Lower bank margins, declining Life insurance growth, recovery in wage growth and more...

This Week In Data #14

In this issue of This Week In Data, we discuss

Decline in spreads of Banks

Declining in premiums collected by Life Insurance companies

Uptick in rural wage growth

Weak FDI

Rising FX Reserves

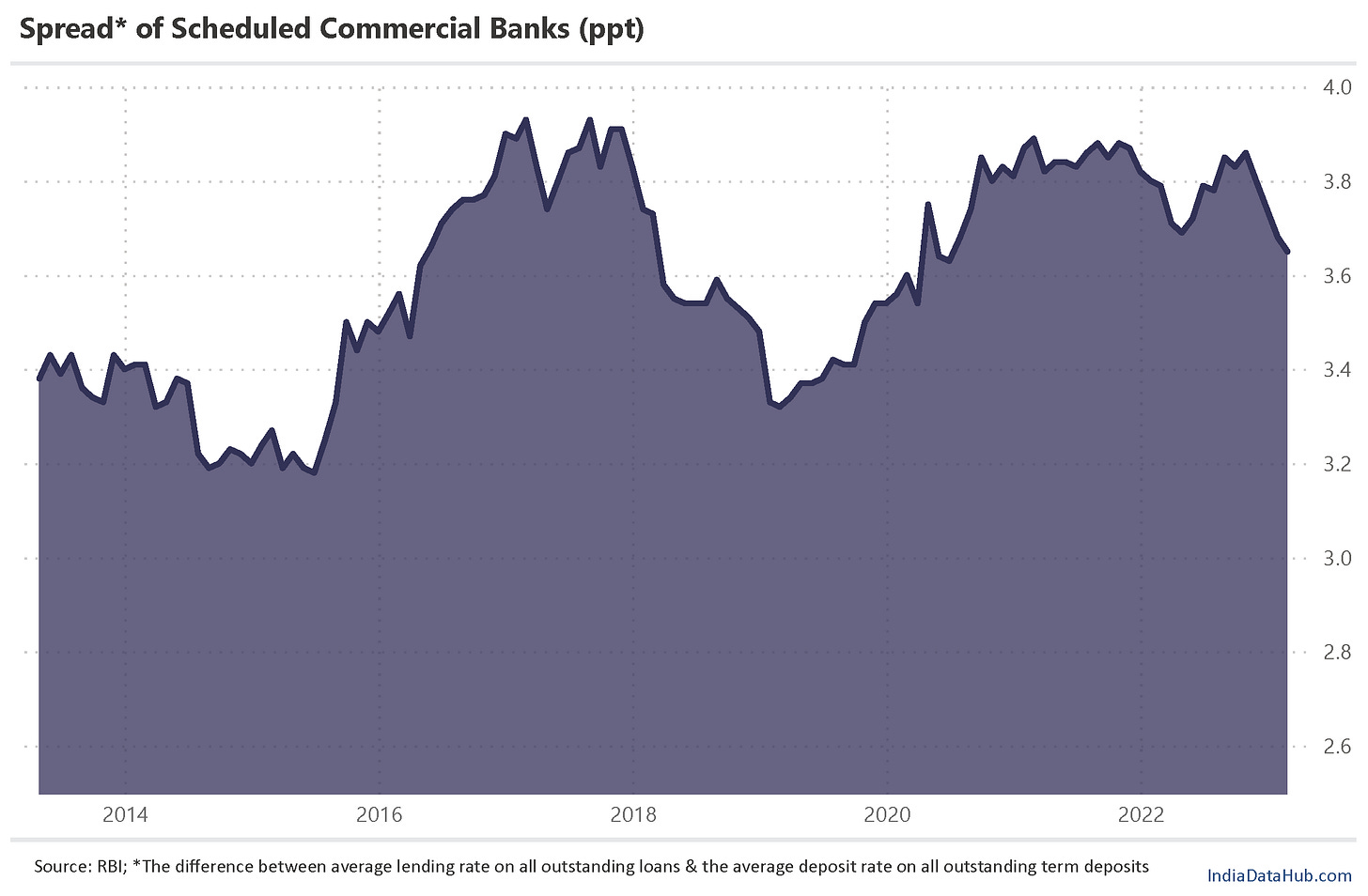

Spreads of scheduled commercial banks (the difference between the weighted average lending rate and weighted average deposit rate) had expanded in the early months of the pandemic. In the first quarter of 2020, the spread stood at just under 360bps – implying the weighted average lending rate on all outstanding loans was approximately 360bps above the weighted average deposit rate on all the outstanding deposits.

By the first quarter of 2021, the spread had increased by 30bps to almost 390bps. Now 30bps sounds like a small change but given that banks are leveraged entities (average asset-to-equity ratio of well over 10x), a 30bps increase in the spread is a pretty sizeable change. This increase reflected easy liquidity conditions maintained by the RBI and relatively weak credit growth which meant that deposit growth was running well above the credit growth.

Last few months the situation has changed completely. Liquidity has tightened and credit growth is running well above deposit growth. And not surprisingly, spreads have narrowed – from almost 390bps at the start of 2021 to just under 370bps in the first two months of this year. And if credit growth continues to run above deposit growth, banks will have to chase deposits, further pushing down the spread as the cost of funds rises faster than the yield on deposits. And while the spread is now just 10bps above the pre-pandemic level they are well above the 2015 or even 2019 lows. There is thus scope for them to contract further, and pressuring bank profitability.

Banks with a lower CASA share which benefitted disproportionately from the easy liquidity environment will have the most risk of a fall in margins and thus profitability. One way for banks to deal with this pressure is by going down the risk curve and increasing the yield on lending. And this is how the credit cycle eventually unfolds.

March was the second consecutive month with a decline in new business premiums for the Life insurance companies. As we wrote here, the decline was due to LIC which saw over 30% decline in NBP for the second consecutive month. Its market share during the March quarter has thus fallen to just 55%, the lowest on record.

Rural wage growth remained largely steady at ~6% YoY in February. It has averaged at this level for the past five months, having increased from sub-5% growth in the preceding 12 months. Wage growth remains stronger in Agricultural activities (~7% YoY) relative to non-Agricultural activities (~5% YoY). Thus while wage growth has ticked up in recent months, in absolute terms it remains modest. Even adjusted for inflation, while wage growth was negative through most of 2022, at current growth levels, the real growth rate is close to 0%. From a rural consumption perspective thus, rural wage growth is not suggestive of any material pick-up as yet.

FY23 continues to be a bad year for FDI. As per data released earlier today, Gross FDI for February declined by a third totalling US$4.8bn. FDI has declined on a YoY basis in 6 of the last 7 months. Consequently, YTD Gross FDI is down by almost 15% YoY. With the repatriation of FDI being almost flat on a YoY basis, the net inflow of FDI has declined by 20% YoY. This will be the biggest YoY decline in FDI in over a decade.

FX Reserves continue to rise, reversing the declining trend of last year. In the first two weeks of April, reserves have risen by almost US$8bn to US$586bn. FX reserves are now the highest since July last year. And from their lows reached in October last year, they have risen by more than US$60bn. However, they are still ~US$56bn below their peak.

That’s it for this week. Next week will have some final data sets for March, so we will talk about them. So long…