Low CPI, Bond market sell off, MF Schemes and Cord cutting...

This Week In Data #149

In this edition of This Week In Data, we discuss:

Another month of low inflation in November

Bond markets have not celebrated the policy rate cut last week

Mutual Funds continue to see strong inflows especially in Equity funds

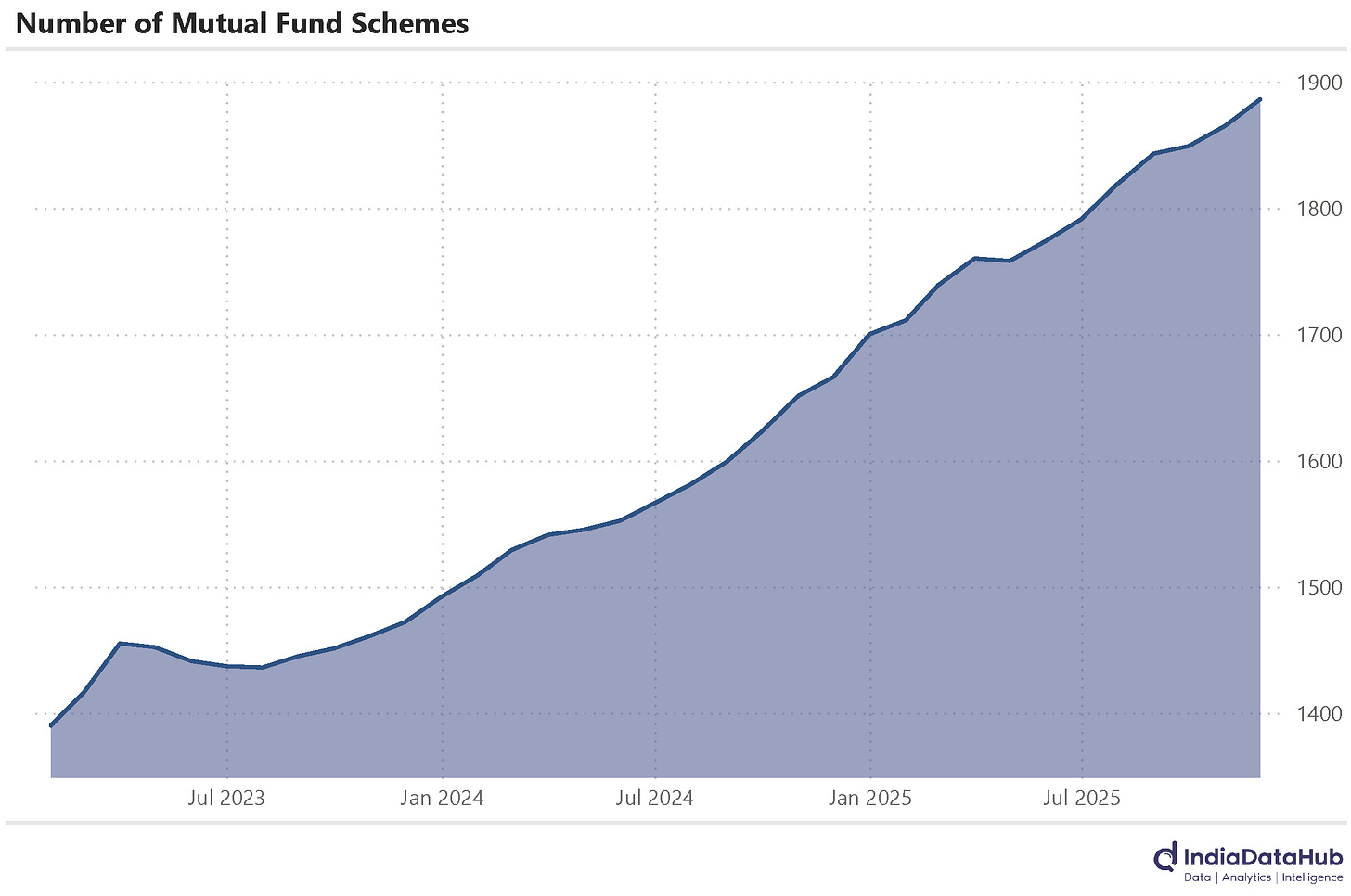

2025 on track for second year of over 200+ increase in MF schemes

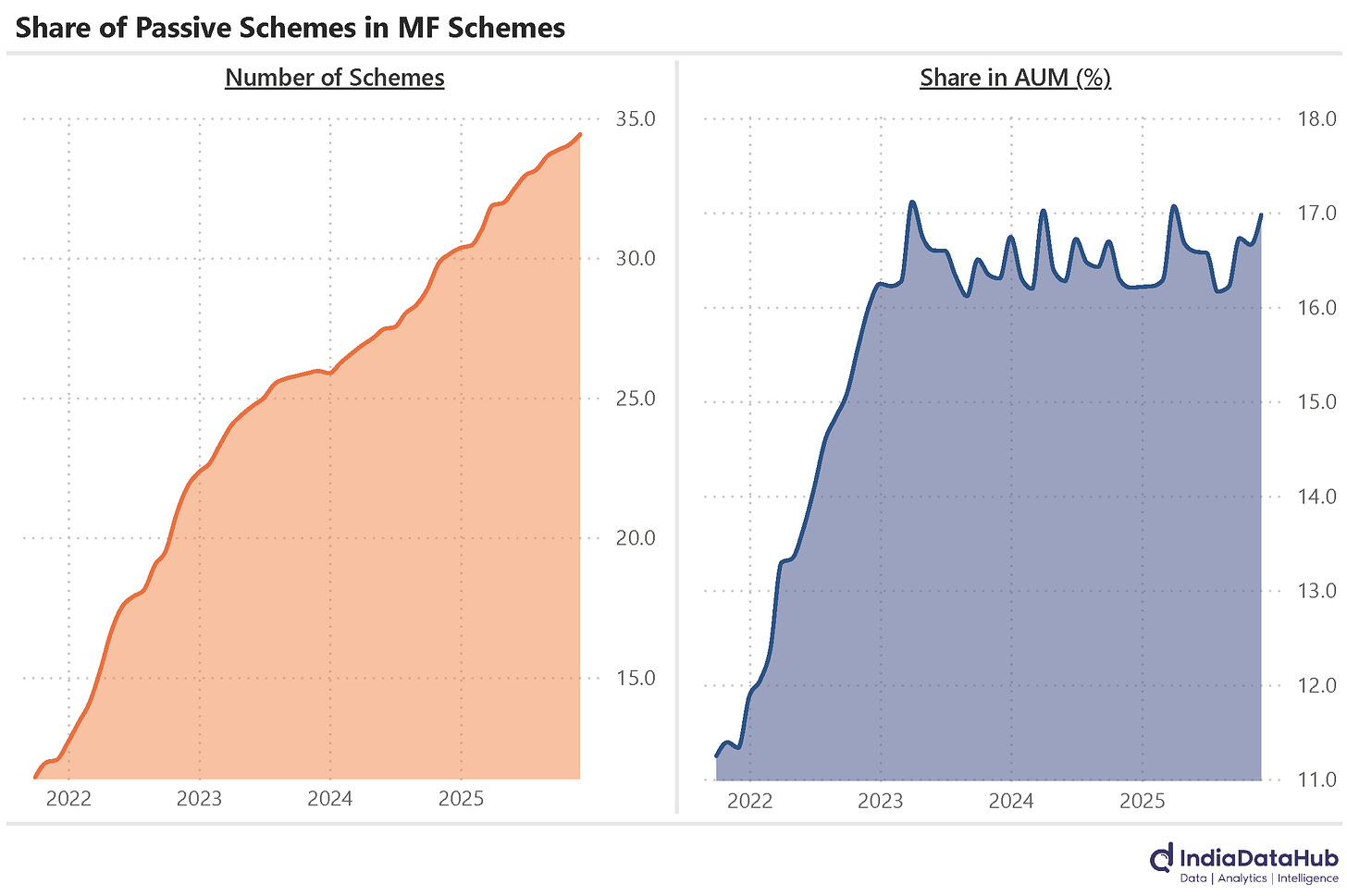

Passive schemes now account for a third of total schemes but only sixth of AUM

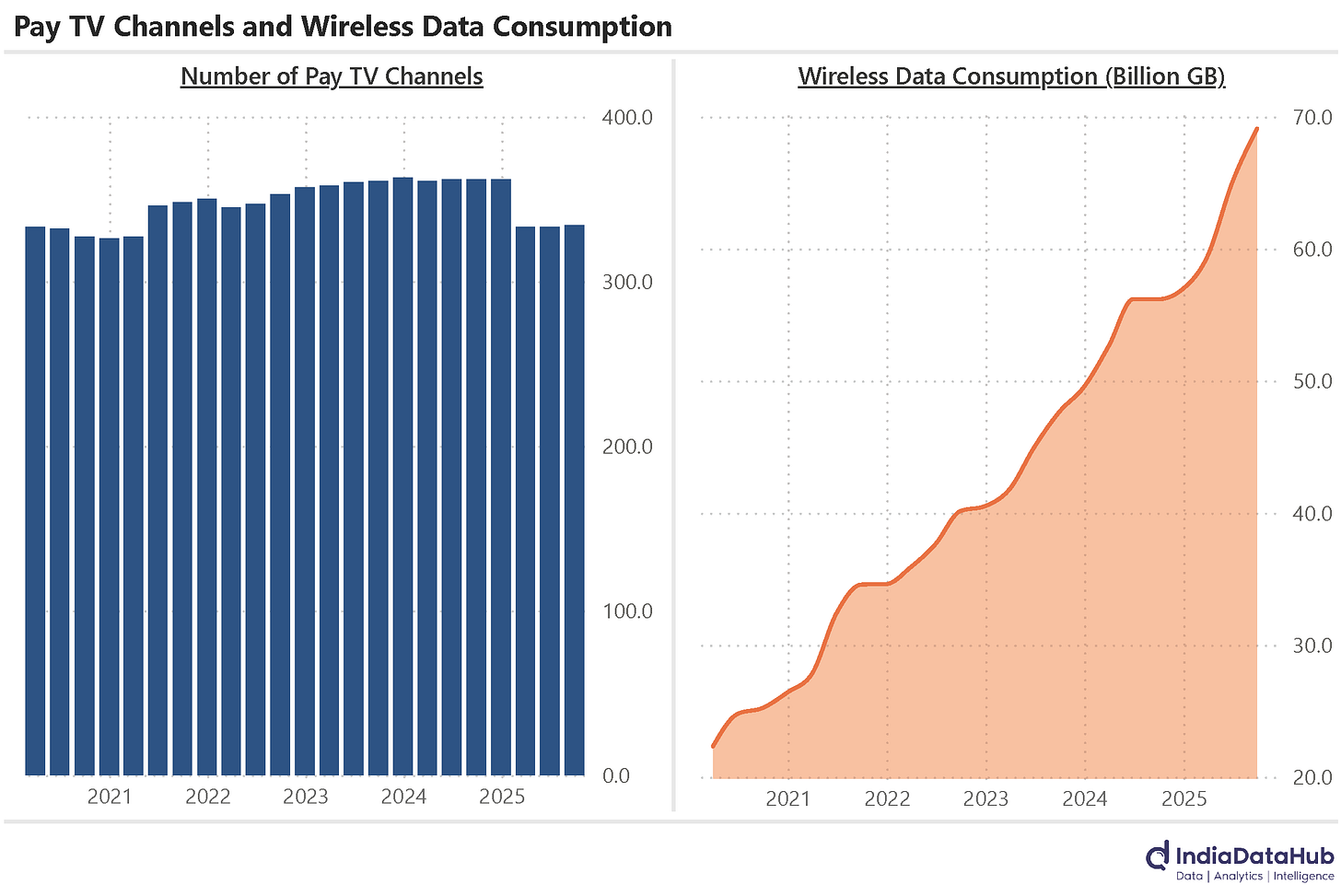

Cord cutting continues and number of Pay channels now starts to decline

Data consumption continues to see strong growth

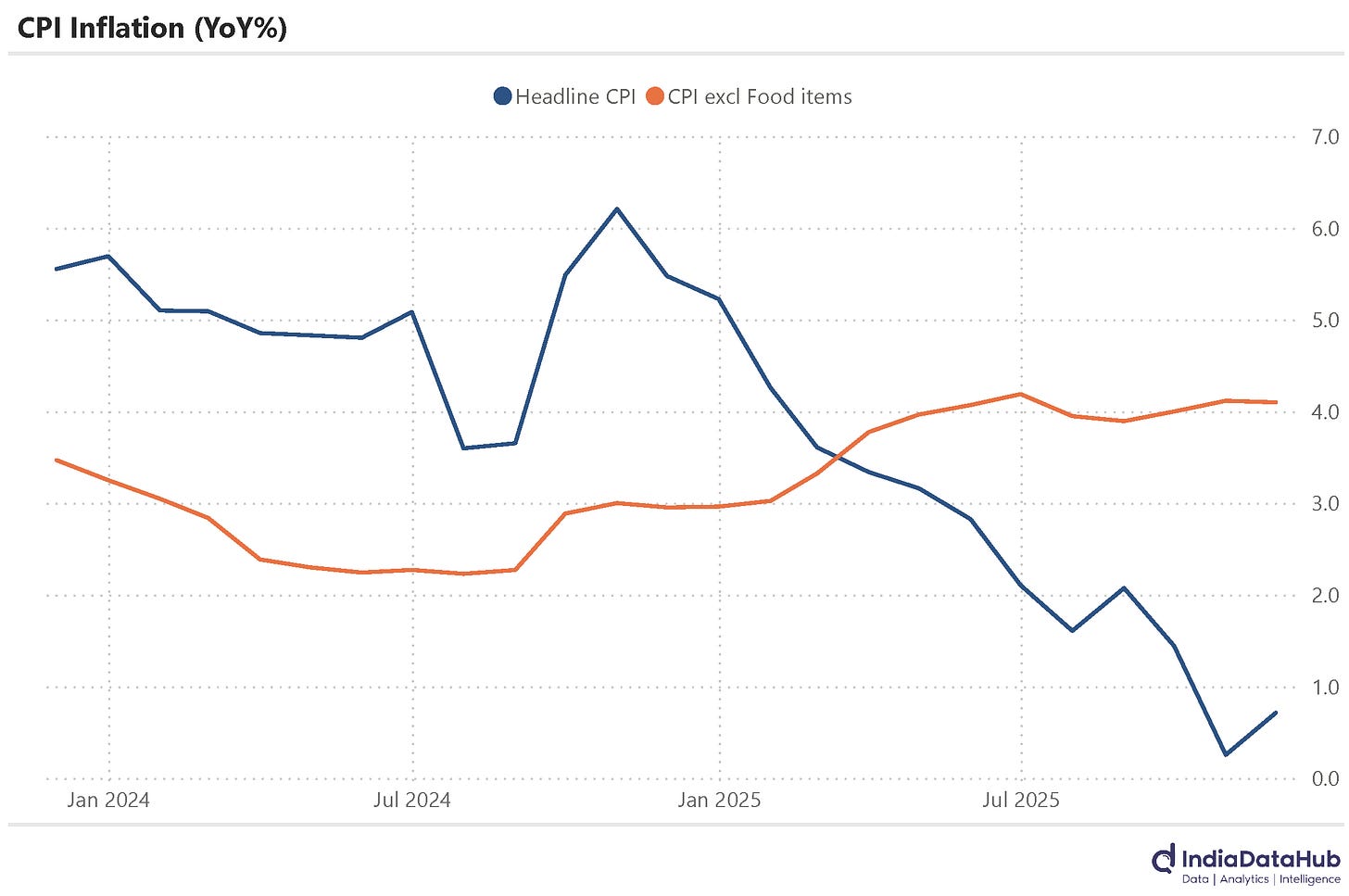

Another month and another low reading on Inflation. CPI Inflation printed at 0.7% YoY in November, up slightly from the 0.3% YoY print in October but well below the RBI’s target of 4%. In fact, CPI is now running even below the lower bound of the CPI target of 2% set for the RBI’s MPC. This quarter is likely to be the second quarter in a row that CPI inflation will average below 2%.

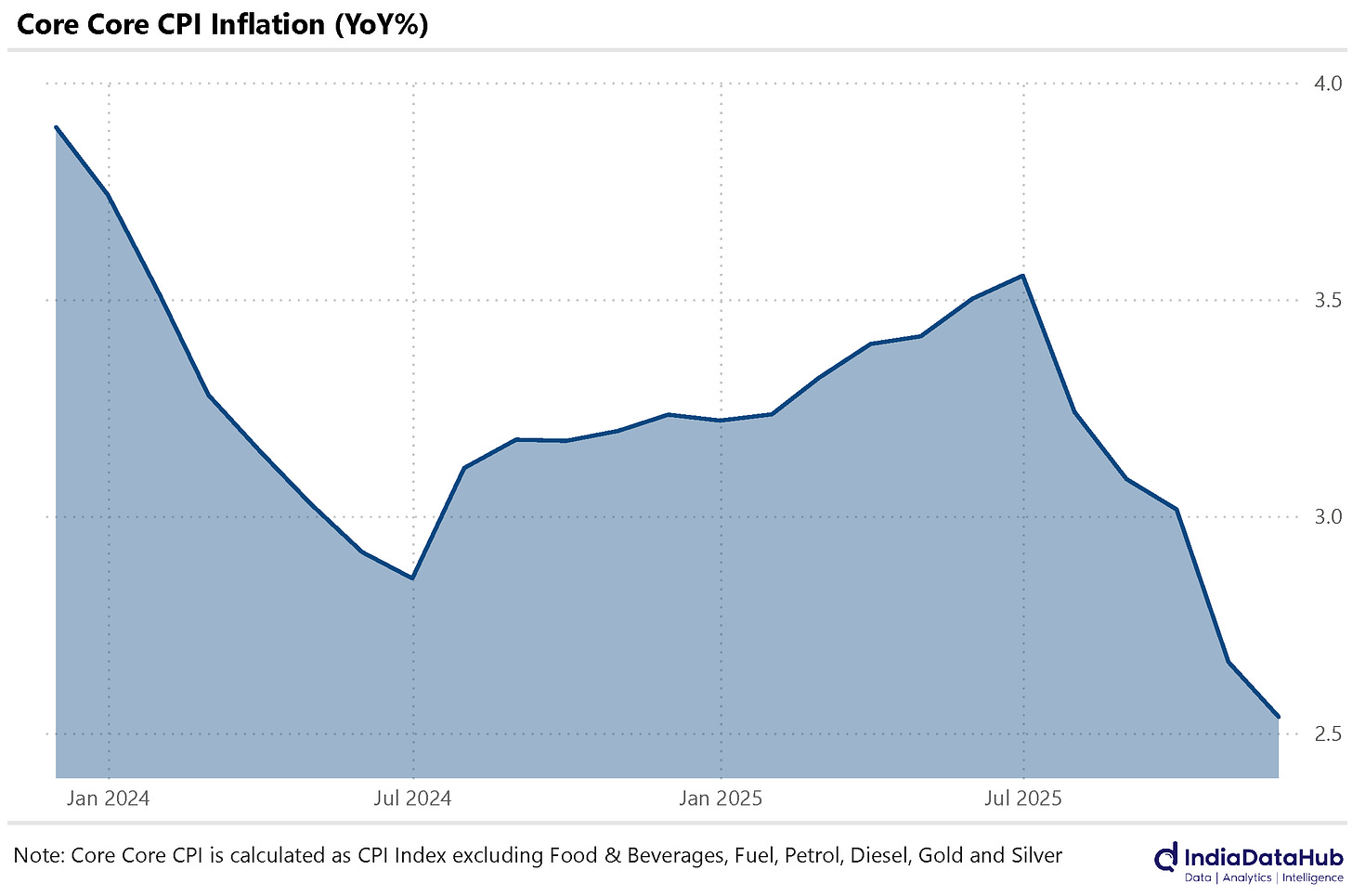

Extremely benign food inflation continues to be the key driver of lower headline inflation. CPI excluding food and beverages has remained stable, averaging around 4% since April this year. But even here, there are non-core factors. Gold prices, which have risen sharply in the last few months, have been an important upward driver of non-food inflation. Accordingly, the core-core inflation that takes out food, energy, fuel and precious metals has fallen sharply – 2.5% YoY in November, the lowest in recent times.

Bottom line is that there do not seem to be any underlying inflationary pressures. And it is this that drove the RBI to cut rates last week. And as things stand now, if inflation continues to undershoot the projected trajectory (RBI expects inflation to average ~3% during the March quarter), there might be another 25bps rate cut in the February policy meet. We shall see…

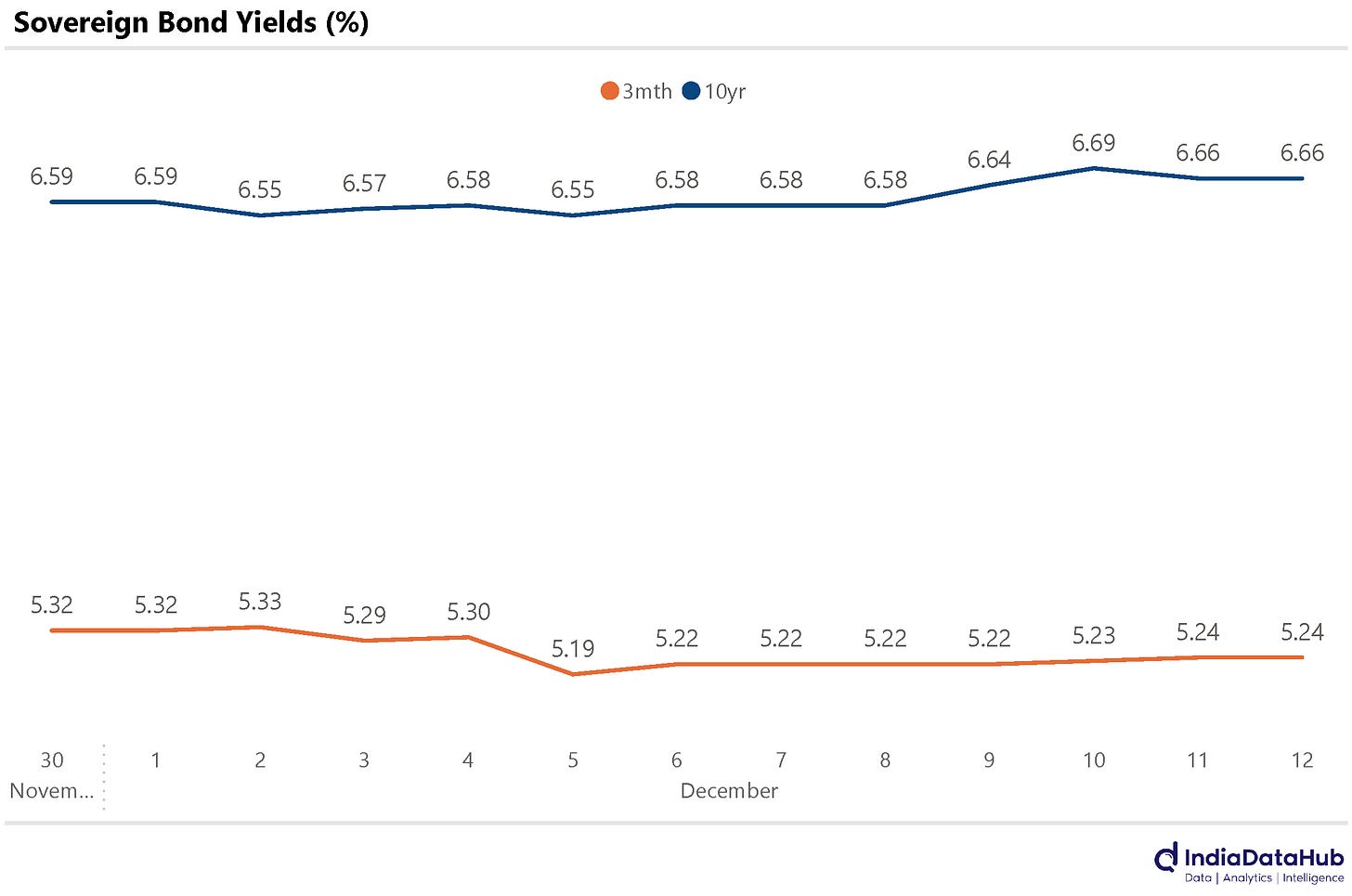

The markets, though, seem to be seeing things differently. The 10-year GSec yield has increased by 10bps in the last 10 days. So there has been a selloff in bonds, at the longer end, post the policy, which saw the RBI cut the policy rate by 25bps. At the short end of the curve, too, the yields have seen a modest 5-10bps change as against the policy rate change of 25bps. Effectively, the markets are suggesting they do not see scope for further rate cuts.

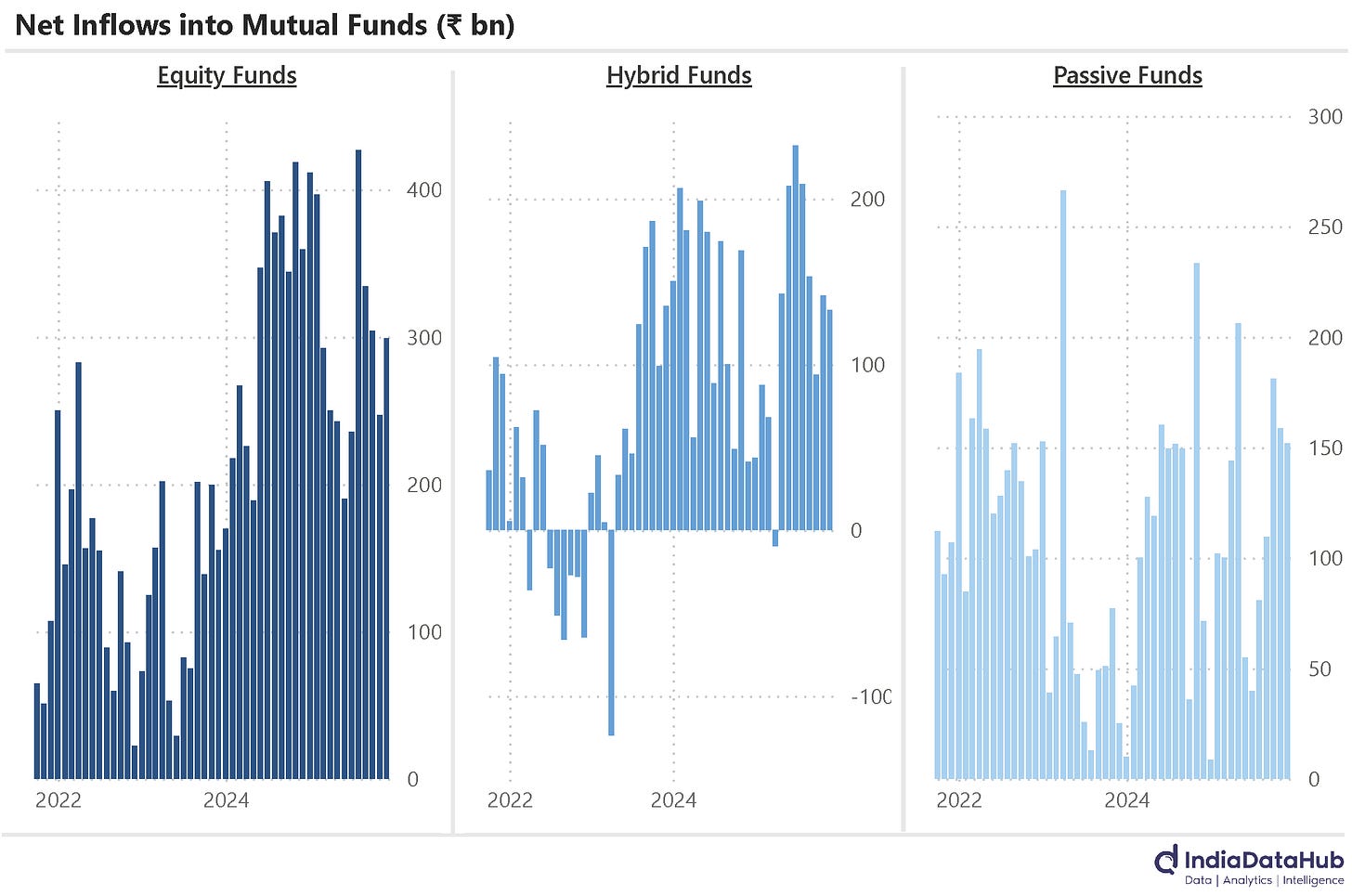

November was another strong month for flows into domestic equity funds. Net inflows totalled ₹300bn, higher than the net inflows of ₹250bn in October. Hybrid funds also saw strong inflows of over ₹130bn in November, although the pace has moderated a bit in recent months. And passive funds have also seen strong inflows in the last few months. November saw net inflows of ₹152bn, among the highest monthly inflows in recent years.

In large part, the strong inflows are being driven by new schemes. 2025 is on track to be the second consecutive month of over 200 schemes being launched. 2024 saw the number of schemes across the industry increase by 208, and so far (till November), the number of schemes has increased by 186. At the pace of the last few months, 2025 will also see the number of schemes increase by over 200.

Most of this increase, though, is happening not in active but in passive schemes. In 2024, just over 60% of the increase in schemes was attributable to passive schemes. And so far in 2025, almost 70% of the increase in schemes is attributable to passive schemes. A third of the active schemes are currently passively managed schemes. Most of these schemes, though, are small, and hence the share of passive schemes in total AUM is much lower at 17%.

Lastly, cord-cutting has continued this year. The number of DTH subscribers, as well as subscribers for the large cable operators, continues to decline. And not surprisingly, the number of Pay TV channels is now declining. As of September, this year, there were a total of 334 Pay TV channels in the country, down 28 from last year.

The flipside of this is the increase in media consumption from the OTT platforms. And this is manifesting itself in the continued increase in mobile data consumption. The September quarter saw a total of 69 billion GB of wireless data, up 6% QoQ and 20% YoY. An average wireless data subscriber now consumes almost 25 GB of data per month. This has more than doubled in the last 5 years.

That’s it for this week. See you next week…