members will be onboard the MPC in its meeting next week. In the last meet the MPC was split 4-2 with two of the outgoing MPC members dissenting. But that becomes moot now. The meeting next week thus resets the MPC and we shall get the dynamics of the reconstituted MPC next week post which we can rebuild our rate expectations. But worth remembering is that the three external members cannot engender a rate cut by themselves because even if the MPC is split 3-3, the Governor has the casting vote.

September was a strong month for FPI flows, especially in debt. FPI flows totalled just under US$4bn in debt, the highest monthly net inflow since June 2017 and the third highest ever. So far (Jan-Sep) the year has seen net inflows into debt of just over US$17bn and at this rate, 2024 will see close to US$24bn inflows for the full year. While this is not quite an all-time high, there is a bit of a caveat. The record debt inflow that India received (US$26bn) was in 2014. But a large part of this inflow was just a reversal of the outflows in 2013 as part of the taper tantrum. In 2013, the debt market had seen outflows of almost US$8bn. But in 2024, this is not the case. Last year, had seen large inflows as well – just over US$7bn. So we can argue that this year is on track to see the highest ‘fresh’ inflows in the debt markets.

Equity markets also saw strong FPI flows at just under US$7bn in September. This is the second-highest monthly inflow since January 2021. However, October has started on a bad note with net selling of almost US$4bn in just the first three trading days of the month. In contrast, the debt markets have continued to see net inflows so far in October. So we shall see how October pans out.

September was another weak month for Automobile sales with an across-the-board decline in retail sales except for Tractors. Tractor sales grew 13% YoY in September. Car, and SUV sales declined 19% YoY while 2W Sales declined 9%. Commercial vehicles such as Construction vehicles, Goods carriers and Passenger vehicles also saw a double-digit decline. Part of this is seasonal due to Pitru Paksha being in September this year while it was in October last year. Accordingly, October should see a rebound in retail sales. But what remains to be seen is whether the two-month growth is in sync with the prior trend.

Power generation barely grew in September marking the second consecutive month of weak growth. While in August power generation declined 4% YoY, in September it grew a modest 0.8%. For reference, between April and July power generation had grown by 10% YoY. So this is a marked slowdown.

Euro area’s CPI Inflation printed at 1.8% YoY in September as per the flash estimate. This is the lowest CPI print in 41 months and more importantly, inflation is now below the ECB’s target of 2%. Turkey has also seen its inflation drop in recent months and in September it printed at 49% as per provisional estimate, down from over 60% a year back and over 80% two years back!

Lastly, the US reported strong payroll data for September. The country added 254k non-farm jobs in September, the highest in the last 6 months. Also, the data for the prior two months was revised upwards by around 70k jobs. Strong labour data has promptly cooled down the expectations of a rate cut from the US Fed. A week ago the Fed fund futures were split 50-50 as to whether the Fed will cut by 25 or 50bps in November. Now they firmly expect a 25bps rate cut. But there is a lot more data to flow between now and November 7th when the Fed meets again so the expectations can change.

That’s it for this week. See you next week.

please correct "DATA" spelling.